[Analysis] Responding to GST Notices – Statutory Provisions | Jurisdiction | Evidence

- Blog|GST & Customs|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 24 January, 2024

Table of Contents

- Overview

- From Strength to Strength

- Statutory Provision Dictates Approach

- Jurisdiction and Proper Officer

- Illegal Evidence

- Bona Fide Demand in Mala Fide Proceedings

- Question-the-Question

Check out Taxmann's How to Deal with GST Show Cause Notices with Pleadings which blends practicality with legal expertise and offers a comprehensive guide on handling GST Show Cause Notices, highlighting their complexities and impacts on taxpayers. It focuses on practical approaches, using real-world examples and solutions derived from the author's litigation experience. The content is divided into 'Notices under GST' and 'Pleadings in GST' and includes features like do's and don'ts, checklists, visualizations, template answers, and suggestions for additional reading.

1. Overview

‘Due process’ of adjudication is not a ‘friendly match’. It is adversarial litigation process, in every sense of the word. Neither side should assume quiet surrender or crude settlement of the dispute. Proper Officer is not the ‘last authority’ who will sit in judgment over the lis. In fact, notice and reply is just the beginning of proceedings that will conclude when a decisive ruling on the lis comes to be rendered by an authority named in the law or when one of the adversaries concedes at any interim stage. Taxpayers are generally averse to litigation. But taxpayer’s confidence to litigate is directly linked to the exuding confidence of the expert who is to advise, assist and offer representation in these proceedings.

Reply to notice is not the last step. It is the place where defences are put forward with eyes set firmly on a ‘day in Court’ when findings reached by Proper Officer in adjudication will be put to the test. After all, adjudication is not the search for the truth but a trial of the interpretation canvassed by Revenue.

Example: Taxpayer urged in appeal that Proper Officer’s actions are without jurisdiction since SCN is issued by Officer of State GST department under section 73 when taxpayer is registered with Central GST department. No proceedings under section 67 were undertaken. Grounds urged was dismissed citing failure to put forward this objection in earlier proceedings and by replying to SCN on merits, taxpayer has acquiesced and rendered ‘valid’ the SCN (and consequent Adjudication Order) as per section 160(2). As such, appeal taken up for consideration on merits.

Outcome of litigation is unlikely to be final at the end of adjudication. Where a notice is issued, Revenue is barred from ‘giving up without a fight’, that is, no demand (in a notice) can attain finality unless every possible avenue to sustain that demand has been tested and by more than one authority. Revenue has the following avenues to wrestle with the demand:

(a) Adjudication by a Proper Officer;

(b) Departmental appeal before First Appellate Authority;

(c) Revision of orders prejudicial to Revenue by Revisionary Authority;

(d) Departmental appeal before Appellate Tribunal; and

(e) Statutory appeal to High Court/Supreme Court on question of law.

Taxpayer too has several avenues to follow. But taxpayer’s willingness is directly tied to awareness. And grounds to be urged in adjudication are vastly different from those to be urged in appeal. Like everything in business, reply to notice must be approached with a strategy. One that entertains the possibility of adverse outcome, at least, in early rounds in this process. Therefore, each round must be approached based on the relief that authority is empowered to allow.

Example: Constitutional validity of the provisions, say, section 16(4) raised before Proper Officer demanding demand to be dropped in adjudication. Proper Officer being a ‘creature of the statute’, is barred from sitting in judgment over the vires of the law being administered. This ground – questioning vires of provisionis for High Court to entertain. And since this is the only ground urged before Proper Officer then, demand stands confirmed.

Verification of computation of input tax credit reversal under rule 42 urged before Appellate Authority. Since the same has already received consideration by Proper Officer and there being no point of disagreement about the computation except to demand fresh consideration and verification of reversal computation, appeal is dismissed.

Taxpayers must understand the several rounds that nearly every notice will need to pass. And not even a favourable order in adjudication is anything to celebrate because Revenue is free to carry such order in departmental appeal within six (6) months from Order or upset it in revisionary proceeding up to three (3) years from Order. When no favourable order merits celebration unless the last avenue available for Revenue has lapsed, taxpayer cannot view any notice to conclude in ‘round one’ itself. And if it will be carried to ‘multiple rounds’, reply to notice must be approached with a strategy. If truth is all there is, experience will show that justice is loosely connected with truth and more firmly with facts in the notice and approach in the reply.

2. From Strength to Strength

Approach to reply involves carrying the case from ‘strength to strength’ as it passes through the entire process from adjudication to appeal. It needs to be nurtured and cared for, preserved and guarded even from taxpayers giving up midway and accepting a ‘compromise’. Care must be taken to guard the notice against private and parallel engagement of taxpayers with Proper Officers to secure a ‘short cut’ resolution that does not exist in this law.

Adjudication is unlikely to procure favourable outcome for the simple reason that the interpretation canvassed in the notice is not without understanding tax position adopted by taxpayer. It is to challenge taxpayer’s interpretation. And unless adjudication confirms the interpretation of Revenue, it will not receive full consideration that it deserves. Taxpayers must embrace the fact that adjudication is the beginning. And those willing to contribute more than that lawfully due and reluctant to resist the error of this new interpretation, will not be turned away. After all, no one can force a taxpayer to avail rights, remedies and safeguards available in this law, at least in adversarial litigation.

As the allegations are ‘chipped away’ at each stage in the entire process, the outcome will become clearer. Adjudication being trial of the interpretation canvassed in the notice, it requires perseverance and patience with the entire ‘due process’ to eventually establish validity of taxpayer’s own interpretation of this law.

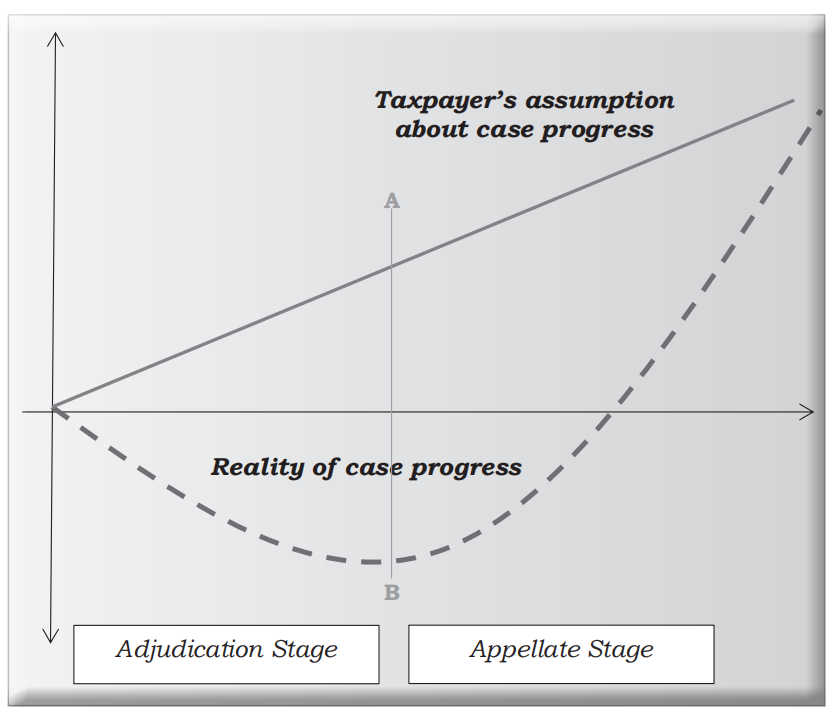

There is a mismatch between ‘assumption’ and ‘reality’. And taxpayers who are averse to litigation, will stop and even abandon further efforts along line A-B (in diagram above) due to alarm and disappointment at the outcome in adjudication, and failure to appreciate ‘reality’ of progress in the case.

Therefore, questions that taxpayer’s need to address are:

(a) Are the right objections placed on record at this stage?

(b) Have the allegations and evidence in support put to test?

(c) Is the scope of notice contained or expanded by new material?

(d) Do the findings reached narrow down the facts-in-issue(s) involved?

(e) Are grounds urged (in appeal) sharpen focus on findings to reach?

(f) What avenues are still left open that may ‘save the demand’?

(g) Does the record bear correct facts, eliminates irrelevant facts and revolve around the correct statutory provisions?

(h) Is the correct relief prayed?

And then consider, “what is the truth, what are the merits?”.

3. Statutory Provision Dictates Approach

“Which section?” is the most important question to be addressed because answer to this question reveals the approach to be followed in replying to the notice. Notice issued under section 63 requires one approach and this approach cannot be applied if the notice is issued under section 76.

There are notices issued under section 35 alleging that books and records are not properly maintained. Right to question the validity of any notice will be lost by delay and by omitting to question its validity due to the embargo in section 160(2). Whether this embargo can really overcome the right to valid notice, is yet to be tested but as it stands today, acquiescence validates an otherwise invalid notice (and hence, rest of the proceedings).

“Which section?” also dictates “which Officer?”. Not every Officer is the Proper Officer. When Officer is not ‘proper’, notice and everything that follows will be ‘improper’. And all this avails to a vigilant taxpayer and not one who is dormant about rights in law. Perhaps taxpayer does not want support of these rights in law and believes that merits alone are sufficient to secure justice. There is room in this law for taxpayer of every hue.

But ‘due process’ of law demands, with the several rounds of adversarial litigation laid down in the law, that sights be set on the ‘next round’ while working on the reply in ‘this round’. Relief that can be easily allowed in appeal may be impossible in adjudication.

Example: SCN issued under section 74 rejecting books and estimating liability. Adjudication concluded on ex parte basis. Appeal allowed due to admission in SCN that estimates and guesswork used to arrive at demand. Use of esti- mates and guesswork compatible with SCN under section 63, not section 74.

Outcome in appeal can be favourable because it may be impossible to ‘save the demand’ within the confines of the grounds in the notice (discussed earlier). After all, adjudication is not a search for the truth, but a trial of ‘view’ canvassed in the notice.

4. Jurisdiction and Proper Officer

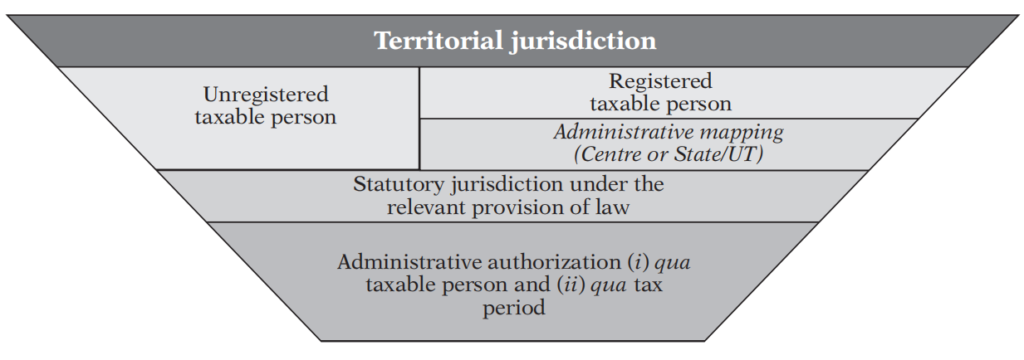

Administrative demands on Proper Officers is complex. And to ensure swift and prompt action, specific Officers are empowered to invoke powers under specific provisions (sections and rules). In so doing, the entire population of taxable persons are allocated based on geographic territory also. Often ‘jurisdiction’ is misunderstood to be limited to ‘territorial jurisdiction’ only. Reference to section 6(2) shows that with respect of anti-evasion action under section 67, simultaneous jurisdiction is vested in officers of Central and State (or UT) GST departments. This opens the question of ‘jurisdiction qua each provision’ in the law. That is, Officer who has granted registration to taxpayer is designated as Proper Officer to initiate proceedings under section 61. Registered taxpayers who are ‘mapped’ to Central GST department must be subjected to audit proceedings under section 65 by Proper Officer in the Central GST Audit Commissionerate only. Officers from the State (or UT) GST department are NOT authorized to initiate audit proceedings in respect of registered taxpayers who are fall within the administrative jurisdiction of Central GST department. And the same is true of registered taxpayers who fall withing the administrative jurisdiction of State (or UT) GST department.

This brings us to the question of “validity of jurisdiction” which must be tested and confirmed. And if there is any doubt, Proper Officer must explain exercise of jurisdiction when validity of notice is questioned in a plain-paper letter in view of the mandate in section 160(2).

Uncertainty about ‘validity of jurisdiction’ goes to the heart of notice and any invalidity can impair and bring the entire proceedings to be grinding halt. And where jurisdiction is lacking, notice is incurable and must be dropped immediately (or eventually if pursued), to avoid vice of highhandedness, abuse of statutory powers and misapplication of law, even if there is merit in underlying demand which is not exposed by prematurely ‘entering into merits’ in the reply.

Example: Although ‘Deputy Commissioner’ is the rank of Officer empowered to issue SCN under sections 73 and 74, in the State Karnataka, there is an administrative procedure for Joint Commissioner to issue ‘Assignment’ to such Deputy Commissioner to issue such SCN (i) in respect of specific distinct person (ii) for specific tax period(s) (iii) either under section 73 or 74 and (iv) for pecuniary limit of demand to be raised, will all be specified in such authorization. Taxpayer must demand copy of said Assignment be test for correctness and completeness of the procedure followed, which is essential before SCN is entertained by way of replying, even if demand is disputed.

Any good book on Administrative Law and Writ Remedies would help realize the importance of this question about ‘jurisdiction’ and ‘due process’ which are, all too often, glossed over. Taxpayers are gripped with fear that they fail to notice that Officer overcome by enthusiasm has omitted to secure specific authorization to initiate said proceedings. In addition, certain States (or UTs) have a further procedure to issue taxpayer-specific authorization to issue notices.

Example: Although ‘Deputy Commissioner’ is the rank of Officer empowered to issue SCN under sections 73 and 74, in the State Karnataka, there is an administrative procedure for Joint Commissioner to issue ‘Assignment’ to such Deputy Commissioner to issue such SCN (i) in respect of specific distinct person (ii) for specific tax period(s) (iii) either under section 73 or 74 and (iv) for pecuniary limit of demand to be raised, will all be specified in such authorization. Taxpayer must demand copy of said Assignment be test for correctness and completeness of the procedure followed, which is essential before SCN is entertained by way of replying, even if demand is disputed.

Unless every single step in the jurisdiction table is tested and satisfied, tax- payer is welcome not to enter into merits in reply to notice. And it would be most expeditious to include in the preliminary letter (discussed earlier) to demand copy of said authorization.

Question of jurisdiction is not ‘simple’ jurisdiction but ‘compound’ jurisdiction as it touches “territory + administrative mapping + statutory provision + specific authorization”. Omission to be mindful of this jurisdictional pyramid can cause irreparable prejudice to taxpayer’s interest.

Jurisdictional Pyramid

Just because statutory duties are being performed, even if there is strong suspicion of revenue leakage, except by following the due process of invoking specific powers conferred within specified boundaries to its exercised and with necessary checks and balances, passionately proceeding with enquiry or inquiry are as much illegal as are proceedings of a roving nature. It may be worthwhile to recount that what power is given to be a particular thing, that thing must be done in that particular manner or not at all. This is the mandate to the Executive by Legislature and the attendant possibilities of loss of revenue is inherently accepted in permitting

(i) self-assessment to taxpayer and

(ii) permitting authority to intervene but within the boundaries laid down in specified provisions.

5. Illegal Evidence

Evidence obtained illegally are NOT barred from being relied upon to issue notice. Objections as to use of illegal means to collect evidence (to support allegations in notice to be issued later) must be objected right at the point when such illegal attempts are observed. ‘Illegal’ in this context does not refer to evidence collected in collusion, but evidence collected using ‘extra legislative’ methods due to misapplication of prescribed procedure for evidence collection.

Most alarming provisions used to collect incriminating evidence are:

(a) Inspection of books of account under section 71 without any ‘reasons to believe’ that there may be some outstanding liability;

(b) Inspection of premises under section 67 and demanding ‘voluntary’ submission of books and records containing reference to some outstanding liability;

(c) Summons issued under section 70 without any authorization under section 67 to conduct ‘inquiry’ in respect of any evasion of tax;

(d) Letters of instruction issued under section 61 calling for books and records to be submitted in relation of ASMT10 issued;

(e) Survey of unregistered persons conducted, and verbal instructions issued to ‘voluntarily’ submit books and records in respect of any outstanding liability to be used in proceedings to be issued under section 63;

(f) Verbal instructions during proceedings for grant of registration in respect of outstanding liability for period prior to registration to be used in proceedings to be initiated under section 63;

(g) Verbal instructions during ‘test purchase’ under section 67(12) to expose stocks for physical verification to unaccounted stock under section 35(6) and initiate proceedings under section 73 or 74; and

(h) Notices are issued akin to summons calling for ‘information’ under section 150 and then initiate proceedings under section 74. ‘Information return’ under section 150 is applicable only to larger carriers of data such as Indian Railways, banks, statutory authorities, mobile operators, etc. And no such ‘information return’ has been notified as yet (discussed earlier) but still, section 150 is relied upon to call for elaborate information and records.

‘Outstanding liability’ referred above, includes any of the following areas that even registered taxpayers are likely to have missed since 2017-18:

|

Output tax |

Input tax credit |

Interest |

| RCM under section 9(3) | Credit mismatch | Unpaid arrears |

| RCM under section 9(4) (up to 13 Oct 2017) | Inward supplies not used in business | Arrears discharged belatedly |

| Deemed supply (multi-GSTIN-holders) | Time barred credits | Tax discharged on debit notes via 3B |

| Staff recoveries (credits in expense accounts) | Reversal of common credits | Interest paid on ‘net tax’ basis (liability paid via DRC3) |

| Other income in P&L | Blocked credits | |

| Value adjustments |

Where evidence is collected through such ‘extra legislative’ methods, followed by notice of demand, notices will not disclose the ‘source’ of said evidence.

Background to intelligence gathered by Revenue is not open for questioning (or disclosure in discovery) by taxpayer (Noticee). Excessive or erroneous detailed in these recitals can be valuable in preparation of defence.

6. Bona Fide Demand in Mala Fide Proceedings

When proceedings are ‘tainted’, it does not matter if the underlying demand is real and due. When it comes to ‘validity’ of proceedings, not even a bona fide demand can legitimize mala fide proceedings. While this is a rule of Administrative Law, there is yet another rule that relief NOT pleaded cannot be allowed, not even in the interests of justice. Justice, therefore, properly understood is not the eventual outcome, especially in taxation matters, but the lawful process of getting to the outcome. And ‘lawfulness’ is not something that will be taken lightly by Revenue or but easily neglected by taxpayers.

Taxpayers are overcome by the bona fides of the demand that they overlook the Legislative mandate that ‘no demand is permitted except by issuing a notice as per law’ and gladly pay up even when the demand cannot lawfully be made.

There are no statutory provisions in Central GST Act to issue SCN demanding interest on inadmissible transition credit availed, utilized and repaid.

Example: There are no statutory provisions for jurisdictional Proper Officer to call for books and records even if discrepancies in the returns are blatant or obvious. After a reply in ASMT11 from taxpayer, jurisdictional Proper Officer is requested to refer the matter for audit under section 65 or 66 or for inspection under section 67 or proceed with issuing SCN under section 73 or 74.

There are no statutory provisions in Central GST Act for Proper Officer conducting audit under section 65 to direct taxpayer to “submit detailed reply to observations in report issued under section 65(6)”. And taxpayer is not obliged to reply to such audit report in ASDT2 but await prenotice consultations vide DRC1A because section 65(7) renders Proper Officer ‘functus officio’ once ADT2 is released.

It is seen that a report containing ‘observations’ are issued ‘under section 65(6)’ but not titled ADT2. Consequence in law remains the same once section 65(6) is invoked. Taxpayers remain hopelessly hopeful that ‘detailed reply’ will make the (imminent) notice ‘go away’. Taxpayer will have preju- diced their (future) defence by exposing the grounds available prematurely. Taxpayers must ensure that ‘facts’ are not misunderstood by Revenue and ‘interpretation of facts’ is beyond taxpayer’s control.

7. Question-the-Question

All the deliberations up to this point about reply to notices, lead to this inescapable truth that ‘before launching to answer the question, it is most prudent for taxpayer to question-the-question’ because ambiguity about the question will expose taxpayer to perils of:

(a) Forfeiture of right to demand that Revenue satisfactorily discharge its ‘burden of proof’ about interpretation canvassed in the notice;

(b) Implicit admission of allegation (in the notice) left undisputed; and

(c) Shifting of ‘onus of proof’ onto taxpayer for introducing new or additional material and information.

And questions will be answered overlooking invalidity of the notice or questions will be left unanswered exposing imputation of wrongdoing without properly bringing home the allegations or actionable causes. In either case, the question itself will limit any curative attempts in ensuing proceedings. It would help to recollect that adjudication is not the search for the truth but to put Revenue’s case on trial to examine if the view canvassed is more accurate and sustainable than that adopted in self-assessment. After all, determination that no tax is payable and hence no requirement to even obtain registration can be the result of self-assessment. And taxpayer may not be consciously aware that the result of examination of facts, taxability, exemption, if any, and decision to remain unregistered, need not be an elaborate and pointed exercise but one that was swiftly decided after a short conversation with someone who has already carried out a thorough exercise, whether an expert or a fellow-taxpayer, it still remains taxpayer’s own assessment of the implications of this law to that business. This is the result of authority in section 59, duly exercised.

No prejudice will be caused to Revenue if taxpayers were to submit preliminary objections allowing Revenue opportunity to consider defects, deficiencies and discrepancies found in notice and either deny them or avail the last opportunity to clarify their position. Sometimes it is thought that no clarifications are warranted once notice is issued. Even then, request for clarification sought and turned down, places taxpayer in a position where the consequences of these defects, deficiencies and discrepancies (in the notice) become compelling grounds of defence.

Example: Demand for CGST-SGST without specifying ‘place of supply’ and its basis, will result in demand being biased, arbitrary and erroneous, formed purely based on presumption and conjecture.

Demand for output tax without specifying ‘HSN code’ is fatal to a well-reasoned confirmation of the demand in adjudication.

Demand for RCM without specifying ‘time of supply’ is incurable and no demand for tax and certainly not for interest can be made. And to demand interest from 31 Mar 20XX would imply that ‘time of supply’ has been assumed to be on the last day of financial year.

It is important for taxpayer, not necessarily by way of defence, to be sure that the allegations in the notice are correctly and completely understood. Taxpayer’s exude so much confidence that they ‘already know the question’, but that is not the role of taxpayers. Taxpayer’s role is to ‘answer the question’. And to be able to do this right, taxpayers cannot be ‘imagine the question, and then proceed to answer’. Taxpayers might recognize the actionable cause. That will not do. Taxpayers must grasp exactly ‘what’ is the allegation and ‘how’ has it been supported in the notice.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA