[Analysis] Insider Trading Reforms | Balancing Regulations with Operational Realities for Effective Implementation

- Blog|Advisory|Company Law|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

- Introduction

- Insider trading norms

- Why the concept of Trading Plans (TP) was introduced?

- Need for amending the trading plan norms

- Key recommendations of the committee

- Conclusion

1. Introduction

SEBI constituted a Working Group in July, 2023 to review provisions relating to ‘Trading Plans’ under the SEBI (Prohibition of Insider Trading) Regulations, 2015 (“ PIT Regulations, 2015” ). The Working Group was mandated to review provisions of the trading plan under PIT Regulations, 2015 so as to provide flexibility to facilitate adoption of trading plans by persons who may be perpetually in possession of Unpublished Price Sensitive Information.

The key proposals include a cool-off period, and minimum coverage period, along with the disclosure timelines and format for reporting the details of the trading plans. The public comments are invited on the latest by 15-12-2023.

2. Insider trading norms

In India, the SEBI (Prohibition of Insider Trading) Regulations, 2015 (“PIT Regulations, 2015”) prohibit insider trading. Insider trading involves the act of trading while in possession of Unpublished Price Sensitive Information (UPSI) — information that, if disclosed, could impact the market price of the traded securities.

The underlying rationale for prohibiting insider trading is that individuals trading in securities may be influenced by the UPSI they possess, giving them an advantage not available to others in the market. However, insiders are permitted to engage in trading as long as they are not in possession of UPSI and comply with the other provisions outlined in the PIT Regulations, 2015.

3. Why the concept of Trading Plans (TP) was introduced?

Among insiders, a specific category includes senior management or key managerial personnel (“KMP”), who face constraints in executing trades due to their continuous possession of Unpublished Price Sensitive Information (UPSI) and mandatory trading window closures, especially during financial results disclosures. However, these insiders may have legitimate reasons for trading, such as meeting minimum public shareholding requirements or engaging in creeping acquisitions. Additionally, stock options often constitute a significant portion of KMP compensation, and these individuals may desire to sell shares acquired through the exercise of such options. Yet, the perpetual possession of UPSI may pose challenges to this.

Consequently, the PIT Regulations, 2015 introduce the concept of ‘Trading Plans’ 1(also known as ‘TP’), providing a framework for individuals consistently holding UPSI to engage in securities trading in a compliant manner.

4. Need for amending the trading plan norms

Since the inception of trading plans in 2015, available data and market feedback indicate that the existing regulatory stipulations concerning trading plans are burdensome. As a result, trading plans have not gained widespread popularity.

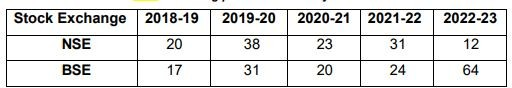

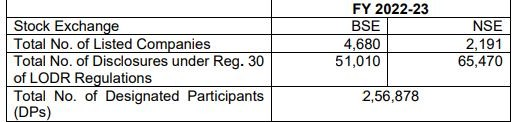

Data2 on the adoption of trading plans by insiders over the past 5 financial years is given in table below.

Number of listed Companies and disclosures by the insiders

The data indicates that despite the considerable number of designated persons (DPs) or insiders, the utilization of trading plans by insiders of listed companies, as disclosed to stock exchanges, is remarkably low. This suggests that trading plans are seldom employed.

5. Key recommendations of the committee

(a) Proposal to reduce the minimum cool-off period between disclosure of TP and implementation of TP

Extant norms

Under the extent norms3, there is a requirement of a minimum cool-off period of 6 months between the day of public disclosure of the trading plan by the insider and the commencement of trading under the plan.

Proposal

It is proposed to reduce the minimum cool-off period between disclosure of TP and implementation of TP may be reduced to 4 months from 6 months.

Rationale behind proposal

Under the extant norms, the insiders have to plan their transactions at least 6 (six) months ahead which may be too onerous for them, as market conditions while implementing the trading plan may be largely different from the time it was formulated. Therefore, the proposal is put to reduce the cooling-off period to 4 months.

(b) Proposal to reduce the Minimum Coverage period

Extant norms

Under the extant norms,4 there is a requirement that a trading plan should cover trades for a period of at least 12 (twelve) months. Meaning thereby an insider is required insider is required to cover the period of at least 12 (twelve) months for any trading plan.

Proposal

It is proposed to reduce the minimum coverage period to 2 months from 12 months.

Rationale behind proposal

The current period of 12 months requires the insider to consider a significantly longer forward-looking outlook while formulating the TP. Given the dynamic and uncertain nature of the securities market, it is difficult to plan trades for a period of 12 (twelve) months in advance. Therefore, it is proposed to reduce the said period to 2 months.

(c) Proposal to do away with the blackout period

Extant norms

Under the extant norms5, there is a black-out period requirement, wherein, the Trading Plan (TP) shall not entail trading for the period between the 20th trading day prior to the last date of a financial period for which results are to be announced and until the 2nd trading day after the disclosure of the results.

Proposal

It is proposed to do away with the requirement of a black-out period for trading in TP.

Rationale behind proposal

Due to the provision of a black-out period, the insider is left with only a few trading days in the entire year to plan their trades. Further, with the reduction of the execution period to a minimum of 2 months, the provision of a black-out period will further reduce the trading days left during the execution period for planning the trades for the insider.

In view of the above, it is proposed that the requirement for a black-out period be done away with. This would provide flexibility to execute trades by insiders through Trading Plans.

(d) Proposal to limit the price to safeguard insiders from substantial adverse price fluctuations

Extant Norms

Currently6, TP shall set out either the value of trades to be effected or the number of securities to be traded along with the nature of the trade and the intervals at, or dates on which such trades shall be effected. Thus, the insider is allowed to mention the nature of trade (acquisition/ disposal); No. or value of securities; date or intervals for trades to get effected.

There is no provision enabling the insider to mention their price limit for the trade, based on their risk appetite, within which they wish to execute the transaction.

Proposal

It is proposed to provide the insider with flexibility. During the formulation of TP, the insider can provide price limits i.e. upper price limits for buy trades and lower price limits for sell trades.

Such price limit shall be within +/ -20% of the closing price on the date of submission of TP. If the price of the security, during execution, is outside the price limit set by the insider, the trade shall not be executed. If no price limit is opted for, the trade has to be undertaken irrespective of the prevailing price.

Rationale behind proposal

The objective of this proposal is to provide protection against loss due to price fluctuation, there is a need to give an option to the insider to indicate a price limit beyond which they do not prefer to trade.

(e) Proposals to introduce Contra-trade restrictions

Extant Norms

The extant norms7 stipulate that restrictions on contra-trade shall not be applicable for trades carried out in accordance with an approved trading plan. Meaning thereby, an insider is permitted to execute opposite trades with a gap of less than 6 months within a trading plan.

Proposal

It is proposed to exempt trades executed under TP from the applicability of contra-trade restrictions to be omitted i.e. contra-trade provisions shall be applicable on trades executed under TP as well.

Rationale behind proposal

The objective of this proposal is that there may be a risk that insiders may misuse this exemption for undertaking a contra-position under the protection of Trading Plan provisions.

(f) Proposals to introduce a specific timeline for Disclosure of TP

Extant Norms

Under the extant norms8 upon approval of the trading plan, the compliance officer shall notify the plan to the stock exchanges on which the securities are listed.

Proposal

It is proposed that disclosure of TP to stock exchanges shall be done within 2 days from the date of approval of TP.

Rationale behind proposal

The committee observed that currently, there is a provision regarding the submission of trading plan to the stock exchange for public disclosure. However, there is no deadline prescribed within which to submit the same. Therefore, it is proposed to prescribe the deadline of 2 days post-approval of a trading plan for more clarity.

(g) Other proposals

The Working Group discussed the feasibility of protecting the privacy of insiders by masking their personal details (Name, Designation, PAN) while disclosing the TP to stock exchanges. The working group proposed that the insider will make separate filings for the stock exchange (with personal details) and for the public (without personal details). The disclosure of the TP to the stock exchange (with personal details) will remain confidential with stock exchanges and the disclosure without personal details will be made public.

To counter any concerns of possible misuse arising from the masking of names from the public, a unique identifier viz., a common reference number with time stamp may be put on these filings for reconciliation purposes.

Further, currently, there is no uniformity in reporting details of the TP and hence, recommended that a suitable format may be specified in consultation with market participants.

6. Conclusion

The Working Group’s key proposals, encompassing the introduction of a cool-off period, minimum coverage period, and revised disclosure timelines and formats, reflect a thoughtful consideration of the practical issues faced by insiders. The overarching aim is to strike a balance between regulatory requirements and the operational needs of insiders, particularly senior management and key managerial personnel (KMP).

The presented data paints a clear picture of the underutilization of trading plans despite the significant number of insiders. This indicates a need for amendments to the existing norms to encourage wider adoption.

- Regulation 5 of the PIT regulations, 2015 deals with the provisions w.r.t Trading Plan

- Source NSE and BSE

- Regulation 5(2) (i)

- Regulation 5(2) (iii)

- Regulation 5(2) (ii)

- Reg 5(2) (v)

- Reg 5(3)

- Reg 5(5)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA