Issuance of Debentures in accordance with Companies Act

- Blog|Company Law|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 19 September, 2023

Table of Contents

1. Creation of Security Interest

1.1 Nature of assets on which charge is to be created

1.2 Exception from creation of security interest

2.1 Instances of modification of charge

2.2 Timelines for registration

2.4 Substantive rights of the creditors

2.5 Shift in priority from the date of creation to date of filing

2.6 Scheme for relaxation of time for filing forms related to creation or modification of charges

3. Debenture Redemption Reserve (DRR) and Debenture Redemption Fund (DRF)

3.1 Maintenance of DRR – Pre-amendment

3.2 Maintenance of DRR – Post-amendment

3.3 Maintenance of DRF – Pre-amendment

3.4 Maintenance of DRF – Post-amendment

3.5 Applicability of DRR and DRF provisions in a nutshell

4.1 Events resulting in redemption

4.3 Early redemption (with the consent of the debenture holders)

4.4 Exercise of Call Option by Issuer

4.5 Exercise of Put Option by investor

4.6 Pursuant to trigger of event of default

4.7 Consequence of default in terms of a debenture

5. Amendments proposed in Companies (Amendment) Bill, 2020

5.1 Definition of listed entity

5.2 Penal provision for non-compliance of order of Tribunal

Checkout Taxmann's Law & Practice Relating to Corporate Bonds & Debentures which provides comprehensive commentary on law relating to Corporate Bonds and Debentures

Issuances of the debentures by companies are subject to various requirements under the Companies Act, 2013 (CA, 2013). The compliance requirements under the CA, 2013 can be segregated into three parts –

(a) compliances which are common for all types of issuances,

(b) companies which are specific to private placement of debentures, and

(c) compliances which are specific to public issue of debentures.

This article broadly discusses the following:

-

- Creation of Security Interest;

- Registration of creation/modification of charge;

- Appointment of Debenture Trustees;

- Maintenance of Debenture Redemption Reserve;

- Maintenance of Debenture Redemption Fund;

- Redemption of Debentures.

1. Creation of Security Interest

Debentures can be either secured or unsecured. Debentures can be secured by creating a charge against the property or asset of the Company or its Holding/Subsidiary/Associate, having value that is sufficient for the repayment of the NCDs and the interest due on them [Rule 18(1)(b) of SHA Rules]. Creation of security interest enables the debenture holder to exercise right as a secured creditor.

1.1 Nature of assets on which charge is to be created

The security for the debentures by way of a charge or mortgage is required to be created in favour of the debenture trustee on [Rule 18(1)(d) of SHA Rules]:-—

i. any specific movable property of the company or its holding company or subsidiaries or associate companies or otherwise; or

ii. any specific immovable property wherever situate, or any interest therein.

In case of NBFCs, it is difficult to have specific or identifiable movable property as the charge is created on the book debt or receivables. Therefore, in case of a non-banking financial company, the charge or mortgage under sub-clause (i) may be created on any movable property [Proviso to Rule 18(1)(d) of SHA Rules].

1.2 Exception from creation of security interest

In case of any issue of debentures by a Government Company which is fully secured by the guarantee given by the Central Government or one or more State Government or by both, the requirement for creation of charge shall not apply [Second proviso to Rule 18(1)(d) of SHA Rules].

In case of any loan taken by a subsidiary company from any bank or financial institution the charge or mortgage may also be created on the properties or assets of the holding company [Third proviso to Rule 18(1)(d) of SHA Rules].

1.3 Tenure

The tenure of secured NCDs can be upto 10 years [Rule 18(1)(a) of SHA Rules]. In other words the date of redemption of the NCDs should be within 10 years from the date of their issue.

However, the following categories of companies can issue secured NCDs maturing upto 30 years from the date of issue [Proviso to Rule 18(1)(a) of SHA Rules]:

i. Companies engaged in setting up infrastructure projects;

ii. Infrastructure Finance Companies:

Infrastructure Finance Company means a non-banking finance company which deploys at least 75 per cent of its total assets in infrastructure loans. [As per the definition provided under Para 2(1)(viiia) of Non-Banking Financial (Non-deposit accepting or holding) Companies Prudential Norms (Reserve Bank) Directions, 20071]

iii. Infrastructure Debt Fund NBFCs.

Infrastructure Debt Fund – Non-Banking Financial Company means a non-deposit taking NBFC that has Net Owned Fund of INR 300 crores or more and which invests only in public private partnerships and post commencement operations date infrastructure projects which have completed at least one year of satisfactory commercial operation and becomes a party to a tripartite agreement. [Para 3(b) of Infrastructure Debt Fund – Non-Banking Financial Companies (Reserve Bank) Directions, 20112]

Companies permitted by a Ministry/Department of the CG or RBI/NHB or other statutory authorities to issue debentures for a period exceeding 10 years.

2. Registration of Charge3

Creation of security interest results in creation of interest or lien on the assets of a company or any of its undertakings, the same is required to be registered with the RoC pursuant to provisions of section 77 (1) of CA, 2013. Any company acquiring the asset subject to charge is also required to be registered with the RoC [Section 79(a) of CA, 2013]. Any modification in the terms or conditions or the extent or operation of any charge registered under section 77 is also required to be registered with the RoC [Section 79(b) of CA, 2013].

The registration of charge can be done by the issuer company under section 77 or by the charge-holder, pursuant to provisions of section 78 of CA, 2013 in case of failure of the issuer company to register the charge.

Registration of charge is a conclusive evidence of creation of charge; acts as a notice to public at large regarding interest of the charge-holder in the charged property and any third party will be entitled to the property subject to the interest of the charge-holder.

2.1 Instances of modification of charge

-

- Modification in the amount of NCD raised under one shelf disclosure document;

- Further charge for the same amount of debentures issued, by way of additional security on different property;

- Release of a particular asset from the operation of the charge by reason either of part redemption of NCDs or otherwise;

- Addition of another creditor as charge-holder with or without any additional NCD;

- Change in the interest rate, tenure or terms of charge.

2.2 Timelines for registration

There has been a change in the timelines for registering the creation and modification of charge under CA, 2013 after November 2, 2018 post enforcement of C(A)A, 2017.

Every company creating/modifying a charge pursuant to issue of NCDs is required to file CHG-9 with the Registrar within 30 days from the date of creation/modification, as applicable. In cases of filing beyond the timeline of 30 days, the Registrar may, on an application by the Company, allow such registration to be made within a period of 60 days of such creation/modification on payment of such additional fees as provided in Table E of Para I of Annex to Companies (Registration Offices and Fees) Rules, 2014.

If registration is not made within a period of 60 days of such creation/modification, the Registrar may on an application allow such registration to be made within a further period of 60 days after the payment of such ad valorem fees as provided in Table E of Para I of Annex to Companies (Registration Offices and Fees) Rules, 2014.

The additional fees payable is as follows:

| Particulars | Date | Remarks |

| Date of creation | Feb. 1, 2020 | |

| Amount secured in INR | 1000 crores | |

| Upto 30 days | March 1, 2020 | No additional fees |

| More than 30 days and up to 60 days | March 2, 2020 to March 30, 2020 | Additional + ad valorem fees as per table below |

| More than 60 days and up to 120 days | March 31, 2020 to May 29, 2020 | Additional + ad valorem fees as per table below |

| Period of delay | Due Date in instant case | Additional Fee applicable (assuming normal fees of ` 600) in case of Small companies and One Person Companies | Additional Fee applicable (assuming normal fees of ` 600) in case of other than Small companies and One Person Companies |

| (1) Up to 30 days | March 2, 2020 to March 30, 2020. | 3 times of normal fees i.e. 1800 | 6 times of normal fees i.e. 3600 |

| (2) More than 30 days and up to 90 days | March 31, 2020 to May 29, 2020. | 3 times of normal fees | 6 times of normal fees |

| (a) Additional fees | 1800 | 3600 | |

| (b) Ad valorem fees | 0.025% of ` 1000 crores = ` 25 lakhs | 0.05% of ` 1000 crores = ` 50 lakhs | |

| Maximum Ad valorem fees | ` 1 lakh | ` 5 lakhs | |

| Actual fee payable | 1,01,800 | 5,03,600 |

Table: Additional fees payable in case of delay in registration

2.3 Filing with ROC

The Company will be required to file eForm CHG–9 with the ROC for creation/modification of charge on NCDs. The details of creation of the charge, appointment of debenture trustee will be required to be filled in the eForm along with other details. Certified true copy of the resolution authorizing the issue of the debenture series and the instrument containing details of the charge created or modified is to be mandatorily attached to this form. [Section 77 of CA, 2013].

No application under section 87 of Companies Act, 2013 can be made to the Regional Director to condone the delay for omission to file the form for creation/modification.

2.4 Substantive rights of the creditors

Registration of charge by companies in favour of the charge-holder is one of the most important requirements. This is because once companies register information pertaining to registration of charge, the information of such encumbered asset becomes available to public at large. Every person including any proposed creditors dealing with the asset of the Company is assumed to have knowledge of these encumbered assets. Charge filing is not merely a contract between the borrower and the lender but also with the world at large since the public relies on the data available based on charge filings. Accordingly, unregistered charges can affect substantive rights of the prospective creditors and public at large as they may not be aware if any first charge has been created on any security or not.

2.5 Shift in priority from date of creation to date of filing

There was a major shift in the provisions of charges by amendments introduced by the Companies (Amendment) Act, 2019 4as is observed under the proviso to section 77 of the CA, 2013 which provides:

“Provided also that any subsequent registration of charge shall not prejudice any right acquired in respect of any property before the charge is actually registered”

Basis the aforesaid proviso, an unregistered charge can be prejudicial to the rights of previous creditor, even if the agreement of charge was executed much before the registration of subsequent charge. Therefore, unless and until a charge is registered, it is not considered to be secured in favour of that party.

Accordingly, the date of registration shall be taken as the date on which the doctrine of constructive notice comes into play, with this effect that any person acquiring the property which has been subjected to the charge or any part thereof or any share or interest therein, shall be deemed to have notice as from the date of registration. [English and Scottish Mercantile Investment Co. Ltd. (1892) 2 QB 700 (CA)]

Further, pursuant to Rule 4 of CHG Rules, 2014 while making an application to the Registrar under section 77 of the CA, 2013 for delayed filing of CHG-1/CHG-9, the company secretary or the director of the company are required to submit a declaration that such belated filing shall not adversely affect the rights of other intervening creditors of the company. Accordingly, charge filing should be made at the earliest timeline provided.

2.6 Scheme for relaxation of time for filing forms related to creation or modification of charges5

2.6.1 About the Scheme

The MCA vide its circular dated 17th June, 2020 6notified a “Scheme for relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013” (‘the Scheme’) for providing relaxation to the companies from additional fee while filing forms relating to registration of modification of the charge during the pandemic.

The scheme was different from the Company Fresh Start Scheme, 20207 which was introduced on 30th of March, 2020 as an amnesty scheme for the pending filing defaults of companies and also did not provide any waiver of fees for the company filing forms under this scheme. The aforementioned scheme simply provided an exclusion period of seven months i.e. from March 1, 2020 to September 30, 2020 for registration or modification of charges without any additional fees.

Thereafter, MCA vide its circular dated 28th September, 2020 extended the aforesaid exclusion period till December 31, 2020.

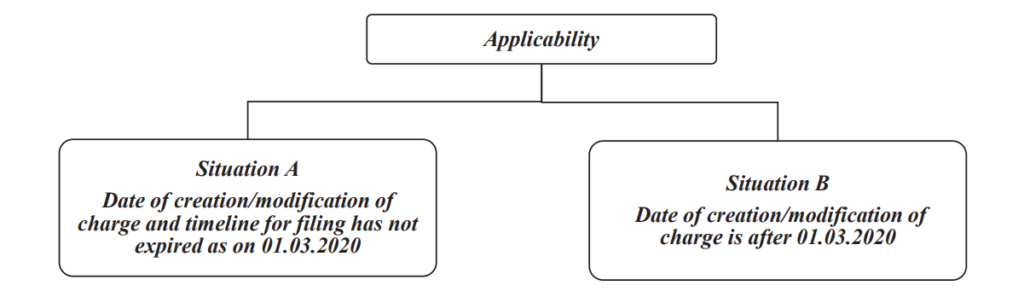

2.6.2 Applicability

The applicability of the scheme is limited to creation and modification of charges i.e. for e-Form CHG-1 and CHG-9 only and does not include satisfaction of charge in its purview, as law permits delayed filing and condonation of delay in case of satisfaction of charge. The applicability of the scheme is divided into two broad heads.

Figure: Applicability of the Scheme summarises the two situations in which the scheme was applicable:

Figure: Applicability of the Scheme

Situation A

This situation provided that if any charge has been created or modified before 01.03.2020 and the timeline for filing the same has not expired as on March 1, 2020, then the company could avail benefit of the scheme.

Considering that the timeline for registering charges with or without additional fees is effectively 120 days, companies that have created charges on or after November 2, 2019 (i.e. 120 days prior to March 1, 2020) are eligible to avail the benefit of the Scheme.

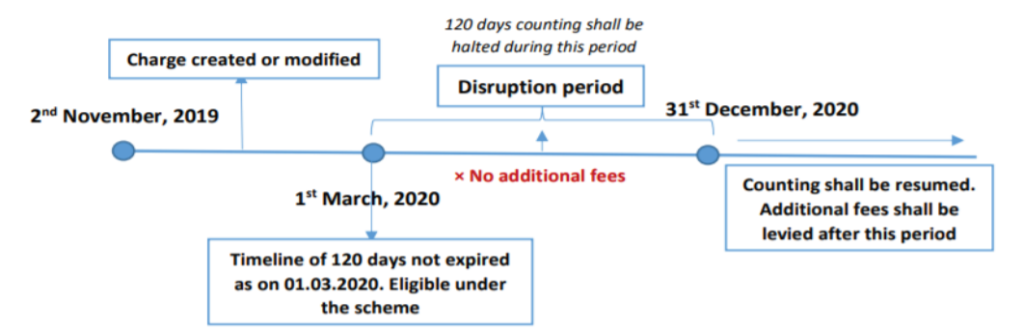

Benefits under Situation A:

The benefit derived under the scheme for cases falling under situation A was that the period from March 1, 2020 to September 30, 2020 was not counted for the purpose of calculation of timeline for registration of charge i.e. 120 days. Accordingly, the exclusion period which was as long as seven months was not being counted for payment of any additional or ad valorem fees.

This has been explained in Figure below: Analysis of Situation A

Figure: Analysis of Situation A

MCA vide its circular dated 28th September, 2020 extended the aforesaid exclusion period till December 31, 2020. Accordingly, the period of 120 days shall not include the Disruption period of 10 months i.e., from March 1, 2020 to December 31, 2020.

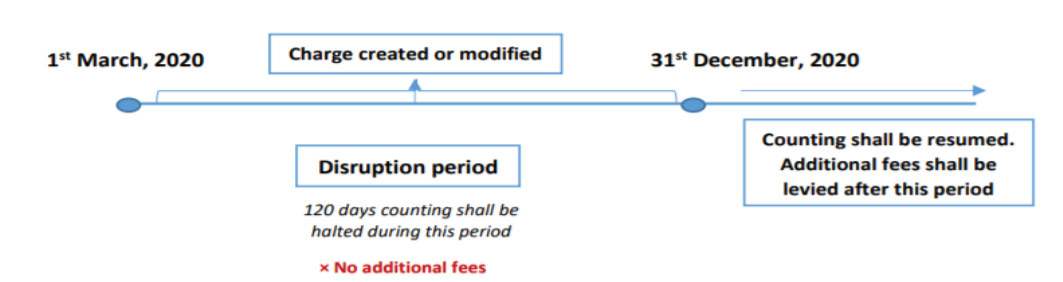

Situation B

Situation B captured cases of creation and modification of charge after March 1, 2020. Here, any charge created and modified after 1st March, 2020 will not be eligible for any additional fees till December 31, 2020 i.e. the exclusion period. Further, the timeline of 120 days will be calculated after December 31, 2020 i.e. from January 1, 2021. This has been explained in Figure: Analysis of Situation B.

Figure: Analysis of Situation B

2.6.3 Cases to which the Scheme was not applicable

Refer Table: Situations in which Scheme will not apply.

| Sr. no | Situations | Applicability of Scheme |

| 1. | CHG-1 and CHG-9 filed before the date of circular | The circular was issued on June 17, 2020 which was approx. three months after the date of applicability of the circular. Hence, companies which were eligible under the circular but had already registered their charges before June 17, 2020 are not eligible to avail the scheme.

Further, any additional fees paid by such companies for the period commencing from March 1, 2020 till the date of filing will not be waived. |

| 2. | Filing of CHG-4 for satisfaction of charge | The scheme did not apply to filing of CHG-4 for satisfaction of charges, because the law already provides a timeline of 300 days from the satisfaction of charge and any delay can be condoned. |

| 3. | Timeline for filing the form as provided under sections 77 and 78 of the Act has already expired before 01.03.2020 | If the timeline of 120 days has expired before March 1, 2020, the scheme could not be availed. |

| 4. | Timeline for filing the form expires at a future date, despite exclusion of disruption period | If the time period of 120 days expires after January 1, 2021 the Scheme shall not be applicable. |

Table: Situations in which Scheme will not apply

2.6.4 Analysis of the scheme

While the law provides a total period of Four months (i.e. 120 days) to register the charge, the exclusion period in the scheme was as long as ten months. Accordingly, pursuant the scheme, a charge can remain dormant for practically fourteen months. Since charge filings are all about getting priority, the period of fourteen months poses a threat to the rights of a secured creditor whose charge filing was preceded by the rights of an intervening creditor who managed to register his charge before the previous creditor. By registering the charge, the creditor secures his security interest in the asset and makes a place in the list of secured creditors under the Insolvency Law.

Delay in charge filings can keep the public at large in dark and pose a risk to the creditors who have already created the charge but could not registered the same. Hence, the charge-holder should actually insist in registering the charge as otherwise, the creditor may prejudice its rights of registration by a subsequent lender in terms of proviso to section 77 of the CA, 2013.

3. Debenture Redemption Reserve (DRR) and Debenture Redemption Fund (DRF)

The requirement of creation of a DRR is unique to India and is globally unheard of. This was inserted in India around the year 1998 in pursuance of recommendation of the Committee formed under the chairmanship of Justice D.R. Dhanuka. The very motivation for having a DRR seems difficult to understand and among the various problems which have inhibited the growth of the Indian bond market over the past many years, the requirement of creation of a DRR has also been one amongst them. The state of bond market in India is quite in its nascent stage, that is to say, in India the bond market is much under-developed as compared to countries having same level of economic development as our country. If one may compare the penetration in bond market in India with certain other countries like Malaysia, Thailand or China, the facts state that the Indian bond market is in great degree of infancy as its penetration as such is extremely low. Therefore, in pursuance to promote the bond market in India the Hon’ble Finance Minister made a Budget pronouncement to relax the requirement of DRR whereas this actually being one of the factors which is impeding the bond markets in the country should have been completely eliminated.

Based on the intent of the Union Budget of 2019-20 which proposed to scrap off the requirement of creation of DRR, the MCA notified Companies (Share Capital and Debentures) (Amendment) Rules, 2019 dated August 16, 20198.

DRR is required to be created out of the profits of the company available for payment as dividend and is to be created in respect of debentures maturing during the year ending on 31st March of next year. The amount so maintained in the DRR cannot be utilised for any purpose other than redemption of the debentures [Rule 18 (7) of SHA Rules].

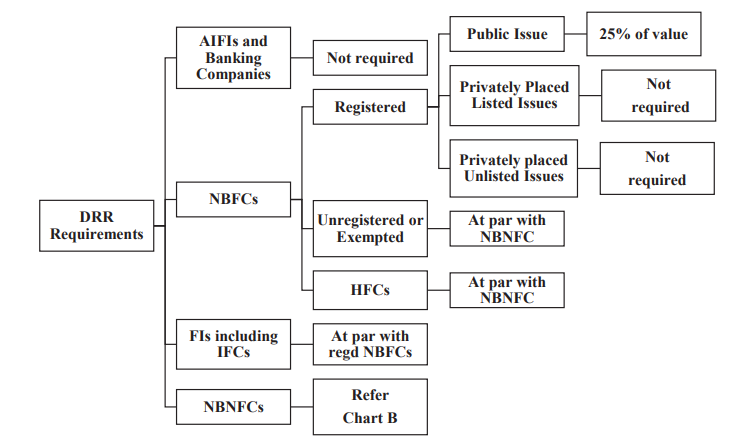

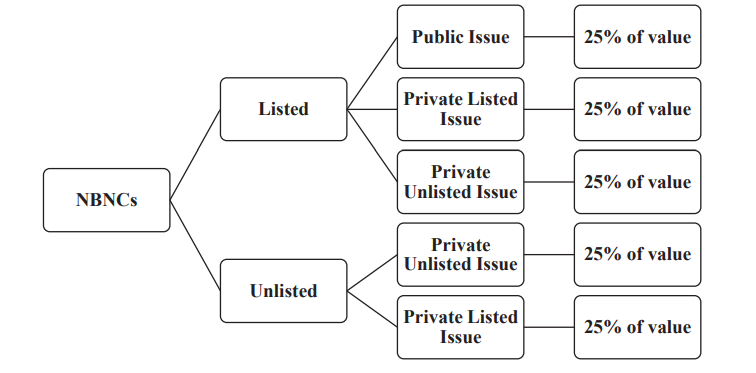

The position for maintenance of DRR for Banks, Financial Institutions, Non-Banking Finance Companies (NBFCs) and Non-Banking Non-Financial Companies (NBNFCs) is summarized in Figure 8: DRR Requirement – Pre-amendment and Figure 9: DRR Requirement for Non-NBFCs – Pre-amendment

3.1 Maintenance of DRR – Pre-amendment

CHART A

Figure: DRR Requirement – Pre-amendment

CHART B

Figure: DRR Requirement for Non-NBFCs – Pre-amendment

3.2 Maintenance of DRR – Post-amendment

Pursuant to the amendments introduced by the Companies (Share Capital and Debentures) (Amendment) Rules, 2019, the requirement of creation of DRR for privately placed debentures was done away with. A synopsis has been provided in Table 11: DRR requirement for different companies- Post amendment.

| Sr. No | Applicability | Requirement to create DRR on public issue of debentures | Requirement to create DRR on private placement of debentures |

| 1. | All India Financial Institutions regulated by RBI and Banking Companies | Not required

[Rule 18(7)(b)(i)] |

Not required

[Rule 18(7)(b)(i)] |

| 2. | Other Financial Institutions within the meaning of clause (72) of section 2 of Act, 2013 | As applicable to NBFCs registered with RBI

[Rule 18(7)(b)(ii)] |

As applicable to NBFCs registered with RBI |

| LISTED (other than those covered in 1 and 2) | |||

| 3. | NBFC/HFC | Not Required

[Rule 18 (7) (b) (iii) (A) A] |

Not Required

[Rule 18 (7) (b) (iii) (B)] |

| 4. | Non-NBFC/HFC | Not Required

[Rule 18 (7) (b) (iii) (A) B] |

Not Required

[Rule 18 (7) (b) (iii) (B)] |

| UNLISTED (other than those covered in 1 and 2) | |||

| 5. | NBFC/HFC | N.A | Not Required

[Rule 18 (7) (b) (iv) (A)] |

| 6. | Non-NBFC/HFC | N.A | 10% of outstanding value of debentures.

[Rule 18 (7) (b) (iv) (B)] |

| Remarks | Earlier, there was no exemption for public issue to NBFCs/HFCs and other listed entities. | Earlier, there was no exemption for Non-NBFCs and the requirement to create was 25%. | |

Table: DRR requirement for different companies – Post amendment

3.3 Maintenance of DRF – Pre-amendment

Only a company required to create DRR was required to maintain at least 15 per cent of the amount of its debentures maturing during the year ending 31st March of the next year in any one or more methods of investments or deposits as provided below:

i. Deposits with any scheduled bank;

ii. Unencumbered securities of the Central methods of deposits or from any charge or lien; Government or any State Government;

iii. Unencumbered securities issued by any other company notified under Indian Trust Act, 1882;

iv. Unencumbered bonds issued by any other company notified under Indian Trust Act, 1882;

The investment/deposit was required to be made on or before 30th April of each year and the amount so invested or deposited could not be used for any purpose other than for redemption of debentures maturing during the year ending 31st March of the next year. [Rule 18(7)(v) & (vi) of SHA Rules]

The amendments introduced by the Companies (Share Capital and Debentures) (Amendment) Rules, 2019 dated 16th August, 2019 (‘Amendment Rules, 2019’) which was supposed to scrap off the requirement of creation of DRR, relaxed the provisions of DRR, however, on the flipside unsettled an otherwise settled matter on creation of DRF as per Rule 18(7). It is pertinent to note that as per the erstwhile provisions, the requirement of creation of DRF was applicable to only those companies on which DRR was applicable. However, pursuant to the amendments introduced, the requirement of creation of DRF was made applicable to all listed companies including NBFCs, other than AIFIs or FIs, irrespective of whether DRR was applicable or not.

Consequent to the notification, the requirement for parking liquid funds, in form of a DRF was made applicable to all bond issuers except unlisted NBFCs. In this regard, considering the ongoing liquidity crisis in the entire financial system of the country, parking of liquid funds by NBFCs was an additional burden for them. Accordingly, the Ministry vide notification dated 5th June, 2020 (applicable from 12th June, 2020) introduced Companies (Share Capital and Debentures) (Amendment) Rules, 2020 to partially modify the Amendment Rules, 2019 so as to exempt listed companies with privately placed debt securities from the requirement of creation of DRF.

Accordingly, the requirement of DRF was amended twice by the Ministry in following manner:

(a) Companies (Share Capital and Debentures) (Amendment) Rules, 2019

As per the erstwhile provisions, the requirement of creation of DRF was only for those companies on which DRR was applicable. However, pursuant to the Amendment Rules, 2019, the requirement of creating DRF was made applicable to all listed companies, other than AIFIs or other FIs as per the clause of section 2(72). The new rule was also made applicable for NBFCs having privately placed debt securities

(b) Companies (Share Capital and Debentures) (Amendment) Rules, 2020

Considering the practical difficulties in creation of DRF by some companies due to the introduction of Amendment Rules, 2019, the Ministry has partially modified the provision of the Rules in tune to exempt following:

(i) Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and for Housing Finance Companies registered with National Housing Bank and coming up with issuance of debt securities on private placement basis.

(ii) Other listed companies coming up with issuance of debt securities on private placement basis.

3.4 Maintenance of DRF – Post-amendment

| Sr. No | Applicability | Requirement to invest in liquid instruments in case of public issue of debentures | Requirement to invest in liquid instruments in case of private placement of debentures |

| 1. | All India Financial Institutions regulated by RBI and Banking Companies | Not Required | Not Required |

| 2. | Other Financial Institutions within the meaning of clause (72) of section 2 of Act, 2013 | Not Required | Not Required |

| LISTED (other than those covered in 1 and 2) | |||

| 3. |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.  Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava. The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

Everything on Tax and Corporate Laws of IndiaTo subscribe to our weekly newsletter please log in/register on Taxmann.com | ||

CA | CS | CMA

CA | CS | CMA