[Analysis] Tiger Global Case – India-Mauritius DTAA Dispute Over Capital Gains Tax

- Blog|International Tax|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 11 October, 2024

The Tiger Global Case involves a legal dispute between Tiger Global entities, private companies incorporated in Mauritius, and Indian tax authorities regarding the taxation of capital gains. Between 2011 and 2015, Tiger Global acquired shares in Flipkart Singapore and, in 2018, transferred them to Fit Holdings S.A.R.L. as part of a broader Walmart acquisition of Flipkart. The dispute arose when Indian tax authorities rejected Tiger Global's claim for exemption under the India-Mauritius Double Taxation Avoidance Agreement (DTAA), arguing that the entities were not independent and were controlled from the U.S., making them ineligible for treaty benefits. The case, which went through the Authority for Advance Rulings (AAR) and the Delhi High Court, centered on whether Tiger Global could claim the treaty benefits and tax exemption under Article 13 of the DTAA, with the High Court ultimately ruling in Tiger Global's favor, upholding the treaty protection.

By CA. Harshal Bhuta – Partner | P.R. Bhuta & Co.

Table of Contents

- Organisational Structure

- Facts of the Case

- Sequence of Events

- Findings by AAR

- Taxpayer Contention

- Revenue Contention

- Key Observations by the High Court

- Key Takeaways

- DTAA Relevant

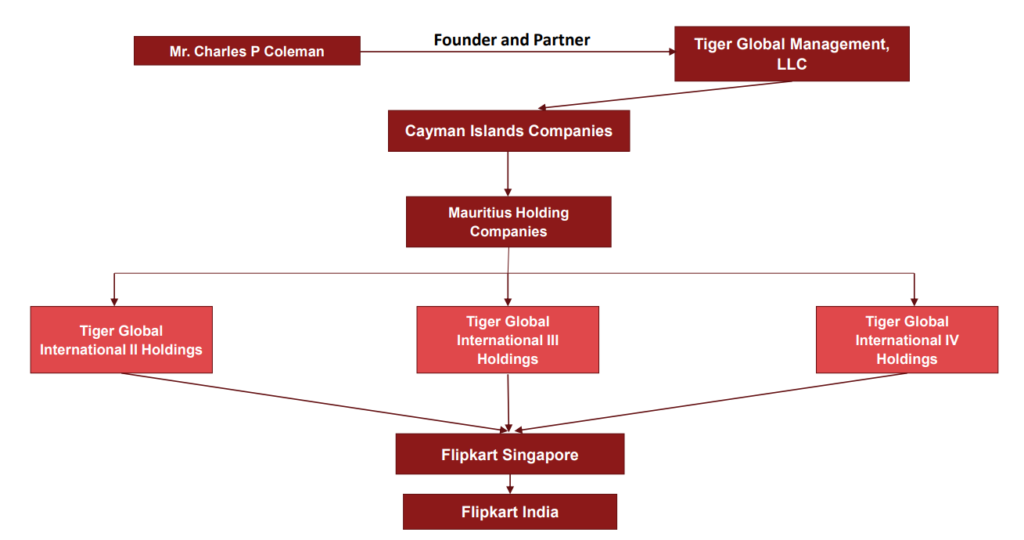

1. Organisational Structure

2. Facts of the Case

- Tiger Global International II, III, IV Holdings (TGI/ taxpayer/applicant) were private companies incorporated in Mauritius, established primarily for investment activities to be conducted on behalf of Tiger Global Management LLC (“TGM LLC”), a company based in Delaware, United States.

- TGM LLC is the applicant’s investment manager. The applicant is owned by a private equity fund that has approximately 500 investors across 30 sovereign jurisdictions.

- TGI have been granted a Category 1 Global Business License and are holding a Tax Residence Certificate issued by the Mauritius revenue authorities.

- Between October 2011 and April 2015, TGI acquired the shares of Flipkart Singapore, which derived their value substantially from assets located in India.

- On 18-8-2018 all three applicants transferred certain shares of Singapore company Flipkart to Fit Holdings S.A.R.L. (Luxembourg Buyer).

- These transfers were undertaken as part of a broader transaction involving the majority acquisition of Singapore company Flipkart by US company Walmart from several shareholders, including the applicants.

- The taxpayers had filed applications with tax authorities on 2nd August for issuance of a ‘Nil’ withholding tax certificate.

- The tax authorities issued a letter dated 17 August 2018, held that the taxpayers were not eligible to claim benefit of the India-Mauritius tax treaty (Article 13) as they were not independent in their decision-making and the control over the decision-making of the purchase and sale of the shares did not lie with them. The tax authorities had passed an order under section 197 on 17-8-2018 prescribing a withholding rate of 10% in respect of sale of shares by the applicants.

- On 18th August 2018, the petitioners transferred their shareholding from Flipkart Singapore to Fit Holdings SARL, a Luxembourg entity. Subsequently, the taxpayers, on 19 February 2019, filed applications before the Authority for Advance Rulings (AAR) to determine whether the gains arising from the sale of FPL shares would be chargeable to tax in India under the Income-tax Act, 1961 (ITA) read with the India-Mauritius tax treaty.

3. Sequence of Events

- October 2011-April 2015 – Tiger Global Entities (II, III, IV Holdings) acquire shares in Flipkart Singapore

- May 2016 – The protocol for amendment of the India-Mauritius DTAA is signed, introducing Article 13(3A) and the grandfathering clause

- April 1, 2017 – Effective date for Article 13 (3A) of the DTAA. Shares acquired before this data are protected by grandfathering clause

- May 9, 2018 – A share purchase agreement is executed between Walmart and shareholders of Flipkart Singapore

- August 2, 2018 – Tiger Global applies for nil withholding tax certificate from tax authorities

- August 17, 2018 – The tax authorities rejected the application and instead require a 10% tax withholding

- August 18, 2018 – Tiger Global Entities transfer their shareholding in Flipkart Singapore in Walmart

- February 19, 2019 – Tiger Global files an application before the AAR seeking confirmation of their tax exemption claim

- March 26, 2020 – AAR rejects Tiger Global’s application, ruling that the transaction was designed for tax avoidance

- May 16, 2024 – Delhi HC reserves its judgement on Tiger Global’s petitions challenging the AAR ruling

- August 28, 2024 – Delhi HC delivers its judgement, overturning the AAR ruling and upholding the benefits of the India Mauritius DTAA for Tiger Global

4. Findings by AAR

- The AAR noted and held the following:

-

- The principal objective of the taxpayers was to act as an investment holding company for a portfolio investment domiciled outside Mauritius.

- Control and management did not mean day-to-day affairs of the business but meant the head and brain of the company.

- The authority to operate bank account of the taxpayers for transaction above US$ 250,000 was with two personnel who were not on the Board of Directors(BODs) of the taxpayer and was required to be countersigned by one of the Mauritius-based directors.

- The said two personnel were key personnel of the Tiger Global group and were managing and controlling the affairs of the entire organisation structure. Thus, the funds were ultimately controlled by the two personnel.

- While the Board of Directors of the taxpayers took the decision for investment or sale but the real control over the decision was with one of the two personnel managing and controlling the affairs of the entire organisation structure.

- In view of the above, the head and brain of the taxpayers and consequently their control and management was not situated in Mauritius, but in the USA.

- The AAR held that the holding structure coupled with prima facie management and control of the holding structure (including the taxpayers) were relevant factors to determine avoidance of tax. Considering that real management and control of the taxpayers was with Mr Coleman, the AAR held that the taxpayers were only see-through entities for availing the benefits of the India-Mauritius tax treaty.

- The AAR held the following with respect to the eligibility of the taxpayers to benefits under Article 13 of the India-Mauritius DTAA:

-

- A treaty was to be interpreted in good faith. The context and purpose of the treaty was to be determined on the basis of preamble, annexure, subsequent agreement, relevant international rules applicable to the treaty.

- As per the clarification issued by the CBDT vide Circular No. 682 dated 30 March 1994, a Mauritian tax resident was exempted from the gains on alienation of shares of an Indian company.

- The taxpayers had transferred shares of Singapore Company and not that of an Indian company.

- The India-Mauritius tax treaty (original as well as amended vide Protocol signed on 10 May 2016) never intended to exempt from capital gains tax, the sale of shares of a company not resident in India.

- In view of the above, the taxpayers were not entitled to claim benefit of exemption from capital gains on the sale of FPL shares.

- The AAR relied on the decision of the Supreme Court in the case of Vodafone International BV v. UOI and held that in the absence of any direct investment in India, the arrangement was pre-ordained transaction created for tax avoidance, since:

-

- The immediate investment destination of the taxpayers was Singapore as investments were made in FPL;

- In absence of foreign direct investment (FDI) in India, the taxpayers did not have business operation or taxable revenue in India.

In view of the above, the AAR held that the issue involved in the question raised in the advance ruling applications, was designed prima facie for avoidance of tax and the third restriction on admission of an advance ruling applied. Thus, the AAR rejected admission of the taxpayers’ applications.

5. Taxpayer Contention

- TRC as Primary Requirement: The taxpayer contended that the Tax Residency Certificate (TRC) is the primary requirement for claiming treaty benefits and should not be questioned based on the motives for establishing the entity in Mauritius.

- India-Mauritius DTAA: The taxpayer argued that despite the 2016 renegotiation of the India-Mauritius DTAA, which followed the incorporation of indirect transfer provisions into the Income Tax Act, no corresponding provisions were added to the DTAA, implying that treaty benefits should remain unaffected.

- Compliance with Article 27A: The taxpayer submitted that entities, including Tiger Global International II Holdings (TG II) and Tiger Global International IV Holdings (TG IV), met the criteria under Article 27A of the DTAA. They asserted that these entities should not be classified as conduit companies, as their expenditures satisfied the conditions under the Limitation of Benefit (LOB) clause.

- Beneficial Ownership Not Applicable: The taxpayer argued that the concept of beneficial ownership does not apply to Article 13 (capital gains) of the DTAA, suggesting that this should not affect their claim to treaty benefits.

- Independent Management: The taxpayer maintained that the entities were independently managed by a Board of Directors in Mauritius, as evidenced by detailed minutes from 70 board meetings, countering the AAR’s claim that the Directors were merely puppets.

- Fund Source and Control: The taxpayer highlighted that the funds were pooled from over 500 investors across 30 jurisdictions and that Mr Coleman, who was alleged to be a beneficiary of the transaction, had no controlling interest in the entities.

6. Revenue Contention

The Revenue argued that TGM LLC, a U.S.-based parent company, was the ultimate controlling entity, with TG III, TG II, and TG IV acting merely as facades. Based on the below, the application for tax exemption was rejected under Section 245R(2) of the Income Tax Act by AAR.

- Income and Investment: The applicant company had no income since its inception, and the funds invested in Flipkart Private Limited originated from Mauritius-based entities, which were controlled by entities in the Cayman Islands, ultimately leading back to TGM LLC in the USA.

- Conduit Allegation: The Revenue suggested that the applicant was not acting independently but was a conduit for the true beneficial owners in the USA.

- Management Control: Authorizing Mr Coleman and Mr Anil Castro to manage funds and decisions, despite Mr Coleman not being on the Board, indicated that effective control was in the USA, not in Mauritius.

- Chapter X-A and Rule 10U: The Revenue referenced the introduction of Chapter X-A in the Finance Act, 2013, and Rule 10U in 2016 of Income tax Rules, which allow tax authorities to investigate the commercial substance of arrangements and assess tax benefits, irrespective of the arrangement’s date.

- DTAA Exemption: The Revenue concluded that effective control was in the USA, and since the shares in question were of a Singapore company, not an Indian company, the exemption under the DTAA failed.

7. Key Observations by the High Court

- Economic Substance of Mauritius Entities: The High Court (HC) observed that the Mauritius-based entities had significant economic substance, engaging in legitimate business operations and pooling substantial investments from global sources (aggregating funds from over 500 investors worldwide). These entities were not mere conduits, and the involvement of TGM LLC as an investment manager did not diminish their independent legal status or economic substance. The petitioners also incurred expenditures above the threshold set by the Limitation of Benefit (LOB) clause in the DTAA, indicating that they had significant economic substance.

- Beneficial Ownership: The HC held that the concept of beneficial ownership would apply only if it could be shown that the holder of income had no control over it and was merely holding it until directed to deploy it elsewhere. This was not established in the case.

- Source of Funds: The HC observed that none of the funds invested in the petitioners originated from TGM LLC. Instead, the funds were pooled from over 500 investors across various global jurisdictions, with the Mauritius companies acting as the fund-pooling vehicles. The AAR failed to provide valid reasons to question the role of TGM LLC as disclosed by the petitioners.

- Board 2/4 Decision-Making: The HC noted that Board resolutions indicated collective decision-making by the petitioner’s BODs. Even though Mr. Coleman was authorized to approve expenditures exceeding USD 250 million, this power was granted by the entire BODs and required counter signature by Mauritian directors, ensuring independent decision-making.

- Parent-Subsidiary Relationship: The HC emphasized that it is legitimate for a parent or holding company to exercise oversight and broad supervision over its subsidiaries, including appointing Board members, key managerial personnel, and auditing. The HC noted that influence from a parent entity does not automatically render a subsidiary a puppet or fully subservient. The mere involvement of two board members connected to the Tiger Global Group did not, by itself, prove that the taxpayers were mere puppets.

- Sanctity of TRCs: The HC held that TRCs are sacrosanct and must be accepted unless there is clear evidence of fraud or sham. The court rejected the notion that investments routed through Mauritius should be inherently suspect or subject to additional scrutiny. The tax authorities are not justified in doubting the validity of a TRC, as doing so would undermine the trust and cooperation between countries.

- CBDT Clarification: The HC referenced a clarification issued by the Central Board of Direct Taxes (CBDT), which affirmed that a TRC issued by Mauritius authorities is sufficient evidence to establish residency status and apply principles of beneficial ownership for claiming benefits under the DTAA.

- Finance Bill 2013: The HC noted that an amendment proposed by Finance Bill 2013, which suggested that a TRC alone was not sufficient for claiming treaty benefits, was never enacted. Subsequently, the Ministry of Finance clarified that a TRC would be accepted as adequate evidence for treaty benefits, and its validity would not be questioned by tax authorities.

- DTAA and LOB Clause: The HC analyzed the provisions of the India-Mauritius Double Taxation Avoidance Agreement (DTAA), noting that the LOB clause, introduced after Chapter X-A and Article 27A, grandfathered transactions involving shares acquired before April 1, 2017. This indicated that the LOB provisions were crafted with existing domestic laws in mind, preventing the Revenue from imposing extra barriers to granting DTAA benefits.

- Grandfathering Clause in DTAA: The HC stated that the DTAA aims to protect transactions completed before April 1, 2017. While the tax treaty set rates for transactions between April 1, 2017, and March 31, 2019, it did not set rates for capital gains from shares acquired before April 1, 2017. This indicates an intent to exclude such gains from taxation, meaning the petitioners’ transaction is protected under the grandfathering clause from capital gains tax.

- Application of Article 13(3A): The HC emphasized that the transaction in question fell squarely within the scope of Article 13(3A) of the DTAA, which grandfathers transactions involving shares acquired before April 1, 2017.

- Primacy of Treaty Provisions: The HC asserted that domestic tax legislation cannot be interpreted in a manner that directly conflicts with a treaty or overrides the provisions of the DTAA.

- Precedent and International Rulings: The HC referenced key judgments, including Union of India v. Azadi Bachao Andolan [2003] 132 Taxman 373 (SC) and Vodafone International Holdings B.V. v. Union of India [2010] 193 Taxman 100 (Bom.), as well as international cases like Cadbury Schweppes and the Burlington case. These rulings established that treaty benefits should not be denied merely based on suspicions or the use of tax-friendly jurisdictions. The court emphasized that tax treaties are designed to facilitate international trade and investment, not to penalize legitimate investors.

The HC concluded that the AAR’s ruling, which deemed the transaction as tax avoidance, was clearly flawed and unsustainable. The transaction is protected by virtue of the grandfathering provisions of the DTAA. Consequently, the court quashed the AAR’s ruling, affirming that the transaction was not designed for tax avoidance, and granted the petitioners all consequential reliefs.

8. Key Takeaways

- This ruling offers significant relief for foreign funds registered in Mauritius that rely on treaty protection, especially for shares acquired before 2017.

- The judgment reinforces the importance of the Tax Residency Certificate (TRC), stating that its validity can only be challenged with substantial evidence of fraud or sham transactions.

- The decision provides clarity on the interpretation of the Limitation of Benefits (LOB) clause versus General Anti-Avoidance Rules (GAAR), dismissing the argument that a parent company’s presence in a favorable tax jurisdiction automatically implies treaty abuse by its subsidiaries.

- The judgment sets the stage for further developments, particularly with the introduction of the Principal Purpose Test (PPT) and modifications to the India-Mauritius DTAA preamble.

- The upcoming Supreme Court decision in the Blackstone case may further clarify the sanctity of TRCs.

- However, the Income Tax Department is likely to appeal the decision to the Supreme Court, and the outcome could have far-reaching implications for foreign investors and the future of treaty protections in India.

9. DTAA Relevant

9.1 Article 13 – Capital Gains

3. Notwithstanding the provisions of paragraph (2) of this article, gains from the alienation of ships and aircraft operated in international traffic and movable property pertaining to the operation of such ships and aircraft, shall be taxable only in the Contracting State in which the place of effective management of the enterprise is situated.

1[3A. Gains from the alienation of shares acquired on or after 1st April 2017 in a company which is resident of a Contracting State may be taxed in that State.

3B. However, the tax rate on the gains referred to in paragraph 3A of this Article and arising during the period beginning on 1st April, 2017 and ending on 31st March, 2019 shall not exceed 50% of the tax rate applicable on such gains in the State of residence of the company whose shares are being alienated;]

4. 2[Gains from the alienation of any property other than that referred to in paragraphs 1, 2, 3 and 3A shall be taxable only in the Contracting State of which the alienator is a resident.]

“4. Gains derived by a resident of a Contracting State from the alienation of any property other than those mentioned in paragraphs (1), (2) and (3) of this article shall be taxable only in that State.”

5. For the purposes of this article, the term “alienation” means the sale, exchange, transfer, or relinquishment of the property or the extinguishment of any rights therein or the compulsory acquisition thereof under any law in force in the respective Contracting States.

9.2 Article 27A – Limitation of Benefits

- A resident of a Contracting State shall not be entitled to the benefits of Article 13(3B) of this Convention if its affairs were arranged with the primary purpose to take advantage of the benefits in Article 13(3B) of this Convention.

- A shell/conduit company that claims it is a resident of a Contracting State shall not be entitled to the benefits of Article 13(3B) of this Convention. A shell/conduit company is any legal entity falling within the definition of resident with negligible or nil business operations or with no real and continuous business activities carried out in that Contracting State.

- A resident of a Contracting State is deemed to be a shell/conduit company if its expenditure on operations in that Contracting State is less than Mauritian Rs. 1,500,000 or Indian Rs. 2,700,000 in the respective Contracting State as the case may be, in the immediately preceding period of 12 months from the date the gains arise.

- A resident of a Contracting State is deemed not to be a shell/conduit company if:

-

- it is listed on a recognized stock exchange of the Contracting State; or

- its expenditure on operations in that Contracting State is equal to or more than Mauritian Rs. 1,500,000 or Indian Rs. 2,700,000 in the respective Contracting State as the case may be, in the immediately preceding period of 12 months from the date the gains arise.

Explanation: The cases of legal entities not having bona fide business activities shall be covered by Article 27A(1) of

the Convention.]

- Paragraphs 3A and 3B inserted by Notification No. SO 2680(E) {NO.68/2016 (F.No.500/3/2012-FTD-II)}, dated 10-8-2016, w.e.f. 1-4-2017 (Assessment Year 2018-19).

- Paragraph 4 substituted by Notification No. SO 2680(E) {NO.68/2016 (F.No.500/3/2012-FTD-II)}, dated 10-8-2016, w.e.f. 1-4-2017 (Assessment Year 2018-19). Prior to its substitution, said paragraph read as under:

“4. Gains derived by a resident of a Contracting State from the alienation of any property other than those mentioned in paragraphs (1), (2) and (3) of this article shall be taxable only in that State.”

[11: Article 27A inserted by Notification No. SO 2680(E) {NO.68/2016 (F.No.500/3/2012-FTD-II)}, dated 10-8-2016, w.e.f. 1-4-2017.]

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA