Demystifying Statutory Valuation and Start Ups | Methods and Market Approaches

- Blog|Income Tax|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 5 February, 2024

By Niki Shah – Partner | SN & Co.

Table of Contents

- Introduction

- Start-Up Valuation

- Statutory Valuation

- Valuation Process – Key Steps

- Valuation Process – Approaches

- Market Approach

1. Introduction

1.1 What is Valuation?

New Trends in Business Environment

1.2 New Trends

- Business for Valuation v/s Profit

- Increase in Serial Entrepreneur

- Is it only Numbers?

- Eternal Truth – Value is in the eye of buyer (Logistic Co)

1.3 Good Valuation = Story +Numbers

Appeal

- Numbers provide a sense of control, a sense of precision and the appearance of objectivity.

- Stories are more easily remembered than numbers and connect with human emotions.

Dangers

- Without narratives to back them up, numbers can be easily manipulated, to hide bias or intimidate those not in the loop.

- Stories that are not anchored to or connected with numbers can veer into fairy tales leading to unreal valuation.

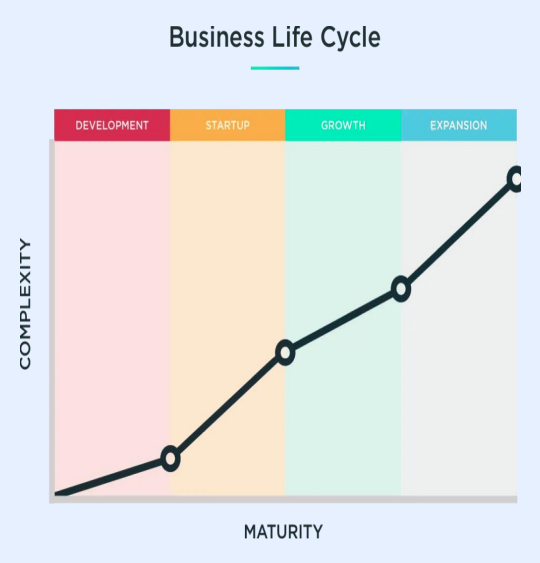

1.4 Valuation at Each Stage

Development Stage

- Ideation

Media Co, Mysa, BYJU’sBYJU’s unique teaching style the idea of creating a digital platform for students. It’s valuation was relatively low, now the company has a valuation of over $16 billion

- Minimum Viable Product/Prototype

Agri, InstagramInstagram MVP focused on making it ease for users to taking and sharing photos quickly. It’s valuation was $1 billion when acquired by Facebook and now it’s in the range of $100 billion.

- Traction

Health, DropboxDropbox service gained traction due to its simplicity and ease of use. Users can upload files from their device to the cloud, and access them from any device. Dropbox was valued at $9.2 billion and at the time of its IPO was around $8 billion.

2. Start-Up Valuation

2.1 Traits/Challenges Faced by Startups

- Limited History and Fierce Competition

- Financial Challenge to raise capital

- Small or no revenues and negative operating

- Illiquidity of Investments

- Focus on Intangibles – Value of the tech business ideas or technology under development or an innovation

- Unique product/Strategic business model and feasibility study is important

- Success ratio – Most don’t survive the test of commercial success and fall

2.2 Examples of Startups

2.2.1 Product

Success depends on consumer need and right vision:

E.g.- Zoom’s valuation increased from around $1 billion in 2017 to over $100 billion in 2021. Zoom’s video conferencing platform was easy to use and reliable, with features that made it popular for remote work and virtual events.

Price

Demands Constant Innovation, Evolving model, Pricing and Scalability:

E.g.- Airbnb‘s valuation increased from around $1.3 million in 2009 to over $100 billion in 2021. Airbnb’s pricing was often cheaper than hotels, especially in popular tourist destinations.

Place

Aggressive expansion plans and marketing strategies leads to a successful startup

E.g.- Uber‘s valuation increased from around $5.9 million in 2010 to over $70 billion in 2021. Uber’s app was available in multiple cities and countries around the world, making it easy for travellers to use the service wherever they went.

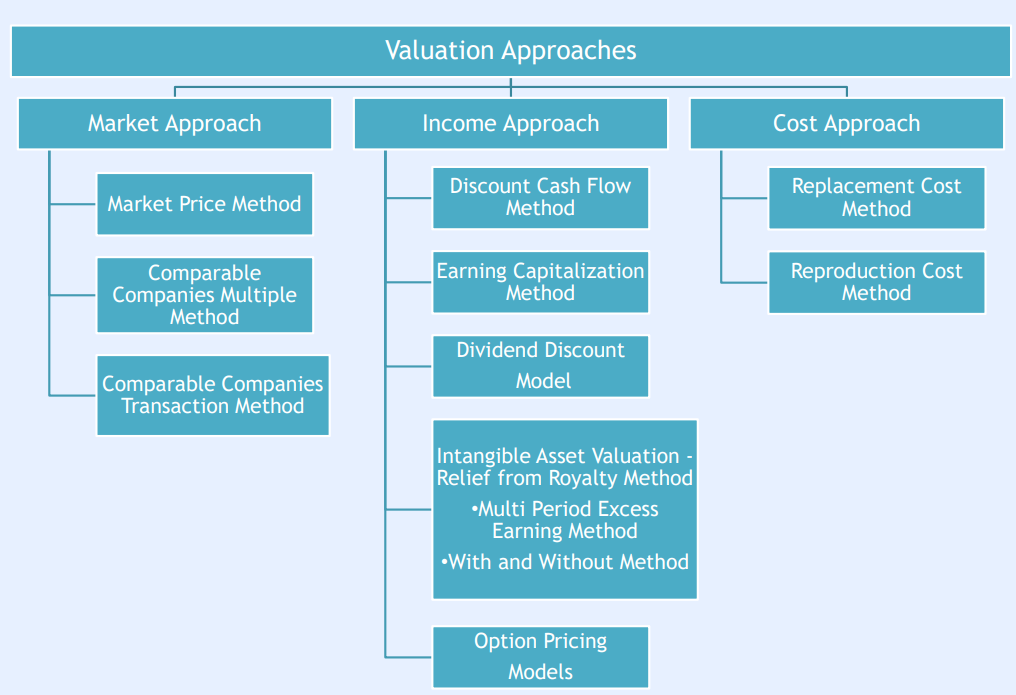

2.3 Popular Methods of Startup Valuation

Methods of Valuation would depend upon the stage of the Company

- Asset Approach – ReplacementCost

- Income Approach – Discounted Cash FlowMethod

- Market Approach – Comparable Companies/transaction

- Venture CapitalMethod

- Chicago Method

3. Statutory Valuation

3.1 Purpose of Valuation

3.1.1 Regulatory Compliance

Companies Act, 2013

- Internationally accepted Valuation Methodology

- Valuation Standards adopted by any RV organisation

FEMA, 1999/Reserve Bank of India

- Internationally Accepted Pricing Methodology

Income Tax Act, 1961

- Discounted Free Cash Flow Method

- Net Asset Value Method as per Rule 11UA

SEBI, 1992

- SEBI Guidelines

IBC, 2016

- Internationally accepted valuation methods

| Companies Act, 2013 | Income Tax Act, 1961 | FEMA, 1999 | |

| Generally accepted valuation methodologies | Net asset value method or Discounted cash flow method | Internationally accepted valuation methodologies | |

| Preferential issue of shares to Indian resident | Shares can not be issued below fair value | Shares can not be issued at more than fair value | NA |

| Preferential issue of shares to Non-resident | Shares can not be issued below fair value | NA | Shares can not be issued below fair value |

| Transfer of shares between resident (R) and non-resident (NR) | NA | Shares can not be transferred below fair value (NAV) | In case of R to NR: Shares can not be transferred below fair value

In case of NR to R: Shares can not be transferred at more than fair value |

Financial Reporting

- IFRS/IndAS

- Purchase price allocation (PPA)

- Fair valuation of tangible and intangible assets or Instruments

- Asset impairment

Commercial Valuation & Fairness Opinion

- Merger andacquisitions

- Private equity placement

- Joint Ventures

- Corporatere structuring (swap ratio)

Internal Reporting Requirements

- PE funds portfolio valuation

- Internal management analysis

3.2 Bird’s Eye View

| Frequent Requirements of Statutory Valuations | ||

| Sr. No | Relevant Section | Valuation Requirement/ Purpose |

| Under Companies Act, 2013 | ||

| 1 | Section 62 read with Rule 8(6) | Valuation for Further Issue of Share Capital |

| 2 | Section 62 read with Rule 8(7) | Valuation of IPR/ know-how/Value addition for Issue of Sweat Equity Shares |

| 3 | Section 62 read with Rule 13(2)(g) | Valuation for Issue of shares on preferential basis |

| 4 | Section 230/ 232 | Valuation under Scheme of Compromise/Arrangement or Scheme of Corporate Debt Restructuring (Mergers & Acquisitions) |

| 5 | Section 236 | Valuation for Purchase of Minority Shareholding |

| Under Insolvency and Bankruptcy Code, 2016 | ||

| 6 | Section 59(3) | Voluntary liquidation of corporate persons |

| Under Foreign Exchange Management Act, 1999 | ||

| 7 | FEMA Regulations | For fresh Issue or transfer of equity instruments of Indian Company (Foreign Direct Investment) |

| 8 | Subscription/ Acquisition of equity shares of Overseas Companies (Overseas Direct Investment) | |

| 9 | Swap of Shares | |

| Under Income Tax Act, 1961 | ||

| 10 | Rule 11UA | Determination of Fair market value of unlisted shares |

3.3 Applicability at a Glance

| Particulars | Registered Valuer | Merchant Banker (SEBI Registered) | Chartered Accountant | Cost Accountant |

| Issue of Shares | ||||

| Companies Act 2013 |

✔ |

X | X | X |

| Income tax Act 1961 | X | ✔(DCF) | ✔(NAV) | X |

| FEMA, 1999 | X | ✔ | ✔ | ✔ |

| SEBI laws | ✔ | ✔ | X | X |

| Transfer of Shares | ||||

| Companies Act 2013 | X | X | X | X |

| Income tax Act 1961 | X | ✔ | ✔ | X |

| FEMA, 1999 | X | ✔ | ✔ | ✔ |

| SEBI laws | X | ✔ | ✔ | X |

SEBI laws includes many rules and regulations which prescribes merchant banker to carry out valuation, however recently those are amended to recognize registered valuer (as per Companies Act,2013)

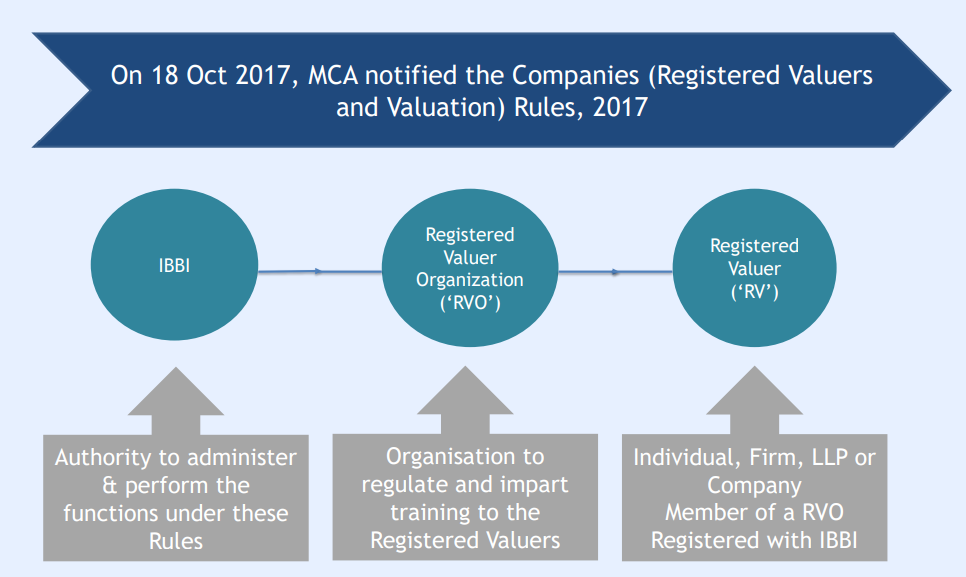

3.4 Registered Valuer Rules

4. Valuation Process – Key Steps

Steps of Valuation as prescribed by ICAI Valuation Standard

- Define the valuation base, premise of the value and valuation date

- Analyze the asset to be valued and collect the necessary information

- Identify the adjustments to the financial and non-financial information for the valuation

- Consider and apply appropriate valuation approaches and methods

- Arrive at a value or a range of values

5. Valuation Process – Approaches

6. Market Approach

Calculation of Market/ Transaction Multiple

| Valuation Multiple | Formula | Remarks |

| EV/Sales | Enterprise Value/Sales* |

|

| EV/EBITDA | Enterprise Value/EBITDA* |

|

| PE Ratio | Price/Earnings* |

|

| Price to Book | Market Cap/Net Worth* |

|

| Industry Specific Multiples |

|

|

* Base for Sales, EBITDA, Earnings, Net worth could be:

- Most recent financial year(Current)

- Last four quarters (Trailing)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA