Corporate Tax in UAE | Basic Primer

- Blog|International Tax|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 29 March, 2023

Table of Contents

- Tax Regime – UAE

- Need to introduce CT in the UAE

- Taxable Persons and Basis of Taxation\

- PE Concept

- Applicability to Free Zone Companies\

- Calculation of Taxable Income

- Losses and Grouping Relief

- Transfer Pricing & GAAR

- Calculation of CT liability and Compliance aspects

- Observations and India-UAE Comparison

1. Tax Regime – UAE

2018 – Introduction of VAT

2019 – Introduction of Economic Substance Regulations

31st Jan, 2022 – Announcement of Corporate Tax (CT)

28th Apr, 2022 – MOF launched Public consultation for CT

9th Dec, 2022 – CT Law issued

1st Jun, 2023 – Applicability of Corporate Tax

2. Need to introduce CT in the UAE

UAE intends to cement its position as a leading global hub for businesses and investment.

- Commitment to meeting International Standards for Tax transparency

- Preventing harmful Tax Practices

- Basis to implement Pillar 2 of BEPS OECD

2.1 CT Rates

Individuals and Juridical Persons

| Taxable Income | Applicable Tax Rate |

| Up to AED 3,75,000 | 0% |

| More than AED 3,75,000 | 9% |

Qualifying Free Zone Persons

| Taxable Income | Applicable Tax Rate |

| On Qualifying Income* | 0% |

| Taxable income that is not Qualifying Income | 9% |

*To be specified in a Cabinet Decision in due course

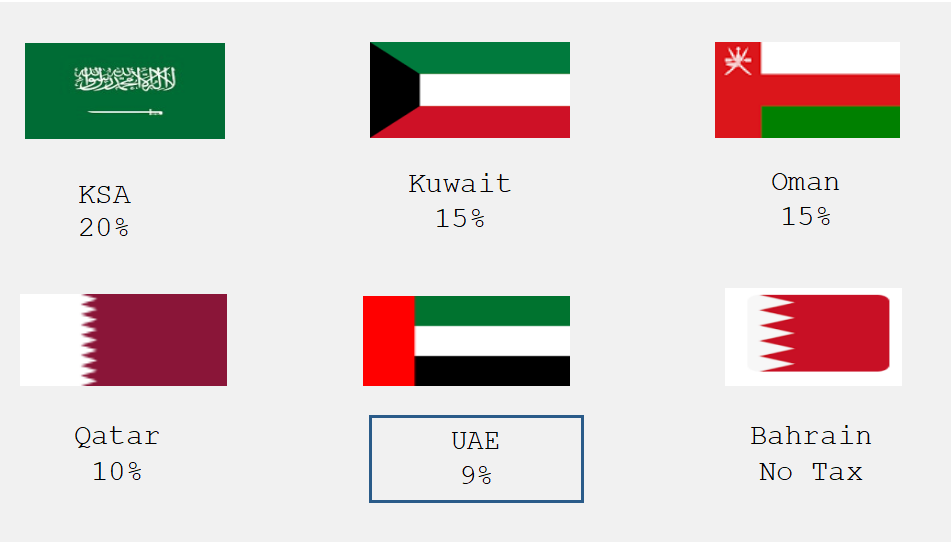

2.2 CT Rates in GCC

2.3 Effective Dates

The CT Law will apply to businesses on tax periods on or after 1st June, 2023

| Serial

Number |

Financial Year | Corporate Tax Effective for the first Time for the year Starting |

| 1 | January – December | 1 January 2024 |

| 2 | April – March | 1 April 2024 |

| 3 | July – June | 1 July 2023 |

3. Taxable Persons and Basis of Taxation

3.1 Taxable Persons

Residents

- Legal persons incorporated or established in the UAE, including Free Zones

- Natural persons who conduct a business or business activity in the UAE

- Foreign entities effectively managed and controlled in the UAE

Non-Residents

- Having a Permanent Establishment (PE) in the UAE

- Earning State sourced income

- Having a nexus in the UAE

3.2 Basis of Taxation

3.2.1 UAE Residents will be taxable on their worldwide income.

However, for a natural person, the scope will be limited to the income earned from their business or business activity (to be specified in the Cabinet decision)

3.2.2 Non-residents will be taxable on:

-

- Income attributable to their in the UAE, or

- State-sourced income not attributable to a PE

- Income attributable to the nexus of the Non-resident.

3.3 Taxation for Individuals in UAE

-

- Individuals who conducts a business or business activity in the UAE Salary, interest etc. earned in personal capacity not taxable

- Categories of business or business activity to be specified in a Cabinet decision

- Wide definition of Business “any activity conducted regularly, on an ongoing and independent basis by any Person

- Income derived from the UAE or from outside the UAE insofar as it relates to the Business or Business activity conducted by the individual in the UAE

3.4 Taxation – Others

3.4.1 Unincorporated Partnership

-

- To be treated as fiscally transparent

- Partners to be considered as conducting business

- Partnership can elect to be considered as a Taxable Person

3.4.2 Family Foundations

-

- Can apply to be treated as Unincorporated Partnership upon meeting certain conditions

4. PE Concept

-

- Fixed Place

-

-

- Branch, office, factory, building site, construction project where activities are carried on for over 6 months etc.

- Exclude: Preparatory or Auxiliary activities

-

-

- Dependent Agent

-

-

- Person having and habitually exercising authority for concluding or negotiating contracts

-

-

- Any other form of nexus in UAE as may be specified

4.1 UAE Sourced Income

-

- Income derived from UAE resident Person

- Income derived from a Non-resident Person where it attributable to PE

- Income accrued or derived from activities performed in UAE, assets located, capital invested, rights used, or services performed or benefitted from in UAE.

- Miscellaneous other categories (sale of goods in UAE, provision of services rendered/utilized/benefitted in UAE, right to use IP in UAE, insured assets located in UAE, the borrower is UAE resident, etc.)

4.2 Exemption List

-

- The UAE Federal/Emirate Government Entity and their department, agencies, authorities, or other publicinstitutions

- Entity wholly owned and controlled Government-owned UAE company that is listed in a CabinetDecision

- Businesses engaged in the extraction of UAE natural resources and related non-extractive activities

- Public Benefit Entities that are listed in a CabinetDecision;

- Investment Funds that meet the prescribed conditions;

- Public or private pension or social security funds thatmeet certain conditions; and

- UAE juridical persons that are wholly-owned and controlled by certain exempted entities after meeting certain conditions.

5. Applicability to Free Zone Companies

1. CT Applicable to companies and branches that are registered in a Free Zone (referred to as ‘Free zone persons’)

2. “Qualifying Free Zone Persons” will be subject to UAE CT at the following rates:

-

-

- 0% on Qualifying Income (to be as specified in the Cabinet decision)

- 9% on Taxable Income that does not meet the Qualifying Income definition

-

3. “Qualifying Free Zone Persons” should meet all of the following conditions:

-

-

- Maintain adequate substance in UAE

- Derives Qualifying income

- Has not elected to be subject to CorporateTax

- Complies with Transfer pricing provisions and documentation

-

4. All Free Zone entities will be required to register and file a CT

6. Calculation of Taxable Income

Accounting net profit/loss as per Standalone FS adjusted for the following:

-

- Any unrealized gains or loss – Exempt Income

- Reliefs (intra- group transfer/business restructuring) – Deductions

- Transactions with Related Parties and Connected Persons – Tax loss relief

- Any Incentives or special reliefs – Any other adjustment (As specified in a decision issued by the Cabinet at the suggestion of the Minister)

6.1 Exempt Income and Deductions

Less: Exempt income

-

- Dividends and other profit distributions received from domestic companies

- Dividends and other profit distributions received from foreign companies subject to Participating Interest

- Capital gains from Participating interest

Participating interest conditions –

-

-

- Minimum 5%shareholding

- Holding period 12 months

- 9% taxation of investee

-

-

- Income from Foreign PermanentEstablishment

- Income earned from operating or leasing aircraft or ships used in international transportation by a non-resident subject to conditions

Add: Non-Deductible Expenditure

-

- Fines and penalties

- Donations to non-qualifying public benefit entity

- Interest expense in excess of 30% of EBITDA (carry forward for 10 years)

- 50% of entertainment expenditure

- Unrealised gain/losses on capital items

- Expenditure for earning exempt income

- Recoverable VAT

7. Losses and Grouping Relief

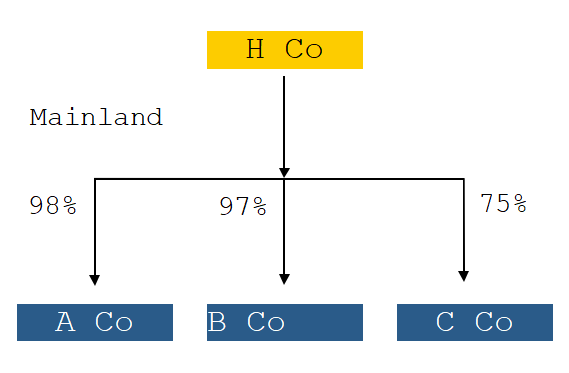

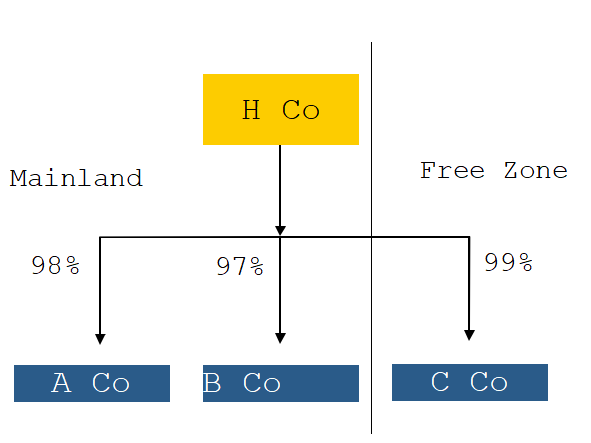

7.1 Tax Grouping

-

- A UAE group of companies can elect to form a Tax group and be treated as a single taxable person (all conditions of at least95% shareholding, voting rights, and profit entitlement, directly or indirectly, are to be satisfied)

- Applicable to Resident Parent companies and subsidiaries

- Exempt person and Qualifying Free Zone person cannot be a group member

- All group members must follow the same financial year and same accounting standards

- Taxable income of the Tax Group shall be determined at a consolidated level, eliminating transactions between the members of the Tax

- Parent company responsible for filing of tax return and payment of CT on behalf of the tax group

- Only a single tax return will be required to be filed

Examples

-

- H Co, A Co and B Co can elect to form a Tax Group

- C Co cannot be a part ofTax Group as the shareholding is 75% (<95%)

-

- H Co, A Co and B Co can elect to form a Tax Group

- C Co cannot be a part of Tax Group as it is a Qualifying free zone person availing 0% CT rate benefit

Illustration

‘000 (in AED)

| PARTICULARS | COMPANY A | COMPANY B | TAX GROUP |

| Revenue (non-intra group) | 1,000 | 4,000 | 5,000 |

| Revenue (intra group) | 1,500 | 0 | 0 |

| Cost (non-intra group) | 500 | 1,500 | 2,000 |

| Cost (intra-group) | 0 | 1,500 | 0 |

| Net taxable Income | 2,000 | 1,000 | 3,000 |

| Tax rate | 9% | ||

| Exemption Threshold | 375 | 375 | 375 |

| Tax Liability | 146.25 | 56.25 | 236.25 |

| Comparative Liability | 202.50 | 236.25 | |

-

- Individual Company’s tax liability can be lower than the Tax Group as they have the benefit of availing separate exemption threshold whereas in case of a Tax Group, the benefit of threshold exemption is available once as a whole

Illustration

‘000 (in AED)

| PARTICULARS | COMPANY A | COMPANY B | TAX GROUP |

| Revenue (non-intra group) | 1,000 | 4,000 | 5,000 |

| Revenue (intra group) | 1,500 | 0 | 0 |

| Cost (non-intra group) | 3,000 | 1,500 | 4,500 |

| Cost (intra-group) | 0 | 1,500 | 0 |

| Net taxable Income | -500 | 1,000 | 500 |

| Tax rate | 9% | ||

| Exemption Threshold | 375 | 375 | 375 |

| Tax Liability | 0 | 56.25 | 11.25 |

| Comparative Liability | 56.25 | 11.25 | |

Tax Grouping can be beneficial in case where individual Companies are loss making

7.2 Tax Losses

-

- Losses incurred allowed to be set off against taxable income in subsequent financial periods

- Maximum loss to be set off capped to 75% of the taxable income

- Excess losses allowed to be carried forward indefinitely provided the same shareholder owns at least 50% of the share capital

- If there is a change in ownership of more than 50%, tax losses may still be available for carry forward provided the new owners carry out same/similar

The following losses will not be available for set off:

-

- Incurred before effective date CIT

- Incurred before person becomes taxpayer for UAECT

- Incurred from activities/assets which generate exempt income

7.3 Transfer of Losses and Regrouping Relief

Special provision for transfer of losses

-

- Both taxable persons are resident juridical persons

- Either taxable person has a direct or indirect ownership interest of at least 75% in the other, or a third person has a direct or indirect ownership interest of at least 75% in each of the taxable person

- The common ownership must exist from the start of the tax period in which the tax loss is incurred to the end of the tax period in which the other taxable person offsets the tax loss transferred against its taxable income

- None of the persons are an exempt person nor a Qualifying Free ZonePerson

- Should follow same financial year and same accounting standards

Group Relief

-

- Intra-group transfer relief will be available for transfers of assets and liabilities between UAE resident companies (condition of 75% shareholdings and 2 years).

- Restructuring or Re-organizing (e.g., merger) will be considered tax neutral on fulfillment of certain conditions (condition of 2 years)

8. Transfer Pricing & GAAR

8.1 Transfer Pricing

-

- The CT regime will have transfer pricing rules applicable to domestic as well as international transactions between“Related Parties” and “Connected Persons’’

- Businesses will need to comply with transfer pricing rules and arm’s length principle as set out in the OECD Transfer Pricing Guidelines

Meaning of Arm’s length principle (ALP)

-

- In order for a transaction or arrangement between Related Parties or Connected Persons to meet arm’s length standard, the results of the transaction or arrangement must be consistent with what the results would have been if they had been between parties that are not related to each other

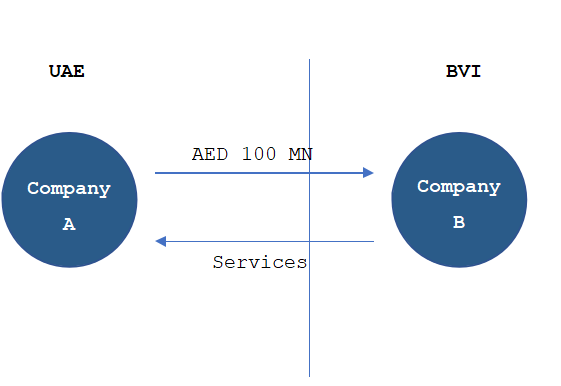

Examples

-

- CT in UAE – 9%

- CT in BVI – 0

- Transfer of profits from Company A to CompanyB

- Transaction Value = AED 100MN

- Arm’s length Value = AED 75MN

- Post CT implementation = AED 75 MN will be allowed as a deduction to Company A

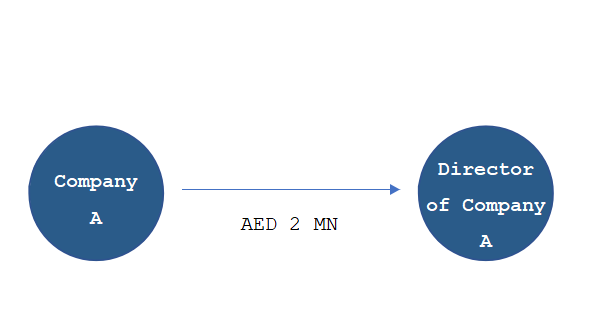

-

- Remuneration to Director = AED 2MN

- Arm’s length Value = AED 1MN

- Post CT implementation = AED 1 MN will be allowed as a deduction to Company A

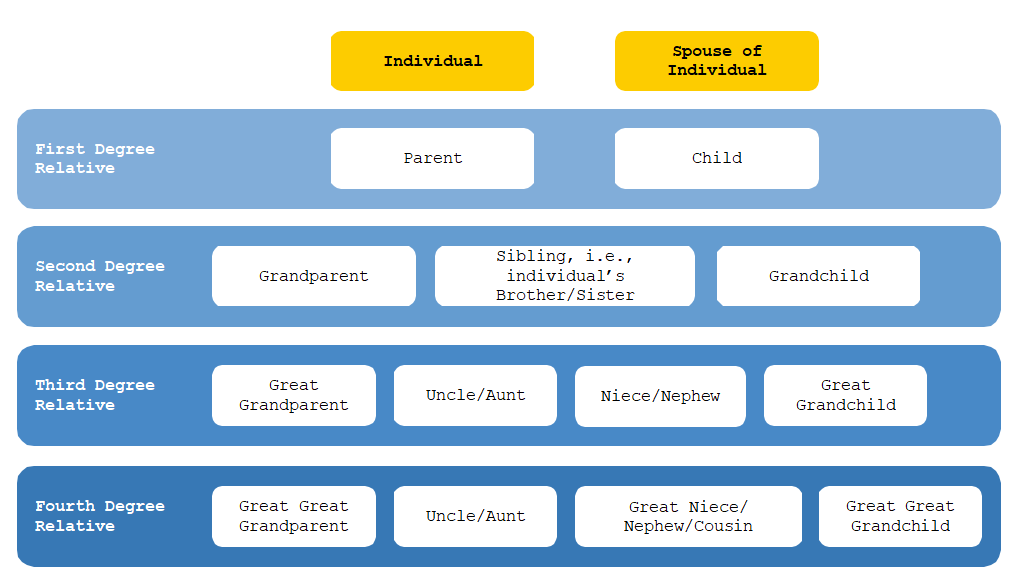

8.2 Related Parties

1. Two or more are individuals related

-

-

- Related to the fourth degree of kinship or affiliation, including by adoption or guardianship

-

2. Individual related to a legal person

-

-

-

- Individual alone or together with a related persons directly or indirectly owns 50% or more of share capital or control

-

-

3. Two or more legal entities are related

-

-

-

- One Legal entity together with related parties directly or indirectly owns 50% or more of shares in other entity or its controls

- Any person alone, or with a related party, directly or indirectly owns a 50% share of each or controls them

- Branch or Permanent Establishment (PE)

- Two or more Partners in the same unincorporated partnership

- Trustee, founder, settlor, or beneficiary of trust/foundation and its related parties

-

-

8.3 Fourth Degree of Kinship

Wide definition of “Control”:

Ability to influence –

-

- 50%Voting rights

- 50% Board of Directors

- 50%Profits

- Exercise significant control

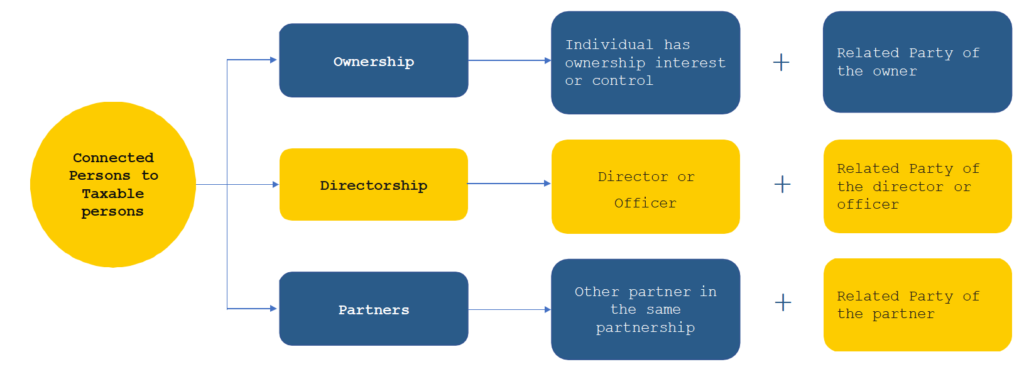

8.4 Connected Persons

8.5 Transfer Pricing Methods

Any other TP method may be applied where none of these methods can be reasonably applied to determine ALP.

Transaction Methods

-

- Comparable Uncontrolled Price (CUP) Method

- Cost Plus Method

- Resale price Method

Profit Methods

-

- Transactional Net Margin Method (TNMM)

- Transactional Profit Split Method

8.6 Transfer Pricing Documentation

-

- Business to submit a disclosure along with the Tax return relating to transactions with related parties and connected persons

- Business to maintain the following transfer pricing documentation regarding their related party and connected persons transactions (conditions to be specified in due course)

– Local file –Detailed information on all relevant material intercompany transactions of a particular group entity in each country, similar to TPdocumentation

– Master File – Global information about a multinational group, including specific information on intangibles and financial activities that is to be made available to all relevant country tax administrations

-

- Documentation to be submitted with 30 days or any other later date as specified when requested by the Authority

- Opening Balance sheet to be prepared taking into consideration the ALP

8.7 General Anti-Abuse Rules (GAAR)

Case 1: No tax planning

UAE Co 1

Total Income = 600K

Total CT liability= 9% (600-375) =~20K

Case 2: Tax planning by splitting business

UAE Co 1

Total Income = 375K

Total CT liability= 0 as below threshold

UAE Co 2

Total Income = 225K

Total CT liability= 0 as below threshold

Will GAAR provisions apply?

-

- Applicable to a transaction or an arrangement entered

– not a valid commercial or other non-fiscal reason which reflects economic reality and

– Main purpose or one of the main purposes is to obtain a Corporate Tax Advantage

-

- FTA may determine to counteract or adjust the transaction/arrangement

- GAAR provisions to apply even for the transition period from the time of law becomes published and till it becomes effective

9. Calculation of CT liability and Compliance aspects

| Determination of CT payable | Amount (in AED) |

| Accounting net profit (or loss) as stated in the financial statement | XXXX |

| Add/less : Non-deductible expenses/exempt income | XXXX |

| Final taxable income | XXXX |

| Final taxable income between AED 0 – AED 375,000 | CT @ 0% (A) |

| When final taxable income is above AED 375,000, the difference between the final taxable income and AED | CT @ 9% (B) |

| CT liability | A + B |

| Less : Foreign Tax Credit | XXXX |

| Final CT payable | XXXX |

9.1 Tax Credits

Foreign Tax Credit

-

- Tax paid in a foreign jurisdiction shall be allowed as a tax credit against UAE CT liability

- The maximum foreign tax credit available will be lower of:

– The amount of tax paid in the foreign jurisdiction

– The UAE CT payable on the foreign sourced income

-

- Any utilized foreign tax credit will not be allowed to be carried forward or carried back

Withholding Tax

-

- Withholding tax is a tax collected at source by the payer on behalf of the recipient of the income

- 0% withholding taxes to apply on domestic and cross-border payments of any nature

- Following income shall be subject to 0% withholding rate

– State sourced income earned by Non-resident persons not attributable toPE

– Any other income as may be specified in Cabinet decision

-

- There will be no obligation to file withholding tax return

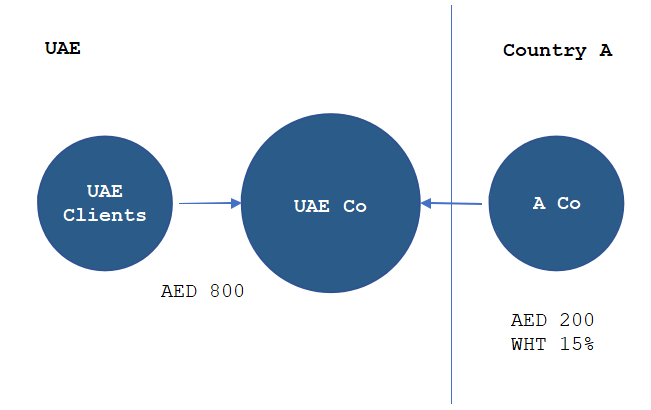

Illustration

-

- Income fromUAE = 800

- Income from CountryA = 200

- Donation paid to unapproved charity = 200

- Penalty = 100

- Withholding tax in Country A = 15%

‘000 (in AED)

| Calculation of CT Liability | ||

| Income (800+200) | 1,000 | |

| Add: Donation to unapproved charity

Penalty |

200

100 |

300 |

| Total taxable Income | 1,300 | |

| Taxable income between AED 0 – AED 375 | CT @0% | 0 |

| Taxable income above AED 375 (1,300-375) = 925 | CT @9% | 83.25 |

| CT liability | 83.25 | |

| Less: Foreign Tax Credit

Lower of – Country A WHT = 200*15% = 30 UAE CT = 200*9% = 18 |

18 |

|

| Final CT payable | 65.25 |

9.2 Tax Compliance – Procedure

1. Registration

Obtain Tax Registration Number (TRN) separately within prescribed time from Federal Tax Authority (FTA).

2. Return

-

-

- One tax return filing requirement.

- Return to be filed within 9 months of relevant tax

-

3. Payment of tax

Tax to be paid before filing of tax return.

4. Assessment

-

-

- Tax Procedures Law and decisions issued in the implementation to be followed.

- Fines and penalties to be determined based on above.

- A Taxable person (including an exempt person) will be required to maintain all records and documents for 7years

-

9.3 Other aspects

-

- A Taxable person (including an exempt person) will be required to maintain all records and documents for 7 years

- Requirement to maintain audited or certified financial statements will be specified in a separate decision

- Option to file Clarification by way of filing application with FTA-

– Regarding application of the CTLaw;

– Conclusion of Advance Pricing Agreements(APAs)

Form and manner of filing the applications would be provided in due course

-

- Simplified compliance obligation for businesses available based on Revenue under Small Business Relief (threshold yet to be specified)

10. Observations and India-UAE Comparison

10.1 Observations

-

- While the intent is to keep compliance simple and provide relief to small businesses, some of the provisions, if implemented as it is, e.g., domestic transfer pricing, PE determination, etc., could be more cumbersome and prone to litigation.

- Its very positive that there are minimum adjustment between book and tax profits however, there should have been a basic consistency in adoption of accounting policy.

- The Law introduces GAAR and the GAAR provisions will be applied if any taxable person has tried to alter its transaction or business model during transition period to obtain only tax benefit.

- Some of the important details are still awaited in the Implementing Regulations only.

10.2 Action Points for Compliance with Corporate Tax

-

- Undertake a high-level assessment of how the draft law could potentially impact the businesses

- Review of existing business structure and evaluate alternatives to restructure to optimize tax and compliance cost

- Adopt changes to compensation mechanism for shareholders/directors/ foreign affiliates to be consistent from CT Perspective

- Prepare to have sufficient information available to meet TP documentation and compliance which are mandatory

- Training of in-house teams on the developments, and changes that may be required from an IT system perspective to collate all information

10.3 CT – Comparison between India and UAE

| Particulars | India | UAE |

| Tax Year | 1st April to 31st March | Any financial year followed for financial statements can be adopted as tax year |

| Tax Rate |

|

9% is applicable on Corporates and Individuals if the taxable Income exceeds threshold limit of 375,000 AED. CT will apply to individuals only if they conduct a business/business activity |

| Free Zones | Deduction based on export turnover |

|

| Advance Tax and Withholding Tax |

|

Advance Tax not applicable Withholding Tax not applicable for residents. In case of non-residents – 0% |

| Particulars | India | UAE |

| Interest Expenses Deduction | Interest expense deduction on payment to non- resident associated enterprise is capped to 30% of EBITDA (threshold of INR 1 crore) | Net Interest expense deduction will be capped to 30% of EBITDA –whether paid to related party or to any other party (threshold to be specified in due course) |

| Transfer Pricing Regulations |

|

|

| General Anti-Avoidance Rule (GAAR) | Threshold of INR 3 Crores specified | No threshold limit prescribed for applicability of GAAR. |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA