A Comprehensive Guide | Input Service Distributor (ISD) vs Cross Charge

- Blog|GST & Customs|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 25 September, 2023

Table of Contents

- Legal Provisions

- Comparative Summary

- Advance Rulings and FAQ

- Circular No. 199/11/2023-GST

- Open Issues

- Challenges if ISD is made mandatory

1. Legal Provisions

1.1 Legal Provisions for Input Service Distributors (ISD)

Definition u/s 2(61) of CGST Act:

‘Input Service Distributor’ means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office;

- Office of supplier of goods/services

- Receives invoice for input services only and not for input goods or capital goods

- Issues prescribed document for distributing ITC – ISD invoice prescribed u/r 54(1)

- ITC is distributed only to units having same PAN

1.2 Legal Provisions for Cross Charge

Cross Charge is not defined under GST law. Following are the relevant provisions which invoke the concept of Cross Charge

- Sec 29: Levy of GST on value of supply made by a taxable person for a consideration and in the course of or furtherance of business.

- Sec 7(1)(c): Activities listed in Schedule I to CGST Act to be supply even if made without consideration

- Entry 2: Supply of goods or services made between distinct persons.

- Sec 25(4) & 25(5): Further distinct person is two or more units of same legal entity (whether or not in same State or Union Territory) when registered separately

1.3 Legal Provisions for Levy, Collection and Valuation

Section 9. Levy and collection

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding twenty per cent., as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.

Section 7. Scope of supply

(1) For the purposes of this Act, the expression – “supply” includes-

(a)….

(b)….

(c) the activities specified in Schedule I, made or agreed to be made without a consideration;

Schedule I – Activities to be Treated as Supply Even if Made Without Consideration

(2) Supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business:

Section 25

(4) A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

(5) Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act.

Provisions governing valuation mechanism for Cross charge

Section 15(1) of CGST Act: The value of supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

Section 15(4) of CGST Act: Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed

Rule 28. Value of supply of goods or services or both between distinct or related persons, other than through an agent. –

The value of the supply of goods or services or both between distinct persons as specified in sub-section (4) and (5) of section 25 or where the supplier and recipient are related, other than where the supply is made through an agent, shall –

(a) be the open market value of such supply;

(b) if the open market value is not available, be the value of supply of goods or services of like kind and quality;

(c) if the value is not determinable under clause (a) or (b), be the value as determined by the application of rule 30 or rule 31, in that order:

Provided that where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person:

Provided further that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

Rule 30. Value of supply of goods or services or both based on cost. –

Where the value of a supply of goods or services or both is not determinable by any of the preceding rules of this Chapter, the value shall be one hundred and ten percent of the cost of production or manufacture or the cost of acquisition of such goods or the cost of provision of such services.

Rule 31. Residual method for determination of value of supply of goods or services or both.

Where the value of supply of goods or services or both cannot be determined under rules 27 to 30, the same shall be determined using reasonable means consistent with the principles and the general provisions of section 15 and the provisions of this Chapter:

Provided that in the case of supply of services, the supplier may opt for this rule, ignoring rule 30.

2. Comparative Summary

2.1 Comparative Summary of ISD vs Cross Charge

| ISD | Cross charge |

| Mandatory separate registration | No separate registration |

| Distribution of only Input services | Cross charge of Common inputs, input services and Capital goods |

| Distribution of ITC as per prescribed formula – sec. 20 read with Rule 39 | Valuation mechanism prescribed – Sec.15 read with Rules 28, 30 and 31 |

| Separate return compliances in GSTR-6 and GSTR-6A | No separate returns |

3. Advance Rulings and FAQ

3.1 Analysis of Specific Advance Rulings

Columbia Asia Hospitals (P.) Ltd., In re [[2018] 96 taxmann.com 245/69 GST 427/15 GSTL 722 (AAR-KARNATAKA) ]

- Services of employee at the HO (like IT services, Payroll Services, HR Services) to the distinct person shall be treated as supply and the same is liable to tax.

- Further AAAR also observed that there is a fundamental difference between the concept of ISD and Cross Charge.

- In the ISD concept, only ITC on input services which are attributable to other distinct entities are distributable.

- Whereas, in case of cross charge mechanism, all expenses incurred by a distinct person which benefits other distinct persons is required to be cross charged.

- In case of cross charge, there is an element of service rendered by person who cross charges to the other units even though they belong to same legal entity whereas in case of ISD, there is no element of service at all, but a mere distribution of ITC.

Cummins India Ltd., In re [[2022] 134 taxmann.com 342/58 GSTL 549/90 GST 753 (AAAR-MAHARASHTRA)]

- Activity of HO availing ITC for common input supplies on behalf of BOs does qualify as supply and would attract the levy of GST.

- The AAAR also held that the HO is not entitled to avail the ITC of such common input supplies.

- HO must register itself as an ISD and distribute such availed common ITC to the company’s branch offices/units.

B G Shirke Construction Technology (P.) Ltd., In re [[2021] 132 taxmann.com 124/55 GSTL 174/88 GST 831 (AAR-MAHARASHTRA)]

- Managerial and leadership services provided by the Registered/Corporate Office to its Group Companies/sites is to be considered as “supply of service“ under Entry No. 2 to Schedule I and liable to GST.

- The Applicant can continue to charge certain lump sum amount, as has been done in the past, in terms of second Proviso to Rule 28 of CGST Rules, 2017 , as most of the recipients of such services are eligible for full credit, barring one or two related persons, who would comply with the provisions of Section 17 of CGST Act, 2017, at their respective ends

3.2 Frequently Asked Questions on Banking, Insurance and Stock Brokers Sector

FAQ: Would Input Tax Credit (ITC) be available to a GST registrant though the services procured from third party vendor are also directly used by various ‘distinct persons’? In such cases, is distribution of ITC required to be done mandatorily through Input Service Distributor mechanism?

Yes. Input Tax Credit (ITC) can be availed by a GST registrant in respect of the services procured in a consolidated manner from third party vendor which are directly used in the course or furtherance of business in more than one State, e.g. statutory audit fees, advertisement and marketing expenses, consultancy fees etc. The same needs to be appropriately invoiced or distributed through the ISD mechanism to the “distinct persons” who have actually used such services.

4. Circular No. 199/11/2023-GST

CBIC has issued Circular No. 199/11/2023-GST dated 17.07.2023. wherein clarifications have been provided in pursuance to taxability of activities performed by an office of an organization in one State to the office of that organization in another State, which are regarded as distinct persons.

Major Clarifications

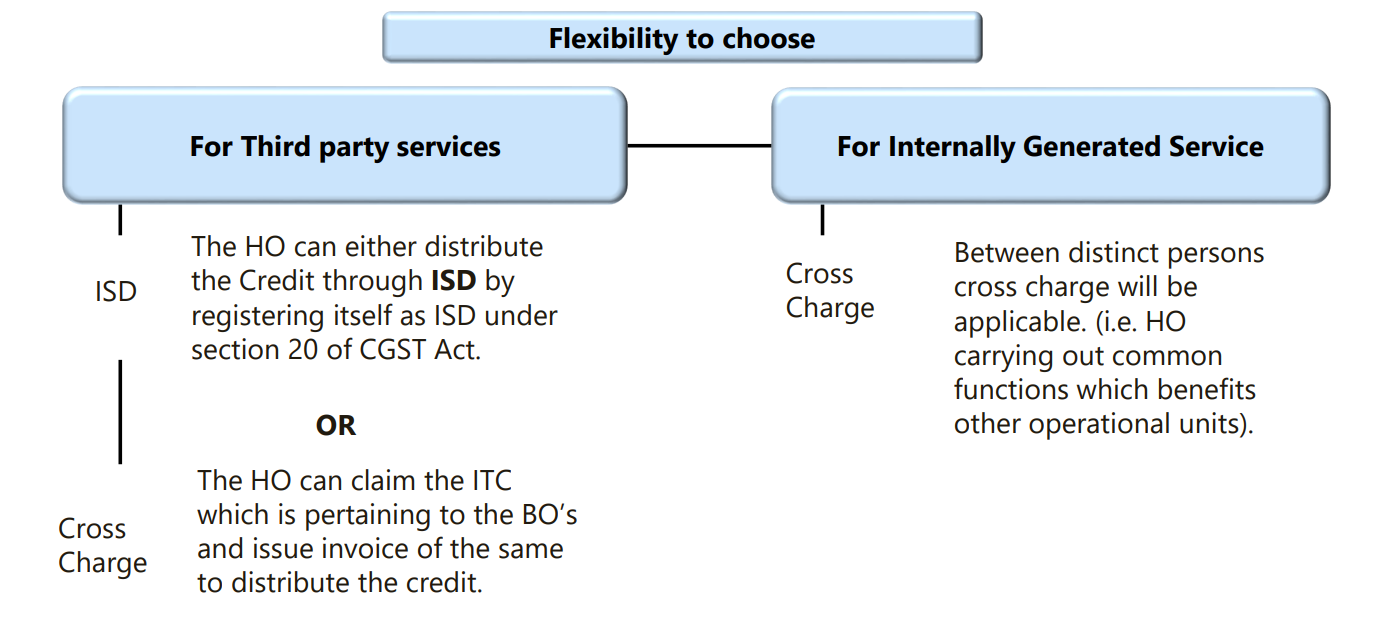

- Distribution of ITC Via ISD or Cross Charge

- Valuation of Services in case of Cross Charge

4.1 Whether ISD or Cross Charge?

4.2 Recipient Eligible for Full ITC

- In cases where the recipient is eligible for full ITC, the value adopted for ‘internally generated services’ in the Cross Charge invoice will be deemed to be the open market value, irrespective of the fact whether cost of employee etc., has been included or not in the value of the services in the invoice.

- While the valuation aspect was relatively clear due to the second proviso to Rule 28 of the CGST Rules, the Circular further reinforces it.

- Notably, the Circular goes even further by clarifying that even in situations where no invoice is raised for ‘internally generated services’ the value can be deemed as NIL and still be considered as the open market value.

4.3 Recipient not eligible for Full ITC

- In cases where the recipient is not eligible for full ITC, it is clarified that it is not mandatory to include the cost of salary of employees while computing the taxable value of the supply of such services.

- Thus, the AAAR in the matter of Columbia Asia supra and Cummins India Ltd has been overruled.

Irrespective of the fact that whether full or partial ITC is eligible to the recipient, it is not Mandatory to include salary cost for the purpose of valuation.

5. Open Issues

- What will be the valuation mechanism for cross charge where the recipient is not eligible for full ITC?

- Whether non-GST or exempt supplies to be included in the cost of provision of services for cross charge?

- How to interpret eligibility of full input tax credit – qua the supply or qua the recipient?

- Whether the taxpayer will have the option to adopt different valuation mechanism wherein one recipient is eligible for Full ITC and other is not eligible for full ITC?

- What will be the consequences for the taxpayer who did not choose any of the option i.e., did not distribute credit through ISD or Cross charge and retained full ITC?

- Whether flexibility to choose between ISD and Cross charge for the common input services will apply when the same service is cross charged in one period and ISD mechanism is applied in another and vice versa?

- Fate of the pending notices/orders issued to the taxpayer on adoption of cross charge vis-à-vis ISD?

- How to interpret the term ‘Internally generated services’ in the context of exclusion of salary cost?

6. Challenges if ISD is made mandatory

- In the 50th GST Council meeting held on 11.07.2023 in New Delhi it was recommended that amendment may be made in GST law to make ISD mechanism mandatory prospectively for distribution of input tax credit of common input services procured from third parties.

- Probable Challenges

- Identification of common input services received from third party.

- Proper communication with vendors to ensure that the invoices are raised on the ISD GSTN for forward charge supplies and on Normal GSTN for reverse charge supplies.

- Proper mechanism to ensure ISD credit is being distributed in the same month.

- Accumulation of ITC in SEZ unit due to credit distribution.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA