Key Amendments Impacting NGOs, Exemptions, and Compliance

- Blog|Income Tax|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 2 September, 2024

The Union Budget 2024 introduces several key amendments affecting NGOs, exemptions, and compliance requirements. A gradual merger of two exemption regimes under Sections 10(23C) and 12AA/AB will begin from October 1, 2024, allowing a shift to a unified approval process. New provisions give the CIT (Exemption) the power to condone delays in applications for registration and renewal under Section 12AB. Amendments in Section 80G now allow NGOs to reapply for approval, although similar flexibility isn’t extended for initial 12AB registrations. Changes to capital gains provisions now restrict companies from gifting capital assets to charitable trusts without incurring tax liabilities. Updates to Form 10B/10BB reporting introduce stricter compliance, including the correct use of forms and revisions to reporting timelines and criteria, with new audit and reporting requirements in ITR-7 for the assessment year 2024-25. These changes aim to streamline processes but also introduce new compliance challenges for NGOs.

By Dr Manoj Fogla – Advocate, Suresh Kumar Kejriwal – Chartered Accountant & Tarun Kumar Madaan – Faculty | Taxmann Academy

Table of Contents

- Union Budget 2024 Amendments

- Gradual Merger of Two Exemption Regimes

- Other Amendments in Section 11 to 13

- Amendment in Relation to Section 80G

- Other Amendments Affecting NGO Sector

- Key Issues in Reporting in Form 10B/10BB

- Changes in ITR-7 for AY 2024-25

1. Union Budget 2024 Amendments

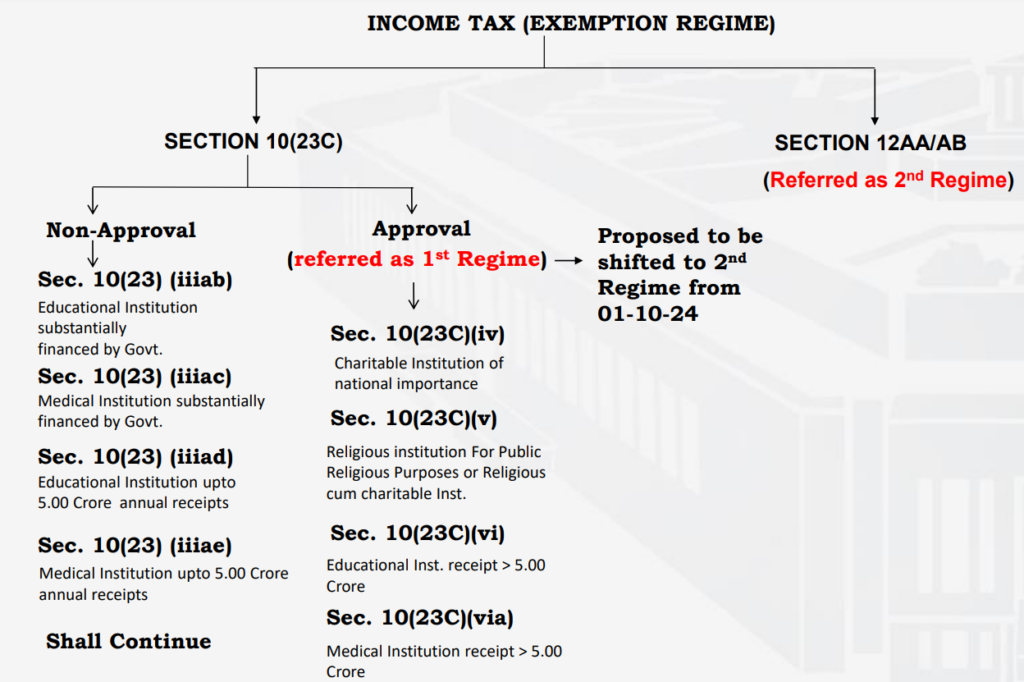

2. Gradual Merger of Two Exemption Regimes

Section 10(23C)

Approval (1st Regime)

Process of Shifting shall start from (01-10-24)

- Application for approval to be made before 01/10/2024

- CIT to consider application only made on or before 01/10/2024, and,

- New proviso inserted providing no approval for application submitted on or after 01/10/2024

Implications

- Non-approval category to continue

- Application can be submitted upto 30/09/2024 under the 1st regime and therefore shifting is gradual and shall last up to AY: 2029-2030. ( New approval for five year having validity from 2025-26 to 29-30)

- The application on or from 01-10-2024 for conversion of provisional approval & renewal shall be made under 2nd regime.

Section 12AA/AB

(Referred as 2nd Regime)

Consequential Changes ( w.e.f 01-10-24)

- Enabling amendment for renewal and for converting provisional approval to regular ( section 12A(1)(ac) (ii) & (iii)

- Section 13(1)(d) proposed to be amended to include certain specified mode of investment as per Section 10(23C) ( voluntary contribution received in the fom of jewellery, furniture etc)

Case Studies

- How to regularize provisional approval u/s 10(23C) on or after 01-10-2024?

- Whether a 10(23C) approved entity can modify its object without the approval of CIT (exemption)?

- Whether voluntary contribution received in the form of Jewellery can be retained by a 12AB registered entity?

3. Other Amendments in Section 11 to 13

3.1 Much Needed Condonation of Delay Power to CIT(E) for 12AB

Pre-amended Position:

- The application for registration u/s 12AB by an existing registered entity as on 1-04-21, renewal of registration, converting provisional registration to a regular registration etc. has a specified timeline.

- Applications made beyond the timeline are subject to exit tax and other implications.

- In the absence of any window for condoning delay with CIT (Exemption), litigation has increased to get appropriate relief.

Amendment (with effect from 1-10-2024):

- New Proviso inserted in section 12A(1)(ac) giving power to CIT (Exemption) to condone the delay in submitting an application under section 12A(1)(ac)(i to vi) if he considers that there is a reasonable cause for the same.

Implication:

- This is a welcome provision as it will reduce litigation.

- However, no such condonation power has been given for 80G approval.

3.2 Key Issue: For Which Registration Category Can a Condonation Petition Be Filed?

The amendment has been made granting the condonation power to the CIT(E). For all category of registration i.e.,

- Re-registration: Trust/institution registered under section 12A or under section 12AA before 01-04-2021

- Renewal: Trust registered under section 12AB and the period of the said registration is due to expire

- Conversion of provisionally registration: Erred under section 12AB to be converted to normal

- Operative: Registration of trust has become inoperative due to approval under section 10(23C) or notification under Section 10(23EC)/10(46)/10(46A)

- Modification in object: Trust has adopted or undertaken modifications of the objects which do not conform to the conditions of registration

- New Cases: where activities have not been commenced and where activities have commenced

3.3 New Section for Merger of Charities: Section 12AC

Pre-amended Position:

- Presently, there is no provision dealing with mergers and amalgamations of charitable trusts.

- Section 115TD may be attracted in certain merger cases in specified situations.

Proposed Amendment: with effect from 01-04-2025 (AY 2025-26)

- A new Section 12AC has been inserted. It provides for the merger of one registered charitable trust: with the trust having the same or similar object, the other trust is registered/approved and fulfils such conditions as may be prescribed.

Implication:

- Section 115TD already exempt such merger 115TD(1)(b). Hence, the proposed insertion is the re-affirmation.

- One needs to wait for conditions to be prescribed.

- One also needs to refer to the law under which the entity is constituted/registered/incorporated and the state laws as applicable.

Case Studies:

- Period of delay which may require explanation for re-registration or conversion of provisional?

- When can a condonation petition be submitted?

- Can applications for five-year registration still be made by entities whose registration expired on 01-04-2021?

- The condonation power has not been granted for 10(23C) approval and 80G approval: How far this is reasonable and what shall be its implications?

- Whether non-approval category under Section 10(23C) entities can merge with a 12AB registered entity?

4. Amendment in Relation to Section 80G

4.1 Window to Get 80G Approval Which Is Not Available Under 12AB

Pre-amended Position:

- From; 1-04-2023, No new application for 80G if the organization has taken benefit of Section 12AB/10(23C) in any Previous Year before making such application.

- As a result most of the NGOs were not able to apply for 80G and therefore not eligible to raise CSR and other Fund.

Amendment: w.e.f 01-10-2024

- in sub-clause (B), the portion beginning with the words “and where no income or part” and ending with the words “such application,” shall be omitted;

(B) commenced and where no income or part thereof of the said institution or fund has been excluded from the total income on account of applicability of sub-clause (iv) or sub-clause (v) or subclause (vi) or sub-clause (via) of clause (23C) of section 10 or section 11 or section12 for any previous year ending on or before the date of such application, at any time after the commencement of such activities:]

Hence after the amendment sub-clause (B) reads as follows:

(B) commenced at any time after the commencement of such activities:

Implication:

- Now, the entity can apply for 80G approval anytime provided they satisfy the conditions of 80G(5).

- However, similar window has not been given for applying for the first time for a 12AB registration in case where charitable activities has commenced. Hence limited benefit of this amendment.

Case Study

- Whether approval under section 80G can be applied again even after cancellation of approval?

- As similar amendment of deleting the condition of no exemption has not been provided for 12AB, What shall be its impact both on 12AB and 80G?

5. Other Amendments Affecting NGO Sector

5.1 Corporate Gift of Capital Assets to Charities to Attract Capital Gain

Pre-amended Position:

- Section 47(iii) provides “any transfer of capital asset by way of a gift or an irrevocable trust shall not be considered as a transfer for capital gain purpose”.

- As a result, a number of companies could transfer its capital asset to an irrevocable charitable registered trust without attracting any capital gain.

Amendment: with effect from the assessment year 2025-26

- It was mentioned that the gift can only be out of natural love and affection, and therefore, section 47(iii) has been amended and to include only “any transfer of capital asset by an individual, HUF under a gift or will or an irrevocable trust”

Implication:

- The transfer for charitable purposes is not out of natural love and affection but towards the social cause. Therefore rationale is not justified for the transfer of capital assets by companies as a gift for charitable purposes to a registered entity

6. Key Issues in Reporting in Form 10B/10BB

6.1 Key issues for audit in Form 10B & 10BB

6.1.1 Not using the correct form shall lead to withdrawal of exemption:

- Rule 16CC & 17B prescribed the form of audit report based upon the income criteria & some other specific conditions.

- It is clarified by CBDT vide Circular 02/2024 dt. 05/03/2024 that non-furnishing of audit report in the prescribed form would result in withdrawal of exemption & one-time window was given to rectify this mistake for AY 2023-24 on or before 31/03/2024.

- Common issues observed during last year: Considering the interest income from FC & treatment of corpus grant for determining the form to be used etc.

6.1.2 No clarity on revision in Tax Audit Report :

- Unlike Rule 6G(3) for audit u/s. 44AB, no such revision power has been made as given in Rule 16CC & 17B to revise the audit report

- However, the Income Tax portal provides the option to revise the audit report.

- It is not clear in case the reports are revised, the date of submission shall be considered to be the date of original submission or the date on which the revised Audit report in 10B/10BB was submitted.

6.1.3 Same form 10B/10BB for both the regimes & therefore, precaution is required as compliances are not exactly similar:

- It is to be noted that same form has been prescribed for the 1st and 2nd regimes.

- It is to be further noted that 1st regimes are not under the similar compliance with that of

2nd regime & therefore certain clauses are not applicable for entity under 1st regime i.e. in form 10BB, for example:

Clause 19 – Application outside India

Clause 23, 17 – Amount deemed to have been applied (Form 9A)

Clause 30(c) – Wherein any part of the income is applied to benefit of specified person - Certain clauses in Form 10B i.e.

Clause 17 – As per Sec. 11(4)

Clause 35(a), 36 – Details of capital assets under sub-section 11(1)(a), etc.

6.1.4 Applicability of circular 6/2023 on the Time line to submit form 9A & form 10:

The timeline to submit Form 9A and Form 10 was amended to be : two months before the due date of submitting the Return. w.e.f 1-04-23 [ Refer exp 1 to section 11(1) & section 11(2 (c)]

However:

- section 13(9) continues to provide that the benefit of accumulation under section 11(2) shall be given so long as form 10 is submitted on or before the due date of furnishing return of income

- Rule 17(1) for submission of form 9A and Rule 17(2) for submission of form 10 continues to provide to submit the form within the due date of furnishing return and not within two months of furnishing return.

- At the same time representation were made the form 9 and 10 can be submitted only when the audit of the accounts are finalised and not earlier.

Circular 6 of 2023 dt 24th May, 2023 has clarified by providing –

“15. It is clarified that the statement of accumulation in Form No. 10 and Form No. 9A is required to be furnished at least two months prior to the due date of furnishing return of income so that it may be taken into account while auditing the books of account. However, the accumulation/deemed application shall not be denied to a trust as long as the statement of accumulation/deemed application is furnished on or before the due date of furnishing the return as provided in sub-section ( I) of section 139 of the Act.”

However, we understand the act should be amended to provide what is intended by the corresponding section and Rules as clarified by Circular 6.

6.1.5 Applicability of circular 17 of 2023 on Details of the person making a substantial contribution during the previous year:

Form No.10B/10BB requires details of a person making substantial contributions exceeding Rs 50000/- whereas ITR 7 requires the details of contributions received exceeding Rs.50,000/- during the previous year.

To remove this anomaly, Circular 17 of 2023 dt. 09/10/2023 clarify as follows:

“3. The matter has been examined with reference to the issue raised in paragraph 2 and it is hereby stated that for the purposes of providing details in (i) Form No. 10B in the Annexure, in row 41 and (ii) Form No. 10BB in the Annexure, in row 28, for assessment year 2023-24:

The aforesaid details (that is, of persons making substantial contribution) may be given with respect to those persons whose total contribution during the previous year exceeds fifty thousand rupees;

Details of relatives of such person, as referred to in (a) above may be provided, if available. Details of concerns in which such person, as referred to in (a) above, has substantial interest may be provided, if available.”

However, again as the above circular specifically mentions that it is for AY 2023-24 and therefore, it is required that necessary clarification to be given that this shall also apply for AY 2024-25 and subsequent assessment year as the anomaly in between ITR 7 and form 10B/10BB still continues.

6.1.6 In consistency of From 10B & 10BB with ITR : inter-charity donation

| Particulars | FACT | As per I. Tax Act, 1961 | As per Form 10B | As per ITR 7 | Remarks |

| Income | 30 | 30 | 30 | 27 | total income less 15% of intercharity donation (30-(15% of 20))i.e 30-3=27 |

| Less: Inter-charity donation(85% of donation) | 20 | 17 | 17 | 17 | |

| Less: Other expenses | 7 | 7 | 7 | 7 | |

| Application | 27 | 24 | 24 | 24 | Same no change |

| Available Surplus | 6 | 6 | 6 | ||

| Less: Statutory Accu. upto 15% | 4.5 | 4.5 | 1.5 | 15% of income — 15% of intercharity donation (i.e 15% of 30 minus 15% of 20) ) i.e 4.5-3 |

|

| Surplus subject to tax or option/accumulation | 1.5 | 1.5 | 1.5 |

Note: No clarity why income & statutory accumulation are reduced by 15% of the Inter charity donation in ITR

6.1.7 In consistency of From 10B & 10BB with the Income Tax Act: Inter-charity donation, Requirement of Tax Audit Report u/s. 44AB

6.1.8 The amount of income needs to be certified on the basis of Income & Expenditure A/cs which are prepared on conventional basis.

6.1.9 Issues of double addition & how to report the same. Like 30% disallowances due to non-TDS and 100% disallowances of some expenses if the payment is made in cash.

6.1.10 No. of subjective issues requiring certification like specified violation, benefit to specified persons, etc.

Hence it is very much important the audit report should be finalized by inserting:

- Auditors’ Responsibilities & Management Responsibilities

- Observations, Clarifications & disclaimer for appropriate clauses

- Management Representation Letter should be obtained from the auditee

Case Studies

- How to consider the FC interest in case of an organisation has only interest on FC fund?

- How to disclose the same while submitting ITR 7 and Form 10B?

- What shall be the treatment of corpus donation while determining the applicability of the prescribed form?

- How to finalise Form 10B for inter charity donation so that there is no inconsistency Audit Report & ITR?

7. Changes in ITR-7 for AY 2024-25

7.1 Amendment in ITR 7

Insertion of new clauses for better compliance check (Four Key changes )

- Furnishing of acknowledgement number of the Audit Report with UDIN

- Reporting of exempted portion of Anonymous Donations (under VC)

- Reporting of income against which exemptions are not available

- To specify the reason for specific violation for applicability of section 13(10) & 13(11).

Insertion due to amendment made by Finance Act, 2023 (Three Key changes )

- Application out of corpus & loan on or after 1-04-21)

- Reporting of Inter-Charity Donations

- Details of filing Form 10 for accumulation of income for 10(23C) approved cases

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA