{Analysis} Beneficial Ownership Concept & Recent Trends – Indian and Foreign Case Laws | Case Studies

- Blog|International Tax|

- 34 Min Read

- By Taxmann

- |

- Last Updated on 7 March, 2024

By CA Anish Thacker – Partner | SRBC & Associates LLP

Table of Contents

- Meaning of Beneficial Ownership

- Streams of Income to Which Beneficial Ownership Applies

- Proving Beneficial Ownership Through Tax Residency Certificate (‘TRC’)

- Beneficial Ownership Under BEPS and MLI

- Foreign Judicial Precedents

- Case Studies

- Indian Judicial Precedents

- Applicability to Capital Gains

1. Meaning of Beneficial Ownership

- The term “beneficially owned” finds its place in the Double Taxation Avoidance Agreements (“DTAA”), predominantly in the Articles governing allocation of taxing rights in respect of passive incomes – dividend, interest and royalty and fees for technical services (‘FTS’).

- The DTAAs provide for right of taxation to a particular country/both the contracting countries in respect of a “resident of a contracting State.” Such right of taxation may either be vested with the resident State or the source State depending upon the character of income and agreement between the countries. In respect of certain incomes, treaties provide for taxation at a concessional rate of tax, if such resident of the contracting State earning the income, “beneficially owns” such income.

- Various practices are adopted by taxpayers to take advantage of concessional rate of tax offered under DTAAs, including establishing ‘pass-through’ corporations in low tax jurisdictions and therefore, avoiding tax which otherwise the taxpayer would not have been able to. This practice of accessing treaties through artificial means to avail benefits offered therein is known as ‘Treaty Shopping’.

- The Hon’ble Supreme Court in case of Azadi Bachao Andolan (263 ITR 706) has defined treaty shopping as “a graphic expression used to describe the act of a resident of a third country taking advantage of a fiscal treaty between two Contracting States.

- OCED, for the first time in its 1977 Model Convention, introduced the concept of ‘beneficial ownership’ in respect of passive incomes earned by residents of a Contracting State. Since then, almost all countries in the world have adopted this concept in their DTAAs.

- However, the term ‘beneficial owner’ or ‘beneficial ownership’ has not been defined either under the DTAA or the Income-Tax Act, 1961.

- Black’s law dictionary:

“One recognised in equity as the owner of something because use and title belong to that person, even though legal title may belong to someone else; esp. one for whom property is held in trust.”

- Webster’s dictionary:

“one who is entitled to receive the income of an estate without its title, custody or control.”

- Law Lexicon

“One who, though not having apparent legal little, is in equity entitled to enjoy the advantage of ownership”

- Klaus Vogel

“Beneficial owner is a person who is free to decide whether or not the capital or other assets should be used or made available for use by others (i.e., the right over capital), or how the yields from them should be used (i.e., the right over income), or both”

- Tainwala Trading and Investments Co. Ltd. [22 taxmann.com 68 (Mumbai ITAT)]:

“A person is said to be a beneficial owner of shares when they are held by someone else on his behalf, meaning thereby that the registered owner is different from the actual or the beneficial owner. Where the shares are not so held by one for and on behalf of another, the concept of beneficial ownership cannot be invoked.”

- Legal ownership beneficial ownership:

- Legal ownership refers to legal title over a particular

- Beneficial Ownership is not commonly It exists if a person has:

- right to enjoy the benefits of the underlying asset; and

- control over use and disposal of the underlying

- Beneficial Ownership can exist even if a person is not the legal

- Determination of beneficial ownership is a fact specific

- Generally, beneficial ownership is said to exist, if the recipient of income:

- is formed for business considerations and not with the primary intent to save tax;

- makes independent decision with respect to the use of such income; and

- assumes risk associated with earning such income.

- Generally, beneficial ownership is said to exist, if the recipient of income:

2. Streams of Income to Which Beneficial Ownership Applies

The term ‘beneficial owner’ is predominantly used in Articles governing taxation of dividend, interest, royalty and FTS under their respective clauses of 2017 OECD Model Convention.

|

Article 10 – Dividends |

Article 11 – Interest |

Article 12 – Royalties |

| However, dividends paid by a company which is a resident of a Contracting State may also be taxed in that State according to the laws of that State, but if the beneficial owner of the dividends is a resident of the other Contracting State, the tax so charged shall not exceed:

a) 5 per cent of the gross amount of the dividends if the beneficial owner is a company which holds directly at least 25 per cent of the capital of the company paying the dividends throughout a 365 day period that includes the day of the payment of the dividend (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganisation, such as a merger or divisive reorganisation, of the company that holds the shares or that pays the dividend); b) 15 per cent of the gross amount of the dividends in all other cases. |

However, interest arising in a Contracting State may also be taxed in that taxed in that State according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed 10 per cent of the gross amount of the interest. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this limitation | The provisions of para-graph 1 shall not apply if the beneficial owner of the royalties, being a resident of a Contracting State, carries on business in the other Contracting State in which the royalties arise through a permanent establishment situated therein and the right or property in respect of which the royalties are paid is effectively connected with such permanent establishment. In such case the provisions of Article 7 shall apply. |

The 2017 UN Model Convention also provides for similar restrictions, tabulated as under:

|

Article 10 – Dividends |

Article 11 – Interest | Article 12 – Royalties |

Article 12A – FTS |

| However, such dividends may also be taxed in the Contracting State of which the company paying the dividends is a resident and according to the laws of that State, but if the beneficial owner of the dividends is a resident of the other Contracting State, the tax so charged shall not exceed:

a) per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the dividends if the beneficial owner is a company (other than a partnership) which holds directly at least 25 per cent of the capital of the company paying the dividends throughout a 365 day period that includes the day of the payment of the dividend (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganisation, such as a merger or divisive reorganisation, of the company that holds the shares or that pays the dividend); b) per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the dividends in all other cases. |

However, such interest may also be taxed in the Contracting State in which it arises and according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the interest. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this limitation. | However, such royalties may also be taxed in the Contracting State in which they arise and according to the laws of that State, but if the beneficial owner of the royalties is a resident of the other Contracting State, the tax so charged shall not exceed per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the royalties. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this limitation. | However, notwithstanding the provisions of Article 14 and subject to the provisions of Articles 8, 16 and 17, fees for technical services arising in a Contracting State may also be taxed in the Contracting State in which they arise and according to the laws of that State, but if the beneficial owner of the fees is a resident of the other Contracting State, the tax so charged shall not exceed percent of the gross amount of the fees [the percentage to be established through bilateral negotiations]. |

3. Proving Beneficial Ownership Through Tax Residency Certificate (‘TRC’)

- The CBDT vide Circular No 789/2000 dated 13 April 2000 has clarified that TRC, obtained from Mauritius tax agency is sufficient proof to accept the residency and beneficial ownership status.

- This was made applicable for availing the treaty benefits in respect of capital gains earned by a Mauritian resident, even though, the Article restricts benefits only to a ‘beneficial owner’.

- The validity of the Circular has been upheld by the Hon’ble Supreme Court in case of Azadi Bachao Andolan (supra).

- Abdul Razak A. Meman (276 ITR 306) (AAR) – TRC not accepted as proof of beneficial ownership since the Circular was issued in context of India-Mauritius DTAA and no such circular issued in respect of India-UAE DTAA.

- Universal International Music BV [214 Taxman 19 (Bombay HC)] – issue of taxation of royalty under India-Netherlands DTAA – TRC held to be valid proof of beneficial ownership.

-

- Followed in HSBC Bank (Mauritius) Ltd. [96 taxmann.com 544 (Mumbai ITAT)] – in context of interest under India-Mauritius DTAA [approved by Hon’ble Bombay HC in 159 taxmann.com 180 dated 24 January 2024]

- Followed in Imerys Asia Pacific Pvt. Ltd. [69 taxmann.com 454 (Pune ITAT)] – in context of royalty under India-Singapore DTAA.

- Vodafone International Holdings [341 ITR 1 (SC)]:

-

- TRC does not prevent enquiry into a tax fraud.

-

– “106……….. if the fraud is detected by the Court of Law, it can pierce the corporate structure since fraud unravels everything, even a statutory provision, if it is a stumbling block, because legislature never intents to guard fraud. Certainly, in our view, TRC certificate though can be accepted as a conclusive evidence for accepting status of residents as well as beneficial ownership for applying the tax treaty, it can be ignored if the treaty is abused for the fraudulent purpose of evasion of tax.”

4. Beneficial Ownership Under BEPS and MLI

- In order to prevent treaty shopping, the BEPS Action Plan 6 on ‘Preventing the granting of treaty benefits in inappropriate circumstances’ was introduced by the OECD/G20.

- In order to implement the Action Plan, the following minimum standards are proposed, which all signatories to the Multi Lateral Instruments are to adopt in their covered tax agreements:

-

- An express statement that their common intention is to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance, including through treaty shopping arrangements.

- Having either:

-

-

- Principal Purpose Test (‘PPT’) alone; or

- A combination of PPT supplemented by either a simple or detailed Limitation of Benefits clause; and

- a detailed LOB rule supplemented by a mechanism would deal with conduit financing arrangements not already dealt with in tax treaties.

-

Express intent to eliminate non-taxation/reduced taxation through tax avoidance schemes:

- Dealt with in Article 6 – Purpose of a Covered Tax Agreement which prescribes the intent for which the treaties are entered into between the countries. The Article focuses on amending the preamble of the treaties entered into between the signatory countries, which lay down the object and purpose for which such treaties are entered into.

- Article 6(1) of MLI provides for modification of the preamble of the covered tax treaties by providing as under:

“A Covered Tax Agreement shall be modified to include the following preamble text: “Intending to eliminate double taxation with respect to the taxes covered by this agreement without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in this agreement for the indirect benefit of residents of third jurisdictions),“

- Therefore, the treaty should be entered between the contracting states with an intent to:

-

- eliminate double taxation;

- not create opportunities for non-taxation or reduced taxation through tax evasion or avoidance; and

- also prohibits treaty shopping arrangements aimed at obtaining reliefs provided in this agreement for the indirect benefit of residents of third jurisdictions.

- Any transaction carried out to evade or avoid tax, even though there is no express prohibition in the respective Articles in the Covered tax agreements, now will be tested in the lines of the preamble which prohibits reduced taxation/non-taxation through tax avoidance/evasion arrangements. This also includes treaty shopping.

- Under Article 6(4) of MLI, a country can make a reservation on the applicability of Paragraph 1 to any of the treaties provided, it already contains a preamble intending as above or a broader preamble. India has not made any specific reservation on the application of Article 6(1).

Prevention of treaty abuse:

- Article 7 of MLI was introduced which deals with prevention of treaty It proposes that, as a minimum standard, the signatories, in their treaties should have either:

-

- Principal Purpose Test (‘PPT’) alone; or

- A combination of PPT supplemented by either a simple or detailed Limitation of Benefits clause; and

- detailed LOB rule supplemented by a mechanism would deal with conduit financing arrangements not already dealt with in tax treaties.

- The PPT is proposed under Article 7(1) to 7(5) of MLI.

- Under Article 7(1) of MLI, the treaty benefit would not be available if, it can be reasonably concluded that obtaining the treaty benefit was one of the principal purposes of any arrangement or transaction that resulted directly or indirectly in that benefit. However, if it is established that granting the benefit is in accordance with the object and purpose of the DTAA, then the treaty benefit would not be denied. Thus, the provision is wide enough to cover even cases where the transaction is undertaken for valid commercial reasons but would still be denied treaty benefit if one of the principal purposes is to avail the treaty benefit.

- The term ‘one of the principal purposes’ has been explained by the OECD in its 2015 Final Report on BEPS Action Plan 6 as

“obtaining the benefit under a tax convention need not be the sole or dominant purpose of a particular arrangement or transaction. It is sufficient that at least one of the principal purposes was to obtain the benefit.”

- Further, it is further explained that where obtaining the benefit was not a principal consideration, the benefit would not be denied, especially in a scenario where the arrangement is inextricably linked to a core commercial activity and the manner in which the arrangement is implemented is not driven by considerations of obtaining the benefit.

- Under Article 7(4) of MLI, in case the treaty benefit is denied by invocation of the PPT rule, then the assessee can approach the Competent Authority of the country denying such benefit, who would review the decision taken and decide accordingly. If such application is made by the resident of the other contracting state, the CA of the country denying the benefit should hold consultations before rejecting such request.

- Simplified LOB rules are laid down under Article 7(6) to 7(14) of the MLI and provides that the treaty benefit would not be available to the resident of the Contracting State, unless, such person is a ‘qualified person’.

-

- The term ‘qualified person’ is defined in Para 9 of the said Article.

- Unlike PPT, the simplified LOB is not a minimum standard prescribed under the BEPS action plan and therefore, unless both the Contracting jurisdictions notify Article 7(6) to 7(14) in their covered tax agreements, the same cannot be read into the treaty.

- Though India has notified simplified LOB test, however, most of the countries with whom India has entered into treaties have chosen not to permit other countries (including India) asymmetrical application of simplified LOB. Therefore, in most of India’s tax treaty, only PPT will apply.

Article 8 – Dividend Transfer Transactions:

- Treaties usually provide for allocation of taxing rights of dividends to either the source state or/and the resident state. Some also provide for concessional rate of tax, provided the beneficial owner of the dividend is a resident of a contracting state.

- Few treaties provide for a minimum shareholding to be held by the companies in the companies paying the dividend in order to avail such benefit of concessional rates (e.g. Singapore provides concessional tax rate @10% if the beneficial owner owns at least 25% of the capital).

- To take benefit of the same, some assessee’s increase the shareholding before the declaration of the dividend.

- In order to curb such practises, Article 8 of MLI seeks to introduce a minimum holding period of 365 days including the day of declaration of the dividend in order to claim the benefit of such concessional rate of tax.

- This test of minimum holding period applies in respect of covered tax agreements where the minimum shareholding percentage is prescribed and not otherwise.

- Insofar as India is concerned, India has made a reservation against application of the provisions of this Article in respect of India- Portugal DTAA as, under Article 10 of India-Portugal DTAA, a higher holding period of 2 years is prescribed.

- India has notified the article in the following treaties by not making specific reservations qua the application of Article 8(1) – Bangladesh, Belarus, Canada, Croatia, Denmark, Italy, Lithuania, Montenegro, Nepal, Oman, Philippines, Qatar, Serbia, Singapore, Slovakia, Slovenia, Syria, Tajikistan, Ukraine, Zambia, etc.

5. Foreign Judicial Precedents

5.1 Indofood International Finance Ltd. v. JP Morgan Chase Bank N.A. London Branch [EWCA Civ 158 (Court of Appeals) (UK)]

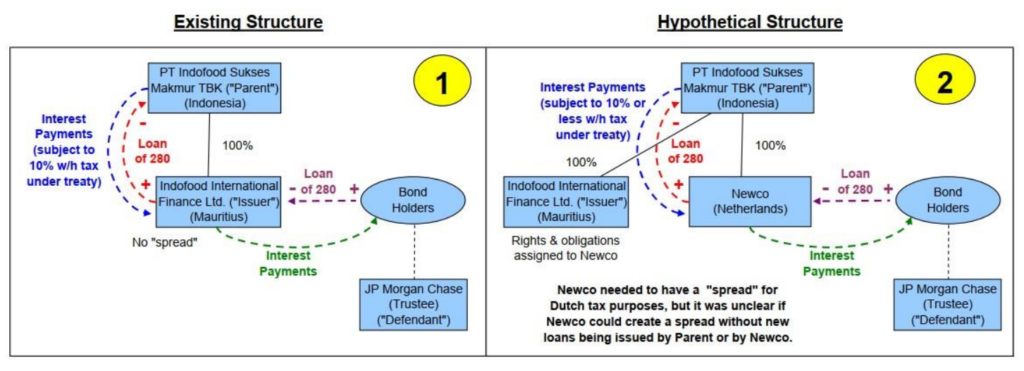

Facts

- No taxing authority was a party to the

- The case involved a contract dispute in which a vaguely defined hypothetical situation had to be analysed by the U.K. Court. The U.K. Court had to interpret Indonesian tax law, as potentially modified by the Indonesia-Netherlands Tax Convention, to determine whether a party to the contract took sufficient measures to avoid taxation.

- The Indonesian Company issued bonds through a Mauritian subsidiary company (SPV). Under the Indonesia- Mauritius DTAA, the withholding on interest was to be done at a concessional rate of 10% as against domestic withholding rate of 20%. Interest payments from the SPV to the bondholders were not subject to withholding in Mauritius, so the SPV could pass on the benefit of the reduced withholding to the bondholders. The terms of the bonds included a clause that if the Indonesian withholding went above 10% and no “reasonable measure” could be found to avoid the increase, then the Mauritian SPV could redeem the bonds.

- Subsequent to the issue of bonds, the Indonesian government terminated its DTAA with Mauritius and as a result, the withholding rate increased to 20% which was to be borne by the Indonesian company. When a proposal to set up a Netherlands company was brought up, the Indonesian tax authorities contented that it was the Indonesian company which was the ultimate beneficial owner and denied the application of Netherlands-Mauritius treaty.

- As per the agreement, the matter was to be adjudicated in the UK Court.

Decision

The Court of Appeal in England concluded that the Netherlands company would not qualify as the beneficial owner of the interest for the following reasons:

- Beneficial ownership is to be interpreted in the context and in light of the purposes and object of DTAAS.

- The international fiscal meaning of beneficial ownership is to be followed rather than any narrow technical domestic interpretation.

- The beneficial owner is the person who has the full privilege to directly benefit from the income.

- An intermediary/conduit company that simply lends on the funds collected under the same conditions does not derive any direct benefit from the interest, so it hardly has the full privilege needed to qualify as the “beneficial owner”.

Even though the subject matter of the case was whether a Dutch company can be interposed or not to avail the treaty benefit, the Judgment stated that neither the Mauritian SPV nor the Dutch SPV qualified as “beneficial owner” and, therefore, were not entitled to claim the benefits.

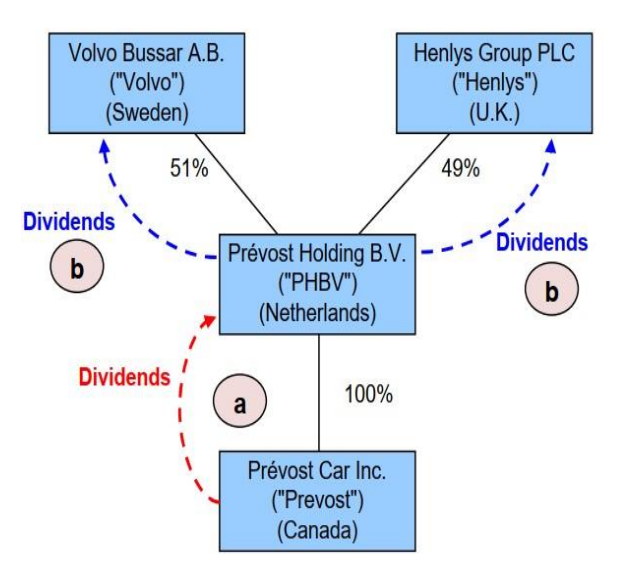

5.2 Prevost Car Inc vs. Her Majesty the Queen [2009 FCA 57 (Federal Court of Appeals) (Canada)

Facts

- A Canadian company paid dividends to its parent, a Netherlands holding company.

- The shares of the Netherlands holding company were owned by a Swedish company and a UK company.

- The Canadian company withheld tax on the dividends paid to the Netherlands holding company at the rate of 5%, as provided under Canada-Netherlands DTAA.

- The Canadian tax authorities denied the treaty benefit of taxation at the concessional rate of 5% as the Netherlands company was not the beneficial owner of the dividends and that its shareholders were the beneficial owners of the dividends and therefore the applicable rates of withholding tax were 10% and 15% (the applicable rates under Canada’s tax treaties with Sweden and the United Kingdom) respectively.

Decision

- The Netherlands company was the beneficial owner of the dividends since

“the person who receives the dividends for his or her own use and enjoyment and assumes the risk and control of the dividend he or she received“.

- It is the company itself and not its shareholders which is the beneficial owner of the income.

“When corporate entities are concerned, one does not pierce the corporate veil unless the corporation is a conduit for another person and has absolutely no discretion as to the use or application of funds put through it as conduit, or has agreed to act on someone else’s behalf pursuant to that person’s instructions without any right to do other than what that person instructs it.”

- Accordingly, the Netherlands holding company was not a conduit because there was “no predetermined or automatic flow of funds” to its shareholders.

5.3 Velcro Canada Inc. v. Her Majesty The Queen [2009 DTC 5053 (Federal Court of Appeals)] (Canada)

Facts

- Velcro Canada Inc. (VCI) paid royalties to a related company, Velcro Industries BV (VIBV), a resident of the Netherlands, calculated as a percentage of net sales.

- In 1995, VIBV became a resident of the Netherlands Antilles, and assigned its rights under the royalty agreement to a subsidiary, Velcro Holdings BV (VHBV), a resident of the Netherlands. In exchange for the assignment, VHBV agreed to pay to VIBV an amount calculated as an arm’s-length percentage of net sales of the licensed products within 30 days of receiving royalty payments from VCI.

- The percentage was subject to the approval of the Dutch tax authorities, but was ultimately determined to be equal to 90% of the royalties received from VCI.

- Canada does not have a tax treaty with the Netherlands Antilles, and if royalties were paid by VCI to VIBV, or VIBV were the beneficial owner of royalties paid to VHBV, the royalties would be subject to a 25% withholding tax, rather than the 10% rate under the Canada-Netherlands treaty (reduced to 0% in 1998).

- The Canada Revenue Agency took the position that VHBV was not the beneficial owner of the royalties, as required by Article 12 of the treaty, and reassessed VCI for not withholding tax at the 25% rate, plus penalties.

Decision

“…the “beneficial owner” of dividends is the person who receives the dividends for his or her own use and enjoyment and assumes the risk and control of the dividend he or she received….When an agency or mandate exists or the property is in the name of a nominee, one looks to find on whose behalf the agent or mandatory is acting…When corporate entities are concerned, one does not pierce the corporate veil unless the corporation is a conduit for another person and has absolutely no discretion as to the use or application of the funds put through it as a conduit, or has agreed to act on someone else’s behalf pursuant to that person’s instructions without any right to do other than what the person instructs it…”

- Similar to the finding in Prévost, there was no “pre-determined flow of funds” from VCI to VIBV, despite the contractual obligation between VHBV and VIBV.

- Upon receipt, the royalty payments were intermingled with VHBV’s other accounts and used for a variety of purposes, at VHBV’s sole discretion. The funds were not segregated and paid directly to VIBV. The funds were transferred to various other accounts in different currencies and used to earn interest and to fund various activities, including loans, investments in subsidiaries, operational expenses and professional fees. The funds were exposed to creditors of VHBV.

- The Court held that VHBV had the “possession, use, risk and control” of the funds, and was the beneficial owner of the royalty income. In addition, VHBV was not an agent or nominee. VHBV did not have the power to legally bind VIBV and was acting on its own behalf at all times. Further, VHBV was not a conduit or “mere channel”.

- Applying Prévost, it was held that a conduit has absolutely no discretion with respect to funds received, which was not the case –

“It is quite obvious that though there might be limited discretion, VHBV does have discretion”.

5.4 Korea vs CJ E&M Co., Ltd. [2017 Du33008 (Supreme Court)] (South Korea)

Facts

- In 2011, a Korean company, CJ E&M Co., Ltd concluded a license agreement relating to the domestic distribution of Paramount films, etc. with Hungary-based entity Viacom International Hungary Kft (‘VIH’), which is affiliated with the global entertainment content group Viacom that owns the film producing company Paramount and music channel MTV. From around that time to December 2013, the Plaintiff paid VIH royalties.

- CJ E&M Co., Ltd did not withhold tax in respect of royalty income in terms of Article 12(1) of the Korea-Hungary DTAA.

- The Hungarian company was interposed between the Korean entertainment company and a Dutch company which previously licensed the rights to the Korean entertainment company.

- The Korean Tax Authorities:

-

- deemed that VIH was merely a conduit company established for the purpose of tax avoidance and that the de facto beneficial owner of the pertinent royalty income was Viacom Global Netherlands BV (‘VGN’), the parent company of VIH based in the Netherlands;

- applied the Korea-Netherlands DTAA rather than the Korea-Hungary DTAA

- The High Court ruled in favour of the tax authorities and held that the Hungarian company was a mere conduit used for treaty shopping purposes.

Decision

- The Korean Supreme Court reversed the High Court’s decision on the grounds that beneficial ownership should not be denied by the mere fact that tax benefits were derived from the relevant tax treaty if the foreign entity was otherwise engaged in genuine business activities in line with the entity’s business purpose.

- The Supreme Court decided that the Hungarian entity should be entitled to the treaty benefits because it did not bear any legal or contractual obligation to transfer the royalty income and thus should be regarded as the beneficial owner; and it had the ability to manage and control the license rights that gave rise to the royalty income, and therefore the GAAR should not apply.

5.5 Profi Credit Bulgaria EOOD [(Case C-170/21) Bulgarian Administrative Supreme Court] (Bulgaria)

Facts

- Profi Funding BV (‘Dutch company’) granted loans to the taxpayer (a Bulgarian single-person private limited liability company). The entire capital of the Dutch company and the taxpayer was owned by Profireal Group CE also based in the Netherlands. While making payment of interest, the taxpayer did not withhold any taxes by treating the Dutch entity as a beneficial owner of the interest income and claimed relief under Article 11(1) of the Bulgaria- Netherlands DTAA, which gave exclusive taxing rights to the residence State.

- The Bulgarian tax authorities disputed the position and denied the treaty benefit basis the following:

-

- The Dutch company was not engaged in any real economic activity and acted only as an intermediary company for obtaining loans and transferring them to related companies;

- The Dutch company did not have any free funds to finance the grant of the loans to the taxpayer, and the said loans were taken from a Cyprus tax resident, for which it incurred interest costs;

- The funds were routed through the Netherlands instead of direct loan by Cyprus resident, to avoid withholding tax @7% in terms of Article 11(2) of the Bulgaria-Cyprus DTAA.

- The Administrative Court of Sofia agreed with the taxpayer holding as under:

- Routing of funds through the Dutch company was part of the strategic initiative of the Profireal Group to create an intragroup financing company.

- Interest rate on loan granted to the Dutch company by the Cyprus entity was lower than that of the Dutch company’s loan to the taxpayer, indicating economic benefit and generation of profit;

- There was no restriction on the Dutch company’s right to dispose-off the income freely for about ten months, i.e., the time gap between the receipt of the interest income from the taxpayer and subsequent interest payment to the Cyprus entity;

- The Dutch company bore the risk of the loan activity, because in case of non-fulfilment of the taxpayer’s obligation, the Dutch company’s obligation to the Cyprus entity would have continued.

Decision:

The Supreme Administrative Court of Bulgaria decided the issue in favour of the tax authorities, holding as under:

- The Dutch entity was registered with a mere capital of €100, and the book value of its assets formed by receivables from group companies almost coincides with liabilities to its sole creditor, i.e. the Cyprus entity;

- The interest income of the Dutch entity almost coincides with the interest expense to the Cyprus entity, and if the Dutch entity disposes of the interest income for purposes other than repayment of interest expense, then the obligation to the Cyprus entity will be dissatisfied. This is incompatible with the stated strategic initiative to set up a company for intragroup financing, as the Cyprus entity’s receivables are secured only by receivables from the group companies.

- The Dutch entity did not have any economic substance as the interest income received from the taxpayer was almost entirely used for paying off the interest to the Cyprus entity, and the balance was utilised for operating expenses;

- Non-fulfilment of the obligation by the group companies towards the Dutch entity would result in non-fulfilment of the obligation by the Dutch entity to the Cyprus entity, and thus the risk is of the Cyprus entity and not the Dutch entity.

5.6 CBS International Netherlands BV [(Case No 3012) Bulgarian Administrative Supreme Court] (Bulgaria)

Facts

- The taxpayer is a tax resident of the Netherlands and a wholly owned subsidiary of CBS International Holdings BV (Netherlands) and ultimately owned by CBS Corporation (United States).

- The taxpayer (tax resident of Netherlands) had entered into a television license contract with Fox Networks Group Bulgaria Ltd. (‘Fox Bulgaria’) and received royalties for granting a television licence to distribute television programs. Fox Bulgaria paid royalty to the taxpayer after withholding tax under the domestic law.

- The taxpayer claimed refund of the taxes withheld by invoking Article 12 of the Bulgaria-Netherlands DTAA read with Article VIII of the appended protocol, which provided exclusive taxing rights to the residence State.

- The tax authorities concluded that the taxpayer is not the beneficial owner on the following grounds:

-

- The majority of the taxpayer’s income is distributed to the owner of the license, i.e., CBS Corporation;

- CBS Corporation assumes the risk of the development activity, the market risk is borne equally by CBS Corporation and the taxpayer, and the only risks taken by the taxpayer are the currency, operational and credit risks, which in turn are not directly related to the development activity.

- The Administrative Court of Sofia reversed the view taken by the tax authorities and allowed the appeal by the taxpayer

Decision

The Supreme Administrative Court of Bulgaria held the taxpayer to be the beneficial owner basis the following:

- The income is derived from the activity of granting rights under underlying television license contracts corresponding to which there is the risk identified in the transfer pricing documentation – development risk, market risk, currency risk, operational risk, and credit risk. Neither the taxpayer nor the Administration have alleged that the taxpayer created the rights from the grant from which the income arose. Nor did the tax authorities deny the taxpayer’s right to grant Fox Bulgaria the use of the copyright objects in return for consideration constituting the income on which the withholding tax was levied;

- The taxpayer is not a company for the channelization of income. It is not controlled by a person not entitled to the same type or amount of relief on direct receipt of income. Control of CBS International Netherlands BV is exercised by another Dutch company which is within the personal scope of the Bulgaria-Netherlands DTAA;

- There are no sources of information that control on the taxpayer is exercised by the ultimate parent company;

- The Administrative Court of Sofia t was correct in finding that the taxpayer had assets, capital, and its specialized personnel, and a comparison of the 2016 and 2017 figures showed that the taxpayer’s employees, offices, and profits were increasing, and therefore it was not a company that did not have assets, capital, and personnel consistent with its business;

- The existence of control over the use of the rights from which the income was earned is indicated by the content of the underlying contracts, which provide for penalties for non-performance and Fox Bulgaria’s obligation to submit monthly reports.

6. Case Studies

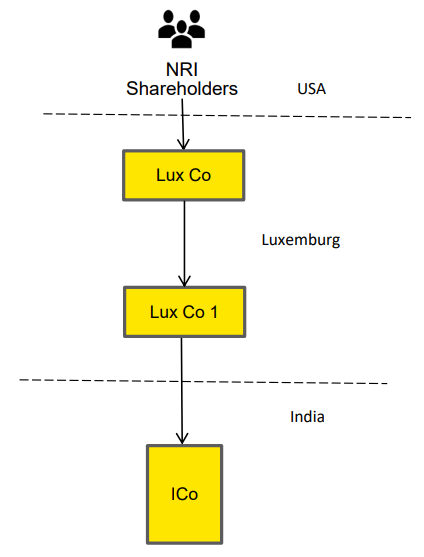

6.1 Case Study 1 – Beneficial ownership with ultimate individual shareholder

- Mr. A and Mr. B are non-resident in India (NR individuals) and are based out of USA and are tax resident of USA. NR individuals have set-up a company in Luxembourg (Lux Co) for purpose of investment.

- Lux Co is the holding company and is resident of Luxembourg. It holds entire share capital of Lux Co1, another entity resident in Luxembourg which in turn holds investment in various operating companies across Asia Pacific Region. Lux Co1 has also invested in shares of I Co (to the extent of 10%) which is engaged in manufacturing business in India.

- Lux Co1 earns dividend income from I Co and the dividend income is received in bank account in Luxembourg. Lux Co1 shall distribute such dividend income earned from I Co and other companies to Lux Co.

- Lux Co is contemplating to declare dividend from such income to its shareholders. The management of Lux Co believes that this decision is considering Lux Co is expected to have such surplus funds, with no immediate deployment plans in the near future.

- Further, under S.90 of the Companies Act, 2013, I Co has disclosed the NR individuals as Significant Beneficial Owner (SBO) as they indirectly hold 10% shares of I Co.

- Issue: While evaluating condition of BO under Article 10(2) of India- Luxembourg tax treaty, whether NR individuals will be considered as BO of dividend income given?

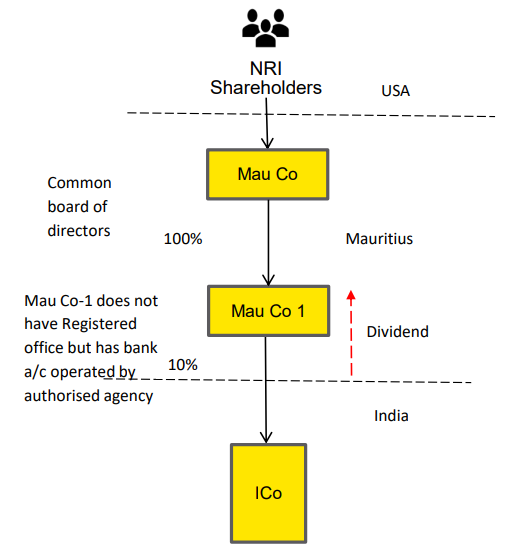

6.2 Case Study 2 – Evaluating treaty benefit where BO and recipient of income are separate

- US investors are desirous of making investments in various Asian Countries. Accordingly, a company in Mauritius is set up as a holding company (Mau Co) for the purposes of making investment and earning long term capital appreciation.

- Mau Co has set-up another special purpose vehicle in Mauritius (Mau Co1) for the purpose of making investment only in companies situated in India. Similar subsidiaries/vehicles are also set up in Mauritius to make investment in other Asian countries. Mau Co has infused the entire share capital in Mau Co 1 for the purposes of making investment in India.

- Mau Co and Mau Co-1 hold valid TRC

- I Co is a company incorporated in India, which also has substantive business activities in real estate sector. In order to raise finance for its business operations, ICo has availed an INR denominated loan in foreign currency from Mau Co1 for the said purposes. I Co pays annual interest on INR loan to Mau Co 1.

- Insofar as Mau Co1 is concerned, it has enough liquidity to smoothly operate its business activities. It is not under a contractual obligation to pass the interest income received from I Co to Mau Co.

- However, past trends reflect that 95% of the amount of interest received from I Co is passed onto Mau Co, by way of dividend declaration. 5% is retained to meet the administrative charges.

- It is assumed that the INR loan received is not covered within the ambit of 194LC/LD and hence the interest income on such loan is taxable at 40% under provisions of Income-tax Act, 1961. Article 11(2) of India-Mauritius tax treaty provides for a concessional tax rate of 7.5% on such interest income.

Issue:

- Whether TRC is sufficient evidence for beneficial ownership test and whether a factual analysis can be ignored on the basis on TRC?

- What are the consequences if Mau Co (and not Mau Co1) is regarded as BO of dividend income? Can Mau Co claim treaty benefit

- Will the answer change if Mau Co and Mau Co1 were situated in Netherlands where Article 11(2) grants tax treaty benefit to the BO, being resident of interest income (by virtue of MFN clause and application of India-Slovenia DTAA)?

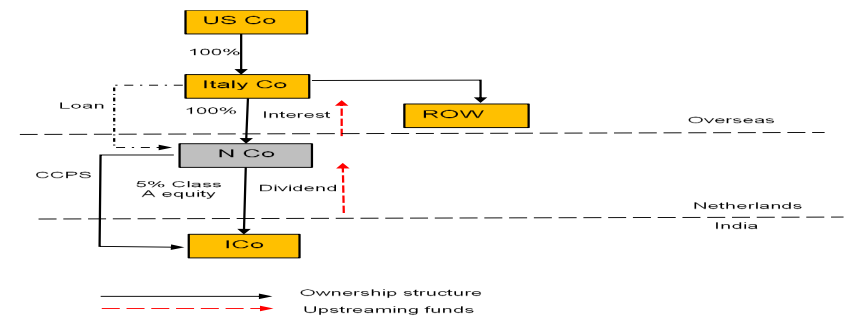

6.3 Case Study 3 – Beneficial ownership under tax treaty and related issues

- US Co is a company acting as investment pooling vehicle and invests in various start-ups

- For Non-US investments, US Co has a holding company in Italy which holds directly or indirectly shareholding interest in companies located in Asian and European companies (in most cases minority interest of about 5 to 15%). Rest of World (‘ROW’) Investments are held by Italy Co

- Italy Co had identified opportunity way back in 2010 of investing in ICo, which has now turned out to be unicorn. Italy Co had invested in ICo through its wholly owned subsidiary (WOS) in Netherlands (N Co).

- For the purposes of better cash flow management and tax efficiency at Italy and US, Italy Co had invested in NCo by mix of loan (predominant component) and equity (smaller component). N Co has in turn invested in equity and CCPS of I Co.

- In respect of dividend paid by ICo for F.Y. 2021-22 and proposed dividend to be paid in September 2022, questions have arisen about treaty entitlement of N Co.

- Functioning of N Co:

-

- Since year 2010 it is a validly organised company which fulfils substance requirement in Netherlands and holds valid TRC and holds own bank account operated by non-resident directors

- N Co is a signatory to various shareholders agreements signed by ICo with NCo and other investors. NCo receives notice of shareholders meeting and its directors participate in the general meeting of ICo either through its directors or proxy.

- BOD of N Co consist of 5 directors of which 3 are also directors in Italy Co (employees of US Co located in USA)

- Basis informal discussion of Board of Directors of N Co with Italy Co, Board of directors of N Co have paid dividend received from ICo without much time lag (i.e. 5-7 days) to Italy Co either by way of payment of interest on loan or repayment of loan. Till date, N Co has not declared any dividend to Italy Co.

- As aforesaid, Italy Co is a holding company which has multiple non-US investments. Funds received from N Co are generally deployed for making further investments at Italy Co level.

- The Group has identified certain other investment opportunities outside India. In view of shortage of liquidity pursuant to pandemic, it is in need of funds for the purpose of making investment. Thus, N Co will transfer some part of its holding in I Co during F.Y. 2022-23.

Issues:

Dividend

- Whether in the facts of the case, which facts will be most relevant for identifying if N Co is a beneficial owner (BO) of dividend income received in its own right and is entitled to benefit of Article 10(2) of India-Netherlands tax treaty?

- What is the impact of Indian judicial precedents in context of AB Mauritius, Tiger Global International, Aditya Birla Nuvo Ltd etc.?

- How far can one rely on foreign judicial precedents in case of Indofood International Finance, Velcro Canada Inc which have laid down attributes of ownership (possession, use, risk, control)?

- Is tax officer justified in suggesting that as part of BO, the taxpayer is implicitly also required to ascertain that the entity was not established in Netherlands for reducing tax liability under Principal Purpose Test rule?

Capital Gain

- In relation to transfer of shares of I Co, the Assessing Officer is considering denying the benefit of India-Netherlands tax treaty on the basis that N Co is not a beneficial owner.

- Question arises is whether one should evaluate BO condition for the purpose of capital gains article under IndiaNetherlands tax treaty?

7. Indian Judicial Precedents

7.1 Golden Bella Holdings [109 taxmann.com 83 (Mumbai ITAT)]

Facts

- The taxpayer is a Cyprus based investment holding company and holds a valid TRC issued by tax authorities from Cyprus.

- The taxpayer subscribed to 15% CCDs of an Indian company, interest from which was offered to tax @10% under Article 11 of the India-Cyprus DTAA. The taxpayer applied for such CCDs on its own account, utilizing a portion of the share capital and the interest free shareholder loan raised from its immediate shareholder.

- The AO denied the DTAA benefit on the basis that the taxpayer was not the beneficial owner of interest income and brought to tax the interest income at the rate in force (i.e. 42%).

- The AO’s reasoning for the taxpayer not being the beneficial owner were as under:

-

- Investment made by the taxpayer in Indian entity is back-to-back loan, on the basis that it had used a shareholder loan raised from its immediate shareholder to invest in Indian entity.

- The taxpayer was acting as a mere conduit for the passage of funds between the taxpayer’s immediate shareholder and Indian entity.

- The taxpayer had outsourced its corporate secretariat and management function to an institutional service provider and it did not carry out any business activities in Cyprus. It was merely a ‘name plate’ company.

- It did not exercise dominion and control over the CCDs as ‘most of the companies’ incorporated in Cyprus and other ‘tax havens’ did not have any independent office or qualified employees to carry out any business or investment activities.

Decision of the Tribunal

- The taxpayer invested in CCDs and received interest income thereon for its own exclusive benefit, and not for or on behalf of any other entity. The mere fact that the investment was funded using a portion of an interest-free shareholder loan and share capital does not affect the taxpayer’s status as the ‘beneficial owner’ of interest income, as the entire interest income was the sole property of the taxpayer.

- Reliance was also placed 2017 OECD model commentary to hold that

“para 10.2 of the OECD Commentary (2017) on article 11 (Interest) of the ‘Model Tax Convention’ may be referred to, to appreciate the meaning of ‘beneficial owner’ and the same provides that where the recipient of interest does have the right to use and enjoy the interest unconstrained by a contractual or legal obligation to pass on the payment received to another person, the recipient is the ‘beneficial owner’ of that interest.”

- Mere fact that the CCDs were funded using monies received by the taxpayer from its immediate shareholder does not make the arrangement a back-to-back transaction. The taxpayer had the absolute control over the funds received from its immediate

shareholder. - The taxpayer wholly assumed and maintained the foreign exchange risk on the CCDs (as they were INR denominated), and the counter party risk on interest payments arising on the CCDs.

- The lower authorities have failed to prove that the taxpayer did not have exclusive possession and control over the interest income received, the taxpayer was required to seek approval or obtain consent from any entity, or to utilise the interest income received at its own discretion and the taxpayer was not free to utilise the interest income received at its sole and absolute discretion, unconstrained by any contractual, legal, or economic arrangements with any other third party.

- Accordingly, the transaction between the taxpayer and Indian entity cannot be considered a mere back-to-back transaction lacking economic substance.

7.2 JC Bamford Investments Rocester [150 ITD 209 (Delhi ITAT)]

- Assessee company was incorporated and was tax resident of UK.

- There was another group company namely JCBE, which was also incorporated under laws of UK. JCBE entered into an agreement with Indian group company, namely JCBI, to license knowhow and related technical documents consisting of all drawings and designs with an exclusive right to manufacture and market Excavator Loader in territory of India. In terms of agreement, JCBE seconded its employees to JCBI on assignment basis.

- Subsequently, JCBE entered into sub-license agreement with assessee whereby license was to be commercially exploited by JCBI as was done earlier, but royalty for such user was to be paid by JCBI to assessee, who in turn was to pass on 99.5 per cent of same to JCBE.

- AO opined that employees of JCBE as seconded to JCBI constituted a service PE of assessee as they were covered under expression ‘or other personnel’ in Article 5(2)(k) of India-UK DTAA.

- Since seconded employees furnished services including managerial services for a period of more than 90 days during relevant assessment year, AO rightly concluded that service PE of assessee was established in India, in such a situation, amount paid to employees of JCBE sent to India on deputation on assignment basis was covered within para 6 of article 13 of India-UK DTAA and, thus, same was chargeable to tax under article 7 of India-UK DTAA, however, fees for services rendered by employees of JCBE falling in second category doing stewardship activities and inspection and testing only, did not fall in para 6 of article 13 and, was, thus, chargeable to tax as per para 2 of article 13 of India-UK DTAA.

- Finally, even though while accepting revenue’s stand that assessee, a resident of UK was not a beneficial owner, still benefit of lower rate of tax under article 13(2) of India-UK DTAA was available to it because beneficial owner of royalty being JCBE, was also a resident of UK

8. Applicability to Capital Gains

- The OECD/UN Model Commentary makes specific reference to requirement of ‘beneficial ownership’ while providing treaty benefit to income in the nature of ‘dividend, interest and royalty/FTS’. However, there is no specific requirement of satisfying condition of ‘beneficial ownership’ under Article 13 of Capital Gains. The issue which arises is whether the test of BO also applies to income earned in nature of capital gains.

- Conventionally, unless something is specifically stated, one cannot read words into treaty provisions. Article 31(1) of Vienna Convention requires interpretation of tax treaty in line with its object and supports that the terms are to be interpreted in ordinary sense. The object of insertion of concept of BO is to tackle the cases of agent, nominee or conduit companies with narrow powers to deal with the income streams of dividend, interest or royalty.

- The OECD Commentary 2017 suggests that the test of beneficial ownership was inserted in OECD MC in 1977 only to clarify the meaning of the term “paid…to a resident” under Article 10-12 which is not present in capital gains article.

- Treaty partners may specifically include test of beneficial ownership with respect to capital gains [e.g. Article 13(5) of Israel-Singapore DTAA].

- Introduction of beneficial ownership in capital gains article is a challenge as the tax administration (particularly of developing countries) may not be able to trace to whom the proceeds have been paid over or how the proceeds of assets are applied and whether they are applied for benefit of the residents of a third state.

- Absence of BO condition in capital gains article is acknowledged by the UN but its impact is not materially different as capital gains is earned by alienator of the capital asset and such alienator needs to be the owner in his own right before the income can be assessed in his hands. As a consequence, if the facts of the case support the allegation of the tax department that the subsidiary does not have attributes of being the true owner, it is likely that by applying the principles provided in Vodafone ruling, the treaty benefit may be denied.

- It may be noted that the evaluation of identifying the true owner is separate from impact analysis under GAAR or Simplified LOB or PPT. The evaluation of whether or not the subsidiary is the true owner is independent of the reasons why a subsidiary may be located in a treaty favourable jurisdiction. The evaluation under capital gains article is under the question of whether the subsidiary is the owner or not. The issue about why the subsidiary is in a treaty favourable jurisdiction cannot be questioned under the evaluation of capital gains article unless the issue is evaluated under GAAR or PPT. Further, the question about who owns shares of subsidiary is not to be raised unless the treaty has condition of Simplified LOB.

8.1 Bid Services Division (Mauritius) Ltd. [148 taxmann.com 215 (Bombay HC)]

Facts:

- The Assessee was a non-resident company incorporated under the laws of Republic of Mauritius having a valid TRC issued by the Mauritian Authorities. The ultimate parent entity of the Assessee was Bid Services Division Proprietary Limited (Bidvest) incorporated in South Africa.

- The Assessee was a part of consortium that filed the expression of interest and successfully obtained the bid for operation, management and development of the Mumbai airport. The Assessee held a 27% share in the joint venture established to carry out the project. Out of such 27% shareholding, the Assessee sold 13.5% shares to other party of the consortium in Finance Year 2011-12. For carrying out such transaction, the Assessee applied and successfully obtained a Nil withholding certificate under Section 197 of the Act.

- After the transaction was complete, the Assessee filed an application under Section 245Q of the Act for obtaining an advance ruling in order to determine the correctness of its belief that the capital gains arising from the transfer of shares will not be subject to tax in India as per India-Mauritius DTAA.

- AAR passed the ruling against the Assessee wherein the benefit of the capital gains tax exemption under the DTAA was denied on the premise that the dominant purpose of interposing the Assessee in the joint venture was to avoid taxes. The AAR further stated that the Assessee was only a shell company not having any tangible assets, employees, office space, etc. and was incorporated only two weeks before the bidding process.

- Accordingly, since the entire set up was a clear design to avoid paying legitimate tax to the Indian Government, therefore, the transaction should be seen after lifting the corporate veil. Where the Assessee was not interposed, the ultimate parent entity of the Assessee would have to pay capital gains tax in India on the sale of shares of the joint venture.

- Aggrieved from the verdict passed by the AAR, the Assessee preferred a writ petition before the High Court of Bombay, wherein the Assessee placed reliance on Circular No.789 dated 13th April 2000 issued by the CBDT which clarifies that companies which are resident in Mauritius would not be taxable in India on income from capital gains arising in India on the sale of shares as per Article 13(4) of the India-Mauritius DTAA. The said circular also clarifies that wherever a TRC is issued by the Mauritian authorities, such certificate will constitute sufficient evidence for accepting the status of residence as well as beneficial ownership for applying the beneficial provisions of the DTAA.

- The Assessee also submitted that the provisions of Article 27A of the DTAA which deals with Limitation of Benefit (LOB) was inserted with effect from 1st July 2017 whereas the sale transaction pertains to the Financial Year 2011-12. Further, the Press Release dated 29th August 2016 stated that the investments made before 01st April 2017 are grandfathered and accordingly not to be subject to capital gains taxation in India.

Decision

- The decisions of the Apex Court in the case of Vodafone International Holding B.V. (supra) & Azadi Bachao Andolan (supra) have clearly upheld the legitimacy of the TRC in the absence of any fraud or illegal activities. The Assessee holds a valid TRC which is sufficient proof of its residence in Mauritius and cannot be enquired into, unless there is a fraud or illegal activity, which in this case, has neither been alleged nor demonstrated.

- The contention of the revenue that the Assessee is a shell company without any tangible assets, employees, office space, etc., incorporated only two weeks before bidding and not having any economic or commercial rationale would not be relevant since the concept of LOB would become applicable to investments with effect from 1st April 2017 only and, in the given case of the Assessee, the investment, as well as divestment of shares, occurred prior to 1st April 2017. Therefore, such provisions cannot be applied in the case of Assessee.

- Due to the aforementioned reasons, the Hon’ble High Court of Bombay set aside the ruling passed by the AAR and remanded back the matter for fresh consideration taking into account the above-mentioned discussion.

8.2 Blackstone FP Capital Partners Mauritius [ITA Nos. 981 and 1725/Mum/2021 (Mumbai ITAT)]

- The Taxpayer is a company incorporated in Mauritius and was also registered as a foreign venture capital investor with the Securities and Exchange Board of India, the Indian securities regulator. The Taxpayer was holding a category I Global Business License issued by the Financial Services Commission, Mauritius, as well as a valid TRC issued by the Mauritian Revenue Authority.

- The Taxpayer earned some capital gains from the transfer of shares held by it in an Indian company, CMS Info Systems Limited, to a Singaporean company named Sion Investment Holdings Private Limited. It sought capital gains tax exemption by claiming the benefits as per the provisions of the Indo-Mauritius tax treaty.

- The AO based on certain information received from the tax authorities in Mauritius and Cayman Islands concluded that the Taxpayer is a wholly-owned subsidiary of Blackstone FP Capital (Mauritius) VA Ltd Cayman Islands, an entity incorporated in the Cayman Islands (“Blackstone Cayman”). He further alleged that the Taxpayer had no independent existence and its activities were entirely controlled by Blackstone Cayman. The AO went on to allege that the entire arrangement of buying and selling shares was undertaken for the benefit of Blackstone Cayman and thus found it to be a fit case to lift the corporate veil.

- Thus the AO, based on his findings, concluded that the beneficial ownership of the shares does not rest with the Taxpayer and it is hence ineligible to claim the benefit of Article 13(4) of the Treaty. The decision of the AO was subsequently confirmed by the Dispute Resolution Panel. Aggrieved, the Taxpayer filed an appeal before the Mumbai ITAT.

- The Hon’ble ITAT initially adjudicated the matter by passing an interim order to hold that the AO had incorrectly proceeded on the assumption that the principle of beneficial ownership can be read into the Indo-Mauritius DTAA, especially when the tax treaty does not provide for the same explicitly. The Hon’ble ITAT quoted the commentaries of the renowned author Mr Philip Baker to hold that the omission of beneficial test provision in certain tax treaties was not inadvertent or unintentional. It further proceeded to hold that reading the principle of ‘beneficial ownership’ into Article 13 of the DTAA would amount to re-writing the tax treaty itself.

- However, instead of concluding the case, the Hon’ble ITAT remitted the matter back to the AO, directing him to find out whether the beneficial ownership test can be applied to the Indo-Mauritius DTAA especially when the tax treaty itself is silent on it.

- Aggrieved, the Taxpayer filed a miscellaneous application seeking rectification of the Hon’ble ITAT order on the ground that the ITAT cannot remand back the matter to lower authorities on the question of law, especially when all the facts and evidences pertaining to the matter have already been provided.

- The ITAT, while adjudicating on the miscellaneous application, concluded that there was indeed a ‘mistake apparent on record’, which was remitting the matter back to the AO on a question of law, when all the material facts were already on record. The ITAT ruled that it ought to have taken the decision on the requirements of beneficial ownership in Article 13 on merits based on the legal submissions made by the parties. The ITAT accordingly allowed the miscellaneous application and posted the case to be heard afresh before a regular bench. The ITAT also observed that remitting the matter to the AO would imply substantial delays in the matter reaching finality.

8.3 KT Co. Ltd. [Case 2011DU4411 (Korean Supreme Court)] (South Korea)

- Insurance giant AIG, invested in a Korean company engaged in the telecommunication business through a chain of three Malaysian subsidiaries, being AIG-AIF Ltd., AIG-AIF II Ltd. and AIG-AOF Ltd.

- The first tier subsidiary’s shares were held by two Bermudian limited partnerships (‘LP’) viz. AIG Asian Infrastructure Fund LP and AIG Asian Infrastructure Fund II LP, and a Cayman LP viz. AIG Asian Opportunity Fund LP based in the Cayman Islands; all established by AIG.

- Subsequently, the Malaysian entities sold their investments to KT Co. Ltd. (‘taxpayer’) which whilst remitting the consideration, did not withhold tax claiming exemption from capital gains tax from the sale of shares under Article 13 of the Korea-Malaysia DTAA.

- The tax authorities held these three Malaysian entities to be conduits established purely for treaty shopping and hence, denied the treaty benefits on the capital gains and accordingly, capital gains to be subjected to withholding tax to the extent capital gains were attributed to the partners in LP established in Bermuda and the Cayman Islands.

- On appeal, the District and High Court upheld the tax authorities’ findings and held the Malaysian entities to be mere conduits which lacked substance and capital gains income had to be attributed to the partners in LP established in Bermuda and the Cayman Islands.

- The Korean Supreme Court also upheld the findings of the tax authorities and held that the Malaysian entities were not the beneficial owner of the capital gains realised and hence, not entitled to the tax treaty benefits. Mere receipt of the capital gains income by the resident of a Contracting State is insufficient to avail the treaty benefits and the Source State cannot be expected to waive its right of taxation on such income. The recipient of capital gains income should necessarily be the beneficial owner of such income to avail the tax treaty benefits.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA