Fate of GST ITC after Retrospective Cancellation of Vendor Registration

- Blog|GST & Customs|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 29 March, 2023

Table of Contents

2. Supplier Non existent at declared POB

3. Non filing of GSTR-3B by Vendor

1. Relevant Legal Provisions

1.1 Claiming ITC – GST Provisions

1.1.1 Who can claim ITC?

Every registered person is eligible to claim credit of input tax of GST paid on goods or services or both which are used by him in the course or furtherance of business

1.1.2 Conditions for claiming ITC

-

- Possession of tax-paying document

- Details of invoice furnished under Form GSTR-1 and communicated to recipient

- Receipt of Goods/services

- Payment of tax by supplier to Government

- Return is filed by the recipient

- Payment is made to vendor within 180 days in specified cases

- Credit is claimed within the specified time limit, etc.

1.1.3 Nature of ITC

ITC mechanism constitutes a concession granted by the legislature

Vedanta Limited vs UOI [2023] 146 taxmann.com 262 (Orissa)

1.2 Cancellation of Registration – GST Provisions

Grounds for cancellation of GST registration (Section 29 of CGST Act):

| Sl. No. | Grounds for Cancellation |

| Cancellation based on Application filed by RP [Section 29(1)] | |

| 1. | Discontinuation/transfer of business |

| 2. | Change in constitution of business |

| 3. | No longer liable to be registered |

| 4. | Opting out of voluntary registration |

| Suo-moto cancellation by PO [Section 29(2)] | |

| 5. | Contravention of specified provisions of GST law (Rule 21) |

| 6. | Non-furnishing of Form GSTR 4 within three months from its due date |

| 7. | Non-furnishing of returns (i.e. Form GSTR 3B) by any person other than a composite dealer:

|

| 8. | Non-commencement of business within six months from registration |

| 9. | Registration obtained by mala-fide means |

Contravention of specified provisions (Rule 21 of CGST Rules):

| Sl. No | Contravention | Description of Contravention |

| 1. | Not doing business from a declared place | Does not conduct any business from declared place of business |

| 2. | Fake invoicing | Issuance of an invoice/ bill without supply of goods/services in violation of GST law |

| 3. | Non-compliance with Anti-profiteering provisions | Violation of Section 171 and related rules |

| 4. | Non-furnishing of Bank account details | Violation of Rule 10A of CGST Rules i.e. non furnishing of bank account details after grant of certificate of registration |

| 5. | Excess claim of ITC | Where ITC is availed in violation of Section 16 of the CGST Act or rules made thereunder |

| 6. | Under-reporting of outward supply in GSTR- 3B | Furnishing details of outward supplies in GSTR-1 for one or more tax periods which is in excess of the outward supplies declared in GSTR-3B for said tax periods |

| 7. | Non-compliance with Rule 86B | Violation of Rule 86B (i.e. Restrictions on use of amount available in electronic credit ledger) |

1.2.1 Retrospective cancellation of Registration

-

- PO is empowered to cancel registration from any retrospective date, as he may deem fit, in the circumstances covered in Sl. No. 5 to 9. Relevant provision reads as under:

The proper officer may cancel the registration of a person from such date, including any retrospective date, as he may deem fit, where,—

(a) ..

(b) ..

(c) ..

[Section 29(2) of CGST Act]

-

- Opportunity of being heard is mandatory to be given before cancelling registration

1.2.2 What is the meaning of ‘as he may deem fit’?

Can registration be cancelled arbitrary from any retrospective date?

Undoubtedly, this expression ‘as it deems fit’ confers a jurisdiction of widest amplitude on the quasi-judicial tribunal. But that does not mean that such tribunal can pass any order in total disregard of the statutory provisions under which the quasi-judicial tribunal is created and is conferred jurisdiction to resolve disputes arising in the implementation of the statute……

…….the discretionary jurisdiction has to be exercised keeping in view the purpose for which it is conferred, the object sought to be achieved and the reasons for granting such wide discretion.

(Narendar Singh Vs. Chhotey Singh, AIR 1983 SC 990)

1.3 Most Common Grounds for Registration Cancellation

A. Non-Existent of supplier at declared place of business

B. Non-filing of GSTR 3B by Supplier

C. Fake Invoicing (other than A)

2. Supplier Non existent at declared POB

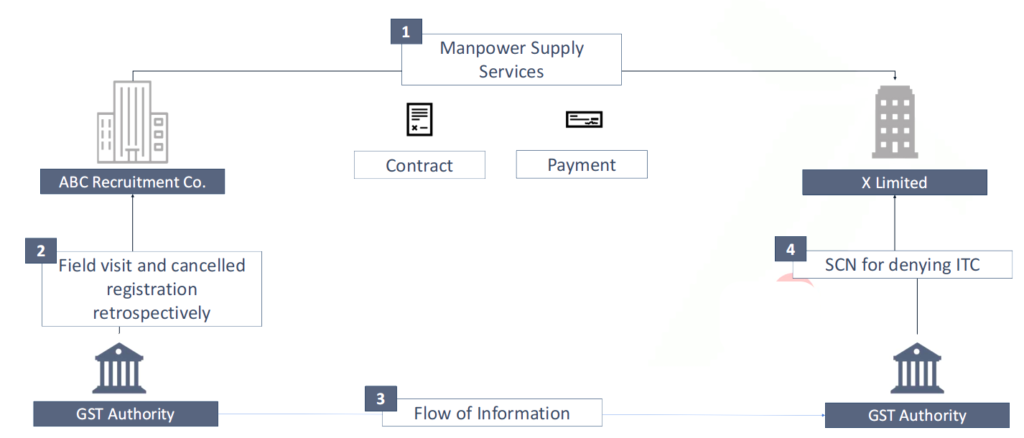

2.1 Illustrative Transaction

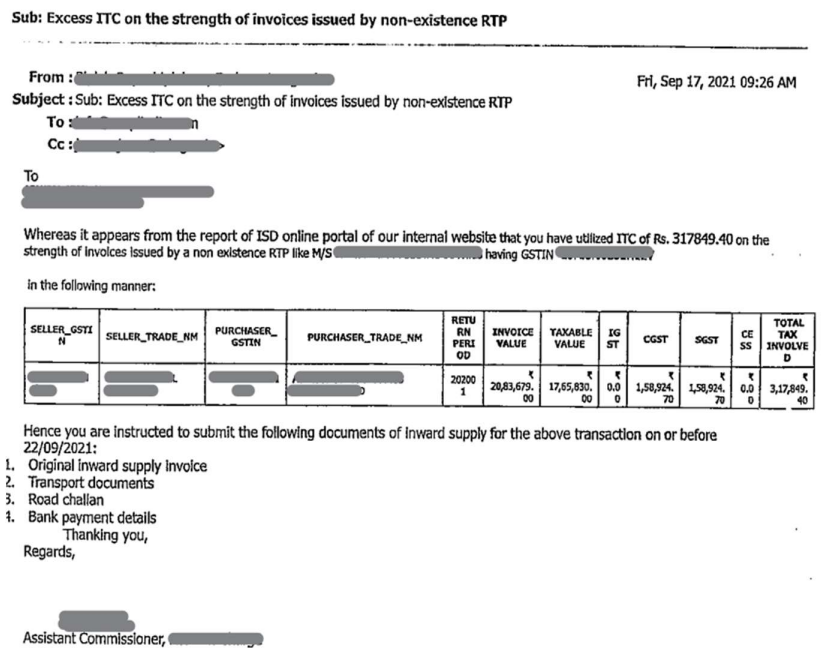

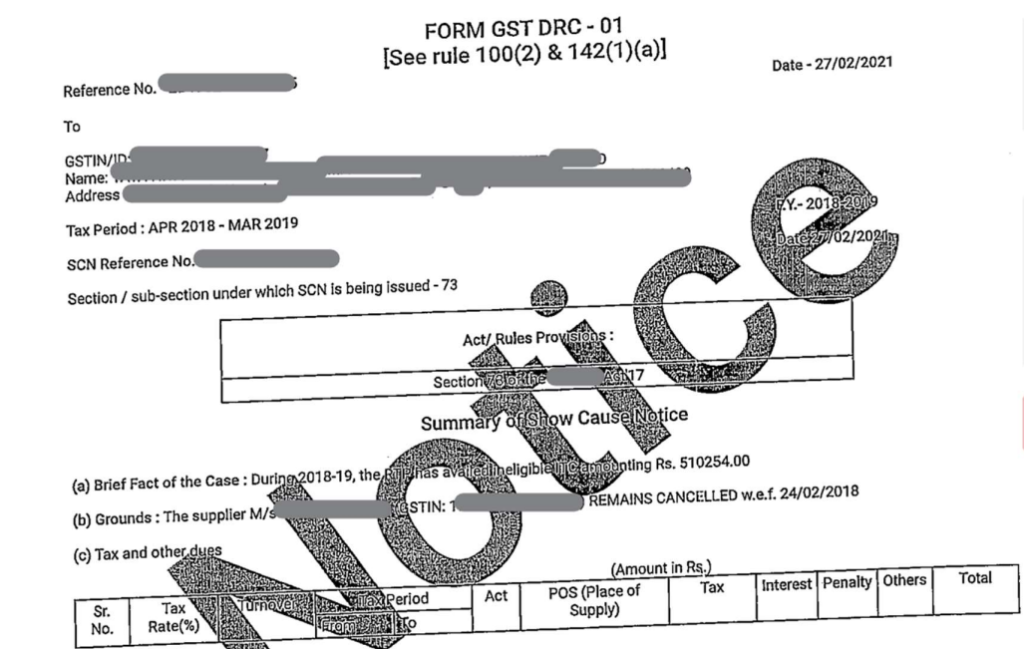

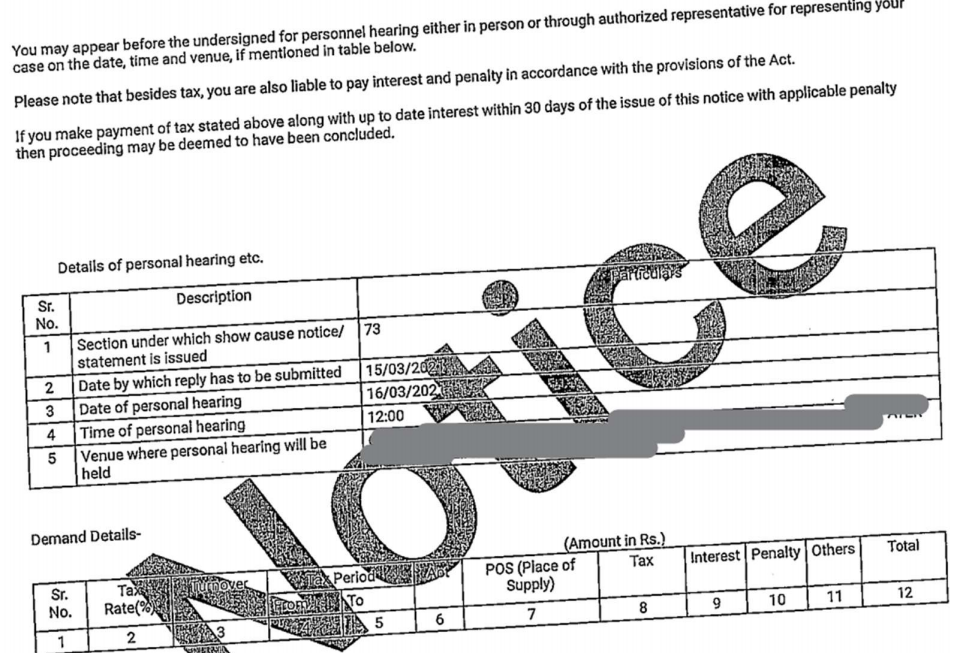

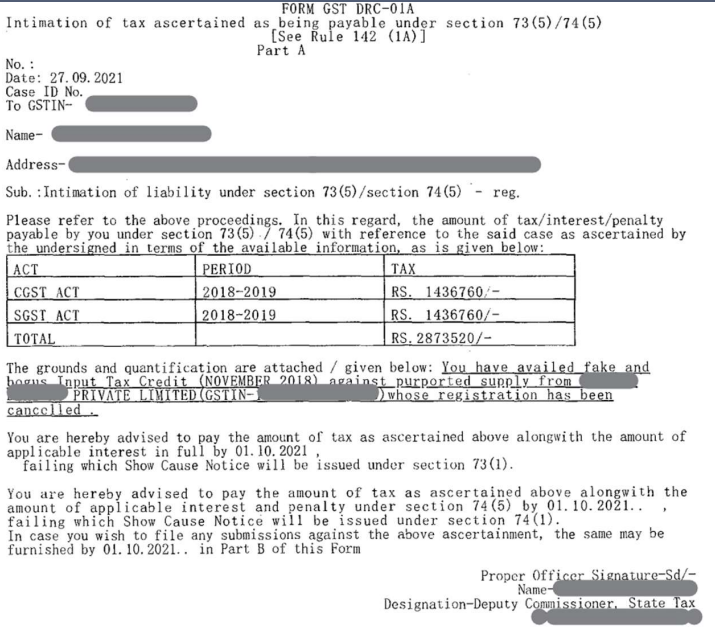

2.2 Allegations – Sample Notice (DRC-01)

2.3 Litigation Strategy

2.3.1 Substantiate genuineness of transaction

Submit all the necessary documents for substantiating genuineness of transactions. For g. in respect of Manpower supply services following can be submitted:

-

- Copy of Agreement

- Invoice details

- Payment details

- List of persons employed

- Sample joining letter

- Sample attendance records

- Copy of GSTR 2A

- Screenshot of report showing difference between GSTR 1 and 3B (as shown on GSTN portal)

Note: Burden of proving claim of ITC lies on recipient (Section 155 of CGST Act).

2.3.2 Supreme Court views of substantiating genuineness of transaction

Dealer claiming ITC has to prove beyond doubt the actual transaction which can be proved by furnishing

-

- Name and address of selling dealer,

- Details of the vehicle which has delivered the goods,

- Payment of freight charges,

- Acknowledgement of taking delivery of goods,

- Tax invoices and payment particulars

Aforesaid information would be in addition to tax invoices, particulars of payment etc. In fact, if a dealer claims Credit on purchases, such dealer/purchaser shall have to prove and establish actual physical movement of goods, genuineness of transactions by furnishing details referred above and mere production of tax invoices would not be sufficient to claim ITC.

Burden to prove genuineness of transaction is on purchasing dealer. Mere production of invoices and/or payment by cheque is not sufficient and cannot be said to be proving burden.

State of Karnataka Vs. Ecom Gill Coffee Trading (P) Ltd (2023) 4 Centax 223 (SC)

2.3.3 Substantiate reasonable steps were taken to ensure supplier is not fictitious

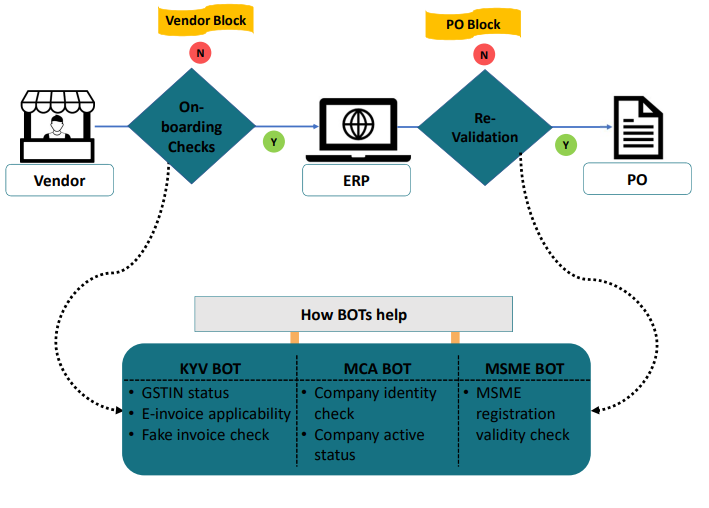

Submit necessary documents to substantiate reasonable steps were taken that supplier is not Like submitting vendor onboarding process followed by Company, copy of portal showing active status of vendor on GSTN portal, etc.

2.3.4 Reliance was place on GST registration granted by GST Authorities

Substantiate that transaction was done relying on active registration granted by GST Authorities.

A purchasing dealer is entitled by law to rely upon the certificate of registration of the selling dealer and to act upon it. Whatever may be the effect of a retrospective cancellation upon the selling dealer, it can have no effect upon any person who has acted upon the strength of a registration certificate when the registration was current. The argument on behalf of the department that it was the duty of the person dealing with registered dealers to find out whether a state of facts exists which would justify the cancellation of registration must be rejected. To accept it would be to nullify the provisions of the statue which entitle persons dealing with registered dealers to act upon the strength of registration certificates.

State of Maharashtra v Suresh Trading Company [1998] 1998 taxmann.com 1747 (SC)/ [1998] 109 STC 439 (SC)

The Calcutta High Court under GST has observed that ITC cannot be denied to a genuine buyer on the fact that supplier is fake. The petitioner with their due diligence has verified the genuineness and identity of the supplier as registered taxable person as available at the government portal. The petitioner could not be faulted if they appear to be fake later on. Matter was remanded to consider based on merits.

LGW Industries Ltd v UOI [2022] 134 taxmann.com 42(Cal)

2.3.5 Ask for Field Verification Report

The taxpayer should ask for the copy of field verification It would help to understand the grounds which enabled the authorities to issue SCN and it will also help in making a precise reply:

While the principle is well established that the person concerned should be adequately informed of the case against him, there may be questions raised about the extent and content of information to be given. Courts may have to decide whether in a particular case all the relevant material or evidence was disclosed to him or not. The court may hold in a case that it was not necessary to disclose a particular document or that what was disclosed was adequate; the extent and content of the information to be disclosed would depend upon facts of each case.

Principles of Administrative law by M.P. Jain and S.N. Jain Fourth Edition of 1986 page 248

2.3.6 Opportunity of Cross examination

It is important to ask for the opportunity to cross examine the persons who have made submissions based on which SCN is issued.

There can be no denying that when any statement is used against an asseesee, an opportunity of cross- examination of the persons who made those statements ought to be given to asseesee, Right of cross examination, of the person who had given a statement against the asseesee, even in a quasi judicial proceeding is a valuable right given to the accused/notice which cannot be taken away unless the circumstances relating to unavailability of such person referred to in Section 136B exists.

Basudev Garg vs Commissioner of Customs [2014] 42 taxmann.com 62 (Del) / [2013] 294 ELT 353

2.3.7 Argue Principle of Lex non Cogit Ad impossibilia

The buyer cannot be put in jeopardy when he has done all that the law requires him to do and further that the purchasing dealer has no means to ascertain and secure compliance of selling How can ITC be denied if subsequent of the transaction suppliers are not found at their place of business? Are authorities not compelling to forecast a future event? Reliance can be placed on judgments like On Quest Merchandising India P Ltd v. Government of NCT of Delhi [2017] 87 taxmann.com 179 (Delhi)/[2018] 10 GSTL 182 / [2017] 64 GST 623 (Delhi)

2.3.8 Veracity of other registered person cannot be checked

Granting registration is a responsibility of Government and its veracity of taxpayer cannot be checked by recipient.

2.3.9 Argue SCN is cryptic and vague

The essential requirements of proper notice are that it should specifically state charges which the noticee has to reply. If charges are not coming clearly then such notice would not be valid. Reliance in this regard can be placed on various decisions including the following:

-

- Oryx Fisheries (P.)Ltd. Union of India [2010] 13 SCC 427

- CCE Shital International [2010] 1 taxmann.com 413 (SC)

- Dilip N. Shroff Jt. CIT [2007] 161 Taxman 218/291 ITR 519 (SC)

- NKAS Services (P.) v. State of Jharkhand [2021] 131 taxmann.com 230 (Jharkhand)/[2022] 63 GSTL 18 etc.

2.3.10 Other important arguments

-

- ITC availed is a vested Right under Article 300A of Constitution and there is no provision under law which requires reversal of impugned ITC

- Provision for cancellation of registration with retrospective date is Arbitrary as it gives the same treatment genuine and bogus transaction (no intelligible differential)

- Honest taxpayers should not be harassed

- Co-relating grounds with Article 14 of Constitution and showcasing that how the procedure adopted by authorities is arbitrary

- Ensure that DIN is mentioned in documents issued by CGST Authorities

| Sl. No. | Particulars |

| 1. | Substantiate genuineness of transaction |

| 2. | Substantiate reasonable steps were taken to ensure supplier is not fictitious |

| 3. | Argue that reliance was placed on GST registration granted by GST Authorities |

| 4. | Ask for field verification report Opting out of voluntary registration |

| 5. | Ask for Opportunity of Cross Examination |

| 6. | Argue SCN Cryptic and Vague (would depend how notice is issued) |

| 7. | Argue ITC availed is a vested right |

| 8. | Argue that law does not compel a taxpayer to do impossible things |

| 9. | Other points

|

3. Non filing of GSTR-3B by Vendor

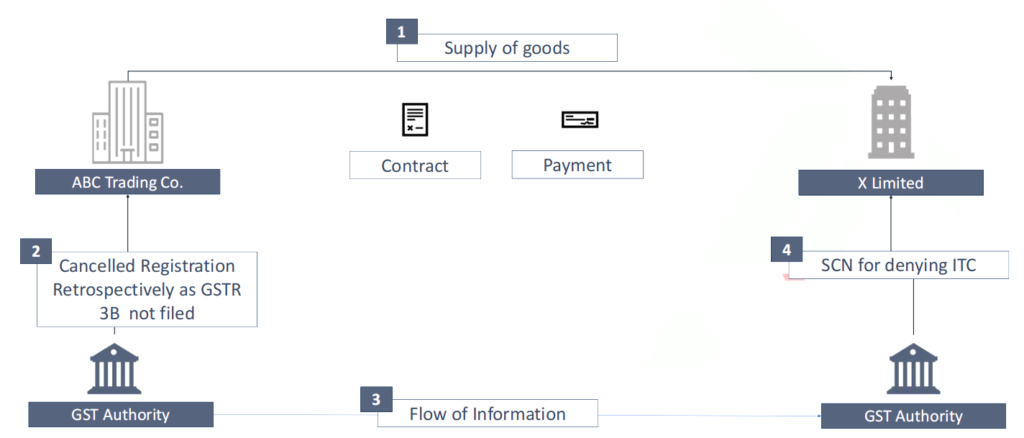

3.1 Illustrative Transaction

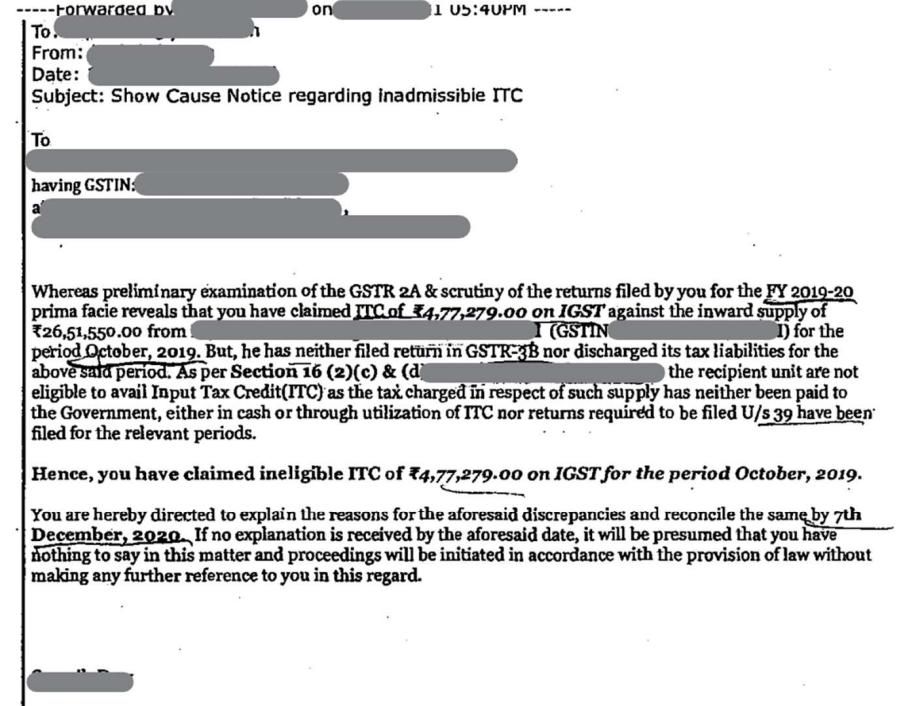

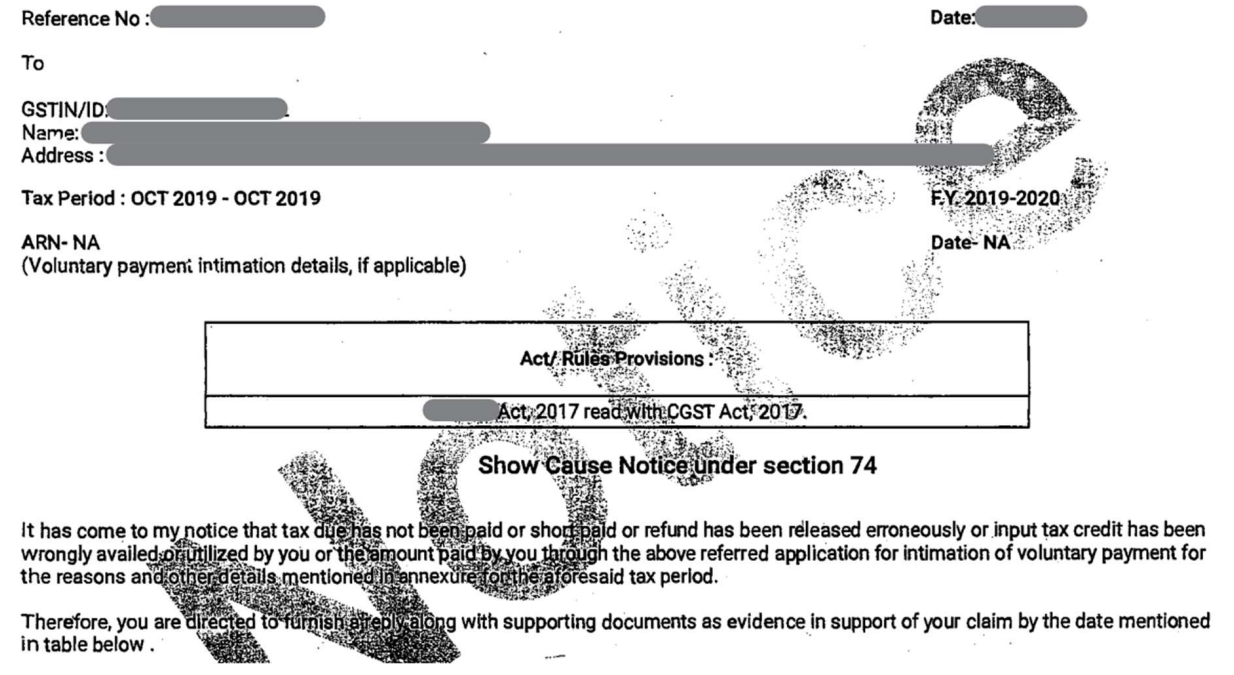

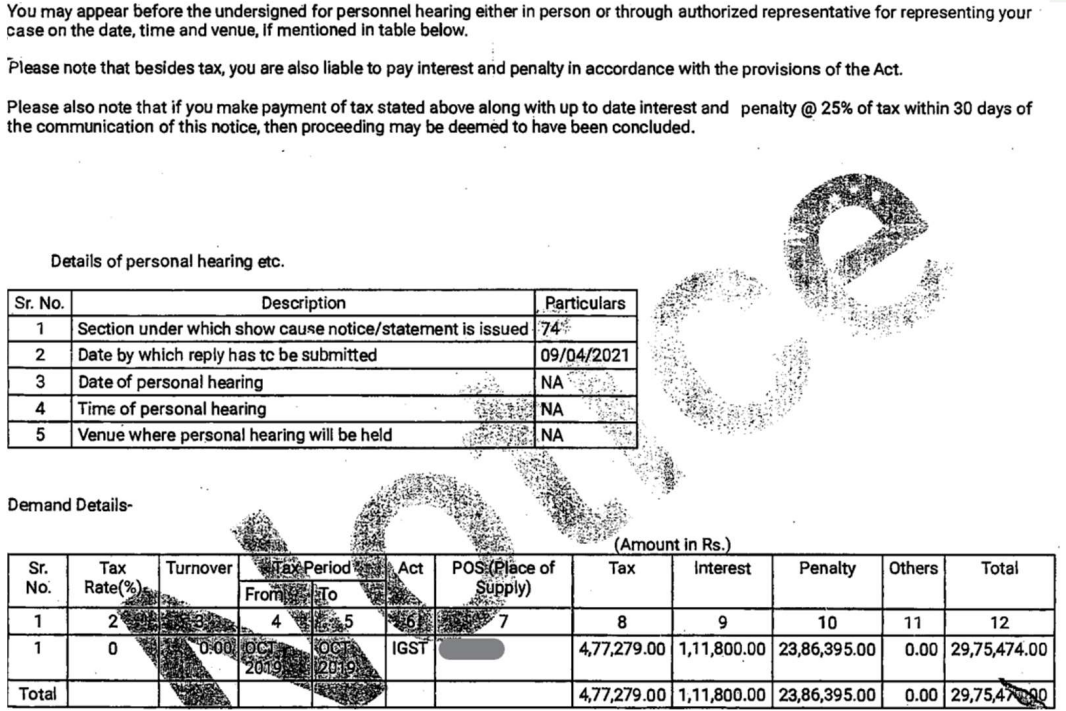

3.2 Allegations – Sample Notice (DRC-01)

3.3 Litigation Strategy

3.3.1 Substantiate value of supply and tax is paid to vendor

Submit all the necessary documents for substantiating that value of supply along with tax is paid to the Documents such as:

-

- Copy of Agreement

- Copy of tax invoices

- E-way bill (in case of goods)

- Payment details (Bank Statement )

- Other documents as sought by authorities

3.3.2 No mechanism in law to cross check whether payment is made by supplier

It is neither possible nor practicable for recipient to verify actual payment of GST by supplier since deposit of GST is not transaction wise but cumulative month wise. The legislature should have considered the absurdity and eventuality of such provision of law.

3.3.3 Argue Principle of Lex non Cogit Ad impossibilia

The buyer cannot be put in jeopardy when he has done all that the law requires him to do and further that the purchasing dealer has no means to ascertain and secure compliance of selling Reliance can be placed in judgments like On Quest Merchandising India P Ltd v. Government of NCT of Delhi [2017] 87 taxmann.com 179 (Del)/[2018] 10 GSTL 182/[2017] 64 GST 623 (Delhi)

3.3.4 Initiate proceedings against supplier

At a first instance the authorities should adjudicate the supplier and in exceptional scenarios it should demand tax from recipient.

GST Council recommendation in this regard:

There would not be any automatic reversal of input tax credit from buyer on non-payment of tax by the seller. In case of default in payment of tax by the seller, recovery shall be made from the seller; however, reversal of credit from buyer shall also be an option available with the revenue authorities to address exceptional situations like missing supplier, closure of business by supplier or supplier not having adequate assets, etc.

(Decision of GST Council in its 27th meeting)

Madras High Court views on impugned GST provisions

If tax not reached to Govt. kitty, the liability may have to be eventually borne by one party, either seller or buyer. When it has come out that seller has collected tax from purchasing dealers, omission on part of seller to remit tax in question must have been viewed very seriously, and strict action ought to have been initiated against him. In this case, the High Court held that order passed by authority has a fundamental flaws, and it quashed the order on following grounds:

- Non- Examination of the supplier in the enquiry

- Non-initiation of recovery action against the supplier in the first place

D.Y. Beathel Enterprises V. State Tax Officer [2021] 127 taxmann.com 80 (Mad)/ 86 GST 400/ [2022] 58 GSTL 269

3.3.5 Precondition of tax payment can be argued as against Article 19(1)(g) of Constitution

Practically it is not possible for recipient of supply to run after supplier at different parts of India for verification of actual deposition/payment of GST at his end, there shall be serious effect of loss of trade on the part of small scale suppliers since after payment of consideration including GST component, no recipient of supply would afford to lose benefit of ITC and as such, pre-condition of payment of tax would eventually result into loss of trade and business by small scale suppliers

3.3.6 Statue does not provide any protection to recipient

Statue does not provide any protection to recipient of supply to the extent his payment of amount consideration together with GST to supplier of goods and services but provides for interest and penal liability upon recipient due to non-deposition of such collected amount of GST by Such a provision is not only absurd but also discriminatory.

3.3.7 Favorable Judgments under erstwhile VAT and Excise Laws

| Case | Particulars |

| Arise India Limited | Section 9(2)(g) of Delhi VAT could not be invoked by VAT officer to penalise a bonafide purchasing dealer for the failure of a selling dealer to submit the requisite records proving the genuineness of the transaction. High Court allowed the purchaser to take credit even if the selling dealer had not discharged VAT on the sale of goods. The SLP was filed before the Supreme Court and rejected (nothing was discussed on merits). |

| On Quest Merchandising India (P.) Ltd. | Delhi High Court observed that buyer cannot be put in jeopardy when he has done all that law requires him to do and further that purchasing dealer has no means to ascertain and secure compliance of selling dealer |

| Tata Motors Limited | Jharkhand High Court held that once a buyer of input receives invoices of excisable items unless factually it is established to contrary, it will be presumed that when payments have been made in respect of those inputs based on invoices, buyer is entitled to assume that excise duty has been/will be paid by the supplier on the excisable inputs. The buyer will be entitled to claim Modvat credit on the said assumption. It would be most unreasonable and unrealistic to expect buyer of such inputs to go and verify the accounts of the supplier or to find out from department of Central Excise whether the actual duty has been on inputs paid by supplier. No business can be done like this, and the law does not expect the impossible. |

| Juhi Alloys Limited | The Allahabad High Court held that once it is demonstrated that the buyer had taken reasonable steps to ensure that the inputs in respect of which credit being taken, appropriate excise duty was paid, which is a question of fact in this case, it would be contrary to the Rules to cast an impossible or impracticable burden on the assessee. |

| SMI Electro wire Pvt Ltd. | In a case before the Punjab and Haryana High Court, the Appellant purchased CC cooper rods from a vendor whose premises were raided. The vendor (proprietor) stated that he was only involved in facilitating parties to obtain fraudulent Modvat/Cenvat credit and not selling any goods. Based on the statement, a show cause notice is issued to the Appellant for wrongly availed credit. The High Court held that the mere fact that the Appellant purchased goods from a seller who engaged in fraudulent activities would not by itself raise an inference of guilt or wrongdoing of the Appellant. |

| Mahalaxmi Cotton Ginning Pressing and Oil Industries | Notably, the Bombay High Court, in a case, have held that ITC is a concession and legislature can put conditions and restriction relating to its availment. The High Court upheld the pre-condition of payment of tax by the supplier. |

| Onyx Designs | The Karnataka High Court held that in the absence of any other allegations made against the purchasing dealer in the assessment orders, merely for the reason that selling dealers had not deposited the collected tax amount or some of the selling dealers had been subsequently deregistered could not be a ground to deny the input tax credit. |

3.4 Litigation Strategy – Conclusion

| Sl. No. | Particulars |

| 1. | Substantiate value of supply and tax paid to supplier |

| 2. | Argue that law does not provide any mechanism to cross check whether tax is paid or not |

| 3. | Argue that law does not compel a taxpayer to do impossible things |

| 4. | Argue authorities should first adjudicate supplier and in exceptional cases ask recipient to reverse ITC |

| 5. | Argue that pre-condition for payment of tax is against Article 19(1)(g) |

| 6. | Rely on the jurisprudence of erstwhile regime and argue provision is against Article 14 |

| 7. | Other points

|

4. Fake Invoicing

4.1 Illustrative Transaction

4.2 Allegations – Sample Intimation (DRC-1A)

4.3 CBIC Clarification on Fake Invoice

| Sl. No. | Particulars | Clarification |

| 1. | RP issued tax invoice without supplies of Goods/ services | Activity does not satisfy criteria of ‘Supply’ u/s. 7 so no demand and recovery is to be made against issuer of invoice but penalty shall be imposed u/s.122 (1)(ii) |

| 2. | Registered person availed and utilized fraudulent ITC based on the tax invoice issued without underlying supply | Person availing the ITC shall be liable for demand or recovery u/s. 73 or 74 of CGST Act on account of availing and utilizing fraudulent ITC and in terms of section 75(13), no penalty including u/s 122 to be levied if penal action is taken under section 74 of CGST Act. |

| 3. | RP avails ITC based on the said tax invoice and further passes on the said ITC to another registered person by issuing invoices without underlying supply of goods or services or both | Person availing the ITC shall ‘NOT’ liable for demand or recovery u/s. 73 or 74 of CGST Act, as the case may be and liable for penal action u/s. 122(1)(ii) and 122(1)(vii) of CGST Act |

Prosecution provisions would also be applicable depending upon the quantum of Involved

4.4 Legal Strategy – Conclusion

| Sl. No. | Particulars |

| 1. | Substantiate genuineness of transaction |

| 2. | Substantiate reasonable steps were taken to ensure supplier is not fictitious |

| 3. | Argue that reliance was placed on GST registration granted by GST Authorities |

| 4. | Ask for report that concludes that supplier is engaged in fake transactions |

| 5. | Ask for Opportunity of Cross Examination |

| 6. | Argue SCN Cryptic and Vague (would depend how notice is issued) |

| 7. | Argue ITC availed is a vested right |

| 8. | Argue that law does not compel a taxpayer to do impossible things |

| 9. | Other points

|

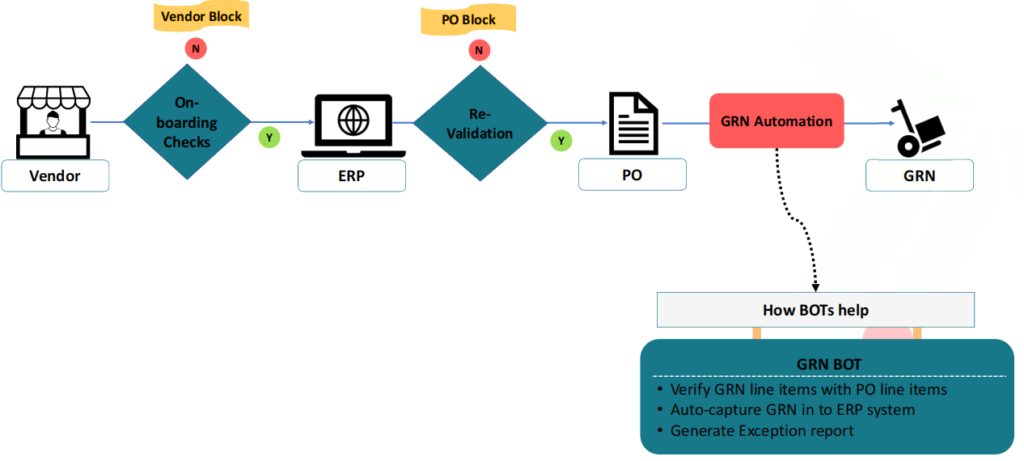

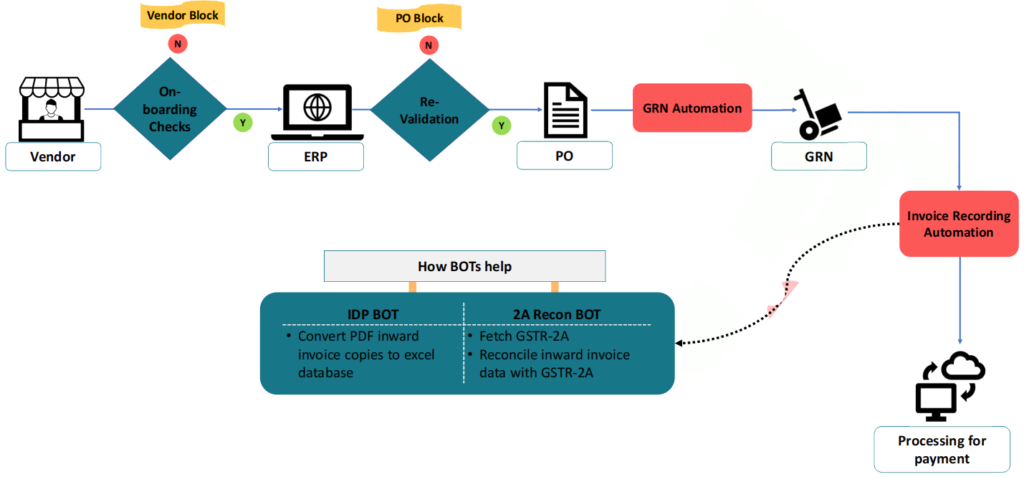

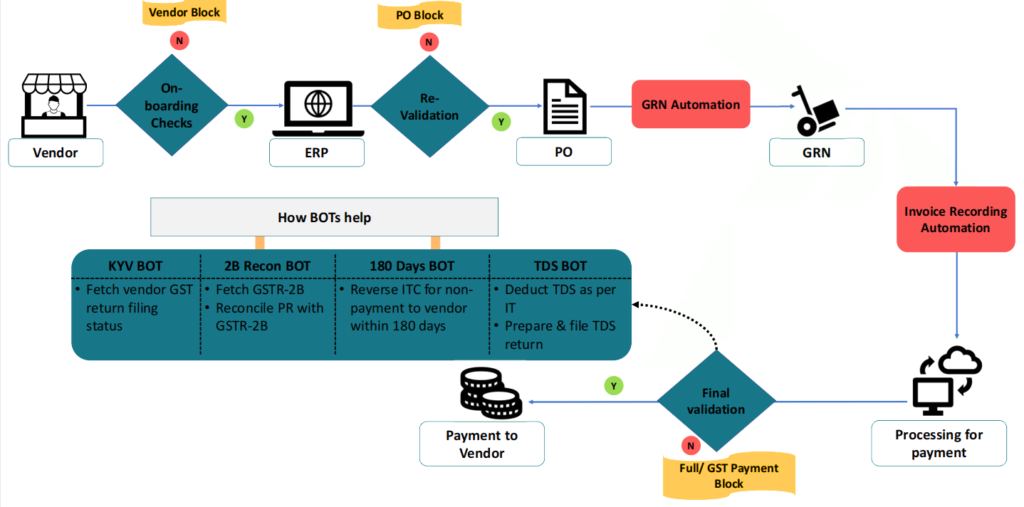

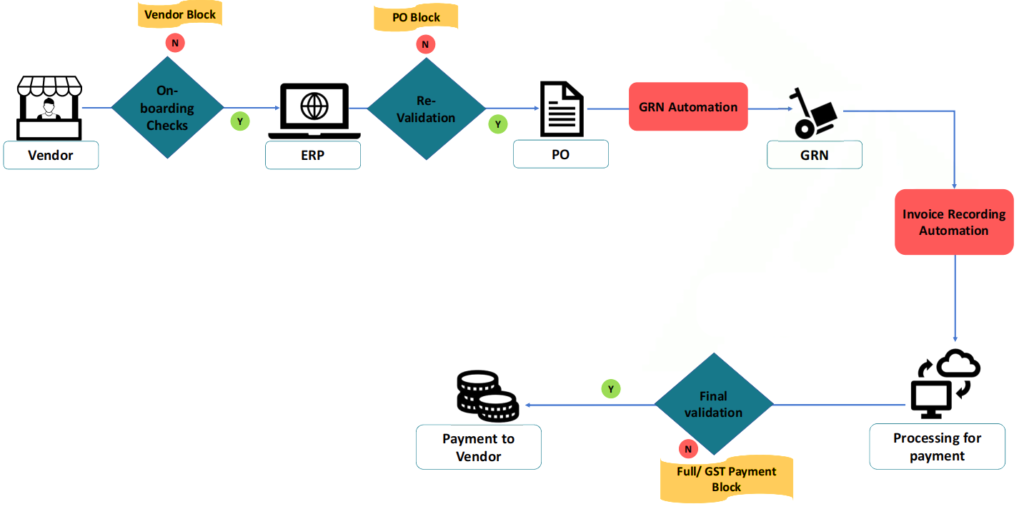

5. Automating P2P Process

5.1 Automation

Some Food for Thought

Robotic Process Automation Will Help Humans Become More Human at Work!

If debugging is the process of removing software bugs, then programming must be the process of putting them in.

— Edsger Dijkstra

The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.

— Bill Gates

5.2 P2P Model – An Ideal Scenario

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA