GST Invoice Management System (IMS) – Streamline ITC Claims and Compliance for GSTR-3B

- Blog|GST & Customs|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 7 November, 2024

The GST Invoice Management System (IMS) is a tool introduced on the GST portal to help taxpayers manage, track, and validate invoices from suppliers in real time, enhancing accuracy in claiming Input Tax Credit (ITC). Through IMS, recipients can accept, reject, or keep invoices pending, which ensures that only verified invoices contribute to their ITC claims in GSTR-2B. Additionally, IMS includes a workflow for tracking inward and outward supplies and enables compliance by providing timely updates and supporting reconciliations. Though currently optional, IMS aims to streamline ITC claims and reduce compliance risks by automating the invoice management process.

By Adv. Ritesh Kanodia – Partner | Aurtus Legal LLP and CA. Chintan Vasa – Director | Aurtus Consulting LLP

Table of Content

- Prevalent Disputes Related to ITC

- IMS Outline

- Updated GSTR-3B Process Flow

- IMS Workflow

- IMS Workflow – Outward Supplies

- Important FAQs

- Challenges

- The Gist

1. Prevalent Disputes Related to ITC

Scenarios

- Fake invoices issued – No supplies have taken place

- Fake Invoices issued by supplier, however genuine supplies

- Genuine invoices/genuine supplies: Invoice mismatch, wrong reporting, returns not filed/tax not paid, vendor registrations cancelled retrospectively, etc.

- Circular Trading: GST paid: Intent could be bank purposes or utilisation of credit

2. IMS Outline

2.1 Objective

Facilitate taxpayers in matching their invoices vis a vis issued by their suppliers for availing correct Input Tax Credit (ITC).

2.2 Mechanics

Recipient can either accept/reject/keep invoice pending in IMS. If No Action is taken – treated as Deemed Accepted.

2.3 Intended Outcome

Basis the response provided by recipient GSTR 2B will be generated to enable the recipient to claim ITC – Ensure accuracy of ITC claimed.

2.4 Implications

While beneficial, will add to the compliances to be undertaken by taxpayers – since real-time monitoring and review of records required – Technology cost.

- Currently, IMS implementation is Optional.

- Functionality was launched on 1st October 2024 and was made available to the taxpayers for taking action from 14th October 2024 – Only for the invoices generated/reported from October 2024.

- A Supplier View is also under development where the supplier can see the action taken on a record by the recipient.

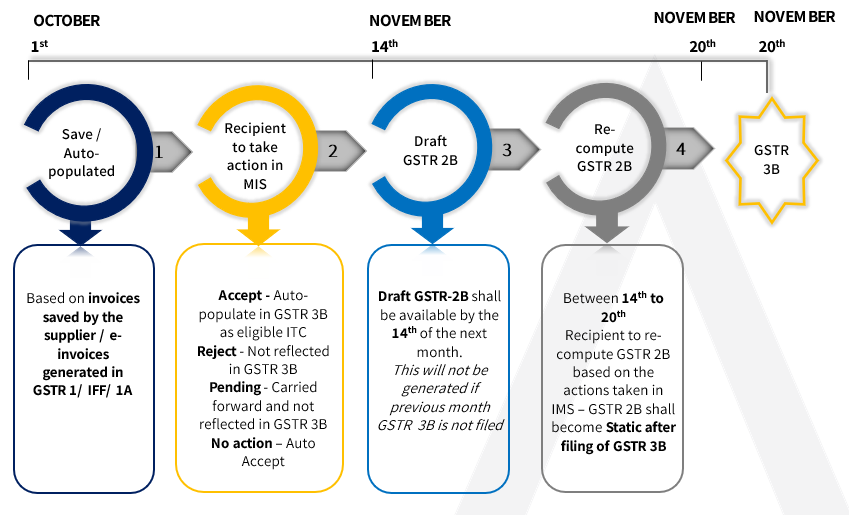

3. Updated GSTR-3B Process Flow

4. IMS Workflow

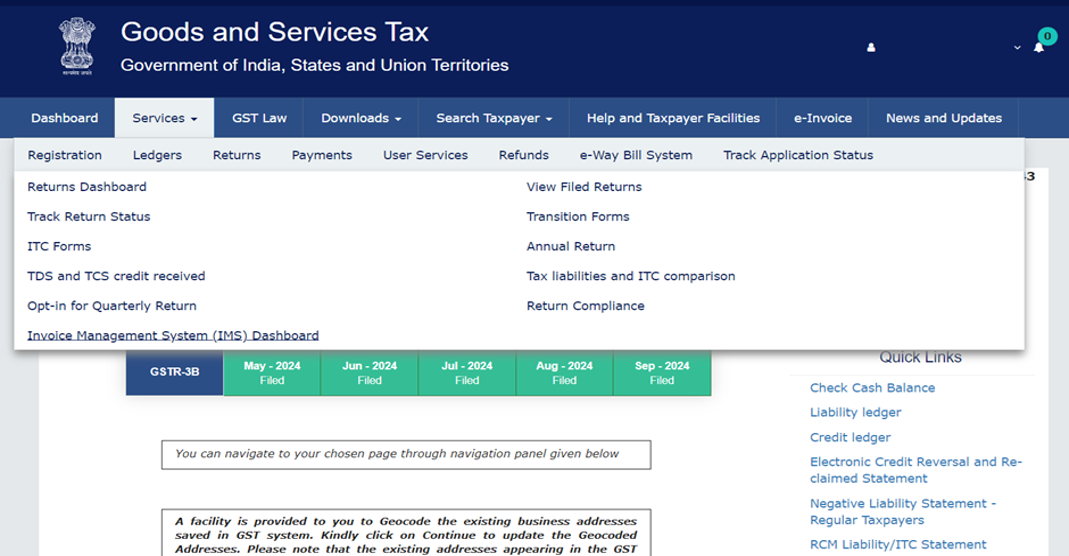

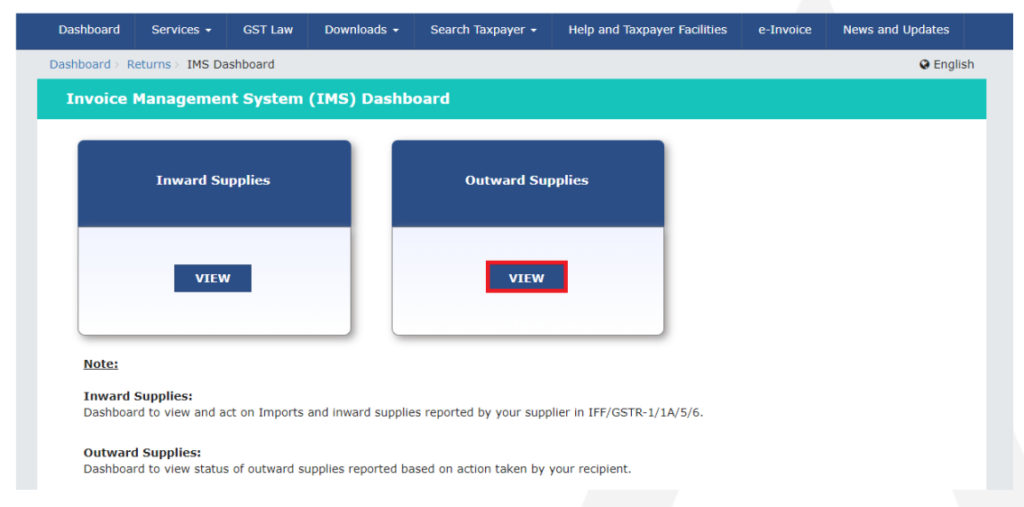

IMS can be accessed on the GST portal under Services > Returns > Invoice Management System (IMS) option.

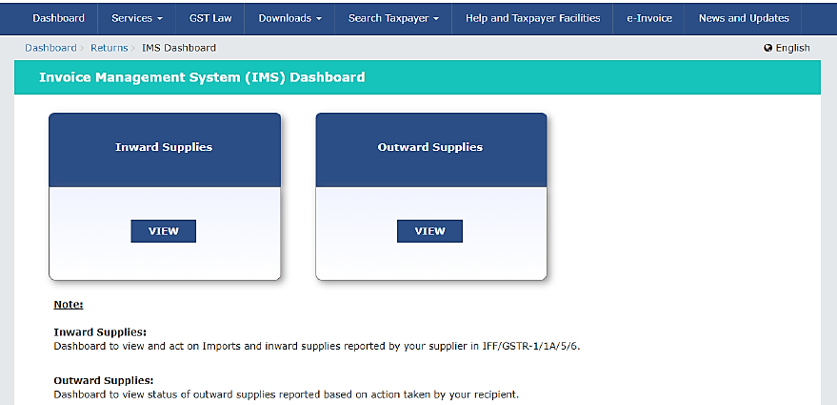

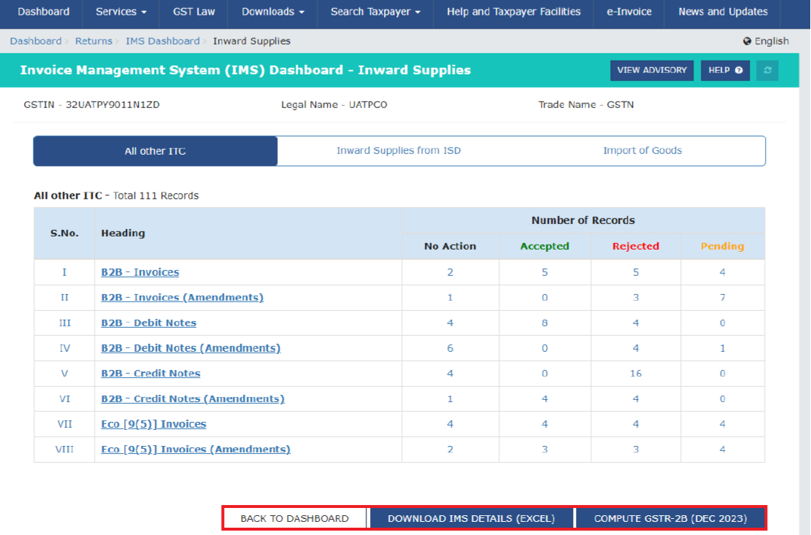

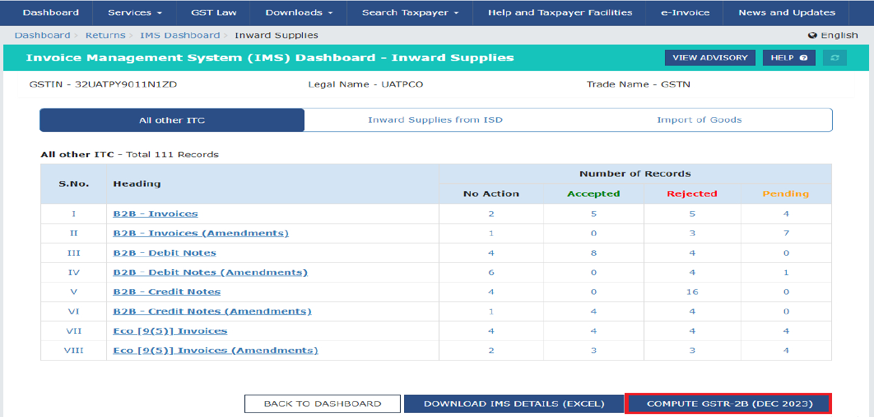

There are 2 sections in the IMS dashboard:

- Inward Supplies: Dashboard to view and act on inward supplies reported by your supplier in GSTR-1/IFF/GSTR-1A.

- Outward Supplies: Dashboard to view status of outward supplies reported based on action taken by your recipient which shall be made available shortly.

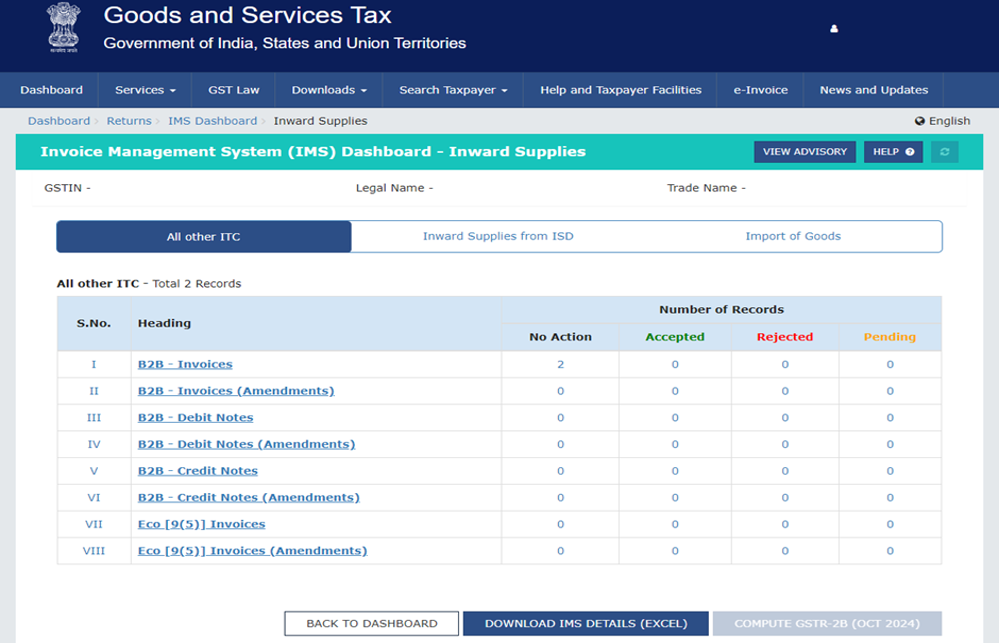

The invoices saved or filed in GSTR-1/1A or IFF by the supplier and received in IMS are categorized in different sections.

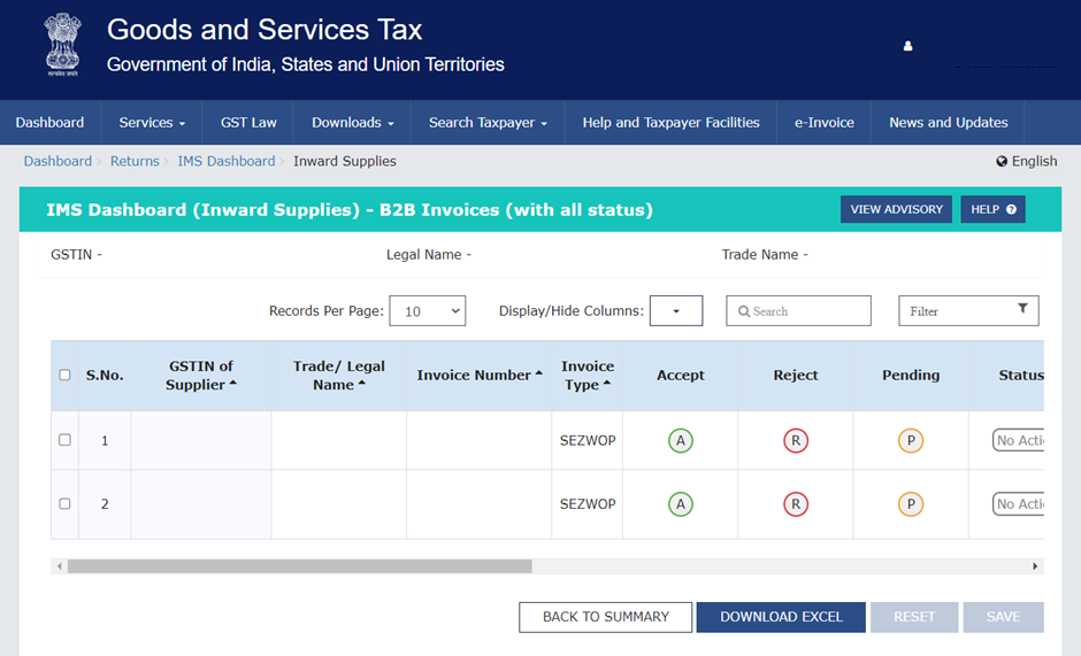

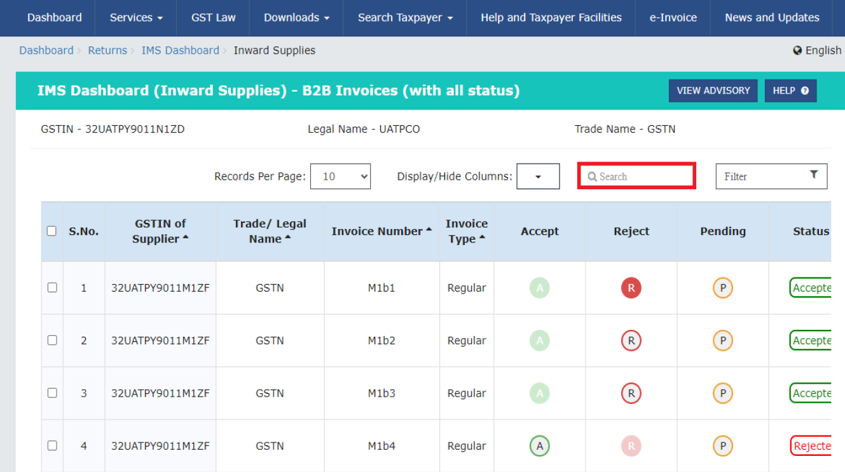

On clicking of B2B-Invoices hyperlink all the records will be displayed on the screen.

A ‘search’ facility is also provided where the taxpayer can enter keywords in the Search field to identify the invoice or any other relevant field where an action is required to be taken.

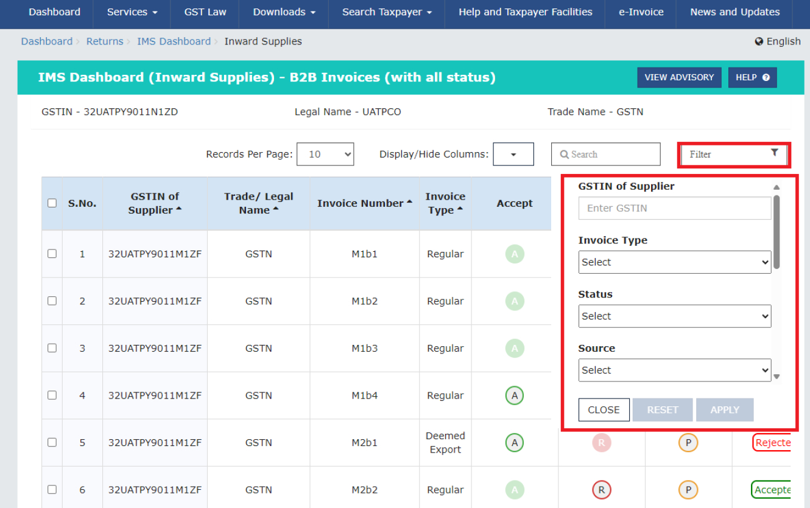

Filter feature is provided to enable taxpayer to filter out the records based on GSTIN, invoice type, etc. and take the desired action on the invoices.

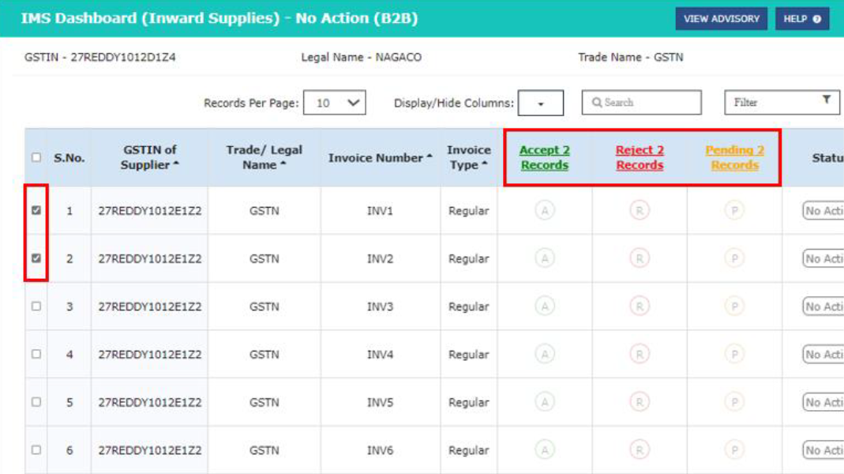

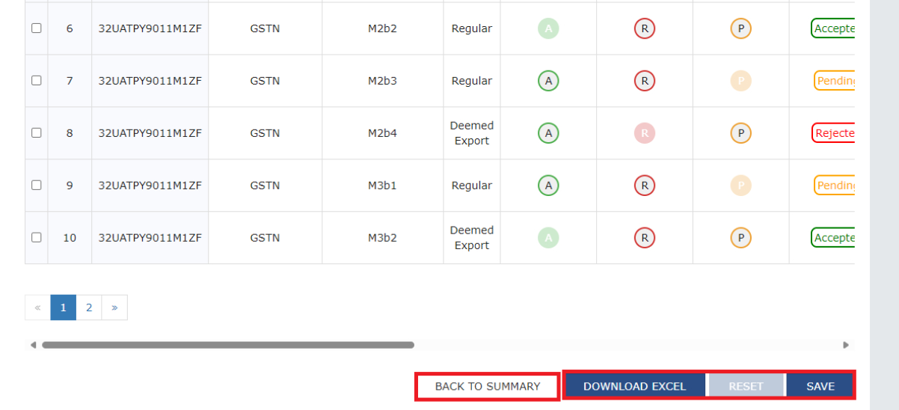

The taxpayer can also select the specified records by clicking on check box for the respective record. After selection, taxpayer can either accept, reject or keep the said records pending by selecting the action from the header. Thereafter, taxpayers need to click on SAVE button to save the action taken on a record.

Reset of Records – The taxpayers are also provided with a RESET button for resetting all the actions taken and saved by them. The selected records can be reset by clicking on RESET button. When one or more record is selected for action RESET button is enabled.

The taxpayer can download the entire IMS details by clicking on DOWNLOAD IMS DETAILS (EXCEL) button.

GST system will automatically generate draft GSTR-2B on 14th of the subsequent period. If recipient takes any action after draft GSTR-2B, they will need to recompute their GSTR-2B before filing of GSTR-3B. Post this, taxpayer can navigate to GSTR-2B to view the latest ITC details and the updated ITC details will auto-populate in GSTR-3B on re-computation of GSTR-2B.

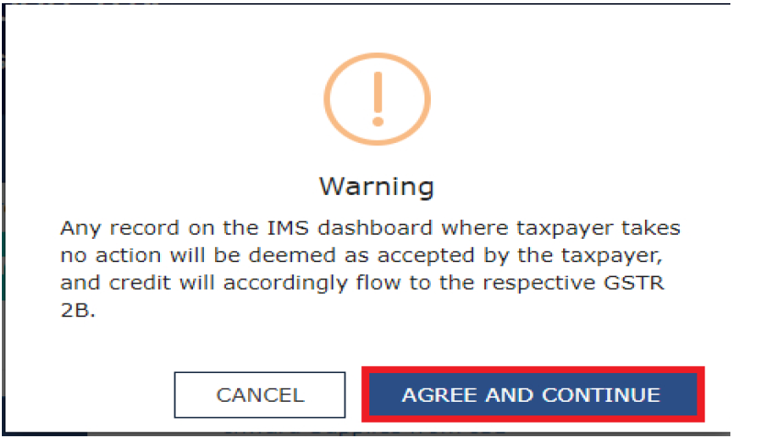

On clicking of COMPUTE GSTR-2B button a popup will be displayed on the screen. Click on AGREE AND CONTINUE button to compute.

5. IMS Workflow – Outward Supplies

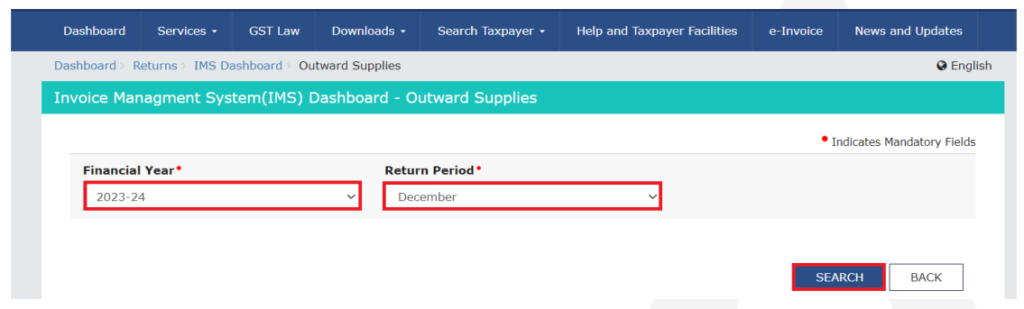

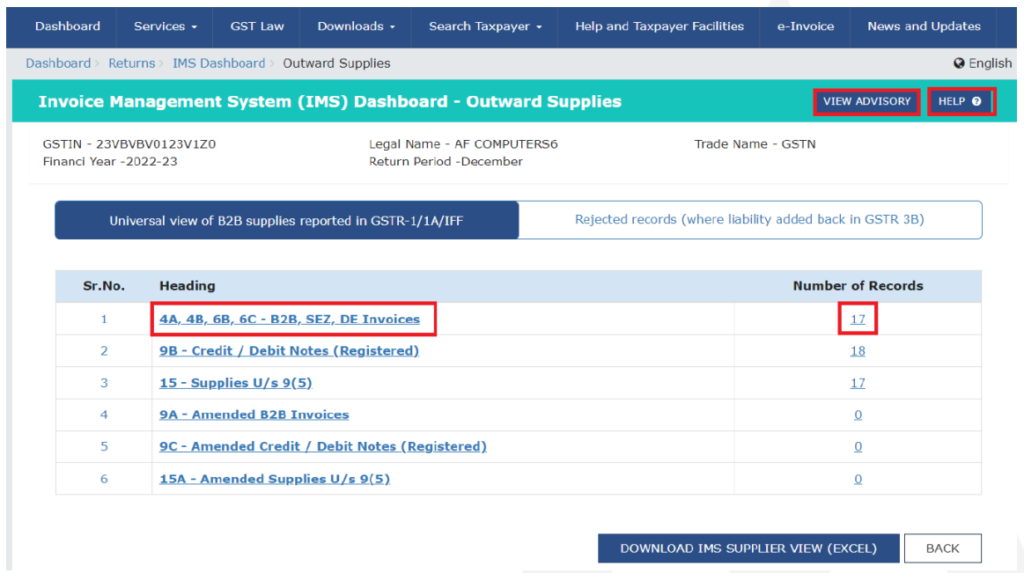

Outward Supplies functionality is provided to view the status of outward supplies reported based on action taken by recipient.

Select Financial Year and Return Period from the respective dropdown list. Click on SEARCH button to proceed further.

Taxpayers can view the different categories of B2B supplies reported in each table by clicking on the description or the Number of Records in the different tables which is also a hyperlink.

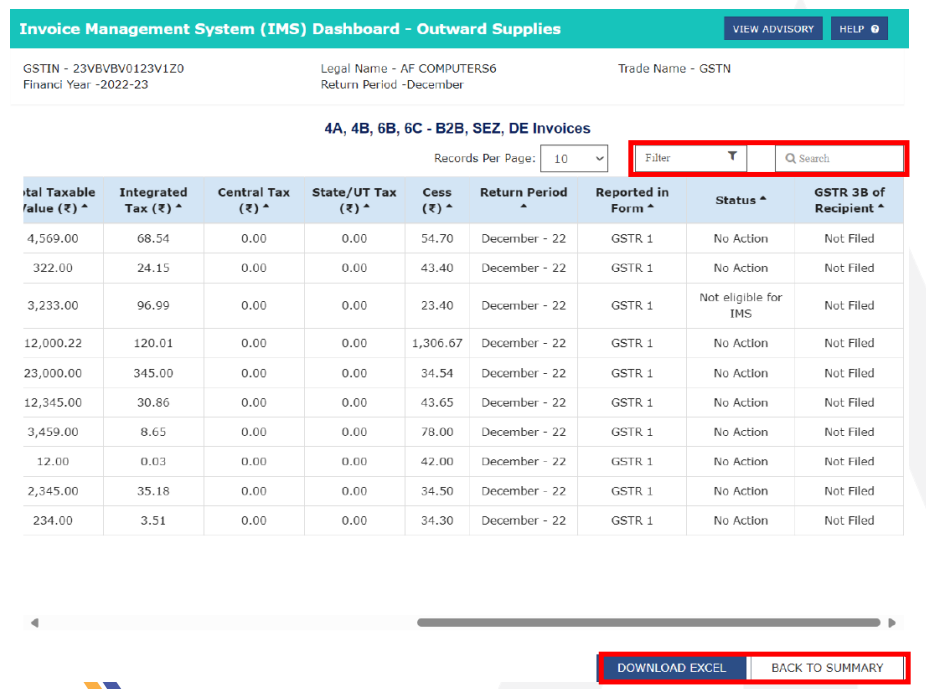

Taxpayer can filter the list by clicking on Filter field or by entering keywords in Search field. Taxpayer can view and download the invoice details for all other tables.

6. Important FAQs

FAQ 1. How many times actions can be taken on an invoice before filing GSTR 3B by the recipient?

Multiple times (till filing of GSTR -3B) and the Last action will be considered

FAQ 2. What are the amendments to the invoice?

Before filing GSTR 1 – The original invoice will be replaced by an amended invoice, irrespective of the action taken by the recipient

After filing GSTR 1 – Amended invoice will also flow to IMS, however, ITC delta corresponding to the amendment will flow in GSTR-2B of the subsequent month

FAQ 3. What is the impact of the amendment of the invoice?

If the original and amended record belongs to:

- Same GSTR-2B return period – Action taken on amended record will prevail over the action previously taken on the original record

- Two different GSTR 2B return periods – Mandatory to first act on the original record and file GSTR 3B before acting on the amended record. IMS will not allow to directly save action on the amended record.

FAQ 4. What documents will not be made available in IMS but will be part of GSTR-2B?

- Records flowing from form GSTR 5 (NRTP), GSTR 6 (ISD)

- ICEGATE documents

- Output RCM records

- Document where ITC is ineligible due to POS rules & Section 16(4) of CGST Act (time limit)

- Documents where ITC is to be reversed on account of Rule 37A (Reversal of input tax credit in the case of non-payment of tax by the supplier and re-availing thereof)

FAQ 5. What are the documents for which invoices “Pending” action is not allowed in IMS?

- Original Credit note

- Upward amendment of the credit note irrespective of the action taken by the recipient on the original credit note

- Downward amendment of the credit note if the original credit note was rejected by him

- Downward amendment of Invoice/Debit note where original Invoice/Debit note was accepted by him and respective GSTR 3B has also been filed

FAQ 6. What happens if the recipient rejects a record?

- Before filing GSTR 1 by the supplier: The invoice/record can be edited by the supplier and can be re-submitted in GSTR 1 with the same or amended details. This amended record will be made available in the IMS for action by the recipient.

- After filing GSTR 1 by the supplier: The supplier needs to amend/add the invoice/record in GSTR-1A or subsequent GSTR 1/IFF with the same detail or amended details. The amended record will then be made available in the IMS for action by the recipient.

- Where an Original Credit Note or Upward amended Credit Note is rejected by the recipient, the resultant liability will be added to GSTR 3B of the supplier for the subsequent tax period.

FAQ 7. How can recipient accept a genuine credit note issued by supplier in IMS as it will result further reduction of the recipient ITC, however recipient had reversed ITC corresponding to invoice itself because of 17(5), Rule 42, 38, 43 etc., or not availed the ITC at all because of POS or 16(4) etc., ineligibility?

In such cases recipient can accept the said credit note in IMS. As recipient had already reversed the ITC, there is no need for reversal of ITC again in case of such credit note.

FAQ 8. How can recipient accept a genuine credit note issued by supplier in IMS as it will result further reduction of the recipient ITC, however recipient had reversed ITC corresponding to invoice itself because of 17(5), Rule 42, 38, 43 etc., or not availed the ITC at all because of POS or 16(4) etc., ineligibility?

In such cases recipient can accept the said credit note in IMS. As recipient had already reversed the ITC, there is no need for reversal of ITC again in case of such credit note.

FAQ 9. Whether liability can be added in the same GSTR 3B in case where credit note has been rejected by the recipient before filing of GSTR 3B by the supplier?

No, if a credit note is rejected by the recipient, the liability of the supplier is increased on the portal to that extent in the GSTR 3B of subsequent tax period and not in the GSTR 3B of same tax period.

FAQ 10. In light of the time limit to avail ITC being till 30th November for FY 2023-24 or furnishing of annual return whichever is earlier, how can the ITC of erroneously rejected invoice in IMS, be taken by the recipient in the FY 2023-24?

In case the recipient taxpayer erroneously rejects an invoice in IMS, then the same invoice can be accepted in IMS again before filing of GSTR-3B. After accepting the said invoice, the recipient taxpayer should recompute the updated GSTR-2B for availing the credit in GSTR 3B for the FY 2023-24.

FAQ 11. Can the Credit Note be kept as pending in IMS? If no, then why?

Credit Note cannot be kept pending in the IMS by the recipient as the supplier has reduced its outward tax liability at the time of issuance of credit note. IMS does not change the existing flow where the documents/records reported by the supplier in GSTR 1 is accepted and resultant impact is reflected in the GSTR 2B. Now because of IMS, an additional option has been provided to recipient to reject the credit note if it does not belong to him.

7. Challenges

- Lack of Legal Sanction – The recipient is required to submit a response on the acceptance or rejection of a transaction itself as opposed to the time limit up to 30th Nov of the next financial year provided by the law.

- Reconciliations and Amendments – Real time reconciliations required, even for accepted items. Where a supplier amends invoices before the filing of GSTR-1, updated records will be available to the recipient. This will require the recipient to constantly carry out reconciliations even for accepted invoices.

- Additional Reconciliations – Additional reconciliation required during GSTR-3B as not all transactions flow into GSTR-2B from the IMS. E.g., ISD, Outward RCM etc.

- IMS Tracking – The invoices marked as Accepted, Rejected, No Action taken (Deemed accepted) will disappear from IMS on GSTR-3B filing

- No Option to Keep Credit Note Pending –Impact of Rejected Credit Notes e.g., Original invoice kept “Pending”/not recorded in the books and Credit Note thereof is “Rejected” by recipient – This will adversely impact the suppliers.

8. The Gist

Pros

- Real-time update of data including amendments

- Only Accepted invoices/credit notes will form part of GSTR 2B

- Reduced litigation if accurately followed

Cons

- In specific situations, where the recipient rejects the records, it will be added to the supplier’s tax liability

- Pending action is not allowed for specific situations, which again impacts suppliers’ liability

- Procedural hassles if anything is inadvertently rejected

- Additional reconciliation for suppliers to track actions taken by recipient and its impact on outward liability

- GSTR 2B will be dynamic, hence, it will have to be updated each time any action is taken

- Though optional, ‘No Action’ will be treated as ‘Deemed Accepted’

- No option to reset after the filing of GSTR-3B

- ]Increase in technology cost

- Increase in compliance burden

- Increase in litigation if not followed rigorously

- Mismatch with the accounts

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

REquire books for ims.