Corporate Guarantee under GST – Ongoing Litigations | Amendment | Clarifications

- Blog|GST & Customs|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 3 September, 2024

A Corporate Guarantee under GST refers to a commitment made by a company, often within a group, to guarantee the repayment of a loan or fulfillment of an obligation for another company, typically without direct consideration. Under GST, this arrangement is classified as a service, and its valuation is guided by Rule 28(2) of the CGST Rules, 2017. This rule specifies that the value of such a guarantee is deemed to be either 1% of the guarantee amount or the actual consideration, whichever is higher, when provided between related parties, such as intergroup companies. The rule ensures that GST is applicable on the provision of corporate guarantees, whether the transaction involves a related party or occurs without consideration. Recent clarifications have outlined that GST applies unless the guarantee is purely contingent and unenforceable until actioned upon by the creditor, with specific provisions for imports and exports as well.

By Sakshi Jhajharia – Chartered Accountant [Indirect Tax Advisory and Litigation]

Table of Contents

- Timeline of Events

- What is a Contract for Guarantee? Section 126 of Indian Contract Act, 1872

- Corporate Guarantee Transaction

- Service Tax Regime

- Scope of Supply – GST

- Value of Supply

- Clarifications Issued vide Circular No. 225/19/2024-GST

- Corporate Guarantee – Import/Export

- Time of Supply

- GST on Corporate Guarantee Prior to Insertion of Rule 28(2)

- Revision of Corporate Guarantee

- Way forward

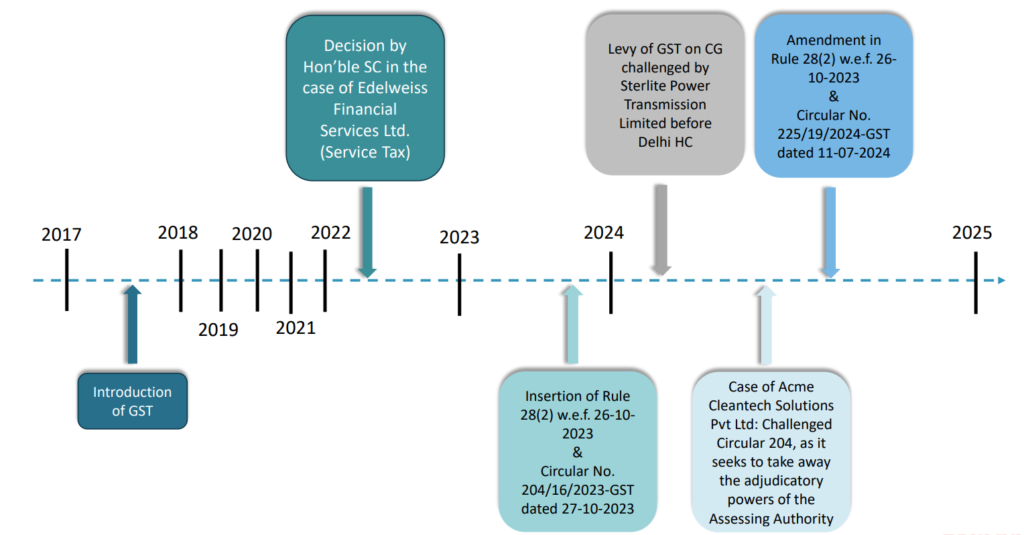

1. Timeline of Events

2. What is a Contract for Guarantee? Section 126 of Indian Contract Act, 1872

- A contract to perform the promise/discharge the liability

- Of a third person

- In case of his default

- May be oral or written

A “contract of guarantee” is a contract to perform the promise, or discharge the liability, of a third person in case of his default.

The person who gives the guarantee is called the “surety”, the person in respect of whose default the guarantee is given is called the “principal debtor”, and the person to whom the guarantee is given is called the “creditor”.

A guarantee may be either oral or written.

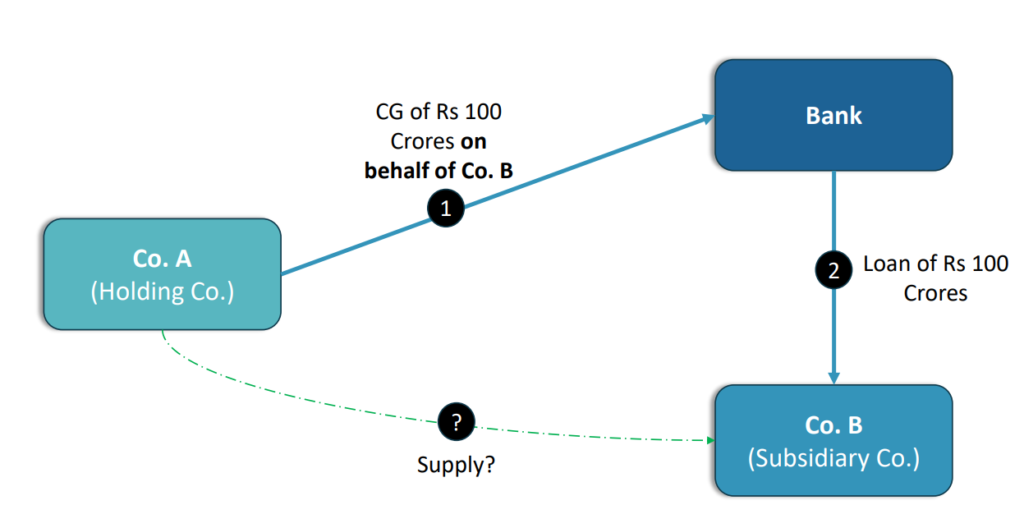

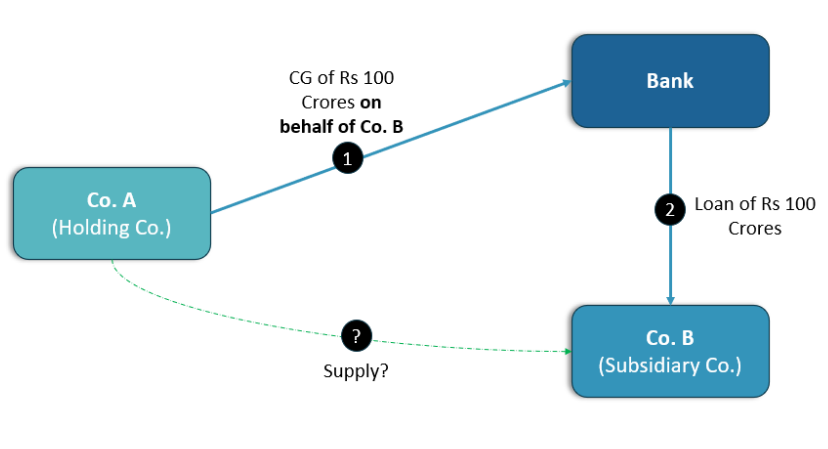

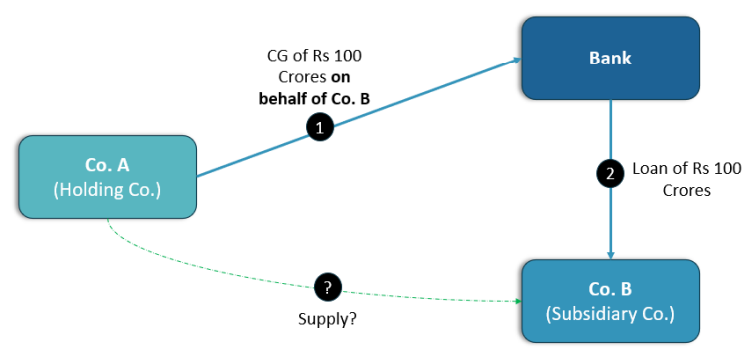

3. Corporate Guarantee Transaction

Key Point: Corporate Guarantee generally is given by intergroup companies for loan availed by another, without consideration

4. Service Tax Regime

Commissioner of CGST & Central Excise v. Edelweiss Financial Services Ltd. [2023] 149 taxmann.com 76 (SC). The appeal by the Revenue was dismissed on the ground that that no effort was made on behalf of the Revenue to demonstrate that issuance of corporate guarantee to group companies without consideration would be a taxable service.

Held: Issuance of corporate guarantee by the taxpayer to group companies without consideration is not a taxable service, under the Service Tax regime.

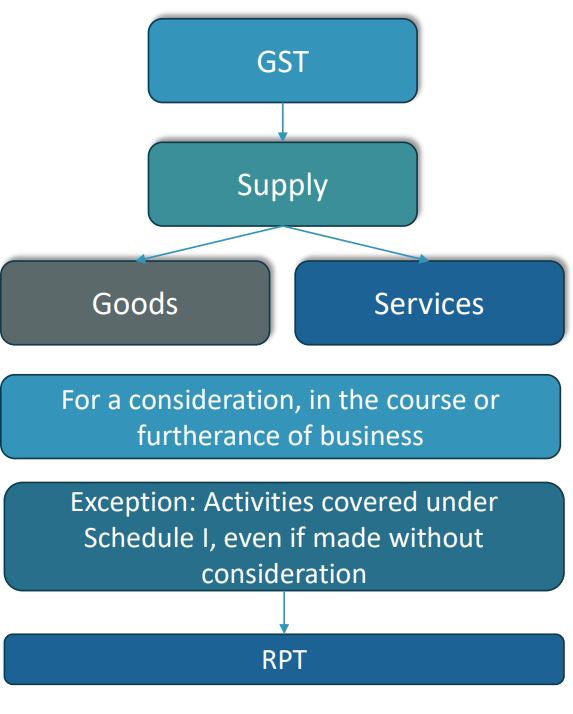

5. Scope of Supply – GST

Section 2(102):

“services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged

Classification entry: 997113

“credit-granting services including stand-by commitment, guarantees & securities”.

Section 7:

“Supply includes –

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

….

(c) the activities specified in Schedule I, made or agreed to be made without a consideration”

Schedule I:

“ACTIVITIES TO BE TREATED AS SUPPLY EVEN IF MADE WITHOUT CONSIDERATION

…..

2. Supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business”

Explanation to Section 15:

“For the purposes of this Act,–persons shall be deemed to be “related persons” if––

……

(iv) any person directly or indirectly owns, controls or holds twenty-five per cent. or more of the outstanding voting stock or shares of both of them;

(v) one of them directly or indirectly controls the other”

Section 2(93): “recipient” of supply of goods or services or both, means–

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered, and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;

6. Value of Supply

6.1 Rule 28 (up to 25-10-2023)

The value of the supply of goods or services or both between distinct persons as specified in sub-section (4) and (5) of section 25 or where the supplier and recipient are related, other than where the supply is made through an agent, shall:

- be the open market value of such supply;

- if the open market value is not available, be the value of supply of goods or services of like kind and quality;

- if the value is not determinable under clause (a) or (b), be the value as determined by the application of rule 30 or rule 31, in that order:

Provided that where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person:

Provided further that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

6.2 Rule 28(2) (inserted vide Notification No. 52/2023 – Central Tax dated 26-10-2023 w.e.f. 26-10-2023)

(2) Notwithstanding anything contained in sub-rule (1), the value of supply of services by a supplier to a recipient who is a related person, by way of providing corporate guarantee to any banking company or financial institution on behalf of the said recipient, shall be deemed to be one per cent of the amount of such guarantee offered, or the actual consideration, whichever is higher.

6.3 Rule 28(2) (amended vide Notification No. 12/2024 – Central Tax dated 10-07-2024 w.e.f. 26-10-2023)

(2) Notwithstanding anything contained in sub-rule (1), the value of supply of services by a supplier to a recipient who is a related person located in India, by way of providing corporate guarantee to any banking company or financial institution on behalf of the said recipient, shall be deemed to be one per cent of the amount of such guarantee offered per annum, or the actual consideration, whichever is higher.

Provided that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the value of said supply of services.

- Valuation rule for corporate guarantee is applicable in cases where supplier and recipient are related persons.

- The corporate guarantee must be given to a banking company or financial institution

- The value of supply shall be deemed to be 1% of the amount of such guarantee offered p.a. or the actual consideration, whichever is higher

- If recipient is eligible for full ITC, value declared on invoice shall be deemed to be VoS of such service

7. Clarifications issued vide Circular No. 225/19/2024-GST

| Sl. No. | Issue | Clarification |

| 1 | Is Rule 28(2) of CGST Rules applicable w.e.f. 26/10/2023 or does it have a retrospective application? | CG issued prior to 26/10/2023: Since Rule 28(2) provides for valuation and not taxability, valuation as per Rule 28 to be adopted.

CG issued/renewed on or after 26/10/2023: Rule 28(2) to apply |

| 2(a) | What is the value of supply (VOS) of CG where the loan amount is less than amount of guarantee? | VOS of the service of providing a CG is the amount of ‘guarantee offered’ and not based on the amount of loan actually disbursed. |

| 2(b) | Is recipient eligible to avail ITC of the above? | Yes. ITC eligibility does not depend on the loan amount. |

| 3 | Is GST applicable on CG in case of takeover of loans, since it is merely an assignment of already issued CG? | Takeover of loans by one bank from another, without issuance of a fresh CG or renewal of CG would not tantamount to provision of CG service. GST not applicable. |

| 4 | Where CG is provided by more than one entity, what is the amount on which GST is payable by each co-guarantor? | If the total consideration paid to the guarantors exceeds 1% of such guarantee offered: VOS to be actual consideration received by each co-guarantor

Other cases: Proportionately on 1% of the guarantee offered by each co-guarantor (in absence of ratio, equal proportion to be taken) |

| 5 | Is intra-group CG liable to RCM? | Supplier & recipient located in India: FCM, supplier to issue invoice

Supplier located outside India, recipient located in India: RCM |

| 6 | What is the periodicity of computation of 1% of guarantee offered? | VOS: 1% of the guarantee offered per annum or the actual consideration, whichever is higher, payable at the time of issuance of such guarantee Example: CG of Rs 1 Crore offered for 5 years. GST payable on (1*5)% = 5% of 1 Crores at the time of issuance of CG |

| 7 | Is the benefit of second proviso to 28(1), not applicable for CG? | Supply of service of CG between related persons, where full ITC is available to the recipient, the value declared in the invoice shall be deemed to be the VOS of the said service |

| 8 | Whether the valuation in terms of Rule 28(2), will apply to the export of the service of providing CG between related persons? | Rule 28(2) shall not apply to the export of the services of providing CG between related persons |

8. Corporate Guarantee – Import/Export

8.1 Import

Section 2(11) of IGST Act: “Import of services”

- the supplier of service is located outside India;

- the recipient of service is located in India; and

- the place of supply of service is in India;

Applicability of RCM: Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient.

If recipient eligible for full ITC: Any value

8.2 Export

(6) “export of services” means the supply of any service when,––

- the supplier of service is located in India;

- the recipient of service is located outside India;

- the place of supply of service is outside India;

- the payment for such service has been received by the supplier of service in convertible foreign exchange or in Indian rupees wherever permitted by the Reserve Bank of India; and

- the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

– Rule 28(2) is not applicable.

– Valuation may be done as per Rule 28(1)

9. Time of Supply

In the absence of consideration, the time of supply may be required to be determined in accordance with Section 13(5) of the CGST Act, which states as under:

(5) Where it is not possible to determine the time of supply under the provisions of sub-section (2) or sub-section (3) or subsection (4), the time of supply shall––

(a) in a case where a periodical return has to be filed, be the date on which such return is to be filed; or

(b) in any other case, be the date on which the tax is paid.

Where it is not possible to determine the time of supply under the provisions of sub-section (2) or sub-section (3) or sub-section (4), the time of supply shall, in a case where a periodical return has to be filed, be the date on which such return is to be filed.

Banking sector FAQs:

CBIC clarified that when no invoice is raised, no payment is made by recipient or no entry is made in the books of account of the recipient of service, the time of supply shall be the date when such costs are determined, or certificate is received and the GST liability on the said costs shall be discharged accordingly.

10. GST on Corporate Guarantee Prior to Insertion of Rule 28(2)

| Issue | Remarks |

| Was CG taxable prior to insertion of Rule 28(2)? | Yes |

| What if till now someone has not paid GST on CG? | Tax can be paid now, with applicable interest. ITC shall be available to the recipient as invoice date would be current date. In case full ITC is available to the recipient, reference may be drawn to Circular No. 199/11/2023-GST or Circular No. 210/4/2024-GST and ‘Nil’ value may be deemed as the value of supply. |

11. Revision of Corporate Guarantee

11.1 Upward Revision

- GST payable on the differential value of CG, for the period.

- In case of increase in the period, GST payable on the entire value for the extended period

11.2 Downward Revision

- Future litigation may arise for exploring refund options

12. Way forward

- Sterlite Power Transmission Limited v. UOI [2024] 160 taxmann.com 381 (Delhi): the petitioner filed writ petition seeking a declaration that activity of holding company providing a Corporate Guarantee to a subsidiary was not in nature of supply of services taxable under section 9 of CGST Act. The petitioner submitted that provision of corporate guarantee to associate is a contingent contract and is not enforceable till the guarantee is enforced by the entity to which guarantee is provided. Hence, it is only where guarantee is enforced, issue of service may arise. Fixing value at 1 per cent of guarantee offered, would put onerous burden on entity providing corporate guarantee. The Delhi High Court has issued notice to the Revenue and granted stay against any coercive action.

- In the case of Acme Cleantech Solutions (P.) Ltd. vs UOI [2024] 162 taxmann.com 151 (Punj. & Har.): The assessee filed a writ petition before the Hon’ble Punjab & Haryana High Court on the ground that the impugned Circular No. 204/16/2023-GST dated 27-10-2023, seeks to take away the adjudicatory powers of the Assessing Authority as well as the Appellate Authority by clarifying provisions in the nature of adjudication. Vide the interim order, the Court stayed the effect and operation of the impugned Circular with respect to the aforesaid clarification and directed the Appellate Authority to decide the case of the assessee without being influenced by the clarification.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA