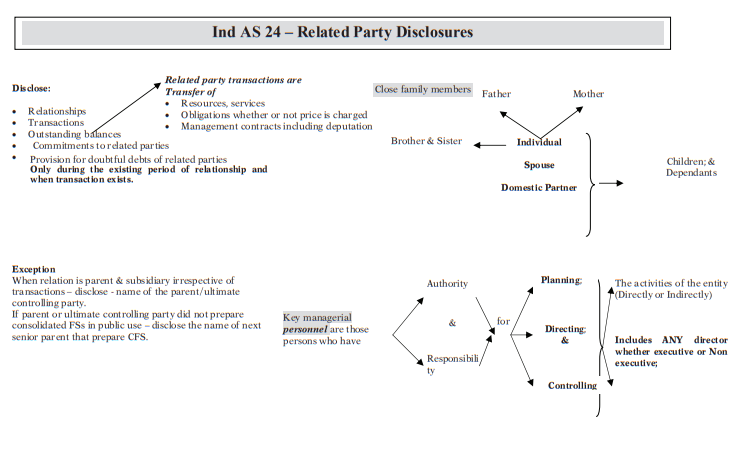

Guide to Ind AS 24: Related Party Disclosures

- Blog|Account & Audit|

- 28 Min Read

- By Taxmann

- |

- Last Updated on 10 July, 2023

Table of Contents

1. Objective

2. Scope

4. Who is ‘Close member of the family’?

5. Who is Key Managerial Personnel?

6. Who are not related parties?

8. Disclosure of Key Management Personnel Compensation

9. Exemption to Government related entities

10. Frequently Asked Questions

1. Objective

Related party relationships are a normal feature of commerce and business. Entities frequently carry on their business activities through its subsidiaries, joint ventures, associates and etc.

In general, users presume that the transactions in financial statements are presented on an “arm’s length” basis. However, the presumption may NOT be valid in case of the transactions between the related parties as the terms and conditions of related parties generally different from unrelated parties. Sometimes related parties may not charge anything for their services like interest free loans, free management services etc. Hence the related party relationship will have an effect on the financial position (BS) and operating results (P&L) of the entity.

Operating results and financial position will be affected because of related party relationship even if there is NO transaction between them. The mere existence of the relationship may be sufficient to affect the transactions of the entity with other parties. For example: a holding company can ask its subsidiary to stop the relationship with a trading partner or it may instruct the subsidiary not to engage in research and development.

Sometimes, transactions would not have taken place if the related party relationship had not existed. For example, a company that sold a large proportion of its production to its holding company at cost might not have found an alternative customer if the holding company had not purchased the goods.

As the related party transactions may not take place at arm’s length, the entity should give sufficient information about the related party relationship and related party transactions so as to make the users understand the financial positions in its perspective. This standard establishes the requirements of such disclosures.

2. Scope

This standard is applicable to the consolidated & separate financial statements of a parent or investors with joint control/significant influence over an investee – who prepared financial statements under Ind AS 110, Ind AS 27. It is applicable to individual financial statements.

This Standard shall be applied in:

(a) identifying related party relationships and transactions;

(b) identifying outstanding balances, including commitments, between an entity and its related parties;

(c) identifying the circumstances in which disclosure of the items in (a) and (b) is required; and

(d) determining the disclosures to be made about those items.

This Standard is NOT applicable in the following circumstances:–

-

- Entities need not follow the standard if the disclosure under this Ind AS affects the reporting entity’s duties of confidentiality.

- In case a statute or a regulator or a similar competent authority governing an entity prohibit disclosing certain information which is required to be disclosed as per this Standard – disclosure of such information is not required. For example: banks are obliged by law to maintain confidentiality in respect of their customers’ transactions.

- In case of consolidated financial statements (CFS) – Intra group transactions need NOT to be presented as CFS present information about the holding and its subsidiaries as a singlereporting entity. This is not applicable for those between an investment entity and its subsidiaries measured at fair value through profit or loss, in the preparation of consolidated financial statements of the group.

Let us enter into the main discussion – I would like to discuss the topic along with the definitions as and when required.

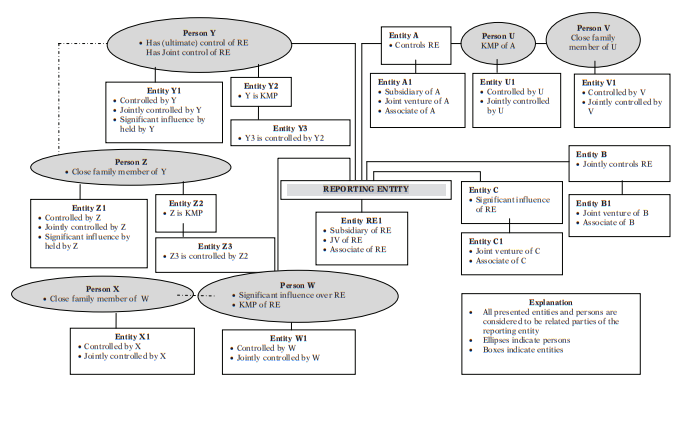

This Standard applies only to the below related party relationships.

3. Who is related party?

A related party can be a person, an entity, or an unincorporated business.

A related party is a person (individual) or entity that is related to the entity that is preparing its financial statements.

(a) A person or a close member of that person’s family is related to a reporting entity if that person:

(i) has control or joint control of the reporting entity;

(ii) has significant influence over the reporting entity; or

(iii) is a key management personnel (KMP) of the reporting entity or it’s parent entity.

(b) An entity is related to a reporting entity if any of the following conditions applies:–

(i) The entity and the reporting entity are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others);

(ii) One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member i.e., associate or joint venture of co-subsidiary);

(iii) Both entities are joint ventures of the same third party;

(iv) One entity is a joint venture of a third entity and the other entity is an associate of the third entity;

(v) The entity is a post-employment benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity;

(vi) The entity is controlled or jointly controlled by a person identified in (a);

(vii) A person identified in (a) (i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity);

(viii) The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity.

Control is the power over the investee when it is exposed or has rights to variable returns from its involvement with the investee and has the ability to affect those returns.

Joint Control is the contractually agreed sharing of control of an arrangement which exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control.

Significant influence is the power to participate in the financial and operating policy decisions of the investee, but is not control of those policies.

Let us now discuss each point separately in depth. [Try to remember the above wordings]

(a) An INDIVIDUAL becomes related party to the reporting entity, when that individual or his family’s close member

-

- Has Control or Joint control or Significant influence over the reporting entity;

- Is Key managerial personnel in the reporting entity or it’s parent entity; (Not in co-subsidiary entity)

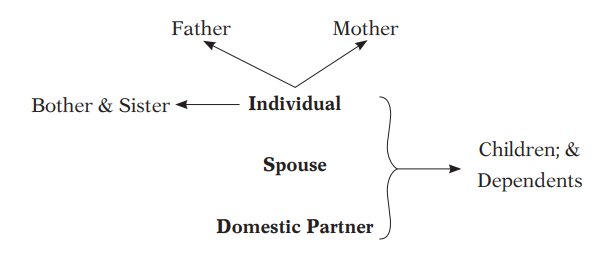

4. Who is ‘Close member of the family’?

Close members of the family of a person are those family members who may be expected to influence, or be influenced by, that person in their dealings with the entity including:

(a) that person’s children, spouse (married) or domestic partner (a person who is living with another in a close personal and sexual relationship but not married), brother, sister, father and mother;

(b) Children of that person’s spouse or domestic partner; and

(c) Dependents of that person or that person’s spouse or domestic partner.

The following diagram explains the same

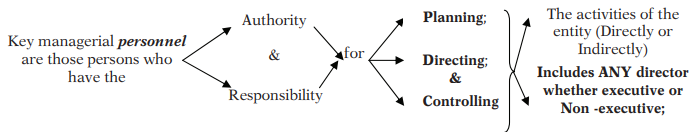

5. Who is Key Managerial Personnel ?

Example of key managerial personnel are Managing director, whole time director, Chief executive officer, and any person in accordance with whose directions or instructions the board of directors of the company is accustomed to act, are usually considered key management personnel.

|

Concept Capsule 1 Directors of subsidiaries as key management personnel of a group. The parent entity has three subsidiaries. The parent’s main activity is to co-ordinate its subsidiaries’ operations. How should management disclose the remuneration of subsidiaries’ directors in the consolidated financial statements? Answer: As per Ind AS 24, an individual becomes related to the entity when he is key managerial personnel in the reporting entity or in its parent’s entity. A director of a subsidiary is not automatically a related party of the group. The director is a related party of the group if he is determined to be a member of the group’s key management personnel. Under Ind AS 24, the remuneration of any subsidiaries’ directors who are identified as key management personnel of the group should be disclosed with the remuneration of the parent’s directors in the consolidated financial statements. Separate disclosure of the remuneration of the individual directors is not required under Ind AS 24 (unless required by law). Under Ind AS 24, total remuneration can be aggregated. |

|

Concept Capsule 2 Can a NON-EXECUTIVE director of the company be considered as key management personnel? Answer: As per Ind AS 24, key management personnel are the one who has authority and responsibility in planning, directing and controlling the activities of the entity, directly or indirectly, whether executive or non-executive director. As the definition of KMP clearly mentions a non-executive director can be a KMP but the question arises, whether he is responsible for planning, directing and controlling the activities of the entity? If the answer is Yes – considered as KMP otherwise NO. |

Let us look at first four points of point (b) carefully.

(b) An entity is related to a reporting entity if any of the following conditions applies:–

(i) Members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others); (Associates and Joint ventures of the group are not part of the group)

(ii) An investor and associate are related; (Say entity A has significant influence over entity B – In this case Entity A is called investor and Entity B is an associate to Entity A);

An associate of a member in the group is also related party – i.e., associate of subsidiary or parent or co-subsidiary;

Joint venture and Venturer are related; a Joint venture of a member of the group is also related i.e., Joint venture of subsidiary or parent or co-subsidiary;

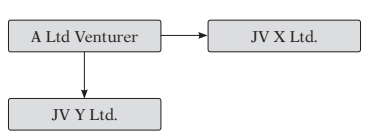

(iii) Two Joint venturers of same third party (Venturer) are related;

Say A Ltd. is a venturer and has joint control in X Ltd. and Y Ltd. In this case X & Y are related)

Two Joint ventures (X & Y) of same third party (A Ltd.) are related;

From A point of view, X & Y are related under point (iii);

From X point view, A Ltd. is related under (ii) and Y is related under (iii);

From Y point view, A Ltd. is related under (ii) and X is related under (iii);

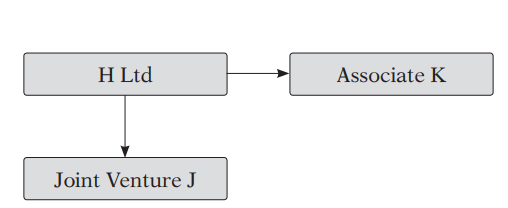

(iv) One entity is a joint venture of a third entity and the other entity is an associate of the third entity;

Let us say –

One entity (J) is a joint venture of a third entity (H Ltd.) and the other entity (K) is an associate of the third entity (H Ltd.);

From H’s point of view, K & J are related under point (ii);

From J’s point of view, H Ltd. is related under (ii) and K is related under (iv);

From K’s point of view, H Ltd. is related under (ii) and J is related under (iv).

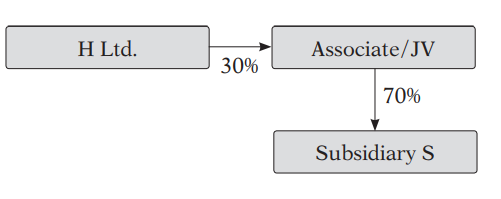

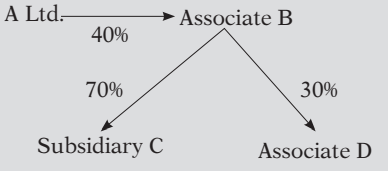

Standard further says – In the definition of a related party, an associate includes subsidiaries of the associate and a joint venture includes subsidiaries of the joint venture. It means, associate’s subsidiary is related to investor and Joint venture’s subsidiary is related to venturer;

In this case,

From H’s point of view, Associate/JV & S are related.

|

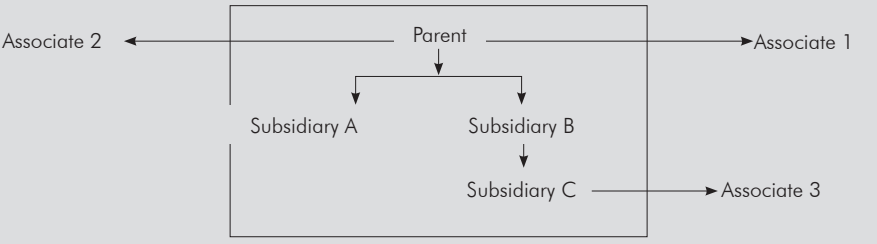

Concept Capsule 3 Observe the following diagram

Identify the related parties from each entity point of view. Answer: As per Ind AS 24, For Parent’s separate financial statements: Subsidiaries A, B and C and Associates 1, 2 and 3 are related parties. [Point (b)(i) and (ii)]; For Subsidiary A’s financial statements: Parent, Subsidiaries B and C and Associates 1, 2 and 3 are related parties [Point (b)(i) and (ii)]; For Subsidiary B’s separate financial statements: Parent, Subsidiaries A and C and Associates 1, 2 and 3 are related parties [Point (b)(i) and (ii)]; For Subsidiary C’s financial statements: Parent, Subsidiaries A and B and Associates 1, 2 and 3 are related parties. [Point (b)(i) and (ii)]; For the financial statements of Associates 1, 2 and 3: Parent and Subsidiaries A, B and C are related parties. Associates 1, 2 and 3 are not related to each other. (Co-associates are not related) For Parent’s consolidated financial statements: Associates 1, 2 and 3 are related to the Group. [point (b) (ii)] |

Points to remember

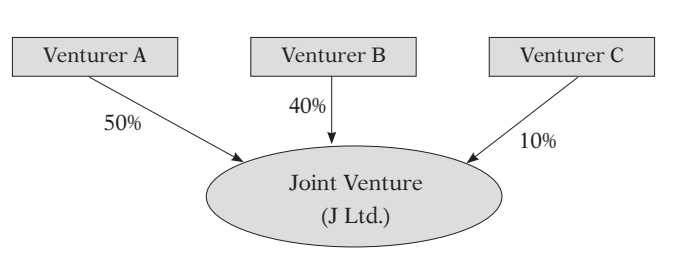

Co-Venturers to Joint venture, Co-investors to an associate are NOT related automatically;

Example

In the above diagram, say Venturer A sold goods to Venturer B; Are they related parties?

A & B are related to J Ltd.. But Co-venturers (A, B) are NOT related to each other automatically. Even A & B are not related to the investor C; Transactions between these three entities need not to be disclosed;

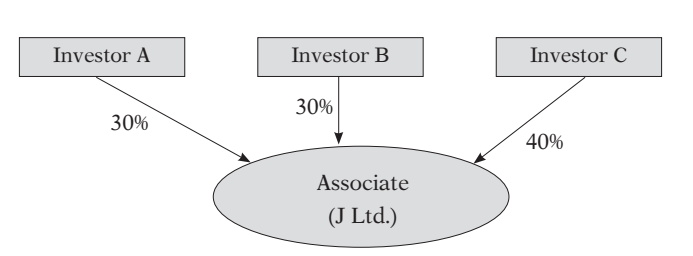

Example

In the above diagram, say Investor A sold goods to Investor B;

A, B and C are related to J Ltd.. But Co-investors (A, B & C) are NOT related to each other automatically. Transactions between these three entities need not to be disclosed;

|

Concept Capsule 4 Entity A owns 40% of the share capital of entity B and has the ability to exercise significant influence over it. Entity B holds the following investments

Answer: As per Ind AS 24, an associate includes subsidiaries of the associate and a joint venture includes subsidiaries of the joint venture. It means, associate’s subsidiary is related to investor and joint venture’s subsidiary is related to venturer. Entity A’s point of view: Entity A’s management should disclose entity A’s transactions with entity C in entity A’s separate financial statements. Entity C is a related party of entity A, because entity C is the subsidiary of entity A’s associate, entity B. So, entity A has significant influence over entities B and C. Entity A’s management is not required to disclose entity A’s transactions with entity D in its financial statements. Entity D is not a related party of entity A, because entity A has no ability to exercise control or significant influence over entity D. Consistent with the above, entity C is required to disclose its transactions with entity A in its financial statements, because, as explained above, entity A is a related party. Entity D is not required to disclose transactions with entity A, because they are not related parties. |

Let us now focus on the remaining four points in point (b) of the definition

(v) The entity is a post-employment benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity.

Say X Ltd., Y Ltd. & Z Ltd. created a group provident fund/gratuity trust for its employees. Trust is related party to X Ltd. and all related parties of X Ltd.

From the trust point of view – all the EMPLOYERS who are sponsoring (contributing) to the trust are related i.e., X Ltd., Y Ltd. and Z Ltd.

(vi) The entity is controlled or jointly controlled by a person (Individual) identified in point (a) i.e., who has control, joint control, significant influence or KMP of the entity or its parent.

Say Mr. A controls X Ltd. and he is also controlling Y Ltd. – In this case, A is related to X & Y and in addition to this X and Y Ltd. are also related parties.

(vii) A person identified in (a) (i) (i.e., who has control or joint control) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity).

Say Mr. A controls X Ltd. and he is a KMP of Y Ltd. – In this case, A is related to X & Y and in addition to this X and Y Ltd. are also related parties.

(viii) The entity (Management entity), or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity.

In the investment management sector, it is common for an investment entity to outsource the day-to-day management of funds to a fund manager. The fund manager could be an entity or a person and might be working under a management contract for a fee.

This point should be clearly understood by reading the agreements between the parties. If the fund manager is investment entity’s parent, ultimate parent or ultimate controlling party, that fact should be disclosed.

If the fund manager is an entity and the employees of the entity will be carrying out the management services to reporting entity. In this case, fees paid to the entity should be disclosed but not the salaries given to managing persons by the management entity.

In some cases, the fund manager may work for only one customer, the investment entity. In this case, one should check whether the fund manager has (whether an entity or a person) has control, joint control or an interest that gives significant influence over the investment entity and accordingly disclose the information.

Say A Ltd. is a parent company with 3 subsidiary companies B Ltd. C Ltd., & D Ltd. E Ltd. provides key management personnel services for its funds to A Ltd. E Ltd., is in a related party relationship with A, B, C & D Ltd.

|

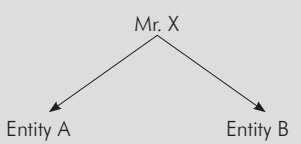

Concept Capsule 5 Mr. X has investment in entities A & B.

Explain when A & B become related parties from both the entities’ point of view? Answer: From Entity A’s point of view: If X controls or jointly controls Entity A and when X has control, joint control or significant influence over Entity B then Entity B is related to Entity A. (Point (b)(vi)–(a)(i) and (b)(vii)–(a)(i)) From Entity B’s point of view: If X controls or jointly controls Entity A, Entity A is related to Entity B when X has control, joint control, KMP or significant influence over Entity B. (Point (b)(vi)–(a)(i) and (b)(vii)–(a)(i)) If X has significant influence over both Entity A and Entity B, Entities A and B are not related to each other. (Co-associates are not related) |

|

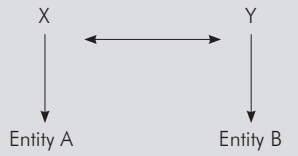

Concept Capsule 6 A person, X, is the domestic partner of Y. X has an investment in Entity A and Y has an investment in Entity B.

Explain when A & B becomes related parties from both the entities point of view? Answer: From Entity A’s point of view: If X controls or jointly controls Entity A (Point (b)(vi)–(a)(i))and when Y has control, joint control or significant influence over Entity B [(b)(vii)–(a)(i)], then Entity B is related to Entity A. From Entity B’s point of view: If X controls or jointly controls Entity A, Entity A is related to Entity B when Y has control, joint control or significant influence over Entity B. If X & Y has significant influence over Entity A and Entity B respectively, Entities A and B are not related to each other. |

|

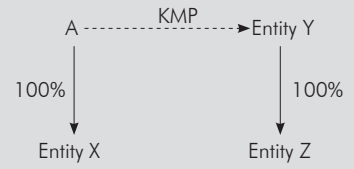

Concept Capsule 7 Mr. A, has a 100% investment in Entity X and is a member of the key management personnel of Entity Y. Entity Y has a 100% investment in Entity Z (Y controls Z).

Who are related parties to Entity X, Entity Y & Entity Z? Answer: Entity X’s financial statements Entity Y is a related party of entity X because Mr. A is a member of key management personnel of entity Y and he also controls entity X. [(b)(vii)] Entity Z is also a related party of entity X, as Mr. A is a member of key management personnel of its parent, entity Y. [(b)(vii)] Entity Y’s separate and consolidated financial statements Entities X and Z are related parties of entity Y, as Mr. A, a member of entity Y’s key management personnel, controls entity X and entity Y controls entity Z. [(b)(vi), (b)(i)] Also, for the purposes of entity Y’s consolidated financial statements, entity X is a related party. Entity Z’s financial statements Entity X is a related party of entity Z because Mr. A controls entity X and he is also a member of entity Z’s parent’s key management personnel. [(b)(vi)] |

In considering each possible related party relationship, attention is directed to the substance of the relationship and not merely the legal form. It means the above discussion is not exhaustive – One should consider substance of relationship over form.

|

Concept Capsule 8 A husband and wife are controlling 34% of voting power in XY Ltd. They are having a separate partnership firm (persons controls the same) which supplies mainly the raw material to the company. The management says that the above transaction need not to be disclosed. Being the statutory Auditor of the company, how would you deal with the following? Answer: As per Ind AS 28 – Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control of those policies. If a person holds, directly or indirectly (e.g., through subsidiaries), 20 per cent or more of the voting power of the investee, it is presumed that the entity has significant influence, unless it can be clearly demonstrated that this is not the case. As per Ind AS 24, point (b) (vi) – The entity is controlled or jointly controlled by a person identified in (a). In the given case, from the company point of view, husband & wife have control over the partnership firm and have significant influence on XY Ltd.., hence XY Ltd. and partnership firm are related parties and the transactions between these two entities should be disclosed as per Ind AS 24. |

6. Who are not related parties?

As per the Standard, the following are NOT considered as related parties

(a) Two entities will not be called as related simply because they have a director or other member of KMP in common OR because a member of key management personnel of one entity has significant influence over the other entity.

|

Concept Capsule 9 (a) Mr. A is a director in X Limited. He is also a director in Y Limited. He has no other interest in either of these companies. Y Limited purchases the entire production of X Limited. The transactions are always at arm’s length. Are X and Y Ltd. are related parties? OR (b) If a majority of directors of one company constitute the majority of the Board of another Company in their individual capacity as Professionals (and not by virtue of their being Directors in Lalith Ltd.), can it be considered that the Companies are related? Answer: As per Ind AS 24, two entities who has common directors cannot be considered as related unless otherwise their relationship is proved. (a) In the given case, it is quite possible that Y Limited may be able to exercise control/significant control over X Limited with respect to purchase of production. As per this Standard substance is more important than mere legal form. Hence X Limited and Y Limited may be related parties (this situation may fall under point (b) (vii) of definition. (b) Thus, the two companies are not related merely because the majority of the Directors of one became the majority of the directors of the second in their individual capacity as professionals. |

(b) Two joint ventures simply because they share joint control of a joint venture. (Discussed earlier)

(c) The parties listed below:—

(i) Providers of finance;

(ii) Trade unions;

(iii) Public utilities;

(iv) departments and agencies of a government that does not control, jointly control or significantly influence the reporting entity.

(d) A customer, supplier, franchisor, distributor or general agent with whom an entity transacts a significant volume of business, simply by virtue of the resulting economic dependence.

This is an economic dependency between the parties but there is neither control nor significant influence between the parties.

It is suggested to go through all the points before you try to answer the below concept capsules.

|

Concept Capsule 10 P Ltd. has 60% voting right (control) in Q Ltd. Q Ltd. has 12% voting right in R Ltd. Also, P Ltd. directly enjoys voting right of 14% in R Ltd. R Ltd. is a listed company and regularly supplies goods to P Ltd. The management of R Ltd. has not disclosed its relationship with P Ltd. How would you assess the situation from the view point of Ind AS 24on Related Party Disclosures? Answer: As per Ind AS 28 – Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control of those policies. If a person holds, directly or indirectly (e.g., through subsidiaries), 20% or more of the voting power of the investee, it is presumed that the entity has significant influence, unless it can be clearly demonstrated that this is not the case. P Ltd. has direct economic interest of 14% and indirectly it has 12% i.e., through subsidiary Q Ltd. In total it has 26% with which it has the ability to exercise significant influence. Also, it is given in the question that R Ltd. is a listed company and regularly supplies goods to P Ltd. Hence related parties under point (b) (ii). Therefore, related party disclosure, as per Ind AS 24, is required by R Ltd. in its financial statements, in respect of goods supplied to P Ltd. |

|

Concept Capsule 11 Narmada Ltd. sold goods for ` 90 lakh to Ganga Ltd. during financial year ended 31-3-2018. The Managing Director of Narmada Ltd. controls Ganga Ltd. The sales were made to Ganga Ltd. at normal selling prices followed by Narmada Ltd. The Chief Accountant of Narmada Ltd. contends that these sales need not require a different treatment from the other sales made by the company and hence no disclosure is necessary as per the accounting standard. Is the Chief accountant correct? Answer: As per Ind AS 24, the entity is controlled or jointly controlled by a person (Individual) identified in point (a) i.e., who has control, joint control, significant influence or KMP of the entity or its parent. In the given case, the entity (Ganga) is controlled by Managing Director i.e., KMP of Narmada. Hence, Narmada Ltd. and Ganga Ltd. are related parties and hence disclosure of transaction between them is required irrespective of whether the transaction was done at normal selling price or not. Hence the contention of Chief Accountant of Narmada Ltd. is NOT correct. |

|

Concept Capsule 12 S Ltd., a wholly owned subsidiary of P Ltd. is the sole distributor of electricity to consumers in a specified geographical area. A manufacturing facility of P Ltd. is located in the said geographical area and, accordingly, P Ltd. is also a consumer of electricity supplied by S Ltd. The electricity tariffs for the geographical area are determined by an independent rate- setting authority and are applicable to all consumers of S Ltd., including P Ltd. Whether the above transaction is required to be disclosed as a related party transaction as per Ind AS 24, Related Party Disclosures in the financial statements of S Ltd.? Answer: As per Ind AS 24, each parent, subsidiary and fellow subsidiary in a ‘group’ is related to the other members of the group. Thus, in the case under discussion, P Ltd. is a related party of S Ltd. from the perspective of financial statements of S Ltd. Being engaged in distribution of electricity, S Ltd is a public utility. Had the only relationship between S Ltd and P Ltd been that of a supplier and a consumer of electricity, P Ltd. would not have been regarded as a related party of S Ltd. However, as per the facts of the given case, this is not the only relationship between S Ltd and P Ltd. Apart from being a supplier of electricity to P Ltd., S Ltd is also a subsidiary of P Ltd; this is a relationship that is covered within the related party relationships to which the disclosure requirements of the standard apply. In view of the above, the supply of electricity by S Ltd to P Ltd is a related party transaction that attracts the disclosure requirements contained in paragraph 18 and other relevant requirements of the standard. This is notwithstanding the fact that P Ltd is charged the electricity tariffs determined by an independent rate-setting authority (i.e., the terms of supply to P Ltd are at par with those applicable to other consumers). Ind AS 24 does not exempt an entity from disclosing related party transactions merely because they have been carried out on an arm’s length basis. |

7. Disclosure requirements

So far, we understood related parties as per the Standard. Before starting the disclosures requirements, let us learn meanings of few terms.

Related party is a person or entity that is related to reporting entity.

Related party transaction is a transfer of resources, services or obligations between related parties, regardless of whether or not a price is charged.

The following information should be disclosed where control exists between the parties (Refer point (b) of related parties)

-

- Name of its parent and ultimate controlling party (if it is other than its parent); and

- Nature of the related party relationship.

- If neither the entity’s parent nor the ultimate controlling party prepares consolidated financial statements available for public use, the name of the next most senior parent (first parent in the group above the immediate parent that produces consolidated financial statements available for public) that does so shall also be disclosed.

- These two should be disclosed irrespective of whether or not there have been transactions between the related parties. Observe that this requirement is only when control exist between the parties. If there is NO Control, entity needs to disclose the information only when there is a transaction.

Such disclosure will be at least as relevant in appraising an entity’s prospects as are the operating results and the financial position presented in its financial statements.

Such a related party may establish the entity’s credit standing, determine the source and price of its raw materials, and determine to whom and at what price the product is sold.

In addition to this disclosure, one should refer Ind AS 112 – Disclosure of interests in other entities.

|

Concept Capsule 13 Mr. Raj a relative of Key Management Personnel received remuneration of ` 25,00,000 for his services in the company for the period from 1.4.2017 to 30.6.2017. On 1.7.2017, he left the service. Should the relative be identified as at the closing date i.e., on 31.3.2018 for the purposes of Ind AS 24? Answer: According to Ind AS 24, a related party transaction is a transaction between a reporting entity and a related party; it means that a transaction with an unrelated party is not a related party transaction. Hence, transactions during 1.4.2017 to 30.6.2017 have taken place between the entity and related parties. So even though the KMP has left the organisation, these transactions should be disclosed as 31.03.2018. |

|

Concept Capsule 14 X Ltd. sold goods to its associate company for the 1st quarter ending 30.6.2012. After that, the related party relationship ceased to exist. However, goods were supplied as was supplied to any other ordinary customer. Decide whether transactions of the entire year have to be disclosed as related party transaction. Answer: As per Ind AS 24, a related party transaction is a transaction between a reporting entity and a related party; it means that a transaction with an unrelated party is not a related party transaction. The company is a related party till 30.06.2012. Hence the transactions of X Ltd. with its associate company for the first quarter ending 30.06.2012 only are required to be disclosed as related party transactions. The transactions for the period in which related party relationship did not exist, hence NO need to report. |

|

Concept Capsule 15 Will transactions with related parties, for services provided/received free of cost, be required to be disclosed? Anju Ltd. has a Corporate Communications Department, which centralises the Public Relations function for the whole group of Anju Ltd. and its Subsidiaries. No charges are, however, levied by Anju Ltd. on its Subsidiaries and accordingly, these transactions are not given accounting recognition. Would these constitute Related Party Transactions requiring disclosure under Ind AS 24 in the Separate Financial Statements of Anju Ltd.? Answer: As per Ind AS 24, a Related Party Transaction is “a transfer of resources, services or obligations between related parties, regardless of whether or not a price is charged”. In the given example, there is a transfer of resources from Anju Ltd. to its Subsidiaries even though no price is charged for the same. These transactions would require disclosure under Ind AS 24 in the separate financial statements of Anju Ltd. |

8. Disclosure of Key Management Personnel Compensation

An entity shall disclose key management personnel compensation in total and for each of the following categories

(a) short-term employee benefits;

(b) post-employment benefits;

(c) other long-term benefits;

(d) termination benefits; and

(e) share-based payment.

Compensation includes all employee benefits as defined in Ind AS 19 – Employee Benefits including share based payments to employees as per Ind AS 102. Employee benefits are all forms of consideration paid, payable or provided by the entity, or on behalf of the entity, in exchange for services rendered to the entity. It also includes such consideration paid on behalf of a parent of the entity in respect of the entity.

If an entity obtains key management personnel services from another entity (the ‘management entity’) [See related party definition – point (b) (viii)] – in such case, the entity should disclose the amount of fees/compensation paid to the management entity. Generally, the reporting entity pays agreed amount to the management entity and in return management entity pays to its employees i.e., who managed the reporting entity. The details of payment by the management entity to its employees/directors are not required to be disclosed in the reporting entity financial statements.

|

Concept Capsule 16 Subsidiary S is owned by its parent P. Mr. X, who works solely for entity S, is a director of entity S, but is not considered to be a member of key management personnel of entity P.

Out of Mr. X’s remuneration of ` 100 lakh, ` 75 lakh is paid by entity S and the remainder (` 25 lakh) is paid by entity P. The remuneration is not paid directly to Mr. X, rather it is paid to entity A, which is controlled by Mr. X. What amount of remuneration should be disclosed in entity S financial statements? Answer: As per Ind AS 24, an entity shall disclose key management personnel compensation in total. Employee benefits are all forms of consideration paid, payable or provided by the entity, or on behalf of the entity, in exchange for services rendered to the entity. In the given case, compensation paid entity P is on behalf of entity S, for the services rendered to the entity S. Hence compensation in the financial statements of entity S should include both the amounts paid by entity S and the amounts paid by entity P, as all Mr. X’s remuneration relates to services to entity S. This disclosure requirement is regardless of whether there is an expense recognised in entity S (for example, by way of a recharge) in respect of the amounts paid by entity P. The fact that the remuneration is paid to entity A and not directly to Mr. X does not affect the disclosure. |

Other related party disclosure

If there have been transactions between related parties during the financial year, the reporting entity should disclose the following SEPARATELY for each category of related party (This is in addition to above discussed disclosures)

(i) Name of the related party;

(ii) A description of the relationship;

(iii) A description of the nature of transactions;

(iv) An amount of transactions;

(v) An amount of outstanding balances, including commitments:

(a) their terms and conditions, including whether they are secured, and the nature of the consideration to be provided in settlement; and

(b) details of any guarantees given or received;

(vi) Provisions for doubtful debts related to the amount of outstanding balances;

(vii) The expense recognised during the period in respect of bad or doubtful debts due from

related parties; and

(viii) Amounts incurred by the entity for the provision of key management personnel services that are provided by a separate management entity shall be disclosed.

Disclosure of details of particular transactions with individual related parties would frequently be too voluminous to be easily understood. Hence, items of a similar nature of transactions can be aggregated and disclosed. However, such aggregation should not mislead the users of financial statements like purchase or sale of goods should not be aggregated with purchase or sale of fixed assets. If the transaction is material, it requires separate disclosure.

Entities should disclose the fact that related party transactions were made on terms equivalent to those that prevail in arm’s length transactions ONLY IF such terms can be substantiated i.e., proved and confirmed.

9. Exemption to Government related entities

For the following discussion

The word ‘Government’ refers to government, government agencies and similar bodies whether local, national or international.

A government-related entity is an entity that is controlled, jointly controlled or significantly influenced by a government.

A reporting entity is exempt from the disclosure requirements in relation to (i) related party transactions, (ii) outstanding balances, and (iii) commitments with:

(a) a government that has control, joint control or significant influence over the reporting entity; and

(b) another entity that is a related party because the same government has control, joint control or significant influence over both the reporting entity and the other entity.

However, it shall disclose:

(a) the name of the government;

(b) the nature of the government’s relationship with the entity (whether the government has control, joint control or significant influence over the entity);

(c) to enable the users of the entity’s financial statements to understand the effect of related party transactions on its financial statements, the following information in sufficient details:

(i) the nature and amount of each individually significant transaction;

(ii) for other transactions that are not significant individually but are significant when aggregated, either a qualitative or quantitative indication of their extent.

The reporting entity is expected to apply its judgment to determine the level of details it is required to disclose as per above. To enable the reporting entity to arrive at decision, it shall consider:

(a) the closeness of the related party relationship;

(b) whether the transaction is significant in size;

(c) whether the transaction is carried out on non-market terms;

(d) whether these are outside the normal day-to-day business operations;

(e) whether they are disclosed to regulatory or supervisory authorities;

(f) whether they are reported to senior management;

(g) whether they are subject to shareholder approval.

Example

On 15th January, 2018, Entity A, a utility company in which Government G indirectly owns 75% of outstanding shares, sold a 10 hectare piece of land to another government-related utility company for ` 5 million. On 31, December 2017 a plot of land in a similar location, of a similar size and with similar characteristics, was sold for ` 3 million. There had not been any appreciation or depreciation of the land in the intervening period.

This transaction can be disclosed considering the size and non-market terms.

|

Concept Capsule 17 Uttar Pradesh State Government holds 60% shares in PQR Limited and 55% shares in ABC Limited. PQR Limited has two subsidiaries namely P Limited and Q Limited. ABC Limited has two subsidiaries namely A Limited and B Limited. Mr. KM is one of the Key management personnel in PQR Limited. · (a) Determine the entity to whom exemption from disclosure of related party transactions is to be given. Also examine the transactions and with whom such exemption applies. (b) What are the disclosure requirements for the entity which has availed the exemption? Answer: (a) As per Ind AS 24, standard a reporting entity is exempt from the disclosure with: (i) a government that has control or joint control of, or significant influence over, there porting entity; and (ii) another entity that is a related party because the same government has control or joint control of, or significant influence over, both the reporting entity and the other entity. According to the above paras, for Entity P’s financial statements : (i) transactions with Government Uttar Pradesh State Government; and(ii) transactions with Entities PQR and ABC and Entities Q, A and B. Similar exemptions are available to Entities PQR, ABC, Q, A and B, with the transactions with UP State Government and other entities controlled directly or indirectly by UP State Government. However, that exemption does not apply to transactions with Mr. KM. Hence, the transactions with Mr. KM needs to be disclosed under related party transactions. (b) It shall disclose the following (a) the name of the government and the nature of its relationship with the reporting entity; (b) the following information in sufficient detail to enable users to understand; (i) the nature and amount of each individually significant transaction; and (ii) for other transactions that are collectively, but not individually, significant, a qualitative or quantitative indication of their extent. |

10. Frequently Asked Questions (FAQs)

FAQ 1 A parent has a wholly owned subsidiary. One of the subsidiary’s directors is the majority shareholder of an otherwise independent third party entity that sells goods on normal commercial terms to the subsidiary. The director is a member of the subsidiary’s key management personnel.

How should transactions with the supplier be presented in:

(a) the subsidiary’s financial statements;

(b) the consolidated financial statements; and

(c) the financial statements of the entity that sells the goods?

Ans: (a) The subsidiary’s financial statements

The subsidiary’s management should present the supplier as a related party of the subsidiary, because the director controls the supplier and, as a key manager, has influence over the subsidiary. [Point (b)(vi)]. Management should disclose in the subsidiary’s financial statements information related to the purchase of goods from this supplier, as well as the nature of the relationship between the subsidiary and the supplier.

(b) The consolidated financial statements

The parent’s management should disclose the information set out under (a) above in the consolidated financial statements if it is determined that the director of the subsidiary is a member of the group’s key management personnel. [Point (a)(iii)]

(c) The financial statements of the entity that sells the goods

The subsidiary is a related party of the third party entity. The subsidiary’s director, as majority shareholder, is a related party of the third party entity. The fact that the director is a member of key management personnel at the subsidiary also makes the subsidiary a related party of the entity that sells the goods [Point (b)(vii)]. So disclosure would be required of sales made to the subsidiary, as well as the nature of the relationship with the subsidiary.

FAQ 2 (Key Management Personnel)

Mr. X has a 100% investment in A Limited. He is also a member of the key management personnel (KMP) of C Limited. B Limited has a100% in vestment in C Limited.

Required

(a) Examine related party relationships from the perspective of C Limited for A Limited.

(b) Examine related party relationships from the perspective of C Limited for A Limited if Mr. X is a KMP of B Limited and not C Limited.

(c) Whether the outcome in (a) & (b) would be different if Mr. X has joint control over A Limited.

(d) Whether the outcome in (a) &(b) would be different if Mr. X has significant influence over A Limited.

(e) what would be your answer if Mr. X is just KMP (does not control A Ltd.) from the perspective of C Limited for A Limited.

Ans: (a) A Limited is related to C Limited because Mr. X controls A Limited and is a member of KMP of C Limited.

(b) Still A Limited will be related to C Limited.

(c) No, Still A Limited will be related to C Limited.

(d) Yes, A Ltd. is not controlled by Mr. X. Therefore, despite Mr. X being KMP of C Ltd., A Ltd., having significant influence of Mr. X, will not be considered as related party of C Limited.

(e) As per point (b) (vi & viii), the entities become related only when a person controls or jointly controls one entity and has significant influence or KMP of another entity. Mere being a KMP of both the companies, A & C companies cannot be related.

FAQ 3 (Partial exemption for government related entities)

Government G directly controls Entity 1 and Entity 2. It indirectly controls Entity A and Entity B through Entity 1, and Entity C and Entity D through Entity 2. Person X is a member of the key management personnel in Entity 1.

Required

Examine the entity to whom the exemption for disclosure to be given and for transaction with whom.

Ans: For Entity A’s financial statements, the exemption of Ind AS 24 applies to: transactions with Government G;and transactions with Entities 1 and 2 and Entities B, C and D. However, that exemption does not apply to transactions with Person X.

FAQ 4 Power Limited is a producer of electricity. Transmission Limited regularly purchases electricity from Power Limited. Power Limited whose financial year ends on March 31, 2018, acquired 100% shareholding of Transmission Limited on July 15, 2017. However, the entire shareholding is disposed of on March 21, 2018. Power Limited and Transmission Limited had transactions when Transmission Limited was a subsidiary of Power Limited and also in the period when it was not a subsidiary of Power Limited.

Required

For which period, related party disclosure should Power Limited make in its financial statements for the year ended March 31, 2018 with respect to transactions with Transmission Limited.

Ans: Power Limited should in its financial statements for the year ended March 31, 2018 make related party disclosures for the period from July 15, 2017 to March 21, 2018 when Transmission Limited was its subsidiary.

|

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Entity A transacts with entities C and D. Should entity A disclose these transactions as related party transactions?

Entity A transacts with entities C and D. Should entity A disclose these transactions as related party transactions?

CA | CS | CMA

CA | CS | CMA