[FAQs] Liability of Buyer u/s 15 of MSMED Act to Make Timely Payments to MSE Suppliers

- Blog|Income Tax|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 21 September, 2024

Section 15 of the MSMED Act mandates that buyers must make payments to micro or small enterprise suppliers for goods or services on or before the agreed-upon date in writing. However, this period cannot exceed 45 days from the date of acceptance or deemed acceptance of the goods or services. If no such agreement exists, payment must be made within 15 days from the day of acceptance or deemed acceptance. This section ensures timely payment to micro and small enterprises to support their financial stability.

Check out Taxmann's FAQs on Timely Payments to MSME – An Interplay between Sec. 43B(h) of the Income-tax Act & MSMED Act which is a comprehensive guide addresses timely payments to MSMEs, focusing on Section 43B(h) of the Income-Tax Act, 1961, and its interplay with the MSMED Act, 2006. It offers in-depth analysis, legal compliance insights, and practical scenarios to assist legal professionals, accountants, and business owners in understanding the obligations and implications of these laws on business practices. Highlighting detailed provisions, applicability to various buyers, compliance under the MSMED Act, and accounting requirements, the book serves as an essential resource for ensuring timely financial transactions with MSMEs.

FAQ 1. What is the time allowed by section 15 of MSMED Act for making payment to a supplier who is a micro or small enterprise?

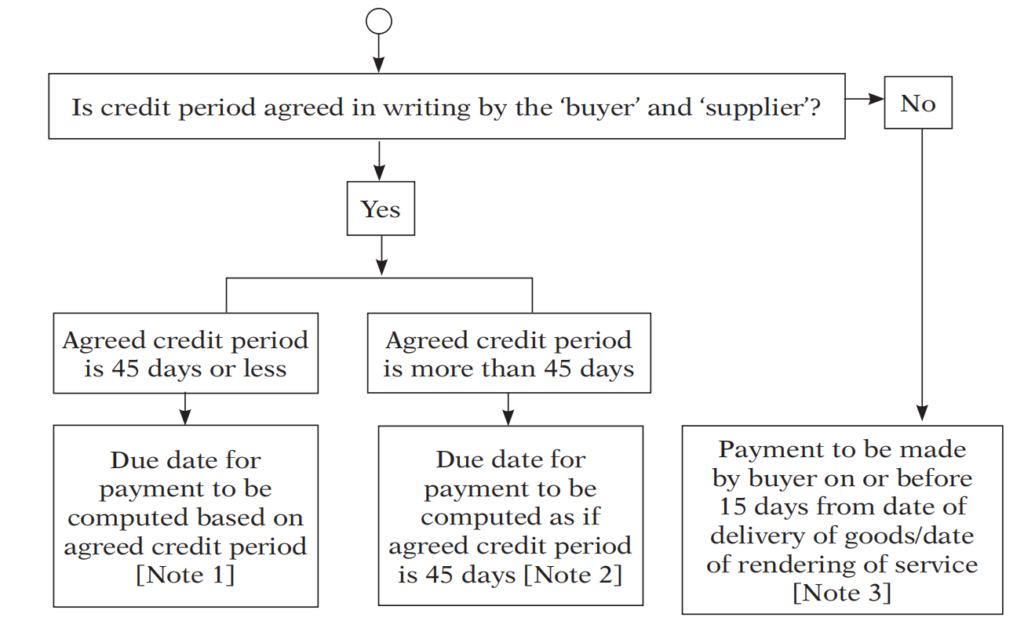

Due Date for Payment to ‘Supplier’

(‘Udyam-Registered Micro/Small Enterprise’) as per Section 15 of MSMED Act

Note 1:

- If written objection is raised by supplier within 15 days from date of delivery of goods/date of rendering of service, due date based on agreed credit period of 45 days or less to be counted from date of removal of objection by supplier.

- If written objection is not raised within 15 days, due date to be computed based on agreed credit period from date of delivery of goods/date of rendering of service

Note 2:

- If written objection raised by buyer within 15 days from date of delivery of goods/date of rendering of service, due date to be computed as if agreed credit period is 45 days. The period of 45 days to be counted from the date of removal of objection.

- If written objection is not raised within 15 days, due date is to be computed as if agreed credit period is 45 days from date of delivery of goods/date of rendering of services.

Note 3:

- If written objection raised by buyer within 15 days from date of delivery of goods/date of rendering of service, due date is 15 days from the date of removal of objection by supplier.

- If written objection not raised within 15 days as aforesaid,due date is 15 days from the date of delivery of goods/date of rendering of service.

Section 43B(h) refers to time allowed by section 15 of MSMED Act. Therefore, it is necessary to examine the said section 15.

Section 15 of the MSMED Act reads as under:

“Liability of buyer to make payment.

Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment there for on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.”

Paraphrasing section 15 of the MSMED Act, the following position emerges:

- Where any supplier supplies any goods or renders any servicesto any buyer, the buyer shall make payment for the same on or before the date agreed upon between him and the supplier in writing;

- In no case, the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or deemed acceptance; and

- Where there is no agreement in writing with regard to credit period, the buyer shall make payment before the appointed day.

It may be noted that where credit period agreed in writing, payment is to be made on or before the agreed due date which shall in no case exceed 45 days. If credit period not agreed in writing, payment to supplier is to be made before the appointed day.

Though section 43B(h) refers to “the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006”, it does not define crucial terms used in section 15 of MSMED Act which are necessary to give force and life to section 15 as well as section 43B(h). The crucial terms on which sections 15 and 43B(h) hinge are “the appointed day”, “the day of acceptance or deemed acceptance”, “supplier”, “goods”, “service” and “buyer”. These terms are, however, defined in section 2 of the MSMED Act.

FAQ 2. What is meant by the terms “the Appointed Day”, “the day of acceptance” and “ the day of deemed acceptance”?

The “appointed day” is relevant only if the buyer and the seller have not agreed to any due date for payment in writing. As per section 2(b) of the MSMED Act, “appointed day” means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.

The following points are noteworthy:

- “The day of acceptance” means the day of the actual delivery of goods or the rendering of services;

- Where any objection is made in writing by the buyer regarding the acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, “the day of acceptance” means the day on which the supplier removes such objection;

- “The day of deemed acceptance” means where no objection is made in writing by the buyer regarding the acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services.

FAQ 3. How the provisions of section 15 of the MSMED Act work?

Illustration 1: No. credit period in writing and no objection in writing from buyer:

| Date of order | 3-1-2024 |

| Date of Supply | 3-2-2024 |

| Credit Period | Nil |

| Whether any Objection in writing raised by buyer | No |

| Date of deemed acceptance | 3-2-2024 |

| Appointed Day (day following immediately after the expiry of 15 days from the date of delivery) | 19-2-2024 |

| Payment to be made before appointed day | On or before 18-2-2024 |

Illustration 2: Credit period of 60 days in writing and no objection in writing from Buyer as regards Goods or services:

| Date of order | 3-1-2024 |

| Date of Supply | 3-2-2024 |

| Credit Period | 60 days |

| Due date of payment as per agreement | 3-4-2024 |

| Whether any Objection in writing raised by buyer | No |

| Due date of payment as per section 15/section 43B(h) | On or before 19-3-2024 |

Illustration 3: No credit period but written objection raised by buyer within 15 days of supply:

| Date of order | 3-1-2024 |

| Date of Supply | 3-2-2024 |

| Credit Period | Nil |

| Date of objection in writing | 15-2-2024 |

| Date of removal of objection | 20-2-2024 |

| Appointed day (day following immediately after expiry of 15 days from the date of removal of objection) | 7-3-2024 |

| Payment to be made on or before | 6-3-2024 |

If the objection is made after 15 days from the date of supply, the same shall not be considered and the appointed date in this case will be 19-2-2004 i.e. day following immediately after the expiry of 15 days from the date of actual delivery of goods. Accordingly, the due date of payment will be 18-2-2024.

Illustration 4: Credit period of 60 days along with written objection from buyer within 15 days:

| Date of order | 3-1-2024 |

| Date of Supply | 3-2-2024 |

| Credit Period | 60 days |

| Due date for payment as per agreement | 3-4-2024 |

| Date of objection in writing | 18-2-2024 |

| Date of removal of objection | 20-2-2024 |

| Payment to be made on or before due date | 5-4-2024 |

If the objection is made after 15 days from the date of supply, the same shall not be considered. Accordingly, the due date of payment as per section 15 will be 19-3-2024.

FAQ 4. What if buyer-entity has no written agreement with MSE suppliers as regards credit period?

In that case, entity will have to pay MSE suppliers within 15 days of delivery of goods or rendering of services. To get more time to pay, entities should enter into written agreements with MSEs stipulating the credit period. Maximum credit period that can be stipulated is 45 days.

FAQ 5.Whether agreements with longer credit period upto 45 days can be made retrospectively applicable by a clause in the agreement to verbal orders of purchases made prior to the date of agreement?

There appears to be no bar to this under MSMED Act or section 43B(h).

FAQ 6. What is the average due date?

Average due date is a computed date on which with fairness to debt- or and creditor one settlement in full may be made for all variously dated items in an account.

[https://www.merriam-webster.com/dictionary/average%20due%20date]

ICAI’s Study material define “average due date” as under:

“Average due date is weighted average of due dates of various transactions where amount of each transaction is used as the weight”.

Further,

“It is the mean or equated date which a single total payment may be made in lieu of different payments on different dates without loss of interest to either party”.

The unique feature of average due date is that the party making payment on average due date gains nothing nor suffers any loss by making a single payment on average due date.

Average Due Date = Base Date+/-/Total of the products/Total of the amounts

Average due date concept allows a person making payment to compensate payee for delayed payment of a Bill by paying other/later Bill/Bills earlier than their due dates.

FAQ 7. The following are due dates u/s 15 of MSMED Act for payments of various Bills of an Udyam Registered Small enterprise supplier which are outstanding on 31-3-2024.

| Amount | Due Date |

| 5,00,000 | 3rd April, 2024 |

| 8,00,000 | 2nd May, 2024 |

| 10,00,000 | 13th May, 2024 |

What will be the average due date for payment of total dues of Rs. 23,00,000?

Taking base date as 3rd April, average due date is calculated as under:

|

Due Dates |

Amount | No. of days from base date |

Products |

| 3rd April, 2024 |

5,00,000 |

0 |

0 |

| 3rd May, 2024 |

8,00,000 |

30 |

2,40,00,000 |

| 13th May, 2024 |

10,00,000 |

40 |

4,00,00,000 |

Total of products/Total amounts = 6,40,00,000/23,00,000 = 28 days

Average due date = 3rd April, 2024 + 28 days = 1st May 2024

On 1st May 2024, entire amount of Rs. 23,00,000 will have to be paid.

In other words, delay in payment of Bills due in April in this case gets compensated by paying early the Bills due in May and June.

FAQ 8. Whether Parties can by written agreement agree that Buyer will pay the MSE Supplier on average due date of all bills falling due for payment according to 45 days due date of section 15?

There is no bar in Contract Act in making such an agreement. However, the proviso to section 15 of MSMED Act seems to implicitly bar such an arrangement. It is suggested that CBDT issue a Circular clarifying that section 43B(h) is not to be invoked if payments falling due in a quarter are made on an average due date.

FAQ 9. What is meant by the term “Supplier”?

The term “Supplier” is defined in section 2(n) of the MSMED Act. Only a “supplier” as defined in section 2(n) of the MSMED Act can avail of the rights under Chapter V of MSMED Act such as right to timely payment under section 15, right to interest on delayed payment under section 16, Right to file plaint with MSEFC for recovery of dues from buyer etc. Section 2(n) defines “supplier” to mean a micro or small enterprise which has filed a memorandum with authority referred to in section 8(1) (i.e. Udyam Registration). The term “supplier” also includes:

- National Small Industries Corporation;

- Small Industries Development Corporation of a State or a Union territory; and

- Any company, co-operative society, trust or body registered or constituted under any law and engaged in selling goods produced by micro or small enterprises and rendering services which are provided by such enterprises.

FAQ 10. Whether micro enterprise/small enterprise will be regarded as ‘supplier’ for supplies made on or before the date of Udyam registration?

It must be noted that only micro enterprises and small enterprises which are Udyam-Registered are considered as suppliers for the purpose of section 15 of the MSMED Act. And they shall be regarded as suppliers in respect of goods supplied by them or services rendered by them on or after the date of Udyam Registration. Udyam Registration is not retrospective. [Silpi Industries v. Kerala State Road Transport Corporation [2021] 129 taxmann.com 228/167 SCL 536 (SC)].

FAQ 11. Whether Udyam-registered medium enterprises are suppliers?

Medium enterprises are not regarded as suppliers and are not entitled to enforce prompt payment under section 15 of MSMED Act and interest for delayed payment under section 16 of the MSMED Act. However, a small enterprise upgraded as medium enterprise shall be regarded as small enterprise for 3 years from the date of upgradation and shall be entitled to rights under section 15 and other provisions of Chapter V of MSMED Act.

FAQ 12. Which enterprises shall not be regarded as suppliers for purposes of section 15 of MSMED Act?

An enterprise shall not be deemed to be a “supplier” for Section 15, if it is:

- A micro or small enterprise which has not filed a memorandum (Udyam Registration) under section 8(1)(a) of the MSMED Act;

- Medium enterprises (unless Medium enterprise was a small enterprise anytime in last three years prior to date of supply of goods/rendering of services); and

- Large enterprises (e. manufacturing enterprises which have an investment in plant and machinery or equipment exceeding Rs. 50 crores or turnover exceeding Rs. 250 crores.

FAQ 13. Can it be argued that since section 43B refers to only section 15 of MSMED Act and does not refer to definition of “Supplier” in section 2(n) of MSMED Act, section 43B(h) will also apply to amounts due to an unregistered micro or small enterprise(i.e. micro or small enterprise not having Udyam Registration)?

The argument cannot be accepted for several reasons. Firstly, the term “appointed day” used in section 15 is defined in section 2(b) of MSMED Act . If that definition is to be ignored on the ground that it is not referred to in section 43B, then section 43B(h) will be rendered nugatory in all cases where there is no written agreement between buyer and the Supplier regarding due date of payment. That section 15 of MSMED Act is to be interpreted in the light of the definition in section 2(b) of the said Act is clear from the following extracts from the Explanatory Memorandum to the Finance Bill, 2023.

The Explanatory Memorandum to Finance Bill, 2023 explains the amendment as under:

“Promoting timely payments to Micro and Small Enterprises

Section 43B of the Act provides for certain deductions to be allowed only on actual payment. Further, the proviso of this section allows deduction on accrual basis, if the amount is paid by due date of furnishing of the return of income.

In order to promote timely payments to micro and small enterprises, it is proposed to include payments made to such enterprises within the ambit of section 43B of the Accordingly, it is proposed to insert a new clause (h) in section 43B of the Act to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 shall be allowed as deduction only on actual payment. However, it is also proposed that the proviso to section 43B of the Act shall not apply to such payments.

Section 15 of the MSMED Act mandates payments to micro and small enterprises within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, the section mandates that the payment shall be made within 15 days. Thus, the proposed amendment to section 43B of the Act will allow the payment as a deduction only on payment basis. It can be allowed on accrual basis only if the payment is within the time mandated under section 15 of the MSMED Act.”

To the same effect is CBDT’s Circular No.1/2024, dated 23-1-2024, which clarifies as under:

21. Promoting timely payments to Micro and Small Enterprises

21.1 Section 43B of the Act provides for certain deductions to be allowed only on actual payment. Further, the proviso of this section allows deduction on accrual basis, if the amount is paid by due date of furnishing of the return of income.

21.2 In order to promote timely payments to micro and small enterprises, payments made to such enterprises have been included withinthe ambit of section 43B of the Act vide Finance Act, A new clause (h) has been inserted in section 43B of the Act to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 shall be allowed as deduction only on actual payment. However, it has also been provided that the proviso to section 43B of the Act shall not apply to such payments.

21.3 Section 15 of the MSMED Act mandates payments to micro and small enterprises within the time as per the written agreement, which cannot be more than 45 If there is no such written agreement, the section mandates that the payment shall be made within 15 days. Thus, this amendment to section 43B of the Act allows the payment as deduction only on payment basis. It can be allowed on accrual basis only if the payment is within the time mandated under section 15 of the MSMED Act.

Applicability: This amendment takes effect from 1st April, 2024 and will accordingly apply in relation to the assessment year 2024-25 and subsequent assessment years.

Therefore, the intent of section 43B(h) is that section 15 should be interpreted for section 43B(h) purposes in the light of definitions given in section 2 of the MSMED Act. Secondly, it is well nigh impossible for any buyer to scrutinise financials, ITRs and GSTRs of all his suppliers to determine their classification into micro, small or medium enterprise and to call for financials, ITR and GST data from Suppliers every now and then to check whether there is any change in classification. The only feasible and accurate method to validate classification of the Supplier is to refer to his Udyam Registration.

FAQ 14. What is the definition of “Buyer”?

According to section 2(d) of the MSMED Act, “buyer” means whoever buys any goods or receives any services from a supplier for consideration.

FAQ 15. What if buyer-entity buys goods from Udyam Registered Micro/Small Enterprise whose Udyam Certificate shows he is a trader? Will section 43B(h) apply?

Para 2 of Office Memorandum: No. 5/2(2)/2020/E/P&G/POLICY dated 2-7-2021 issued by Central Government has clarified that “The Government has received various representations and it has been decided to include Retail and wholesale trades as MSMEs and they are allowed to be registered on Udyam Registration Portal. However, benefits to Retail and Wholesale trade MSMEs are to be restricted to Priority Sector Lending only.” Central Government’s office memoran- dum 1/4(1)/2021- P&G Policy, dated 1-9-2021, further clarifies that “the benefit to Retail and wholesale trade MSMEs are restricted upto priority sector landing only and, other benefit, including provisions of delayed payments as per MSMED Act, 2006, are excluded. In view of the above Office Memorandum, dated 1-9-2021, a Supplier who is a micro or small enterprise cannot be treated as “Supplier” for section 15 and section 43B(h) purposes if his Udyam Certificate shows his activity as only a trader.

Although there does not appear to be any legal basis in MSMED Act for the Office Memorandum and Wholesale and Retail Trade are treated as distribution services under GATT/WTO, the above position in OM will prevail till any Trader/Traders body challenges the OM in Court and gets it quashed.

FAQ 16. How to know the correct status of Supplier, whether he is manufacturer or service provider or trader?

Udyam Certificate shows the activity of the Supplier. The buyer is not required to go beyond the Udyam Certificate. [FAQs 33 and 34]

FAQ 17. What if the Status of Micro/Small “Supplier” changes from Manufacturer to Trader?

Section 43B(h) will not apply for any supplies of goods made by the Micro/Small “Supplier” on or after the date of the change as reflected in the Udyam Certificate. Buyer not expected to go beyond Udyam Certificate. It would be good idea to search the Udyam Number of Supplier on the Udyam Portal everytime any goods or services are received from him. [FAQs 33 and 34]

FAQ 18.What if the Status of Micro/Small “Supplier” changes from Trader to Manufacturer?

Section 43B(h) will not apply for any supplies of goods made by the Micro/Small “Supplier” on or after the date of the change as reflected in the Udyam Certificate. Buyer not expected to go beyond Udyam Certificate. It would be good idea to search the Udyam Number of Supplier on the Udyam Portal everytime any goods or services are received from him. [FAQs 33 and 34]

FAQ 19. Does Udyam Portal allow search of MSME status of Supplier based on his name?

As of now, one can only search or verify MSME status on Udyam portal if one has Supplier’s Udyam Number.

FAQ 20. Can one do bulk search of Udyam Numbers of many suppliers?

Udyam Portal does not permit it as of now. Some private players have developed softwares/apps for this purpose. One may use them if found suitable.

FAQ 21. There is a popular eatery in front of our Office from where we order tea and snacks for staff, guests and visitors. There is no written agreement as to due date. We settle the bills of the eatery on a monthly basis. Whether section 43B(h) would apply to the Bills of the eatery?

If the eatery is registered in Udyam as Service provider, Section 15 of MSMED Act and Section 43B(h) will apply. As there is no written agreement, bills have to be settled within 15 days. It may be a good idea to enter into written agreement with eatery for settlement of bills as a monthly basis. However, case will have to be taken that outer time-limit of 45 days in section 15 of MSMED Act is not exceeded while filing the due date in written agreement and while making the payment.

FAQ 22. Will section 43B(h) apply to fees payable to CA firm who is internal auditor/concurrent auditor?

Nothing in the MSMED Act or Chartered Accountants Act, 1949 disqualifies a CA firm from filing Udyam Registration as a micro or small enterprise. The MSMED Act does not exclude professional ser- vices from the ambit of the expression “service”. Therefore, a CA firm may be registered as a micro or small enterprise in terms of specified turnover and investment by applying for an Udyam Registration.

FAQ 23. What if CA firm submitted internal audit report on 15-3-2024 and obtained Udyam Registration on 16-3-2024 and internal audit fees bill is pending as on 31-3-2024? Will section 43B(h) apply in this case?

Since services were rendered by CA firm prior to the date of Udyam Registration, Section 43B(h) will not apply here.

FAQ 24. If contract between buyer and Udyam Registered MSE supplier is of the nature of works contract, will section 43B(h) apply?

There are judicial decisions which have held that works contract is neither goods nor service and hence works contract activity can be neither manufacturing nor service. In Dezhou Shengli Pipeline Crossing Engineering India Pvt. Ltd. v. Ministry of Petroleum and Natural Gas and Ors (legalcrystal.com/1215401), the Delhi High Court held that the MSMED Act defines goods on section 2(f). However, there is no definition of services. Section 11 of the MSMED Act states that to facilitate promotion and development of micro and small enterprises, the Central Government can by order notify from time to time the preference policies in respect of the procurement of goods and ser- vices produced and provided by small enterprises by its ministries, departments, agencies etc. It is therefore clear that whether a works contract falls within the definition of goods and services is as yet not certain. IOCL’s position that a works contract, being inherently indivisible cannot be the subject matter of the MSMED Act, cannot be termed as a patent or manifest illegality.

FAQ 25. Whether section 43B(h) would apply to provision for statutory audit fees/tax audit fees made as of 31st March of relevant financial year if CA firm who is auditor is an Udyam Registered micro or small enterprise?

Statutory audit reports are issued after 31st March . Though provision is made, it may be the audit report is issued may be in May or June or July. Section 15 would come into operation only after statutory audit report is issued. Where there is no written agreement between Company and auditor as regards due date of payment, provision will be subject to disallowance if payment of fees is not made within 15 days of submission of statutory audit report to Company. Where there is a written agreement as regards due date of payment, disallowance will be attracted if payment not made within agreed period or 45 days, whichever is less.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA