Formation of Company – Promotion and Incorporation

- Blog|Company Law|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 27 March, 2025

Formation of a company under the Companies Act, 2013 refers to the legal and procedural process through which a company comes into existence and is registered as a separate legal entity. This process involves several stages, including promotion, incorporation, and, in the case of companies having share capital, commencement of business. As per Section 3 of the Act, a company may be formed by one or more persons (depending on its type—public, private, or OPC) for any lawful purpose by subscribing their names to a Memorandum of Association and complying with the provisions of the Act in respect of registration.

Table of Contents

- Promotion

- Legal Position of Promoter

- Remuneration of Promoter

- Pre-Incorporation Contracts (or Preliminary Contracts)

- Formation of Company (Sec. 3)

- Process of Formation or Incorporation of Company (Sec. 7)

- Online Registration of a Company

- Commencement of Business, etc. (Sec. 10A)

Check out Taxmann's Company Law – UGCF | NEP which comprehensively covers every phase of a company's journey—from formation to winding up—focusing on regulatory procedures, documentation, and capital-raising processes. It is organised into five units, integrating the latest legal updates (e.g., Demat of shares, revised Secretarial Standards, virtual meetings, and CPC for e-forms) alongside practical exercises, case studies, and question banks. This textbook follows a NEP-aligned approach to ensure clarity and depth. Systematically guiding readers through core concepts equips students with the knowledge and skills needed for academic and professional excellence.

All the companies other than statutory companies come into existence only through the process of registration under the Companies Act. Various stages in formation of company are –

- Promotion

- Incorporation

- Declaration for Commencement of Business in case of a company having a share capital – A company having a share capital shall not commence any business or exercise any borrowing powers unless the conditions stipulated under Sec. 10A are fulfilled.

1. Promotion

Persons who initiate formation of a company are known as promoters. It needs to be noted that person acting only in professional capacity e.g. solicitor, bankers, accountant etc. are not regarded as promoters.

Promoters do everything from inception of idea of forming the company and take all steps required for it as entering into agreements with bankers and drafting the memorandum and articles etc.

Meaning of Promoter – As per Sec. 2(69) Promoter means a person

- who has been named as such in a prospectus or is identified by the company in the annual return referred to in Sec. 92; or

- who has control over the affairs of the company, directly or indirectly whether as a shareholder, director or otherwise; or

- in accordance with whose advice, directions or instructions the Board of directors of the company is accustomed to act.

A person shall not be covered by this clause who is acting merely in a professional capacity.]

2. Legal Position of Promoter

- Promoter as Agent of the Company – Promoter is an agent as he acts for the But he is not agent in complete sense of the term as there is no principal who has appointed him. Company is yet to come into existence.

- Promoter as Trustee – Promoter acts in trust for the company. Again he is not trustee in real sense because the company (trust) is yet to be formed.

- Promoter Stands in Fiduciary Relationship with the Company – i.e. the relationship of utmost good-faith. It is the best description of promoter’s position viz-a-viz company. Promoter is to act in the best interest of the company which he is going to form. By virtue of this relationship he is to give benefit of all the negotiations made by him relating to the affairs of the company. This position of promoters was emphasized by various judgments.

2.1 Case Law

Erlanger v. New Sombrero Phosphate Co. (1874-1880)

A ‘syndicate’ represented by Erlanger purchased the lease of the island (in the West Indies, in which were deposits or beds of phosphate of lime) from the liquidator of a former company for £ 55,000 and re-sold it to the company promoted by them (new company registered on Sept. 21st, 1871) for £ 1,10,000. In November, 1871 the purchase price was paid. Contract of purchase was ratified by directors who were all nominated by Erlanger. In February, 1872, the first meeting of shareholders took place. ‘Committee of shareholders’ after investigating the matter of purchase, filed the case for setting aside the purchase on December 24th, 1872. It was held that company could do so as promoters did not discharge their fiduciary duty in the manner expected of them as directors who ratified purchase transaction were their nominees only.

Lord Cairns said “the promoters of a company stand undoubtedly in a fiduciary position. They have in their hands the creation and moulding of the company. I do not say that the owner of property may not promote and form a joint stock company and then sell his property to it, but I do say that, if he does, he is bound to take care that he sells it to the company through the medium of a Board of Directors who can and do exercise an independent and intelligent judgment on the transaction.”

Lord Justice Lindley in Lidney & Wigpool Iron Ore Co. v. Bird described the position of a promoter as follows –

“Although not an agent for the company, nor a trustee for it before its formation, the old familiar principles of law of agency and of trusteeship have been extended and very properly extended to meet such cases. It is perfectly well settled that a promoter of a company is accountable to it for all monies secretly obtained by him from it just as the relationship of the principal and agent or the trustee and cestui que trust had really existed between him and the company when the money was obtained.”

In Gluckstein v. Barnes (1900) case it was held that part of the profits which was not disclosed (secret profits) needs to be paid back to the company. Promoter can make profits but no secret profits. Now the question arises to whom the disclosure is required to be made. Disclosure can be made to the independent Board of Directors or whole body of prospective shareholders or in prospectus or Articles of the company.

3. Remuneration of Promoter

Law nowhere speaks about the remuneration of promoter but in practice his efforts may be rewarded through profit made by him in certain dealings, of course with proper disclosure.

3.1 Liability of Promoters

1. Related to Incorporation

As per 7(6), where at any time after the in- corporation of a company, it is proved that the company has been got incorpo- rated by furnishing any false information or by suppressing any material fact in any of the documents or declaration filed for incorporating such company, the promoters shall be liable for action under Sec. 447.

2. Related to Matters to be Stated in Prospectus

Every prospectus issued shall state such information and set out such reports on financial information as may be specified by the Securities and Exchange Board in consultation with the Central Government (Sec. 26).

If a prospectus is issued in contravention of the provisions of Sec. 26, every promoter who is knowingly a party to the issue of such prospectus shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to three lakh rupees.

3. Civil and Criminal Liability for Misleading Prospectus

- Civil Liability for Misleading Prospectus – Where a person has subscribed for securities of a company relying on misleading prospectus and has sustained any loss or damage as a consequence thereof then promoter of the company shall be liable to pay compensation to every person who has sustained such loss or damage.

- Criminal Liability for Mis-statements in Prospectus – Where a prospectus issued includes any statement which is untrue or misleading, every promoter who authorized the issue of such prospectus shall be liable under Sec. 447.

4. Pre-Incorporation Contracts (or Preliminary Contracts)

Pre-incorporation contracts are the contracts entered into by promoters before incorporation of the company, like purchase of land, ordering machinery etc. Whether these contracts shall be binding on the company or not needs to be examined. Prior to Specific Relief Act, 1963 it was held in one of the renowned judgments i.e. Kelner v. Baxter, that such contracts are not binding on the company and promoters themselves shall be liable for such contracts.

After passing of Specific Relief Act, 1963, Secs. 15(h) and 19(e) of this Act rationalizing the need of such contracts for bringing efficiency and commercial prudence provided that such contracts shall be binding on the company if it can be established that these were entered into for the purpose of the company and warranted by the terms of incorporation (i.e. very well related to the business for which company is being formed) and adopted by the company later on and such acceptance is communicated to the other party to the contract.

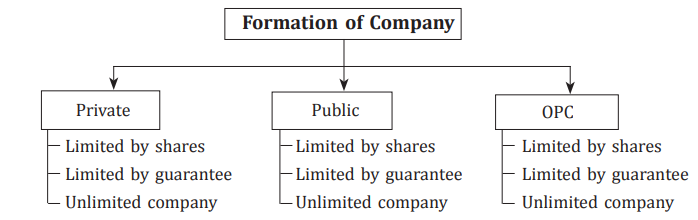

5. Formation of Company (Sec. 3)

As per Sec. 3(1) A company may be formed for any lawful purpose by –

- seven or more persons, where the company to be formed is to be a public company;

- two or more persons, where the company to be formed is to be a private company; or

- one person, where the company to be formed is to be One person company that is to say, a private company,

by subscribing their names or his name to a memorandum and complying with the requirements of this Act in respect of registration.

A company formed may be either –

- a company limited by shares, or

- a company limited by guarantee, or

- an unlimited

6. Process of Formation or Incorporation of Company (Sec. 7)

- Application for Registration – Application for registration shall be filed with the Registrar within whose jurisdiction the registered office of the company is proposed to be situated.

- Documents and information to be filed for registration –

-

- Memorandum of Association, signed by all the subscribers;

- Articles of Association, signed by all the subscribers;

- Declaration in Form No. INC-8 –

-

-

- a declaration in Form INC-8 by professionals (an advocate, a chartered accountant, cost accountant or company secretary in practice), who is engaged in the formation of the company, and

- by a person named in the Articles as a director, manager or secretary of the company;

-

that all the requirements of this Act and the rules made thereunder in respect of registration and matters precedent or incidental thereto have been complied with;

- Declaration from subscribers and first directors in Form No. INC-9 – A declaration from each of the subscribers to the Memorandum and from persons named as first directors, if any, in the Articles that he is not convicted of any offence in connection with the promotion, formation or management of any company, or that he has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act or any previous Company Law during the preceding five years and that all the documents filed with the Registrar for registration of the company contain information that is correct and complete to the best of his knowledge and belief;

- Address for correspondence – The address for correspondence till its registered is established needs to be provided;

- Particulars of every subscriber to the Memorandum along with the proof of identity;

- Particulars of first directors including proof of identity along with particulars of the interest of the first directors of the company in other firms or bodies corporates;

- Consent of the persons mentioned as first directors of the company in Form No. DIR-2.

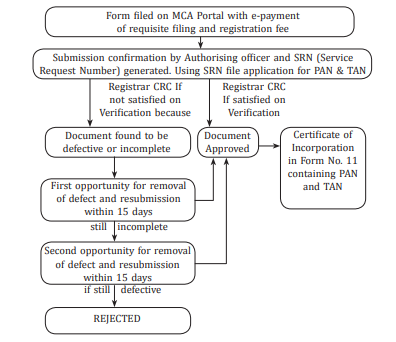

Issue of Certificate of Incorporation by the Registrar

The Registrar on the basis of documents and information filed shall register in the register and issue a Certificate of Incorporation in Form No. INC-11 to the effect that the proposed company is incorporated under this Act.

Corporate identity Number

On and from the date mentioned in the Certificate of Incorporation, the Registrar shall allot to the company a Corporate Identification Number (CIN), which shall be a distinct identity for the company and this is also included in the Certificate. CIN is a 21 digit alpha numeric number.

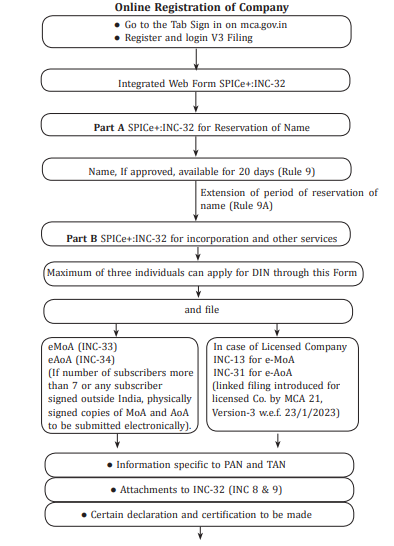

7. Online Registration of a Company

Company comes into existence through a legal process of registration. The process starts with reservation of name which can be done through Part A of Simplified Proforma for Incorporating Company Electronically Plus – INC-32 (i.e. SPICe+ – INC-32)*. Name proposed, if approved is available for 20 days from the date of approval under Rule 9. With effect from 26th January, 2021, Rule 9A has come into force. Rule 9A provides for extended period for name reserved, upto –

(a) 40 days, on payment of fees of 1000 before the expiry of 20 days from the date of approval under Rule 9;

(b) 60 days from the date of approval under Rule 9, on payment of fees of ` 2000 made before the expiry of 40 days as referred in point (a);

(c) 60 days from the day of approval under Rule 9, on payment of fees of ` 3000 made before the expiry of 20 days from the date of approval under Rule 9.

In case applicant wants to apply for name, incorporation and other integrated services together, he can also do so by filling necessary information in Part A and Part B of SPICe+ – INC-32 together. Memorandum of Association and Articles of Association along with certain declarations shall have to be filed. DIN (Director Identification Number) is not a pre-requisite for filing application for incorporation. Because DIN up to 3 directors can be obtained through SPICe+ – INC-32 itself.

Using integrated Web Form SPICe+ – INC-32, Private, Public, OPC, Section 8 company and Producer company can be incorporated in India. Web Form SPICe+ shall be accompanied by e-form AGILE-PRO-S** [Application for Goods & Services Tax Identification Number (optional), Employees State Insurance Corporation Registration plus Employees Provident Fund Organization Registration, Professional Tax Registration (for States of Maharashtra, Karnataka and West Bengal), opening of Bank Account and Shops & Establishment Registration (at Delhi)] i.e., linked e-form INC-35 [as per Rule 38A of the Companies (Incorporation) Amendment Rules, 2020]. The process of incorporation ends with Certificate of Incorporation in Form-11.

Note – In SPICe + Part-A, NIC Code 2008 have been introduced with the option of selecting three business activities (w.e.f. 23/1/2023).

The entire process of ‘online registration of a company’ is explained in the flow diagram below –

Did you know?

Ministry of Corporate Affairs (MCA) has integrated with National Single Window System (NSWS) for the Incorporation of Companies. Incorporation services can also be availed through NSWS portal.

Explanation of Terms Used in Flow Diagram –

CRC means Central Registration Center

PAN means Permanent Account Number

TAN means Tax Deduction and Collection Account Number

INC-8 for declaration by an Advocate, a Chartered Accountant, Cost Accountant, Company Secretary in practice and by Director, Manager or Secretary that all requirements related to incorporation have been complied with.

INC-9 for declaration under Sec. 7(1)(c) from each subscriber and person named as director that they are not guilty of any fraud and documents give a true and complete information.

DIR-2 for consent of directors to act in that capacity (now in form of declaration only w.e.f. 23/1/2023).

Notes –

- In SPICe + if correspondence address provided is the address of registered office then the Geo-coordinates (i.e. longitude and latitude) need to be provided.

- Where a person seeking appointment as director is a national of a country which shares land border with India, the security clearance from the Ministry of Home Affairs is required w.e.f. 1/6/2022.

7.1 Effect of Registration

Sec. 9 explains that on registration, the company shall be a body corporate by the name contained in the memorandum, capable of exercising all the functions of the incorporated company under this Act and having perpetual succession with power to acquire, hold and dispose of property, both movable and immovable, tangible and intangible, to contract or to sue and to be sued, by the said name.

7.2 Certificate of Incorporation (CoI) and Its Conclusiveness

Under Secs. 34 & 35 of the erstwhile Companies Act i.e., Companies Act, 1956, the CoI used to be described as conclusive evidence of the fact of existence of compa- ny & compliance with legal formalities relating to incorporation stage and once the company obtained it, nothing could be enquired into its validity even if it was acquired by wrong means. However, there is no concept of conclusiveness of CoI in the Companies Act, 2013. Let us examine the consequences of incorporation by wrong means in the ensuing section.

7.3 Consequences of Incorporation By Wrong Means

- If any person furnishes any false or incorrect particulars of any information or suppresses any material information being aware of it in any of the documents filed, he shall be liable for action under Sec. 447.

- If at any time after the incorporation of a company, it is proved that the com- pany has been got incorporated by furnishing false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company, or by any fraudulent action, the promoters, the persons named as the first directors of the company and the persons who made declaration shall each be liable for action under Sec. 447.

- As per 7(7) where a company has been incorporated by furnishing false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company, or by any fraudulent action, the Tribunal may, on an application made to it –

-

- pass such orders for regulating the management of the company including changes in Memorandum and Articles; or

- direct that the liability of the members shall be unlimited; or

- direct removal of the name of the company from the register of the companies; or

- pass an order for the winding-up of the company; or

- pass such other orders as it may deem

However, before making any such order the company shall be given a reasonable opportunity of being heard and Tribunal shall also take into consideration the transaction and obligations of the company undertaken so far.

8. Commencement of Business, etc. (Sec. 10A)*

1. A Company having a Share Capital shall not commence any business or exercise any borrowing powers unless it fulfils the conditions stipulated under Sec. l0A. Stipulated conditions are as follows –

(a) Filing of declaration – A declaration is filed by a director within a pe- riod of one hundred and eighty days of the date of incorporation of the company in Form INC-20A and verified by CA or CS or Cost Accountant in practice in such manner as may be prescribed, with the Registrar that every subscriber to the memorandum has paid the value of the shares agreed to be taken by him on the date of making of such declaration; and

(b) Filing a verification of registered office – The company has filed with the Registrar a verification of its registered office (in Webform INC-22) under Section 12(2). Any of the following documents shall be attached to above Form –

(i) the registered document of the title in the name of the company, or

(ii) the notarized copy of lease or rent agreement with rent receipt, or

(iii) authorization from the owner to use the premises, and

(iv) the evidence of any utility service like telephone, gas, electricity depicting address of the premises.

Note – At the time of incorporation company may specify the address for correspondence only. Address of registered office can be intimated to RoC within 30 days of incorporation.

2. Penalty in case of Default – If any default is made in complying with the requirements of this section, the company shall be liable to a penalty of fifty thousand rupees and every officer who is in default shall be liable to a penalty of one thousand rupees for each day during which such default continues but not exceeding an amount of one lakh rupees.

3. Consequence of non-filing of Declaration – In case no declaration has been filed with the Registrar under Sec. 10A(1)(a) and the Registrar has reasonable cause to believe that the company is not carrying on any business or operations, he may initiate action for the removal of the name of the company from the Register of Companies under Sec. 248.

Did you know?

There is zero fee for the incorporation of companies with –

- authorized capital upto 15 lakh, or

- up to 20 members where no share capital is applicable.

* New web form SPICe+ – INC-32 has replaced erstwhile SPICe Form, w.e.f. 23/2/2020. Again revised w.e.f. 23/1/2023

** AGILE-PRO has been replaced by AGILE-PRO-S w.e.f. 7th June, 2021.

* Inserted by the Companies (Amendment) Act, 2019 w.r.e.f. 2/11/2018.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA