Guide to Ind AS 27: Separate Financial Statements

- Blog|Account & Audit|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 17 July, 2023

Table of Contents

2. Definitions

3. Presentation

4. Dividend Income from subsidiary or Associate or joint venture

5. Reorganisation of structure of the Parent – by establishing a new entity as its Parent

6. Disclosure

7. First time adoption of the Ind AS

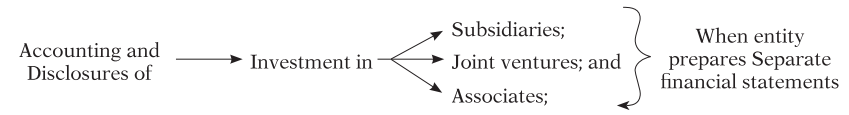

1. Objective & Scope

This Standard prescribes

This Standard is applicable to those entities, which elect to prepare separate financial statements on their own or it is required by the law; BUT this standard does not mandate any entity to prepare separate financial statements.

Dive Deeper:

Financial Statements – Types, Objectives, Components

2. Definitions

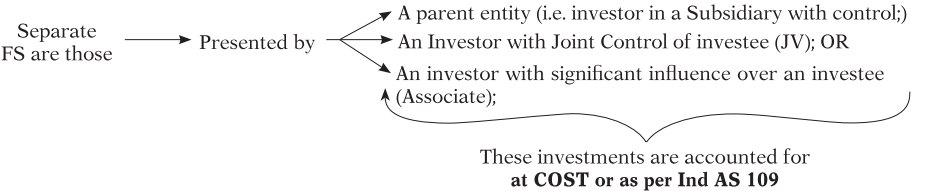

What do you mean by Separate financial statements?

One must refer to Ind AS 110, 111, 28 for the definitions of subsidiary, control, associate and joint venture.

These separate financial statements are prepared in addition to

-

- Consolidated financial statements; or

- Financial statements where equity method is followed for accounting investments in associates and Joint ventures.

Separate financial statements need not be accompanying the above financial statements.

|

Concept Capsule 1 Harsha Ltd. does not have any subsidiaries/investment in joint ventures or associates. They prepared financial statements. Can these financial statements be called as Separate financial statements? Answer: As per Ind AS 27, Separate financial statements are those where the entity’s investment in subsidiary, joint venture or associate at cost or as per Ind AS 109. In the given case, the entity does not have any investment – hence these cannot be called as separate financial statements. If the entity is following equity method to account for investment in joint venture or associates – that set of financial statements also cannot be called as separate financial statements. These may be called as consolidated financial statements. |

As per Para (4) of Ind AS 110 and Para (17) of Ind AS 28, a parent entity need not prepare consolidated financial statements and apply equity method, if it meets all the following conditions.

(i) it is a wholly-owned subsidiary or is a partially-owned subsidiary of another entity and all its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not presenting consolidated financial statements;

(ii) its debt or equity instruments are not traded in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets);

(iii) it did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market; and

(iv) It’s ultimate or any intermediate parent produces consolidated financial statements that are available for public use and comply with Ind AS.

In addition to the above –

An Investment entity as per Ind AS 110 (i.e. who obtained funds from others and invested in other entities with an intention to earn capital appreciation and/or investment income) – should not consolidate its subsidiaries. It presents these investments at fair value (FVTPL) as per Ind AS 109.

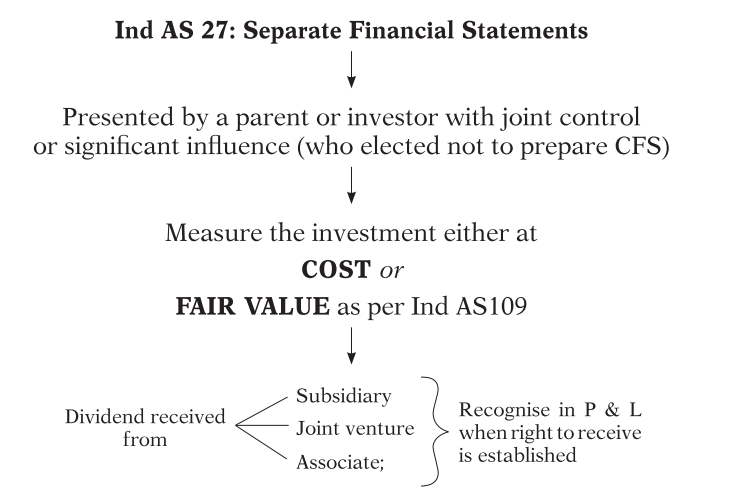

3. Presentation

Separate financial statements shall be prepared in accordance with ALL applicable Ind AS except Investment in subsidiaries, Joint ventures and Associates; as these are accounted either at

(a) COST; or

(b) In accordance with Ind AS 109.

The same accounting should be applied on each category of investments.

Investments which are accounted for at cost shall be accounted for in accordance with Ind AS 105, when they are classified as held for sale.

The measurement of investments accounted for in accordance with Ind AS 109 is not changed in such circumstances.

What is COST?

There is no definition in Ind AS 27. These wordings are taken from Ind AS 28 – it says – ‘COST’ comprises, its purchase price and any directly attributable expenditures necessary to obtain it. At the date of acquisition, an estimate of the contingent consideration is included as part of the cost of the acquisition.

|

Concept Capsule 2 Tata Mutual funds has ten associates. The entity has elected to account these investments at FVTPL as per Ind AS 109. How should they account for these investments in separate financial statements as per Ind AS 27? Answer: As per Ind AS 28, an entity that is a venture capital organisation, or a mutual fund, unit trust and similar entities including investment-linked insurance funds, can account for their investments in associates or joint ventures at fair value through profit or loss in accordance with Ind AS 109. As per Ind AS 27, same accounting must be followed in the separate financial statements also i.e. it must be accounted at fair value (FVTPL). |

|

Concept Capsule 3 An investment entity has investment in subsidiaries and during the period, the intentions of the entity changed and it is no more investment entity. How to account for investment in subsidiary? Answer: As per Ind AS 27, the entity shall account for the change from the date when the change in status occurred, it should account either at (a) Account for investment in subsidiary at COST; The fair value of the subsidiary investment on the date of change shall be used as deemed cost; or (b) It can continue to account for an investment in a subsidiary in accordance with Ind AS 109. |

|

Concept Capsule 4 PP Ltd., a non-investment entity, is the parent of Praja Ltd. within the meaning of Ind AS 110 ‘Consolidated Financial Statements’. The investment in Praja Ltd. was carried in the separate financial statements of PP Ltd. at fair value with changes in fair value recognised in the other comprehensive income. On 1st April, 20X2, PP Ltd. qualifies as one that is an investment entity. Carrying amount of the investment on 1st April, 20X2 was ` 8,00,000. The fair value of its investment in Praja Ltd was ` 10,00,000 on that date. PP Ltd had recognised in OCI an amount of ` 1,00,000 as a previous fair value increase related to the investment in Praja Ltd. How would PP Ltd account for the investment in Praja Ltd on the date of change of its classification/status as an investment entity, in its separate financial statements? Answer: As per Ind AS 27, the entity shall account for the change from the date when the change in status occurred. (i) It should account for the investment in a subsidiary at fair value through profit or loss as per Ind AS 109. (ii) The difference between the previous carrying amount of the subsidiary and its fair value at the date of the change of status of the investor shall be recognised as a gain or loss in profit or loss. (iii) The cumulative amount of any fair value adjustment previously recognised in OCI in respect of those subsidiaries shall be treated as if the investment entity had disposed of those subsidiaries at the date of change in status i.e. it should be reclassified within equity like transfer to retained earnings (should not be transferred to P&L statement). In the given case, on the date of change, i.e., 1st April, 20X2, PP Ltd. (the parent) becoming an investment entity, its investment in Praja Ltd. (the subsidiary) shall be at FVTPL as per Ind AS 109. Accordingly, the new carrying amount will be ` 10,00,000. The difference of ` 2,00,000 should be transferred to P&L as gain. As per Ind AS 107, requires disclosure of any transfers of the cumulative gain or loss within equity during the period and the reason for such transfers. Accordingly, PP Ltd. shall provide the disclosures if it transfers the cumulative gain or loss from one component to the other within equity.

|

|

Concept Capsule 5 Entity A is a 60% unlisted subsidiary of another entity that produces publicly available consolidated financial statements in accordance with Ind AS. Entity A has an associate but no subsidiaries. Entity A has no plans to issue shares or debentures to the public. The other 40% shareholders of entity A have been informed of entity A’s intention not to produce ‘consolidated’ financial statements and have not objected. There is a local legal requirement for parent companies and investors in associates to prepare separate financial statements in addition to consolidated financial statements. What kind of financial statements does entity A need to prepare in this case? Answer: Entity A is entitled to the exemption from preparing ‘consolidated’ financial statements (that is, equity accounting for its associate) because it meets all of the conditions set out in paragraph 17 of Ind AS 28 for exemption. However, it must prepare separate financial statements in addition to consolidated financial statements. |

|

Concept Capsule 6 Entity A is a 60% listed subsidiary of another entity that produces publicly available consolidated financial statements in accordance with Ind AS. Entity A has an associate but no subsidiaries. There is a local legal requirement only for parent companies (that is, investors in subsidiaries) to prepare separate financial statements in addition to consolidated financial statements. What kind of financial statements does entity A need to prepare in this case? Answer: Entity A is not entitled to the exemption from equity accounting its associate (that is, preparing ‘economic interest’ financial statements) because its shares are listed. It is required to prepare ‘consolidated’ financial statements as its only financial statements, because there is no local legal requirement for an investor that has no subsidiaries to additionally prepare separate financial statements. |

|

Concept Capsule 7 Entity A is 100% owned by entity X, which is listed. X prepares consolidated financial statements in accordance with Ind AS. Entity A has one subsidiary and one associate. There is a local legal requirement for parent companies to prepare separate financial statements. What kind of financial statements does entity A need to prepare in this case? Answer: Entity A prepares separate financial statements as its only financial statements. A is entitled to take advantage of the exemptions in paragraph 4 of Ind AS 110 and paragraph 17 of Ind AS 28 and not produce consolidated financial statements. |

|

Concept Capsule 8 A company, AB Ltd. holds investments in subsidiaries and associates. In its separate financial statements, AB Ltd. wants to elect to account its investments in subsidiaries at cost and the investments in associates as financial assets at FVTPL as per Ind AS 109, Financial Instruments. Whether AB Limited can carry investments in subsidiaries at cost and investments in associates in accordance with Ind AS 109 in its separate financial statements? Answer: As per Ind AS 27, when an entity prepares separate financial statements, it shall account for investments in subsidiaries, joint ventures and associates either at cost, or Fair value as per Ind AS 109. Further, the entity shall apply the same accounting for each category of investments. There is no guidance on the word ‘category’ in the standard. It seems that subsidiaries, associates and joint ventures would qualify as separate categories. Thus, the same accounting policies are applied for each category of investments – i.e., each of subsidiaries, associates and joint ventures. In the present case, investment in subsidiaries and associates are considered to be different categories of investments. Thus, AB Limited can carry its investment in subsidiaries at cost and its investments in associates as financial assets at fair value as per Ind AS 109 in its separate financial statements. |

4. Dividend Income from subsidiary or Associate or joint venture

An entity shall recognise a dividend from a subsidiary, a joint venture or an associate in profit or loss in its separate financial statements when its right to receive the dividend is established.

|

Concept Capsule 9 Parent entity, who is preparing separate financial statements, received bonus shares from its subsidiary. How to account for this in separate financial statements? Answer: As per Ind AS 27, an entity shall recognise a dividend from a subsidiary, a joint venture or an associate in profit or loss in its separate financial statements when its right to receive the dividend is established. In the given case, it is not a receipt of a distribution from the subsidiary; No distribution is deemed to have occurred. Hence, the parent should not record it as income. The parent makes no entries in its separate financial statements. No gain is recognised and the carrying amount of the investment in subsidiary is not changed. (Think logically. Bonus issue has really not changed anything except the number of shares from the parent point of view. Overall investment value before and after bonus issue remains the same & hence, no entry is required.) |

5. Reorganisation of structure of the Parent – by establishing a new entity as its Parent

When a parent reorganises the structure of its group by establishing a new entity as its parent in a manner that satisfies the following criteria:

(a) New parent obtains control of the original parent by issuing equity instruments in exchange for existing equity instruments of the original parent;

(b) Assets and liabilities of the new group and the original group are the same immediately before and after the reorganisation; and

(c) Owners of the original parent before the reorganisation have the same absolute and relative interests in the net assets of the original group and the new group immediately before and after the reorganisation.

and the new parent accounts for its investment in the original parent at COST in its separate financial statements – the new parent shall measure cost at the carrying amount of its share of the equity items shown in the separate financial statements of the original parent at the date of the reorganisation.

Similarly, an entity that is not a parent might establish a new entity as its parent in a manner that satisfies the above criteria. The accounting treatment suggested above will be applicable to such reorganisations. In such cases, references to ‘original parent’ and ‘original group’ are to the ‘original entity’.

6. Disclosure

When a parent elects not to prepare consolidated financial statements and instead prepares separate financial statements as per Para 4(a) of Ind AS 110, it shall disclose the following in separate financial statements:

(a) the fact of using the exemption; and the name and principal place of business of the entity whose consolidated financial statements that comply with Ind ASs have been produced for public use; and the address i.e. from where those are obtainable.

(b) a list of significant investments in subsidiaries, joint ventures and associates, including:

(i) the name of those investees.

(ii) the principal place of business (and country of incorporation, if different) of those investees.

(iii) its proportion of the ownership interest (and its proportion of the voting rights, if different) held in those investees.

(c) a description of the method used to account for the investments listed under (b).

An investment entity – which is parent entity prepares separate financial statements as its only financial statements;

(i) Disclose that fact;

(ii) Present the disclosures relating to investment entities required by Ind AS 112;

When a parent or an investor with joint control of, or significant influence over, an investee prepares separate financial statements, the parent or investor shall identify the financial statements prepared in accordance with Ind AS 110, Ind AS 111 or Ind AS 28 to which they relate. The parent or investor shall also disclose in its separate financial statements:

(a) the fact that the statements are separate financial statements

(b) a list of significant investments in subsidiaries, joint ventures and associates, including:

(i) the name of those investees.

(ii) the principal place of business (and country of incorporation, if different) of those investees.

(iii) its proportion of the ownership interest (and its proportion of the voting rights, if different) held in those investees.

(c) a description of the method used to account for the investments listed under (b).

7. First time adoption of the Ind AS

As per this Ind AS, investment is valued either at

-

- Cost; or

- Fair value as per Ind AS 109.

If the investment is measured at cost, it shall measure in separate financial statements any one of the following

-

- Cost determined in accordance with Ind AS 27 or

- Deemed cost (which may be fair value on the date of transition OR Carrying amount as per previous GAAP)

|

Concept Capsule 10 A Ltd. acquired B Ltd. in a business combination transaction. A Ltd. agreed to pay certain contingent consideration (liability classified) to B Ltd. As part of its investment in its separate financial statements, A Ltd. did not recognise the said contingent consideration (since it was not considered probable). A Ltd. considered the previous GAAP carrying amounts of investment as its deemed cost on first-time adoption. In that case, does the carrying amount of investment required to be adjusted for this transaction? Answer: In accordance with Ind AS 101, an entity has an option to treat the previous GAAP carrying values, as at the date of transition, of investments in subsidiaries, associates and joint ventures as its deemed cost on transition to Ind AS. If such an exemption is adopted, then the carrying values of such investments are not adjusted. Accordingly, any adjustments in relation to recognition of contingent consideration on first time adoption shall be made in the statement of profit and loss (further payment should be charged to P&L). |

– Sri Rama Krishna Paramahamsa |

Held in sale/distribution

If measured at Cost ….. Follow Ind AS 105

If measured at FV ….. Follow Ind AS 109

Disclosures

-

- State that they are Separate Financial Statements

- List of significant subsidiaries, JVs & Associates

- Name of Investees

- Principal place of business & country of incorporation

- Proportion of ownership interest & voting rights

- Description of method used to account

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA