Comprehensive Guide to ESOP Policy | Planning | Taxation | Legal Compliances

- Blog|Company Law|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 4 December, 2024

ESOP Policy and Taxation: An Employee Stock Option Plan (ESOP) is a program that grants employees the right to purchase company shares at a pre-determined price after meeting specific conditions, such as tenure or performance. ESOPs are designed to retain talent, align employee interests with company goals, and boost ownership culture. Taxation on ESOPs occurs at the time of exercise, where the difference between the exercise price and the Fair Market Value (FMV) is taxed as a perquisite under salary income. Upon sale, the capital gains tax applies based on the holding period. Companies can structure ESOP policies with tenure-based or performance-based vesting, and may use a trust route for simplified management and liquidity.

Table of Contents

- ESOP v/s Sweat Equity

- Community Stock Options Pool

- How are ESOPs Planned?

- Drafting an Effective ESOP Policy

- Backfire & Safeguard

- Trust Route of Issuing ESOP

- Why Private Limited Company Choose the ESOP Trust Route?

- Legal Compliances

By CA. Darshak Shah – Partner | S N & Co.

1. ESOP v/s Sweat Equity

| Features | ESOP | Sweat Equity |

| Eligibility |

|

All permanent Employees and Directors whether in India or Outside of Subsidiary and Holding who are into business for more than 1 year |

| Lock-in-period | As per Plan/Scheme | 3 years as per Company’s Rules |

| Valuation |

|

|

| Restriction | As mentioned in eligibility | As per Companies Rules:

This clause is not applicable to eligible startups. |

| Taxation | At exercise of option: Difference of Exercise price and FMV of shares taxed as Salary (Explained in detail in the later part) | At Allotment of Shares: Taxed as Salary |

2. Community Stock Options Pool

2.1 Advantages

- Efficient Standard Agreement

- Access to Growth Stage Startups

- Financial Protection

- Direct Investment

- Information Rights

2.2 Disadvantages

- No Entry on the Cap Table

- Mandatory Call Option

- No Voting Rights

- No GST Credit

|

Features |

Share Payments | Non-Share Payments | |||

| ESOP | Sweat Equity | SAR | Phantom Shares | CSOP | |

| On Allotment | Conditional allotment | Direct Allotment | No equity dilution | No equity dilution | What happens at initial stage of allotment |

| On Exercise | Option get converted to equity share on future date | Shares issued to employees at discounted price | Compensation given to employees for appreciation of company share price over a period of time | It is form of SAR | Are shares issued here? |

| Cash-Flow | No cash outflow at all | Share can be sold by employees after completion of lock in period | Mostly issued by listed company since FMV is readily available | No initial cash outflow as shared from wealth created | Whether there is any cash outflow for subscribers? |

| Issued to Whom? | To employees and directors to retain them | To acquire IPR from Employee and Directors | Can be used to pay employees | Can be used to pay vendors and consultants | Used at which level and how? |

| Impct on Financials? | Impact to P&L during vesting period: Grant value – exercise value | Impact to P&L in the year of allotment: FMV value | Impact to P&L each reporting year until liability is Discharged | Impact to P&L each reporting year until liability is Discharged | What can be the impact on financials? |

| Taxation? | Tax on Exercise | Taxed on Allotment | Taxed on receipt | Taxed on receipt | How will it be taxed in the hands of subscriber and the Company? |

| Valuation? | FMV – Exercise price | Taxed on FMV | Taxed on differential value | Taxed on differential value – business income | What will be the valuation at redemption? |

3. How are ESOPs Planned?

A company is planning to introduce ESOP in their co. where, vesting is through performance based conditions for the upper management (KRA & KPI). For Marketing Manager, the vesting conditions are:

| New Cities | Year | Options |

| 15 | 1 | 200 |

| 20 | 2 | 300 |

| 25 | 3 | 500 |

Wherein the additional conditional is to earn minimum Revenue of Rs. 1 Cr per city annually

Performance-based conditions for the upper management (KRA & KPI)

For Operations Manager (role of bookings), the vesting conditions are:

| Tickets booked | Year | Options |

| 10L | 1 | 200 |

| 15L | 2 | 300 |

| 20L | 3 | 500 |

Tenure based conditions for the middle management:

For Managers, wherein FMV = 100 based on minimum 3 years with exercise price = 20

| Vesting | Options |

| 1 | 75 |

| 2 | 100 |

| 3 | 125 |

4. Drafting an Effective ESOP Policy

- Eligibility

-

- Tenure-Based: Employees who have completed more than 12 months in the company.

- Performance-Based: (KRA) or (KPI).

- Grant and Acceptance

-

- Formal offering of ESOPs to eligible employees.

- Employees must accept the grant to participate.

- Vesting Schedule/Conditions

-

- Tenure-Based: Vesting is linked to the employee’s duration of service.

- Performance-Based: Vesting depends on meeting specific performance targets.

- Exercise

-

- Exercise Price: Determined using the Black-Scholes Valuation Model.

- Exercise Period: Employees have a 5-year window to exercise their options.

- Lock-in Period

-

- A lock-in period of 5 years applies to the shares acquired through the ESOP

5. Backfire & Safeguard

Ways to retain the employees who desire to leave the company:

- Reverse Vesting Clauses to Safeguard the Company:

-

- Unvested Shares Forfeiture

- Partially Vested Shares Buyback

- Performance Clawbacks

- Hybrid Vesting

- Second ESOP Grant Plan

- Profit Sharing (Cash Bonus)

- Leadership Perks

Ways Safeguarding employees:

- Define Clear Tiers: Segment ESOP grants based on roles and contributions.(to rule out imbalance)

- Performance-Linked ESOPs: Tie the vesting of ESOPs at all levels (CEO, senior managers, and others) to company-wide goals

- Non-Equity Rewards for Balance: Complement ESOPs with cash bonuses, profit-sharing, or promotions for non-ESOP employees to create a sense of fairness

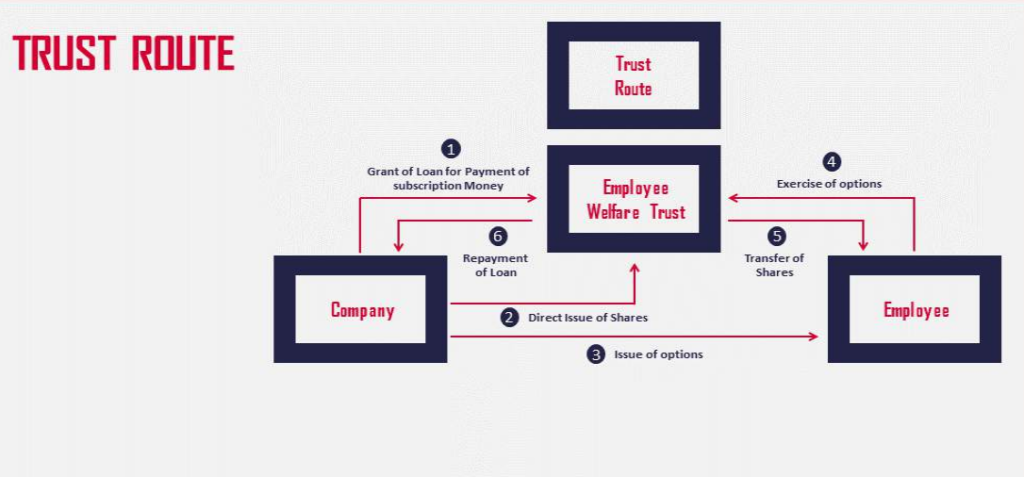

6. Trust Route of Issuing ESOP

7. Why Private Limited Company Choose the ESOP Trust Route?

Simplified Approval Process

- Using an ESOP trust, the company avoids the need for separate approvals for every individual stock allotment.

- Once the ESOP scheme is approved by shareholders and regulators, the trust can manage allotments in line with the pre-approved framework, reducing administrative overhead.

Liquidity Management

The ESOP trust can buy back shares from exiting employees. This ensures:

- Liquidity for employees when they leave the company.

- Retention of ownership within the company by preventing shares from being sold to external parties.

8. Legal Compliances

8.1 ROC

- Board Approval: The Board drafts the ESOP scheme and passes a resolution.

- Remuneration Committee: Approval of the scheme by the committee.

- Shareholder Meeting: Convene a meeting, approve the scheme, and pass a special resolution for trust creation.

- Submit Scheme to Income Tax Dept.

- Employee Details: Shareholder notice must include employee details and pricing.

- Trust Setup: Prepare and register a Trust Deed under the Indian Trusts Act with Registrar

- PAN and Bank Account: Obtain PAN and open a bank account for the trust.

- Valuation: Get a Registered Valuer’s report for share valuation (for unlisted companies).

- Loan to Trust: Provide a loan to the trust to purchase shares.

- Share Allotment: Allot shares to the trust.

- Transfer to Employees: The trust transfers shares to employees at the Exercise Price.

- Loan Repayment: Trust repays the loan to the company using proceeds from employees.

8.2 Trust

- ESOP Trust registration is done under Indian Trusts Act, hence company need to prepare a Trust Deed. This need to be executed on stamp paper.

- A Trust Deed is to be registered in a sub-registrar.

8.3 Taxation FAQs

- Tax Deductibility of ESOP Expenses

- Taxation at the Time of Exercise (TDS)

- Taxation under Trust Route

8.4 Valuation of ESOPs

- Grant of options: Registered Valuer

- Exercise of options:

-

- Listed Co.: FMV of RSE

- Unlisted Co.: Merchant Banker

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA