Mastering Price Adjustments & Earn-outs in Indian M&A | Key Legal & Tax Insights

- Blog|FEMA & Banking|International Tax|Company Law|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 30 November, 2023

Table of Contents

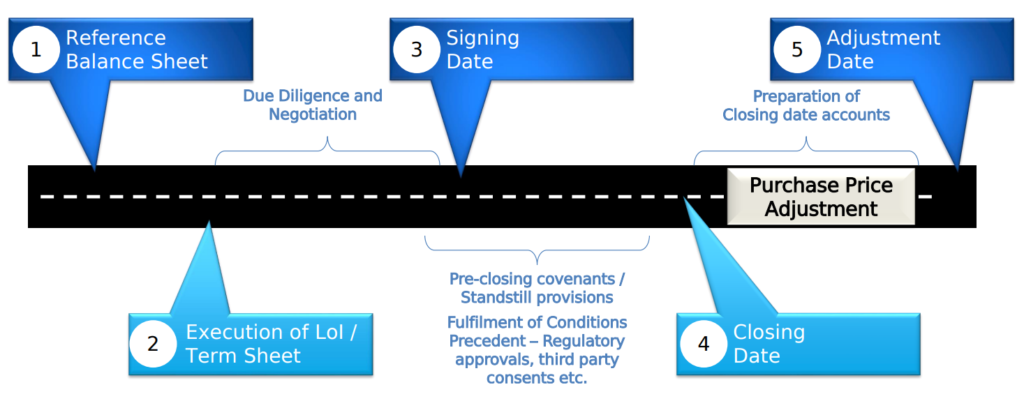

1. Purchase Price Adjustments

1.1 What is it?

1.2 Why is it required?

Buyer Perspective

- Preserve value and equitably allocate risks

- Protect against value erosion and value leakage until closing

- Better protection than warranties and indemnities

Seller Perspective

- Fair allocation of risk

- Potential for upside if the cash or working capital position improves

1.3 Structuring Purchase Price Adjustments

What could trigger such a fee?

Financial measures

- Cash: Estimated Cash minus Actual Cash

- Net working capital: Current assets (e.g., cash, accounts receivable and inventory) minus current liabilities (e.g., debt, trade creditors or accounts payable)

- Net assets: Total assets minus total liabilities

- Net debt: Short and long-term debt minus cash and cash equivalents

Non-financial measures

- Penalties for delay in closing

- Occurrence of a MAE event

Net Working capital adjustment is commonly used in M&A transactions (included in 87% of deals from the 2021 ABA study)

1.4 Regulatory Issues

- Indian foreign exchange regulations liberalised

-

- Amount: Upto 25% of the total consideration can be deferred

- Time period: Upto 18 months from the date of the definitive agreement

- Adjustment can be structured as holdback or through escrow

- The upfront amount paid as well as total consideration finally paid must comply with the pricing guidelines

- Pricing guidelines are not applicable to FVCI investments

- For public companies, SCRA requires that consideration should be paid simultaneously or within 1 day of transfer of shares

1.5 Drafting Issues – Legal and Contractual

- Financial metric should be defined

- Timelines and process of drawing up accounts should be pre-agreed

- Dispute resolution process and engaging of experts to settle disputes

- Allocation of costs incurred

- Set out the mode and manner of payment

- Any caps on adjustments

- Items which are expressly excluded from the scope of adjustments

1.6 Tax Considerations

General principles

- Timing: Taxable at the time of sale – “accrual” vs “receipt” debate

- Characterization: Same as the upfront consideration, as capital gains

- Agreed terms/clauses are key

Holdback/Escrow – Specific issues

- Entire consideration (including holdback) taxable upfront?

- Whether any deductions from holdback escrow could potentially reduce the taxable consideration?

Other Considerations

- Tax deduction/collection at source:

– in case of upward/downward adjustments to the consideration

– interest on additional taxes to be deducted/collected in case of an upward adjustment - Where purchase price adjustment spills over to another financial year – ability of seller to file a revised tax return or option of revision application to be explored

- Adjustments based on litigation outcome at a later date (eg after 2 years) – tax treatment and whether akin to indemnity

2. Earn-outs

2.1 What is it?

Earn out

- Contingent payment basis future performance and/or achievement of pre-defined milestones.

- Earn out resolves differences between the parties on the expected growth and future performance of the target company.

Advantages of earn outs

Buyer’s perspective

- Mitigates risk of overvaluation

- Deferment in payment obligation

- Access to additional resources to discharge consideration

Seller’s perspective

- Potential to earn higher valuation

- Benefit from economies of scale and increased investment

Basis of earn-outs

Monetary thresholds

- Increase in revenue, income, profit, sales or cash flows

Non-monetary thresholds/milestones

- product development, governmental approval, number of employees, number of offices etc.

2.2 Why use an earn-out?

The buyer and seller cannot agree on the value of the target company

The seller may be more optimistic regarding the target company’s prospects than the buyer. Without an earn-out, the price the buyer is prepared to pay may be discounted as a result of doubt about the actual profitability or value of the target company. In this scenario, an earn-out can facilitate a more accurate valuation based in part on actual future performance, rather than past or predicted future performance.

Continued involvement of the seller is key

In some transactions, the continued involvement of certain sellers (such as founder shareholders) in the management of the target company after completion is important to secure the future success of the acquired business. In this scenario, an earn-out can be used as a mechanism to retain the relevant sellers and to incentivize them to maximize the target company’s profitability after the transaction has completed.

2.3 Structuring Earn-out Commercials

Sale of part

Vendors may transfer a proportion of their share holding to a purchaser on

completion and enter into matching put/call options with the purchaser over the remainder of their shares, linking the exercise price of the options to future performance.

Payments Based on turnover

Earn out payments may be linked to turnover rather than profits. Appropriate where the parties have adopted sales to value goodwill of the company.

Service Agreement

Deferred payments linked to future performance under profit sharing clauses in service agreements, although such payments are likely to be treated as income receipts of the vendors.

All or nothing profit targets

All or nothing profit targets rather a profit multiplier. Substantial risks for vendors in case the targets are not reached. Providing for the carry forward and carry back of profits over the target figures to other years in the earn-out period.

Question: What is better for the buyer? All-or-nothing or milestone based earn out?

Answer: Buyer would typically insist on all or nothing approach. Seller should insist on milestone based staggered payment structure.

Question: What is better for the seller? A short or a long time frame?

Answer:

- Depends on the character of the business.

- If growth spurt is expected, a shorter time frame may be best.

- Generally, a balanced period of performance should be preferred.

Tip for buyer: If period is too short, seller may hurt long term interests of the target.

2.4 Regulatory Issues

- In cross-border deals, earn out period available only for 18 months from signing

- To elongate time period, earn outs can be structured as manager compensation or perquisite. The tax issues relating to this are discussed later

- The consideration paid upfront as well as finally paid must comply with the pricing guidelines

2.5 Tax Considerations

Seller perspective

- Contingent vs deferred payments

- Contingent payments – taxable in year of transfer vs year of accrual

-

- Contrary decisions of Bombay High Court and Delhi High Court

- Recent tribunal decisions – taxable at the time of accrual

- Characterization of deferred payment:

-

- Capital gains vs employment linked income

- Practical issues

-

- Limited window to revise income tax return – 9 months from end of FY

Buyer perspective

- Withholding tax obligation

-

- On entire consideration (including deferred component) vs initial consideration

- Any interest exposure?

- Contractual protections for any withholding tax claim

- Cost-basis

-

- Mode of allocation of deferred consideration in case of a slump sale

2.6 Post-completion operations of the target company

Managed by Buyer

- Undertaking by buyer not to make any material changes to the company’s business

- Buyer to maintain separate books for the target company and to provide the seller with access to those books

- An undertaking by buyer not to sell the target company or a material part of its business and assets during the earn-out period

Managed by Seller

- An undertaking by seller not to falsify the operations or the books of the target during the earn-out period

- Buyer may want to seek “reverse” contractual protections to ensure that the earn-out is not distorted to its detriment

2.7 Drafting issues – Legal and Contractual

Decision Making Powers

- Level of autonomy/rights of seller to operate the target business post-closing

- Buyer should have levers/controls through reserved matters, board representation etc. to check seller actions

Scope of Business for Earn Outs

- Straightforward in case of a single business division

- Complex in case of multiple business divisions or merger of target’s business with buyer’s business

Calculation of Earn Outs

- Typically, buyer since it is in control

- Seller should retain some degree of control and a right to review and dispute

Cost Exclusions

- Seller should exclude long term costs/expenses

2.8 Mechanics for measuring performance against earn-out targets

Determining whether the earn-out targets have been satisfied

- Which financial statements will be used to measure the target company’s performance? Can the target company’s statutory accounts for the relevant period be used, or will it be necessary to draw up special purpose accounts?

- For how long will the preparing party have to prepare and circulate its earn-out calculations to the other party?

- Applicable accounting framework adopted

Seller Representative

- If there are several sellers, consider including a provision in the SPA appointing one seller as the sellers’ agent with authority to exercise on their behalf all the sellers’ rights concerning the review and agreement of the earn-out calculation

2.9 Drafting Issues

- Easily identifiable metric

-

- Performance metric should be straightforward with less chances of manipulation

- Revenue or EBITDA linked performance generally preferred

- Include a right-to-audit clause, providing full access to the accounts and set out the frequency of such procedures

2.10 Determining a suitable structure

- To address tax and regulatory issues, delinking the earn-out component from the transfer of asset, could be explored – subject to commercial feasibility

- Option of structuring earn-outs as an employment linked payment or service fee could be explored – subject to ability to demonstrate “substance” in such arrangements

- Agreements to be carefully drafted to ensure intended tax outcome

- Valuation norms to be complied with in each case. Disproportionate or differential pricing structures to be supported by commercial rationale

- The transaction structure to be backed by commercial reasons and not driven primarily by tax reasons

3. Conclusion | Key Takeaways

- Risk Allocation – Risk allocation between the parties has always been the most significant aspect of any M&A deal. The sellers and buyers should accept purchase price adjustment and earn-out structure to bridge any valuation gap.

- Contractual Provisions – Watertight contractual provisions governing the mechanisms related to purchase price adjustment and earn-out structure should be included in the transaction documents to avoid issues at the time of implementation and ensure clear tax treatment.

- Involving Experts – Expert legal and tax advice should be taken to ensure that the provisions meet the regulatory requirements as well as are carefully thought through to protect the interest of transacting parties.

- Integration & Customization – Every contract has different specifications and circumstances. The extent and need of price adjustments and/or earnouts must be determined on a case–to–case basis.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA