Compounding, Adjudication and Condonation under the Companies Act, 2013

- Blog|Company Law|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 14 July, 2023

Table of Contents

- Purpose of Company Law Committee

- Understanding of Terminologies – Fine, Penalty, Default and Offence

- Compounding of Offences

- Condonation of Delay

- Adjudication for Penalties

- Process of Adjudication and Appeal against the Order of Adjudicating Authority

1. Purpose of Company Law Committee

1.1 Constitution of Company Law Committee [2018 & 2019]

- De-clogging the courts

- Ease of Living of Corporates and Ease of doing business

- Speedy disposal of procedural non-compliance cases

- Introduction of Inhouse Adjudication Mechanism

- Conversion of offences of Criminal Nature to Civil Only

2. Understanding of Terminologies – Fine, Penalty, Default and Offence

2.1 ‘Fine’ & ‘Penalty’

- Meaning of ‘Fine’- As per Dictionary of Law (Oxford Quick Reference)-

A sum of money that an offender is ordered to pay on conviction by court.

As per Black’s Law Dictionary 4th Edition- A sum of money paid at the end, to make an end of a transaction, suit, or prosecution.

- Meaning of ‘Penalty’- As per Oxford Dictionary

A punishment imposed for breaking a law, rule, or contract.

2.2 Basic Difference Between ‘Fine’ & ‘Penalty’

In case penal provisions carry punishment of ‘Fine’-

Proper trial or prosecution must happen by the Court or tribunal.

In case penal provisions carry ‘Penalty’-

There is no requirement to have proper trial before court of law and authority prescribed can levy penalty by its own.

2.3 Meaning of ‘Default’ and ‘Offence’

Meaning of ‘Default’ as per Black’s Law Dictionary 4 th Edition, Pg. 505 – By its

derivation, a failure. Meadows v. Continental Assur. Co., C.C.A.Tex., 89 F. 2d 256. An omission of that which ought to be done. Town of Milton v. Bruso, 111 Vt. 82, 10 A. 2d 203, 205. Specifically, the omission or failure to perform a legal duty.

Meaning of ‘Offence’ – Section 3(38) of The General Clauses Act, 1897 – “offence” shall mean any act or omission made punishable by any law for the time being in force;

As per Black’s Law Dictionary, 4th Edition, Pg. No. 1232 – A crime or misdemeanor;

a breach of the criminal laws

Note: Every default need not be that much grave which can lead to offense, but every offense have the ingredient of default in it which has actually harmed the intention of legislature or public at large.

2.4 Difference between Criminal Wrong & Civil Wrong

| Criminal Wrong |

Civil Wrong |

| Public at large is affected/Society is harmed | Public at large is not affected |

| Proper prosecution or trial will happen before the court of law | Normal proceeding before the concerned authority |

| Grave and serious act | Technical or minor wrongs, not much serious |

| State takes the action (generally) | Aggrieved person takes the action |

| Court Imposes fine/imprisonment | Appropriate Authority imposes monetary punishment. |

| Presence of Mens Rea | Not required |

2.5 Criminal Wrong v. Civil Wrong

- Offences – Punishable with fine

- Default – Liable to Penalty

3. Compounding of Offences

3.1 Meaning of Compound/Compounding- As per Black Law Dictionary 4th Edition-Pg. No. 358

Compound, v. To compromise

Compounding A Felony – The offense committed by a person and who having

been directly injured by a felony, agrees with the criminal that he will not prosecute

him, on condition of the latter’s making reparation, or on receipt of a reward or bribe

not to prosecute.

The offense of taking a reward for forbearing to prosecute a felony; as where a party

robbed takes his goods again, or other amends, upon an agreement not to

prosecute. Rieman v. Morrison.

3.2 Changes in Section 441

- Section 441(1) opening paragraph- for the words ‘fine only’ the words “not being an offence

punishable with imprisonment only, or punishable with imprisonment and also with fine” has been substituted by Companies (Amendment) Act, 2017 – Effective from 9th February, 2018 - Section 441(6)-

Earlier – Notwithstanding anything contained in the Code of Criminal Procedure, 1973,—

(a) any offence which is punishable under this Act, with imprisonment or fine, or with imprisonment or fine or with both, shall be compoundable with the permission of the Special Court, in accordance with the procedure laid down in that Act for compounding of offences;

(b) any offence which is punishable under this Act with imprisonment only or with imprisonment and also with fine shall not be compoundable.

Presently – Notwithstanding anything contained in the Code of Criminal Procedure, 1973, any offence which is punishable under this Act with imprisonment only or with imprisonment and also with fine shall not be compoundable.

Effect of above changes – Now, offences punishable with fine only, fine or imprisonment, fine or imprisonment or both can be compounded by Tribunal or Regional Director, as the case may be. No permission of special court is required for compounding offences punishable with imprisonment or fine, or imprisonment or fine or with both.

3.3 Offences which can be compounded under Companies Act, 2013

Offences punishable with

- Fine

- Fine or imprisonment

- Fine or Imprisonment or both

3.4 Offences which cannot be compounded under Companies Act, 2013

- Punishable with imprisonment only, or

- Punishable with fine and imprisonment

3.5 Further Changes

Section 441(1)(b) – For the words ‘does not exceed five lakh rupees’ the words ‘does not exceed twenty-five lakh rupees’ has been substituted initially by way ordinance(s), 2018 & 2019 and lastly inserted into Act by way Companies (Amendment) Act, 2019- Effective date 02nd November, 2018.

Effect of such change – Now, Regional Director can compound matters involving fine upto INR 25 Lacs.

3.6 Language of Section 441(1)

“Notwithstanding anything contained in the Code of Criminal Procedure, 1973 (2 of 1974), any offence punishable under this Act (whether committed by a company or any officer thereof)[not being an offence punishable with imprisonment only, or punishable with imprisonment and also with fine], may, either before or after the institution of any prosecution, be compounded by:

(a) the tribunal; or

(b) where the maximum amount of fine which may be imposed for such offence does not exceed twenty-five lakh rupees]]], by the Regional Director or any officer authorised by the Central Government,

(c) on payment or credit, by the company or, as the case may be, the officer, to the Central Government of such sum as that Tribunal or the Regional Director or any officer authorised by the Central Government, as the case may be, may specify:……”

3.6.1 Illustrations

- X ltd. was not able to hold its AGM in due time, and held it with a delay of 100 days. Total fine on calculation was coming roughly around 10 lakhs (in total of Company and Officers in default). Who is authorised to Compound the offence, Tribunal or Regional Director?

- Whether this limit of 25 lacs prescribed has to be calculated individually or combinedly?

3.7 Language of Section 441(2)

Nothing in sub-section (1) shall apply to an offence committed by a company or its officer within a period of three years from the date on which a similar offence committed by it or him was compounded under this section.

Explanation. For the purposes of this section,—

(a) any second or subsequent offence committed after the expiry of a period of three years from the date on which the offence was previously compounded, shall be deemed to be a first offence;

(b) “Regional Director” means a person appointed by the Central Government as a Regional Director for the purposes of this Act.

3.7.1 Queries

- Suppose company has violated the provisions of Section 185 in the FY 2016-17, 17-18 and 18-19. Now they moves an application for compounding of offence for the financial year 2016-17 only. NCLT/RD after observing the matter passes the compounding order and post the compliance of order, company wants to move an application for remaining FY in violation of Section 185. Whether company can do so?

- Suppose company holds its AGM for the FY 2016-17 in the year 19-20 with delay. And for the financial year 17-18 & 18-19, the AGM is still to be held. Meanwhile, the company moves an application for compounding of offence for the financial year 2016-17. NCLT after observing the matter passes the compounding order and post the compliance of such order, company holds it AGM for remaining FY 17-18 & 18-19 and again moves an application for the compounding. Whether company can do so?

- Mr X is director of A Ltd., B Ltd. and C Ltd. Now, for the year 2022 all the companies defaulted in holding AGM in due time. Mr X moved an application for compounding for A ltd, and got the favourable order. Now Mr X wants to move the same application for B Ltd. And C Ltd.

- Mr X is director of A Ltd., B Ltd. and C Ltd. Now, for the year 2022, A ltd. Defaulted in holding AGM but rest two companies did the same on time. Mr X moved an application for compounding for A ltd, and got the favourable order. Now, for 2023, B Ltd. and C Ltd. defaulted in holding the same. Now Mr X wants to move the same application for B Ltd. And C Ltd. Whether he can do so?

3.8 Language of Section 451- Punishment for Repeated Default

If a company or an officer of a company commits an offence punishable either with fine or with imprisonment and where the same offence is committed for the second or subsequent occasions within a period of three years, then, that company and every officer thereof who is in default shall be punishable with twice the amount of fine for such offence in addition to ANY imprisonment provided for that offence.

3.9 What will be the Penal Provision? Section 451 Interpretation

Non-compliance of Section 185- Penal Provision –

(4) If any loan is advanced or a guarantee or security is given or provided or utilised in contravention of the provisions of this section,—

(i) the company shall be punishable with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees;

(ii) every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees;

and

(iii) the director or the other person to whom any loan is advanced or guarantee or security is given or provided in connection with any loan taken by him or the other person, shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees, or with both.]

Suppose Section 185 has not been complied with for the period of two continuous financial years

Whether Mandatory Imprisonment will be must to be imposed or not?

3.9.1 Illustration

- X ltd. held its AGM for the financial year 2016-17, 17-18 and 18- 19 on 30.09.2020 along with AGM of 19-20. Now, company wants to compound the offence for the said three financial years w.r.t delay in AGM. Whether company can do so? If No, why and If yes, How?

- Whether combined application can be moved for all the three years, or separate application needs to be moved for every year? Quote relevant provisions.

3.9.2 Case Laws

Magnon Solutions Pvt. Ltd v. Registrar of Companies [2018] 93 taxmann.com 108/147 SCL 293 (NCLAT)/Pahuja Takii Seed Ltd. v. Registrar of Companies [2018] 98 taxmann.com 424/150 SCL 243 (NCL-AT)

Findings of NCLT

- Where the maximum amount of fine does not exceed five lakh rupees, only RD can compound the matter and not NCLT.

- Repeated defaults with in three years cannot be compounded by virtue of Section 441(2)

explanation.

Explanation of sub-section (2) of Section 441 where with regard to that Section, it is provided that “any second or subsequent offence committed after the expiry of a period of three years from the date on which the offence was previously “compounded”, shall be deemed to be a first offence”.

- There is no provision for combined application and therefore no combined application can be entertained by this tribunal

- Section 451 brings mandatory imprisonment into picture and where mandatory imprisonment provision is there, compounding is not possible.

Magnon Solutions Pvt. Ltd & Ors V. Registrar of Companies/Pahuja Takii Seed Ltd. & Ors V. Registrar of Companies (NCLAT) (2018)

Findings of NCLAT

- where the maximum amount of fine does not exceed five lakh rupees, can be compounded by the ‘Tribunal’ as also by ‘the Regional Director’ or ‘any officer authorised by the Centra; Government’. Tribunal is having power to compound any offence irrespective of the limit of fine.

- Repeated defaults with in three years can be clubbed for compounding in one application, and combined application is allowed. [Section 441 read with Section 451]. Combined application is allowed for same offence and same facts only. Rajendra Prasad Gupta v. Prakash Chandra Mishra and Ors.

- Explanation of sub-section (2) of Section 441 where with regard to that Section, it is provided that “any second or subsequent offence committed after the expiry of a period of three years from the date on which the offence was previously “compounded”, shall be deemed to be a first offence”.

- It is apparent that unless previously the offence has been “compounded”, the rigour of higher punishment as contemplated under Section 451 would not get attracted.

- Imprisonment in case of Company is not possible and in case of officer it is the discretion of the competent court. It is not mandatory to impose imprisonment. Usage of word ‘any’ implies the discretionary power of court.

3.10 Who will Compound?

Offence punishable with

|

Penal Provision |

Who can compound? |

Answers |

| Fine Only |

? |

Tribunal, RD or Authority appointed by CG |

| Fine or Imprisonment (Fine is up to 25 Lacs) |

? |

Tribunal |

| Fine or Imprisonment (Fine is more than 25 Lacs) |

? |

Tribunal |

| Fine or Imprisonment or both |

? |

Tribunal |

| Fine and Imprisonment |

? |

Not Compoundable under CA, 2013 |

| Imprisonment only |

? |

Not Compoundable under CA, 2013 |

3.10.1 Queries

Where to move an application for Compounding? What authority you address while drafting your petition?

Do you calculate quantum of fine and decide accordingly and address application to RD or NCLT?

Language of Section 441(3)(a)-

Every application for the compounding of an offence shall be made to the Registrar who shall forward the same, together with his comments thereon, to the Tribunal or the Regional Director or any officer authorized by the Central Government, as the case may be.

Rule 88 of NCLT Rules- — Any reference to the Tribunal by the Registrar of Companies under section 441 of the Act, or any reference to the Tribunal by the Central Government under proviso to sub-section (5) of section 140, 221, sub-section (2) of section 224, sub-section (5) of section 224, sub-section (2) of section 241 of the Act, or reference under sub-section (2) of section 75 or any complaint by any person under sub-section (1) of section 222, or any reference by a company under clause (c) of sub-section (4) of section 22A of the Securities Contracts (Regulations) Act, 1956 shall be made by way of a petition or application in Form No. NCLT- 9 in Annexure A and shall be accompanied by documents mentioned in Annexure-B.

3.10.2 Illustrations

- Whether compounding application can be rejected? In what circumstances? or

- Whether compounding is possible if SFIO, ED or any other’s department proceeding is pending?

Reebok India Co. (2017) NCLT, New Delhi Bench – Where the defaults by MD were incurable and not done due to bonafide omission and offences committed, if compounded would demolish and prejudice prosecution of the director, the MD cannot be entitled to avail compounding of offences.

Subhinder Singh Prem v. Union of India (NCLAT) (2017)- Managing Director of Reebok India Co. – Merely because SFIO and court case is pending does not mean Compounding cannot be done.

Note – Now in the present scenario if investigation is pending under Companies Act, 2013 compounding is not possible.

- Whether compounding order passed by RD or NCLT can be challenged? Where to challenge?

Note: MMC Doortech Services Private Limited V. ROC [NCLT Chennai Bench]

3.10.3 When Compounding is not possible

- In case offence is punishable with imprisonment only

- In case offence is punishable with imprisonment and fine both

- In case investigation is pending in the Company under this Act, and

- In case similar offence has been compounded in last three years.

3.10.4 Pre-requisite for filing any compounding application

Making of Offence Good

- Continuing Offence: [Offence needs to be made good, mandatorily]

- One Time Offence: [For example: Section 129- Financial Statement]

4. Condonation of Delay

4.1 Language of Section 460

Notwithstanding anything contained in this Act,—

(a) where any application required to be made to the Central Government under any provision of this Act in respect of any matter is not made within the time specified therein, that Government may, for reasons to be recorded in writing, condone the delay; and

(b) where any document required to be filed with the Registrar under any

provision of this Act is not filed within the time specified therein, the Central

Government may, for reasons to be recorded in writing, condone the delay.

4.2 Queries

- Whether company not able to make condonation application under Section 87, can make an application under Section 460 to Central Government for condonation of delay?

- What are the obligations on Central Government before approving and rejecting any application?

- Whether condonation means non-compliance has been legally forgiven?

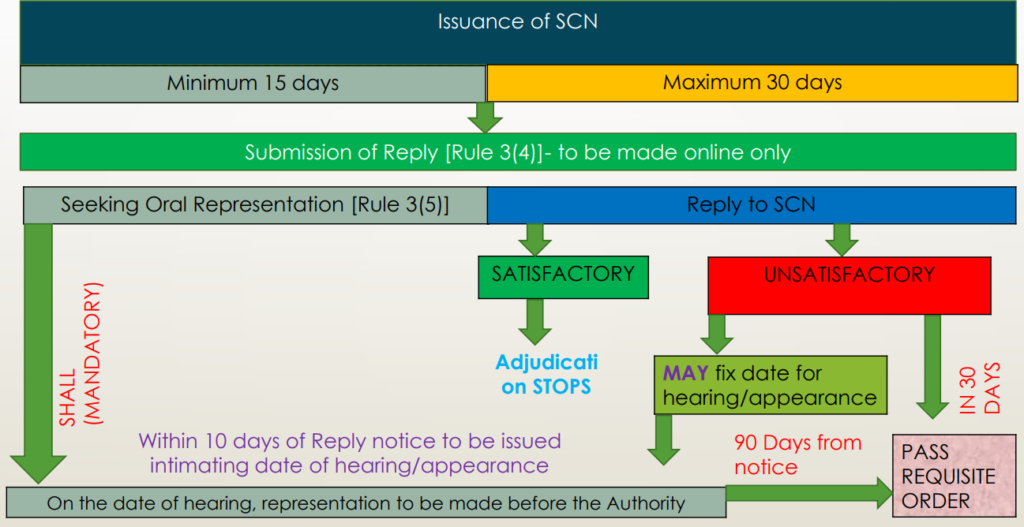

5. Adjudication for Penalties

5.1 Meaning of Adjudication

Adjudication is the process by which the Authority imposes the penalty on the noncompliance after examining your data and information filed with them and

giving you reasonable opportunity of being heard.

5.2 What show cause notice must contain?

Rule 3 sub-rule (2) read with sub-rule (3) of Companies (Adjudication of Penalties) Rules, 2014 states that every notice shall detail out about the-

- Nature of non-compliance or default under the Act,

- Relevant penal provisions of the Act,

- Maximum penalty which can be imposed on the company, and each of the officers in default, or the other person

- Must state the time period to show cause. [Minimum 15 days and Maximum 30 days]

5.3 Language of SCN w.r.t Serving of Notice

WHEREAS the Company is also directed to serve a copy of the said notice to the directors/KMPs and this notice will be treated as deemed to have been served upon every

officers in default of the company in terms of section 20 of the Companies Act. 2013.

5.4 Reasonable Opportunity of being heard

Rasik Lal V. CWT (ITR) – Opportunity of being heard must be provided in proper spirit and mere compliance would not satisfy the requirement of law.

Union of India V. Col. J.N. Sinha (SC) – Rule of natural justice does not supplant the law rather supplement it. If the provisions can be read with rules of natural justice, court must do it, but where it has been specifically excluded, it cannot be read as such with provisions.

5.5 Points to be considered while passing an order [Rule 3(12)]

- Size of the Company

- nature of business carried on by the company

- injury to public interest

- nature of the default

- repetition of the default

- the amount of disproportionate gain or unfair advantage, wherever quantifiable, made

as a result of the default - the amount of loss caused to an investor or group of investors or creditors as a result of

the default

5.6 Proviso to Rule 3(12)

In no Case: The penalty imposed shall not be less than the minimum penalty prescribed

5.7 Rule 3(13)

In case a fixed sum of penalty is provided for default of a provision, the adjudicating officer shall impose that fixed sum, in case of any default therein

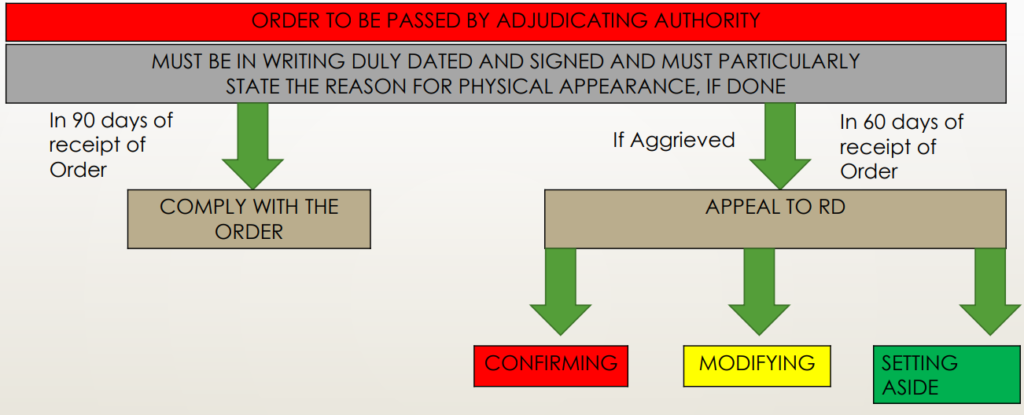

6. Process of Adjudication and Appeal against the Order of Adjudicating Authority

6.1 Difference between Adjudication, Compounding & Condonation

|

ADJUDICATION |

COMPOUNDING |

CONDONATION |

|

It will always be Civil wrong only |

It will be Criminal Wrong |

It is merely for getting authority to file forms with delay |

|

Subsequent Adjudication in less than 3 years of same default is allowed |

Minimum 3 years shall elapsed between two offences of same nature | NOT APPLICABLE |

| Liable to Penalty | Punishable with Fine |

NOT APPLICABLE |

|

Penalty |

Compounding Fee | NOT APPLICABLE |

| Started by Authority | Suo Moto |

Suo-moto |

|

No more non-compliance |

No more non-compliance |

Non-compliance still remains there, except for non-filing |

6.2 How to make reply to MCA SCN? Thought Process

- Interpretation of law as per you,

- Limitation Act,

- Request for representation,

- Deny the offence in case it has not actually occurred,

- Alternate Options, if available,

- Whether form on the basis of which SCN is issued is STP or processed through Approval Mode? and

- Officers in default

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA