Cross-Border Digital Services Taxation – Egypt VAT and India GST Overview

- Blog|GST & Customs|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 20 November, 2024

Cross-border Digital Services Taxation refers to the application of tax laws on digital services provided by businesses across international borders. It includes services such as online advertising, streaming, cloud computing, and e-books. Jurisdictions like Egypt and India impose taxes like VAT (Value Added Tax) or GST (Goods and Services Tax) on these services to ensure tax compliance, whether the service provider is resident or non-resident. Taxation mechanisms include Reverse Charge Mechanism (RCM) for B2B transactions and simplified vendor registration for B2C transactions, with specific rates, exemptions, and compliance obligations varying by country.

Table of Contents

- Indirect Taxation Landscape

- Digital Services – Overview and Coverage

- Taxability of Cross-border Digital Services

- Rate of Tax and Place of Supply

- Registration and Periodical Compliances

- Penal Consequences

By Khaled Mandor – VAT Expert & Member of E-Commerce Unit, Sara Abdelfattah – Tax Officer and Coordinator & Member of E-Commerce Unit | Egyptian Tax Authority & Kishore Harjani – Leader | Taxmann’s Advisory and Research

1. Indirect Taxation Landscape

1.1 Overview of Indirect Taxation Landscape – VAT in Egypt

1.1.1. Levy

- Standard goods and services (VAT)

- Table goods and services (table tax then VAT or table tax only).

- Exempted Goods and services (57).

- Imported goods (custom tax +VAT).

- Imported services ( VAT or RCM).

1.1.2 Rates

- 0%

- 5%

- 8%

- 10%

- 14% 15% & 30%

- Excise tax

1.1.3 VAT on B2C and B2B

- Exclusions – Salaries, public governmental services, Financing loans Intra combination group, stock and derivatives Exchange.

- Exemptions – 57 goods and services, fresh Food, milk products, Tea, sugar, coffee bean, education, health and medicine, financial services*, Insurance, mining products, flights and overseas ships services.

1.1.4 Time of supply

- Goods – Earlier of date of “risk transfer”, removal, invoice, payment on advance

- Services – Earlier of date of invoice or payment on advance* except 4 continuing services. ** professional fee

1.1.5 Place of Supply & Threshold

- The place of jurisdiction include any local or Imported transaction to a benefit of a local customer.

- Thresholds;

- Stamdard goods and services 500k EGP.

- Table goods and services 0 EGP.

1.1.6 Credit

- The credit is always applied to inputs at a standard rate in the ordinary course of business, so any direct and indirect expenses associated with sales subject to the standard rate are tax deductible*

1.2 Overview of Indirect Taxation Landscape – GST in India

1.2.1 Levy

- Dual GST regime

- CGST+SGST on intra-state supplies

- IGST on inter-state supplies (including import of goods)

1.2.2 Rates

- 0%

- 5%

- 12%

- 18%

- 28%

- Cess as applicable

1.2.3 Exclusions

- Basic Customs Duty and Customs Cess

- Petroleum products,

- Alcohol,

- Power

- Stamp Duty

1.2.4 Time of Supply

- Goods–Earlier of date of removal/ invoice/ payment

- Services–Earlier of date of invoice or payment

1.2.5 Place of Supply

- PoS Rules to determine levy/jurisdiction for goods and services

1.2.6 Credits

- Credit for all expenses in course or furtherance of business

2. Digital Services – Overview and Coverage

2.1 Overview of Cross-border Digital Services – VAT in Egypt

2.1.1 Scope of Main Digital Services

- Streaming services

- Software and online licenses,

- Website design and tools.

- Legal, accounting, Consultancy and Professional services.

2.1.2 Place of Services

- Egyptian Taxpayer, Business, NPO, Government body.

- Pemanent resident in Egypt.

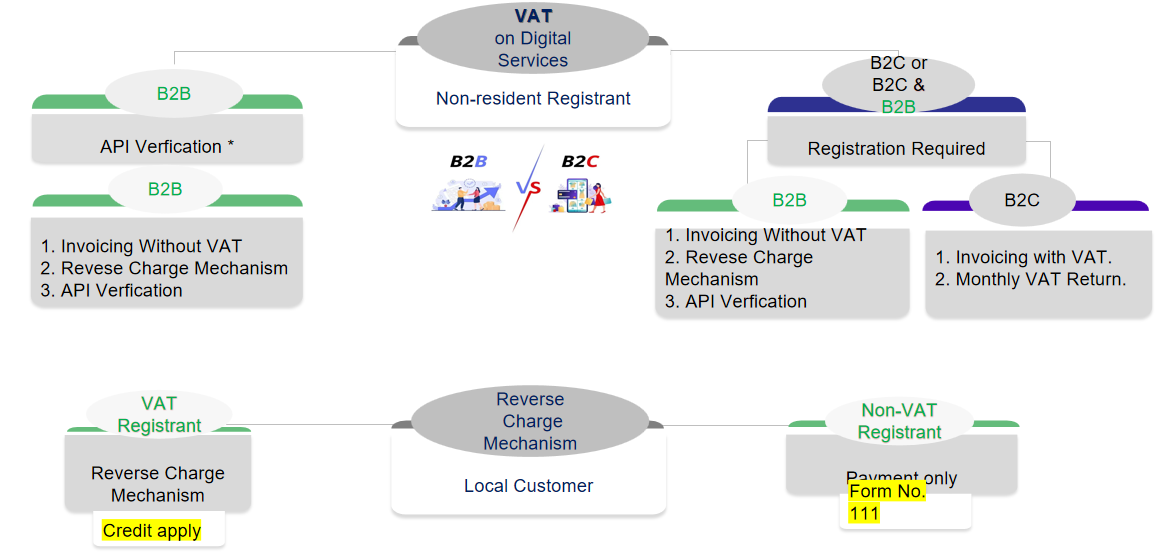

2.1.3 VAT on B2C and B2B

- B2C > Simlified Vendor Registtaion “VAT Obligations”

- B2B > Revese Charge Mechanism “API”

2.1.4 Compliance and Obligations

- Registration, TRN, Invoicing EU, API Verification of local business

- TRN.

- Tax Period, Currency,

- Taxable amount at the VAT rate.

2.1.5 VAT Rate and VAT Refund

- Standard Rate14%

- Professional services 10%.

- Examption Servecies.

- A refund to recover input VAT they have incurred in Egypt

2.1.6 Penalties

- Ban access to Egyptian markets.

- A risk review.

- 1.5% additional tax on the taxpayer per month or part of a month

2.2 Digital Services – Egypt VAT perspective

- Non-resident Vendor

- Renders Digital services

- Recipient in Egypt

- VAT to be paid in Egypt

For the said services, a Recipient is considered to be in Egypt,.

- Non-registered person having permanent residence in Egypt

- Registered taxpayer in Egypt

- Governmental Body, Public or Economic Authority, other Authority or non-registered entity in Egypt

If recipient has multiple establishments Place of supply will not be in Egypt if the service is predominantly used by recipient’s permanent establishment in another Country.

2.3 Coverage of Digital Services – Egypt VAT Perspective

2.3.1 Remote Services

Where at the time of the performance of the service, there is no necessary connection between the physical location of the recipient and the place of physical performance

- Advertising on the internet

- Providing cloud services, Domain name, Email tools

- Provision of Content; e-books, music, images, videos.

- Software and other intangibles and other related services license and maintenance.

- Providing data or information: newspapers subscription, Forex tread, and the like.

- Online supplies of digital content (movies, television shows, and the like.

- Online gaming.

2.3.2 On-the-spot Services

Services that require customer’s physical presence in a specific location to receive are not remote services, even if they are booked online.

- Booking of hotel services

- Physiotherapy services

- Physical entry to entertainment or sporting events.

- Restaurant and catering services; and Passenger transportation services.

2.4 Digital Services – India GST Perspective

- Popularly known as Online Information and Database Access or Retrieval Services (‘OIDAR’)

- It refers to services:

-

- whose delivery is mediated by information technology

- over the internet or an electronic network and

- the nature of which renders their supply impossible to ensure in the absence of information technology

2.5 Coverage of OIDAR Services – India GST Perspective

- Advertisement on Internet

- Cloud services

- E-books, Movies, Music etc. through telecommunication network or internet

- Database access or Retrieval in electronic form through a computer network

- Online supplies of digital content

- Digital data storage

- Online gaming except online money gaming

3. Taxability of Cross-border Digital Services

3.1 Taxation of Cross-border Digital Services – Egypt VAT Perspective

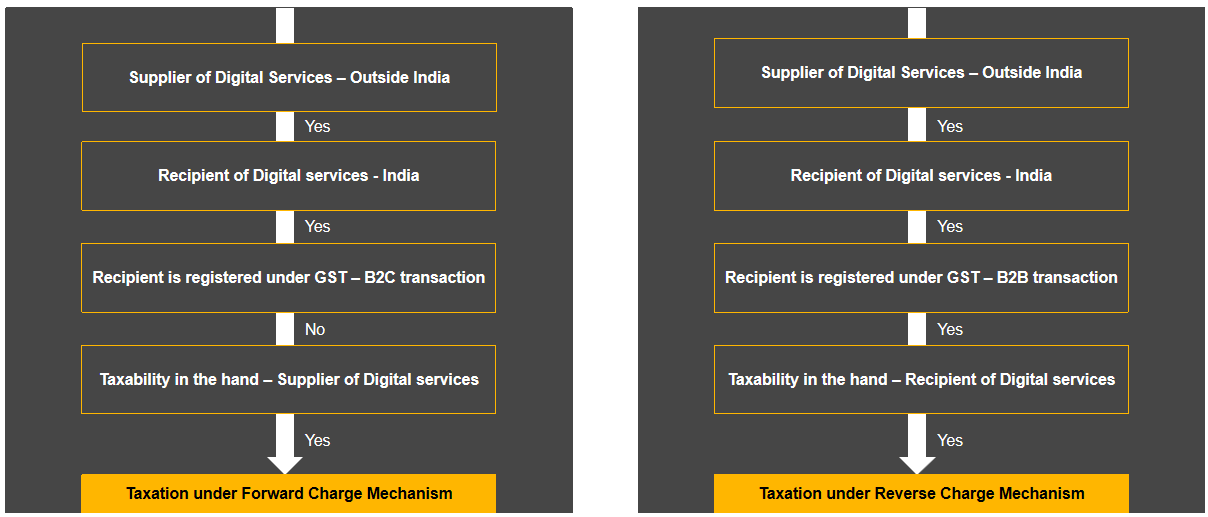

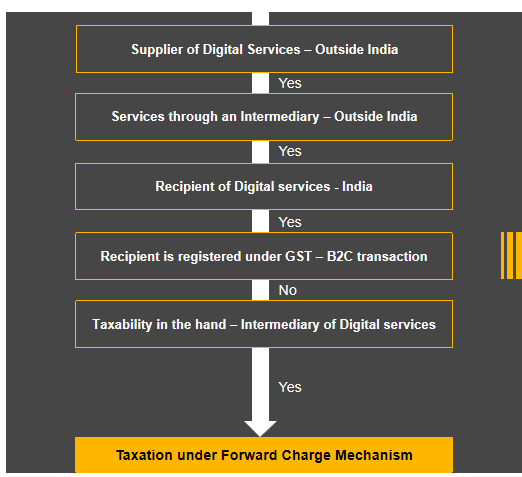

3.2 Taxation of Cross-border Digital Services – India GST Perspective

Intermediary is not liable

- Invoice from intermediary separately identifies services by him and digital service provider

- Intermediary not responsible for collection or processing of payment

- Terms and conditions of supply are not determined by intermediary

4. Rate of Tax and Place of Supply

4.1 Rate Digital Services – Egypt VAT Perspective

4.1.1 Standard Rate of VAT 14%

Digital Services

- Digital Services are liable to VAT at a standard rate of 14%

- Advertising on the internet

- Providing cloud services, Domain name, Email tools

- Provision of Content; e-books, music, images, videos.

- Software and other intangibles and other related services license and maintenance.

- Providing data or information: newspapers subscription, Forex tread, and the like.

- Online supplies of digital content (movies, television shows, and the like.

- Online gaming.

4.1.2 Reduced Rate of VAT 10%

Professional Services

- Legal, Accounting, Consultancy, Professional Certificates services and Freelancers services are liable to VAT at a rate of 10%.

4.1.3 Exemption of VAT

Educational Services

- Training and Educational Services are exempted of VAT*.

- *Under certain conditions

4.2 Rate of Tax and Place of Supply of Digital Services – India GST Perspective

4.2.1 Place of Supply

- Place of supply of OIDAR services shall be the location of the recipient of service

- Person receiving such services shall be deemed to be located in the taxable territory, if any two of the following non contradictory conditions are satisfied, namely:

-

- Location of address presented by the recipient through internet

- The credit card or debit card or any other card by which the recipient settles payment;

- The billing address of the recipient;

- The IP address of the device used by the recipient

- The bank of the recipient in which the account used for payment;

- The country code of the SIM card used by the recipient;

- The location of the fixed land line through which the service is received by the recipient

4.2.2 Rate of tax

OIDAR Services

- Liable to GST at a standard rate of 18%

5. Registration and Periodical Compliances

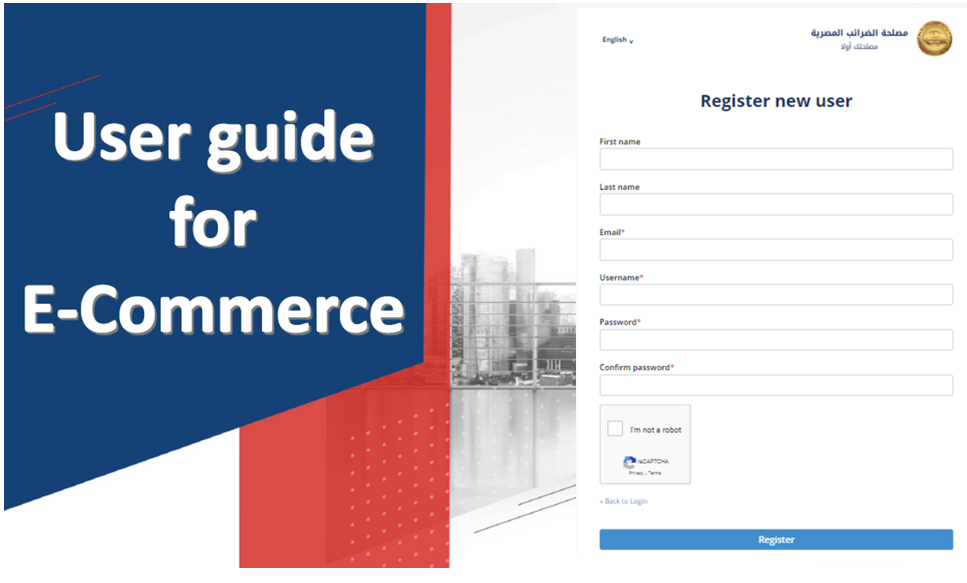

5.1 Registration and Periodical Compliances – Egypt VAT Perspective

Step 1 – Submitting application

Step 2 – Review of application by ETA

Step 3 – Entry into designated register

Step 4 – Assigning registration no.

Step 5 – Fails to apply for registration

If a person responsible to apply for registration fails to apply, they will be treated as registered under the simplified vendor registration regime – starting from the date their sale value reaches the registration threshold.

https://www.eta.gov.eg/sites/default/files/2023-06/e-commerce_user_guide.pdf

Invoicing Requirements (B2C)

- Invoice Reference: Invoice/receipt issuing date, Invoice/receipt number.

- Registrant data: The name and the tax registration number of registrant.

- Services Data: description of the service supplied, its amount, and the rate and the amount of VAT

- Additional data of advertising services: Name and ID of the consumer (EU).

Invoicing Requirements (B2B)

- Invoice Reference: Invoice/receipt issuing date, Invoice/receipt number.

- Registrant data: The name and the tax registration number of registrant.

- Customer data: The name of the resident taxpayer, tax registration number of the resident taxpayer (must me verified through API system).

- Services Data: description of the service supplied, amount (no VAT applying)*, the resident taxpayer must comply Reverse Charge Mechanism RCM.

API integration System

- The system of non-resident Registrant should integrate with the API system, allowing for the automated exchange of information between the non-resident Registrant and the ETA, enabling real-time verification of the tax registration number and UIN of resident taxpayer.

https://www.eta.gov.eg/sites/default/files/2023-06/20230619_ecommerce_tax_api_platform.pdf

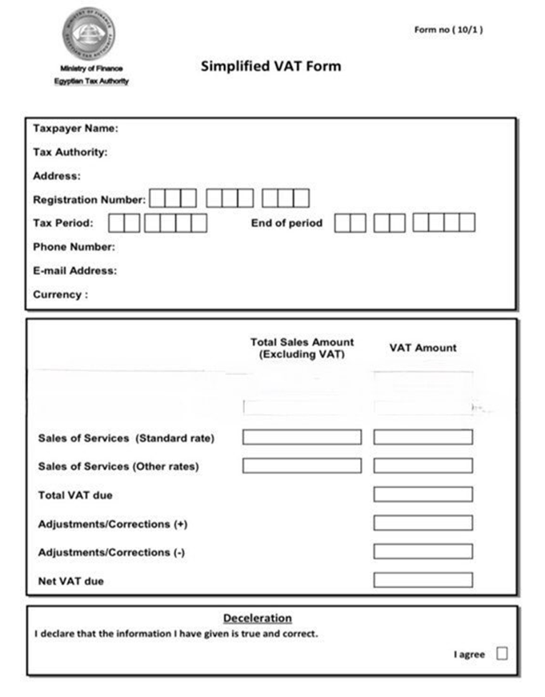

Filing Simplified VAT Return

- VAT Return: within the end of the month following the expiration of the taxable period (monthly tax return).

- Required Data: Supplier’s or platform’s registration Name – Tax Identification Number, Tax Period – Currency, Taxable amount at the standard rate, Taxable amount at a reduced rate(s), if any, Tax amount payable.

- Payment: When submitting a simplified VAT return, you must include the bank transfer swift document in the attached icon, and the swift’s specific details are as follows:

-

- Beneficiary Bank Name: Central Bank of Egypt

- Beneficiary Cust Name: Ministry of Finance/Egyptian Tax Authority.

- SWIFT Code: CBEGEGCXXXX

- USD; IBAN Code: EG140001000100000004082189165

- Euro; IBAN Code: EG510001000100000004082189178

- GBP; IBAN Code: EG670001000100000004082189181

5.2 Registration and Periodical Compliances – India GST Perspective

Mandatory Registration

- Overseas supplier of Digital services liable to obtain GST registration

- Registration is mandatory irrespective of the Turnover

- Registration to be obtained within 30 days of becoming liable

Registration Process

- Single registration under Simplified Registration Scheme

- Form GST REG – 10

- Application to be filed online

Registration by Representative

- Overseas supplier of digital services can appoint a person in the taxable territory for the purpose of:

-

- Registration under GST

- Payment of taxes

Monthly Return

- Monthly return

- Form GSTR-5A

- Timeline: 20th of month succeeding the relevant calendar month

Annual Return

- Exemption from filing of Annual Return unlike a domestic supplier of service who needs to file Annual Return in GSTR-9

- Exemption from filing of Annual Reconciliation Statement unlike a domestic supplier of service who needs to file the reconciliation statement in form GSTR-9C

Invoicing Requirement

- Requirement to issue a Tax invoice

- Tax invoice to include name of Recipient State – This will be considered as official address of the recipient for determination of place of supply of service

6. Penal Consequences

6.1 Penal Consequences for Non-compliances – Egypt VAT Perspective

| Particulars | Charges |

| Late VAT payment (1) | ETA charges 1.5% additional tax on the taxpayer per month or part of a month |

| Late filing/Non filing of the VAT return/declaring inaccurate information (1) | ETA is entitled to impose a penalty between EGP 3K and EGP 50K |

| VAT return not submitted within 60 days of the due date (1) | A penalty between EGP 50K and EGP 2M will be imposed |

| Tax evasion (1) | Penalty of EGP 5K to EGP 50K and/or imprisonment between 3 and 5 years. Double if recommitted within 3 years. |

| Not reporting invoices in time (1) | Penalty between EGP 20K and EGP 100K |

| Failure to obtain registration by non-resident (2)

|

ETA may ban access to Egyptian markets until registration is obtained. Also, when Egyptian tax laws are not complied, ETA will contact the responsible person, and if they don’t respond, ETA may commence a risk review.

A Risk Review may result in: Registering the person for Egyptian VAT and sending an assessment of liability based on ETA’s calculation with additional penalties. Registering the debt in the court in the responsible person’s Country |

- (Law no. 206 of 2020)

- (Law no. 3 of 2022)

6.2 Penal Consequences for Non-compliances – India GST Perspective

6.2.1 Failure to File GSTR-5A (Monthly Return)

INR 200/- per day of default [i.e. INR 100/- each per day under CGST Act and SGST Act] subject to a maximum of INR 10000/- [i.e. INR 10000/- each under CGST and SGST Act]

6.2.2 Interest for Delay in Payment of Tax

18% P.A. for the period in default

6.2.3 Failure for Payment of Tax

Higher of the following:

INR 20000/- [i.e. INR 10000/- each under the CGST act and SGST act

OR

Amount equivalent to tax evaded

6.2.4 Failure to Obtain Registration

Higher of the following:

INR 20000/- [i.e. INR 10000/- each under the CGST act and SGST act

OR

Amount equivalent to tax evaded

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA

One thought on “Cross-Border Digital Services Taxation – Egypt VAT and India GST Overview”