Ind AS 32: Financial Instruments (Presentation)

- Blog|Account & Audit|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 22 June, 2022

Also, Check out Taxmann's Financial Reporting by Parveen Sharma & Kapileshwar Bhalla. This book serves as a guide for students & professionals. It helps the reader acquire the ability to integrate & solve problems in practical scenarios on Indian Accounting Standards (Ind AS). It also assists the reader in deciding the appropriate accounting treatment and formulation of suitable accounting policies. While preparing and presenting the financial statements, this book helps in the ability to recognize and apply disclosure requirements specified in Ind AS. Acquiring/developing the skill to prepare financial statements of group entities based on Ind AS. Develop an understanding of the various forms of reporting (other than financial statements) and accounting for special transactions, and apply such knowledge in problem-solving

Definitions:

Ind AS 32 – Financial Instruments (Presentation)

What is a ‘Financial Instrument’?

Paragraph 11 of Ind AS 32 defines:

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Author’s commentary:

The keywords in the definition are:

Presence of a ‘contract’ – A contract would essentially be between 2 parties.

Where,

‘Contract’ and ‘contractual’ refers to:

An agreement between two or more parties that has clear economic consequences that the parties have little (if any) discretion to avoid usually because the agreement is enforceable by law.

Note: Contracts need not be in writing.

Example 1:

M Ltd. has an incentive receivable in the form of sales tax refundable from the government, under a scheme of government on complying with the certain stipulated conditions.

Whether such incentives receivable from government will fall under the definition of financial instruments under Ind AS 109 considering that there is no formal one to one contractual agreement between government and the company?

Answer:

A contract need not be in writing only and may take various forms.

In India, government does give incentives in the form of taxation benefits etc. to promote industry or for some other reasons as the case may be. Although under such schemes, there may not be a one to one agreement between the entity and the government as to the rights and obligations but there is an understanding between the government and the potential applicant/company that on complying the stipulated conditions attached to the scheme, the entity will be granted benefits of the scheme.

If in the given case, the entity has complied with the conditions attached to the scheme then it rightfully becomes entitled to the incentives attached to the scheme.

Accordingly, such incentive receivable will fall under the definition of financial instruments and will be accounted for as a financial asset as per Ind AS 109.

In case of Financial Instruments, the two parties are called:

(a) Issuer of an instrument who presents it on the Liability side of the Balance Sheet as per Schedule III – Division II.

(b) Holder of an instrument who presents it on the Asset side of the Balance Sheet as per Schedule III – Division II.

Ind AS 32 deals with the presentation of Financial instrument in the Balance Sheet.

Typically, it is the Issuer who needs to decide whether the instrument is to be presented as financial liability or equity instrument.

Irrespective the holder would always present it as financial asset.

Let us now make some deep analysis which will help us in appreciating the need for Ind AS 32 which focuses on Financial Instrument – Presentation.

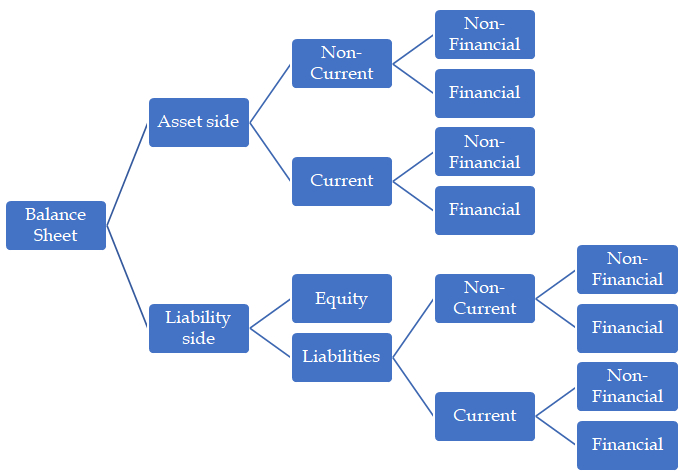

An analysis of Schedule III – Division II gives us an insight as under:

-

- Assets segregated into non-current and current; further segregated in terms of non-financial and financial in nature.

- Liability side segregated into Equity and Liability; liabilities are split in terms of non-current and current; and further segregated in terms of non-financial and financial in nature.

We can summarize this as under:

Let us analyse which Ind AS would apply for which aspect.

| S.No. | Particulars | Applicable Ind AS |

| 1. | Assets segregated into Current and Non-current | 1 |

| 2. | Liabilities segregated into Current and Non-current | 1 |

| 3. | Financial or Non-Financial Asset | 32 |

| 4. | Financial or Non-Financial Liability | 32 |

| 5. | Equity Instrument or Financial Liability | 32 |

Once an issuer has decided that a Financial Instrument is an Equity Instrument or Financial Liability as per Ind AS 32 it would focus as under:

Ind AS 109 – For Recognition and Measurement.

Ind AS 107 – For Disclosures.

Also, the holder has to apply the above standards for the same purpose i.e. for Financial Assets;

Ind AS 109 – For Recognition and Measurement.

Ind AS 107 – For Disclosures.

Now the most important terms we need to understand before we fully understand the definition of Financial Instrument are:

-

- Financial Liability.

- Financial Asset.

- Equity Instruments.

Let’s take, these terms one by one.

| What is a ‘Financial Liability’?

Paragraph 11 of Ind AS 32 defines: A financial liability is any liability that is: (a) a contractual obligation: (i) to deliver cash or another financial asset to another entity; or (ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; or (b) a contract that will or may be settled in the entity’s own equity instruments and is: (i) a non-derivative for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or (ii) a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose, rights, options or warrants to acquire a fixed number of the entity’s own equity instruments for a fixed amount of any currency are equity instruments if the entity offers the rights, options or warrants pro rata to all of its existing owners of the same class of its own non-derivative equity instruments. Apart from the aforesaid, the equity conversion option embedded in a convertible bond denominated in foreign currency to acquire a fixed number of the entity’s own equity instruments is an equity instrument if the exercise price is fixed in any currency. Also, for these purposes the entity’s own equity instruments do not include puttable financial instruments that are classified as equity instruments in accordance with paragraphs 16A and 16B, instruments that impose on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation and are classified as equity instruments in accordance with paragraphs 16C and 16D, or instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments. As an exception, an instrument that meets the definition of a financial liability is classified as an equity instrument if it has all the features and meets the conditions in paragraphs 16A and 16B or paragraphs 16C and 16D. |

Author’s commentary:

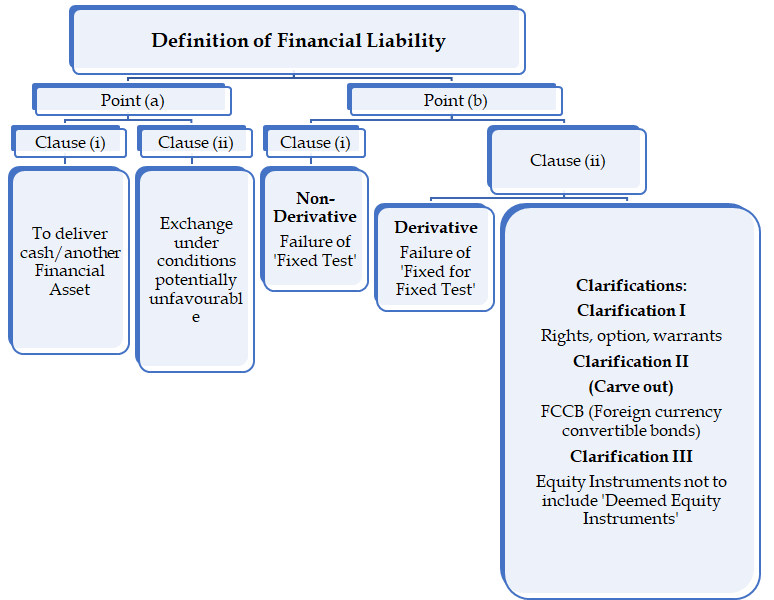

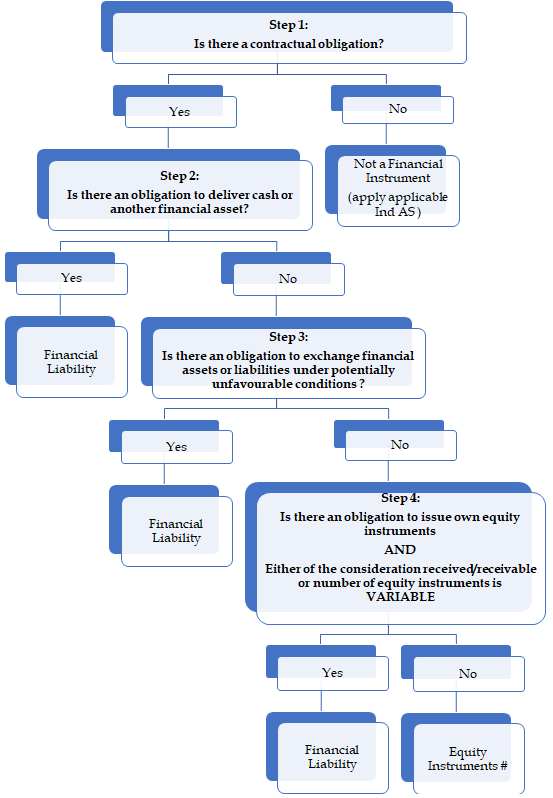

To understand the above definition first of all let us see the different aspects of this definition with the help of a diagram and then we shall discuss each aspect separately.

The entire definition of ‘financial liability’ has been set up as under in Paragraph 11 of Ind AS 32:

Aspect 1:

Any Liability:

It will include:

-

- Actual liability.

- Contingent liability.

(Though there is Ind AS 37 dealing with the same; See discussion in scope later for more understanding)

-

- Derivative liability.

- Non-derivative liability.

Aspect 2:

Contractual obligation:

There has to be an obligation which is contractual in nature.

For example:

Income tax to be paid to government is an obligation but not contractual in nature. It is statutory in nature; therefore, would not be a financial liability.

Aspect 3:

Ways in which the contractual obligation is discharged:

Note:

Not all ways have been discussed at this stage.

- Point (a)(i) of the definition:

-

- Cash (includes through bank and cash and cash equivalents) or another Financial Asset

- Point (b)(i) of the definition:

-

- Own equity instruments (but variable in number)

Special Issues: (Discussed separately)

Point (a) (ii) – Exchange

Point (b) (ii) – Derivative

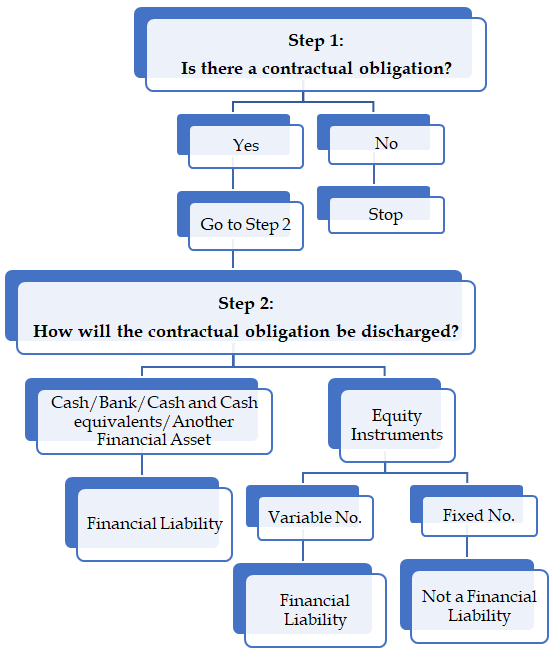

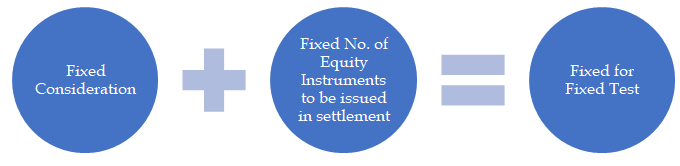

Ind AS 32 recognizes the use of own equity instruments as a medium of settlement of an obligation.

This concept is called in case of non-derivative “Fixed Test”.

In simple words,

If an entity issues Fixed no. of equity instruments it passes the Fixed Test and the instrument is not a financial liability in that case.

If an entity issues Variable no. of equity instruments it fails the Fixed Test and the instrument is a financial liability in that case.

Let us put the above discussion in the form of a step chart to make our thought process clear.

Let us take some examples to make the above concept absolutely clear especially when we use own equity instruments as a medium for settlement.

Example 2:

X Ltd. issues convertible debentures to Y Ltd. for a subscription amount of Rs. 250 crores. Those debentures are convertible after 5 years into equity shares of X Ltd. using a pre-determined formula. The formula is:

100 crores × (1 + 10%) ^5

Fair value on date of conversion

Examine the nature of the financial instrument.

Answer:

Such a contract is a financial liability of the entity where the entity is using own equity instruments as a medium (currency) to settle the transaction.

It is not an equity instrument because the entity uses a variable number of its own equity instruments as a means to settle the contract.

(It fails the Fixed Test)

Example 3:

A Ltd., issues convertible debentures to B Ltd. for a subscription amount of Rs. 340 crores. Those debentures are convertible after 5 years into 40 crore equity shares of Rs. 10 each.

Examine the nature of the financial instrument.

Answer:

This contract is an equity instrument because number of equity instruments to be received or delivered is fixed.

(It passes the Fixed Test)

Test your knowledge:

A Ltd. took a borrowing from Z Ltd. for Rs. 20,00,000. Z Ltd. enters into an arrangement with A Ltd. for settlement of the loan against issue of a certain number of equity shares of A Ltd. whose value equals

Rs. 20,00,000.

For this purpose, fair value per share (to determine total number of equity shares to be issued) shall be determined based on the market price of the shares of A Ltd. at a future date, upon settlement of the contract.

Evaluate the nature of financial instrument?

Answer:

A Ltd. is under an obligation to issue variable number of Equity shares equal to a total consideration of Rs. 20,00,000.

Hence, equity shares are used as currency for purpose of settlement of an amount payable by A Ltd. Since this is variable number of shares are to be issued in a non-derivative contract, it implies the use of equity shares as ‘currency’ and hence, this contract meets definition of financial liability in books of A Ltd.

(It fails the Fixed Test)

Special Issue 1:

Exchange:

Point (a) (ii):

“To exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity”

Example 4:

P Ltd. takes a short position in a call option with A Ltd. (long position) to subscribe to P Ltd.’s equity shares at a price of Rs. 200 per share.

The call option is to be settled on a ‘net’ basis i.e. without physical delivery of shares.

Analysis:

If on the balance sheet date, market value of equity share of P Ltd. is Rs. 210 per share, P Ltd. will be obliged to pay Rs. 10 to settle the option.

Such a condition is potentially unfavourable to P Ltd. and hence Rs. 10 represents a financial liability for P Ltd.

Special Issue 2:

Derivative:

Point (b) (ii):

“A derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments.”

Look at the italicized words carefully. You can see the words – Fixed for Fixed.

This concept is called in case of derivative “Fixed for Fixed Test”.

In simple words,

Example 5:

S Ltd. purchases an option from T Ltd. entitling the holder to subscribe to equity shares of issuer at a fixed exercise price of Rs. 60 per share at any time during a period of 3 months. Holder paid an initial premium of Rs. 5 per option.

Examine how will the financial instrument will be classified?

Answer:

For the issuer A Ltd., this option is an equity instrument as it will be settled by the exchange of a fixed amount of cash for a fixed number of its own equity instruments.

(It passes the Fixed for Fixed Test)

We can summarize the concept of both ‘Fixed Test’ and ‘Fixed for Fixed Test’ as under:

| S. No. | Particulars | Remarks | Logic |

| 1. | Non-Derivative

Passes Fixed Test |

Equity Instruments | Fixed no. of equity instruments is being issued. |

| 2. | Non-Derivative

Fails Fixed Test |

Financial Liability | Variable no. of equity instruments is being issued. |

| 3. | Derivative

Passes Fixed for Fixed Test |

Equity Instruments | Issuer does not have an obligation to pay cash.

Holder is not exposed to variability. |

| 4. | Derivative

Passes Fixed for Variable Test |

Financial Liability | Own variable equity instruments are used to settle obligation for fixed amount. |

| 5. | Derivative

Passes Variable for Fixed Test |

Financial Liability | Issuer does not have an obligation to pay cash.

Holder is exposed to variability. |

| 6. | Derivative

Passes Variable for Variable Test |

Financial Liability | Both parties (issuer and holder) are exposed to variability. |

Aspect 4:

Rights, options or warrants:

Point (b) (ii):

‘Rights, options or warrants to acquire a fixed number of the entity’s own equity instruments for a fixed amount of any currency are equity instruments if the entity offers the rights, options or warrants pro rata to all of its existing owners of the same class of its own non-derivative equity instruments.’

Aspect 5:

Equity conversion option embedded in a convertible bond denominated in foreign currency

(simply called FCCB):

Point (b) (ii):

‘Equity conversion option embedded in a convertible bond denominated in foreign currency to acquire a fixed number of the entity’s own equity instruments is an equity instrument if the exercise price is fixed in any currency.’

| The position in Ind AS is different from IFRS. Let us pin point the Carve-out on this issue:

As per IFRS (i.e. IAS 32): As per accounting treatment prescribed under IAS 32: · Equity conversion option · In case of foreign currency denominated convertible bonds (FCCBs) · Is considered a derivative liability which is embedded in the bond Gains or losses arising on account of change in fair value of the derivative need to be recognised in the Statement of profit and loss as per IAS 32. Carve out (Based on Ind AS 32): In Ind AS 32, an exception has been included to the definition of “Financial liability‟ in Paragraph 11(b) (ii), whereby:

Is classified as an equity instrument

Reasons for the carve-out: The treatment as per IAS 32 is not appropriate in instruments, such as, FCCB’s since the number of shares convertible on the exercise of the option remains fixed and the amount at which the option is to be exercised in terms of foreign currency is also fixed; (Merely the difference in the currency should not affect the nature of derivative, i.e., the option.) Further, the fair value of the option is based on the fair value of the share prices of the company. If there is decrease in the share price, the fair value of derivative liability would also decrease which would result in recognition of gain in the statement of profit and loss. This would bring unintended volatility in the statement of profit and loss due to volatility in share prices. This will also not give a true and fair view of the liability as in this situation, when the share prices fall, the option will not be exercised. However, it has been considered that if such option is classified as equity, fair value changes would not be required to be recognised. Accordingly, the exception has been made in definition of financial liability in Ind AS 32. |

Example 6:

Entity A issues a bond with face value of USD 1000 and carrying a fixed coupon rate of 6% p.a. Each bond is convertible into 10,000 equity shares of the issuer.

Examine the nature of the financial instrument.

Analysis:

While the number of equity shares is fixed, the amount of cash is not.

The variability in cash arises on account of fluctuation in exchange rate of INR-USD. Such a foreign currency convertible bond (FCCB) will as per IFRS i.e. IAS 32 qualifies the definition of financial liability.

However, Ind AS 32 provides, “the equity conversion option embedded in a convertible bond denominated in foreign currency to acquire a fixed number of the entity’s own equity instruments is an equity instrument if the exercise price is fixed in any currency.”

Accordingly, FCCB will be treated as an equity instrument.

Aspect 6:

Entity’s own equity instruments do not include….

Point (b) (ii):

‘Also, for these purposes the entity’s own equity instruments do not include puttable financial instruments that are classified as equity instruments in accordance with paragraphs 16A and 16B, instruments that impose on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation and are classified as equity instruments in accordance with paragraphs 16C and 16D, or instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments.’

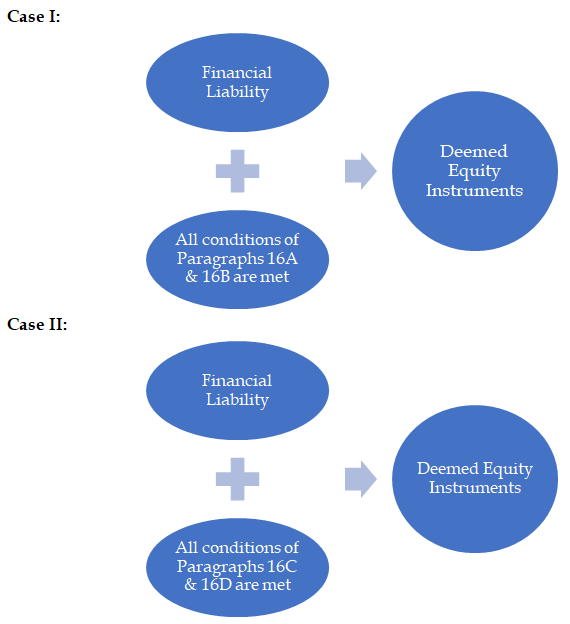

| Ind AS 32 in the definition of Financial liability gives us 3 instruments which are not considered as equity instruments for settlement of financial liability; though they are regarded as “deemed equity instruments” (see Aspect 7 below).

1. Puttable financial instruments. (Classified as equity instruments if all conditions of paragraphs 16A and 16B are met – Discussed in detail later.) 2. Instruments that impose on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation. (Classified as equity instruments if all conditions of paragraphs 16C and 16D are met – Discussed in detail later.) 3. Instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments. |

Aspect 7:

Exception:

(Clarification at the end of the definition)

“As an exception, an instrument that meets the definition of a financial liability is classified as an equity instrument if it has all the features and meets the conditions in paragraphs 16A and 16B or paragraphs 16C and 16D.”

These are technically called “Deemed equity instruments”. (Discussed in detail later)

They are ‘Financial liabilities’ but treated as ‘Equity Instruments’ if certain conditions are met.

At this stage we can only keep one simple concept in mind.

Case I:

Case II:

Let’s recall;

These equity instruments are not considered as equity instruments for settlement of Financial Liability. See Aspect 6 above.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA