Beginners Guide to the Derivatives Market of India

- Blog|Company Law|

- 29 Min Read

- By Taxmann

- |

- Last Updated on 20 February, 2023

Table of Contents

- Introduction to Derivative

- Classification of Derivatives

- Participants (Or Traders) In Derivatives Market

- Forwards

- Futures

- Options

Check out Taxmann's Investing in Stock Markets which has been written to provide a comprehensive understanding of the investment environment, the investment decision process, and the trading mechanism in stock markets. It also explains the various concepts, tools, and techniques related to investment in financial assets with lively examples and suitable illustrations. The book's focus is investment in stock markets, primarily equity shares.

1. Introduction to Derivatives

Derivatives are financial instruments whose value depend upon or is derived from some underlying assets. The underlying assets can be real assets such as commodities, gold etc. or financial assets such as index, interest rate etc. A derivative does not have its own physical existence. It emerges out of the contract between the buyer and seller of the derivative instrument. Its value depends upon the value of the underlying asset. Hence returns from derivative instruments are linked to the returns from underlying assets. The most common underlying assets include stocks, bonds, commodities currencies, interest rates and market indexes. Stock futures are derivative contracts based on individual stocks in the securities market. Stock index futures are derivative contracts where the underlying asset is an index. In case of wheat futures, the underlying asset is wheat. In case of gold futures the underlying asset is gold. Similarly we have derivatives based on various real as well as financial assets. Now a days we also find derivatives which are based on other derivatives. The derivative itself is merely a contract between two or more parties.

Securities Contracts (Regulation) Act, 1956 defines derivative as under:

“Derivative” includes—

(A) a security derived from a debt instrument, share, loan, whether secured or unsecured, risk instrument or contract for differences or any other form of security,

(B) a contract which derives its value from the prices, or index of prices, of underlying securities.

2. Classification of Derivatives

Derivatives can be classified into broad categories depending upon the type of underlying asset, the nature of derivative contract or the trading of derivative contract.

2.1 Commodity derivatives and Financial derivatives

Derivatives can be classified into Commodity derivatives and Financial derivatives on the basis of the type of underlying asset. In case of Commodity derivatives the underlying asset is a physical or real asset such as wheat, rice, jute, pulses, or even metals such as gold, silver, copper, aluminium, oil etc. In case of financial derivatives the underlying asset is a financial asset such as equity shares, bonds, debentures, interest rate, stock index, current, exchange rate etc. Financial derivatives are more popular the world over. Commodity derivatives are traded on Multi Commodity Exchange (MCX) and National Commodities and Derivatives Exchange (NCDEX) in India. Commodity derivatives based on agricultural commodities are more popular than those based on metals. It must be noted that the derivatives were developed to hedge the price risk in case of agricultural commodities. Hence initially commodity derivatives were developed. Financial derivatives were developed later in the decade of 1980s. Financial derivatives are traded on BSE, NSE, United stock exchange (USE) and MCX-SX in India.

2.2 Elementary derivatives and Complex derivatives

Elementary or basic derivatives are those derivatives which are simple and easily understandable. Such derivatives are futures and options. Complex derivatives have complex provisions and features which make them difficult to understand by an investor. Complex derivatives include exotic options, synthetic futures and options and so on.

2.3 Exchange traded derivatives and Over The Counter (OTC) derivatives

Derivatives may be traded on an exchange or they may be privately traded over the counter (OTC). Exchange traded derivatives are standardised derivative product traded as per the rules and regulations of the exchange. For example Stock index futures, stock index options and Stock futures and options in India are exchange traded derivatives. OTC derivatives are private bilateral contracts between two parties and are non standardised. These derivatives are specific to the needs of the parties involved. For example forward contracts in foreign exchange market are OTC derivatives.

3. Participants (Or Traders) In Derivatives Market

Different types of parties participate in derivatives market and make it a liquid and smooth market. Derivatives were initially developed to provide hedging against price risk. However now a days these instruments are also widely used for the purpose of speculation. Further, if there is any mispricing then arbitrage opportunities arise which can be exploited to restore equilibrium. Three categories of traders in derivative market are- Hedgers, Speculators and Arbitrageurs.

-

- Hedgers: Investors having long position in assets are exposed to price risk i.e. the risk that asset prices will go down. On the other hand investors having short position in assets are also exposed to price risk i.e. the price of the asset may go up. Hence they want to hedge their position to be immune to price risk. Hedgers use financial derivatives to reduce or eliminate the risk associated with price of an asset. Futures contracts enable both the parties (having long or short position) to hedge or eliminate their risk. In case of hedging, risk is actually transferred from the hedger to the speculator. Options are widely used by hedgers to reduce their risk exposure.

- Speculators use derivatives to get extra leverage and earn quick and large potential gains on the basis of future movements in the price of an asset. They can increase both the potential gains and potential losses by usage of derivatives in a speculative venture. Speculators take position on the basis of their assessment of future price movements. Futures are widely used by speculators. If a speculator expects that the stock price will go up, he buys futures and vice versa.

- Arbitrageurs are those traders who take advantage of any discrepancy in pricing and exploit it to bring in equilibrium. Arbitrageurs are in business to take advantage of a discrepancy between prices in two different markets. Arbitrage is possible over space as well over time. Derivatives allow arbitrageurs to exploit arbitrage opportunities over time as well. If, for example, they see the futures price of an asset getting out of line with the cash price, they will take offsetting positions in the two markets (overtime) to lock in a profit.

3.1 Types of Financial derivatives

The subject matter of this chapter is financial derivatives. Financial derivatives are those derivatives where the underlying asset is the financial asset or instrument such as index, stocks, bonds, currency, interest rates etc. Financial Derivatives are generally classified as Forwards, Futures, Options and Swaps depending upon their nature and features. In this book we focus only on the first three categories i.e. Forwards, Futures and Options. They are explained below:

4. Forwards

A forward contract is a private bilateral agreement between two parties to buy and sell a specified asset at a specified price on a specified future date.

Consider a farmer in Punjab, Mr Singh, plans to grow 5000 Kgs of wheat this year. He can sell his wheat for whatever the price is when he harvests it, or he could lock in a price now by selling a forward contract that obligates him to sell 5000 kgs of wheat to Pillsbury after the harvest for a fixed or specified price. By locking in the price now, he can actually eliminate the risk of falling wheat prices. On the down side, if prices rise later, he is foreclosing the opportunity of super profits. But then, he must have played safe and insured himself against the possibility of prices falling down eventually. The transaction that Mr. Singh has entered into is known as Forward transaction and the contract covering such transaction is known as Forward Contract.

Hence a forward is a contract between two parties to buy or sell a specified asset at a pre-determined price on a specified future date.

A financial forward contract is that forward contract where the underlying is a financial asset such as currency. For example assume that an Indian company XYZ Ltd. has to pay its import bills in 20000 US dollars after three months. However the company faces the risk of rupee depreciation, i.e. the price of the US dollar may go up. To guard against this exchange rate risk, the company may enter into a forward agreement with some other company to buy 20000 US dollars at a specified price after 3 months. This way it has hedged its position. If after three months the exchange rate is higher, the company `stands to gain. If on the other hand the rupee appreciates and US dollars are available at a lower price, the company stands to lose. In any case the company’s position is certain in the sense that it will get 20000 US dollars at the pre-specified price after 3 months.

4.1 Features

Forward contract has following features:

-

- Customised – Each contract is custom designed and parties may agree upon the contract size, expiration date, the asset type, quality, etc.

- Underlying asset – The underlying asset can be a stock, bond, commodity, foreign currency, interest rate or any combination thereof.

- Symmetrical rights and obligations – Both the parties to a forward contract have equal rights and obligations. The buyer is obliged to buy and the seller is obliged to sell at maturity. They can also enforce each other to perform the contract.

- Non-regulated market – Forward contracts are private and are largely non-regulated, consisting of banks, government, corporations and investment banks. It is not regulated by any exchange.

- Counter-party Risk or default risk – This is a risk of non-performance of obligation by either party as regards to payment (buyer) or delivery (seller). Being a private contract, there are chances of default or counter party risk.

- Held till maturity – The contracts are generally held till maturity. A forward contract cannot be squared up at the wish of one party. It can be cancelled only with the consent of the other party.

- Liquidity – Liquidation is low, as contracts are customised catering to the needs of parties involved. They are not traded on an exchange.

- Settlement of Contract – Settlement of a derivative contract can be in two ways – through delivery or through cash settlement. Most of the forward contracts are settled through delivery. In this case the buyer pays the price and seller gives the delivery of the specified asset at maturity. Some of the forward contracts are also cash settled. In case of cash settlement, the parties only pay/receive the price differential so as to settle the contract. No physical delivery of asset takes place and hence no full payment is made for the contract.

5. Futures

A Futures contract is a refined or modified forward contract. A futures contract is a contract to buy or sell a specified asset (physical or financial asset) at a specified price on a specified future date. It is traded on an exchange and is a standardised contract. A financial futures contract is a contract wherein two parties agree to buy or sell a specified financial asset at a specified price on a specified future date. Futures contracts are generally traded on an exchange which sets the basic standardized rules for trading in the futures contracts.

5.1 Features

-

- Standardised Contract – Terms and conditions of future contracts are standardized. They are specified by the exchange where they are traded.

- Exchange based Trading – Trading takes place on a formal exchange which provides a place to engage in these transactions and sets a mechanism for the parties to trade these contracts.

- No default risk – Futures contract has virtually no default risk because the exchange acts as a counterparty and guarantees delivery and payment with the help of a clearing house.

- Clearing house – The clearing house protects the parties from default by requiring the parties to deposit margin and settle gains and losses (or mark to market their positions) on a daily basis.

- Liquidity – Futures contracts are highly liquid contracts as they are continuously traded on the exchange. Any party can square up his position any time.

- Before maturity settlement possible – An investor can offset his future position by engaging in an opposite transaction before the stipulated maturity of the contract.

- Margin requirement – All futures contracts have margin requirements. Margin money is required to be deposited with the exchange by both the buyer as well as seller at the time of entering into the contract. Margin is important to safeguard the interest of the other party. There are two types of margins – initial margin and maintenance margin. Initial margin is the margin amount to be deposited initially with the exchange. If contract value is ` 100000, initial margin requirement is 5% and maintenance margin is 2%, then the buyer of the contract has to deposit ` 5000 with the exchange in his margin account. Now margin account is settled on daily basis i.e. mark to market settlement. If margin amount in the account on any day falls below the maintenance margin of ` 2000, then a variable call is made to replenish the margin amount to the level of initial margin.

- Settlement mechanism – Settlement of a derivative contract can be in two ways- through delivery or through cash settlement. Very few of the futures contracts are settled through delivery. In this case the buyer pays the price and seller gives the delivery of the specified asset at maturity. Most of the futures contracts are cash settled. In case of cash settlement, the parties only pay/receive the price differential so as to settle the contract. No physical delivery of asset takes place and hence no full payment is made for the contract. In case of Index futures the settlement is done only through cash as an Index cannot be delivered.

5.2 Futures Contract Terminology

-

- Spot price – The price at which an underlying asset trades in the spot market.

- Futures price – The price that is agreed upon at the time of the futures contract for the delivery of an asset at a specific future date.

- Contract cycle – It is the period over which a contract trades on the exchange. Every month on Friday following the last Thursday; a new contract having a three-month expiry is introduced for trading, on NSE and BSE.

- Expiry date – Is the date on which the final settlement of the contract takes place. Last Thursday of every month is expiry date for futures contracts. If that happens to be a trading holiday then previous working day.

- Contract Size or Lot size – The quantity of the underlying asset that has to be delivered under one contract.

- Price steps – The minimum difference between two price quotes. The price step in respect of CNX Nifty futures contracts is ` 0.05.

- Price bands – The minimum and maximum price change allowed in a day is termed as price bands. It is generally +- 10%. There are no day minimum/maximum price ranges applicable for CNX Nifty futures contracts. However, in order to prevent erroneous order entry by trading members, operating ranges are kept at +/- 10%.

5.3 Comparison between Forwards and Futures

Though both forwards and futures share common characteristics, they differ on the following grounds:

| BASIS | FORWARDS | FUTURES |

| Standardisation of contract | Forward contracts are private agreements between two parties and are non-standardised. | Futures contracts are exchange traded and standardised contracts as terms and conditions are set in advance. |

| Trading & Regulation | Forwards are not traded on stock exchange. They are not regulated. | Futures are traded on stock exchange and are regulated. |

| Counter party default risk | There is always a possibility that a party may default. | Clearing houses guarantee the transaction, thus minimising the default risk. |

| Liquidity | Liquidity is low, as contracts are tailor-made contracts catering to the needs of parties involved. Further, they are not easily accessible to other market participants. | Liquidity is high, as contracts are standardised exchange-traded contracts. |

| Price Discovery | Price discovery is not efficient, as markets are scattered. | Price discovery is efficient, as markets are centralised. |

| Settlement | Settlement of the Forward contract occurs at the end of the contract, i.e. Settlement date only. | Futures contracts are mar-ked-to market on daily basis which means that they are settled day by day until the end of the contract. |

| Hedging/speculation | Forward contracts are popular among hedgers. | Futures are popular among speculators. |

| Margin Requirements | There is no requirement for depositing margin money by either party. | Both the buyer and seller have to deposit margin money with the exchange. |

| Examples | Foreign Currency market in India | Commodities futures, Index futures and Individual Stock futures in India. |

5.4 Types of Financial Futures Contracts

Financial futures contracts can be – index futures, stock futures, currency futures, interest rate futures depending upon the underlying asset. In case of index futures, the underlying asset is an Index. In this chapter we deal with only two types of financial futures viz – Index futures and Stock Futures.

a. Index Futures

In case of Index futures the underlying asset is a stock index say NIFTY or SENSEX. A stock index is constructed by selecting a number of stocks and is used to measure changes in the prices of that group of stocks over a period of time. Futures contracts are also available on these indices. This helps investors make money on the performance of the index.

-

-

- Contract size : Index futures contracts are dealt in lots. The stock indices points – the value of the index – are converted into rupees.

For example, suppose the BSE Sensex value was 6000 points. The exchange stipulates that each point is equivalent to ` 1, Further each contract has a lot size of 100. Then the value of one contract will be 100 times the index value – ` 6,00,000 i.e. 1×6,000×100. - Expiry : An open position in index futures can be settled by conducting an opposing transaction on or before the day of expiry.

- Duration: Index futures have three contract series open for trading at any point in time – the near-month (1 month), middle-month (2 months) and far-month (3 months) index futures contracts.

- Contract size : Index futures contracts are dealt in lots. The stock indices points – the value of the index – are converted into rupees.

-

Example : If the index stands at 3550 points in the cash market today and an investor decide to purchase one Nifty 50 July future, he would have to purchase it at the price prevailing in the futures market.

The price of one July futures contract could be anywhere above, below or at ` 3.55 lakh (i.e., 3550×100), depending on the prevailing market conditions. Investors and traders try to profit from the opportunity arising from this difference in prices.

b. Stock Futures

Stock futures are futures contracts where the underlying is an individual stock. For example SBI stock futures have SBI stock as the underlying asset.

-

-

- Lot/Contract size : In the financial derivatives market, the contracts are not traded for a single share. Instead, every stock futures contract consists of a fixed lot of the underlying share. The size of this lot is determined by the exchange and it differs from stock to stock. For instance, a Reliance Industries Ltd. (RIL) futures contract has a lot of 250 RIL shares, i.e., when you buy one futures contract of RIL, you are actually trading 250 shares of RIL. Similarly, the lot size for Infosys is 125 shares.

- Duration : Stock Futures contracts are also available in durations of 1 month, 2 months and 3 months. These are called near month, middle month and far month, respectively. The month in which it expires is called the contract month and new future contracts are issued on the day after expiry of the last contract.

- Expiry : All three maturities contracts are traded simultaneously on the exchange and expire on the last Thursday of their respective contract months. If the last Thursday of the month is a holiday, they expire on the previous business day. In this system, as near-month contracts expire, the middle-month (2 month) contracts become near-month (1 month) contracts and the far-month (3 month) contracts become middle-month contracts.

-

Example: If an investor purchased a single June futures contract of XYZ Ltd., he has to buy at price at which the June futures contracts are currently available in the derivatives market. Let’s say these futures are trading at ` 1,000 per share. This implies, the investor agrees to buy/sell at a fixed price of ` 1,000 per share on the last Thursday in June. However, it is not necessary that the price of the stock in the cash market (or spot market) on last Thursday has to be ` 1,000. It could be ` 992 or ` 1,005 or anything else, depending on the prevailing market conditions. This difference in prices lead to profit or loss.

6. Options

An options is a contract that gives its buyer (holder) a right (but not obligation) to buy or sell a specified asset at a specified price (exercise price) on or before a specified future date. An options is a contract sold by one party (option-writer) to another party (option holder). The holder of the options can exercise the option at specified price or may allow it to lapse. The specified price is also termed as strike price or exercise price.

The options contract gives a right to the buyer. The seller has the obligation but no right. If the option holder exercises the option, then the writer or seller of the option will be obliged to perform. Hence when the option holder has a right to buy, the option writer has the obligation to sell. When option holder has a right to sell, then the option writer has the obligation to buy. Hence in case of options, the buyer and sellers are not on equal footing. The buyer has a privileged position. Since the buyer has a right but no obligation, he has to pay some price, known as options premium to the seller (or writer) of the option. NO RIGHT COMES FREE OF COST. Hence the buyer pays options premium to the seller to buy the right to buy or sell. The seller receives this options premium as a compensation for the obligation he undertakes. Hence options contracts are asymmetrical w.r.t. rights and obligations. The buyer of the options contract has a right but no obligation. The seller or writer of the options has an obligation but no right. Since the holder of the option has a right, he may not exercise his right if the conditions are unfavourable. Hence it is possible that the options contract is not exercised at all.

This clearly differentiate options contract from futures contract discussed above. In case of futures contracts, both the buyer as well as seller has equal rights and obligations. They can enforce each other to perform the contract. At the same time they are obliged to perform the contract.

Comparison Between Futures and Options

| BASIS | FUTURES | OPTIONS |

| Rights | Both the parties have right to ask for the performance of the contract. | Only the buyer (or holder) of the options has the right to buy or sell. Seller does not have any right. |

| Obligations | Both the parties are obliged to perform the contract. | Only the seller is obliged to perform the contract. |

| Premium payment | No premium is paid by either party. | The buyer pays the options premium to seller. |

| Margin requirement | Both the parties have to deposit some initial margin as per the requirements of the exchange. | Only the option writer has to deposit initial margin with the exchange as only the seller is exposed to price risk. No margin is to be deposited by the option holder, as he has a right but no obligation. |

| Profit and loss potential | The buyer as well as the seller of the futures contract are exposed to all the downside risk and has potential for all upside profits. The gain to the buyer is loss to the seller and the loss to the buyer is gain to the seller. There is unlimited gain and loss possibility for both the parties. | The option holder’s loss is limited (to the extent of premium paid), but has potential for all upside profits. The seller’s gain is limited to the amount of options premium but he is exposed to all the downside risk (i.e. potential loss is unlimited). |

| Realisation of profits/losses | Profit or loss on futures are ‘marked to market’ daily, meaning the change in the value of the positions is attributed to the accounts of the parties at the end of every trading day – but a futures holder can realize profits/losses by going to the market and taking the opposite position. | The gain on option can be realized in the following ways:

a. Exercising the option at expiry b. Going to the market and taking the opposite position, or c. Waiting until expiry and collecting the difference between the asset price and the strike price. |

| Execution of contract | Futures contract are settled through cash or delivery but they are always executed. | Buyer may or may not exercise the option and therefore the option contract may lapse without being exercised or become a waste. |

| Purpose | Futures are used to hedge and speculate. | Usually used as a hedge instrument. Options are a better hedging instrument than futures. This is because here the hedger keeps all the potential for upside gain but his loss is limited. |

6.1 Types of Options

a. Call options – An options contract that gives its holder the ‘right to buy’ a specified asset at a specified price on or before a specified future date, is termed as call option. The seller has the obligation to sell. A call option is bought when the buyer of the call option fears a rise in underlying asset’s price. A call option is exercised when the stock price is greater than the exercise price. In such a case the holder of the call options can buy the stock or asset at the exercise price which is lower than the prevailing market price.

For example: Let us assume that the current price of SBI shares is ` 119. Mr. A expects that the price of SBI share will go up, hence he buys a call option on SBI shares at the exercise price of ` 120. The expiration date is after 1 month. Further assume that the option can be exercised only on the expiry date and not before that. Now if on the expiry date, the prevailing market price of SBI share is more than 120, say ` 125, then Mr. A will exercise the option. He will buy a share of SBI by exercising his call option at the price of ` 120. He can sell it at the market price of 125 in spot market and make a gain of ` 5. If on the other hand the market price is ` 115 on the date of expiry, then Mr. A will not exercise this call option. His loss in this case will be the amount of option premium that he must have paid at the time of buying this call option.

b. Put options – A put option provides a right to sell. An options contract that gives its holder the ‘right to sell’ a specified asset at a specified price on or before a specified future date, is termed as put option. The seller has the obligation to buy. A put option is bought when the buyer of the put option fears a decline in underlying asset’s price. A put option is exercised when the stock price (or the underlying asset’s price) is lower than the exercise price. In such a case the holder of the put option can sell the stock (or asset) at the exercise price which is higher than the prevailing market price.

For example: Let us assume that the current price of SBI shares is ` 119. Mr. A expects that the price of SBI share will go down, hence he buys a put option on SBI shares at the exercise price of ` 120. The expiration date is after 1 month. Further assume that the option can be exercised only on the expiry date and not before that. Now if on the expiry date, the prevailing market price of SBI share is less than 120, say ` 116, then Mr. A will exercise the option. He will sell a share of SBI by exercising his put option at the price of ` 120, and make a gain of ` 4. If on the other hand the market price is ` 123 on the date of expiry, then Mr. A will not exercise this put option. His loss in this case will be the amount of option premium that he must have paid at the time of buying this put option.

6.2 Styles of Options

a. European options – A European style options contract can be exercised only on the expiration date. In the above examples the call options as well as put options were of European style as it is given that they can be exercised only on the expiration date and not before that.

b. American options – An American style options contract can be exercised at any time before the expiration or on the expiration date. American options provide more flexibility to the holder of the options, as he may exercise the options anytime till maturity. Therefore, American style of options have higher options premium than the European style of options.

6.3 Covered Options and Naked options

There are two ways to write options – Covered option writing and Naked option writing.

a. Covered option – Covered option means an option for which the seller owns the underlying securities. When the option writer has the underlying stock and writes (or sells) the option to buy that stock (i.e. writes the call option), then such a call option is known as Covered Option. If the option is exercised then the writer supplies the stock that he holds or has previously purchased. In this case the option is covered with the stock that the option writer is holding. Covered option writing is a less risky strategy.

b. Naked option – Naked option means an option for which the seller does not own the underlying security. When the option writer does not have the underlying stock but writes (or sells) the option to buy that stock (i.e. writes the call option), then such a call option is known as Naked option. If the price of the stock rises and the call option is exercised, the option writer must buy the stock at the higher market price in order to supply it to the buyer. With naked option the potential for loss is considerably greater than with covered option.

6.4 Index, stock, currency and interest rate options

Options can be classified on the basis of the underlying assets as well. Here we have – index options, stock options, currency options and interest rate options.

a. Index options : In case of Index options, the underlying security is a stock index such as NIFTY or SENSEX. Hence the value of an index option is derived from the value of the underlying index. In India Options are available on NIFTY and SENSEX.

b. Stock options : In case of stock options, the underlying security is a stock such as TCS ICICI BANK etc. Hence the value of a stock option is derived from the value of the underlying stock. In India Options are available on more than 100 stocks listed on NSE and BSE.

c. Currency options : In case of currency options, the underlying security is a foreign currency such as US Dollar, EURO etc. Hence the value of a currency option is derived from the value of the underlying foreign currency.

d. Interest Rate options : In case of interest rate options, the underlying security is a particular interest rate such as Repo rate or MIBOR. Hence the value of an interest rate option is derived from the value of the underlying interest rate.

6.5 Basic Terminology Used in Case of Options

-

- Exercise price (or strike price) – It is the specified price at which an option can be exercised. It is also known as strike price. The exercise price for a call option is the price at which the security can be bought (on or before the expiration date) and the exercise price for a put option is the price at which the security can be sold (on or before the expiration date).

- Expiration date – The date, on or before which, the option may be exercised is termed as expiration date. Beyond this date the right of the options holder ceases to exist. On or before the expiration date, the option may be exercised if conditions are favourable to the buyer. If conditions are not favourable then the option is not exercised and is left to lapse.

- Option premium – In options contract, the option holder (or the buyer of the options) has to pay some amount known as options premium to the option writer (or seller of the options) for availing the right. It is required because the buyer of the options has a right while seller of the options has obligation to buy or sell at the specified price. Hence there is a transfer of risk from the holder to the writer of the options. Hence the holder of the options must pay some amount to the writer to buy the options. The amount of option premium depends upon strike price, time to expiry, risk free rate of return and volatility of the underlying asset.

6.6 Payoffs From Basic Option Positions

6.6.1 Call Option

As you already know by now, a Call option gives the option holder a right to purchase a security at the exercise price. In stock market a long position means buying and a short position means selling.

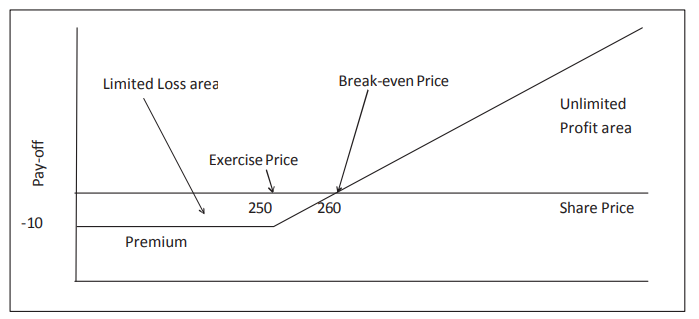

1(a) Long Call (Buying a call option)

Let us suppose an investor buys a call option of ABC Ltd. share with exercise price (or strike price) of ` 250 at a premium of ` 10. The option holder will exercise his option to buy the share when the actual market price of the share on the expiration date is more than ` 250. In that case the holder of the call option can buy the stock at exercise price of ` 250 and can immediately sell it at a higher market price in the market. At price below ` 250, the option holder shall choose not to exercise the call option. He can buy the share from the market at a lower price if he so desires. Hence, payoff of a call option at expiration will be as under. It is also termed as the value of the call option at expiry.

| Payoff of a Long Call (i.e. call option buyer or call option holder) | = S1 – X | if S1 > X |

| = 0 | if S1 ≤ X |

Where S1= Stock Price at expiration and X = Exercise Price.

One of the noteworthy points about option is that payoffs to the buyer or holder cannot be negative. This is because, the option is exercised only if S1> X. If S1 < X, option holder won’t exercise the call option and the call option expires with zero value. The loss to the option holder shall be limited to the premium paid by him originally. Profit to the option holder is the value of the option at expiration minus the premium paid.

It must be noted that the option holder must pay an amount called Option premium to the option writer so as to buy the call option. If the amount of call option premium is C, the Net payoff (or profit and loss) of a Long Call (i.e. of a buyer of a call option) is determined as under

| Net Payoff (profit or loss) to Long call (call holder) | = S1 – X – C | if S1 > X |

| = 0-C = – C | if S1 ≤ X |

The investor would break-even if market price is equal to exercise price plus the option premium already paid. When market price is higher than this break-even point then the call option holder makes profits. On the other hand if market price is lower than the break-even point then the call option holder incurs a loss, maximum of the amount of option premium.

In our example the buyer of a call option would break-even if the market price is ` 260. The net payoff of the call with the exercise price ` 250 can be given as under for different stock prices at expiration.

| Share price on exercise date (S1) | 240 | 250 | 260 | 270 | 280 |

| Exercise price (E) | 250 | 250 | 250 | 250 | 250 |

| Exercise option | No | No | Yes | Yes | Yes |

| Buyer’s Inflow | 0 | 0 | 260 | 270 | 280 |

| Buyer’s outflow | 0 | 0` | -250 | -250 | -250 |

| Premium Paid | -10 | -10 | -10 | -10 | -10 |

| Net Payoff Or Loss/Profit | -10 | -10 | 0 | 10 | 20 |

Figure 1: Net Pay-off to Buyer of Call Option (Long Call)

In the Figure 1 above, it could be observed that if the share price is less than the exercise price, the loss of the option holder is constant and is limited to the option premium paid. However, as the share price increases beyond the exercise price, his loss reduces and breaks even when the share price equals exercise price plus premium. When the share price is beyond this break-even point then the option holder makes profit or gains. The potential for the gains is unlimited. The higher the share price the greater is the gain. Hence the loss to a long call (or call option holder) is limited to the amount of option premium paid, but gains are unlimited.

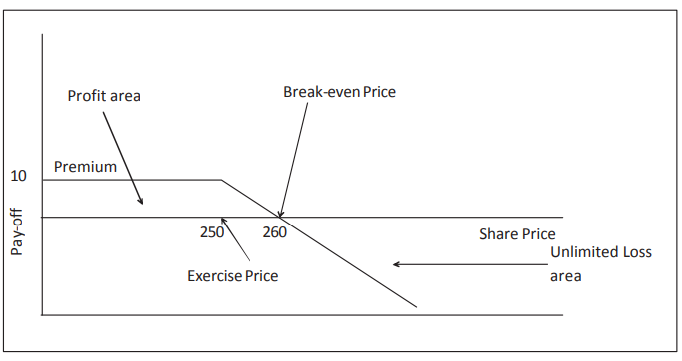

1(b) Selling a call option (Short Call or call option writer)

The position of a call option writer is exactly opposite of call option holder.

The seller of a call option receives option premium for writing the call option but bears all the downside risk. A short call (i.e. seller of call option) incurs losses if the share price is higher than the exercise price. In that case, the option holder will exercise the call option and the writer or seller has to fulfil his obligation deliver the share worth S1 (stock price at expiration) for only X (exercise price) amount:

| Payoff of a Short call (or call option writer) | = –(S1 –X) | if S1 > X |

| = 0 | if S1 ≤ X |

Where S1= Stock Price at expiration and X = Exercise Price.

Since the seller of the call options receives a premium of C irrespective of the outcome of the call option, the net payoff (or profit and loss) to a short call (or to call option seller) is given below:

| Net Payoff (profit or loss) to Short call(or call writer) | = –(S1 – X)+C | if S1 > X |

| = 0+C = C | if S1 ≤ X |

Where C = call option premium amount.

It must be noted that the net gain to a short call is limited to C while his potential loss is unlimited. The higher the stock price at expiration the greater will be the loss to a short call. Please note that the net payoff of a seller of a call option is exactly the opposite of the net payoff of the holder of a call option. Hence gains to the option holder is loss to the option seller and loss of the option holder is the gain to the option seller. The break-even point of call option seller is same as the break-even point of call option holder.

The call writer is exposed to losses if the share price increases: In our example the net payoff to a seller of the call option will be as under for different stock prices.

| Share price at expiration (S1) | 240 | 250 | 260 | 270 | 280 |

| Exercise price | 250 | 250 | 250 | 250 | 250 |

| Whether option is Exercised by the holder | No | No | Yes | Yes | Yes |

| Seller’s Inflow | 0 | 0` | 250 | 250 | 250 |

| Seller’s Outflow | 0 | 0 | -260 | -270 | -280 |

| Premium received | 10 | 10 | 10 | 10 | 10 |

| Net payoff (Loss/Profit) | 10 | 10 | 0 | -10 | -20 |

The position of call option seller or option writer can be depicted in Figure 2 as follows:

It can be observed that Figure 2 is just the reverse of Figure 1. This is because net payoff to a short call is exactly opposite of the net payoff to a long call. In Figure 2, the option seller makes the profit when the share price is less than the exercise price plus premium. However, the profit reduces when the share price increases beyond 250. So the profit potential of a call seller is limited to 10 only i.e. the premium received. But chances of losses are unlimited and are dependent upon the market price of share. The higher the market price the greater will be the potential loss.

Figure 2: Net Payoff of a Short Call (Or Call Option Writer/Seller)

6.6.2 Put Option

A Put option provides the holder of the option, the right to sell, a security at the exercise price .

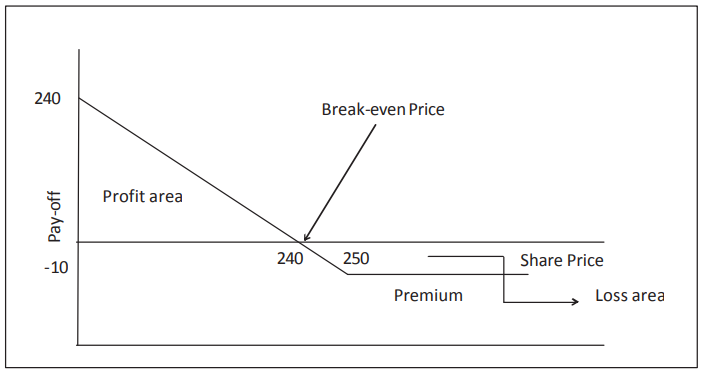

2(a) Long Put (i.e. Buying a Put option or Put option holder)

Let us suppose an investor buys a put option of ABC Ltd. share with exercise price (or strike price) of ` 250 at a premium of ` 10. The option holder will exercise his put option to sell the share when the actual market price of the share on the expiration date is less than ` 250. In that case the holder of the put option can buy the share at a lower price from market and sell the share at exercise price of ` 250 by exercising his put option. At share price equal to or above ` 250, the option holder will choose not to exercise the put option. He can sell the share in the market at a higher price if he so desires.

To generalise, a put option is exercised by the holder only when the stock price at expiration (S1) is lower than the exercise price (X). In such a case the put option holder will sell his stock at exercise price to the seller of the option rather than selling it in the market where he will get a lower price for his stock. The option holder will not exercise his option if the stock price at expiration is equal to or higher than the exercise price. Hence the payoff from a put option is given below. It is also termed as the value of a put option at expiry.

| Pay-off to a Long Put (Put option buyer or Put option holder) | = 0 | if S1 ≥ X |

| = X-S1 | if S1 < X |

It must be noted that the option holder must pay an amount called put Option premium to the option writer so as to buy the put option. If the amount of option premium is P, the Net payoff of a Long Put (i.e. of a buyer of a put option) is determined as under

| Net Payoff to Long Put (Put option buyer or Put option holder) | = 0-P = -P | if S1 ≥ X |

| = X-S1 -P | if S1 < X |

The investor would break-even if stock price is equal to exercise price minus the option premium already paid. When stock price is lower than this break-even point then the put option holder makes profits. On the other hand if stock price is higher than the break-even point then the put option holder incurs a loss, maximum to the amount of option premium.

Continuing our example, the position of a put option buyer or holder could be summarised as follows:

| Share price at expiration | 220 | 230 | 240 | 250 | 260 | 270 |

| Exercise option | Yes | Yes | Yes | No | No | No |

| Buyer’s cash inflow | 250 | 250 | 250 | 0 | 0 | 0 |

| Buyer’s cost or cash outflow | 220 | 230 | 240 | 0 | 0 | 0 |

| Premium Paid | -10 | -10 | -10 | -10 | -10 | -10 |

| Net Payoff (Loss/Profit) | 20 | 10 | 0 | -10 | -10 | -10 |

The Net Payoff diagram of a Long Put or buyer of a put option is provided in Figure 3.

Figure 3: Net Pay Off of a Put Option Holder (Buyer)

As it could be observed, the option holder of a put option exercises his option as long as the stock price is lower than the exercise price. But he will not make profit unless the difference between exercise price and stock price is more than the amount of put option premium already paid by the option holder. His profit is equal to the exercise price less the sum of stock price and premium. Further, the option holder would like his option to lapse in case the stock price is more than the exercise price. In that case the loss to the option holder is equal to the amount of option premium already paid. The option holder’s maximum loss is limited to the amount of premium paid i.e. ` 10. The maximum gain to the put option holder will be when stock price is zero (which is a hypothetical condition). In such a case the gain to the put option holder will be equal to exercise price minus the amount of premium paid. In our example it would be ` 250-10 = ` 240.

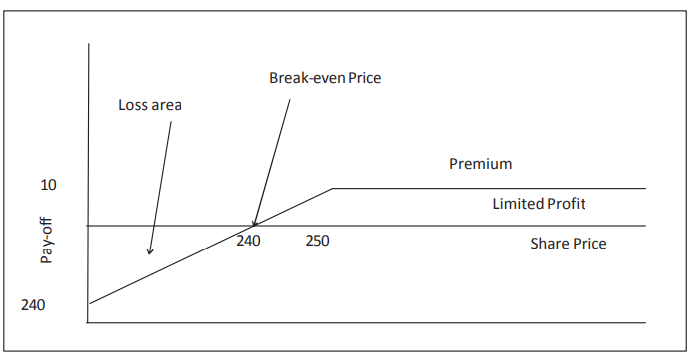

2(b) Short Put (or Selling a Put Option or Put Option writer)

The position of a put option writer is exactly opposite of the put option holder.

As seen above, the option holder will not exercise his option unless the stock price is lower than the exercise price. Hence when stock price is higher than the exercise price, the put option will lapse and its value will be zero. But if stock price is lower than the exercise price then put option is exercised and the loss to the put option seller will be equal to the difference between exercise price and stock price. The payoff from a short put option or for a seller of a put option is given below:

| Payoff to Short Put (or Put option Writer) | = 0 | if S1 ≥ X |

| = -(X-S1) | if S1 < X |

Since the seller of the put option receives a premium of P irrespective of the outcome of the put option, the net payoff to a short put (or to option seller) is given below:

| Net Payoff to Short Put (or Put option Writer) | = 0 + P = P | if S1 ≥ X |

| = -(X-S1) + P | if S1 < X |

It must be noted that the net gain to a put option writer is limited to P while his potential loss is unlimited. The lower the stock price at expiration the greater will be the loss to a short put (or put writer). Please note that the net payoff of a seller of a put option is exactly the opposite of the net payoff of the holder of a put option. Hence gains to the option holder is loss to the option seller and loss of the option holder is the gain to the option seller. The break-even point of put option seller is same as the break-even point of put option holder.

The put option writer is exposed to losses if the stock price decreases. In our example the net payoff to a seller of the put option will be as under.

| Share price | 220 | 230 | 240 | 250 | 260 | 270 |

| Whether put option is exercised by its holder | Yes | Yes | Yes | No | No | No |

| Seller’s cost or cash outflow | -250 | -250 | -250 | 0 | 0 | 0 |

| Seller’s benefit or cash outflow | 220 | 230 | 240 | – | – | – |

| Premium Received | 10 | 10 | 10 | 10 | 10 | 10 |

| Net Payoff (Loss/Profit) | -20 | -10 | 0 | 10 | 10 | 10 |

The Net payoff matrix for writer of a put option looks like the Figure 4.

Figure 4: Net Payoff of a Short Put (i.e. Put Option Writer)

The net payoff for the put option writer is negative if stock price is less than (X–P). His loss potential is substantial and dependent upon the share price. The lower the share price the greater will be the loss. However as the share price cannot fall below zero, the maximum loss will be equal to exercise price less premium. Hence in our example the maximum loss to a put option writer will be ` 240 (i.e. 250-10). Please note that in our example the maximum gain to a put option holder was ` 240. Further, the profit to a put option writer is limited to the option premium received.

Break even position of Option parties

The above discussion shows net payoffs to a call option holder, call option writer, put option holder and put option writer. In the discussion we have also specified the break-even level or position in each case. It must be noted that the buyer and seller of options (whether call or put) have completely opposite net payoffs. Hence their break-even level is also same. No gain or loss to buyer also means no gain or loss to the seller.

In case of a call option, it will be exercised when stock price at expiration (S1) is higher than the exercise price (X). But the buyer of a call option will be break even, having no gain or loss, only when the stock price at expiration(S1) is equal to exercise price (X) plus call option premium (C). This is because the call option premium is also a cost which is already incurred by the call option holder. Hence the break-even point for a call option holder is when stock price is equal to X+C. The same is the break even position for the writer of a call option.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA