GST Implications for Indian Transport | Exemptions | Compliance for Goods Transport Agencies

- Blog|GST & Customs|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 18 January, 2024

Table of Contents

- A Big Exemption

- Who is a Goods Transport Agency (GTA)?

- Essential Items Exempt for a GTA

- Unregistered Recipients

- Option to GTA

- What is the Tax Rate to be charged in such a case?

The introduction of Bharatiya Nyay Sanhita, imposing harsher penalties for hit-and-run offenses in India, faces strong opposition from transport groups. Amidst this, the integration of the unorganized sector, like truck drivers and transport agencies into the Goods and Services Tax (GST) Act is a crucial aspect. Nitin Gadkari, the Minister of Road Transport and Highways of India said that the “Logistics sector to gain the most from GST as costs will be down by 20%”. This discussion explores the complexities of the GST Act for Goods Transport Agencies, providing insights into their taxation choices within the transportation sector.

1. A Big Exemption

As per Entry 18 of Notification No. 12/2017 CT (Rate), services by way of transportation of goods are exempt except in the case of,

- Goods Transport Agency or,

- Courier Agency.

2. Who is a Goods Transport Agency (GTA)?

It means any person who provides service for the transport of goods by road and issues consignment notes, by whatever name called. Issuance of the consignment note is sine-qua-non for a service supplier to be considered as GTA.

Truck drivers or tempo operators who do not issue consignment notes are excluded from the definition of Goods Transport Agency (GTA). Consequently, their services fall under Entry 18, leading to an exemption from the Goods and Services Tax (GST).

3. Essential Items Exempt for a GTA

As per Entry 21, services provided by a goods transport agency by way of transport of goods carriage of items listed below are also exempt from GST:

- Agricultural Produce

- Milk, Salt & Food grains

- Organic Manure

- Defense or military equipment

- Newspapers or Magazines

- Relief Materials

4. Unregistered Recipients

As per Entry 21A, services provided by a GTA to an unregistered person, including an unregistered casual taxable person are exempt, other than the following recipients namely: –

- Factory registered under the Factories Act, of 1948; or

- Society registered under the Societies Registration Act, of 1860; or

- Co-operative Society; or

- Any body corporate; or

- Any Partnership firm whether registered or not, including an association of persons; or

- Any person registered under the GST Act

For the persons mentioned above, as outlined in Section 9 of the CGST Act, in conjunction with Notification 13/2017 – CT (Rate), the provision of services by a Goods Transport Agency (GTA) for the transportation of goods by road attracts a tax liability at a rate of 5% (comprising 2.5% CGST and 2.5% SGST/UTGST or 5% IGST). This tax is to be paid under the reverse charge mechanism, where the recipient is responsible for paying the tax directly to the government upon receiving such services.

Imagine Mr. Rahul, a working professional, is in the process of relocating residences and opts for ABC Movers to handle the transportation of his household belongings. Who will pay GST in such a case? Rahul is not registered under GST, and if ABC Movers is also unregistered, GST is not applicable vide entry 21A. But if Rahul falls under the category of the specified persons discussed above like a company or a firm, then he has to pay GST on the Reverse Charge Mechanism (RCM) basis at the rate of 5%.

This implies that a GTA is never obligated to impose goods and services tax on its customers under the GST Act. Instead, their services either fall under exemptions stipulated in notifications (similar to the case of an unregistered supplier) or are subject to a reverse charge mechanism, wherein the recipient bears the responsibility of directly remitting the tax to the government. Thus, GTA is exempt from obtaining registration under the GST Act even if its turnover exceeds the threshold limit.

5. Option to GTA

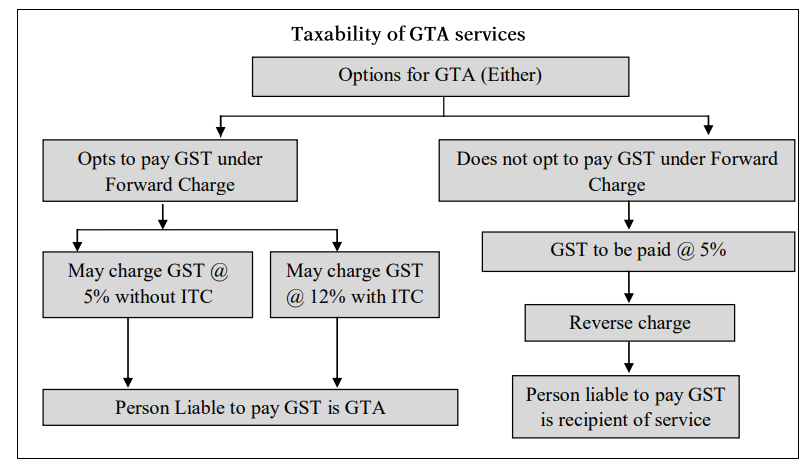

GTA at its discretion can take registration under the GST Act, 2017, and exercise the option that its services would be taxable under forward charge, that is, GTA will charge GST in its invoice to its customers and file its GST returns to pay the same to government.

In such case, the above-mentioned persons do not have to pay under the reverse charge mechanism and GTA has to issue a Tax invoice and make a declaration on its invoice stating the fact of exercising the option.

6. What is the Tax Rate to be charged in such a case?

GTA services are taxable at the following two rates:

- 5% (2.5% CGST + 2.5% SGST/UTGST OR 5% IGST) without availing any Input tax credit; or

- 12% (6% CGST + 6% SGST/UTGST OR 12% IGST) with no restriction on availing Input tax credit on goods or services used in supplying GTA services by GTA.

Continuing with the above example, if ABC Movers is registered, it has the option to discharge GST at a rate of 5% (without Input Tax Credit) or 12% (with Input Tax Credit) on a forward charge basis. No RCM would be paid by the recipient in that case.

The whole taxability of GTA services can be summarised by the following chart:

Transportation plays a pivotal role in the economy, and any disruptions within this crucial sector can have widespread implications across the entire business channel. India has a road network of 63 Lakh Kilometers of roads, which is the second largest in the World after the United States of America and Bharatiya Nyay Sanhita marks a significant shift in addressing hit-and-run offenses on these roads, facing opposition from transport groups.

Turning to the Goods and Services Tax (GST) Act, the impact on the unorganized sector, particularly truck drivers and transport agencies, is evident. The exemption of services related to goods transportation, criteria for Goods Transport Agencies (GTAs), and the choice between forward and reverse charge mechanisms with different GST rates showcase the complexity of GST regulations. This underscores the importance of a nuanced understanding of the GST framework in the transportation sector in India.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA