[FAQs] Double Entry System – Principles | Examples | Benefits

- Blog|Account & Audit|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 15 November, 2024

The Double Entry System, introduced by Fra Luca Pacioli in 1494, is a fundamental accounting method where every financial transaction impacts two accounts in opposite directions—one account is debited, and another is credited. This dual aspect ensures a complete and accurate record of all transactions. The principle is based on the concept that for every debit, there is a corresponding credit, maintaining the accounting equation. For instance, selling goods on credit affects both the sales account (credit) and the buyer's account (debit). This system provides a structured way to track financial activities, ensuring reliability and accuracy in financial records.

Check out Taxmann's Accounting (Accounts) | CRACKER which offers comprehensive coverage of past exam questions, including those from the September 2024 exam, alongside additional important questions, theoretical concepts, illustrations, short notes, and true/false questions. The book also features chapter-wise marks distribution from May 2019 onwards, making it an essential resource for focused and effective exam preparation. CA-Foundation | New Syllabus | Jan./May 2025 Exams

FAQ 1. What is Double Entry System?

- This system was invented by an Italian merchant named Fra Luco Pacioli in 1494 A.D.

- According to this system, every transaction has got a two-fold aspect (dual aspect), i.e., one party giving the benefit and the other receiving the benefit and it has effect of opposite nature on two financial items.

- Information of one financial nature at one place is known as an account which is divided into two sides, debit and credit.

- In short, one account is to be debited and another account is to be credited for every transaction in order to have a complete record of the same.

- Therefore, every transaction affects two accounts in opposite direction.

- For example, if goods are sold to Mr. A on credit, the same will affect goods/sales account and A’s account and entries will be made in opposite direction in these two accounts.

- This system is called Double Entry System since it keeps records for every transaction in two accounts.

- Therefore, the basic principle, under this system, is that for every debit there must be a corresponding credit or vice versa.

- Before going to discuss the double entry principle it becomes necessary to explain certain terms which are frequently used in accounting.

2. What is the meaning of Transactions and Events?

Meaning of Transactions:

- A business dealing, which can be measured and expressed in terms of money and must be recorded in the books of account, is called a ‘transaction’.

- In a transaction, there must be some monetary change between the parties.

- In other words, the meaning of a transaction is to ‘receive’ and ‘give’, viz., one party receive and the other party gives, e.g. if X gives ` 400 to Y, Y is receiving ` 400 whereas X is giving the same and there is a monetary change between the parties.

- This give and take can be of Cash, Property, Goods, Services and benefits etc. which has monetary value.

- So, a transaction also means a change in affairs that alters the financial state of parties in any way.

- There are always two parties in a transaction of which one must be the entity in whose books, accounting is being done.

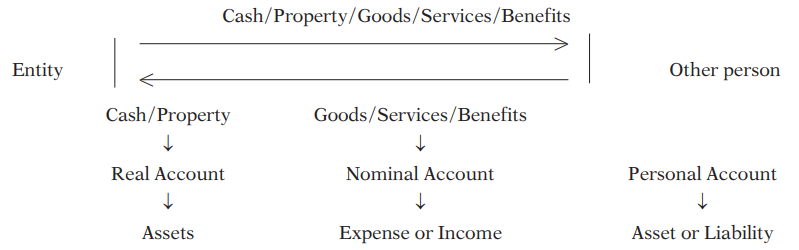

TRANSACTION

(Transaction is a give & take which has some financial effect on entity)

Goods a/c if prepared is treated as a real a/c but instead of preparing goods a/c, we prepare Purchase a/c, Sale a/c etc. to get full information, which are treated as nominal a/c.

Goods a/c if prepared is treated as a real a/c but instead of preparing goods a/c, we prepare Purchase a/c, Sale a/c etc. to get full information, which are treated as nominal a/c.- In the above analysis you can observe:

-

- There are two persons of which one is the entity.

- Something (i.e. cash, property, goods, service or benefits) is given & in return something else is taken.

- These both the arrows indicating give & take may take place at the same point of time (known as cash transaction) or at different point of time. (known as credit transactions).

- Irrespective of whether both give & take is done at same time or at different point of time (i.e. indicating only one arrow at a time), there are always two accounts involved in a transaction (dual aspect concept).

- These accounts can be classified according to function into Real, Nominal & Personal a/c or according to nature into Expense, Income, Asset or liability.

Meaning of Events:

- Event is happening of something, which has financial effect on the entity.

- Ex. A fire destroys furniture, Stock Balance at the end of the year etc.

FAQ 3. What is a Petty Cash Book?

- This is to be prepared to record the petty (small) expenses, which are incurred frequently.

- On the payment side the amount is classified into various columns depending upon the account to which it has to be debited.

- The columns can be for conveyance expenses, postage, repairs & maintenance, printing & stationery, salary, wages and so on.

- It is also known as analytical cash book.

- In petty cash book receipt will be from main cash book.

Posting:

- The total of this column is debited to respective expense accounts in the ledger after a specific period may be monthly, weekly etc.

- The Balance of petty cash book (i.e. receipts (-) payments) shows the balance of cash in hand which will be shown in Trial balance.

FAQ 4. What is the Imprest System?

- An amount is fixed which is given to petty cashier who meets expenses out of it & periodically or when the amount is spent, he takes reimbursement from main Cashier exactly equal to amount spent hence his cash balance again becomes equal to fixed imprest amount.

- This is the upper limit of cash which petty cashier can have.

- It is a version of Petty cash book only.

- Ex. Imprest amount is fixed at ` 1000. Petty cashier has spent ` 785 in that period, thus he has balance of ` 215. Now he will get reimbursement from main cashier ` 785, thus his balance will again become ` 1000.

FAQ 5. What is a Sales Book?

- The Sales Day-Book is a register specially kept to record credit sales of goods dealt in by the firm.

- Cash sales are entered in the Cash Book and not in the Sales Day Book.

- Credit sales of things other than the goods dealt in by the firm are not entered in the Sales day Book; they are journalised.

- For accounting, Goods means only those items in which the particulars concern is doing business i.e. purchasing & selling it.

- It is a subsidiary book/subsidiary journal & posting is made from it to the sales account and accounts of the customers.

Posting:

- The total of sales register is credited to sales a/c periodically say monthly.

- And individual amounts are debited to respective parties (debtors) a/c.

| Sales Account is a final record and postings are made to it from Cash Book (Cash sales) and Sales Day Book (credit sales). |

| Sales Account is maintained in the ledger in the manner, the other accounts are maintained. |

| Sales Account is a nominal account and its balance is used for ascertaining gross profit or gross loss. |

FAQ 6. What is a Purchase Book?

- All credit purchases of goods are recorded in purchase book.

- Cash purchases are entered in the Cash Book and not in the Purchases Day Book.

- Credit purchases of things other than the goods dealt in by the firm are not entered in the Purchases day Book; they are journalised.

- It is a subsidiary book/subsidiary journal & posting is made from it to the purchases account and accounts of the suppliers.

Posting:

- The total of purchase register is debited to purchase a/c periodically say monthly &

- Individual amounts are credited to respective parties (suppliers) a/c.

| Cash sales & Cash Purchases will be recorded in Cash Book and credit sales & credit purchase of Assets will be recorded in Journal. Comments for sales account made above equally apply to purchase account. |

FAQ 7. What is the Principal Book (Ledger)?

- All accounts are opened in a separate register known as a ledger

- Only exception is cash & Bank a/c. which are not prepared in ledger because cash & Bank book itself is cash & Bank account also (when Cash cum Bank Book is prepared).

- All other books are only books of entry they are not ledger accounts.

- Hence when we enter a transaction in a book of entry, we decide/write which account should be debited & which account should be credited.

- But actual debit & credit gets completed only when we write the amount from this book to respective accounts in ledger on debit or credit side as the case may be.

- This process of writing the amount from books of entry to ledger account is known as ‘posting’.

Posting:

- Each account will have two sides, left hand side is known as debit side & right hand side as credit side.

- If the amount is written on debit side that means that account is debited

- If written on credit side means that account is credited.

- All these accounts are then totalled & balanced.

- All the accounts which are having balances either debit or credit are listed on a statement known as Trial Balance.

- With the help of this Trial Balance, Final accounts namely Trading & P&L A/c and Balance sheet is prepared.

| Instead of one ledger, concern can maintain multiple ledgers like Debtors ledger, Creditors ledger, General ledger etc. |

Ledger Account

Dr. Cr.

| Date | Particulars | F | Amount | Date | Particulars | F | Amount |

| To

To |

By

By |

||||||

| Total | Total |

FAQ 8. What is the Mercantile System of Accounting & Cash System of Accounting?

- A transaction is recognized when either a liability is created (i.e. when goods/services/benefits or properties are received) and/or an asset is created (i.e. when goods/services/benefits or properties are given).

- Whether payment is made or received is immaterial in accrual basis accounting.

- Accrual basis of accounting is also known as mercantile basis of accounting.

- On the other hand, cash basis of accounting is system of accounting by which a transaction is recognized only if cash is received or paid, no entry is being made when a payment or receipt is merely due.

- Accrual basis accounting is the only generally accepted accounting method for business entities which are supposed to operate for long period.

- Cash basis accounting is suitable for short duration ventures.

- All the chapters which you will study are on accrual basis only exception may be joint venture.

FAQ 9. What is Journal Proper?

If there is no special book meant to record a transaction, it is recorded in the Journal (proper).

- Opening entries – When books are started for the new year, the opening balance of assets and liabilities are journalised.

- Closing entries – At the end of the year nominal accounts are transferred to the profit and loss account. This is done through journal entries called closing entries.

- Rectification entries – If an error has been committed, it is rectified through a journal entry.

- Transfer entries – If some amount is to be transferred from one account to another, the transfer will be made through a journal entry.

- Adjusting entries – At the end of the year the amount of expenses or income may have to be adjusted for amounts received in advance or for amounts not yet settled in cash. Such an adjustment is also made through journal entries. Usually, the entries relating to Outstanding expenses, Prepaid expenses, Interest on capital and Depreciation are necessary.

- Entries on dishonour of Bills – If someone who accepted a promissory note (or bill) is not able to pay it on the due date, a journal entry will be necessary to record the non-payment or dishonour.

- Miscellaneous entries – The following entries will also be shown in Journal proper:

-

- Credit purchase of things other than goods dealt in or materials required for production of goods e.g. credit purchase of asset will be journalised.

- An allowance to be given to the customers.

- Receipt of promissory notes or issue to them if separate bill books have not been maintained.

- On an amount becoming irrecoverable, because of the customer becoming insolvent.

- Effects of accidents such as loss of property by fire etc.

FAQ 10. What is the difference between Trade Discount & Cash Discount?

Trade Discount

- Trade discount is a discount on the selling price for bulk purchase or for purchasing above a minimum quantity or is offered generally to regular customers.

- It is also called quantity discount.

- This is a technique of sales promotion.

- It is generally determined at the stage of sale itself & is deducted from the sale/purchase value & hence doesn’t appear separately in the Books of a/cs & Final a/cs.

Cash Discount

- Cash discount is the discount offered by the supplier in consideration of early or timely payment.

- It may vary with the period of payment.

- It is accounted as a separate item & appears in the Profit & loss a/c.

- Cash discount is usually given at the time of payment/receipt as against trade discount is given at the stage of sale/purchase.

FAQ 11. What is the difference between a Debit Note and a Credit Note?

Debit Note

- A debit note is a statement sent by one party to the other stating/informing him that his account has been debited with a specified amount and the reason for debit.

- A debit note is sent to the supplier when the goods purchased from him are returned (purchase return) or for discount to be received from him or for any expenses incurred for him.

| Entry | In the books of sender of Debit note | In the books of receiver of Debit note |

| Party (to whom it is sent) a/c Dr. | Sales return/Discount allowed etc. a/c Dr. | |

| To Purchase return/Discount received etc. | To Party (who sent it) a/c |

Credit Note

- A Credit note is a statement/letter sent by one party to the other stating/informing him that his account has been credited with a specified amount and the reason for credit.

- A credit note is sent to the customer when we receive good returned by them or for discount to be allowed to him or for any expenses incurred for us by him.

| Entry | In the books of sender of Credit note | In the books of receiver of Credit note |

| Sales return/Discount allowed etc. a/c Dr. | Party (who sent it) a/c Dr. | |

| To Party (to whom it is sent) a/c | To Purchase return/Discount received etc. |

FAQ 12. What are the advantages of subsidiary books?

Following are the uses & advantages of subsidiary book:

- Division of work – In place of one journal, there will be multiple subsidiary books & therefore the accounting work can be easily divided amongst a number of clerks.

- Specialization and efficiency – When the same work is allotted to a particular person over a period of time, he acquires full knowledge of it and becomes efficient in handing it. Thus division of work results in advantage of specialization of efficiency.

- Saving of the time – Various accounting process can be undertaken simultaneously because of the use of multiple subsidiary. This result in the work being completed quickly.

- Availability of information – Since a separate register or book is kept for each class of transactions, the information relating to each transactions will be available at one place, in a comprehensive manner.

- Facility in checking – When the trial balance does not match, the locating of the error or errors is facilitated by the maintenance of separate subsidiary books. Even the commission of errors and frauds will be checked by the use of multiple subsidiary books.

FAQ 13. What is the importance of a Journal?

Journal is the primary book of accounts in which financial transactions are recorded in a chronological order, ie., in the sequence they are entered into from the accounting voucher which is prepared on the basis of source documents, ie., cash memo, invoices, etc.

Importance of Journal:

- Provides an information of the transaction – Along with the entry in the Journal, narration is written so that it is made easy to understand the entry properly.

- Records a chronological order of all transactions – Transactions are entered in the Journal in a chronological order, i.e., in the sequence of date or order they are entered.

- Reduces the possibility of error – The possibility of errors is reduced as the amounts to be debited and credited are written side by side and the two can be compared to see that the total of two sides of the transaction recorded are equal.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA