How to do GST Registration Online?

- Blog|GST & Customs|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 19 October, 2021

GST Registration:

The registration under the GST can be obtained by a taxable person by following the specified procedures. It must be acknowledged that as there are different types of taxable persons defined under GST, therefore, there are different set of registration procedures applicable to different taxable persons.

Who is required to file GST REG-01?

In general, the normal taxpayer can apply for registration by filing Form GST REG-01 while there are other forms of registration for other class of persons. Form GST REG-01 is applicable to normal taxpayer other than: 1.Non-Resident taxable person 2.A person required to deduct TDS under section 51 3.A person required to collect TCS under section 52 4.A person supplying online information and database access or retrieval (OIDAR) services from a place outside India to a non-taxable online recipient Normal taxpayer is residual category where such taxable person shall not fall any of the specified taxpayer category in GST. It is worthwhile to note that E-commerce may require to register as Normal Taxpayer as well as Tax Collector [TCS] if require to collect TCS.

GST Registration Procedure:

In order to apply for a new GST registration, the applicant has to file Form GST REG-01 in two parts – Part A and Part B.

Filing of Part A of GST REG-01:

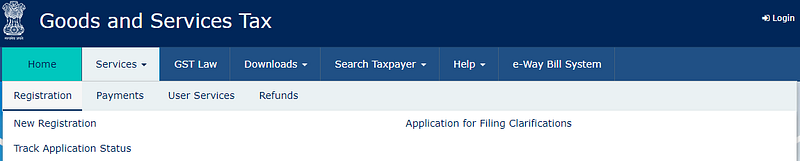

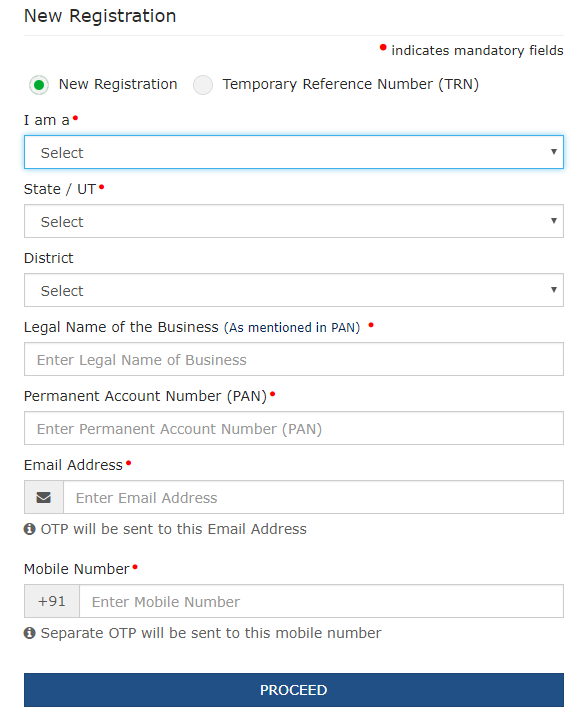

Step 1: Go to www.gst.gov.in Step 2: Click on Services > Registration > New Registration  Step 3: Select ‘New Registration’ from the Radio Button and fill the basic information

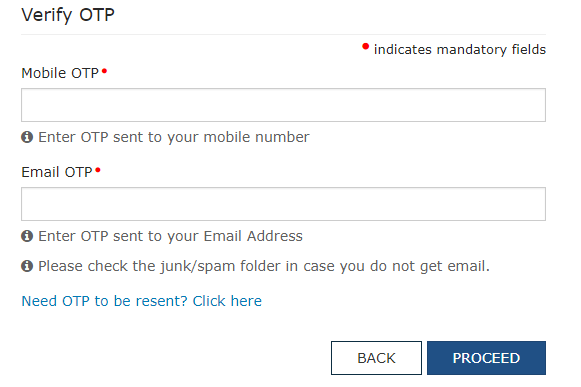

Step 3: Select ‘New Registration’ from the Radio Button and fill the basic information  Step 4: Verify your email id and mobile by validating the OTP sent on your registered email id and mobile number.

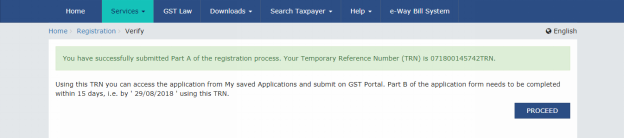

Step 4: Verify your email id and mobile by validating the OTP sent on your registered email id and mobile number.  Step 5: After verification of e-mail id and mobile number, a Temporary Reference Number (TRN) shall be generated. It is a unique 15-digit reference number require to proceed further to fill the Part B of GST REG-01. It is valid for 15 days from the date of creation.

Step 5: After verification of e-mail id and mobile number, a Temporary Reference Number (TRN) shall be generated. It is a unique 15-digit reference number require to proceed further to fill the Part B of GST REG-01. It is valid for 15 days from the date of creation.

Filing of Part B of GST REG-01:

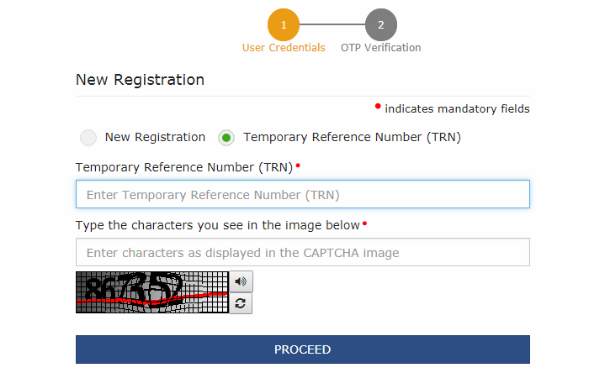

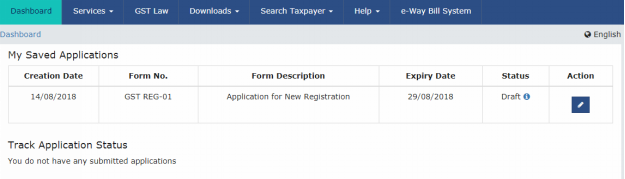

Step 1: Click on Services > Registration > New Registration Step 2: Select ‘Temporary Reference Number’ from the Radio Button, fill the required information and click ‘Proceed’. Step 3: On next screen, enter the OTP sent on registered mobile number and e-mail id and click proceed to fill details in Part-B of REG-01.  Step 4: Click on Action Button to begin the process to fill Part-B of GST REG-01. The status of application shall be changed from ‘Draft’ to ‘Pending for Validation’ on submission of Part A.

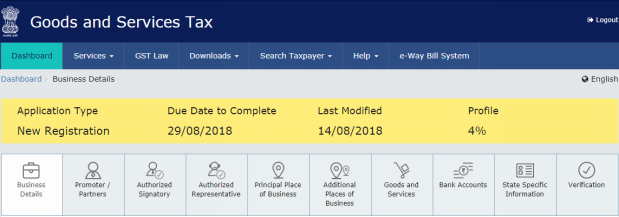

Step 4: Click on Action Button to begin the process to fill Part-B of GST REG-01. The status of application shall be changed from ‘Draft’ to ‘Pending for Validation’ on submission of Part A.  Step 5: Furnish the information required in 10 Major Tabs, inter-alia, Business Details, Promoter/ Partners, Place of Business, Goods and Services, Bank Accounts, etc.

Step 5: Furnish the information required in 10 Major Tabs, inter-alia, Business Details, Promoter/ Partners, Place of Business, Goods and Services, Bank Accounts, etc.  Step 6: In the last tab, verify the application and Submit with any of the three following options: a)Submit with Digital Signature b)Submit with E-Signature c)Submit with EVC Step 7: Application Reference Number (ARN) receipt is sent on the e-mail address and mobile phone number. On receipt of an application, an acknowledgement shall be issued electronically to the applicant in Form GST REG-02. Step 8: Once all the details are verified, the GST registration shall be issued in GST REG-06.

Step 6: In the last tab, verify the application and Submit with any of the three following options: a)Submit with Digital Signature b)Submit with E-Signature c)Submit with EVC Step 7: Application Reference Number (ARN) receipt is sent on the e-mail address and mobile phone number. On receipt of an application, an acknowledgement shall be issued electronically to the applicant in Form GST REG-02. Step 8: Once all the details are verified, the GST registration shall be issued in GST REG-06.

Related Articles:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Comments are closed.