[Case Study] Mergers & Acquisitions – Adani’s NDTV Buyout | Piramal’s Strategic DHFL Takeover and More

- Blog|Company Law|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 28 February, 2024

By Dr Mukul Shastry – General Counsel | Cube Highways and Transportation Assets Advisors (P) Ltd., Gautam Shahi – Partner (Competition Law and Policy) | Dua Associates and Dr Sudhanshu Kumar [Moderator] – Associate Professor | NLSIU Bengaluru

Table of Contents

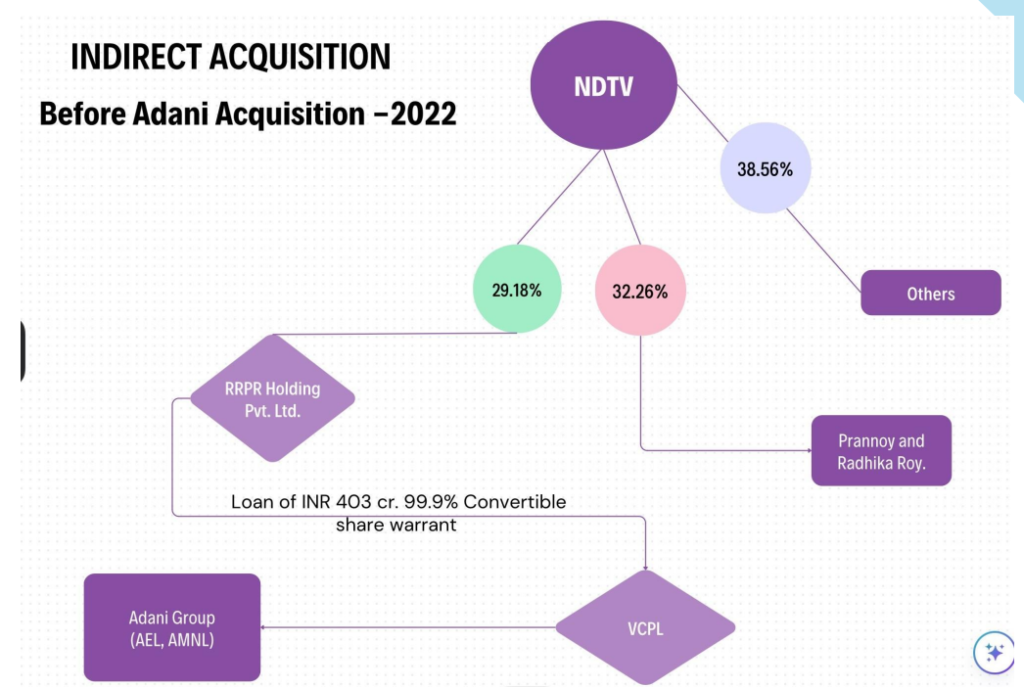

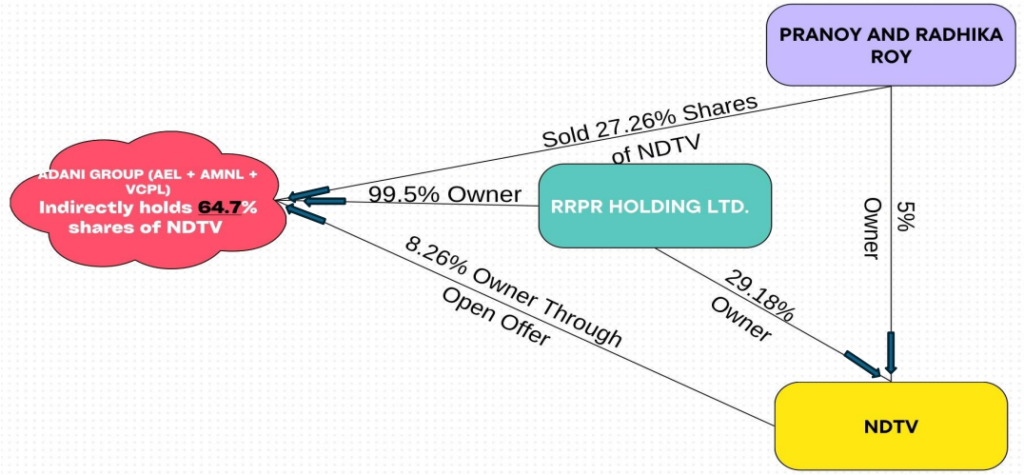

1. Case Study – Adani’s acquisition of NDTV

1.1 Post Adani Acquisition

2. Case Study – Piramal’s acquisition of DHFL

Transaction highlights

- The first successful resolution under the IBC route in the financial services sector and amongst the largest resolutions in value terms

- Total consideration of ~INR 34,250 Crores paid for the completion of the acquisition

- 94% of the creditors had voted in favor of Piramal’s resolution plan

- Approvals obtained from Reserve Bank of India (RBI), Competition Commission of India (CCI) and National Company Law Tribunal (NCLT)

- Piramal Capital and Housing Finance Ltd. (PCHFL) to merge with DHFL. Resultant entity to be named as PCHFL

- Most of the DHFL creditors are recovering nearly 46% through successful completion of the resolution process

Source: https://www.piramal.com/wp-content/uploads/2021/09/Press-Release_Piramal-DHFLAcquistion_Sept-29-.pdf

2.1 Piramal – DHFL Reverse Merger

- 20th Nov 2019 – RBI suspends DHFL’ Board owing certain financial irregularities;

- 3rd Dec 2019 – RBI filed company petition to start CIRP for DHFL;

- Administrator appointed.

- CIRP commenced and erstwhile Piramal was Successful Resolution Applicant (SRA);

- Administrator filed various petition for Avoidance of Transaction worth Rs 45,000 cr.

- SRA to merge in DHFL and a new entity PCHFL to come into being;

- Piramal was successful but it got the order to keep the recovery of Avoidance Agreement for itself for Rs. 1

2.2 Major Issue Rs. 45000 Crores Avoidance Agreement

- COC-constituted of Union Bank of India, State Bank of India, Bank of India, Canara Bank, Punjab National Bank, and Central Bank of India among other.

- 63 moons limited (erstwhile Financial Technology-which owned MCX) filed petition before NCLAT

- NCLAT declared that Avoidance Agreement recovery going to SRA for INR 1 is stayed.

- Above members of COC filed petition to Supreme Court – matter pending there.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA