[Analysis] Reverse Flipping – Why Global Companies are Returning to India

- Blog|Company Law|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 23 September, 2024

Reverse flipping, also known as internalization, refers to the process where companies that were initially incorporated abroad move their legal headquarters back to their home country, such as India. This shift is driven by factors like investor-friendly regulations, new growth opportunities, and increased confidence in the local market. Reverse flipping helps companies capitalize on domestic benefits like tax incentives, expanded capital market access, and a growing consumer base while reducing reliance on foreign jurisdictions for operational and financial advantages.

By CA. Pankaj Agarwal – Director | Aeka Advisors India LLP

Table of Contents

- What is Reverse Flipping? or Internalisation

- Why Did Companies Set Up In Foreign Countries?

- Why Companies Are/Should Return To India?

- Reverse Flip Story So Far

- Key Factors to Choose Between Options

- Relevant Structures to Achieve Reverse Flip

- GIFT City – Preferred Destination for Internalization

1. What is Reverse Flipping or Internalisation?

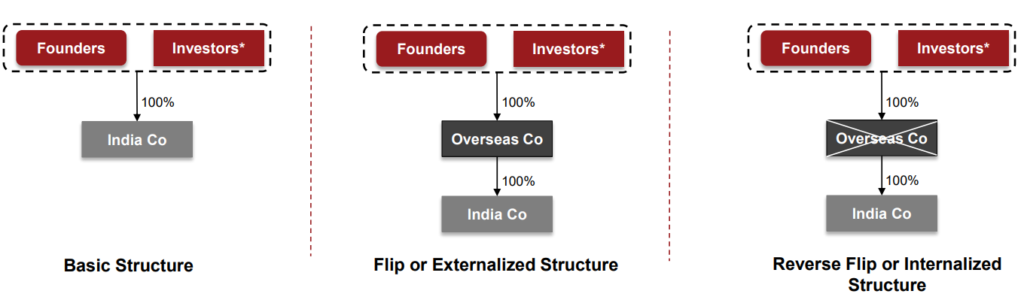

The once-common practice of ‘flipping’ or “externalized structure”, where companies incorporated their operations abroad to tap into specific benefits, is giving way to a phenomenon known as ‘reverse flipping’ or ‘internalization.’ This reversal involves Indian companies, initially established overseas, strategically repatriating their legal headquarters back to India.

*Investors include resident and non-resident investors

2. Why Did Companies Set Up In Foreign Countries?

- Easier access to foreign capital and investor confidence

- Lucrative global markets and brand recognition

- Favorable regulations abroad

- Stringent intellectual property protection laws abroad

- Tax optimization for investors

- Better exit valuations

3. Why Companies Are/Should Return To India?

I Investor-friendly regulatory reforms (Tax incentives, FDI relaxations, Make in India incentives, etc)

N New growth opportunities across diverse sectors, from e-commerce and fintech to healthcare and renewable energy offers significant growth potential and strong returns on investment

D Demographic Advantage – Massive consumer base and a dynamic workforce

I Increased investors base in India and confidence in the Indian start-up ecosystem

A Accelerated Capital Market reach – Surge in successful IPOs, particularly in the technology and startup sectors

4. Reverse Flip Story So Far*

4.1 Completed Flips

- Phone Pe: First unicorn to reverse flip from Singapore through a share transfer transaction

- Groww: Moved its domicile from the USA back to India in March 2024 through an inbound merger

- Pepperfry: Shifted its domicile back to India through an inbound merger

4.2 Pursuit for Flips

* Based on information in the public domain and logos for illustration purposes only

5. Key Factors to Choose Between Options

- Sector of operations and stage of business

- Overseas tax and legal considerations for the shareholders and Overseas Hold Co.

- India tax and legal Considerations

- Disruption to business model and business operations

6. Relevant Structures to Achieve Reverse Flip*

- Setting up a new structure – For early-stage companies

- Liquidation of Overseas Hold Co

- Transfer of Shares of India Co followed by dividend/capital reduction by Overseas Hold Co

- Swap of shares

- Inbound Merger

*Overseas tax and regulatory implications would need to discussed with the overseas consultants depending on the jurisdiction of the Overseas Hold Co and residential status of the Shareholders

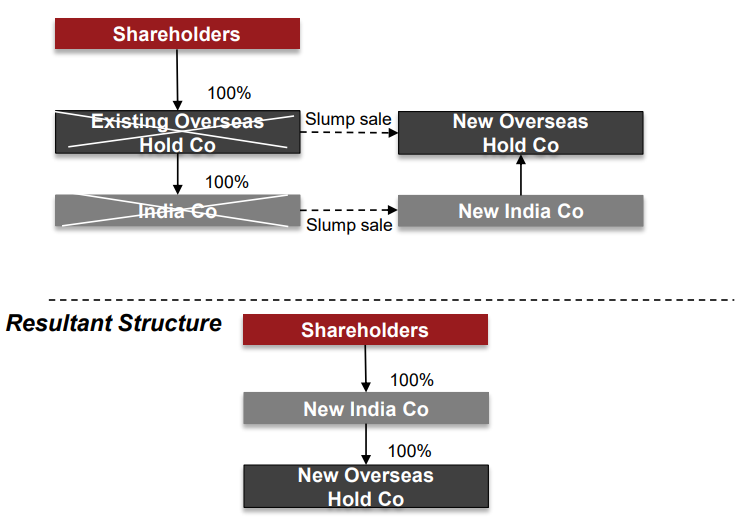

6.1 Option 1 – Setting Up a New Structure for Reverse Flipping

Step 1: Shareholders of Existing Overseas Hold Co to incorporate a new India Co with mirror shareholding and New India Co to set-up a New Overseas Hold Co

Step 2: Existing India Co and Overseas Hold Co to transfer assets and liabilities (including employee and contracts, if any) to New India Co. and New Overseas Hold Co respectively through slump sale

─ India Co and Existing Overseas Hold Co to be liquidated over a period assuming that both companies have insignificant operations

Key India Tax Considerations

- Excess of sale consideration over cost of acquisition shall be taxable as capital gains

- Carried forward business loss of Existing India Co may lapse on account of change in shareholding pursuant to liquidation

- Timeline: 1-2 months for the transition into the New India Co

Resultant Structure

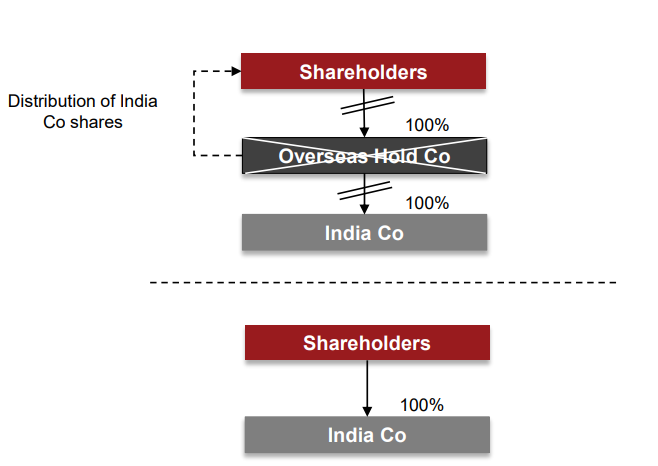

6.2 Option 2 – Liquidation of Overseas Hold Company

Step 1: Overseas Hold Co to undertake voluntary liquidation in compliance with the laws of overseas jurisdiction

Step 2: Overseas Hold Co to distribute assets and liabilities (including shares of India Co) to its existing shareholders

Key India Tax Considerations

- No India tax implications for Overseas Hold Co on distribution of shares of India Co pursuant to liquidation

- FMV of the assets received on liquidation shall be taxed as dividend to the extent of accumulated profits and the balance shall be deemed to be the sale consideration for transfer Overseas Hold Co’ shares for determining capital gain implications

- Indirect transfer tax implications may arise in the hands of nonresident shareholders. Further, receipt-based taxation may also need to be evaluated if the situs of shares of Indian Co is in India

- Reset of period of holding and cost of acquisition for the Shareholders

- Carried forward business loss of India Co may lapse on account of change in shareholding

- Timeline: May vary as per the laws of host jurisdiction

Resultant Structure

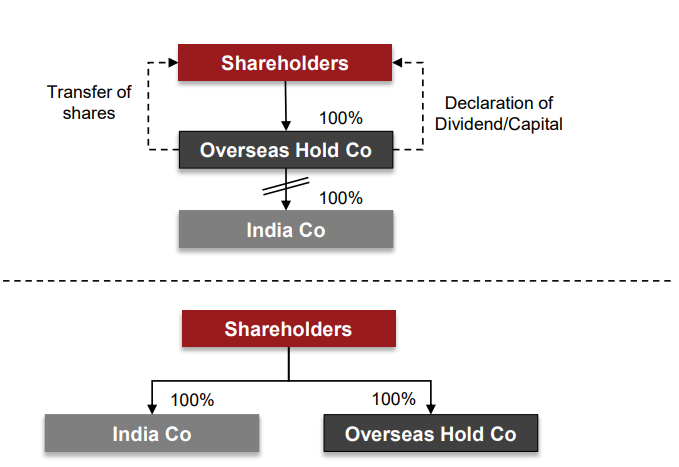

6.3 Option 3 – Transfer of Shares of India Company Followed by Dividend/Capital Reduction by Overseas Hold Company

Step 1: Overseas Hold Co to transfer shares held in Indian co to the shareholders (Consideration to remain outstanding)

Step 2: Overseas Hold Co. to undertake capital reduction/declare dividends and set-off against the consideration receivable from the Shareholders

- Excess of sale consideration over cost of acquisition shall be taxable as capital gains on transfer of shares of Indian Co.

- No India tax implication in the hands of Non-resident shareholders on receipt of dividend from Overseas Hold Co.

- Carried forward business loss of India Co may lapse on account of change in shareholding

- Timeline: 4 to 6 weeks

Resultant Structure

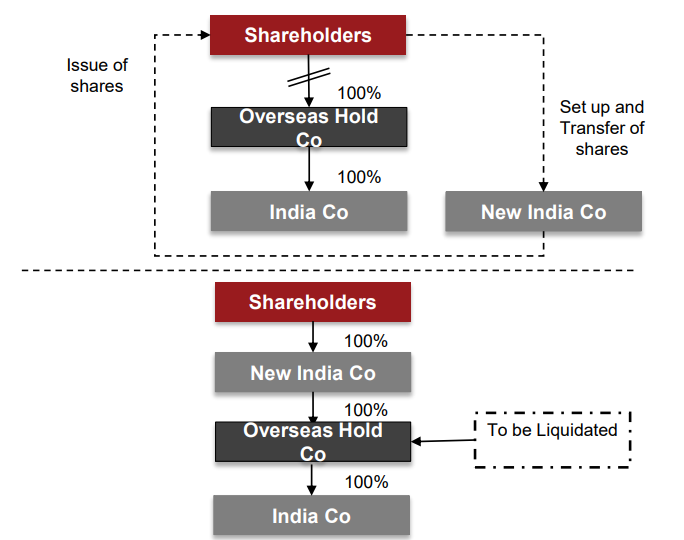

6.4 Option 4 – Swap of Shares

Step 1: Shareholders to set up of New Indian Co and transfer shares held in Overseas Hold Co to New India Co in exchange of shares of New India Co

Step 2: Overseas Hold Co to liquidate and distribute assets and liabilities (including shares of India Co) to New India Co

Key India Tax Considerations

- Indirect transfer tax implications may arise in the hands of nonresident shareholders. Further, receipt-based taxation may also need to be evaluated if the situs of shares of Indian Co is in India

- No India tax implications for Overseas Hold Co on distribution of shares of India Co pursuant to liquidation

- FMV of the assets received on liquidation shall be taxed as dividend to the extent of accumulated profits and the balance shall be deemed to be the sale consideration for transfer of Overseas Hold Co’ shares for determining capital gain implications

- Carried forward business loss of India Co may lapse on account of change in shareholding

- Timeline: 6 to 8 weeks (May vary as per the laws of host jurisdiction)

Resultant Structure

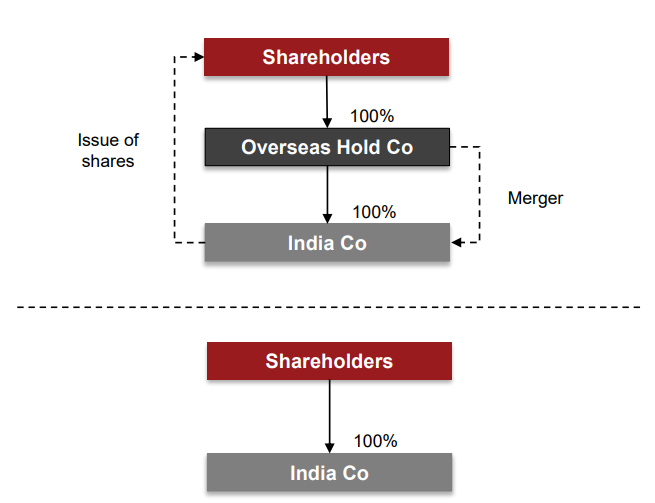

6.5 Option 5 – Inbound Merger

Step 1: Merger of Overseas Hold Co into India Co under fast-track route

Step 2: Issue of shares by India Co to the Shareholders of Overseas Hold Co as consideration for merger

Key India Tax Considerations

- Merger of foreign company with India Co to be tax-neutral for the Overseas Hold Co, Shareholders and the India Co subject to compliance with prescribed conditions

- Carried forward business loss of India Co may lapse on account of change in shareholding

- Continuation of the period of holding and cost of acquisition for the Shareholders

- Merger to be compliant with laws of overseas jurisdiction

- Timeline: 9-12 months

Resultant Structure

7. GIFT City – Preferred Destination for Internalization

IFSCA has introduced International Financial Services Centres Authority (Listing) Regulations, 2024 to provide access to global capital without domestic listing and has set up Padmanabhan committee to develop a plan to Onshore the Indian innovation to GIFT IFSC

7.1 Key Recommendations by the Committee

- IFSCA should be a nodal office for application for incorporation and other regulatory approval under one form

- Tax neutral structure for relocation of overseas holding companies into GIFT IFSC

- Grandfathering of existing investment of overseas holding companies and protection from tax on disposal of existing investments post relocation

- Exemption from applicability of provision relating to place of effective management

- Protection from lapse of losses of the Indian operating entity and overseas holding companies due to change in shareholding upon relocation

- Exemption from taxation of dividend income receivable by holding company from its subsidiaries

- Enhancing the LRS limit for investment in the Gift IFSC

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA