Interplay of Insolvency & Bankruptcy Code with Income Tax

- Blog|Insolvency and Bankruptcy Code|Income Tax|

- 17 Min Read

- By Taxmann

- |

- Last Updated on 1 September, 2023

Table of Contents

1. Key Sections

1.1 Terms under IBC

Preamble – Insolvency and Bankruptcy Code, 2016 (IBC) was introduced w.e.f 28 May, 2016 consolidating existing laws relating to insolvency in a single legislation thereby facilitating a time bound resolution of stressed business including alteration in the order of priority of payment of Government of dues

Debtors – means a corporate person who owes a debt to any person

Creditors – means any person to whom a debt is owed and includes a financial creditor, an operational creditor, a secured creditor, an unsecured creditor and decree-holder.

Under IBC, there are two categories of creditors, viz.

- Financial creditor

- Operational creditor

Financial creditor – Section 5(7) of IBC-a person to whom financial debt is owned (including a person to whom debt has been legally assigned)

Financial Debt – Section 5(8) of IBC-debt along with interest disbursed against consideration for time value of money and includes specified borrowings. [Means a person from whom loan is received and would therefore, include banks and financial institutions]

Operational creditor – Section 5(20) of IBC- a person to whom operational debt is owed (including a person to whom debt has been legally assigned or transferred)

Operational Debt – Section 5(21) of IBC-claim in respect of goods or services, including employment, or debt in respect of payment of dues under any law and payable to Central Government/ State Government/Local Authority [Q- Nature of Income Tax Liability?]

1.2 Approval of Resolution Plan under IBC – Section 31

Resolution Plan

Section 5(26) – Resolution plan” means a plan proposed by resolution applicant for insolvency resolution of the corporate debtor as a going concern in accordance with Part II

Explanation – For removal of doubts, it is hereby clarified that a resolution plan may include provisions for the restructuring of the corporate debtor, including by way of merger/amalgamation and demerger.

Section 31 – If the Adjudicating Authority is satisfied that the resolution plan as approved by the committee of creditors under sub-section (4) of section 30 meets the requirements as referred to in sub-section (2) of section 30, it shall by order approve the resolution plan

The resolution plan shall be binding on the corporate debtor and its employees, members, creditors, including the Central Government, any State Government or any local authority to whom a debt in respect of the payment of dues arising under any law for the time being in force, such as authorities to whom statutory dues are owed, guarantors and other stakeholders involved in the resolution plan [Q-Whether the Resolution plan will binding to the tax authorities?]

1.3 Distribution of assets under IBC – Section 53

Proceeds from the sale of liquidation assets shall be distributed: Section 53

(a) the insolvency resolution process costs and the liquidation costs paid in full;

(b) the following debts which shall rank equally between and among the following:

(i) workmen’s dues for the period of twenty-four months preceding the liquidation commencement date; and

(ii) debts owed to a secured creditor in the event such secured creditor has relinquished security in the manner set out in section 52

(c) wages and any unpaid dues owed to employees other than workmen for the period of twelve months preceding the liquidation commencement date

(d) financial debts owed to unsecured creditors;

(e) The following dues shall rank equally between and among the following: –

(i) any amount due to the Central Government and the State Government including the amount to be received on account of the Consolidated Fund of India and the Consolidated Fund of a State, if any, in respect of the whole or any part of the period of two years preceding the liquidation commencement date; [Meaning there by that the income tax liability will be part of due to central govt- further will not be treated as secured creditors]

(ii) debts owed to a secured creditor for any amount unpaid following the enforcement of security interest;

(f) any remaining debts and dues;

(g) preference shareholders, if any; and

(h) equity shareholders or partners, as the case may be.

1.4 Nature of income tax liability under IBC

1.4.1 Ghanashyam Mishra Case

Position as operation creditors – Claims up to initiation of CIRP-income tax liability are part of due to govt. authorities- as held by Supreme Court in Ghanashyam Mishra and sons (P.) Ltd. v. Edelweiss Asset Reconstruction Co. Ltd. [SC] [2021] 126 taxmann.com 132/166 SCL 237 (SC).

That once a resolution plan is duly approved by the Adjudicating Authority under sub section (1) of Section 31, the claims as provided in the resolution plan shall stand frozen and will be binding on the Corporate Debtor and its employees, members, creditors, including the Central Government, any State Government or any local authority, guarantors and other stakeholders. On the date of approval of resolution plan by the Adjudicating Authority, all such claims, which are not a part of resolution plan, shall stand extinguished and no person will be entitled to initiate or continue any proceedings in respect to a claim, which is not part of the resolution plan.

1.4.2 Rainbow Paper Case – Latest

- Position as Secured Creditors – State is a secured creditors under GVAT Act and are to be treated at par with first priority u/s 53 of IBC as held by Supreme Court that State Tax Officer v. Rainbow Papers Ltd. [SC] [2022] 142 taxmann.com 157/174 SCL 250 (SC)

- As the SC judgment is land of law and statutory authorities need to abide by it.

- Tax Authorities are now following the Rainbow Paper case judgment, wherein the Income tax liability is considered as secured creditors.

- Secured creditor means a creditor in favour of whom security interest is created.

2. Interplay – IBC vs. Income Tax

2.1 Nature of income tax liability under IBC – Modification of notices

Modification and revision of notice in certain cases – Section 156A

It has been noted that in the cases of business reorganization, instances have been found where the Court or Tribunal or an Adjudicating Authority, as defined in clause (1) of section (5) of the Insolvency and Bankruptcy Code, 2016, as the case may be, as a part of the restructuring process, recast the entire liability to ensure future viability of such sick entities and in the process, modify the demand created vide various proceedings in the past, by the Income Tax department as well, amongst other things.

No procedure or mechanism provided in the Act to reduce such demands from the outstanding demand register. Hence, in order to remove this anomaly, it is proposed to insert a new section 156A.

“Where any tax, interest, penalty , fine or any other sum in respect of which a notice of demand has been issued under section 156, is reduced as a result of an order of the Adjudicating Authority as define in clause (1) of section 5 of IBC, 2016, the AO shall modify the demand payable inconformity with such order and shall thereafter serve on the assessee a notice of demand specifying the sum payable if any, and such notice of demand shall be deemed to a notice under section 156 and the provisions of this Act shall accordingly, apply in relation to such notice.

Where the order referred to in sub-section (1) is modified by the National Company Law Appellate Tribunal or the Supreme Court, as the case may be the modified notice of demand as referred to in sub-section (1), issued by the AO shall be revised accordingly.”

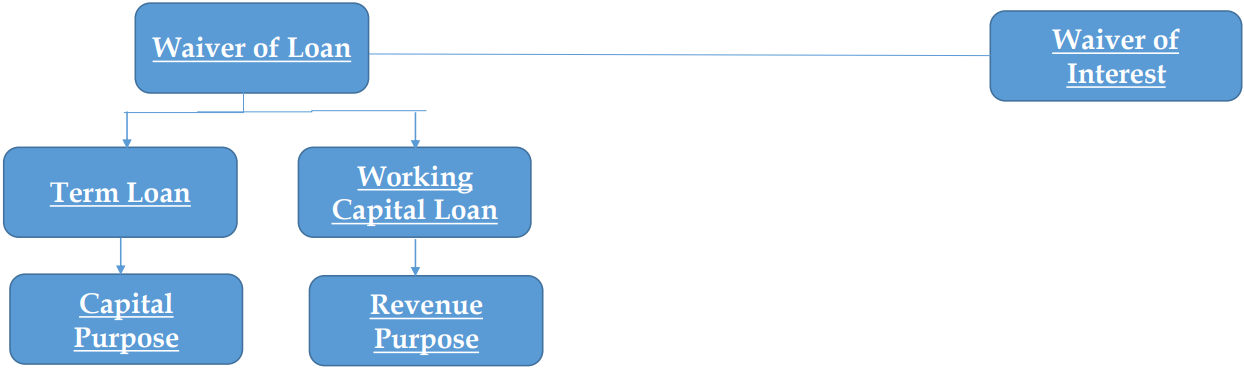

2.2 Income tax implication under IBC – Waiver of Loan

Tax Implications on waiver of loans and other liabilities

Under resolution plan approved by NCLT, would generally involve waiver of loans and other liabilities of corporate debtor, which is subject to IBC Proceedings

Tax implications on waive of loans can be bifurcated based on type of loan & end user as under: [Financial Creditor]

Dependent on its utilization e.g, capital purpose and working capital loan.

Potential tax implication under section 41(1), 28(iv) and 194R

Analysis of section 41

“Where an allowance or deduction has been made in the assessment for any year in respect of loss, expenditure or trading liability incurred by the assessee and subsequently during any previous year

The first mentioned person has obtained, whether in cash or in any other manner whatsoever, any amount in respect of such loss or expenditure or some benefit in respect of such liability by way of remission or cessation thereof, the amount obtained by such person or the value of benefit accruing to him shall be deemed to be profits and gains of the business”

Q. Whether the waiver or write of loans will be taxable u/s 41?

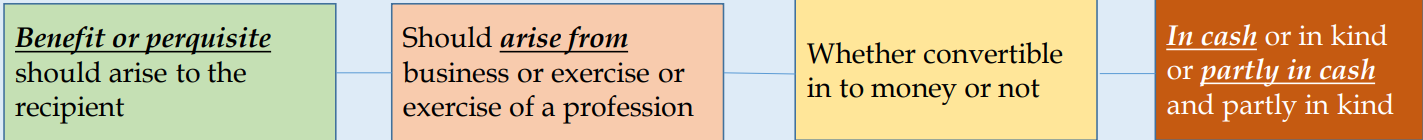

Analysis of section 28(iv)

“Erstwhile section” – [Pre-amendment to Finance Act, 2023]

The value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession. There are three ingredients:

- Benefit or Perquisite should arise to the recipient;

- Should arise from business or exercise of a profession;

- Whether convertible into money or not.

2.2.1. Erstwhile Law

1. Term “benefit or perquisite” – Not defined in the act. To be referred in dictionary and judicial definitions

- Benefit – [Black’s Law Dictionary]-defines benefit-advantage, fruit; profit; privilege

CIT v. Smt. Kamalini Gautam Sarabhai [1994] 208 ITR 139 (Guj.) – rendered in context of2(24)(iv)

The word “benefit” implies an element of advantage, profit or gain. The word “benefit” occurring in clause (iv) of section2(24) would mean any advantage, gain or improvement in condition

- Perquisite – Section 17(2) of the Act defines “Perquisite” inclusively –however, this applies to salary income and not “PGBP”;

[Black’s Law Dictionary] – defines “Perquisite” – A privilege or benefit given in addition to one’s salary or regular wages –often shortened to perk.

2. Arising from business and profession – The “benefit” or “perquisite” should have a connection with business or profession of the recipient and not with the business or profession of the person providing the perquisite of benefit.

- CIT v. Bhavnagar Bone, & Fertiliser Co. Ltd. [1987] 32 Taxman 180 (Guj.) and CIT v. General Electrodes & Equipments Ltd [1985] 20 Taxman 205/155 ITR 78 (Bom.) – This amount had no connection or nexus with the business of the assessee. It did not represent value of any benefit or perquisite arising from the business of the assessee. This amount, therefore, would not partake of the character of the income.

- ITO v. Undavalli Constructions [2021] 131 taxmann.com 204/191 ITD 749 (Visakh.-Trib.) – it is necessary to show and prove the proximate cause or nexus between the alleged benefit or perquisite and the business actually carried on by the assessee. The nexus or the proximate cause must be real, immediate and not illusionary or imaginary. The benefit or perquisite contemplated by sec. 28(iv) must necessarily have a live connection with the business carried on by the assessee and the benefit must accrue or arise in the course of carrying on of such business.

- Gujarat HC – CIT v. Chetan Chemicals (P.) Ltd. [2004] 139 Taxman 301 (Guj.) and further in CIT v. Gujarat State Fertilizers & Chemicals Ltd. [2013] 36 taxmann.com 230/217 Taxman 229/358 ITR 323 (Guj.) – It cannot be said that the assessee-company was carrying on business of obtaining loans and that the remission of such loans by the creditors of the company was a benefit arising from such business.

3. Whether Convertible in to money or not”

- CIT v. Mahindra and Mahindra Ltd. [2018] 93 taxmann.com 32/255 Taxman 305 (SC) – Amount received as cash receipt due to the waiver of loan -very first condition of Section 28 (iv) of the Act which says any benefit or perquisite arising from the business shall be in the form of benefit or perquisite other than in the shape of money, is not satisfied.

- Gujarat HC – CIT v. Chetan Chemicals (P.), Ltd. [2004] 139 Taxman 301 (Guj.) and further in CIT vs. Gujarat State Fertilizers & Chemicals Ltd. (2013) 358 ITR 323 (Guj) – It cannot be said that the assessee- company was carrying on business of obtaining loans and that the remission of such loans by the creditors of the company was a benefit arising from such business.

- CIT v. Alchemic (P.) Ltd. [1981] 5 Taxman 55 (Guj.) – The phrase “whether convertible into money or not“ would normally mean something else than money. Section 28(iv) would not apply when the amount received is cash or is considered in terms of money.

4. Purpose of Loan – Capital or Revenue

- CIT v. T.V. Sundaram Iyengar & Sons Ltd. [1996] 88 Taxman 429 (SC) – Taxpayer received certain deposits from customers. Such deposits were not claimed by the customers and hence, taxpayer transferred it to P&L a/c. Although it was treated as deposit and was of capital nature at the point of time it was received, by influx of time the money had become the assessee’s own money. It became a definite trade surplus.

- Logitronics (P.) Ltd v. CIT [2011] 9 taxmann.com 302/197 Taxman 394 (Delhi) – Where loan was taken for acquiring capital asset, waiver thereof would not be taxable; If loan was taken for trading purpose, waiver thereof would result in income, more so when it was transferred to P&L.

- CIT v. Ramaniyam Homes (P.) Ltd. [2016] 68 taxmann.com 289/239 Taxman 486 (Mad.) – Amount representing principal loan waived by bank under onetime settlement scheme would constitute income falling under section 28 (iv)

- Over ruled by SC in Mahendra & Mahendra

2.2.2 Amended Law

Amended Provision of section 28(iv) – w.e.f 1-4-2023

The value of any benefit or perquisite arising from business or the exercise of profession, whether-

(a) Convertible in to money or not

(b) In cash or in kind or party in cash or in kind

Comments in the Memorandum for the Amendment

- The intention of legislature while introducing this provision was also to include benefit or perquisite whether in cash or in kind. However, courts have interpreted that if the benefit or perquisite are in cash, it is not covered within the scope of this clause of section 28 of the Act.

- In order to align the provision with the intention of legislature, it is proposed to amend clause (iv) of section 28 of the Act to clarify that provisions of the said clause also applies to cases where benefit or perquisite provided is in cash or in kind or partly in cash and partly in kind.

Amended section 28(iv)

- Four Ingredients of amended section 28(iv)

Waiver of Loan – Post amendment – section 28 (iv)

- The Hon’ble Supreme Court in Mahendra & Mahendra has settled a law that waiver of loan is the benefit in cash and will not be part of section 28(iv).

- Post amendment – all benefits whether convertible in to money or not or in cash will be part of section 28(iv)

- Question – Waiver of loans in restructuring would be taxable u/s 28(iv) ????

- Question – Whether waiver of such loan can be considered as “arising from” business or exercise of profession? Refer Chetan Chemicals (P.) case decided by the Hon’ble Gujarat High Court

2.2.3 Section 194 R

Section 194R Implication – Circular no 12/2022 and Circular 18/ 2022

- Prior to amendment in section 28(iv)- monetary benefits were not covered within the ambit of section 28(iv) – Mahendra & Mahendra (SC)

- One time loan settlement with the borrowers or waiver of loan granted on reaching settlement with the borrowers by specified institutions [Banks and Public financial institutions] would not be subjected to deduction of tax at source under section 194R.

- Waiver of loan apart from the specified borrower – Applicability of section 194R?

- Write of Bad-debts – Applicability of section 194R?

- The treatment of such settlement/waiver in the hands of the person who is benefitted from such waiver would not be impacted by this clarification. The taxability of such settlement/waiver in the hands of the beneficiary will be governed by the relevant provisions of the Act.

2.2.4 Accounting Treatment

Implication under Accounting Standards

- Capital receipt(s) arising out of transaction(s) on capital account, like, profit on sale of capital asset, write back of principal amount of loan etc., not arising in the ordinary course of business, forms part of capital reserve.

- A Transaction on capital account (not arising out of ordinary business activities, is not be regarded as giving rise income which can be credited to profit an loss account.

Implication under Indian Accounting Standards “ Ind AS”

- Ind AS 109 states that upon waiver of loan , the difference between the carrying amount of loan and the consideration actually paid towards such waiver would be routed through profit and loss account.

- Therefore, if a financial liability (Loan) is extinguished without paying any consideration, the entire extinguished liability would be treated as part of income in the profit and loss statement of the debtor.

2.3 Income tax implication under IBC – Waiver of Interest

Implication under Income tax Act

- Interest Expenses is allowed as deduction u/s 36(1)(iii) under Income Tax Act- subject to section 43B

- Waiver of interest amount would constitute income and be taxable under section 41(1) of the Act.

- If the interest was claimed and disallowed u/s 43B in earlier years, the same is not taxable under section 41(1).

- It was also held that waiver cannot be taxable under section 28(iv)

- Waiver of interest – Taxable u/s 41(1) if deduction claimed in earlier years

2.4 Income tax implication under IBC – MAT – Section 115 JB

Applicability to MAT provisions to IBC

- No specific exemption is available for IBC Companies

- Loan and interest waiver is credited in the Profit and loss account – it will be subject to MAT.

- Loan and interest waiver is credited in Capital Reserve – will not be subject to MAT

- AO has no power to re cast the audited profit and loss account for the books profit – as held by SC in Apollo Tyre judgement

MAT will not applicable even if credited in Profit and loss account

As waiver of loan is considered as Capital receipt and MAT will not be applicable as held in:

- JSW Steel Ltd. v. Asstt. CIT [2017] 82 taxmann.com 210 (Mum.-Trib.);

- Shivalik Venture (P.) Ltd v. Dy. CIT [[2015] 60 taxmann.com 314/70 SOT 92/173 TTJ 238 (Mum.-Trib.)];

- Shree Cement Ltd. vs. Asstt. CIT [[2014] 49 taxmann.com 274/[2015] 152 ITD 561 (J.P.-Trib.)]

MAT will be applicable even if credited in Profit and loss account- Loan Waiver

However, contrary rulings are also present which state that if an amount is credited to Profit and Loss account – MAT is applicable:

- B&B Infotech Ltd. vs. ITO (Bangalore-Tri) (130 TTJ 213)

- Duke Offshore Ltd. v. Dy. CIT [2011] 9 taxmann.com 214/45 SOT 399(Mum.-Trib.)

- Based on accounting principles, if loan and interest waiver is not credited to profit and loss a/c, MAT may not apply to such wavier

Brought forward loss and depreciation under MAT

- While computing the book profits tax, the brought forward loss or depreciation whichever is less as per books of the company, is allowed to be deducted for computing book profits.

- In case of CIRP cases, as the company would have done for restructuring, the carried forward loss/depreciation would have been wiped out from the books. Consequently there may be a tax on the write back of liabilities.

- To avoid this, the Finance Act 2018 allowed aggregate deduction of tax loss/brought forward depreciation in CIRP cases

- As per amendment made in section 115JB by Finance Act 2018, for companies that have been admitted by NCLT under IBC, total of brought forward losses and unabsorbed depreciation as per books of accounts has to be reduced.

- Hence, as against lower of brought forward losses or unabsorbed depreciation for rest of the companies, substantial relaxation is provided for companies under IBC.

2.5 Income tax implication under IBC – Change in shareholding u/s 79

Carried forward of losses in case of change in shareholding u/s 79

- Section 79 provides that if there is change in shareholding by more than 51% in a company (in which public is not substantially interested), losses would not be carried forward.

- In case of companies referred to in IBC, there would be change in shareholding resulting into lapses of losses as per tax provisions.

- Hence, specific exemption provided under section 79 to IBC companies by Finance Act, 2018 if the resolution plan is approved by IBC and after affording a reasonable opportunity of being heard is provided to jurisdictional/Principal Commissioner.

2.6 Income tax implication under IBC – Amalgamation

Income tax implications in case of Merger/Amalgamation

- There are no specific provisions under IT Act dealing particularly with tax implications in case of corporate structuring pursuant to IBC provisions.

- Amalgamation need to be complied the conditions as per section 2 (IB) of IT, Act

- Tax neutrality for company – No Capital gain implication [Section 47 (vi); depreciation shifts to the amalgamated company.

- Tax neutrality for shareholders section 47(vii)

- Carried forward of losses and depreciation [Section 72A, Rule 9C]

Carried forward of losses of Merger/Amalgamation

- For Carried forward of losses all conditions as per section 72A (2)(a)(b) must be fulfilled. Compliance of Industrial Undertaking conditions

- On fulfilling the conditions accumulated losses will be allowed to carried forward for fresh period of 8 years as held in (Supreme Industries Ltd. v. Dy. CIT [2007] 17 SOT 476/[2008] 115 ITD 225 (Mum.-Trib.)

- Unabsorbed depreciation can be carried forward indefinitely

- If the conditions as per Section 72A(2) has not been fulfilled, the set off loss or allowance of depreciation will be deemed income of the amalgamated company

- Carried forward and set off Minimum Alternate Tax (MAT) is available to the amalgamated company. As held in Ambuja Cements Ltd. v. Dy. CIT [2019] 111 taxmann.com 10/179 ITD 436 (Mum.-Trib.)

2.7 Income tax implication under IBC – Demerger

Income tax implication of Demerger

- Resolution plan as per section 5 (26) to be on going concern basis and it includes provisions of restructuring of corporate debtor, including by way of merger and demerger.

- Demerger under Income tax act is governed by section 2(19AA) – which also specifies that the demerger of the undertaking should be on going concern basis.

- Question – Whether the demerger of IBC companies which are already in stress stage will be the on going concern basis – as per IT Act?

2.8 Income tax implication under IBC – Conversion of loan in to equity

Conversion of loan in to equity

- Section 269T mandates that loan/deposit have to be re-paid by account payee cheque or electronic clearing system/electronic mode system.

- The issue which arises for determination is whether conversion of loan in to equity can be said to be in contravention of provisions of section 269T of the Act.

- Judiciary in case of Arkit Vincom Private Limited vs. ACIT (ITA no 2397-Kol-Tri) held that the transaction with respect to the conversion of loan in to equity carried out by the taxpayer through book entries without any physical outflow of funds cannot be considered to the violation of provisions of section 269T. Therefore levy of penalty u/s 271E is to be deleted.

- Further held in CIT v. Triumph International Finance (I) Ltd. [2012] 22 taxmann.com 138/208 Taxman 299/345 ITR 270 (Bom.)

2.9 Income tax implication under IBC – deeming provisions

Deeming provisions Section, 50CA, 56(2)(x)

- No specific exemption provided for IBC Companies

- Section 50CA and 56(2)(x) refers to the fair market value of shares to be determined as per Rule 11UA

- Section 50CA – Where the consideration received or accruing as a result of the transfer by an assessee of a capital asset, being shares of a company other than quoted shares.

- In case of IBC companies, possible that real fair market value of equity shares is much lower than FMV computed as per rule 11UA

- Possibility of tax litigation cannot be ruled out.

2.10 Income tax implication under IBC – Treatment of tax proceedings

Tax Proceedings and claims – during and after resolution

Moratorium under section 14 of the Insolvency and Bankruptcy Code,2016 (IBC) will also apply to appeals being made by the Income Tax Department against the orders of Income Tax Appellate Tribunal, in respect of tax liability of a debtor under CIRP. Pr. CIT v. Monnet Ispat And Energy Ltd. [2019] 107 taxmann.com 481 [SC upholding Delhi HC ruling]

Kitply Industries Ltd. v. Asstt. CIT (TDS) [2019] 102 taxmann.com 116 (NCLT- Guwahati) as held that Proceeding before the Income-tax Department which has resulted in freezing of the bank accounts is a proceeding of quasi judicial nature and continuation of such a proceeding during moratorium period is illegal in view of the prohibitions under section 14(1)(a) of the Code.

2.11 Income tax implication under IBC – IBC has overriding effect

IBC has overriding effect over provisions of Income Tax [Section 238]

Where there is a conflict between provisions of the Code and those of the Income tax Act, the Code will prevail over the Act

The Hon’ble Supreme Court in the case of Pr. CIT v. Monnet Ispat & Energy Ltd. [SLP (C) No. 6487 of 2018, dated 10-8-2018] has upheld overriding nature and supremacy of the provisions of the IBC over any other enactment in case of conflicting provisions, by virtue of a non obstante clause contained in section 238 of the Code

The Apex Court in case of Alchemist Asset Reconstruction Co. Ltd. v. Hotel Gaudavan (P.) Ltd. [2017] 88 taxmann.com 202/[2018] 145 SCL 428 (SC) has also held that even arbitration proceedings cannot be initiated after imposition of the moratorium u/s 14 (1) (a) has come into effect and it is non est in law and could not have been allowed to continue.

U/s 178(6) of the IT Act, as amended w.e.f. 01.11.2016, the Code shall have overriding effect. The provisions of section 14 of the Code institution of suits or continuation of pending suits or proceedings against the corporate debtor including execution of any judgement, decree or order in any court of law, tribunal, arbitration panel or other authority shall be prohibited during the moratorium period under Insolvency and Bankruptcy Code.

ITAT Delhi in JCIT, Circle-22(2), New Delhi vs SR Foils & Tissue P. Ltd.

….in view of the provision of section 238 of CIRP code, the proceedings before Ld. NCLT would have over- riding effect

ITAT Delhi in ACIT Vs. ABW Infrastructure Ltd.

It is well settled now that, IBC has overriding affect on all the acts including Income Tax Act which has been specifically provided u/s 178 (6) of the I.T. Act as amended w.e.f. 01.11.2016

2.12 Income tax implication under IBC – Filing of return of income

Carried forward of losses and filing of return of income

Section 80 specifies that loss would be carried forward only if return of income is filed before the due date. No specific amendment for companies and hence, it may be possible that due to ongoing CIRP proceedings, return of income may be filed beyond due date resulting in to losses being lapsed.

The assessee can approach to CBDT u/s 119(2)(b) of the Act for filing of delay return in case of genuine hardship

Section 140 The Income tax return shall be verified by the insolvency professional appointed by such adjudicating authority

2.13 Income tax implication under IBC – Miscellaneous

NOC from Income Tax Department u/s 281

- Section 281 states that Income Tax Department has the right to recover outstanding tax dues by treating the transfer of assets (including securities) as void

- Exceptions to provision:

- buyer is a bonafide purchaser with out notice; or

- where a no-objection is obtained from the Income Tax Department

- Obtaining NOC is a time consuming process

Stamp duty on transfer of property under IBC

- No specific exemptions on payment of stamp duty upon transfer of property under IBC

Applicability of GAAR

- An arrangement under IBC may have the risk of being considered as an impermissible avoidance agreement and tax consequences may arise if the arrangement leads to significant tax benefits.

- As per a CBDT circular, GAAR will not apply to such an arrangement where a Court or NCLT has explicitly and adequately considered the tax implication, while sanctioning an arrangement.

Deductibility of insolvency resolution process costs

- Section 5(13) of IBC defines “insolvency resolution process costs ”as costs of interim finance, fees of RP, costs incurred by RP in running day-to-day business, and costs incurred to facilitate resolution process.

- As per Section 35DD, costs incurred on amalgamation or demerger are allowed as deduction over five years.

- No clarifications issued by CBDT till date as to whether it should be accounted as a revenue expenditure or a capital expenditure.

Issuance of notice to Corporate Debtor u/s 148

- IT Department cannot raise claims against the Corporate Debtor once the resolution plan is approved

- The Hon’ble Bombay High Court in Murli Industries Limited vs. Asstt. CIT [2022] 441 ITR 8 (Bom.) held that the IT Department is not entitled to issue notice against the Corporate Debtor for unpaid tax claims after the approval of the resolution plan by the adjudicating authority.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA