An Overview of Bank Statutory Audit

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 18 September, 2023

Table of Contents

1. Introduction

2. Meaning & Types

3. Who appoints the bank auditor?

4. Who can be appointed as bank auditor?

5. Remuneration of Bank Auditor

6. Bank Auditors Report

7. Long Form Audit Report

8. Reporting to RBI

9. Conducting the Audit of Banks

10. Classification of Advances

11. Government Guaranteed Advances

12. Audit of Advances

13. Audit of Revenue items

14. Audit of Expenses

1. Introduction

Banks play an important role in the development of any country. It’s like an agent of the economy. Like all economic activities, the banking sector is also exposed to various risks in its operations. It is of utmost importance to ensure that the banking sector stays healthy, safe, and sound. For the safe and sound banking sector, one of the most important factors is reliable financial information supported by quality bank audits.

2. Meaning & Types

A Bank audit is a routine examination of the records and services of the organization to ensure whether they are in compliance with the laws and standards of the industry. Banks have to get many types of audits done such as statutory audit, revenue audit, concurrent audit, etc. This may be carried out by external or internal agencies. In this blog, we will have an overview of the statutory audit of the Branch of the Bank that is carried out as per guidance provided by RBI.

3. Who appoints the bank auditor?

Appointment of Statutory central auditor of PSB, select all India Financial Institutions, RBI, and branch auditor for PSB is done in accordance with the norms prescribed by RBI.

4. Who can be appointed as bank auditor?

-

- Appointment of Statutory central auditor of PSB, select all India Financial Institutions, RBI, and branch auditor for PSB is done in accordance with the norms prescribed by RBI.

- The auditor of a banking company is to be appointed AGM of shareholders.

- In nationalized banks auditor is appointed by the bank concerned acting through its Board of Directors. Here, approval of the Reserve Bank of India is required before the appointment.

- The Comptroller and Auditor General of India in consultation with the Central Government appoint the auditor of the State Bank of India.

- State Bank of India appoints the auditor for its subsidiaries.

- The concerned bank of regional rural banks appoints its auditor with the approval of the Central Government.

5. Remuneration of Bank Auditor

The remuneration of the auditor of a banking company is fixed in the general meeting in accordance with the provisions of Section 142 of the Companies Act, 2013.

Reserve Bank of India in consultation with the Central Government fixed the remuneration of auditors of nationalized banks and State Bank of India.

6. Bank Auditors Report

The statutory auditor should ensure that the audit report issued by them complies with the requirements of Standards on Auditing. The auditor should ensure that not only information relating to a number of unaudited branches is given but quantification of advances, deposits, interest income, and interest expense for such unaudited branches has also been disclosed in the audit report.

The statutory auditor is also required to state in his report the matters covered by Section 143 of the Companies Act, 2013. However, it is pertinent to mention that the reporting requirements relating to the Companies (Auditor’s Report) Order, 2016 is not applicable to a banking company, as defined in clause (c) of Section 5 of the Banking Regulation Act, 1949.

7. Long Form Audit Report

The terms of appointment of auditors of public sector banks, private sector banks, and foreign banks including its branches. Besides, the audit report requires auditors to furnish a long-form audit report (LFAR). It includes a detailed questionnaire prepared by the Reserve Bank of India. LFAR is to be submitted before 30th June every year for the completion of which on time proper planning is required. LFAR does not have the requirement for executive summary. However, members may consider providing the same to bring out the key observations from the whole document.

8. Reporting to RBI

RBI issued a Circular relating to the liability of the accounting and auditing profession, where the matter should be referred to RBI, in case an auditor finds any fraudulent activity or act of excess power or any foul play in any transaction. Any deliberate failure on the part of the auditor should render himself liable for action.

Auditors also need to consider the provisions of SA 250, “Consideration of Laws and Regulations in an Audit of Financial Statements” and SA 240 “The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements”. If the auditor, while performing his audit, comes across any instance of fraud, he should report the matter to the RBI in addition to the Chairman/MD/Chief Executive of the concerned bank.

9. Conducting the Audit of Banks

The audit of banks or their branches involves the following stages –

1. Initial consideration by the statutory auditor in regards to:

a) Declaration of Indebtedness

b) Internal Assignments in Banks by Statutory Auditors

c) Planning an Audit of Financial Statements

d) Communication with Previous Auditor

e) Terms of Audit Engagements

f) Initial Engagements

g) Assessment of Engagement Risks

h) Understanding the Bank and its Environment

2. Identifying and Assessing the Risks of Material Misstatements

3. Understanding the Bank and Its Environment including Internal Control

4. Understanding the Bank’s Accounting Process

5. Understanding the Risk Management Process

6. Engagement Team Discussions

7. Establishing the Overall Audit Strategy

8. Developing the Audit Plan

9. Summarizing the audit plan by preparing an audit planning memorandum

10. Determining the Audit Materiality by considering the relationship between the audit

11. While obtaining an understanding of the bank, the auditor should consider whether there are events and conditions which may cast significant doubt on the bank’s ability to continue as a going concern

12. Assessing the Risk of Fraud including Money Laundering

13. Assessing specific risks

14. Assessing the risk associated with outsourcing of activities

15. Responses to the Assessed Risks

16. Reviewing the other reports by taking into account the adverse comments, if any, such as:

a) Previous year’s audit reports

b) Latest internal inspection reports of bank officials

c) Reserve Bank’s latest inspection report

d) Concurrent / Internal audit report

e) report on verification of security

f) Any other internal reports specially related to particular accounts

g) Manager’s charge-handing-over report when incumbent is changed

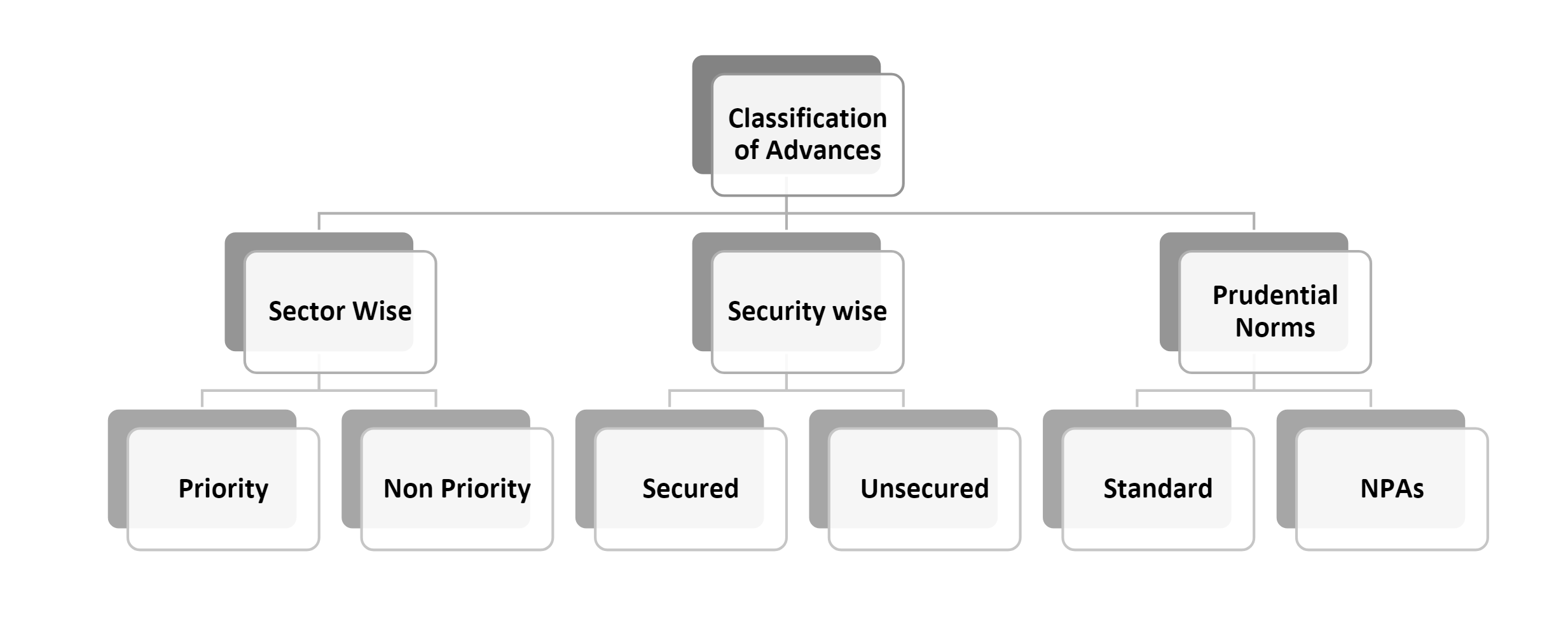

10. Classification of Advances

Advances, generally, constitute the largest item on the assets side of the balance sheet of a bank and are a major source of its income. Audit of advances is one of the most important areas covered by auditors in bank audits. It is necessary that auditors should have adequate knowledge of the banking industry and the regulations governing the banks. Auditors must be aware of the various functional areas of the bank/branches, its processes, procedures, systems, and prevailing internal controls with regard to advances.

10.1 Classification of Advances Sector Wise

RBI issues common guidelines for lending to Priority Sector such as agriculture, MSME, Education, Housing, etc. which banks are required to follow. These guidelines cover rate of interest, service charges, receipt, sanction, rejection, disbursement Register; the issue of Loan Application Acknowledgement. RBI also issues targets for banks for lending to Priority Sector.

10.2 Classification of Advances Security Wise

Banks ask for Security or Collateral while lending to assure that the Borrower will return the money to the bank in a prescribed time. Depending on the nature of the item concerned, the creation of security may take the form of a mortgage, pledge, hypothecation, assignment, set-off, or lien.

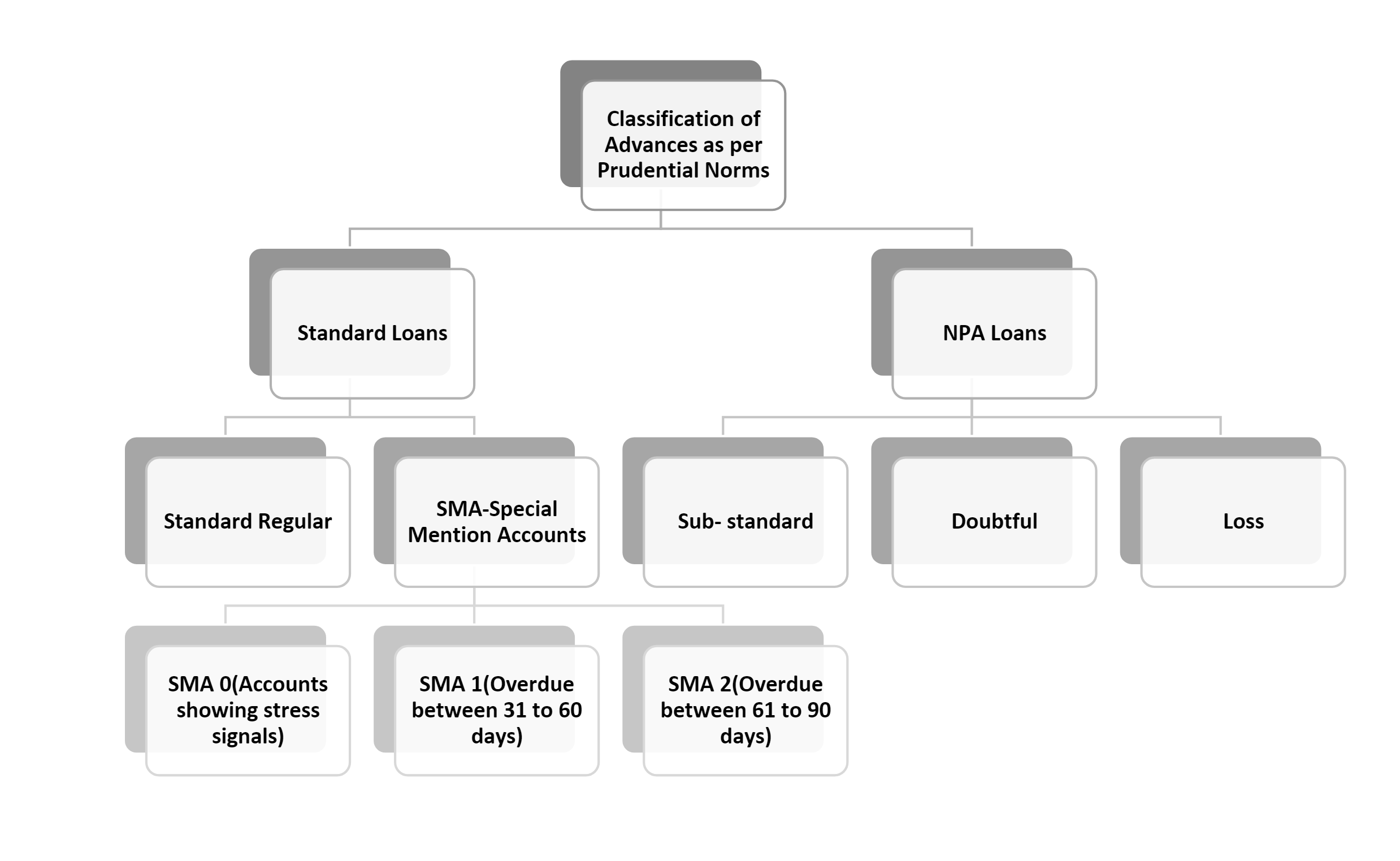

10.3 Classification of Advances as per RBI Prudential Norms

-

- Non-performing Assets: An asset becomes NPA when it ceases to generate income for the Bank, where:

a) interest and/ or installment of principal remain overdue for a period of more than 90 days in respect of a term loan;

b) the account remains ‘out of order’ in respect of an Overdraft/Cash Credit (OD/ CC);

c) the bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted.

d) where the remittances by the borrower under consortium lending arrangements are pooled with one bank and/or where the bank receiving remittances is not parting with the share of other member banks, the account should be treated as NPA.

-

- Out of Order: An account should be treated as ‘out of order’ if:-

a) the outstanding balance remains continuously in excess of the sanctioned limit/drawing power or

b) in cases where the outstanding balance in the principal operating account is less than the sanctioned limit/drawing power, but there are no credits continuously for 90 days as on the date of Balance Sheet; or

c) credits are there but are not enough to cover the interest debited during the same period, these accounts should be treated as ‘out of order’.

-

- Overdue: Any amount due to the bank under any credit facility is ‘overdue’ if it is not paid on the due date fixed by the bank. Accounts regularized near the Balance Sheet Date should be handled with care and without scope for subjectivity.

11. Government Guaranteed advances

In the case of Central Govt. guaranteed Advances, where the guarantee is not invoked, would be classified as Standard Assets, but regarded as NPA for Income Recognition purposes.

However, where the advance is guaranteed by State Government, it is considered NPA if it remains overdue for more than 90 days for both Provisioning and Income recognition purposes.

12. Audit of Advances

In carrying out the audit of advances, the auditor is primarily concerned with obtaining evidence about the following:

a) Amount of advance outstanding at the date of the balance sheet.

b) Advances representing the amount due to the bank.

c) Amounts due to the bank are appropriately supported by loan documents and other documents as applicable to the nature of advances.

d) Existence of unrecorded advances, if any.

e) Existing basis of valuation of advances is appropriate.

f) Advances are disclosed, classified, and described in accordance with recognized accounting policies and practices and relevant statutory and regulatory requirements.

g) Appropriate provisions towards advances have been made as per the RBI norms, Accounting Standards, and generally accepted accounting practices

13. Audit of Revenue items

The auditor is primarily concerned with obtaining reasonable assurance that the recorded income arose from transactions that pertain to the relevant period. Also, there is no unrecorded income and the income is recorded at an appropriate amount.

As directed by RBI, any income which exceeds one percent of the total income of the bank if the income is reckoned on a gross basis or one percent of the net profit before taxes if the income is reckoned net of costs should be considered on an accrual basis as per Accounting Standard 9. However, if any item of income is not considered to be material then it may be recognized when received.

Income such as interest, fees, and commission are recorded on an accrual basis, i.e., as it is earned. It is an essential condition for accrual of income if there is a certainty for its ultimate collection. However, in case, where, a significant uncertainty regarding the ultimate collection of income arises in respect of non-performing assets, then banks should not recognize income on non-performing assets until it is actually realized.

In the case of a credit facility and Government guaranteed account, when it is classified as non-performing for the first time, interest accrued and credited to the income account in the corresponding previous year which has not been realized should be reversed or provided for. In case of Interest on advances against Term Deposits, National Savings Certificates (NSCs), Indira Vikas Patras (IVPs), Kisan Vikas Patras (KVPs) and Life policies may be taken to income account on the due date, provided adequate margin is available in the accounts.

In case of bills purchased outstanding at the close of the year the discount received thereon should be properly apportioned between the two years. Interest (discount) component paid by Bank/Branch on rediscount of bills from other financial institutions, is not to be netted off from the discount earned on bills discounted.

In case of bills for collection, the auditor should also examine the procedure for crediting the party on whose behalf the bill has been collected. The procedure is usually such that the customer’s account is credited only after the bill has actually been collected from the drawee either by the bank itself or through its agents, etc. The commission of the branch becomes due only when the bill has been collected.

Fees and commissions earned by the banks as a result of re-negotiations or rescheduling of outstanding debts should be recognized on an accrual basis over the period of time covered by the re-negotiated or rescheduled extension of credit.

14. Audit of Expenses

Expenditure is to be shown under three broad heads:

a) Interest expense

b) Operating expense

c) Provisions and contingencies.

The auditor is primarily concerned with assessing the overall reasonableness of the amount of interest expense by analyzing ratios of interest paid on different types of deposits and borrowings to the average quantum of the respective liabilities during the year.

For this, an auditor may obtain from the bank analysis of various types of deposits outstanding at the end of each quarter. From such information, the auditor may work out a weighted average interest rate. The auditor may then compare this rate with the actual average rate of interest paid on the relevant deposits as per the annual accounts and enquire into the difference if material.

Also, an analytical review of corresponding figures for the previous years should be done to find out material differences, if any.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

This is a good note but does not capture the process for appointment of statutory auditors for the overseas / foreign branches of Indian banks, which is separately prescribed by the RBI vide a rather old circular. Of course, this appointment would also be subject to the prescriptions of each host-country banking regulator where the foreign branch is located, but the RBI approval is still required..

The appointment of Overseas Branch Auditor is done by the respective Bank’s Head Office. The audit is conducted by the local auditor of that country. RBI has also mandated the modalities and procedure for the appointment of such auditors. In the case of Public Sector Banks having overseas branches, one-third are covered by rotation for quarterly/half-yearly review, and audit is done through audit firms operating in the countries where the branches are functioning.