Comprehensive Guide to Managing Inventories and Trade Receivables

- Blog|Account & Audit|

- 24 Min Read

- By Taxmann

- |

- Last Updated on 11 April, 2023

Table of Contents

1. Inventories and Trade Receivables

2. Classification of Inventories and Trade Receivables

3. Importance of Separate Disclosure

4. Analysis of inventories and Trade Receivables

9. Bottom line

Check out Taxmann's Balance Sheet Decoded – Keys to Unlock Balance Sheet Secrets which provides a systematic approach to analysing financial statements by connecting different elements such as details, observations, and discussions. It allows for a clear understanding of the entity's business model and ensures accuracy and authenticity, thus fulfilling the objective of logically examining and interpreting financial statements.

1. Inventories and Trade Receivables

Inventories and trade receivables are current assets and it includes assets such as raw materials, work-in-progress, finished goods, stores and spares, packing materials etc. which are intended for consumption or sale in course of normal operating cycle. Inventories are related to items which are expected to be consumed in the manufacturing process being raw material, work-in-progress or the items which are held for the purpose of trade or sale, such as inventory of finished goods or stock-in-trade.

Current assets also include trade receivables which are expected to be realised within 12 months from the Balance Sheet date.

Trade receivables are that part of the amount receivable which pertains to amounts due on account of goods sold or service rendered in the normal course of business. Therefore, the amount due under contractual obligation such as – insurance claim, sale of property, sale of plant and machinery, reimbursement of expenditure etc. cannot be considered as trade receivables.

The inventories include raw materials, work-in-progress, finished goods and by-products in the case of a manufacturing entity. In the case of a trading entity, it includes stock-in-trade i.e. the goods acquired for the purpose of trading. Even if the entity is a manufacturing unit but still doing some trading activity, and if any stock remained at the close of the year, it is shown as “stock-in-trade”. Similarly, the amount of stock relating to stores and spares, fuels, packing materials, loose tools, scrap, etc. are required to be shown separately and form part of the inventories.

Inventory also includes Goods-in-transit, as ownership is transferred to the entity, upon delivery of goods, but since the same has not arrived at the business premises (destination), they are shown as goods-in-transit.

2. Classification of Inventories and Trade Receivables

2.1 Inventories

The inventory primarily held for the purpose of trade requires to be treated as current, even if the same is not expected to be realised within the operating cycle. For example, if the operating cycle is of 6 months and the entity has excess finished goods inventory, which is not expected to be realized in 6 months, the same is still considered as “current”, as the goods are sold as a part of normal operating cycle.

2.2 Trade receivables

Trade receivable also require to be classified between current and non-current. A trade receivable is considered as current, if it is likely to be realized within 12 months from the balance sheet date or operating cycle of the business.

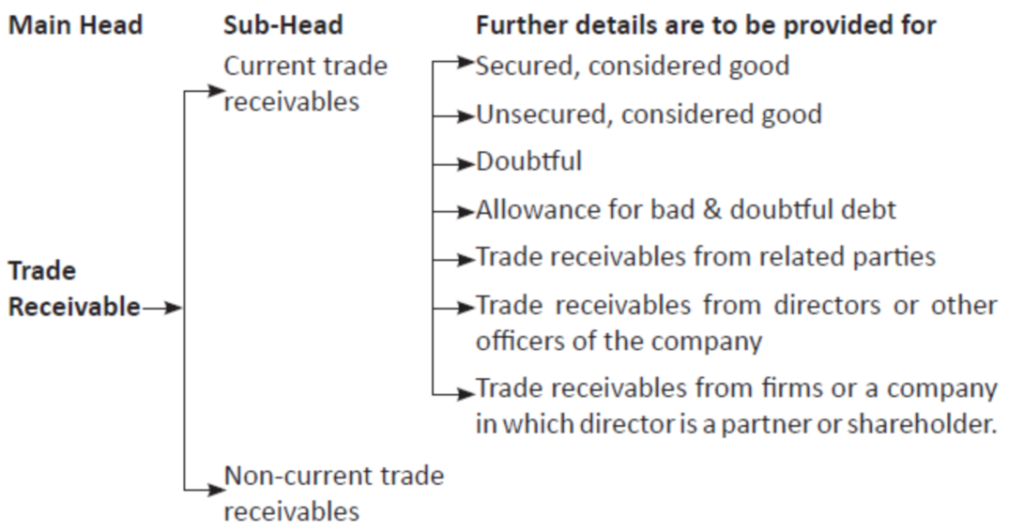

The trade receivables are required to be classified as per Chart 10:

W.e.f. 1st April, 2021 based on amendment in Schedule III to the Companies Act, the trade receivables are to be shown based on ageing periods – less than 6 months, 6 months to 12 months, 1-2 years, 2-3 years and more than 3 years. Further, the trade receivables are to be bifurcated between undisputed-considered good, undisputed considered doubtful, disputed considered good and disputed considered doubtful.

As per Ind AS 109 – “Financial Instruments”, any expected credit loss on trade receivables is required to be recognized as impairment loss allowances (ILA). The amount of impairment loss allowance is not required to be reduced from the amount of trade receivables, but the same is required to be shown as separate line item as deduction from the gross amount of trade receivables.

The separate details of goods-in-transit with respect to each item of the inventory is required to be shown in the notes to the balance sheet.

The mode of valuation of each class of inventory is also required to be disclosed separately.

3. Importance of Separate Disclosure

Separate disclosure is required to be made for inventories pertaining to stock-in-trade. Therefore, if the inventory includes stock-in-trade in the case of a manufacturing or processing entity, it indicates that the entity is also doing trading activities. Therefore, the sales may also include trading sales as there is inventory pertaining to trading. If the trading activity is not a part of the business activities, it may indicate that the entity has undertaken the trading activity, may be for achieving the top line or may be for meeting the growth in the revenue, as projected.

Sometimes, it is also found that the major amount of profit before tax (PBT) is due to trading activities, whereas overall volume of such trading activities as against manufacturing activities is nominal.

Further, which are the items of various inventories which have been carried to balance sheet, can be learnt only when one analyses the details of the inventory. On the basis of analysis of details of inventories, it is also possible to know how much stock is kept by an entity and whether the level of such stock is low or high can be ascertained by comparing the inventory level with the annual sales.

Similarly, what amount of sales made during the year or even earlier year remained unrealized can be learnt only on analysing trade receivables.

4. Analysis of inventories and Trade Receivables

4.1 Inventories

For the purpose of analysis of inventories, the first step is to look at what are the items of the inventory. For example, in the case of a manufacturing entity inventories will be relating to raw material, work-in-progress and finished goods. In the case of a trading concern, the inventory will pertain to stock-in-trade. In the case of a finance company, there will be no inventory. As against this, in the case of a construction entity, the inventory will relate to unsold units or construction under development. Therefore, the first point is to look at the items of inventories and find out whether they match with the business operations of the entity. If inventory items are not related with the business carried out, one needs to ask for the details and find out the reasons.

Thereafter, the most important part of the analysis of the inventory is to find out the holding period of each item of the inventory. For raw materials the holding period is calculated on the basis of average monthly cost of material consumed and dividing the same by the total value of the raw material. The logic behind considering the cost of material consumed for the holding period is that raw material is valued at cost or market price, whichever is less, and normally raw materials are valued at cost.

Cost of material consumed is also based on the actual cost incurred and therefore, used for the purpose of finding out the holding period. In case of work-in-progress, the manufacturing or the processing cost is also added to cost of materials consumed to find out the holding period of work-in-progress.

While working out the holding period of work-in-progress, one should also keep in mind the normal processing/manufacturing cycle. The work-in-progress inventory normally should not exceed the processing/manufacturing cycle. For example, in the case of a textile unit if the processing cycle is 15 days from raw material to finished goods, the stock of work-in-progress, should be less than 15 days. Similarly, holding period of finished goods is calculated based on the cost of material consumed and complete manufacturing cost.

After finding out the holding period, the trend with respect to earlier years and industry trend needs to be compared. If there is too much deviation, the reasons thereof need to be examined.

If the inventory includes packing material, stores and spare parts, fuel etc. the holding period on the basis of average monthly consumption needs to be worked out. Normally, the holding period of these items should be around 3 to 6 months, unless it is imported item or where such items is not readily available. In such a case, the inventory of these items may be higher. Therefore, for the purpose of inventory of packing material, stores and spare parts, fuel etc. the type of industry/business is relevant. For example, in the case of ship manufacturing units the inventory of stores and spare parts may be substantially higher than steel manufacturing units.

4.2 Trade receivables

In the case of trade receivables, the normal credit period is relevant. The trade receivables normally should match the credit period and be of equivalent term. To find out the same, the average monthly sales is worked out on the basis of total sales. On the basis of average monthly sales, how many months of sales is outstanding is worked out and the same needs to be compared with the normal credit period. In case of substantial difference, the reasons thereof need to be ascertained.

The moment the holding period of the inventory or trade receivables is found substantially higher than past trend, or industry practice, it indicates that the inventory may include slow moving/non-moving/obsolete items, and trade receivables may include non-recoverable amounts. In such cases, a detailed analysis and further examination of various facts is required.

The above analysis of holding period in case of inventories and trade receivables is not applicable in the case of seasonal industries. In the case of seasonal industries, the holding period is compared to past trends and industry practice.

5. Case Analysis I

This case analysis pertains to a steel manufacturing company situated in Gujarat. In the Balance Sheet as on 31st March, 2021, the details relating to inventories was shown in Schedule 6, as given in Box 50.

5.1 Box 50

| Particulars | As at March 31, 2021 (` ) | As at March 31, 2020 (` ) |

| SCHEDULE 6: INVENTORIES

(As taken, valued & certified by management) (Cost or Net Realisable value whichever is less) |

||

| Stores & Spares | 14,06,80,773 | 14,49,93,208 |

| Raw Materials [Including Goods in Transit and Stock Lying at Port of ` 6,82,93,691/- (P.Y. ` 21,45,26,137)] | 15,57,49,510 | 30,48,56,272 |

| Finished Goods | 11,61,23,537 | 4,14,50,299 |

| Semi-finished Goods | 39,44,904 | 5,00,92,036 |

| By-Products | 11,20,29,824 | 17,77,93,241 |

| TOTAL | 52,85,28,548 | 71,91,85,056 |

For the analysis and unlocking the secrets of inventories, the statement of profit and loss, needs to be looked into. In the Box 51, the profit and loss account of the said company for the said FY 2021 is provided.

5.2 Box 51

Profit and Loss Account for the year ended on 31st March, 2021

| Sch. | Year Ended on 31-3-2021 (` ) |

Year Ended on 31-3-2020 (` ) |

|

| (A) INCOME | |||

| 1. Gross Income from operations | 13 | 3,41,20,74,797 | 3,15,35,53,941 |

| Less :- Excise Duty | 21,11,64,617 | 16,87,30,039 | |

| Net sales | 3,20,09,10,180 | 2,98,48,23,902 | |

| 2. Increase/(Decrease) in Stocks | 14 | (3,72,37,311) | (6,23,89,070) |

| 3. Other Income | 15 | 2,37,78,804 | 5,74,13,144 |

| TOTAL | 3,18,74,51,673 | 2,97,98,47,976 | |

| (B) EXPENDITURE | |||

| 1. Material Consumed | 16 | 2,02,54,88,795 | 1,77,31,42,158 |

| 2. Manufacturing & Other Expenses | 17 | 73,18,92,494 | 72,02,49,343 |

| 3. Interest & Finance Charges | 18 | 22,13,80,899 | 26,87,72,245 |

| TOTAL | 2,97,87,62,188 | 2,76,21,63,746 | |

| (C) Net Profit before Depreciation and Taxation | 20,86,89,485 | 21,76,84,230 | |

| (D) Depreciation | 18,90,71,802 | 19,60,26,610 | |

| (E) Profit before Taxation | 1,96,17,683 | 2,16,57,620 | |

| (F) Provision for Taxation | |||

| Current Tax | 36,00,000 | 20,00,000 | |

| Wealth Tax | 74,069 | 34,000 | |

| Deferred Tax | 47,48,081 | 68,79,614 | |

| Income Tax of Earlier Years | 63,09,560 | 0 | |

| 1,47,31,710 | 89,13,614 | ||

| (G) Profit after Tax | 48,85,973 | 1,27,44,006 | |

| (H) Prior Period Adjustments(refer note No. 16 of Sch. 19) |

21,59,218 | 44,62,982 | |

| (I) Profit for the year | 27,26,755 | 82,81,024 |

Analysis

As can be seen from the profit and loss account that PBT of ` 1.96 crore is shown after considering other income of ` 2.38 crore. The other income is mainly of credit balance written off to the tune of ` 1.57 crore. Thus, the profit is not sufficient, from manufacturing. From the perusal of the details of inventories (Box 50), it is clear that for FY 2021, the total inventories are ` 52.85 crore, as against ` 71.92 crore in FY 2020. It is further seen that out of the total inventories of ` 52.85 crore in FY 2021, the major part is:

-

- Stores & spares of ` 14.07 crore.

- Raw materials of ` 15.57 crore, which includes goods-in-transit and stock lying at port of ` 6.83 crore.

- By-product of ` 11.20 crore.

All the above 3 items of the inventories are unusual in nature, in as much as stores & spare parts inventory is close to 27% of the total inventory in FY 2021 and 20% in FY 2020. Goods-in-transit and stock lying at port is equivalent to 13% in FY 2021 which was equivalent to 30% in FY 2020. Similarly, by-product is equivalent to 21% in FY 2021 and 25% in FY 2020 of the total inventory.

Considering that the entity is into manufacturing of steel, all the above referred 3 items of inventory being disproportionately higher, a further analysis was made. So far as inventory relating to raw materials is concerned, which inter alia included goods-in-transit and stock lying at port, the details relating to CIF value of import and FOB value of export as available in the financial statement is examined. Since, the entity is claiming substantial raw material in FY 2021 as well as FY 2020, as goods-in-transit and stock lying at port, the major item naturally pertains to goods lying at port, because year after year there cannot be substantial amount of raw material in transit at the end of the year.

Information with respect to import and export (as a part of mandatory disclosure) has been provided in the notes on account, as per Box 52.

5.3 Box 52

(J) CIF VALUE OF IMPORTS (Amount in `)

| Particulars | 2020-21 | 2019-20 |

| Raw Materials | 12,61,64,500 | 7,42,80,916 |

| Capital Goods | – | – |

| Stores & Spares | – | – |

(K) EXPENDITURE IN FOREIGN CURRENCY

| Particulars | 2020-21 | 2019-20 |

| NIL | NIL | NIL |

Analysis

Since the stock lying at the port forms part of raw materials, the total raw materials imported by the entity in FY 2011 is of ` 12.61 crore as against which stock claimed at port was of ` 6.83 crore and in FY 2010, against the total import of raw materials of ` 7.43 crore, the raw materials claimed as lying at port was of ` 21.45 crore.

Please note that while imports are of ` 12.61 crore and ` 7.43 crore in the full years ending on 31st March, 2021 and 2020 respectively, at the same time the amount of inventory lying at port during these years are of ` 6.83 crore and ` 21.45 crore.

Considering such glaring disparity in facts, this case was investigated and during the verification of the stock statement which was submitted for the purpose of drawing power, the entire amount in the stock statement has been claimed as lying at port. It was found that the said inventory lying at port was only on paper and did not exist.

While dealing with the issue relating to physical verification, as required to be reported in the CARO report, the observations of the auditor on this issue is as per Box 53.

5.4 Box 53

(a) As explained to us, inventories (excluding Goods in Transit and Goods lying at Port) were physically verified by the management at reasonable intervals during the year. In our opinion, the frequency of verification is reasonable.

Analysis

Therefore, the auditor in the CARO report has clearly stated that stock relating to goods in transit and goods lying at the port was not physically verified during the year. The similar observation was made by the auditor even in the earlier two financial years.

On the basis of these disclosures in the balance sheet the important facts emerges are-

(a) Substantial inventory of raw material was claimed as lying at port

(b) There was no corresponding import of the raw material

(c) Inventory relating to goods lying at port was not physically verified, as per CARO report

Therefore, bank in this case has deputed a team during the investigation to verify the stock lying at the port, as the same was forming part of drawing power. To their utmost surprise, no such stock was found and the entity was wrongly claiming the same as part of inventory. Interestingly, the word “Goods-in-transit” was also added along with the “stock lying at the port”, to mislead the readers/bankers.

Therefore, all parts of the inventories requires critical examination.

In this case analysis, the inventory relating to stores & spares is also found to be inflated. The huge inventory of stores & spares is reported in the stock statement as well as in the balance sheet, for the purpose of higher drawing power, as is apparent from the analysis of consumption of stores & spares and level of inventory, as given in Box 54 below:

5.5 Box 54

Stores and Spares

| Particulars | FY 2020 | FY 2021 | FY 2022 |

| Opening stock | 17.70 | 14.50 | 14.07 |

| Purchases during the year | 5.26 | 5.60 | 3.76 |

| Consumption during the year | 8.46 | 6.03 | 3.26 |

| Closing stock | 14.50 | 14.07 | 14.57 |

Analysis

From the perusal of the above details of stores & spares, it is absolutely clear that yearly purchases are in the range of ` 3.76 crore to ` 5.60 crore and consumption is also in the range of ` 3.26 crore to ` 8.46 crore. With these facts, how could the inventory of ` 14 crore be justified?

This is a clear-cut case of inflated inventory of stores & spares is shown in the books for the purpose of drawing power, as stores & spares is routine in nature, indigenous and in a case of steel industry, one cannot have inventory of stores & spares equivalent to 3 years of consumption.

The actual facts as found are that the stores & spares have been consumed but since profit was not sufficient, the same was carried to Balance Sheet as an inventory, to show higher profit, better current ratio, improved net worth and higher drawing power, as this case was investigated by me, on behalf of a leading nationalised bank.

6. Case Analysis II

The most important part of any balance sheet analysis is to find out early warning signs, so that corrective action can be taken before accounts turned into stress and then non-performing assets.

The analysis of inventories and trade receivables is a crucial part of the analysis of a balance sheet to unlock secrets.

The analysis of the inventories and trade receivables is always based on the trend. The trend is ascertained with regard to level of inventories and trade receivables. The principle is to find: What is the average holding period of raw material, work-in-progress, finished goods, stock-in-trade, in terms of month and similarly, in the case of trade receivables, how many months of sales is outstanding?

To understand the issue properly, mark how the level of inventory and trade receivables are gradually “built up” and thereafter, all issues such as “inventory includes slow moving, non-moving, obsolete stock” and/or “debtor’s balance is subject to confirmation” etc., come up after certain period of time.

This phase comprising of several years can be termed as:

– Base phase;

– Built-up phase;

– Stress phase.

Initial period (base phase) is the period comprising 3-4 years wherein a rosy picture is depicted, built-up phase is after the initial period comprising another 2-4 years wherein the inventory level and debtor’s level is gradually built up to show progress for the purpose of better financial position, good current ratio, for better drawing power etc. Then comes the last phase (stress) in which the bubble is burst.

To explain this important issue, which is found to be commonly used, I have selected a case analysis of a company, comprising of 6 years (from FY 12 to FY 17), wherein, all the 3 phases are found with respect to inventories and trade receivables.

This case analysis pertains to a leading integrated multi-product textile company, manufacturing knitted garments, terry towels, fabric and various kinds of yarn. In the Box 55, the profit & loss statement of the year ended 31st March, 2013 is provided, to give the position of the company for the year 31st March, 2012 and 31st March, 2013, being base-phase.

6.1 Box 55

profit and Loss Statement for the year ended 31st March, 2013

| Particulars | Note No. | Current Year (in ` ) | Previous Year (in ` ) |

| I. Revenue from Operations | 21 | 31,54,21,69,176 | 20,38,34,24,066 |

| II. Other Income | 22 | 1,71,98,82,463 | 96,27,90,199 |

| III. Total Revenue (I+II) | 33,26,20,51,639 | 21,34,62,14,264 | |

| IV. Expenses | |||

| Cost of Material Consumed | 23 | 14,64,90,27,312 | 13,88,48,60,451 |

| Purchases of Stock-in-Trade | 10,49,86,98,540 | 3,81,98,24,992 | |

| Changes in Inventories of Finished Goods, Work in | |||

| Progress and Stock in Trade | 24 | (1,89,62,39,327) | (2,21,76,10,087) |

| Employee Benefits Expenses | 25 | 1,27,77,00,610 | 60,32,80,694 |

| Finance Costs | 26 | 2,67,93,19,495 | 1,70,58,52,005 |

| Depreciation and Amortization Expenses | 28 | 1,35,59,26,493 | 75,11,17,651 |

| Other Expenses | 27 | 3,01,62,06,968 | 1,71,98,09,048 |

| Total Expenses | 31,58,06,40,091 | 20,26,71,34,755 | |

| V. Profit Before Exceptional and Extraordinary | |||

| Items and Tax (III-IV) | 1,68,14,11,548 | 1,07,90,79,509 | |

| VI. Exceptional Items | – | – | |

| VII. Profit Before Extraordinary Items & Tax (V-VI) | 1,68,14,11,548 | 1,07,90,79,509 | |

| VIII. Extraordinary Items | – | – | |

| IX. Profit Before Tax (VII-VIII) | 1,68,14,11,548 | 1,07,90,79,509 | |

| X. Tax Expense: | |||

| (1) Current Tax | 32,87,00,000 | 20,89,00,000 | |

| (2) Wealth Tax | 5,50,000 | 2,00,000 | |

| (3) Deferred Tax | 54,96,18,899 | 33,90,31,686 | |

| (4) MAT Credit Entitlement | (29,57,60,100) | (18,73,81,400) | |

| (5) Earlier Years | 3,39,51,779 | – | |

| XI. Profit/(Loss) for the period from Continuing: | |||

| Operations (IX-X) | 1,06,43,50,970 | 71,83,29,223 | |

Analysis

From the analysis of Profit & Loss Statement for FY 2013 and FY 2012, it is seen that revenue from operation has increased from ` 2,038 crore in FY 2012 to ` 3,154 crore in FY 2013. The sales have increased by 55% which is a good sign.

The profit before tax has also increased from ` 108 crore to ` 168 crore which is also about 56% income.

On the basis of analysis of Balance Sheet and other part of the financial statement of this case analysis, the following important facts were noticed:

-

- In FY 2012-13, the company issued 22 crore equity shares of the face value of ` 10 per share consequent to Global Depository Receipts (GDRs) for ` 220 crore.

- Secured term loan from 17 banks was at ` 1,511 crore as on 31st March, 2012, which has increased to ` 1,572 crore as on 31st March, 2013.

- Another secured loan of ` 464 crore has been obtained from banks during the FY 2013, as working capital loan. As a result, the working capital loan which was at ` 802 crore as on 31st March, 2012 has increased to ` 1,266 crore as on 31st March, 2013.

- The gross block of fixed assets which was ` 1,546 crore as on 31st March, 2012 has increased to ` 2,847 crore as on 31st March, 2013. The net addition to fixed assets block in FY 2013 was of ` 1,300 crore. The addition to fixed assets of ` 1,300 crore includes CWIP capitalized of ` 1,275 crore.

- In one of the subsidiaries, additional investment of ` 381 crore is made in FY 2013.

- The inventory level and trade receivables also increased substantially due to increase in revenue from operation in FY 2013. In the Box 56, the details of inventories as per note-16 and trade receivables as per note-17 of the Balance Sheet is given.

6.2 Box 56

Note 16: INVENTORIES

| Particulars | As at 31.03.2013 (in ` ) | As at 31.03.2012 (in ` ) |

| (Taken as, valued & certified by the Management) | ||

| (a) Raw Materials | 4,631,084,220 | 1,413,639,241 |

| (b) Work in Progress | 1,612,903,925 | 976,639,800 |

| (c) Finished Goods | ||

| – In Godown | 1,243,027,860 | 2,660,937,165 |

| – In Transit | 429,321,799 | 203,188,246 |

| (d) Stock in Trade | 2,451,750,954 | 546,481,702 |

| (e) Stores & Spares | 384,974,561 | 364,357,517 |

| TOTAL | 10,753,063,318 | 6,165,243,671 |

| Note 17: TRADE RECEIVABLES | ||

| Particulars | As at 31.03.2013 (in ` ) | As at 31.03.2012 (in ` ) |

| (Unsecured, considered good) | ||

| (a) Outstanding for a period exceeding six months from the date they are due for payment | 1,055,457,143 | 1,567,112,661 |

| (b) Other Receivables | 4,466,819,824 | 4,752,072,642 |

| TOTAL | 5,522,276,967 | 6,319,185,303 |

For the purpose of analysis of inventories and trade receivables, it is essential to look into the break-up of revenue from operations. The details of revenue from operations is provided in note-21 which is given in Box 57.

6.3 Box 57

Note 21: Revenue from Operations for the year 31st March, 2013

| Particulars | Current Year (in ` ) |

Previous Year (in ` ) |

| Sale of Products | ||

| Finished Goods | 22,49,71,31,288 | 16,48,74,40,618 |

| Traded Goods | 8,65,25,17,374 | 3,61,90,65,471 |

| Other Operating Income | ||

| Sale Scrap | 39,38,27,533 | 27,81,87,856 |

| 31,54,34,76,195 | 20,38,46,93,945 | |

| Less: Excise Duty | 13,07,019 | 12,69,879 |

| TOTAL | 31,54,21,69,176 | 20,38,34,24,066 |

| Details of Sales (Finished Goods) | ||

| Particulars | Current Year (in ` ) |

Previous Year (in ` ) |

| Yarn | 11,98,94,69,087 | 5,18,04,88,422 |

| Hosiery Garments | 2,17,99,64,472 | 1,54,75,48,293 |

| Terry Towel | 3,19,74,26,108 | 2,57,21,81,335 |

| Knitted Cloth | 5,13,02,71,621 | 7,18,72,22,568 |

| 22,49,71,31,288 | 16,48,74,40,618 | |

| Less: Excise Duty | 13,07,019 | 12,69,879 |

| TOTAL | 22,49,58,24,269 | 16,48,61,70,739 |

| Details of Sales (Traded Goods) | ||

| Particulars | Current Year (in ` ) |

Previous Year (in ` ) |

| Yarn | – | 55,26,64,458 |

| Hosiery Garments | 8,04,83,76,431 | 2,95,84,48,697 |

| Raw Cotton | 97,43,191 | 9,35,74,026 |

| Knitted Cloth | 59,43,97,752 | 1,43,78,290 |

| TOTAL | 8,65,25,17,374 | 3,61,90,65,471 |

Analysis

The following is the combined analysis of revenue from operations, inventories and trade receivables of Base Phase of case analysis-21:

-

- From the analysis of revenue from operation, it can be seen that the sales of products include traded sales. The said traded sales is also substantial and in FY 2013, the traded sales has increased from ` 362 crore to ` 865 crore.

- Therefore, so far as manufacturing sales is concerned the same has increased from ` 1,649 crore to ` 2,250 crore in FY 2013. The rise in manufacturing sales is only 36% as against overall increase in sales of 55%.

- Moreover, the sales relating to manufacturing of knitted cloth have declined substantially in FY 2013, whereas, in case of yarn it is almost 2.3 times of sales of FY 2012. Similarly, for hosiery garments and terry towel there is substantial increase.

The analysis of the inventory in terms of holding period is as under:

(` in crore)

| S. No. | Particulars | FY 2012 | FY 2013 | Analysis |

| 1 | Cost of raw material consumed (Box 55) | 1,369.82 | 1,440.47 | – |

| 2 | Average monthly consumption (1 divided by 12) | 114.15 | 120.04 | – |

| 3 | Inventory of raw material (Box 56) | 141.36 | 463.10 | Inventory of raw material which was equivalent to 1.2 months in FY 2012 has increased to 3.85 months. |

| 4 | Inventory of WIP (Box 56) | 97.66 | 161.29 | Inventory of WIP which was equivalent to 0.9 months has increased to 1.3 months. |

| 5 | Inventory of Finished Goods (Box 56) | 286.41 | 167.23 | Inventory of finished goods which was equivalent to 2.5 months has reduced to 1.4 months. |

| 6 | Total sales(Box 57) | 2,038.34 | 3,154.21 | |

| 7 | Average Monthly Sales (6 divided by 12) | 169.86 | 262.85 | |

| 8 | Trade receivable (Box 56) | 631.92 | 552.23 | Trade receivables which were equivalent to 3.7 months has reduced to 2.1 months. |

Thus, the major change is in raw material inventory holding period which has increased from 1.2 months to 3.85 months and trade receivables has decreased from 3.7 months to 2.1 months.

Conclusion on Financials of FY 2012 and FY 2013 (Base Phase):

-

- For both the years, auditor’s report is clean.

- In the CARO report also for both the years, there is no adverse observation. Such as no loan has been given to related party, internal audit system is commensurate with the size and nature of business, there is no default in making payment of undisputed statutory dues, no disputed tax liability, no default in repayment of dues to banks and FIs etc.

- In the notes on accounts also there is no adverse remark.

- Overall sales have increased by 55%.

- The profit before tax has increased from ` 108 crore to ` 168 crore which is increased by about 56%.

- GDRs issue of ` 220 crore in FY 2013.

- Substantial expansion in manufacturing capacity in FY 2013.

- In FY 2012, turnover increased from ` 1,583 crore to ` 2,038 crore.

However, some of the concerns were visible in the financials of the case analysis-21 relating to FY 2012 and FY 2013, as under:

-

- In FY 2013, though the sales have increased from ` 2,083 crore to ` 3,154 crore, the PBT has also increased from ` 108 crore to ` 168 crore.

- In FY 2012, the PBT of ` 108 crore is after considering other income of ` 96 lakhs. The other income inter alia includes foreign exchange fluctuation gain of ` 53 lakhs in FY 2012 which was an expenditure of ` 66 lakhs in FY 2011, whereas FOB value of exports in FY 2012 was at ` 465 crore as against ` 319 crore in FY 2011.

- The revenue from operations includes substantial trading sales.

In FY 2013, the PBT of ` 168 crore includes income from other sources of ` 172 crore. The income inter alia includes export incentive, foreign exchange fluctuation etc.

-

- Raw material inventory level in FY 2013 has increased from 1.2 months to 3.8 months, which is a substantial increase.

7. Case Analysis III

The relevant financial position of the very said company for the subsequent two financial years i.e. FY 2014 and FY 2015 are considered. This period is considered as Built-up Phase. In the Box 58, the statement of profit and loss for the year 31st March, 2015 and 31st March, 2014 is provided.

Built-up Phase

7.1 Box 58

Profit and Loss Statement for the year ended 31st March, 2015

| Particulars | Note No. | Current Year (in ` ) | Previous Year (in ` ) |

| I. Revenue From Operations | 20 | 23,25,78,46,914 | 29,56,03,95,263 |

| II. Other Income | 21 | 1,22,62,42,933 | 90,12,18,027 |

| III. Total Revenue (I+II) | 24,48,40,89,847 | 30,46,16,13,290 | |

| IV. Expenses | |||

| Cost of Material Consumed | 22 | 14,72,29,98,415 | 22,12,23,92,529 |

| Purchases of Stock-in-Trade | 1,99,34,68,337 | 2,13,47,76,076 | |

| Changes in Inventories of Finished Goods, Work in: | |||

| Progress and Stock in Trade | 23 | (1,26,91,95,570) | (1,87,09,09,269) |

| Employee Benefits Expenses | 24 | 1,10,95,69,108 | 1,22,78,93,052 |

| Finance Costs | 25 | 2,47,81,31,914 | 3,12,22,43,276 |

| Depreciation and Amortization Expenses | 27 | 2,93,27,22,331 | 2,12,43,10,725 |

| Other Expenses | 26 | 3,84,77,25,058 | 3,79,01,09,559 |

| Total Expenses | 25,81,54,19,594 | 32,65,08,15,948 | |

| V. Profit Before Exceptional and Extraordinary | |||

| Items and Tax (III-IV) | (1,33,13,29,747) | (2,18,92,02,658) | |

| VI. Exceptional Items | – | 1,80,94,31,166 | |

| VII. Profit Before Extraordinary Items & Tax (V-VI) | (1,33,13,29,747) | (3,99,86,33,824) | |

| VIII. Extraordinary Items | – | – | |

| IX. Profit Before Tax (VII-VIII) | (1,33,13,29,747) | (3,99,86,33,824) | |

In Box 59, the break-up of the sales is provided:

7.2 Box 59

DETAILS OF SALES (FINISHED GOODS)

FOR THE YEAR ENDED 31ST MARCH, 2015

| Particulars | Current Year (in ` ) | Previous Year (in ` ) |

| Yarn | 1319,70,60,203 | 1212,96,75,372 |

| Hosiery Garments | 164,21,52,369 | 166,08,42,196 |

| Terry Towel | 466,51,75,759 | 423,26,99,803 |

| Knitted Cloth | 117,03,28,483 | 646,83,96,968 |

| 2067,47,16,814 | 2449,16,14,339 | |

| Less: Excise Duty | – | – |

| TOTAL | 2067,47,16,814 | 2449,16,14,339 |

| Details of Sales (Traded Goods) for the year ended 31st March, 2015 | ||

| Particulars | Current Year (in ` ) | Previous Year (in ` ) |

| Yarn | 37,26,32,294 | 83,70,77,720 |

| Hosiery Garments | 178,55,37,942 | 396,16,84,400 |

| Raw Material | 6,163 | 42,43,542 |

| TOTAL | 215,81,76,399 | 480,30,05,662 |

u In the Box 60, the level of inventories and trade receivables, for the purpose of proper analysis as provided is considered:—

7.3 Box 60

NOTE 15: INVENTORIES

| Particulars | As at 31.03.2015 (in `) |

As at 31.03.2014 (in `) |

| (Taken as, valued & certified by the Management) | ||

| (a) Raw Materials | 500,28,26,043 | 123,66,42,835 |

| (b) Work in Progress | 91,13,48,799 | 132,37,12,953 |

| (c) Finished Goods | ||

| – In Godown | 570,77,22,735 | 391,68,60,386 |

| – In Transit | 44,86,06,678 | 54,59,08,902 |

| (d) Stock in Trade | – | 1,20,00,400 |

| (e) Stores & Spares | 6,88,22,666 | 6,46,43,851 |

| TOTAL | 1213,93,26,920 | 709,97,69,327 |

| Note 16: TRADE RECEIVABLES | ||

| Particulars | As at 31.03.2015 (in `) |

As at 31.03.2014 (in `) |

| (Unsecured, considered good) | ||

| (a) Outstanding for a period exceeding six months from the date they are due for payment | 326,04,11,089 | 310,77,79,058 |

| (b) Other Receivables | 415,93,99,871 | 506,03,20,057 |

| TOTAL | 741,98,10,960 | 816,80,99,115 |

Analysis

On the basis of analysis of the financials of the case analysis-22, for FY 2014 and FY 2015, being Built-up Phase, the following important facts emerges:

-

- In FY 2012, the PBT was ` 108 crore which has increased to ` 168 crore in FY 2013. Interestingly, in FY 2014, the PBT is at loss of ` 400 crore and in FY 2015, it is also at loss of ` 133 crore.

- The revenue from operations of finished goods in FY 2014 has increased to ` 2,449 crore from ` 2,249 crore in FY 2013 and ` 1,649 crore in FY 2012.

- The raw material inventory has increased from ` 124 crore in FY 2014 to ` 500 crore in FY 2015, which is equivalent to 0.7 months in FY 2014 has increased to 4.2 months in FY 2015.

The finished goods inventory which was equivalent to 1.4 months in FY 2013, increased to 2.3 months in FY 2014 and 5.2 months in FY 2015. In terms amount as under:-

-

- As at 31st March, 2013 – ` 167 crore

- As at 31st March, 2014 – ` 446 crore

- As at 31st March, 2015 – ` 616 crore

The trade receivables which were equivalent to 2.1 months of sales in FY 2013 have increased to 3.3 months in FY 2014 and 3.9 months in FY 2015.

Export incentive and foreign exchange fluctuation continues to be major part of other income.

In FY 2015, auditor under “Emphasis of Matters” referred note-37 regarding CDR, as given in Box 61:

7.4 Box 61

| Note-37. The Company followed an aggressive growth path in the last ten years, it had considerably grown its balance sheet, including debt. Due to the industry situation in general viz. slowdown and company specific issues such as growing debt, delayed realization of debtors, working capital shortfall, delay in project completion and cash flow mismatch, which had adversely affected the liquidity position of the company, the company was facing financial problems and finding difficulty in servicing its debt obligation. Therefore, it approached the lenders for restructuring its debts under Corporate Debt Restructuring (CDR) mechanism. During the year, the Company’s proposal for restructuring of its debts was approved by Corporate Debt Restructuring Cell (“CDR Cell”) vide Letter of Approval (LOA) dt. 30.06.2014. The cut-off date (COD) for implementation of CDR was 30th September, 2013. The Company executed Master Restructuring Agreement (MRA) with CDR Lenders on 24th September, 2014. The details of the Restructuring package as approved by CDR cell are as under:

(a) Restructuring of repayment schedule for term loans under Technology Upgradation Funds Scheme (TUFS) and Non-TUFS Term Loans, reduction in interest rates, additional facilities in the form of Working Capital Term Loan (WCTL) & Funded Interest Term Loan (FITL). (b) The promoters to bring contribution equivalent to 25% of the sacrifice amount of by lenders. Accordingly, promoters have brought in an amount of ` 69.71 crores as 1% Redeemable, Non-Cumulative, Non-Convertible Preference Shares. (c) Lenders with the approval of CDR EG shall have the right to recompense the reliefs/sacrifices/waivers extended by respective CDR lenders as per the CDR guidelines. The recompense payable is contingent on various factors including improved performance of the Company and many other conditions, the outcome of which is currently materially uncertain. Tentative recompense amount comes to ` 129.51 crores. |

Analysis

-

- In the CARO report of FY 2015, the auditor has also reported about default by the company regarding repayment of dues to banks.

8. Case Analysis IV

In the Box 62 below, the financial position of the very said company for the subsequent two financial years i.e. FY 2016 and FY 2017 are provided. This period is considered as Stress Phase.

Stress Phase

8.1 Box 62

Profit and Loss Statement for the year ended 31st March, 2017

| Particulars | Note No. | Current Year (` in Lakhs) | Previous Year (` in Lakhs) |

| I. Revenue From Operations | 26 | 171,061.80 | 194,773.46 |

| II. Other Income | 27 | 9,201.25 | 11,043.52 |

| III. Total Income (I+II) | 180,263.05 | 205,816.97 | |

| IV. Expenses | |||

| Cost of Material Consumed | 28 | 131,514.42 | 111,485.40 |

| Purchases of Stock-in-Trade | 3,354.20 | 7,017.11 | |

| Changes in Inventories of Finished Goods, Work in | |||

| Progress and Stock-in-Trade | 29 | 40,939.36 | 4,326.72 |

| Employee Benefits Expenses | 30 | 10,746.20 | 10,864.26 |

| Finance Costs | 31 | 12,256.12 | 34,240.03 |

| Depreciation and Amortization Expenses | 32 | 11,408.91 | 28,450.25 |

| Other Expenses | 33 | 32,831.44 | 35,172.09 |

| Total Expenses (IV) | 243,050.65 | 231,555.85 | |

| V. Profit/(Loss) Before Exceptional Items and | |||

| Tax (III-IV) | (62,787.60) | (25,738.88) | |

| VI. Exceptional Items | 34 | 22,650.08 | 30,060.93 |

| VII. Profit/(Loss) Before Tax (V-VI) | (85,438.20) | (55,799.81) | |

In Box 63, the break-up of the sales is provided:

Stress Phase

8.2 Box 63

Note 26: Revenue from Operations

| Particulars | Current Year (FY 2017) (` in Lakhs) |

Previous Year (FY 2016) (` in Lakhs) |

| Sale of Products | ||

| Finished Goods | 162,609.29 | 184,221.84 |

| Traded Goods | 4,521.05 | 7,251.22 |

| Other Operating Income | ||

| Waste/Sale Scrap | 3,931.47 | 3,300.39 |

| TOTAL | 171,061.80 | 194,773.46 |

In the Box 64, the level of inventories and trade receivables, for the purpose of proper analysis is provided.

Stress Phase

8.3 Box 64

Note 11: INVENTORIES

| Particulars | As at 31.03.2017 (` in Lakhs) | As at 31.03.2016 (` in Lakhs) |

| (a) Raw Materials | 58,532.85 | 72,095.73 |

| (b) Work-in-Progress | 8,784.35 | 7,737.25 |

| (c) Finished Goods | ||

| – In Godown | 14,025.72 | 55,474.35 |

| – In Transit | 2,600.64 | 2,681.75 |

| (d) Stock-in-Trade | – | 456.71 |

| (e) Stores & Spares | 481.21 | 606.30 |

| TOTAL | 84,424.76 | 139,052.09 |

| Note 12: TRADE RECEIVABLES | ||

| Particulars | As at 31.03.2017 (` in Lakhs) | As at 31.03.2016 (` in Lakhs) |

| Unsecured, considered good | 99,991.82 | 89,948.18 |

| TOTAL | 99,991.82 | 89,948.18 |

Combined Analysis of FY 2016 and 2017 (Stress Phase)

On the basis of analysis of the financials from the case analysis of the same company for FY 2016 and FY 2017, the following important facts emerge:

-

- In FY 2016, the PBT is at loss of ` 558 crore and in FY 2017, it is also a loss of ` 854 crore.

- The revenue from operations, in FY 2013 increased by 55% and same is decreased in FY 2014 by roughly 6% amounting to ` 2,956 crore. In FY 2015, the said revenue from operations further decreased to ` 2,325 crore (Box 33), which is further decreased to ` 1,947 crore in FY 2016 and ` 1,711 crore in FY 2017 (Box 38).

- The raw material inventory which was equivalent to 4.2 months in FY 2015 has increased to 8 months in FY 2016 and reduced to 5.5 months in FY 2017.

- The finished goods inventory which was equivalent to 5.2 months in FY 2015 was increased to 6.5 months in FY 2016 and in FY 2017, the same is equivalent to 1.6 months.

- The trade receivables have increased from being equivalent to 2.1 months of sales in FY 2013 to 3.3 months in FY 2014. Further, the same has increased to 3.9 months in FY 2015, 5.6 months in FY 2016 and 7.2 months in FY 2017. Not only that, the auditors in auditor’s report in FY 2017 have referred note-38, stating that outstanding in the trade receivables is overdue and same has not been written off. In the Box 65, the said note is provided.

8.4 Box 65

| Note-38. The balances of Trade Receivables, Loan and Advances, Deposits and Trade Payables are subject to confirmation/reconciliation and subsequent adjustments, if any. During the year, e-mails/letters have been sent to various parties with a request to confirm their balances as on 31st March, 2017 out of which few parties have confirmed their balances direct to the auditors or to the company. No provision has been created for trade receivables as they are realizable as per management of the company. |

Analysis

-

- Look at how in the initial phase trade receivables are shown which has increased year by year, disproportionate to the sales and then stating that the same is subject to confirmation. In all likelihood, the same will be charged to statement of profit and loss as bad debts, in the subsequent years, as appears on the basis of remarks.

- Similarly, in the case of inventory initially the same is built up disproportionate to the cost of material consumed, and then identifying non-moving/slow moving etc., as per notes on accounts, note 43 as given in the Box 66.

8.5 Box 66

| Note 43. The Company has identified non-moving, slow moving, obsolete and damaged inventory in finished goods during the year and recognized an aggregate amount of ` 12,172.29 lakhs as reduction in value of inventories due to write down thereof to net realizable value, which is charged to Statement of Profit & Loss. |

It is also interesting to find a note in the notes on accounts in such type of situation. In the note-49, as given in the Box 67, an unusual fact has been highlighted.

8.6 Box 67

| Note-49. On 17th May, 2017, a major fire broke out at one of the Company’s unit situated at Bajra Road, Ludhiana, resulting in the loss of stocks/machinery and building. We were fortunate that there were no human casualties. The Surveyor deputed by the insurance company is in process of assessing the loss. However, operations at the unit were hampered for short period and have since resumed. |

9. Bottom line

Inventories and trade receivables are like a black box, which provide vital information about the financials of an entity. The proper analysis, keeping in mind the trend of holding period, industry practice, observation of the auditor and the remark relating to “slow moving”, “obsolete” or the auditor using the phrase “as valued and certified by the management” indicate that all is not well with such inventories.

Similarly, in the case of trade receivables, the amount of debtors should match with the normal credit period and there has to be regular recovery of the sales made. The remark in the auditor’s report or in the notes on account, stating that balance of debtors is subject to confirmation, also indicate early warning signs.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA