[Analysis] Interplay of Section 43B with MSME Act – Background | Case Studies

- Blog|Income Tax|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 11 March, 2024

By CA Deepak Bhholusaria | Partner – Daksm (दक्षम:) & Co LLP

Table of Content

1. Background

1.1 MSME & Indian Economy

- Almost 33% GDP of India is from MSME sector

- Almost 45 to 50% export contribution is by MSMEs

- More than 95% of business units come from MSME

- Amidst the celebration of ‘Amrit Kal,’ the journey toward achieving developed country status by 2047 is reliant on the pivotal support of the MSME sector

2. Section 43B (h) – Payments to MSMEs

2.1 Section 43B

43B. Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of

(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him:

Provided that nothing contained in this section except the provisions of clause(h) shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub- section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return

Explanation 4.—For the purposes of this section,—

(e) “micro enterprise” shall have the meaning assigned to it in clause (h) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006);

(g) “small enterprise” shall have the meaning assigned to it in clause (m) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006)

2.2 Analysis of 43B(h)

- Applicable w.e.f. 01-04-2023 (i.e AY 2023-24)

- Does not apply to any outstanding as on 31-03-2023

- If payment is made to Micro or small enterprises (M&SE) within the time allowed by section 15, then section 43B(h) shall not apply

- If payment is made to MSE beyond due date as per sec 15 of MSME act, deduction to be allowed only in the year of payment (benefit of proviso to section 43B not available)

- It is irrelevant in which FY such liability was captured by the assessee basis method of accounting regularly employed by him

3. MSME Act

3.1 Section 2 of MSME Act

“micro enterprise’ means an enterprise classified as such under sub-clause (i) of clause (a) or sub-clause (i) of clause (b) of sub-section (1) of section 7

“small enterprise” means an enterprise classified as such under sub-clause (ii) of clause (a) or sub-clause (ii) of clause (b) of sub-section (1) of section 7

| Definition | Reference of section 7 of MSME Act |

| Micro | 7(1)(a)(i) or 7(1)(b)(i) |

| Small | 7(1)(a)(ii) or 7(1)(b)(ii) |

3.2 Section 7 of MSME Act

| Activities and type of enterprise | Reference of section 7 of MSME Act | |

| Manufacturing | (a) in the case of the enterprises engaged in the manufacture or production of goods pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (65 of 1951), as- | |

| Micro | 7(1)(a)(i) | (i) a micro enterprise, where the investment in plant and machinery does not exceed twenty five lakh rupees; |

| Small | 7(1)(a)(ii) | (ii) a small enterprise, where the investment in plant and machinery is more than twenty-five lakh rupees but does not exceed five crore rupees; |

| Services | (b) in the case of the enterprises engaged in providing or rendering of services, as- | |

| Micro | 7(1)(b)(i) | (i) a micro enterprise, where the investment in equipment does not exceed ten lakh rupees |

| Small | 7(1)(b)(ii) | (ii) a small enterprise, where the investment in equipment is more than ten lakh rupees but does not exceed two crore rupees; or |

Explanation 1.–For the removal of doubts, it is hereby clarified that in calculating the investment in plant and machinery, the cost of pollution control, research and development, industrial safety devices and such other items as may be specified, by notification, shall be excluded

Notwithstanding anything contained in section 11B of the Industries (Development and Regulation) Act, 1951 (65 of 1951) and clause (h) of section 2 of the Khadi and Village Industries Commission Act, 1956 (61 of 1956), the Central Government may, while classifying any class or classes of enterprises under sub-section (1), vary, from time to time, the criterion of investment and also consider criteria or standards in respect of employment or turnover of the enterprises and include in such classification the micro or tiny enterprises or the village enterprises, as part of small enterprises.

3.3 Revised criteria w.e.f. 01-07-2020

| Activities and type of enterprise | Investment in P&M | Turnover criteria | |

| Micro | does not exceed 1 crore rupees | & | does not exceed 5 crore rupees |

| Small | does not exceed 10 crore rupees | does not exceed 50 crore rupees |

Unlike earlier, there is no differentiation between manufacturing and services activities and these criteria are equally applicable for “suppliers” engaged in supply of goods or services.

Notification no. SO 1702(E) dated 1st June 2020

3.4 Can “traders” be micro/small enterprises?

Office Memorandum dated 02-07-2021:

“2. The Government has received various representations, and it has been decided to include Retail and wholesale trades as MSMEs and they are allowed to be registered on Udyam Registration Portal.

However, benefits to Retail and Wholesale trade MSMEs are to be restricted to Priority Sector Lending only.”

Effectively:

- Traders are allowed to be registered on MSME portal

- Benefits of registration are only for the purpose of “Priority Sector Lending”

- Mere registration of trader on MSME portal will not entitle them to claim as “Micro, Small or Medium” enterprise

- Consequently, no benefit of MSME act are available to them (e.g. Section 15)

- Thus, for the purpose of section 43B of IT Act, traders MSMEs to be

Activities (NIC code) under MSMED Act, 2006 for Udyam Registration

| NIC Code | Activities |

| 45 | Wholesale and retail trade and repair of motor vehicle and motorcycles |

| 46 | Wholesale trade except of motor vehicles and motorcycles |

| 47 | Retail Trade Except of Motor Vehicles and motorcycles |

3.5 OM No. 2(28)/2007-MSME(Pol), dated 26-8-2008

- In the absence of suppliers mentioning their MSE status on their supply orders, invoices, letterheads and other relevant documents, it would be very difficult for the buyer entities to identify MSE suppliers, their dues, disclose them in annual accounts, comply with section 15 and for auditors of buyer entities to verify required disclosures in annual

- OM clarifies that –

‘it is advisable that the Micro or Small Enterprises should mention/get printed on their letter heads, supply order sheets, invoices, bills and relevant documents, the Entrepreneurs Memorandum (EM) number…., so that there always remains an identification of being an MSE supplier.”

3.6 Section 8 of MSME Act

(1) Any person who intends to establish,–

(a) a micro or small enterprise, may, at his discretion; or

***

shall file the memorandum of micro, small or, as the case may be, of medium enterprise with such authority as may be specified by the State Government under sub-section (4) or the Central Government under sub-section (3):

3.7 Section 15 of MSME Act

15. Liability of buyer to make payment

“Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty- five days from the day of acceptance or the day of deemed acceptance.”

Section 2:

(b) “appointed day‘ means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier

Explanation.–For the purposes of this clause,–

(i) “the day of acceptance” means,–

(a) the day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

(ii) “the day of deemed acceptance” means, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services;

(n) “supplier” means a micro or small enterprise, which has filed a memorandum with the authority referred to in sub-section (1) of section 8 {Udyog Aadhar}

| Type of payment arrangement | Payment time limit specified in section 15 of MSME Act |

| Agreement exists in writing |

As per agreement in writing Or 45 days from date of acceptance or deemed acceptance whichever is earlier |

| No agreement for payment |

15 days following date of acceptance or deemed acceptance |

- Terms of payment mentioned on the face of invoice/PO to be treated as agreement in “writing”

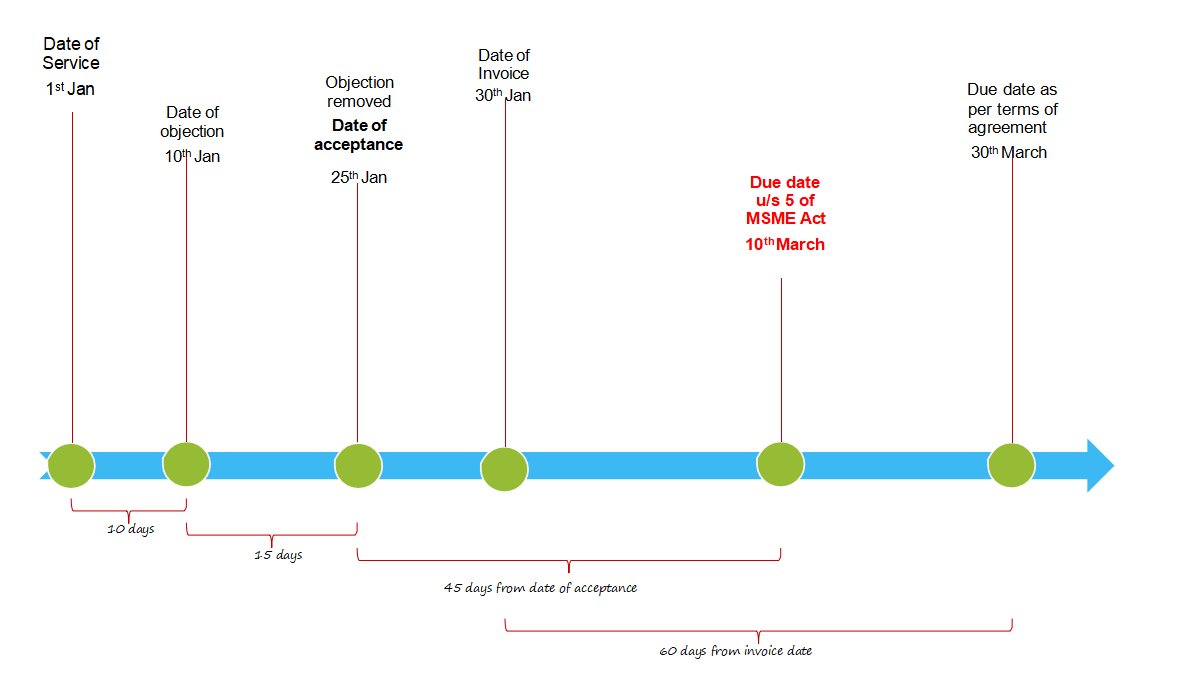

3.8 Agreement exists in writing

Payment terms – 60 days from the date of invoice

Payment terms – 60 days from the date of invoice

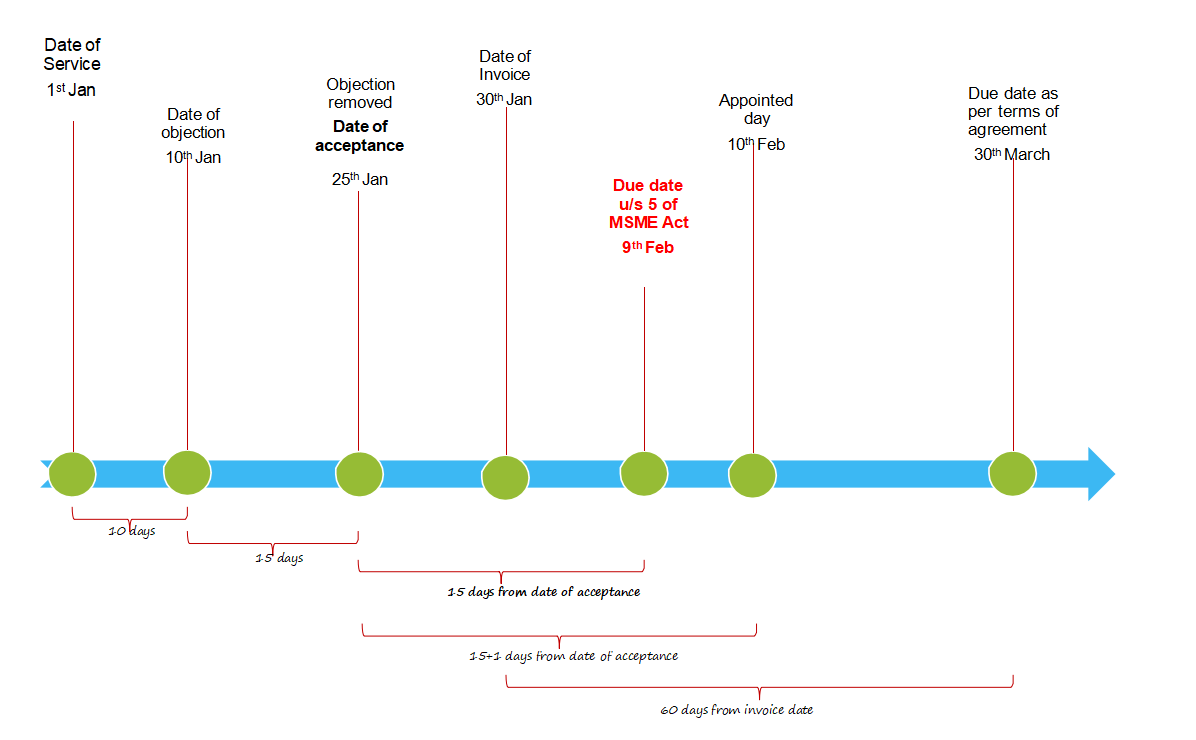

3.9 No agreement exists in writing

Payment terms – 60 days from the date of invoice (verbal)

| Type of payment arrangement | Payment time limit specified in section 15 of MSME Act |

| Agreement exists in writing |

As per agreement in writing Or 45 days of acceptance or deemed acceptance whichever is earlier |

| No agreement for payment | 15 days of acceptance or deemed acceptance |

- Terms of payment mentioned on the face of invoice/PO to be treated as an agreement in “writing”

3.10 Supplier

An enterprise shall not be deemed to be a “supplier” for Chapter V, if it is:

- A micro or small enterprise which has not filed a memorandum (Udyam Registration) under section 8(1)(a) of the MSMED Act;

- Medium enterprises; and

- Large enterprises (i.e. manufacturing enterprises that have an investment in plant and machinery or equipment exceeding Rs. 50 crores or turnover exceeding Rs. 250 crores.

3.11 Buyer – Section 2(b) of MSME Act

“buyer” means

- Whoever buys

- any goods or receives any services

- from a supplier for

From section 18(4) of the MSMED Act, it appears that the buyer can be located “anywhere in India”, and a foreign buyer not located in India will not fall within the definition of “buyer”.

4. Case Studies on Due Dates under MSME Act

4.1 Due date u/s 15

| Type of supplier | Payment terms | Date of supply | Date of invoice | Date of objection in writing | Date of resolving objection | Date of acceptance or deemed acceptance | Due date of payment u/s 15 |

| Services | Past practice of 45 days from the date of invoice | 28-02-2024 | 15-03-2024 | 16-03-2024 | 20-03-2024 | 28-02-2024 | 13-03-2024 |

| Manufacturing | 60 days from the date of invoice as per PO | 01-02-2024 | 01-02-2024 | 10-02-2024 | 01-04-2024 | 01-04-2024 | 15-05-2024 |

| Trader | Immediate on delivery | 01-03-2024 | 01-03-2024 | None | NA | 01-03-2024 | NA |

| Services | Within 30 days of invoice (mentioned on invoice) | 01-03-2024 | 31-03-2024 | None | NA | 01-03-2024 | 15-04-2024 |

| Manufacturer doing trading | Silent | 15-02-2024 (Challan on approval) | 22-02-2024 | None | NA | 22-02-2024 | 07-03-2024 |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA