[FAQs] Boosting Social Impact through Social Stock Exchange and Audit

- Blog|Advisory|Company Law|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

1. Introduction

The Social Stock Exchange (SSE) in India is an innovative platform for social enterprises and voluntary organizations and investors to come together to promote socially responsible business practices. SSE offers a transparent, regulated and efficient platform for investors to invest in socially responsible companies, and enables companies to raise capital for their sustainable and impactful initiatives.

2. Frequently Asked Questions

FAQ 1. What is a Social Enterprise?

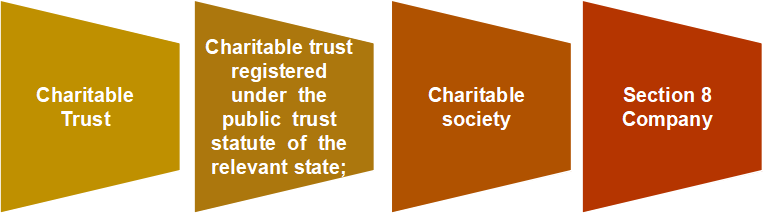

A Social Enterprise is a Not-for-Profit Organization. A Social Enterprise can be any of the following entities:

-

- A charitable trust registered under the Indian Trusts Act, 1882;

- A charitable trust registered under the public trust statute of the relevant state;

- A charitable society registered under the Societies Registration Act, 1860;

- A company incorporated under section 8 of the Companies Act, 2013

FAQ 2. What are the eligibility conditions for being identified as a Social Enterprise?

The entity shall be a Not-for-Profit Organization or a For Profit Social Enterprise, who has established primacy of its social intent by engaging itself at least one of the activities prescribed[1].

Pursuant to SEBI Regulations[2], a Not for Profit Organization shall mandatorily seek registration with a Social Stock Exchange before it raises funds through a Social Stock Exchange.

FAQ 3. Whom shall Social Enterprise target?

The Social Enterprise shall target[3] underserved or less privileged population segments or regions recording lower performance in the development priorities of central or state governments.

FAQ 4. How can a Social Enterprise raise funds?

A Social Enterprise may raise funds through the following means[4]: –

(a) A Not-for-Profit Organization may raise funds on a Social Stock Exchange through:

-

-

-

- Issuance of Zero Coupon Zero Principal Instruments;

- Donations through Mutual Fund schemes;

- Any other means as specified by the Board from time to time.

-

-

(b) A For-Profit Social Enterprise may raise funds through:

-

-

-

- Issuance of equity shares on the main board, SME platform or innovators’ growth platform or equity shares issued to an Alternative Investment Fund including a Social Impact Fund;

- Issuance of debt securities;

- Any other means as specified by the Board from time to time.

-

-

FAQ 5. What is a Social Stock Exchange?

A “Social Stock Exchange”[5] means a separate segment of a recognized stock exchange having nationwide permitted to register Not for Profit Organizations and / or list trading terminals the securities issued in accordance with the provisions of Chapter X-A of SEBI (ICDR), Regulations, 2018.

FAQ 6. What is a Social Audit?

The Social audit is a systematic and independent evaluation of an entity’s social and environmental performance, impact, and accountability. It involves an assessment of a company’s policies, practices, and procedures against established social and environmental standards and benchmarks.

As per ICSI[6], the “Social Audit” means an independent, qualitative and quantitative assessment regarding a Social Enterprise engaged in any of the activity enumerated[7].

The SEBI mandates[8] Social Audit of the Social Enterprise. The Social Audit Standards issued by the ICSI shall be complied by the Social Auditors empanelled with the ICSI Institute of Social Auditors who undertake the Social Audit assignment.

FAQ 7. Who shall be the Social Auditor?

A “Social Auditor”[9] means an individual registered with a self-regulatory organization under the Institute of Chartered Accountants of India or such other agency, as may be specified by the Board, who has qualified a certification program conducted by the National Institute of Securities Market and holds a valid certificate.

FAQ 8. What are the issues that must be addressed by the Social Auditor?

Some of the issues which must be addressed by the Social Auditor are as under:

-

- Will the project significantly impact the economic, environmental and social condition of the local community?

- Will there be a significant change in the general access that the communities have to natural resources, such as drinking water and energy?

- Does the local community have effective governance mechanisms to deal with the project’s long-term effects?

- Will the project increase or decrease the demand for services, such as education or health?

- Will the project produce any population or demographic movement, such as a change in the size of the communities affected by the project?

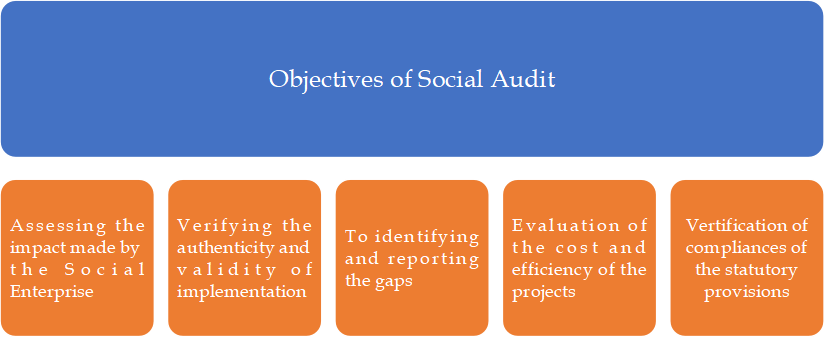

FAQ 9. What are the key objectives of Social Audit?

The main object of a Social Audit is to ascertain the impact made by the Social Enterprise through its activities, intervention, programs or projects implemented during the reporting period. Some of the key objectives are as follows:

-

- Assessing the impact made by the Social Enterprise through the implementation of activities, interventions, programs or projects;

- Verifying the authenticity and validity of implementation of activities, interventions, programs or projects;

- To identify and report the gap between desired object and the actual impact made by the Social Enterprise;

- Evaluating the cost and efficiency of the projects/ interventions being carried out by the Social Enterprise;

- Verifying whether all the statutory requirements are fulfilled or not.

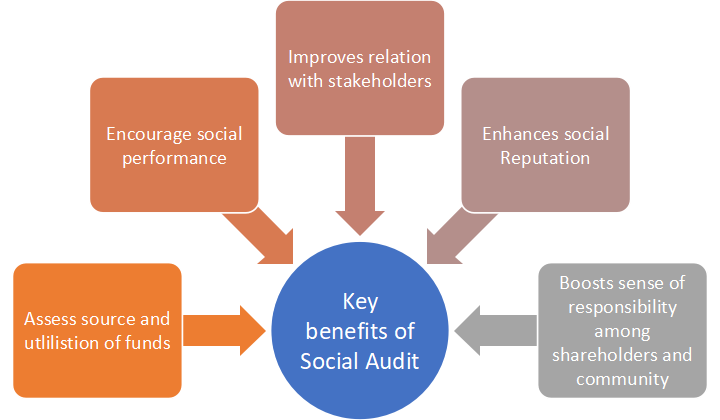

FAQ 10. What are the key benefits of the Social Audit?

Some of the key benefits are as follows:

-

- Social Audit assesses the source of funding, its utilisation and appropriate reporting to the Governing Body of the Social Enterprise.

- Encouragement for social performance.

- Improve relationships with Stakeholders.

- Enhances Social Reputation.

- Sense of Social Responsibility among Shareholders and the Community as a whole.

FAQ 11. For how many years, the evidence collected during a social audit shall be preserved?

The Social Auditors empanelled under IISA shall maintain and preserve the records and evidences collected in the course of Social Audit for a minimum period of eight (8) years[10] from the date of the respective Social Impact Assessment Report.

FAQ 12. What is the Format of Social Audit Report?

The Report of Social Audit shall be as per the format notified by the ICSI from time to time. Presently, there is no prescribed format as per SEBI Regulations.

[1] Regulation 292E (2) (a) of SEBI (ICDR) Regulations, 2018

[2] Regulation 292F (1) of SEBI (ICDR) Regulations, 2018

[3] Regulation 292E (2) (b) of SEBI (ICDR) Regulations, 2018

[4] Regulation 292G of SEBI (ICDR) Regulations, 2018

[5] Regulation 292A (f) of SEBI (ICDR) Regulations, 2018

[6] ICSI’s Exposure Draft on Social Audit Standards

[7] Regulation 292E (2) (a) of SEBI (ICDR) Regulations, 2018

[8] Regulation 91 E of the SEBI (LODR), 2015

[9] Regulation 292A (f) of SEBI (ICDR) Regulations, 2018

[10] Draft exposure of ICSI on Social Audits

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA