Comprehensive Guide to Intangible Assets – Definitions, Attributes, Recognition, Valuation, and Considerations

- Blog|Account & Audit|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 7 December, 2023

Table of Contents

- Definition of Intangible Assets

- Critical Attributes of Intangible Assets

- Recognition of Intangible Assets

- Classification of Intangible Assets

- Valuation Approaches for Valuing Intangible Assets

- Important Considerations

1. Definition of Intangible Assets

Definition as per Ind AS 38 on Intangible Assets and ICAI Valuation Standard 302 – Intangible Assets

An intangible asset is an identifiable non-monetary asset without physical substance.

Definition as per IVS 210 – Intangible Assets

An intangible asset is a non-monetary asset that manifests itself by its economic properties. It does not have physical substance but grants rights and economic benefits to its owner.

Definition as per IGBVT

The International Glossary of Business Valuation Terms (IGBVT) defines intangible assets as

“non- physical assets such as franchises, trademarks, patents, copyrights, goodwill, equities, mineral rights, securities and contracts (as distinguished from physical assets) that grant rights and privileges, and have value for the owner.”

2. Critical Attributes of Intangible Assets

Identifiability

- Can be separated and sold, transferred, licensed, rented or exchanged, or

- Arises from contractual or legal rights

Control

- Obtain future economic benefits

- Restrict access of others to those benefits

Future Economic Benefits

- Revenue from sale of products, services or processes

- Cost savings

- Other benefits from the use of an asset

3. Recognition of Intangible Assets

An intangible asset can be purchased or developed internally

Separate Acquisition

The cost of a separately acquired intangible asset would comprise:

(a) its purchase price; and

(b) any directly attributable cost of preparing the asset for its intended use.

Acquisition as part of Business Combination

If an intangible asset is acquired in a business combination, the cost of that intangible asset is its fair value at the acquisition date.

An intangible asset should be recognised if, and only if:

(a) it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and

(b) the cost of the asset can be measured reliably.

4. Classification of Intangible Assets

- Marketing related Intangible Assets: Trademarks | Trade Names | Trade Design | Trade Dress | Internet Domain Names

- Technology related Intangible Assets: Patent | Trade Secret | Database | Formulae | Designs | Software | Processes | Recipes

- Artistic related Intangible Assets: Books | Films | Plays | Music

- Customer related Intangible Assets: Customer contracts and related customer relationships| Non-contractual customer relationships | Production/Order Backlog | Customer lists

- Contract related Intangible Assets: Licensing and royalty agreements | service or supply

contracts | lease agreements | permits | broadcast rights | servicing contracts | non-competition agreements | natural resource rights

Purposes for valuing intangibles

- Accounting and Financial Reporting

- General consulting and support

- Litigation/Dispute/Divorce

- Financing (as collateral)

- Transaction (M&A or individual sale/purchase)

- Taxation/Transfer Pricing/Gift Planning

5. Valuation Approaches for Valuing Intangible Assets

| Income Approach | Market Approach |

Cost Approach |

| Excess Earnings Method | Guideline Transactions Method | Replacement Cost Method |

| Relief from Royalty Method | ||

| With-and-Without Method | Comparable Companies’ Multiple Method (CCM) | Reproduction Cost Method |

| Greenfield Method | ||

| Distributor Method |

6. Important Considerations

6.1 Economic Life of Intangible Assets

- Finite life – legal, functional, economic or technological factors

- Indefinite Life

Company ABC has introduced a pharmaceutical formula protected by a patent with legal life of 5 years till 2026. Company XYZ introduces a drug with a more enhanced formula in 2024. What is the economic life of the technology of Company ABC?

Company PQR uses the formula of Company ABC in 2028 to manufacture generic drugs. What is the economic life of the technology of Company ABC in this case?

Conclusion: To determine the economic life of an intangible, we need to assess the legal, functional, economic or technological factors affecting it.

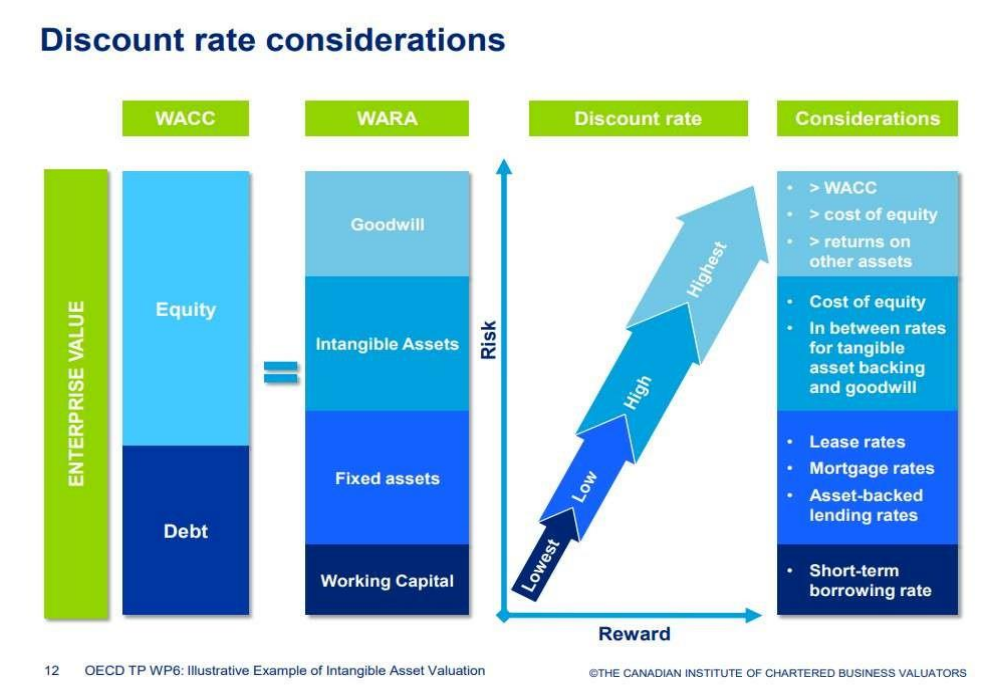

6.2 Discount Rate

Discount Rate Benchmarks

- Weighted Average Cost of Capital

- Cost of Equity

- Cost of Debt with similar maturities to the life of the intangible

- Risk-free rate with similar maturities to the life of the intangible

- Internal Rate of Return (IRR) if recent transaction including subject intangible

- Weighted Average Return on Assets (WARA)

6.3 Tax Amortisation Benefit (TAB)

- Intangible assets can get tax shield on their amortisation, which effectively increase the value of the intangible asset depending on nature of intangible assets and purpose of valuation – Patents Technology

- Tax deductibility of amortisation of intangible assets is dependent upon corporate income tax legislations of individual countries – Customer Relationships

- Tax rate to be considered same as that of the business – Trademark

- Period of amortisation to be considered as per law or to the extent of having the WDV of the intangible nil – Know-how

- The discount rate to determine present value could be of the business or the subject intangible asset – Goodwill

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA