Udyam Registration | MSME Registration on Government Portal

- Blog|Indian Acts|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 5 April, 2023

Introduction

MSME stands for Micro, Small and Medium Enterprises. MSMEs are governed under the MSME Act which aims to facilitate the promotion, development and enhancing the competitiveness of micro, small and medium enterprises. The MSME Act doesn’t mandate the requirement of registration under the Act however, many business units get themselves registered under the Acts so as to avail certain benefits such as credit facilities, loans, participation in Govt. tenders for MSMEs. Both Manufacturing and Service Sectors can register under the Act.

1. What is MSME?

The Government of India has introduced MSME or Micro, Small, and Medium Enterprises in harmony with Micro, Small and Medium Enterprises Development (MSMED) Act of 2006. These enterprises are primarily engaged in the production, manufacturing, processing, or preservation of goods and commodities.

As per Notification No. S.O. 1702(E) Dated 01.06.2020, effective from July 01, 2020, the MSMEs are categorised on the basis of Investment in plant and machinery and Annul Turnover as under.

| Criteria | Micro | Small | Medium |

| Investment in Plant and Machinery | Not exceeding Rs.1 crore | Not exceeding Rs. 10 crore | Not exceeding Rs. 50 crore |

| Annual turnover | Not exceeding Rs.5 crore | Not exceeding Rs.50 crore | Not exceeding Rs.250 crore |

2. How to Calculate the Value of Plant & Machinery?

The Govt. by way of office memorandum dated Aug 06, 2020, clarified that the Value of Plant and Machinery or Equipment shall have the same meaning as assigned to the plant and machinery in the Income Tax Rules, 1962 framed under the Income Tax Act, 1961 and shall include all tangible assets (other than land and building, furniture and fittings).

The online Form for Udyam Registration captures depreciated cost as of 31st March each year of the relevant previous year. Therefore, the value of Plant and Machinery or Equipment for all purposes of the Notification No. S.O. 2119(E) dated 26.6.2020 and for all the enterprises shall mean the Written Down Value (WDV) as at the end of the Financial Year as defined in the Income Tax Act and not the cost of acquisition or original price, which was applicable in the context of the earlier classification criteria.

3. What are the documents required for MSME registration?

Following documents/details should be kept ready before starting the registration process on the MSME portal:

-

- Aadhar (mandatory)

- PAN

- Latest Balance sheet – for Turnover and Investment calculation

- Certificate of Incorporation (in case of Company)

- Certificate of commencement of business

- List of total number of employees with gender-wise breakup

4. What are the benefits of registering under MSME?

Although the registration has no statutory basis. Enterprises normally get themselves registered to avail benefits, incentives or support given either by the central or state govt. benefit available under MSMED Act. Registration of micro, small and medium (MSM) enterprises under the MSMED Act is a very powerful medium to enjoy the regime of incentives offered by the Centre generally contain the following:

-

- Protection against delay in payment from Buyers and rights of interest on delayed payment

- Time-bound resolution of disputes with buyers through conciliation and arbitration

- Enterprise gets registration under MSMED Act, MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES, GOVERNMENT OF INDIA

- Easy fiance availability from Banks, without collateral requirement

- Lower interest rates and availability and access to greater credit:

- Preference in Government tenders

- Reimbursement of ISO certification Expenses/subsidy on ISO certification/ patent and trademark

- Registration with National Small Industries Corporation NSIC

- Reservation policies to manufacturing/production sector enterprises

- Participation in government purchase registrations

5. Registration Process for MSME

The registration process is very simple. An applicant can directly submit an online application using an Aadhar number through the MSME portal

The registration process is divided into two categories as under:

5.1 New Registration: For new entrepreneurs who are not registered yet as MSME

New registration is to be obtained by those applicants who do not hold UDYOD Aadhar (UAM) or EM-II. To make fresh registration, new applicants need to visit the MSM portal on www.udyasmregistration.gov.in.

5.2 Migration: For entrepreneurs having already registered as EM-II or UAM

The Government by way of office memorandum dated August 05, 2020, has clarified that existing enterprises registered prior to June 20, 2020, shall continue to be valid only for a period up to March 31, 2021, and therefore, the Govt. emphasized that all existing EM part II and UAMs obtained till 30.06.2020.

6. Steps to Obtain New Registration

New registration is to be obtained by those applicants who do not hold UDYOD Aadhar (UAM) or EM-II. To make fresh registration, new applicants need to visit the MSM portal on www.udyamregistration.gov.in.

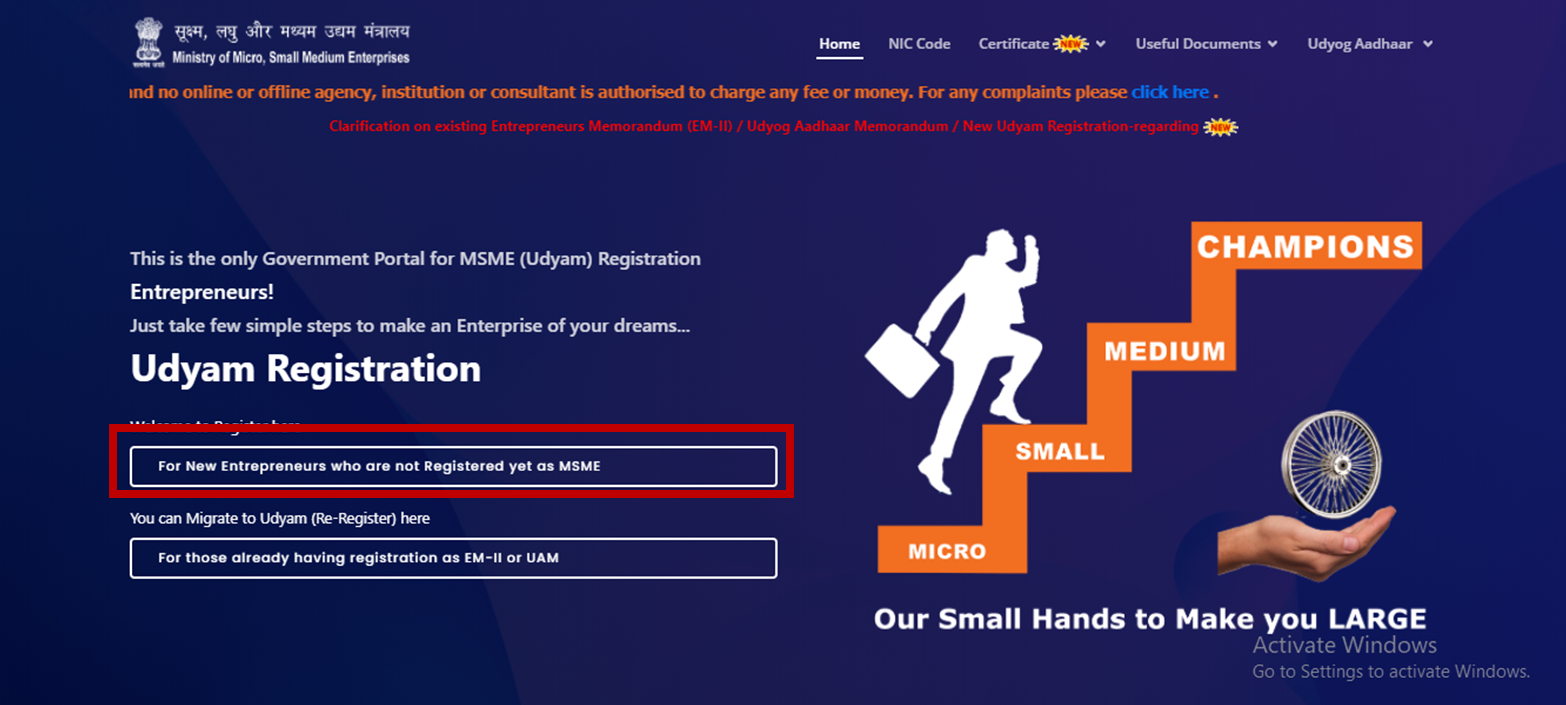

Step 1: Click on the button “For New Entrepreneurs who are not registered yet on MSME”

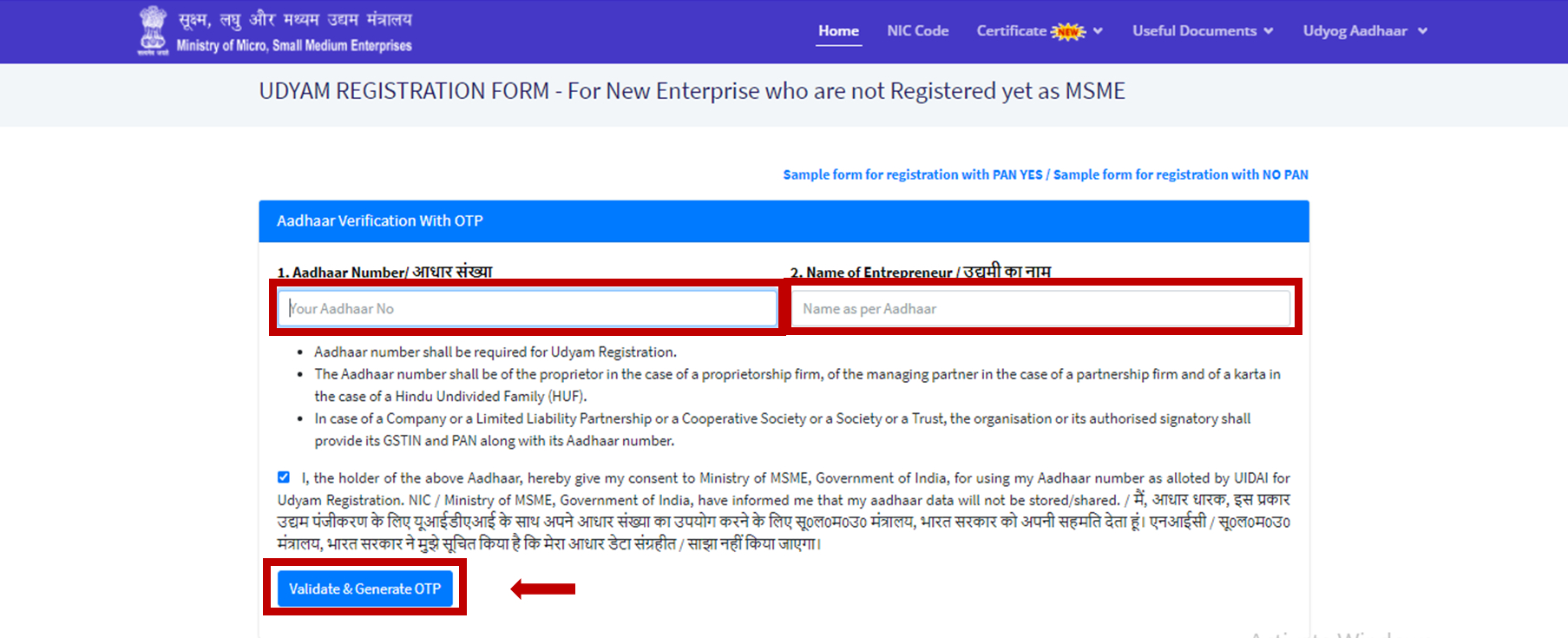

Step 2: Enter Aadhar Number and Name of the Entrepreneur

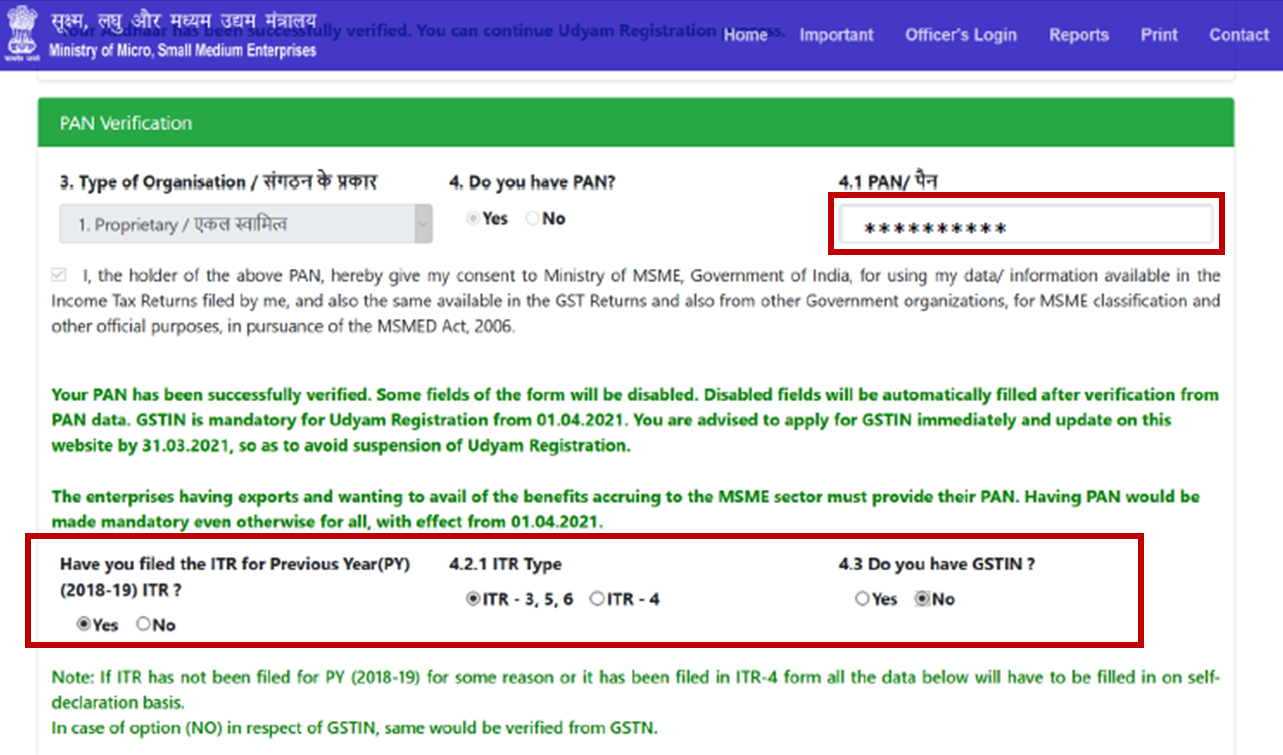

Step 3: Choose the type of organization from the dropdown and Enter the PAN Details

If the PAN already exists in Udyam registration then a message will appear “Udyam Registration has already done through this PAN”

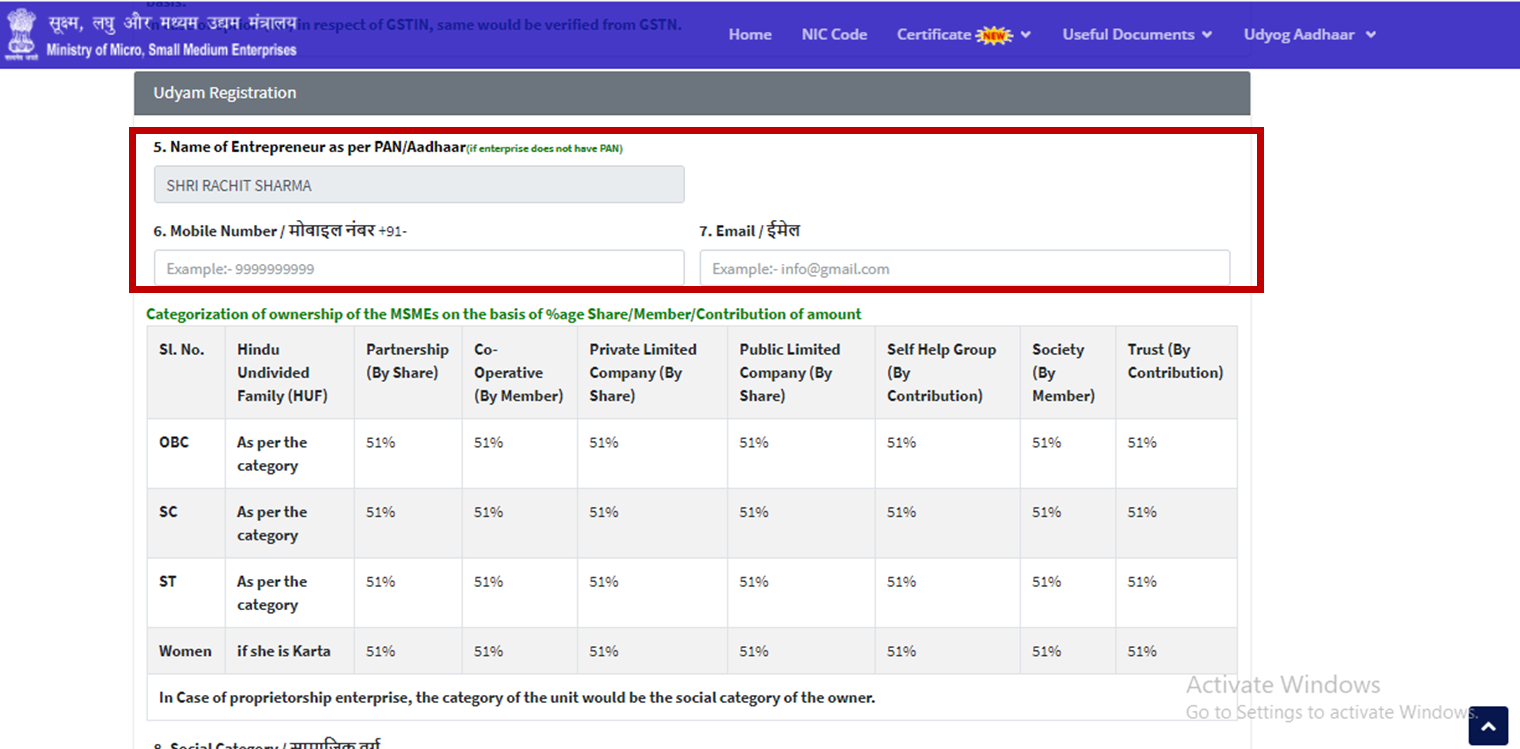

Step 4: Enter the Mobile Number and Email Address of the Entrepreneur

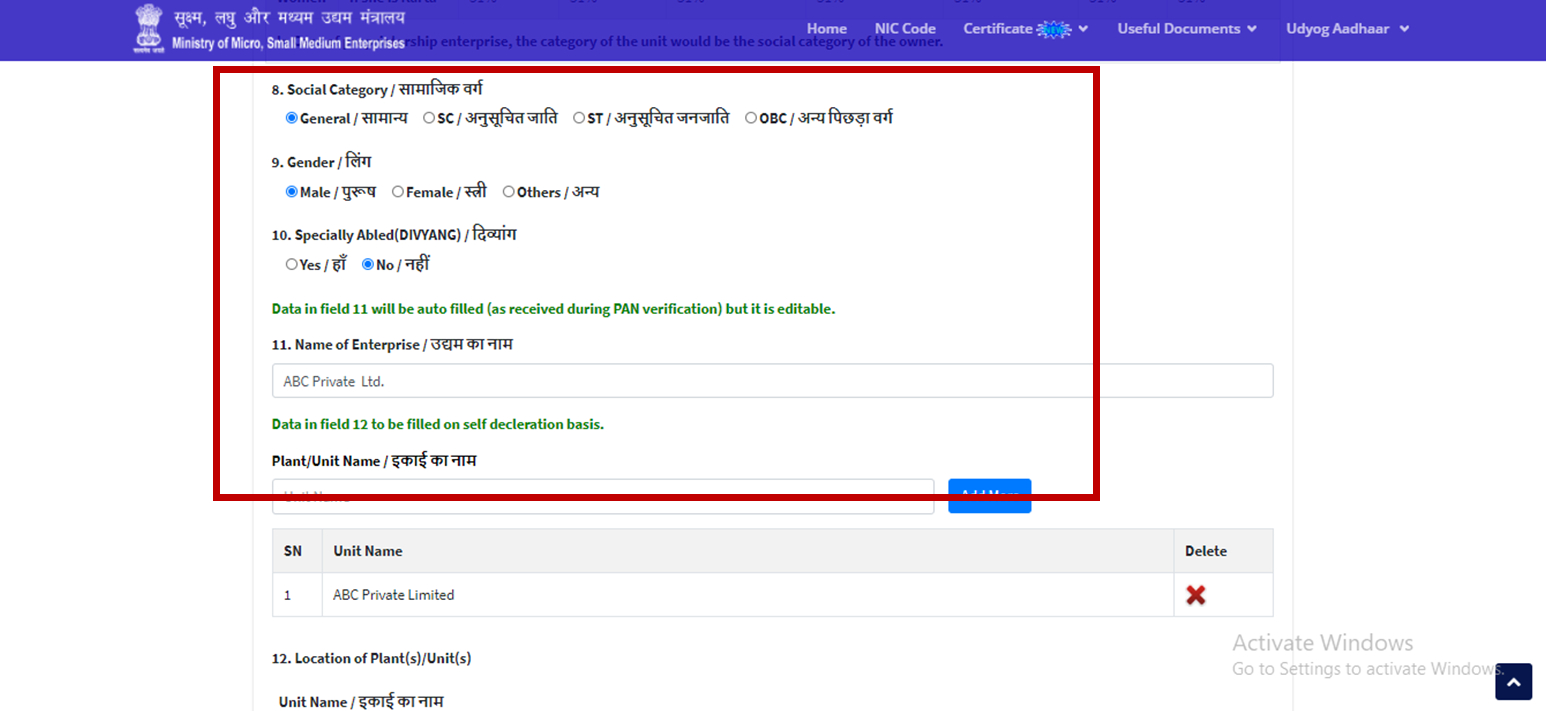

Step 5: Enter the details relating to the social category, Gender, Name of Enterprise, Name of Unit

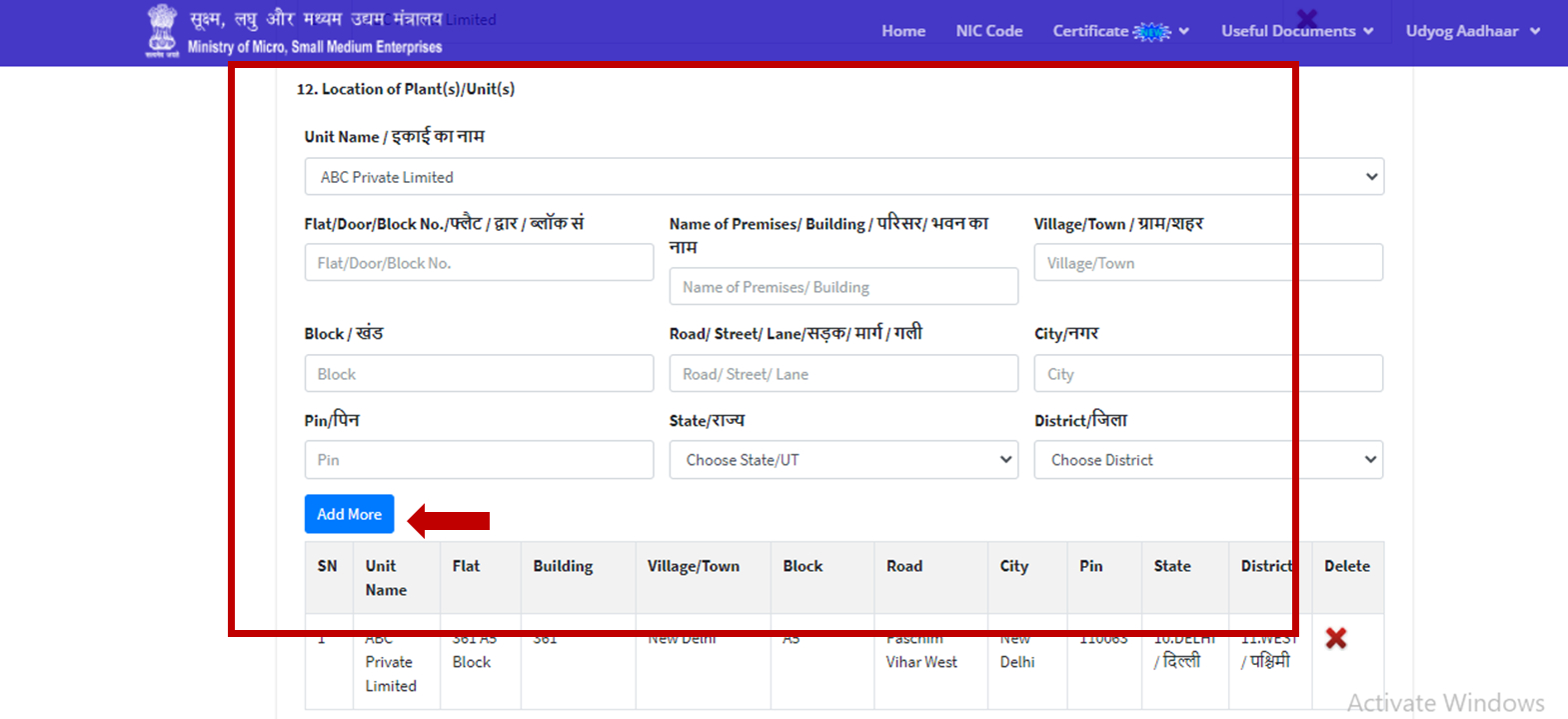

Step 6: Enter the details relating to the social category, Gender, Name of Enterprise, Name of Unit

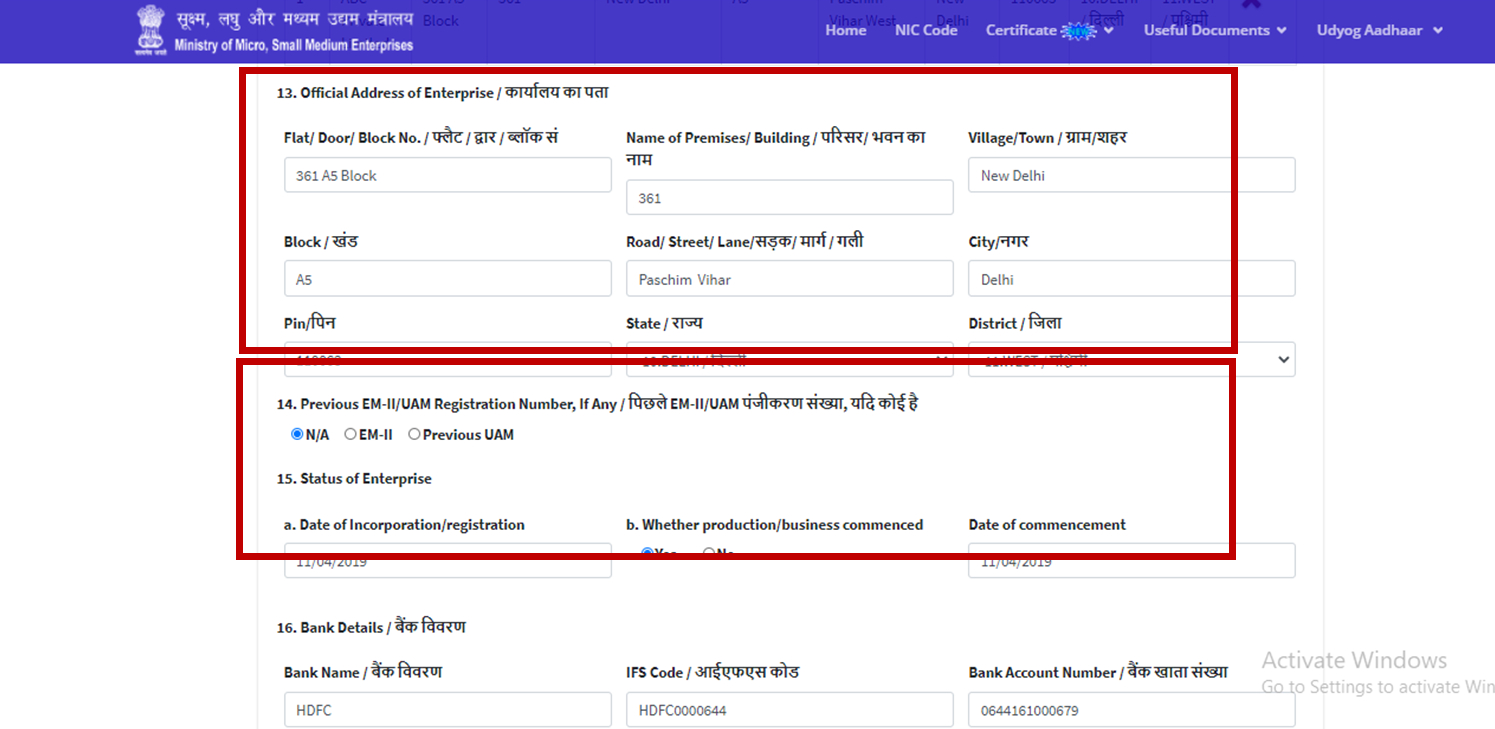

Step 7: Enter the details relating to Official Address, Status of Enterprises, Bank Details

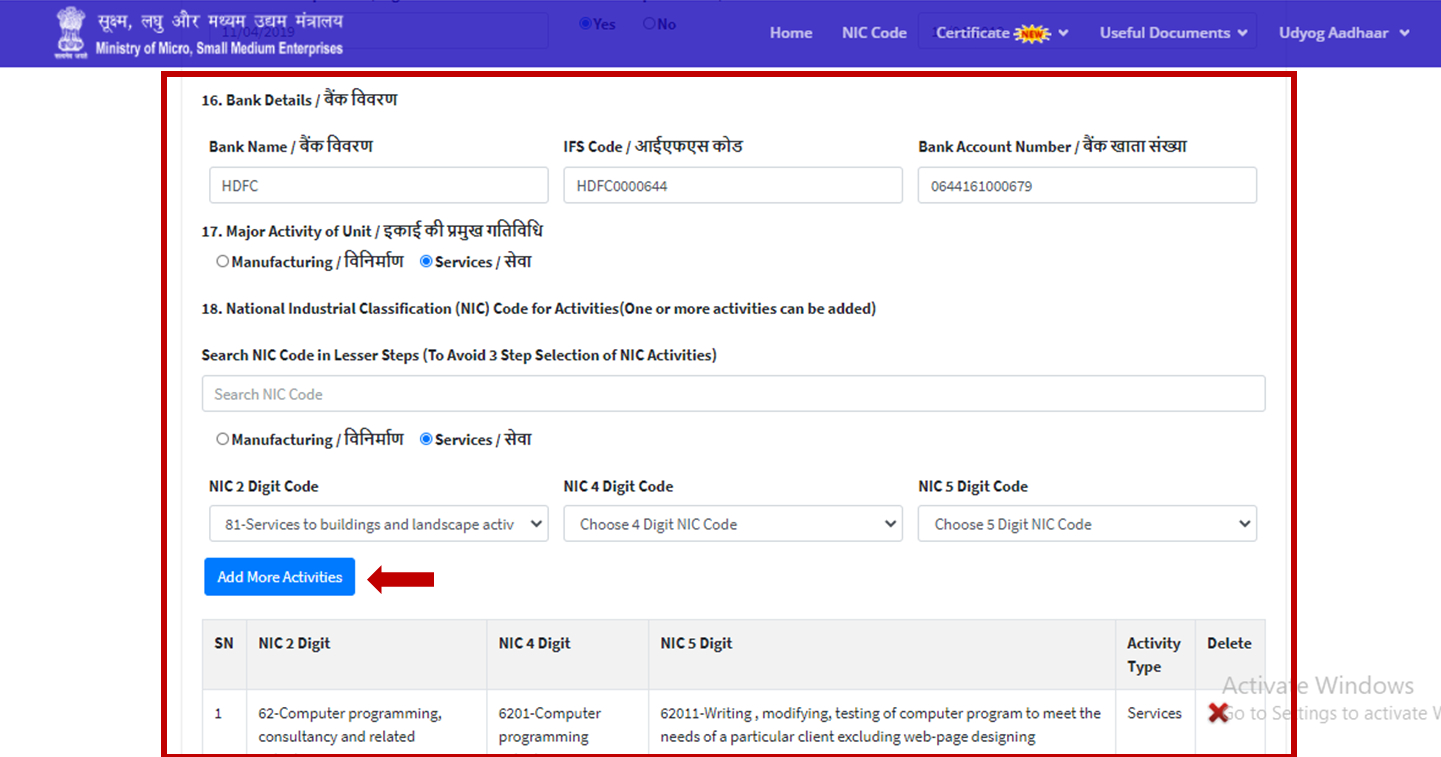

Step 8: Enter the Bank Details, Major Activity of Units, NIC, Relating to Official Address, Status of Enterprises, Bank Details

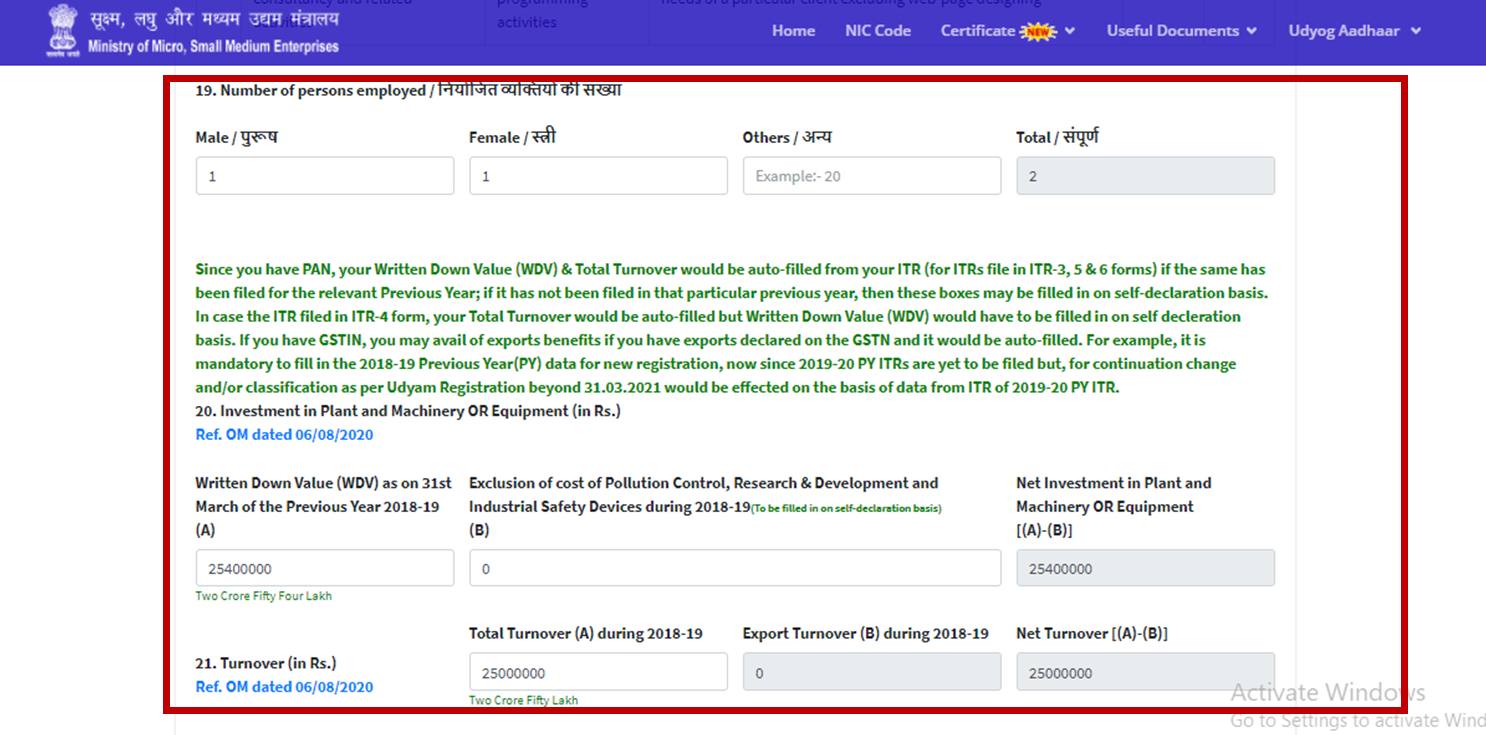

Step 9: Enter the details of Employees, Investment in Plant & Machinery, Turnover

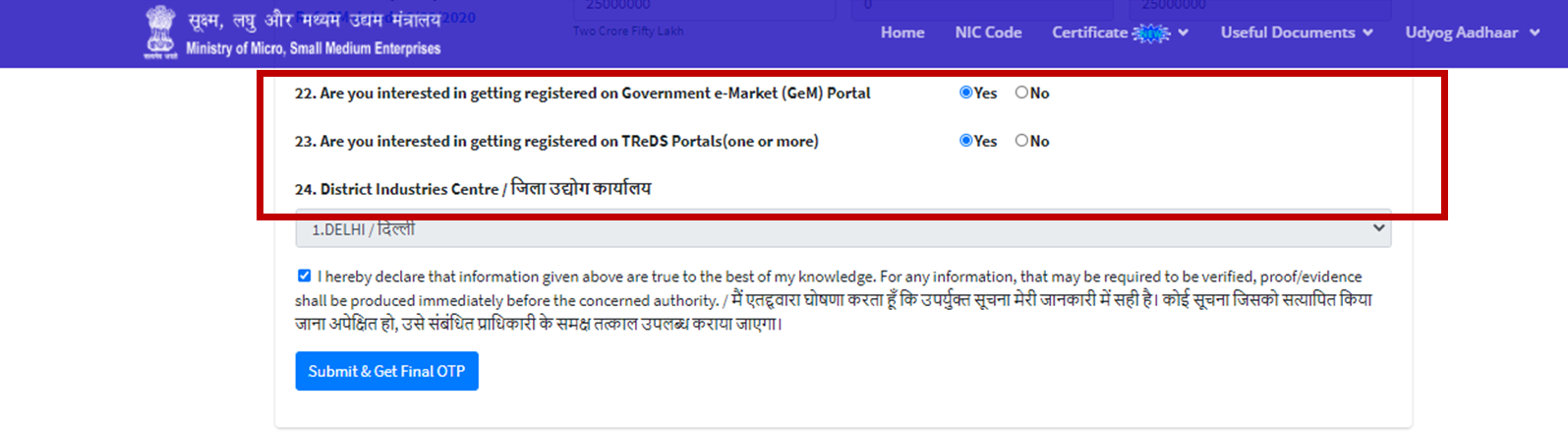

Step 10: Select if you are interested in getting registered on the e-Market Portal & TReDS portal

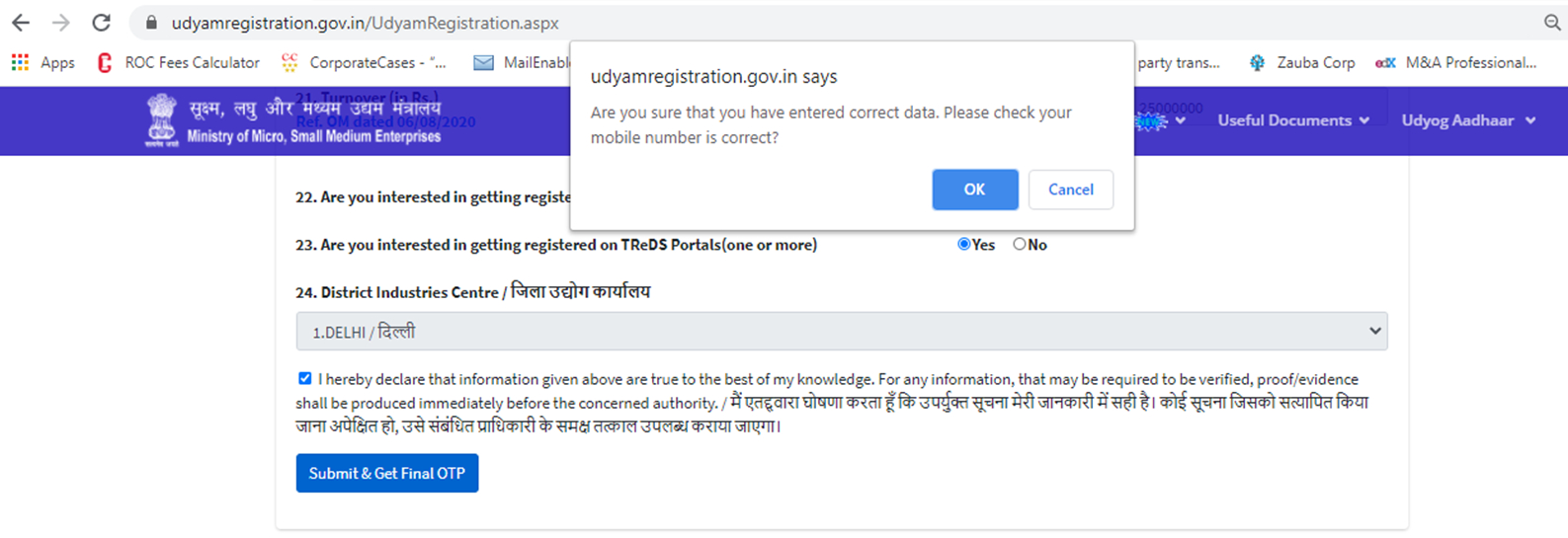

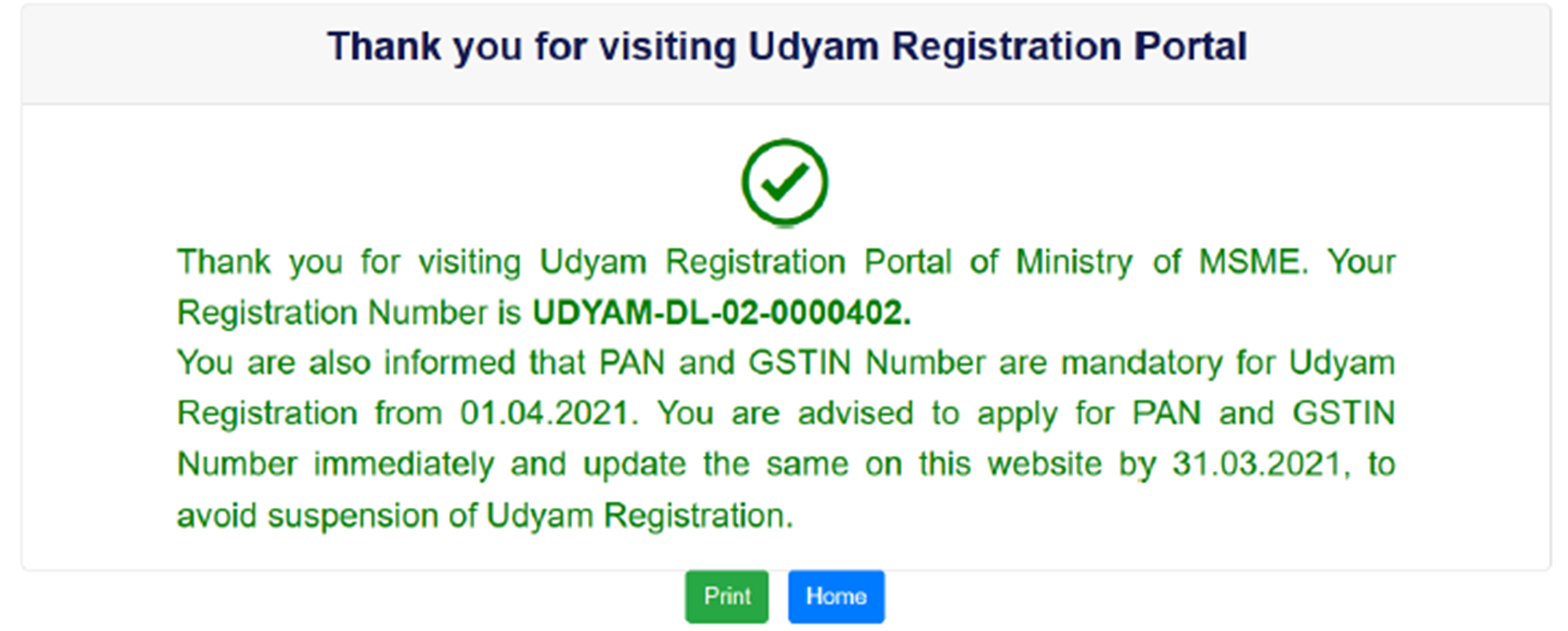

Step 11: Click on Submit and Generate OTP

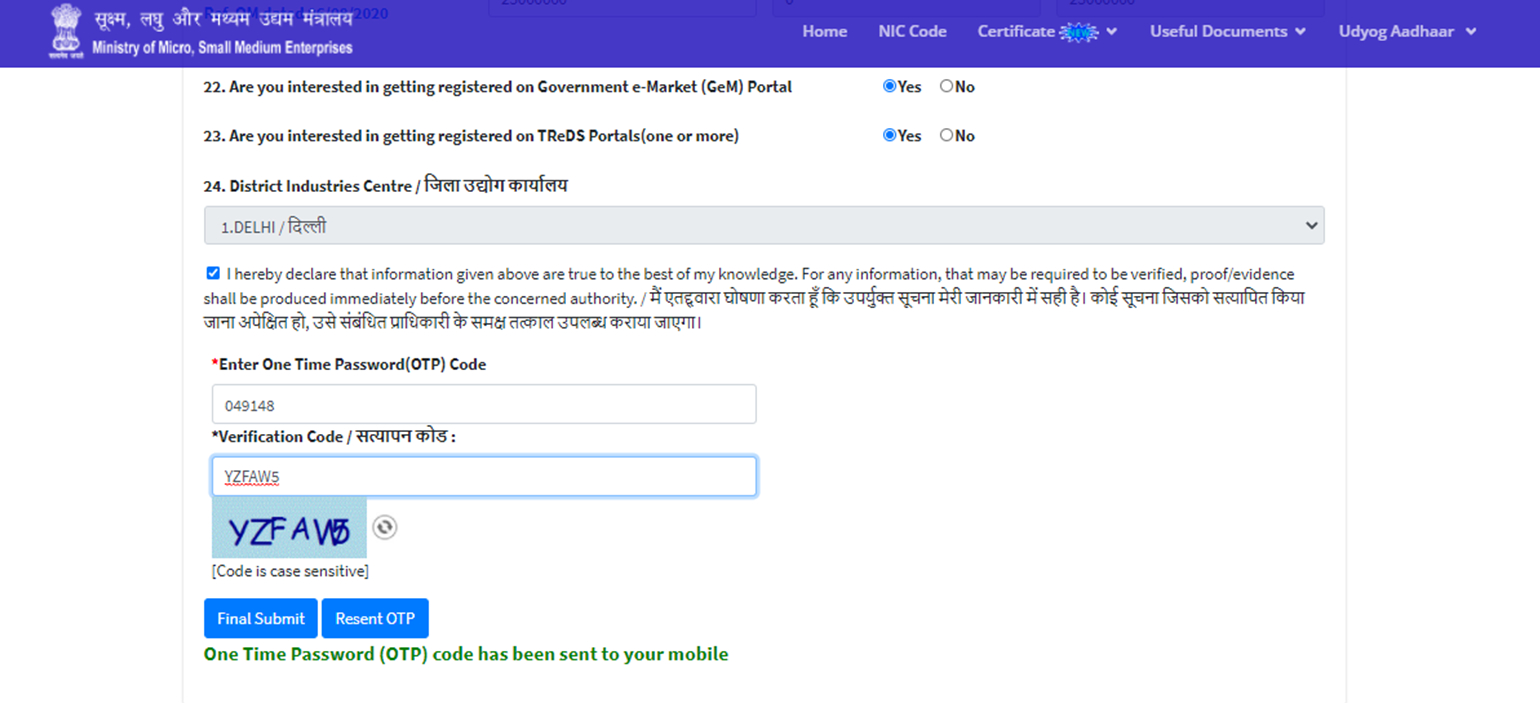

Step 12: Verify with OTP and Verification Code

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA