Auditing | Internal Control – Meaning, Objective & Duties

- Blog|Account & Audit|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 30 September, 2023

Check out Taxmann's Auditing and Corporate Governance | B.Com. (Hons.) | CBCS which is a UGC-recommended, comprehensive & authentic textbook or concepts of auditing, corporate governance, CSR, etc. This book covers the entire syllabus for undergraduate students of B.Com. (Hons.), B.Com. (Programme), BBA, BMS of Delhi University and other Universities.

Table of contents

1. What is Internal Control?

Internal control comprises of the policies and procedures adopted by the management of an entity to assist in achieving the following objectives:

(a) Orderly and efficient conduct of business.

(b) Adherence to management policies

(c) Safeguarding of assets

(d) Prevention and detection of fraud and errors

(e) Accuracy and completeness of accounting records

(f) Timely preparation of financial statements

“Internal control is regarded as the whole system of controls, financial and otherwise established by the management in the conduct of a business including internal check, internal audit and other forms of control. “ According to American Institute of Certified Public Accountants:” Internal control comprises of the plan of organization and all the coordinate methods and measures adopted within a business to safeguard its assets, check the accuracy and reliability of its accounting data, promote operational efficiency and to encourage adherence to prescribed managerial policies.”

Internal control is an all-embracing term. It comprises of financial controls, non-financial controls, internal check and internal audit.

2. Objectives

-

- To encourage adherence to prescribed policies: The system of internal control is introduced to provide reasonable assurance that the various plans, policies and procedures laid down by the entity are being followed.

- To avoid frauds and errors: The main objective of any control system is to detect and prevent frauds and errors by keeping an inherent check.

- To promote operational efficiency: The internal controls within an organization are meant to prevent unnecessary duplication of efforts, protect against waste and discourage any inefficient use of resources of the organization.

- To safeguard assets and records: The other important objective of internal control system is to safeguard the assets and records from unauthorized access, use and disposition.

- To provide accurate and reliable data: The internal control system ensures that all the transactions are recorded in the correct amount, in the appropriate account and in the accounting period to which they relate.

- To assist in timely preparation of Financial Information: Information is of no use if it is not provided in time. Internal control system facilitates timely preparation of financial statements.

2.1 Limitations

SA-315 (earlier AAS 6) issued by Institute of Chartered Accountants of India highlights the inherent limitations of internal control, which are mentioned below:

-

- Internal Control System involves expenditure of time and money. Management’s consideration that internal control system should be cost-effective weakens the effectiveness of the system.

- Internal control is more concerned with the transactions of routine nature, so unusual and irregular transactions may be overlooked.

- It has the potential for human error especially when a new employee is involved in the internal control system without proper orientation.

- Possible collusion may circumvent internal control system Internal Control system involves division of duties between employees of the organization. Collusions among employees may perpetuate the frauds within an organization.

- There is always a possibility that a person responsible for exercising control may abuse his authority e.g., embezzlement of cash by cashier, misappropriation of goods by store keeper etc.

- The changes in conditions may make the procedures ineffective and it may deteriorate the internal control system.

- The manipulations by the management may defeat the objectives of internal control.

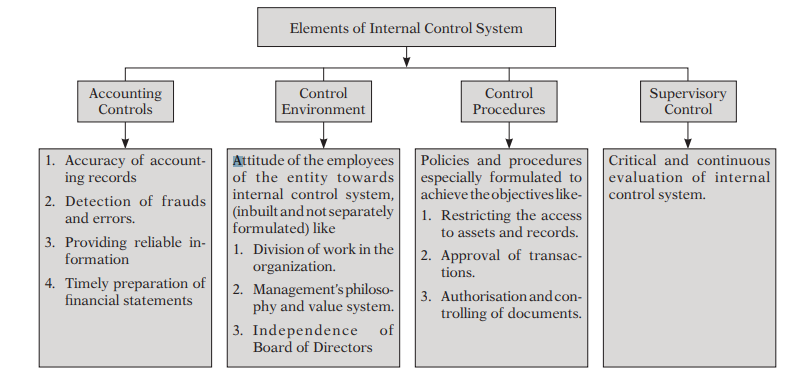

Elements of Internal Control System

2.1.1 Internal Control and Auditor

The introduction of internal control system in the organization is basically the responsibility of the management. However, it is a matter of great interest for the auditor. The auditor should study and evaluate the system of internal control so as to decide the degree of reliance that can be placed on the internal control system. If there is an efficient internal control system, the auditor can rely on the same and his work becomes easy. But it, in no way, means that the auditor can take shelter behind internal control system and shirk his responsibility. The whole responsibility is on the auditor to do his work carefully and efficiently.

2.1.2 Tools to Study and Evaluate Internal Control System

-

- Narrative Records: It is the complete written description of internal control system being actually used in the organization. This method is usually followed by small business as it requires actual testing to keep such a comprehensive record.

- Checklist: It is a series of instructions which a member of audit staff follows or answers. Answer to a checklist instruction may be yes, no or not applicable. Whenever a checklist is completed by the auditor/his staff, it is studied by the management to ascertain the existence and efficiency of control system.

- Internal Control Questionnaire (I.C.Q.): It is a comprehensive series of questions which are prepared by the auditor to test the adequacy of internal control system. The I.C.Q. is so framed that it may be answered into yes, no, or not applicable. The client has to get the I.C.Q. filled from the employee concerned. Afterwards, the auditor prepares a report indicating deficiencies and recommending the suggestions for the improvement.

- Flow Chart: It is graphic presentation of the internal control system. With the help of symbols, it depicts the various controls being employed in the organization.

2.2 Internal Check

Internal check is used as tool for executing internal control. It is the arrangement of duties of staff in such a manner that the work of one person is automatically checked by another which minimizes the chances of errors and frauds.

“Internal check may be defined as an arrangement of accounting routine that errors and frauds are automatically prevented or discovered by the very operation of book keeping itself”.

According to Spicer and Pegler:

“A system of internal check is an arrangement of staff duties whereby no one person is allowed to carry through and to record every aspect of the transaction, so that without collusion between two or more persons, fraud is prevented and at the same time the possibilities of errors are reduced to the minimum.”

-

- Internal check is a part of overall internal control system.

- Internal check is related to the job allocation aspect of control system.

- Internal check is an inbuilt check in the accounting process itself.

2.2.1 Main Objects

Internal check in an organization serves the following purposes:

-

- It helps in arranging the duties in such a way that work of one person is automatically checked by another or work of one person is complementary to another and there is no duplication of work.

- The work is divided in such a way that no transaction is left unrecorded.

- It ensures the reliability and accuracy of information provided by accounting system.

- It reduces the chances of errors and frauds as there is automatic checking.

- It helps in fixation of responsibility as there is a clear division of work.

- It helps in increasing the efficiency of accounting staff as the work is divided among individuals according to their capacity and qualification.

2.2.2 Advantages

Following are some of the advantages of internal check:

-

- It helps in putting moral check on the members of staff and helps in increasing integrity.

- It helps in fixation of responsibilities of employees. The member of the staff may be held responsible for the irregularity caused by him.

- The chances of frauds are less under the system of internal check as it helps in detecting errors and frauds at initial stages.

- The concept of internal check is based on division of work, therefore, it helps in increasing efficiency.

- Any irregularity in the system can be detected at an early stage without doing much damage to the system.

- It automatically helps in making correct and complete record of all the transactions on each balancing of the books of account.

- It helps in speeding up the audit task because it facilitates test checking.

- In internal check system, the financial statements are prepared without any loss of time.

2.2.3 Disadvantages

-

- The system of internal check is suitable in a big organization. The small organization cannot afford it because it is expensive.

- Lack of coordination among the staff may not serve the purpose.

- Most of the time, an auditor believes the system to be effective; therefore, prefers test check rather than thorough check and works carelessly.

- Internal check does not guarantee the prevention of all errors and frauds. There always remains a possibility of different employees joining hands to mastermind fraud.

2.3 Duties of an Auditor in respect of Internal Check

The auditor should consider the system in force in the concern by following procedure:

-

- A written statement should be received from the company regarding the system of internal check.

- The auditor should assess its effectiveness instead of simply relying on its working.

- He should find out the deficiencies, if any, which may result into errors or frauds.

- An auditor may depend upon the effectiveness of the operation of the system only to a certain extent which is primarily based on the size of the business concern.

- In case the auditor is not satisfied through the test checking of the transaction, he may conduct careful analysis.

- Test checking of cash transaction should be avoided by the auditor even if he finds effective internal check system in force.

- If the system in force is not efficient, then the auditor can suggest ways to avoid the defects. In case his suggestions are not implemented, he should unambiguously state the concern that he should not be held responsible for any error at later date.

Dive Deeper:

[FAQs] Internal Audit of the Company

[FAQs] on Quality Control for an Audit of Financial Statements

3. Internal Check vs Internal Control

Internal control system consists of various controls set up by the management for conducting business. It includes internal check, internal audit and other forms of control. The distinction between internal check and internal control is summarized below:

Difference between Internal Control and Internal Check

| Basis of Difference |

Internal Control | Internal Check |

| 1. Meaning | It consists of the whole system of controls, financial or otherwise, established by the management to ensure smooth functioning of business of the company. | It is an arrangement of duties among the employees in such a manner that the work done by one employee is automatically checked by other employee. |

| 2. Scope | It is wider in scope and application. It includes internal check. | It is a narrower in scope and application. |

| 3. Objective | The main objective is safeguarding of assets, accuracy of records and adherence to management policies. | The main objective of internal check is prevention of errors and frauds and fixation of responsibilities. |

| 4. Flexibility | Internal control system is more flexible as it is reviewed for the change in circumstances | It is less flexible. It more or less remains stable. |

3.1 Internal Check as regards certain transactions

A. Cash Receipts

-

- The correspondence like inward mails and remittances should be handled by some responsible official.

- There should be a separate clerk, known as cashier, to deal with cash receipts.

- The cashier should not have access to the books of account.

- Pre-numbered and pre-printed receipt book should be used for all cash collections.

- All cash receipts should be deposited in the bank on daily basis through pay-in slips.

- Bank pay-in slips should not be prepared by the same person who is in charge of making actual deposits in bank.

- Counterfoils of receipts issued should be preserved.

- Cancellation of spoiled receipts (not to be torn off).

- Safe custody of unused receipts.

- If some alteration is made in the receipt already issued, it should be properly initialled.

- Bank reconciliation statement should be prepared at regular intervals to reconcile bank balance and cash balance.

- Some responsible officer should verify the cash balance by carrying out a surprise physical check from time to time.

- There should be segregation of the functions like receipt of cash, accounting of cash and custody of cash.

B. Cash Sales: Sales at the Counter

- The salesman, authorized to sell the goods at the counter, should be specifically named. A specific number should be allocated to every salesman.

- Cash memos shall be printed in numerical sequence.

- The salesman sells goods to the customer and prepares four copies of cash memo, three of them handed over to customer and one is retained by him.

- The customer will carry all the three copies to the cashier. After collecting the cash, the cashier will return two copies to the customer, duly stamp marked as cash paid.

- Goods are handed over to the customer by gatekeeper and one copy of cash memo is retained by the gatekeeper and the other one will remain with the customer.

- At the end of the day, salesman – cashier – gatekeeper prepares the summaries of cash, sales separately and then they reconcile it, for any difference.

- The amount received from the cash sales should be deposited daily in the bank.

C. Cash Sales: Sales by Travelling Salesman/Agents

In some of the organizations, travelling salesman is appointed for direct sales promotion and collection. In such a case, the internal check system should be:

-

- The salesman should be authorized to issue money receipts.

- They should deposit the entire cash collection daily to the cashier or to the bank account of the company.

- The salesman should submit the daily report of sales and collection.

- The salesman should not keep any cash with him.

- No cash collection should remain outstanding.

- If possible, the salesman should be transferred from one area to another to avoid the frauds.

D. Cash Payments

-

- The official responsible for making cash payments should have no connection with the receipt of cash.

- All payments, as far as possible, should be through cheques or NEFT/RTGS/IMPS.

- The cheques should be signed by the authorized official only.

- All payments exceeding some specified limit should be duly authorized.

- Safe custody of unused cheques.

- Vouchers should be prepared for all the payments.

- Vouchers should be serially numbered.

- The voucher supporting any payment should be marked as paid to avoid the double payment.

- For all payments, receipt should be obtained.

- Counterfoils of cheques issued, or the vouchers marked as paid, should be preserved.

- All the payments should be recorded in the cash book.

- Bank reconciliation statement should be prepared to reconcile the bank balance and cash balance by the person other than cashier.

E. Payment of Wages and Salaries

In case of manufacturing companies, the internal check system for payment of wages and salaries is devised carefully because they employ a large number of workers and there is a great possibility of frauds. The internal check system is so planned

-

- To avoid incorrect time records or piecework records.

- To avoid the inclusion of dummy workers.

- To avoid the fraudulent manipulation of wage sheet.

- To avoid misappropriation of money, etc.

-

-

- Proper Maintenance of Wage Records: The workers are paid wages either on the basis of time spent by them or number of pieces produced by them. Therefore, there should be proper time records or piecework records. The overtime records should also be kept in the organization.

- Preparation of Wage Sheets:

(i) The wage sheets should be prepared by a separate official.

(ii) The wage sheets should include all the essential particulars like name of employee, number allotted, total time worked, rate, bonus, overtime, etc.

(iii) There should be proper checking of calculations made in the wage sheet. The permissible amount (like Income Tax, Provident Fund, etc.) should be deducted from gross wages to show the net wages payable to workers.

(iv) The wage sheet shall be signed by the person who has prepared it before making any payment. - Actual Payment of Wages:

(i) Separate persons should be responsible for preparation of wage sheets, approval of wage bills and the actual payment thereof.

(ii) Every worker who is to receive the wages should be personally present and he has to prove his identity at that time.

(iii) If possible, wages should be disbursed in the presence of departmental foreman concerned.

(iv) Signatures of the workers should be obtained whenever they receive the wages.

(v) There should be proper arrangement for dealing with unclaimed wages.

(vi) If possible, a separate bank account should be operated for wage payments. It will help in maintaining track of such payments or disbursements.

-

F. Cash Purchases

(i) The purchase order should be prepared on the basis of purchase requisition duly authorized by a competent official.

(ii) The terms and conditions of purchase should be decided on the basis of comparative tenders and quotations.

(iii) The materials purchased should be verified as regards quantity and quality by the person independent of purchase department and store department.

(iv) The purchase-invoice should be verified with purchase order and goods received note.

(v) Payment against invoices should be authorized by a responsible official.

(vi) All the entries should be properly recorded in purchase book and cash book.

G. Credit Sales

-

- The sales department receives a purchase order from the customer. On receipt of the order, it should be numbered and preserved in the order received book.

- Before the sales orders are processed, credit department should determine the credit worthiness of the customers.

- The dispatch department should be given a copy of order.

- The storekeeper who maintains custody over the inventory should issues goods to the dispatch department.

- The statement of goods prepared by dispatch department should be checked with customers’ order and then invoice should be prepared. The invoices are checked by a responsible official.

- On dispatch of goods, outward note is prepared. Entries are made in the dispatch register and sales book.

- Billing the Customers.

- Periodical follow-up measures on collection of customers’ account.

- For goods returned by customers, entries should be made in goods inward book. Credit notes should be prepared, checked and initialed by the responsible official. With the help of credit notes, entries should be made in Sales Return Book.

H. Purchases

-

- The department who is in need of material, should fill in the requisition slip duly signed and shall send it to purchase department.

- The purchase department should make an enquiry about the terms and conditions of purchases from different suppliers on the basis of tenders and quotations.

- The purchase department should place the purchase order. Four copies of purchase order are prepared. One is sent to the vendor, second to the stores department, third to the accounting department and fourth is kept by the purchase department with itself.

- On receipt of goods, they are properly inspected and entries are made in the goods inward register.

- The purchase department should check the invoice and send the same to the accounting department for payment.

- For the goods returned to the supplier entries should be made in the Purchase Return Book and a debit note is issued to the supplier.

4. Internal Audit

Internal audit is review of operations and records undertaken within a business by internal staff or outside agency specially deputed for this purpose. This review may be periodic or continuous. It is an important tool in the hands of management. It is a type of control which functions by evaluating the effectiveness of other types of controls.

According to the Institute of Internal Auditors, USA,

“Internal auditing is an independent appraisal function established within an organization to examine and evaluate its activities as a service to the organization. The purpose is to assist members of the organization in the effective discharge of their responsibilities. Thus, internal auditing furnishes them with analysis, appraisals, recommendations, counsel and information concerning the activities reviewed.”

4.1 Scope and Objectives

-

- To review the internal control system.

- To review the custodianship and safeguarding of assets.

- To review the compliance with plans, policies, procedures and regulations.

- To review the relevance and reliability of information.

- To review the utilization of resources.

- To review the accomplishment of goals and objectives.

Difference between Internal Check vs. Internal Audit

| Basis of Difference |

Internal Check | Internal Audit |

| 1. Meaning | It is an arrangement of duties in such .a manner that work done by one person is automatically checked by another in the normal-course of work. | It is an independent review of internal controls, accounting record and actual performance. |

| 2. Objective | To prevent errors and frauds. | To detect errors and frauds. |

| 3. Nature | It is device for doing work. | It is devise of checking work. |

| 4. Timing | It is conducted during the course of a transaction. | It starts after the transactions are recorded. |

| 5. Check | It is a simultaneous check. | It is a post-mortem check. |

| 6. Appointment of Employees | There is no need of any new appointment in case of internal check. | Internal audit is done by the staff specially appointed for this purpose. |

| 7. Scope | It has narrow scope but its scope remains more, or less same everywhere. | The scope may vary from business to business and from organization to organization. |

4.2 Statutory Audit vs. Internal Audit

Statutory audit means an audit, which is compulsory by any statute or law whereas internal audit is an independent appraisal activity within an organization for the review of accounting, financial, and other operations as a service to the management. The differences between these are summarized below:

Difference between Internal Audit and Statutory Audit

| Basis of difference |

Internal Audit | Statutory Audit |

| 1. Objective | The objective of internal audit is to state accuracy of information and compliance with plans and policies of management. | The objective of statutory audit is to express an opinion on true and fair view of financial results and financial position of the company. |

| 2. Scope | The scope of work of internal audit is determined by the management. | In this case, scope of work and responsibilities of the statutory auditor are determined by law. |

| 3. Nature | It is conducted at the option of the management. It is not a legal requirement. | Statutory audit is required under law and is legally compulsory. |

| 4. Qualification | No qualification is prescribed for internal auditor. | Statutory auditor must possess the qualification prescribed under law. |

| 5. Appointment | Internal auditor is appointed by the management. | Statutory auditor is normally appointed by the shareholders. However, in certain cases he may be appointed by the directors of the company or the government. |

| 6. Removal | The internal auditor can be removed by the management or the directors. | The statutory auditor can be removed only by the shareholders and not by the management or the directors. |

| 7. Remuneration | It is fixed by the management. | It is fixed by the shareholders. |

| 8. Status | Internal auditor may be employee of the company. | Statutory auditor is an independent person and, in no case, be employee of the organization. |

| 9. Test check | All the transactions are checked | Test check is conducted. |

| 10. Report | The report prepared by internal auditor is submitted to the management of the company | The report prepared by statutory auditor is submitted to shareholders. |

4.3 Why Internal Audit is Gaining Importance

Internal Audit is not compulsory under any statute; so, usually, only the large-scale organizations used to get internal audit done. However, these days the concept of internal audit is gaining significance because of the following reasons :

-

- According to Companies Audit Report Order, 2003, in case of specified companies, the statutory auditor is required to report whether internal audit system of the company commensurate with the size and nature of the business. Specified company means a company whose paid up capital and reserves exceed ` 50 lakhs or whose average annual turnover for the last three financial years preceding the current financial year exceed ` 5 crores.

- Internal audit as per section 138 of the Companies Act, 2013 is mandatory for every listed public company and other public companies with a paid up share capital of ` 50 crores or more. The Act also makes internal audit mandatory for all companies including private companies with an annual turnover of ` 200 crores or more, or outstanding loans or borrowings from banks or public financial institutions exceeding ` 100 crore.

- The audit committee of companies, besides other functions, are required to ensure the adequate compliance with the internal control system.

Dive Deeper:

[FAQs] on Nature, Objective and Scope of Audit

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA