All-about SEBI’s Consultation Paper on ICDR Amendments

- Blog|Advisory|Company Law|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

- Introduction

- SEBI proposes mandatory appointment of underwriters before filing of ‘Red Herring Prospectus’ (RHP)

- SEBI proposes mandatory in-principal approval for listing of pre-bonus securities & opening of demat account

- SEBI proposes the inclusion of pension funds sponsored by lead manager associates in Anchor Investor Category

- SEBI proposes to enhance the disclosures & mandate the issuer company to host the offer-related documents on their website

- Conclusion

1. Introduction

Recently, the SEBI has released a Consultation Paper proposing certain amendments to the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 to increase transparency and streamline certain processes.

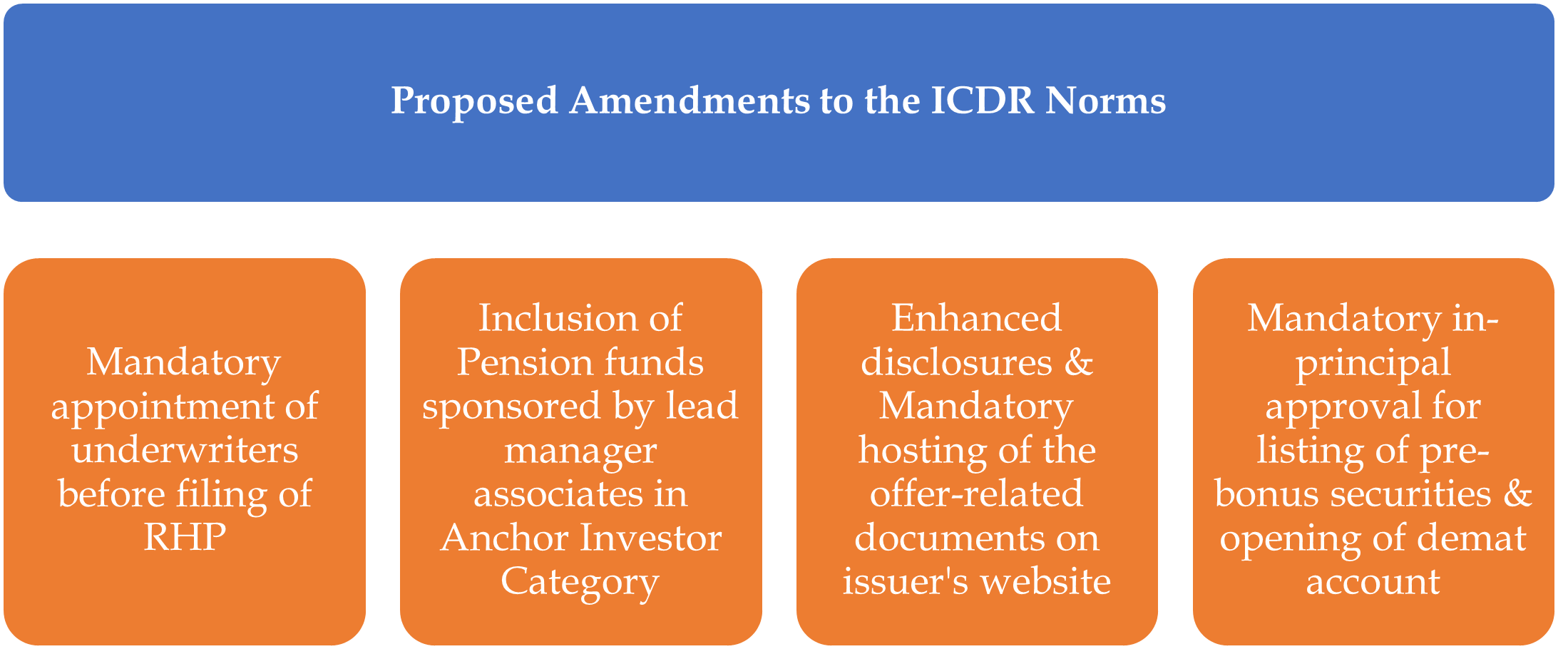

The key proposals include (a) mandatory appointment of underwriters before filing of Red Herring Prospectus (RHP); (b) mandatory in-principal approval for listing of pre-bonus securities and opening of demat account; (c) enhanced disclosure norms & mandate issuer company to host offer-related documents on websites and (d) the inclusion of pension funds sponsored by lead manager associates in the Anchor Investor Category.

This article discusses in detail the key proposals of the consultation paper floated by SEBI as hereunder –

2. SEBI proposes mandatory appointment of underwriters before filing of ‘Red Herring Prospectus’ (RHP)

Current Scenario

Currently, Issuers enter into the underwriting agreement after finalization of price and the Red Herring Prospectus (‘RHP’) contains a disclosure to this effect.

Issue under the current scenario

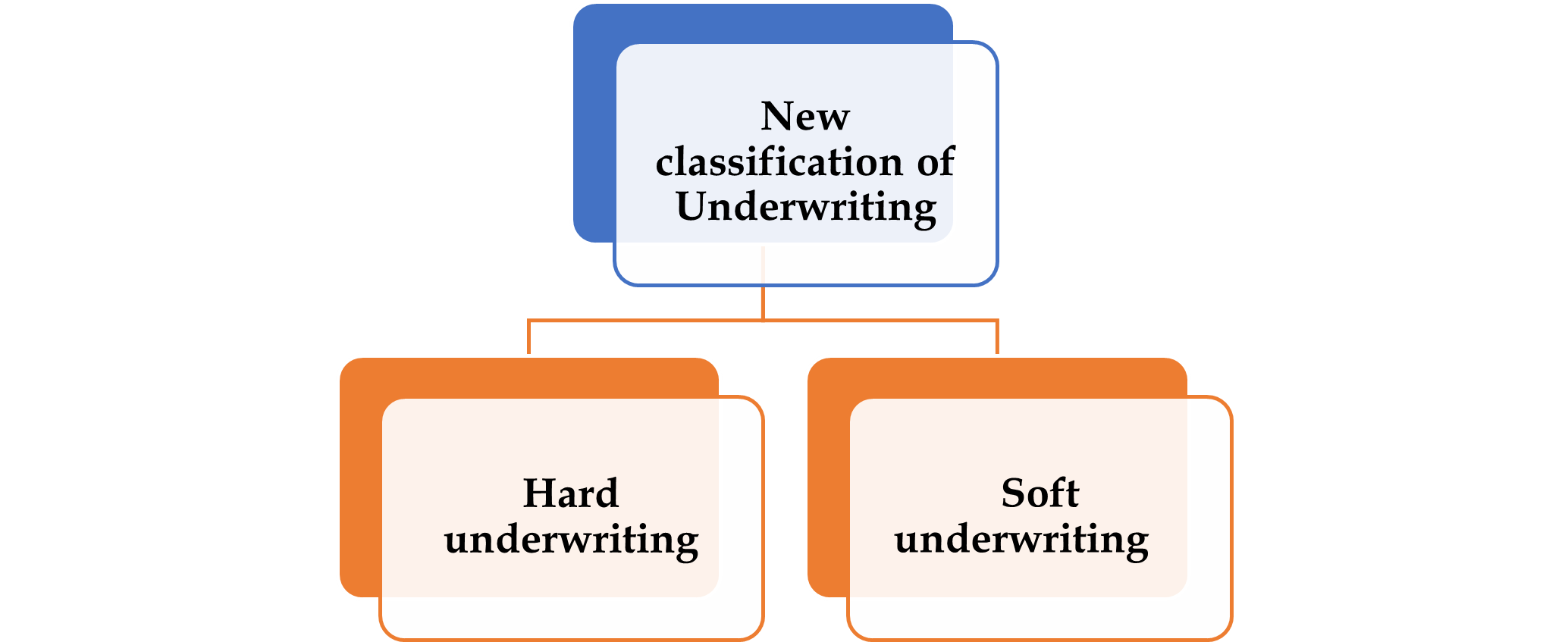

The SEBI noted that presently ICDR regulations specifically does not differentiate between underwriting for technical rejections and underwriting for shortfall in demand (hard underwriting).

Proposed Change

Now, the SEBI has proposed that if an issuer intends to have an initial public offering (IPO) underwritten to cover under-subscription, it must appoint merchant bankers or stock brokers who are registered with the Board to act as underwriters.

Further, the issuer, before filing the red herring prospectus must enter into an underwriting agreement with the underwriters.

Also, the underwriting agreement must specify the maximum number of specified securities that the underwriters will subscribe to, either themselves or by procuring subscription, at a pre-determined price that is not less than the issue price.

The SEBI has also proposed to classify underwriting into two types –

-

- Hard underwriting – refers to the underwriting that takes place in case of under-subscription of an issue.

- Soft underwriting – refers to the underwriting that takes place in case of under-subscription on account of technical rejections.

In case of hard underwriting, an agreement to be entered into prior to filing Red Herring Prospectus whereas in case of soft underwriting, the agreement to be entered into prior to filing the prospectus with stock exchanges.

3. SEBI proposes mandatory in-principal approval for listing of pre-bonus securities & opening of demat account

Current Scenario

The Companies Act, 2013 provides for certain conditions for issuance of Bonus Shares such as bonus issue may be issued out of its free reserves, or securities premium or the capital redemption reserve account. The ICDR Regulations provide for certain additional conditions, restrictions for bonus issue by a listed entity.

Issue under the current scenario

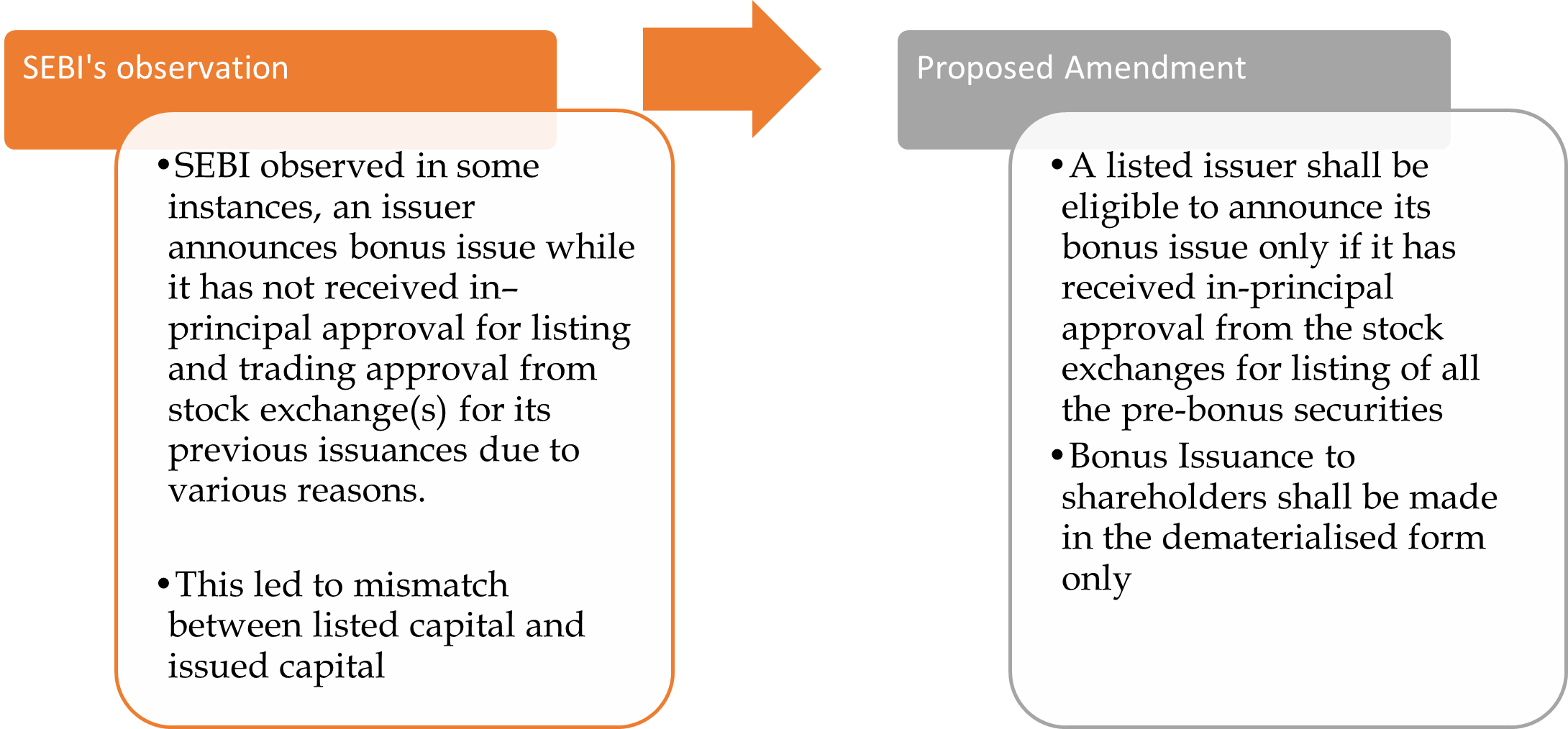

The SEBI observed in some instances, an issuer announces a bonus issue while it has not received in–principal approval for listing and trading approval from stock exchange(s) for its previous issuances due to various reasons. This led to mismatch between listed capital and issued capital.

Further, it is observed that % of bonus shares issued in physical mode is very less. The physical issue cause various risk such as loss, theft, mutilation and fraud etc.

Proposed Change

Consequently, the SEBI has proposed that a listed issuer shall be eligible to announce its bonus issue only if it has received in-principal approval from the stock exchanges for listing of all the pre-bonus securities issued by the listed entity. However, in case of the Employee Stock options (ESOPs) and convertibles shares/ warrants, in principal approval is not required.

Further, it has been proposed that the Bonus Issuance to shareholders shall be made in the dematerialised form only to mitigate the loss associated with the physical issue. Where the investor does not have demat account then, issuer companies are required to open a separate demat account for dealing with such unclaimed securities.

4. SEBI proposes the inclusion of pension funds sponsored by lead manager associates in Anchor Investor Category

Current Scenario

Presently, as per clause 10(k) of Schedule XIII of ICDR Regulations, the Lead Manager(s) and its associates are restricted from participating as Anchor Investors in public issue. However, mutual funds, insurance companies, Alternative Investment Funds (AIFs), foreign portfolio investors sponsored by entities which are associate of the lead manager can participate as an Anchor Investor.

Issue under the current scenario

The SEBI noted that Pension funds sponsored by entities which are associate of the lead manager, do not fall under the exception available under clause 10(k) of Schedule XIII of ICDR Regulations. However, an exception has been made for Pension Funds of entities which are associate of the lead manager, for participation as an Anchor Investor in public issue of REITS.

Proposed Change

Now, SEBI has proposed that Pension Funds sponsored by entities that are associates of lead managers be allowed to act as Anchor Investors

Anchor Investors, under ICDR Regulations, mean a qualified institutional buyer (QIB) who makes an application for a value of at least ten crore rupees in a public issue on the main board made through the book building process.

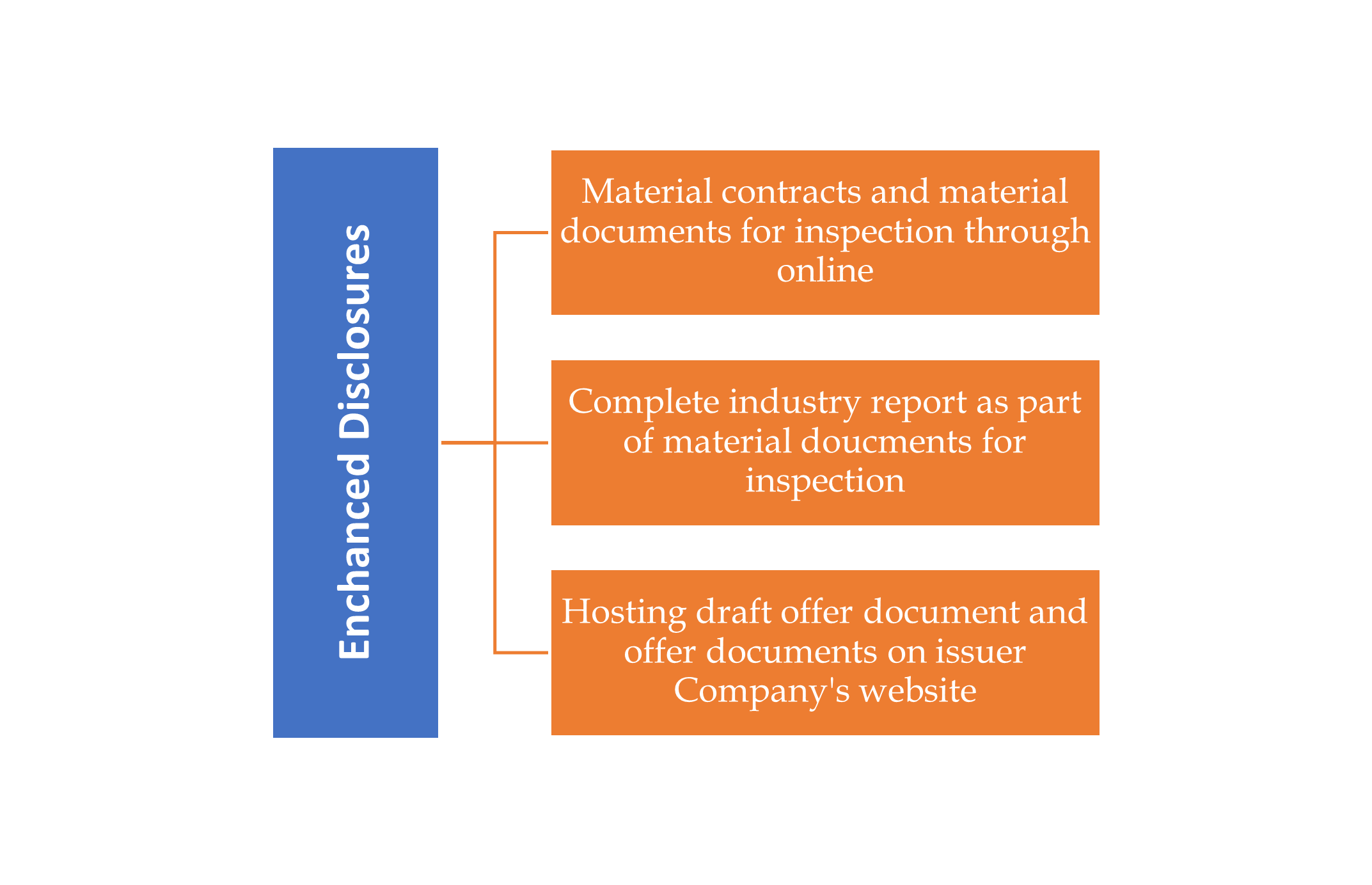

5. SEBI proposes to enhance the disclosures & mandate the issuer company to host the offer-related documents on their website

Current Scenario

Presently, the draft offer document and offer document is required to be hosted on the websites of SEBI, Stock Exchange(s) and Book Running Lead Managers (BRLMs) associated with the issue.

Issue under the current scenario

In this regard, various suggestions were received that draft offer document and offer document should be also be displayed on the website of the issuer company. Though, some issuers on a voluntary basis display their draft offer document and offer document on their website, after filing the same with SEBI/stock exchanges.

However, a need is felt that this requirement may be incorporated mandating all issuers to host draft offer document and offer document on their website.

Proposed Change

Therefore, the SEBI has proposed to enhance disclosure requirements by the issuer company in terms of disclosures made in the offer document:

-

- Providing access to material contracts and material documents (as per the list provided in the DRHP/RHP) for inspection through online means apart from inspection at the registered office.

- Providing complete industry report as part of material documents for inspection both through offline and online modes.

- Hosting draft offer document and offer document(s) on website of Issuer Company.

6. Conclusion

The amendments proposed by SEBI to the ICDR Regulations are a significant step towards enhancing the transparency and accountability of the Indian capital markets. With the introduction of online disclosure requirements, investors can access vital information promptly, promoting increased participation and investment in the markets.

These amendments signify a positive shift towards a more robust and reliable investment ecosystem in India, benefiting both investors and companies alike. Further, in order to take into consideration, the views of various stakeholders, public comments are invited on the proposals by the SEBI. Comments may be sent by email to consultationcfd@sebi.gov.in latest by March 08, 2023.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA