Key Considerations for Foreign Companies while Setting Up a Presence in India

- Blog|CS|Advisory|Income Tax|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

- How are Foreign Enterprises Taxed?

- Modes of Establishing Presence in India

- Permanent Establishment (“PE”) Risk

- POEM Risk – Tax Residence of Foreign Company in India

- Anti-Avoidance Rules

- Key Takeaways

1. How are Foreign Enterprises Taxed?

- Foreign Enterprises are taxed on their business income earned from India at the rate of 40% (plus applicable surcharge and cess) on net basis if the foreign enterprise carries out its business in India through a fixed base or a PE – where a Tax Treaty exists between India and country of Residence of the Foreign

- Where no Tax Treaty exists:

- Concept of ‘business connection’ – which is wider that the concept of PE under India’s Tax Treaties

- Significant Economic Presence – ‘Digital Tax’

- Foreign Enterprises are also subject to Indian withholding taxes at applicable rates for the following Income streams

- Royalties

- Fee for technical/Included services

- Interest

- Capital Gains

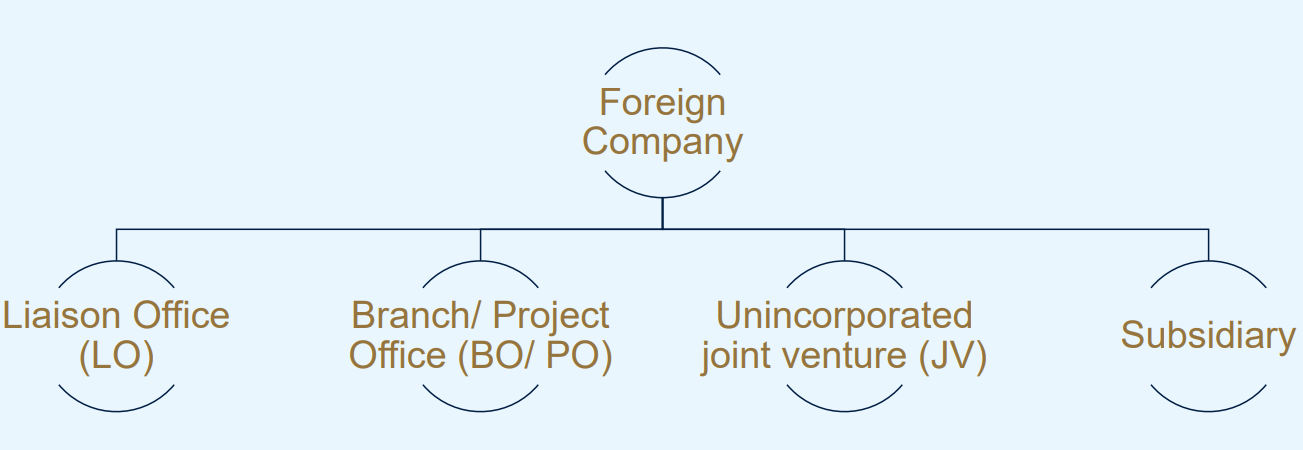

2. Modes of Establishing Presence in India

2.1 Liaison Office (LO)

- An extension of the foreign company, akin to representative office – good tool to

test waters - Easy to set up – Low min. capital requirement & profit making track record in immediately preceding 3 years

- Set up under express approval from RBI. Can carry out only permitted activities. Cannot carry out business activities

- Permitted activities – typically preparatory & auxiliary

- Permanent Establishment risk if scope of activities exceeds permitted activities, in such case TP will also apply

2.2 Branch/Project Office

- An extension of the foreign company – PE

- Set up under express approval from RBI. Can carry out only permitted business activities – usually similar to the HO

- Dependent on receipts from HO and business activities carried out it India – can also remit profits to HO

- Transfer Pricing Regulations apply on all transactions between the HO & BO/PO – Arm’s length criteria

3. Permanent Establishment (“PE”) Risk

3.1 What is a PE?

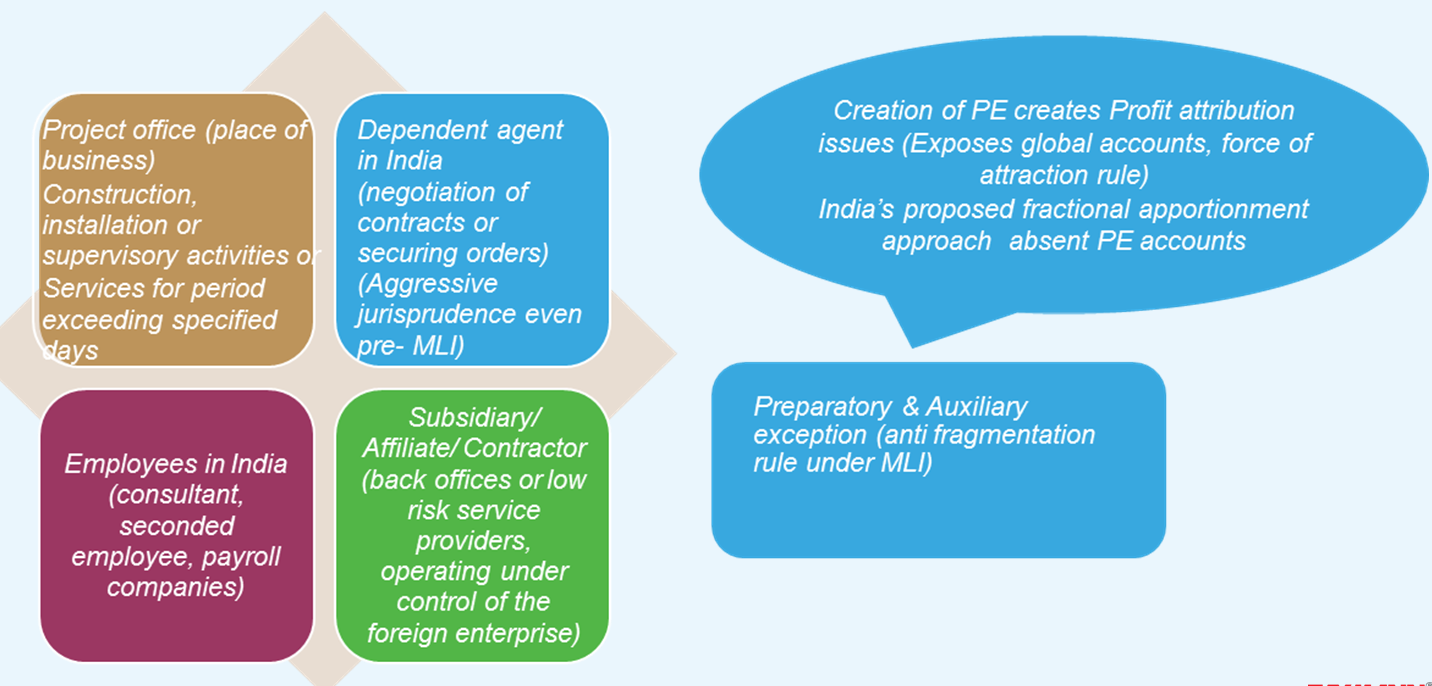

Very broadly, PE is the minimum threshold of ‘physical presence’ that a foreign enterprise must meet in the source country to be subject to taxes there (say, India) in respect of its business income. Typically, a PE may arise in India if:

- A foreign enterprise has a fixed place of business in India (branch, project office, warehouse, place of management, workshop);

- A foreign enterprise has employees present in India for significant durations rendering services on its behalf or undertaking other business activities; and

- A foreign enterprise has a dependent agent in India who negotiates or concludes contracts in India or secures orders in India on its behalf

Once a foreign enterprise sets up a PE in India, it will need to maintain separate books of accounts in India for such PE for purposes of tax payment and audit.

In case a PE is created, profits of the foreign enterprise that are attributable to the Indian PE are subject to Indian taxes at 43.68%.

3.2 Factors that can give rise to a PE

3.3 Managing PE Exposure

| Do’s | Don’ts |

| Remunerate contractor at arm’s length to prevent any additional attribution (transfer pricing study recommended) | Contracts, correspondence and conduct should not indicate the authority to negotiate or conclude contracts |

| Clear demarcation of roles & responsibilities, and risks & rewards with the contractor | Social media references, official and networking websites and business cards should not allude to a PE |

| Monitor employees duration of stay for service PE & fixed place PE thresholds – use secondment structures where applicable | Close intra- group interdependence should not blur the identity of individual entities (including Indian contractor and foreign enterprise) to third parties |

| Control on contractor restricted to stewardship activities | Visiting employees should not have any fixed place or room at any premises at their disposal |

Exploring appropriate secondment structures?

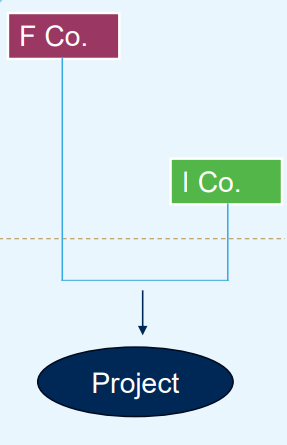

3.4 Unincorporated JV & AOP risk

3.4.1 What is an AOP?

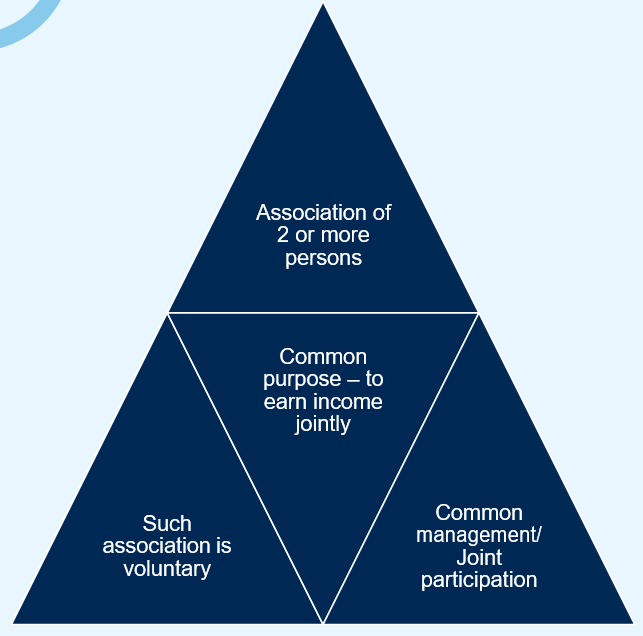

An association of persons or an AOP is a separate taxable entity recognized under tax laws. When two or more persons combine to undertake a joint enterprise with commonness of purpose, risks and rewards, they may be treated as an association of persons or AOP under the IT Act.

3.4.2 Why is AOP a risk for unincorporated JV’s?

An AOP is considered to be tax resident in India in any previous year, in every case, except where during that year the control and management of its affairs is situated wholly outside India.

As such, in case the control and management of the affairs of the AOP is even partially situated in India at any time during the relevant tax year, by virtue of I Co participating in the decisions that concern control and management of the affairs of the AOP from India, the AOP may be classified as a tax resident of India.

3.4.3 Tax Treatment

In case an AOP is treated as an Indian tax resident, entire income of the AOP (, i.e., income of both F Co and I Co), net of deductible expenditure, would be taxed in India in the hands of AOP. Further, since AOP is treated as a tax resident of India , the provisions of Tax Treaty will not be applicable.

As such, the AOP’s income (to the extent of I Co’s share) will be taxed at the maximum marginal rate of 42.744% and AOP’s income (to the extent of F Co’s share) will be taxed at 43.68% applicable to foreign companies under the IT Act.

3.4.4 Attributes of an AOP

3.4.5 When will AOP not come into existence?

- Independence & separation in roles, responsibility, use of resources, costs incurred, risk & rewards

- Each member earns profit or incurs losses, based on performance of the contract falling strictly within its scope of work.

- The resources and materials used for any area of work should be under the risk and control of respective members.

- Control & management should not be unified (except for coordination)

3.5 Subsidiary

- Separate legal entity – taxed at corporate tax rates applicable to domestic company

- Ring fencing of PE risk – No default PE, unless factors creating a PE under the relevant tax treaty are present

- Can carry out business operations & generate business income

- Repatriation of profits permissible – Dividend, interest, royalty, FTS

- Transfer Pricing regulations apply to all transactions between the Foreign company & the Indian subsidiary

- Thin capitalization norms applicable

4. POEM Risk – Tax Residence of Foreign Company in India

4.1 Residence Risk – POEM

- Please note that a foreign company can be treated as an Indian tax resident if its place of effective management (“POEM”) is in India. As a result thereof, the global income of the foreign company could be subject to tax in India per the provisions of the IT Act and the benefits, if any, under the applicable tax treaty can be denied.

- POEM is defined under the IT Act to mean a place where key management and commercial decisions necessary for the conduct of the business of such foreign company, as a whole are, in substance made. Further, the POEM test is applied each year to a foreign company to ascertain its residential status for Indian tax purposes.

- Additionally, note that POEM test shall not be applicable for a foreign company so long as its total turnover or gross receipts in any financial year does not exceed INR 500 million.

- For a foreign company having active business outside India (“ABOI”) – POEM presumed to be outside India if majority of board meetings take place outside India. However, if the board is standing aside, and key decisions are taken by Indian affiliate, POEM will be in India (cases where the board is merely following a group policy in re HR, IT, accounting etc. are not covered).

4.2 Residence Risk – POEM – ABOI Criteria

- Passive income (interest, dividend, royalty, FTS, intra- group sales, etc.) is less than 50% of total income

- Assets in India are less than 50% of total assets

- Employees situated or resident in India are less than 50% of total employees

- Payroll expenses on such employees is less than 50% of total payroll expenses

4.3 Jurisdictional Analysis

| Particulars | Domestic tax law | US | Singapore | Mauritius | Netherlands | UAE |

| Dividend | 21.84% | 15% (if more than 10% of the voting power is held by a US company).

25% in any other case. |

10% (if 25% or more of the shares are held by a Singapore company). 15% in any other case | 5% (if more than 10% is owned directly by a Mauritian company).

15% in any other case. |

10% | 10% |

| Interest | 5.46*%-43.68% | 15% | 15% | 7.5% | 10% | 12.5% |

| Royalties/FTS | 21.84% | 15%, (restricted scope of FTS due to make available clause) | 10%, (restricted scope of FTS due to make available clause) | 15% for royalties; 10% for fee for technical services | 10% (restricted scope of FTS due to make available clause) | 10% Fee for technical services are not taxable in India (unless UAE resident has a PE in India) |

| Capital gains on sale of shares and/securities in Indian company | Taxable | No benefit | India can tax sale of shares in an Indian company.

India’s taxation rights restricted in case of transfer of other financial instruments, such as debt securities. |

Same as Singapore. | Sale of shares to a non-resident purchaser not taxable in India.

In case of sale of shares to an Indian resident, transaction is taxable only if more than 10% stock is sold. Separate rules apply if the Indian company derives its principal value from immovable property. |

Same as Singapore. |

* The IT Act also allows for reducing the cascading effect of taxes on dividends by providing a deduction of an amount equal to the dividend received from a domestic or foreign subsidiary to the extent of the dividend declared by the domestic company prior to the due date for filing its ITR

**5% rate is available in case of long term infrastructure bonds, rupee denominated bonds (4% rate applicable where such bonds are listed on IFSC, ECB, Govt. bonds and securities issued to FII/QFIs etc.

– Not available July 1, 2023 onwards.

4.4 Forms of business entities

Direct Presence

| Liaison office | Branch office | Project office | |

| Purpose | Akin to a representative office – cannot engage in business activities. | Set up as on office of the foreign enterprise | Set up for a specific project |

| Taxability | Not a taxable presence under the preparatory and auxiliary exception | Taxed as a PE | Taxed as a PE |

- No branch profits tax in India

- No ring fencing of Indian operations in case of direct entry

- Approval route under exchange control laws

- Direct entry may create a permanent establishment (PE) in India. Business profits attributable to PE taxed at 43.68% (inclusive of applicable surcharge & cess)

Separate taxable entity

| Subsidiary | Unincorporated joint venture | |

| Ordinary tax rate | (A) Applicable CIT rate if tax holidays/deductions are not opted:

(B) Applicable CIT rate if tax holidays/deductions are not opted:

|

Taxed as a separate taxable entity “association of persons” (AOP) except in certain circumstances.

If shares of members determinate – tax rates applicable to members Indeterminate share – maximum marginal rate (35.88%) |

| WHT on Dividends | Taxable in the hands of shareholders.

WHT at 10.92% on dividends (subject to tax treaty relief in India) in case of resident shareholders and 21.84% in the hands of non-resident shareholders |

No distribution tax |

| PE risk | Ring fenced – as separate legal entity – No presumption of PE as against direct presence unless other ingredients present | PE risk may arise if employees of foreign company visit India for prolonged durations to carry out business activities |

| Liability of shareholder/member |

Shareholder not personally liable for taxes of the company (directors may be liable in case of gross neglect or misfeasance) |

Members personally liable for taxes of LLP in case of nonrecovery |

| Certainty in tax treatment |

Established tax jurisprudence | Less certainty in comparison to a company |

A subsidiary in the form of a company preferred choice –greater acceptance by banks, financial institutions & government bodies floating tenders

No straight jacket formula

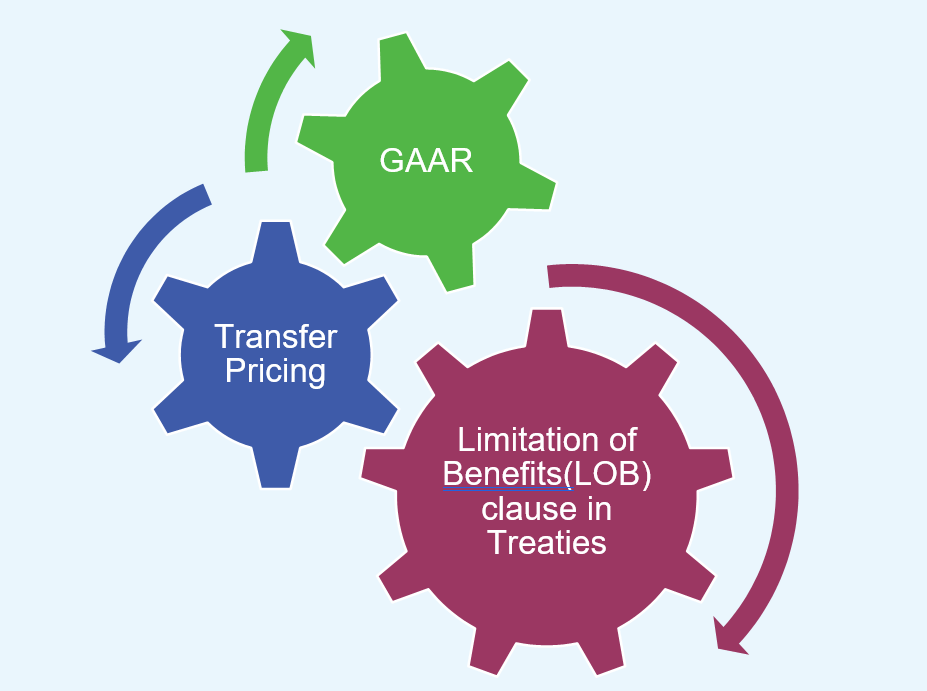

5. Anti-Avoidance Rules

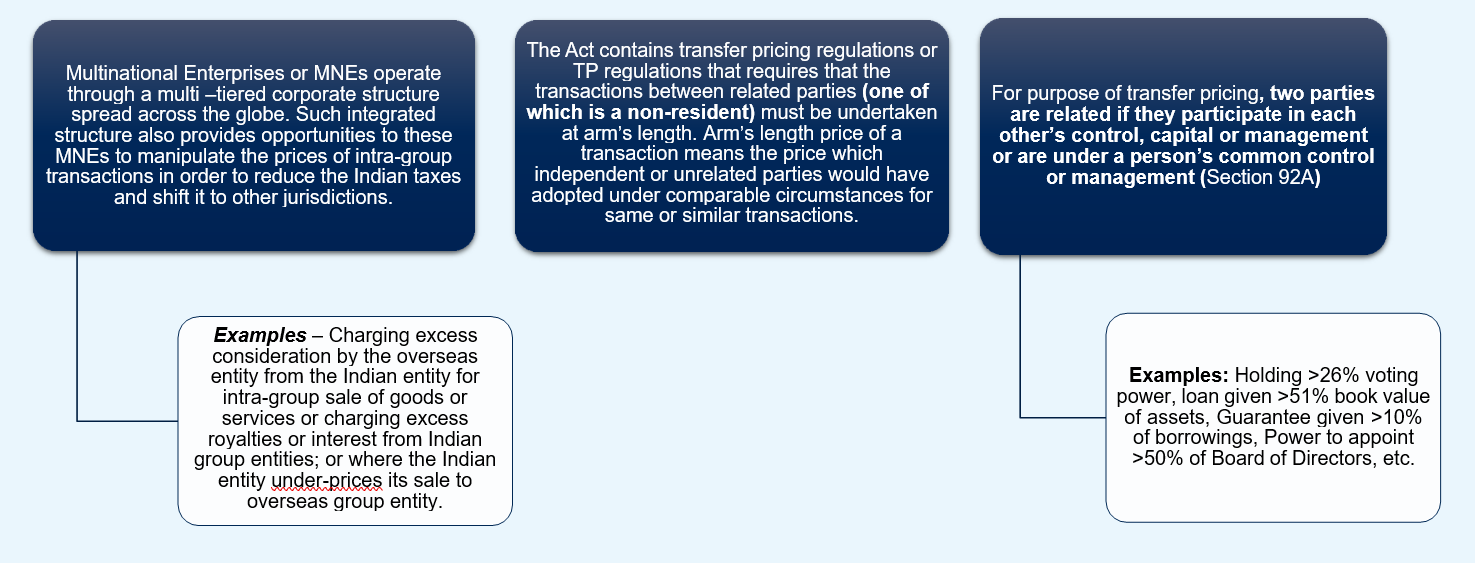

Transfer pricing regulations

- Include secondary adjustments

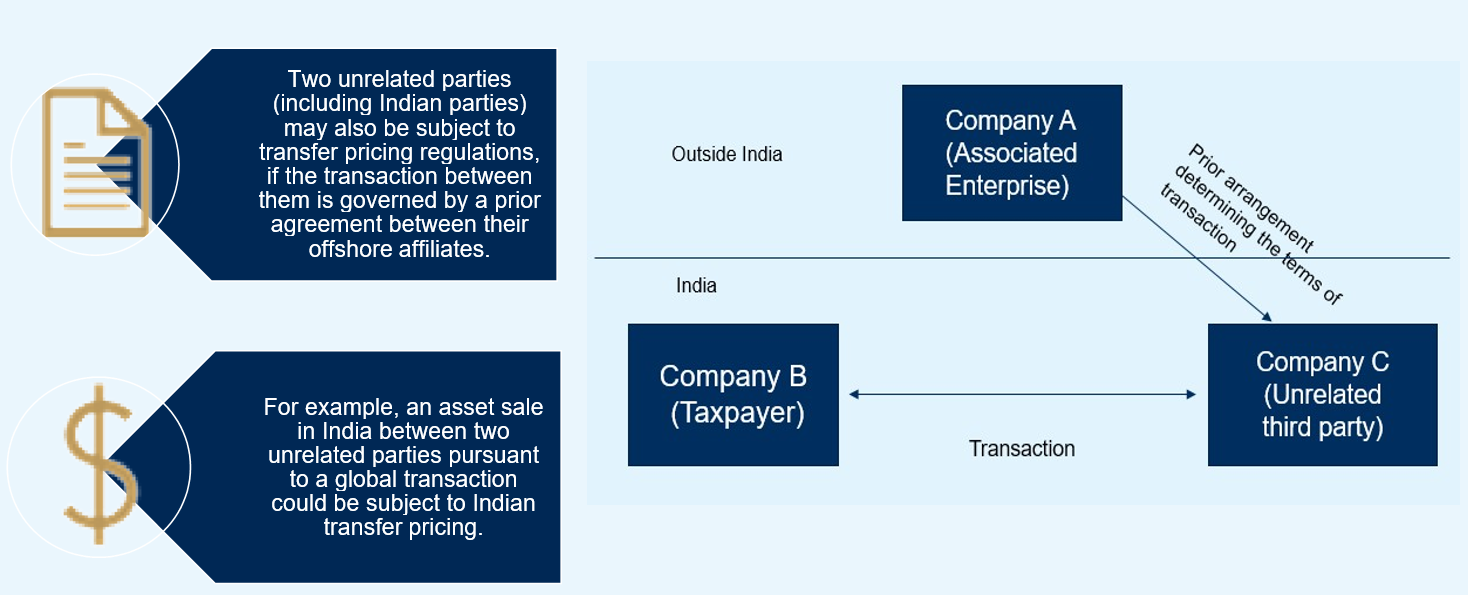

- Concept of deemed international transaction

- Mandatory annual reporting of related party transactions

- Bilateral and unilateral advance pricing arrangements and safe harbor rules available

Thin Capitalisation norms

- Disallowance of interest expense in excess of 30% of EBITDA

- Carry forward of disallowed interest expense permitted for 8 years

General anti-avoidance rules

- Codifies substance over form doctrine

- Broad powers to re-characterize transactions lacking commercial substance

- Currently untested

5.1 Anti-Abuse Rules

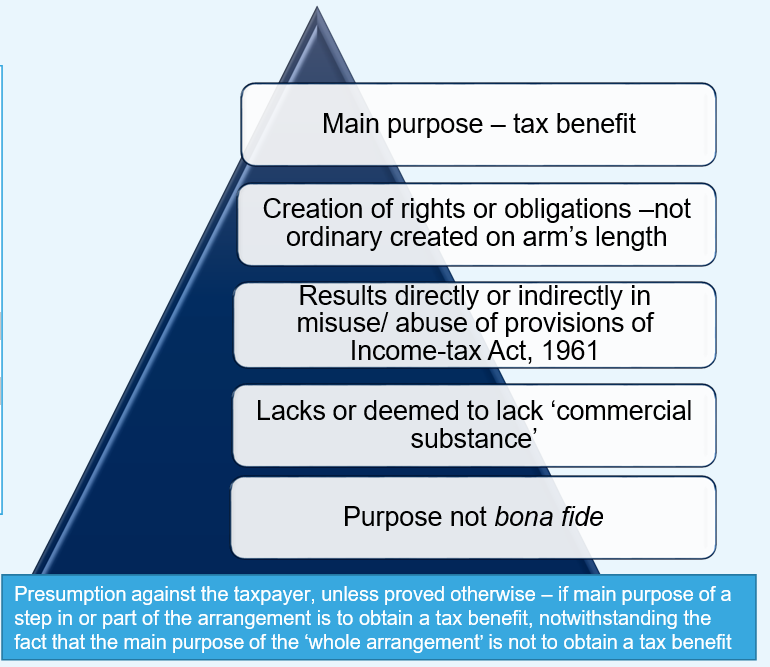

5.2 General Anti-Avoidance Rules (GAAR)

Applies to:

- An ‘Impermissible Avoidance Arrangement

- Assessment Year 2018-19 onwards

- Provisions apply even to a step in or part of the arrangement

- Provisions apply in addition to any other basis of determination of tax liability

- Threshold – tax benefit arising, in aggregate, to all the parties to the arrangement does not exceed INR 3 crores (30 million)

- A tax benefit obtained from the arrangement on or after April 1, 2017, irrespective of when the arrangement is entered into;

Note: Tax benefit includes – reduction, avoidance or deferral of tax, as defined.

5.3 GAAR – To override Tax Treaty claim

An Arrangement is deemed to lack commercial substance if:

- The substance or effect of the arrangement as a whole is inconsistent or differs significantly from, the form of its individual steps; or it involves or includes—

(a) round trip financing;

(b) an accommodating party;

(c) elements that have effect of offsetting or cancelling each other; or

(d) a transaction which is conducted through one or more persons and disguises the value, location, source, ownership or control of funds which is the subject matter of such transaction; or

- it involves the location of an asset or of a transaction or of the place of residence of any party which is without any substantial commercial purpose other than obtaining a tax benefit; or

- it does not have a significant effect upon the business risks or net cash flows of any party to the arrangement apart from any effect attributable to the tax benefit that would be obtained.

Factors that are not relevant:

- Period or time for which the arrangement exists;

- Fact of payment of taxes directly or indirectly under the arrangement;

- Fact that an exit route (including any transfer of activity or business or operations) is provided by the arrangement

5.4 Transfer Pricing

5.4.1 Domestic Transfer Pricing

TP may be applicable between purely domestic entities, if any entity claiming specified tax holidays and aggregate to related party transactions >INR 20 crores in a financial year.

Because of transfer pricing, if intra-group transactions are not at arm’s length price, the difference between arm’s length price and transfer price may be imputed as income or disallowed as a tax expense, as the case may be, and taxed in India.

5.4.2 Deemed transfer pricing

6. Key Takeaways

- Form of business presence – direct entry or setting up of legal entity should be evaluated on a case to case basis based on business objectives

- Right blend of repatriation mechanics to strike a balance between tax efficacy (in India and abroad) and exposure to anti avoidance rules

- Structuring of investments for exit tax efficacy should meet GAAR commercial substance test

- Any continued business interaction with India, directly or through contractors or consultants, should be vetted for PE exposures

- Secondment structures should be carefully implemented to pass the test of integration

- Indian tax authorities aggressive on source based taxation – all receipts emanating from India should be vetted for withholding tax exposures

- Global reorganization and business acquisitions with Indian assets and business interests need to consider Indian tax implications

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA