Exploring the Impact of Ind AS on Income Tax

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 23 June, 2023

Table of Contents

- Overview of Income Tax

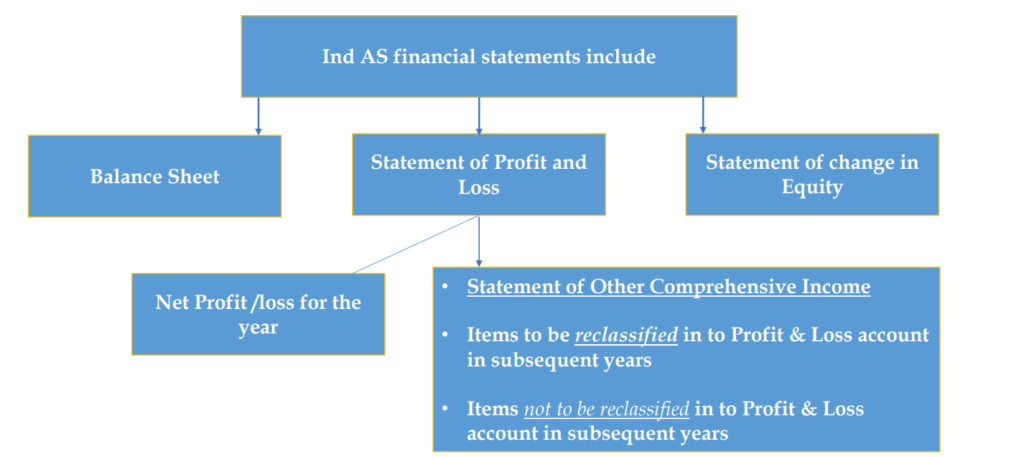

- Financial Statement – Ind AS

- Interplay Between Ind AS and Income Tax

- Principles of Taxation

- Ind AS Adjustment under MAT

- Tax Impact Calculations – Reliance on Books of Accounts

- Ind AS and Tax Impact

- Business Restructuring Demerger

1. Overview of Income Tax

Section 2[24] of ‘ITA’ prescribed about the income and which is inclusive definition it includes

- profits and gains

- …..

- …..

Section 4 & 5 of ‘ITA’ is charging section for levy of income tax

Section 145 –method of accounting- either cash or mercantile subject to Income Computation and disclosure standards [ICDS]

2. Financial Statement – Ind AS

3. Interplay Between Ind AS and Income Tax

| ICDS – Key features |

|

|

|

|

|

|

| List of ICDS | |

| ICDS 1 | Accounting policies |

| ICDS II | Valuation of inventories |

| ICDS III | Construction contracts |

| ICDS IV | Revenue Recognition |

| ICDS V | Tangible Fixed Assets |

| ICDS VI | Effect of changes in foreign exchange rates |

| ICDS VII | Government Grant |

| ICDS VIII | Securities |

| ICDS IX | Borrowings |

| ICDS X | Provisions, contingent liabilities and contingent assets |

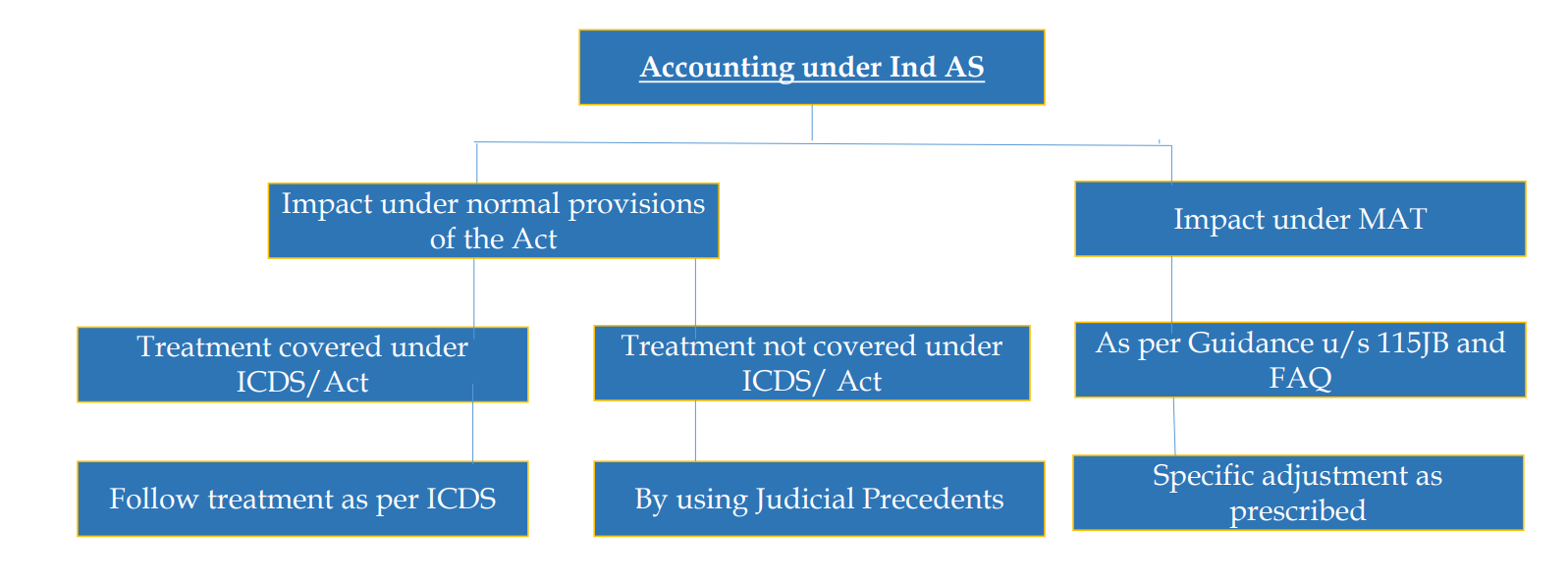

Profits as computed following Ind AS to be the starting point for computing taxable income and further adjusted in the light of principles as per tax laws

3.1 Key Principles for computing taxable income

a) Business income is computed in accordance with the method of accounting regularly employed by the taxpayer – could be either cash or mercantile / accrual [Section 145(1)- subject to ICDS compliance]

b) Business income as per method of accounting adopted to be adjusted by the specific deductions/allowances/disallowances specified in the Act.

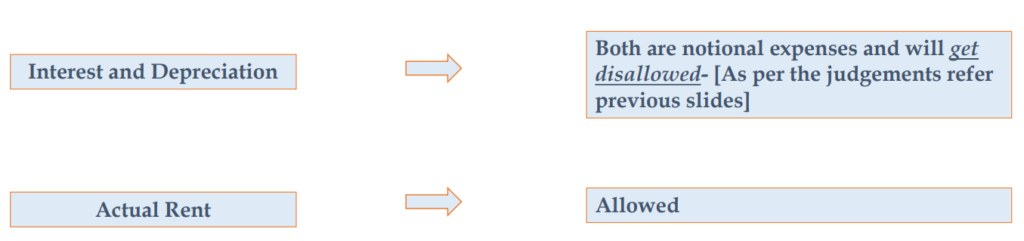

c) Real income is taxable and not hypothetical income.

d) Unrealized gains/losses not recognized for tax computation.

e) Concept of time value of money not recognized.

f) Notional expenses not allowable. However, provisions are allowed if created on a scientific basis.

g) Adjustments to be made to accounting profits as per notified Income Computation and Disclosure Standards.

4. Principles of Taxation

4.1 Income

Right to receive – Income can be taxed only if assessee has a right to receive the income. There must be a debt owed to him by somebody [E.D. Sassoon 26 ITR 27] [SC}

Real Income –Income tax can be levied on real income. If income does not result at all, there cannot be a tax, even though in book-keeping, an entry is made about a ‘hypothetical income’, which does not materialize. Where, however, the income can be said not to have resulted at all, there is obviously neither accrual nor receipt of income, even though an entry to that effect might, in certain circumstances, have been made in the books of account.“ [CIT vs. Shoorji Vallabhdas 46 ITR 144]

Only the Real income will be taxed and not the notional income as per books of account

Deductions – Whether the assessee is entitled to a particular deduction or not will depend on the provision of law & not on existence or absence of entries in the books of account be decisive or conclusive [Kedarnath Jute Mfg. Co. Ltd. v. CIT [1971] 82 ITR 363 (SC)]

Deductions/Allowances – The question whether a receipt of money is taxable or not or whether certain deductions from that receipt are permissible in law or not has to be decided according to the principles of law and not in accordance with accountancy practice; Accounting practice cannot override the provisions of the Act [Sutlej Cotton Mills Ltd. v. CIT [1979] 116 ITR 1 (SC)]

Notional expenses cannot be allowed under Income Tax

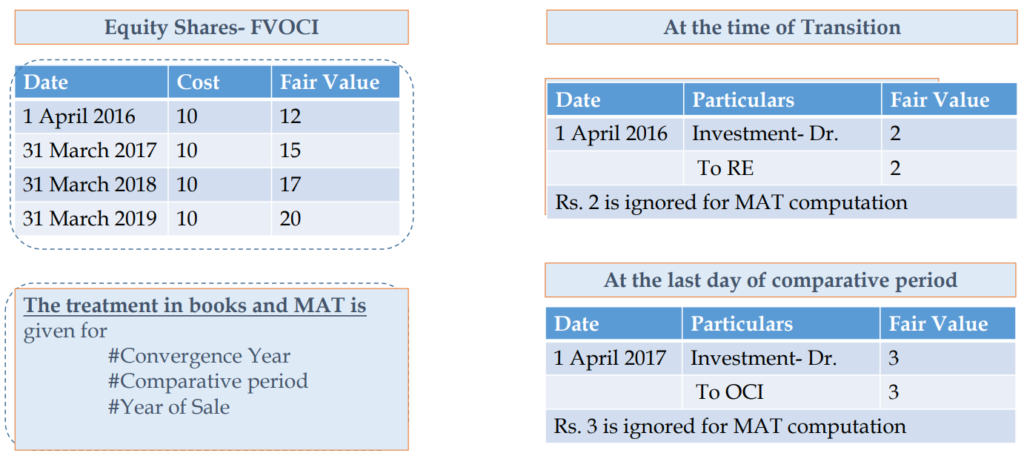

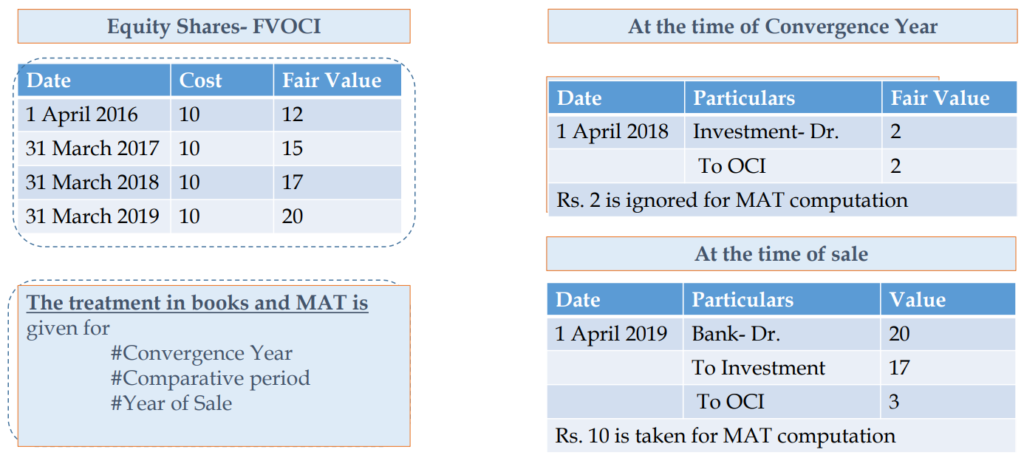

5. Ind AS Adjustment under MAT

Annual adjustment –[Section 115JB- 2A] OCI items that will permanently recorded in reserves [which will never be classified to the statement of P&L] to be adjusted in book profits as under:

| Item | Point of time of inclusion |

|

Realization/disposal |

|

|

|

Every year, as the gain or loss arises |

Transition adjustments [Section 115JB-2C]

| Items- recorded in OCI | Treatment |

|

To be included in book profits at the time of disposal/realization |

|

|

|

Equally over a period of 5 years starting from the year of first time adoption of Ind AS |

Transition Amount – amounts ‘adjusted in other equity’ [excluding capital reserve and securities premium reserves] [Section 115JB[2C]

| Items | Treatment |

|

|

|

|

|

|

|

|

Amount adjusted in other equity

Reliance Industrial Investment Holding Ltd. Vs. Dy. CIT [2023] 149 taxmann.com 113 (Mumbai – Trib.) ]

“At the time of transition from AS to Ind AS , Liability like [Cumulative Convertible Debentures ] is shown under equity the same will not be included in the transition amount under section 115JB [2C] of the Act.”

5.1 Starting point for computation of MAT

| Division II of schedule III of Companies Act, 2013 | Amount |

|

|

|

|

|

|

|

|

|

|

MAT to be computed on the profit of the year [before OCI] – considering the adjustments as per 115JB

6. Tax Impact Calculations – Reliance on Books of Accounts

- Determination of ‘accumulated profits’ for the purpose of deemed dividends [Section 2(22)]

- Forms basis of book profits for MAT taxation

- Transfer pricing – determination of ALP, comparability, etc

- Limits on interest deduction paid or payable to AE

- Impact on disallowance under section 14A

- Ascertaining fair market value for the purpose of taxability under section 56(2)(x)/section 50CA

- Properties/Liabilities are transferred at book values in case of demerger [Non Ind AS Companies]

7. Ind AS and Tax Impact

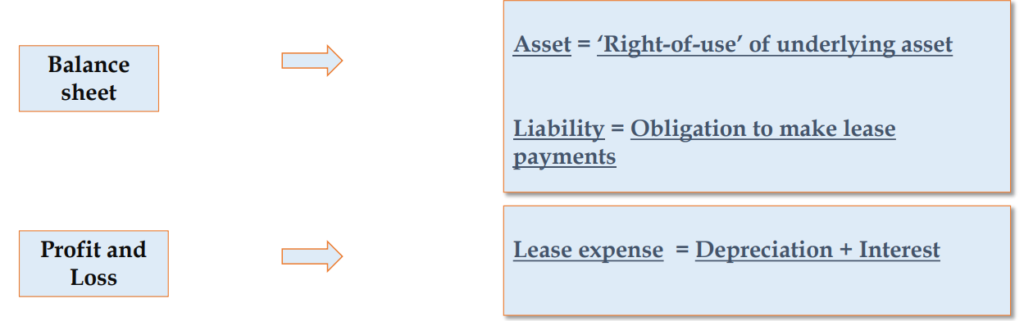

7.1 Ind AS 116 – Leases impact

- A lessee applies a single lease accounting model under which it recognises all major leases on balance sheet

- At the commencement date, a lessee shall recognise a right of use assets and a lease liability

7.2 Tax Impact vs. Ind AS 116

Section 32 – Allows depreciation on the assets owned, wholly or partly by the assessee and used for the purpose of the business or profession

7.3 Financial Instruments Ind AS 109, 107 & 32

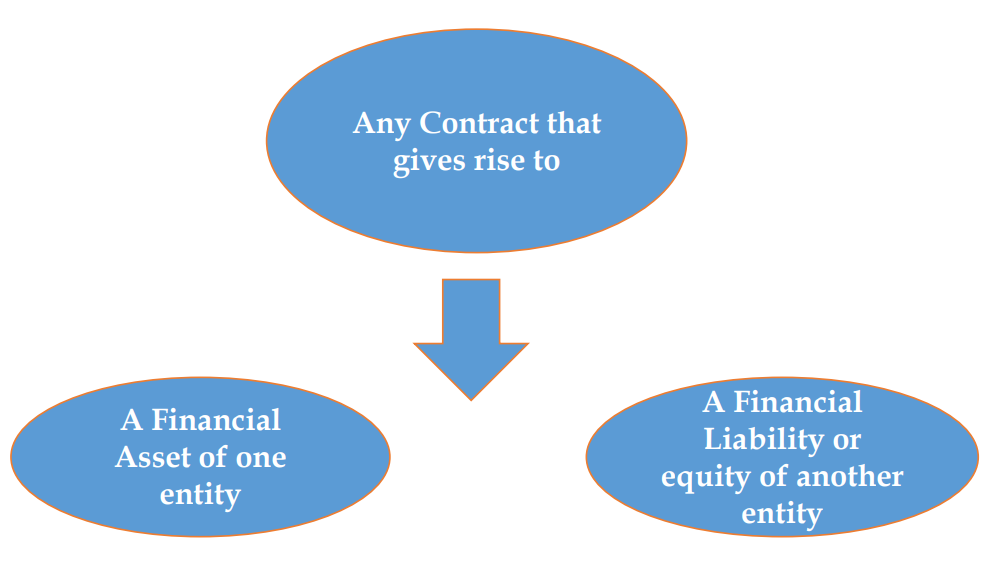

Financial instrument or its component parts should be classified by issuer upon initial recognition as a FL or equity instrument according to substance of contractual arrangement rather than legal form.

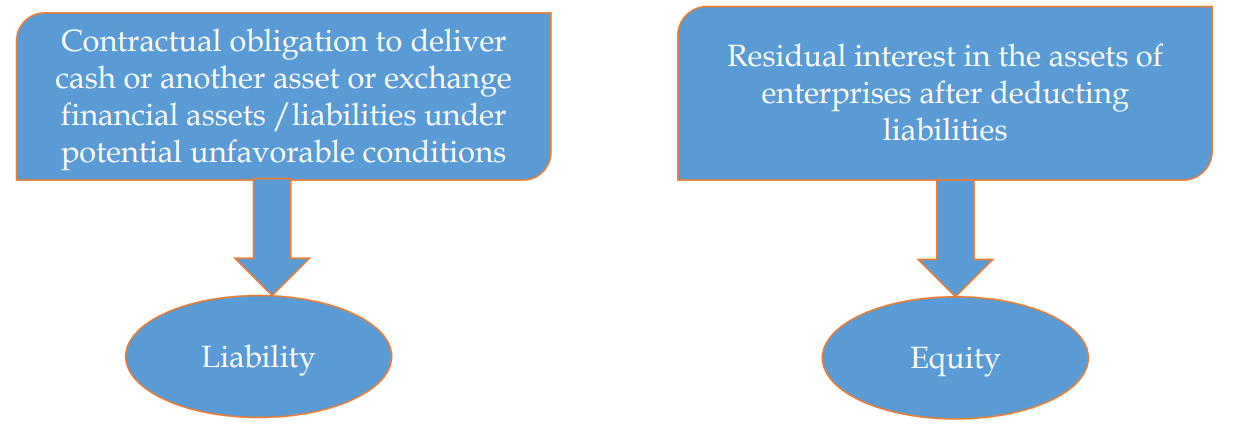

7.3.1 Liability or Equity

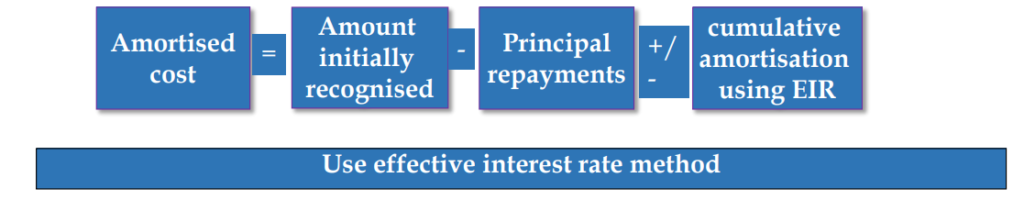

7.4 Amortized Cost

The amortised cost a financial asset or financial liability is the amount at which the financial asset or financial liability is measured at initial recognition minus principal repayments, plus or minus the cumulative amortisation using the effective interest method of any difference between that initial amount and the maturity amount, and for financial assets, adjusted for any loss allowance.

Section 36(1)(iii) of the Act– The amount of the interest paid in respect of capital borrowed for the purpose of the business or profession.

The amortised cost using the effective interest method will be the notional amount only the actual interest paid is allowed.

Example

|

||||||

| Year | Amortised cost at the beginning (a) | Interest income-10% (b) | Cash flows (c) | Amortised cost at the end (d= a+b-c) | ||

| 20×1 | 1000 | 100 | 59 | 1,041 | ||

| 20×2 | 1,041 | 104 | 59 | 1,086 | ||

| 20×3 | 1,086 | 109 | 59 | 1,136 | ||

| 20×4 | 1,136 | 113 | 59 | 1,190 | ||

| 20×5 | 1,190 | 119 | 1250+59 | – | ||

7.5 Liability

| Instrument | Ind AS | Tax/MAT |

| Term Loans | Classified at amortised cost Interest expenses recognized based on effective interest rate resulting in to amortization of transaction cost | Actual interest allowed as per section 36(1)(iii)

Notional interest expenses-disallowed Transaction Cost – Deductibility of fees and other transaction cost will be dealt with the basic principles of taxation (accrual basis and judicial precedents) MAT – No adjustment to be made in MAT calculation including notional interest |

| Trade Payables | ||

| Non Convertible debentures | ||

| Preferences shares- Convertible | May be treated as Compound Instrument Interest to be recognized as per EIR |

Disallowed– any interest/dividend to be disallowed

MAT– Dividend/Interest to be added back.[FAQ8-CBDT] |

| Preference Shares-Redeemable | Classified as liability | Disallowed – any interest/dividend to be disallowed

MAT – Dividend/Interest to be added back. [FAQ8] |

7.6 Assets

| Instrument | Ind AS | Tax impact |

|

FVTPL, FVOCI- Irrevocable choice | Current Investments/ Stock in trade- FVTPL

Non Current Investments [FVOCI or amortised cost]

MAT

|

|

Amortised cost or FVTPL | |

|

Amortised cost, FVTPL, FVOCI | |

|

FVTPL | |

|

FVTPL |

7.7 Expected Credit Loss [ECL]

![Expected Credit Loss [ECL]](https://www.taxmann.com/post/wp-content/uploads/2023/06/1-5-1024x545.png)

7.8 Examples

7.9 Inventories

- Ind AS requires that where the purchase of inventories on deferred settlement terms effectively contains a financing element, the same is to be recognized as interest expense over the period of financing.

- For example, difference between the purchase price for normal credit terms and the amount paid on deferred settlement terms, is to be recognized as interest expense.

- Example

- A company purchases an item of inventory for Rs. 10,000 payable in two years time. Purchase price for normal credit terms is Rs. 9,000

Ind AS

- Purchases 9,000

- Interest 500

- Creditors 9,500

- Interest 500

- Creditors 500

ICDS

- ICDS/tax laws does not stipulate splitting of the purchase price to recognize interest component

Issue

- Allowability of interest under section 36(1)(iii)?

7.10 Provisions

- Ind AS requires that companies are required to discount provisions to their present value where the effect of time value of money is material. The increase in the provisions due to passage of time will be recognised as a finance cost- resulting in higher interest.

- For example, difference between the purchase price for normal credit terms and the amount paid on deferred settlement terms, is to be recognized as interest expense.

- Example

Ind AS

- Expenses 9,000

- Provisions 9,000

- Interest 500

- Provisions 500

ICDS

- ICDS/tax laws provides that the amount of provision should not be discounted to its present value.

Issue

- Provision recognised on scientific basis should be allowed

- Allowability of interest under section 36(1)(iii)?

8. Business Restructuring – Demerger

Section 2[19AA]– Allows all assets and liabilities by demerged company of its undertaking to the resulting company to be at book value except in case of Ind AS companies.

In case of Ind AS companies allows the resulting company to records the value of the property and the liabilities of the undertakings at value different from the value appearing in the books of account.

MAT Adjustment 115JB [2B]

- Fair value to be ignored while calculating the book profit of the resulting company.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA