Part 2 of GSTR-9 (Details of Outward & Inward Supplies Made During the Financial Year)

- Blog|GST & Customs|

- 20 Min Read

- By Taxmann

- |

- Last Updated on 2 December, 2022

This article explains the GST Audit & Annual Returns for F.Y. 2019-20. The focus of is on Part 2 of GSTR-9. It is written in a clause-wise/table-wise format of presentation, which also incorporates clarifications issued from time-to-time. The explanation in done by using practical examples, along with commentary & relevant case-laws to ascertain the impact in annual returns and audit.

Topics covered in this Article are as follows:

- What details are required to be furnished in Part II of GSTR 9?

- How to Furnish the Details in Table 4 of Part II of GSTR 9?

- Which Details are Required to be Furnished in Table 4A of GSTR 9?

- How to Furnish the Details in Table 4B of GSTR 9?

1. What details are required to be furnished in Part II of GSTR 9?

Part II consists of the details of ALL outward supplies, inward supplies liable under RCM & advances received during the financial year for which the annual return is filed.

Part Description Tables Description Initial Form Amended Form Initial Form Amended Form II Details of Outward and inward supplies declared during the financial year Details of Outward and inward supplies declared made during the financial year 4 Details of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year Details of advances, inward and outward supplies as declared in returns filed made during the financial year on which tax is payable 5 Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year Details of Outward supplies as declared in returns filed made during the financial year on which tax is not payable As per the earlier format of GSTR 9, the detail filled in Part II was the consolidation of all the supplies declared by the taxpayer in the returns filed during the financial year. The earlier heading conveyed the following meaning:

- Only the details which have been declared in the returns (GSTR 1 and GSTR 3B) can be filed in GSTR 9 as the words used were ‘declared by the taxpayer in the returns filed’. It lead to the conclusion that no correction or amendment can be made in GSTR 9 even though some supplies has been FAILED TO BE REPORTED in GSTR 1 and GSTR 3B filed during the FY 2017-18.

- Only the details which has been declared in the returns pertaining to the FY 2017-18 can be filed in GSTR 9 as the words used were ‘returns filed during the financial year’. It lead to the conclusion that details of such supplies cannot be furnished in GSTR 9 which has been failed to be reported in GSTR 1 and GSTR 3B filed during the FY 2017-18 but reported in the GSTR 1 and GSTR 3B of the SUBSEQUENT TAX PERIOD.

However, the intention of the Government appeared to seek the details of actual supplies MADE during the Financial Year 2017-18 for which the annual return is to be filed, but the nomenclature/language used to describe the heading changed the meaning. Hence, in order to clarify the fact that all the supplies pertaining to the period for which the annual return is being filed can be reported in GSTR 9 i.e. even the additional liability can be reported in GSTR 9, has been made by amending the nomenclature of the heading of Part II i.e. instead of the words ‘supplies declared’, the words ‘supplies made’ has been substituted. Hence, all the supplies belonging to the period FY 2017-18, must be reported in GSTR 9. The amendment has been done in the form GSTR 9 and as the amendment in the form is not specific to particular FY, therefore, the same applies for all the FYs including FY 2019-20 also.

Useful Link: FAQs on Form GSTR 9 – GST Annual Return

- Clarification by Government – Press Release by Ministry of Finance dated 4th June, 2019: The major confusion of the trade and industry in reporting the details in Part II and Part V was arising due to the mismatch in reporting done in GSTR 1 & GSTR 3B, reporting in GSTR 1 of FY 2017-18 and reporting in GSTR 3B of FY 2018-19, reporting of supplies of FY 2017-18 in returns of FY 2018-19, etc. Hence, the Government has principally clarified by way of Press Release that irrespective of when the supply was declared in FORM GSTR-1, the principle of declaring a supply in Part II or Part V is essentially driven by when was tax paid through FORM GSTR-3B in respect of such supplies.

- Reporting in PART II: If the tax on such supply was paid through FORM GSTR-3B between July, 2017 to March, 2018 then such supply shall be declared in Part II.

- Reporting in PART V: If the tax was paid through FORM GSTR-3B between April, 2018 to March, 2019 then such supply shall be declared in Part V of FORM GSTR-9.

The aforesaid clarification clearly stipulates that the principle of declaring a supply in Part II or Part V is essentially driven by ‘when was tax paid through FORM GSTR-3B’ in respect of such supplies. However, a subsequent Press Release dated 3rd July, 2019 stipulated that ideally, information in GSTR-1, GSTR-3B and books of account should be synchronous and the values should match across different forms and the books of account. However, in case any additional liability arises then the same shall be declared in annual return and tax should be paid. The extract of the said Press Release is reproduced below for ease-of-reference:

- Clarification by CBIC vide Press Release dated 3rd July, 2019 | Primary data source for declaration in annual return: Time and again taxpayers have been requesting as to what should be the primary source of data for filing of the annual return and the reconciliation statement. There has been some confusion over using GSTR-1, GSTR-3B or books of account as the primary source of information. It is important to note that both GSTR-1 and GSTR-3B serve different purposes. While, GSTR-1 is an account of details of outward supplies, GSTR-3B is where the summaries of all transactions are declared and payments are made. Ideally, information in GSTR-1, GSTR-3B and books of account should be synchronous and the values should match across different forms and the books of account.If the same does not match, there can be broadly two scenarios:

- Either tax was not paid to the Government: In this scenario, the same SHALL be declared in the annual return and tax should be paid and

- Tax was paid in excess: In this scenario, all information MAY be declared in the annual return and refund (if eligible) may be applied through GST RFD-01A (Now GST RFD-01).

Further, no input tax credit can be reversed or availed through the annual return. If taxpayers find themselves liable for reversing any input tax credit, they may do the same through GST DRC-03 separately.

Since both the aforesaid Press Release were issued primarily for the annual return of FY 2017-18, therefore, in order to bring more clarity for FY 2017-18, Instruction No. 4 was introduced which stipulated that ‘all the supplies for which payment has been made through GSTR 3B between July, 2017 to March, 2018 SHALL be declared in Part II along-with the clarification that additional liability for the FY 2017-18 not declared in GSTR 1 and GSTR 3B MAY be declared in this return’. It is to be observed carefully that even for the subsequent FY 2018-19 or FY 2019-20 also, the Instruction No. 4 stipulates that additional liability MAY be declared in this return. It means that the details of actual supplies can also be shown as per the books of account and not merely what has been reported in GSTR 1/3B. In simple words, GSTR 9 gives an opportunity to the taxpayers to correctly report the details in the annual return if the same has not be reported correctly in its original GSTR 1/3B return. If the additional liability, if any, is ascertained but not furnished in its annual return also, then it may be ascertained and reported by the GST auditor who files reconciliation statement i.e. GSTR 9C. Further, it may also lead to exposure in the hands of Proper Officer who may impose penalty along-with the recovery of tax and interest. It is worthwhile to note that the aforesaid opportunity of correction in GSTR 9 is not in respect of each and every FYs and is made available initially only for FY 2017-18 and FY 2018-19 which has further been made available for FY 2019-20 also vide Notification No. 79/2020-CT dated 15-10-2020.

Value in Tables 4, 5, 6 and 7 shall be pertaining to the FY only and the value pertaining to the preceding FY shall not be reported here.

Situation: Since the auto populated GSTR 9 for the FY 2018-19 (Tables 4, 5, 6 and 7) also includes the data for FY 2017-18. However, this information for FY 2017-18 has already been furnished by the taxpayers in the annual return (GSTR 9) filed for FY 2017-18 and there is no mechanism to show the split of two years (2017-18 & 2018-19) in FORM GSTR-9 for FY 2018-19.

What should be the implication for FY 2019-20?

Solution: In this regard, it is clarified vide Press Release by Ministry of Finance dated 9th October, 2020 that the taxpayers are required to report only the values

pertaining to FY 2018-19 and the values pertaining to FY 2017-18 which may have already been reported or adjusted is to be ignored.

It has been categorically stated that no adverse view would be taken in cases where there are variations in returns for taxpayers who have already filed their GSTR-9 of Financial Year 2018-19 by including the details of supplies and ITC pertaining to Financial Year 2017-18 in the Annual return for FY 2018-19.

Further, it has been incorporated in the Form GSTR 9 also by way of new Instruction No. 2A vide Notification No. 79/2020 – Central Tax dated 15th October, 2020 that value in Tables 4, 5, 6 and 7 shall be pertaining to the financial year only i.e. the value pertaining to the preceding financial year shall not be reported here.

In regard to FY 2019-20, since the auto populated GSTR 9 for the FY 2019-20 (Tables 4, 5, 6 and 7) will also include the data for FY 2018-19, and as this information for FY 2018-19 has already been furnished by the taxpayers in the annual return (GSTR 9) filed for FY 2018-19 and as there is no mechanism to show the split of two years (2018-19 & 2019-20) in FORM GSTR-9 for FY 2019-20, hence, as per the Instruction No. 2A, value in Tables 4, 5, 6 and 7 shall be pertaining to the FY 2019-20 only i.e. the value pertaining to the preceding financial year shall not be reported here.

2. How to Furnish the Details in Table 4 of Part II of GSTR 9?

As per the previous format of GSTR 9, the heading of Table 4 sought for the detail of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year. So, it appeared that only the transactions which is declared in returns FILED during the Financial Year is to be reported in Table 4 which created the restrictions on the taxpayer to declare the actual amount of supplies made during the Financial Year.

Does this mean that no additional supplies/advances can be shown in annual return which has been left out to be shown in respective tax period returns? Ideally, if any supply attracting output liability is missed to be reported in GSTR 1 and/or GSTR 3B, then the same should be shown in GSTR 1 and/or GSTR 3B only of the next tax period. Annual Return is not the return to originally report the transactions. Origination of transaction has to be from GST monthly/quarterly returns and not the annual return.

However, as per the amendment made in the format of GSTR 9 vide Notification No. 74/2018-Central Tax dated 31st December, 2018, the heading of the Table 4 has been amended which seeks the details of advances, inward and outward supplies MADE during the financial year on which TAX IS PAYABLE. In simple terms, the transactions (inward supply, outward supply and advances) attracting TAX is to be reported on the consolidated basis in Table 4. In other words, now, the taxpayer can:

- Report the supplies directly in GSTR 9 which has not been declared in GSTR 1 and GSTR 3B in any tax periodse. additional liability can be declared in GSTR 9.

- Clarification by Government – Press Release by Ministry of Finance dated 4th June, 2019

Any additional outward supply which was not declared by the registered person in FORM GSTR-1 and FORM GSTR-3B shall be declared in Part II of the FORM GSTR-9. Such additional liability shall be computed in Part IV and the gap between the “tax payable” and “Paid through cash” column of FORM GSTR-9 shall be paid through FORM DRC-03.

For instance, PQR Ltd. has supplied goods bearing an invoice dated 1st April, 2019 of INR 1,18,000 having IGST of INR 18,000. The invoice was failed to be reported in GSTR 1 & GSTR 3B of the FY 2019-20. Since the tax has not been paid on this supply, therefore, this becomes an additional outward supply which shall be declared in Part II of the FORM GSTR-9. Such liability shall be computed in Part IV and the gap between the “tax payable” and “Paid through cash” column of FORM GSTR-9 shall be paid through FORM DRC-03. GST common portal has given a functionality to pay the additional liability through Form DRC-03.

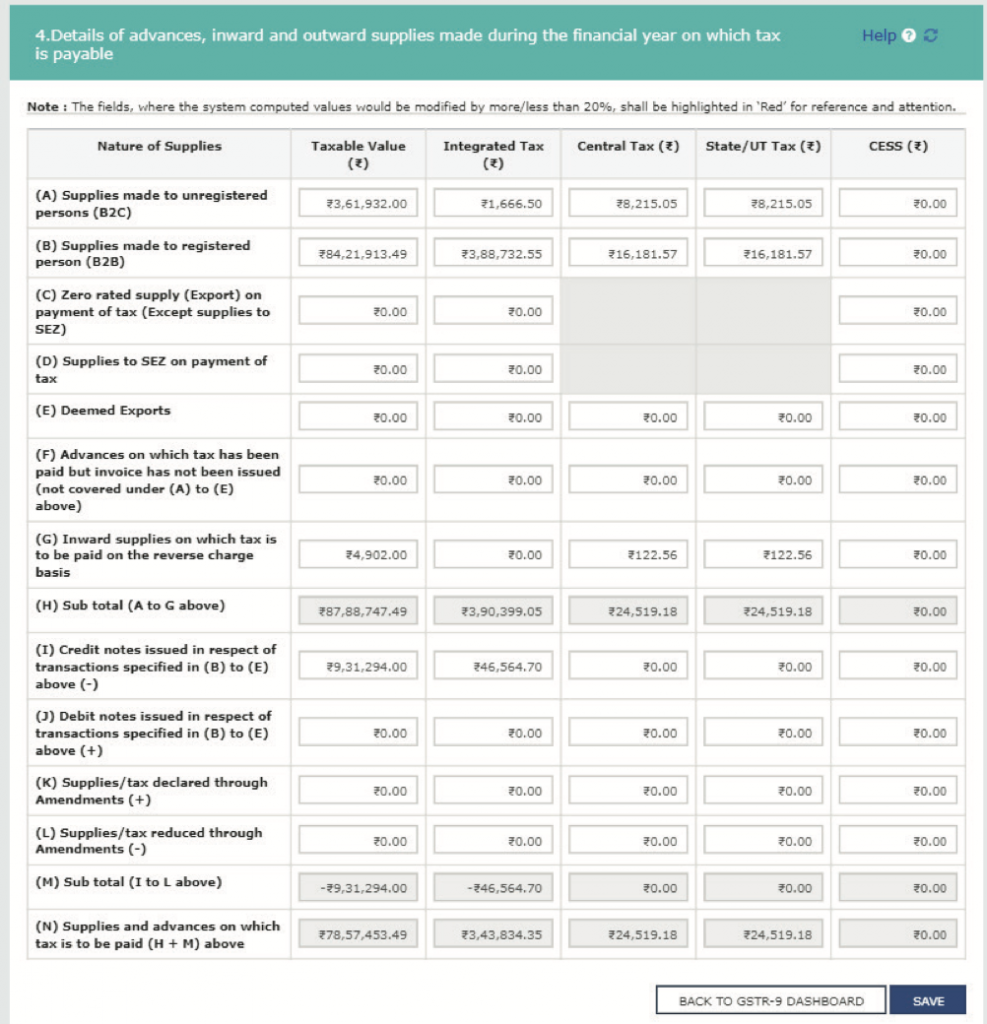

(Amount in INR in all tables) Nature of Supplies Taxable Value Central Tax State Tax/UT Tax Integrated Tax Cess 1 2 3 4 5 6 Pt. II Details of Outward and inward supplies made during the financial year (Amount in INR in all tables) Nature of Supplies Taxable Value Central Tax State Tax/UT Tax Integrated Tax Cess 1 2 3 4 5 6 4 Details of advances, inward and outward supplies made during the financial year on which tax is payable A Supplies made to un-registered persons (B2C) B Supplies made to registered persons (B2B) C Zero rated supply (Export) on payment of tax (except supplies to SEZs) D Supply to SEZs on payment of tax E Deemed Exports F Advances on which tax has been paid but Invoice has not been issued (not covered under (A) to (E) above) G Inward supplies on which tax is to be paid on reverse charge basis H Sub-total (A to G above) I Credit Notes issued in respect of transactions specified in (B) to (E) above (-) J Debit Notes issued in respect of transactions specified in (B) to (E) above (+) K Supplies/tax declared through Amendments (+) L Supplies/tax reduced through Amendments (-) M Sub-total (I to L above) N Supplies and advances on which tax is to be paid (H + M) above The screenshot of Table 4 appearing on www.gst.gov.in is shown below:

Table 4 of GSTR 9 is auto-populated on the basis of GSTR 1 and GSTR 3B of the relevant FY. The facility to EDIT has been given. It is significant to note that the fields, where the system computed values would be modified by more/less than 20%, shall be highlighted in ‘Red’ for reference and attention.

- Clarification by Government – Press Release by Ministry of Finance dated 4th June, 2019

Many taxpayers have reported a mismatch between auto-populated data and the actual entry in their books of account or returns. One common challenge reported by taxpayer is in Table 4 of FORM GSTR-9 where details may have been missed in FORM GSTR-1 but tax was already paid in FORM GSTR-3B and therefore taxpayers see a mismatch between auto-populated data and data in FORM GSTR-3B. It may be noted that auto-population is a functionality provided to taxpayers for facilitation purposes, taxpayers shall report the data as per their books of account or returns (please note that GSTR 3B is a return and GSTR 1 is a Statement) filed during the financial year. - Clarification by CBIC vide Press Release dated 3rd July, 2019

Annual Return serves as an additional opportunity to declare summary of supply against which payment of any unpaid tax has been made through DRC-03: Section 73 of the CGST Act provides a unique opportunity of self-correction to all taxpayers i.e. if a taxpayer has not paid, short paid or has erroneously obtained/been granted refund or has wrongly availed or utilized input tax credit then before the service of a notice by any tax authority, the taxpayer may pay the amount of tax with interest. In such cases, no penalty shall be leviable on such taxpayer. Therefore, in cases where some information has not been furnished in the statement of outward supplies in FORM GSTR-1 or in the regular returns in FORM GSTR-3B, such taxpayers may pay the tax with interest through FORM GST DRC-03 at any time. Therefore, it has been clarified that even the annual return provides an additional opportunity for such taxpayers to declare the summary of supply against which payment of tax is made.

Caution for FY 2019-20: Consolidated ‘tax’ invoice when supply of service is made to unregistered person: A registered person [other than the supplier engaged in making supply of services by way of admission to exhibition of cinematograph films in multiplex screens- inserted vide Notification No. 33/2019-Central Tax dated 18th July, 2019 w.e.f. 1st September, 2019] may not issue a tax invoice in accordance with the provisions of section 31(3)(b) subject to the following conditions, namely,-

- the recipient is not a registered person; and

- the recipient does not require such invoice,

and shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.

Caution for FY 2019-20: Tax invoice in case of admission to exhibition of cinematograph films in multiplex screens

- Rule 54(4A) of the GST Rules, 2017 has been inserted vide Notification No. 33/2019-Central Tax dated 18th July, 2019 w.e.f. 1st September, 2019, which stipulates that a registered person supplying services by way of admission to exhibition of cinematograph films in multiplex screens shall be required to issue an electronic ticket and

- The said electronic ticket shall be deemed to be a tax invoice for all purposes of the Act,

- Even if such ticket does not contain the details of the recipient of service

- But contains the other information as mentioned under rule 46.

- However, the supplier of such service in a screen other than multiplex screens may, at his option, follow the above procedure.

Caution for FY 2019-20: Is GSTR 3B a return?

GSTR-3B is not a return in lieu of return required to be filed in Form GSTR-3. Press release dated 18th October, 2018, which clarified that ITC for invoices issued during July, 2017 to March, 2018 can be availed until last date of filing GSTR-3B was illegal and contrary.

Return prescribed under section 39 is a return required to be furnished in Form GSTR-3 and not Form GSTR-3B. GSTR-3B was not introduced as a return in lieu of return required to be filed in GSTR-3 but was only a temporary stop gap arrangement until due date of filing return in Form GSTR-3 was notified. Government on realizing that return in Form GSTR-3B is not intended to be in lieu of Form GSTR-3 omitted such reference retrospectively, vide Notification No. 17/2017 -Central Tax dated 27-7-2017. Applicant challenged press release dated 18th October, 2018, which clarified that input tax credit (ITC) for invoices issued during July 2017 to March 2018 can be availed until last date of filing Form GSTR-3B for September 2018, i.e., until 20th October, 2018. It has been held that para 3 of press release dated 18th October, 2018, was illegal and contrary to section 16(4) read with section 39(1) and rule 61 of the CGST Rules.

However, an SLP has been filed before The Hon’ble Supreme Court wherein a notice has been issued on 6th December, 2019 along-with the direction that the operation of the impugned judgment and order shall remain stayed. – Union of India v. AAP and Co. – 2020 (33) G.S.T.L. J125 (S.C.)

CBIC amends the laws which makes GSTR 3B a ‘return’ retrospectively

Rule incorporating the functionality of GSTR 3B as a return is rule 61(5). The said rule has been substituted retrospectively with effect from 1st July, 2017 vide Notification No. 49/2019-Central Tax dated 9th October, 2019 wherein it has been stipulated that where the time limit for furnishing of details in FORM GSTR-1 under section 37 or in FORM GSTR-2 under section 38 has been extended, the return specified in section 39(1) shall, in such manner and subject to such conditions as the Commissioner may, by notification, specify, be furnished in FORM GSTR-3B electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner. However, where a return in FORM GSTR-3B is required to be furnished by a person referred to in rule 61(1) then such person shall not be required to furnish the return in GSTR-3.

3. Which Details are Required to be Furnished in Table 4A of GSTR 9?

Sub-Table Description of Sub-Table Auto/Manual Link with GST Returns Corresponding Tables 4A Supplies made to un-registered persons (B2C) Auto [Editable] GSTR 1 Table 5, Table 7 along with respective amendments in Table 9 and Table 10 – GSTR 3B Table 3.1(a) - Details to be included:

- Aggregate value of supplies made to CONSUMERS and UNREGISTERED PERSONS on which tax has been paid.

- Aggregate value of supplies made through E-Commerce operators to consumers and unregistered persons on which tax has been paid.

- Debit Note & Credit Note:

- These details are to be declared as net of credit notes or debit notes issued in this regard.

- Important Points to remember:

- Even though the person is registered under GST having valid GSTIN and does not furnish the same to the supplier then such transaction shall be assumed as B2C supply. Thus, these supplies shall be called as supplies made to

- Interlink with GSTR 1:

- As far as the taxability of the goods and services are concerned, supply of goods and/or services made by the supplier can be taxable, exempt or non-taxable. The term taxable supply has been defined under section 2(108) of the GST Act, 2017 which means a supply of goods and/or services which is leviable to tax under this Act. If the supplier undertakes any taxable supplies then the same shall be reported under Tables 4, 5, 6 and 7 of the GSTR 1.

- The details of aggregate value of supplies made to consumers and unregistered persons can be fetched from Table 5 and Table 7 of GSTR 1. GSTR 1 captures the details in respect of both outward supplies to registered as well as un-registered person. In regard to supply made to un-registered persons, three separate tables have been designed to capture the information namely in Tables 5, 6A and 7. However, for the purpose of Table 4A of GSTR 9, only Tables 5 and 7 has to be considered as because details of exports e. Table 6A of GSTR 1 has been sought in another table of GSTR 9.

- The value of supplies made through E-Commerce operators to consumers and unregistered persons on which tax has been paid is already captured in Tables 5 and 7 of GSTR 1, so it won’t require an extra effort the capture the information. Supplies made to unregistered persons e. B2C Supplies through e-commerce operators is reported under Table 7A(2), Table 7B(2) and Table 5B of GSTR 1.

- It must be pertinent to note that the value of taxable supplies in case of B2C supply – Intra-State B2C and Inter-State B2C having invoice value upto INR 2.5 lakhs is reported net of debit and credit note in Table 7 of GSTR 1. Further, if any corresponding amendments have been done in Table 10 of GSTR 1 then the same has to be considered.

- However, in case of B2C inter-state supplies with invoice value more than INR 2,50,000 which is reported in Table 5 of GSTR 1, the reporting of Debit/Credit Note in respect of Table 5 is done separately. Therefore, the taxpayer needs to maintain caution while fetching the details wherein he has to consider Table 9 of GSTR 1. Besides, if any corresponding amendments have been done in Table 9 of GSTR 1 then the same has to be considered.

- Interlink with Tables of GSTR 1

Table Sub- Table Reporting of supplies Classification Debit/Credit Note/Amendments Reporting in Table 4A of GSTR 9 4 4A B2B B2B Separately in Table 9 – 4B B2B – RCM B2B Separately in Table 9 – 4C B2B – Through E-commerce operator B2B Separately in Table 9 – 5 5A B2C – Inter-State – Invoice value more than INR 2.5 lakhs B2C Separately in Table 9 Yes 5B B2C – Inter-State – Invoice value more than INR 2.5 lakhs – Through E-Commerce operator B2C Separately in Table 9 Yes 6 6A Exports B2C Separately in Table 9 Even though the same is B2C transaction, but the same has been captured in another Table of GSTR 9. 6B SEZ unit/developer B2B Separately in Table 9 – 6C Deemed Exports B2B Separately in Table 9 – 7 7A(1) B2C – Intra-State B2C Net Off in Table 7; Amendment in Taxable value figure in Table 10 Yes 7A(2) Out of supplies reported in 7A(1), supplies through E-Commerce B2C Net Off in Table 7; Amendment in Taxable value figure in Table 10 No – Because the figures has already been considered in Table 7A(1) 7B(1) B2C – Inter-State – Invoice value upto INR 2.5 lakhs B2C Net Off in Table 7; Amendment in Taxable value figure in Table 10 Yes 7B(2) Out of supplies reported in 7B(1), supplies through E-Commerce B2C Net Off in Table 7; Amendment in Taxable value figure in Table 10 No – Because the figures has already been considered in Table 7B(1)

- Interlink with GSTR 3B:

- GSTR 3B is a summarized return which captures the details of taxable outward supplies without any bifurcation between B2B and B2C supply in Table 3.1(a). The taxpayer should refer the working papers of GSTR 3B wherein he would find the segregation between the supplies made to registered person (B2B) and supply made to unregistered person (B2C) for the purpose of extracting figures for Table 4A of GSTR 9.

- The figures in Table 3.1(a) as per Instruction of GSTR 3B states that the value to be reported in the Table should be net of Debit Note, Credit Note and advances received. Since the value that needs to be furnished in Table 4A of GSTR 9 should also be net of Debit Note and Credit Note, therefore, there should not be any hiccups in extracting the figures from GSTR 3B for the purpose of Table 4A of GSTR 9. However, it is worthwhile to note that as per Instruction No. 4 of GSTR 9, Table 4A seeks to be declare B2C supplies as net of credit notes or debit notes issued in this regard. It is to be observed that the said instruction does not cover advance received in regard to B2C supplies. Hence, the details of advance received in regard to B2C supplies for the FY reported in GSTR 3B against which no invoices have been issued during the same FY needs to be reduced from the figure reported in GSTR 3B and then should be reported in GSTR 9. Further, in support to this view, Table 4F of GSTR 9 seeks for advances on which tax has been paid but invoice has not been issued under Table 4A.

- Interlink with Tables of GSTR 3B

Table Sub-Table Reporting of supplies Classification Debit/Credit Note/Amendments Reporting in Table 4A of GSTR 9 3.1 (a) Outward taxable supplies (other than zero rated, nil rated and exempted) B2B + B2C Net Off in Table 3.1(a) Yes – Only B2C supplies (b) Outward taxable supplies (zero rated) B2B + B2C Net Off in Table 3.1(b) – (c) Other outward supplies (Nil rated, exempted) B2B + B2C Net Off in Table 3.1(c) – (d) Inward supplies (liable to reverse charge) B2B + B2C Net Off in Table 3.1(d) – (e) Non-GST outward supplies B2B + B2C Net Off in Table 3.1(e) –

- Important points to remember:

- Even though the person is registered under GST having valid GSTIN and does not furnish the same to the supplier then such transaction shall be assumed as B2C supply. Thus, these supplies shall be called as supplies made to

- It is very important to note that although the details that needs to be furnished in Table 4A has to be as per the supplies for which payment has been made through Form GSTR 3B but as it has been clarified vide CGST (Fourth Amendment) Rules, 2019 dated 28-6-2019 that any additional liability may also be reported for FY 2017-18 or FY 2018-19, it means that the details of actual supplies can also be shown as per the books of account and not merely what has been reported in GSTR 1/3B. In simple words, GSTR 9 gives an opportunity to the taxpayers to correctly report the details in the annual return if the same has not be reported correctly in its original GSTR 1/3B return. If the additional liability, if any, is ascertained but not furnished in its annual return also, then it may be ascertained and reported by the GST auditor who files reconciliation statemente. GSTR 9C. Further, it may also lead to exposure in the hands of Proper Officer who may impose penalty along-with the recovery of tax and interest. It is worthwhile to note that the aforesaid opportunity of correction in GSTR 9 is not in respect of each and every FYs and is made available initially only for FY 2017-18 and FY 2018-19 which has further been made available for FY 2019-20 also vide Notification No. 79/2020-CT dated 15-10-2020.

4. How to Furnish the Details in Table 4B of GSTR 9?

Sub-Table Description of Sub-Table Auto/Manual Link with GST Returns Corresponding Tables 4B Supplies made to registered persons (B2B) Auto [Editable] GSTR 1 Table 4A and Table 4C – GSTR 3B Table 3.1(a) Details to be included:

- Aggregate value of supplies made to registered persons on which tax has been paid shall be declared here.

- Aggregate value of supplies made to registered persons on which tax has been paid shall also include supplies made to UINs.

- These will include supplies made through E-Commerce operators.

- Details not to be included:

- Supplies on which tax is to be paid by the recipient on reverse charge basis.

- Debit Note & Credit Note:

- Details of debit and credit notes are to be mentioned separately.

Relaxation in reporting given vide Notification No. 56/2019-Central Tax dated 14th November, 2019 for FYs 2017-18 & 2018-19 – relaxation extended for FY 2019-20 also vide Notification No. 79/2020-Central Tax dated 15th October, 2020 The taxpayers have been given the OPTION to report the details in Table 4B net of Debit Note instead of reporting separately in Table 4J of GSTR 9.

The taxpayers have been given the option to report the details in Table 4B net of Credit Note instead of reporting separately in Table 4-I of GSTR 9.

The taxpayers have been given the option to report the details in Table 4B net of amendments instead of reporting separately in Tables 4K & 4L of GSTR 9.

Option applicable for the period: FY 2017-18, FY 2018-19 & FY 2019-20

It is significant to note that this is only an option given to the taxpayers in case there is difficulty in reporting such details separately in this table.

- Interlink with GSTR 1:In GSTR 1, the details in respect of taxable outward supplies is furnished in Table 4 which captures the information only in regard to details of taxable outward supplies made by the registered taxable person to another registered taxable person i.e. B2B Supplies.Now the question may arise that – Are there different types of registered taxable persons? The answer is YES. The supplies can be made to another registered persons such as:

- regular registered person,

- person registered under the composition scheme,

- person registered as Input Service Distributor (ISD) and

- person holding Unique Identification Number (UIN).

When the outward supplies are made to these persons then the same is required to be reported under Table 4 of GSTR 1 as B2B supplies.

Since Table 4 of GSTR 1 seeks data in segregated manner in Tables 4A, 4B and 4C, therefore, it gets significant to identify which details needs to be shown Table 4B of GSTR 9.

- Table 4A of GSTR 1

- Supplies other than those attracting reverse charge and supplies made through e-commerce operator

These outward supplies are as good as normal supplies on which tax is charged under forward charge basis. Details of the tax invoices is required to be furnished as these are B2B supplies. These supplies has to be shown in Table 4B of GSTR 9.

- Table 4B of GSTR 1

- Supplies attracting tax on reverse charge basis

Though such supplies are B2B supplies but as the tax is not payable by the supplier in this case instead the recipient is liable to pay tax, therefore, the intension to capture the details attracting tax in Table 4 of GSTR 9 will not satisfy, therefore, an altogether different table i.e. Table 5C of GSTR 9 has been made to capture such details.

- Supplies attracting tax on reverse charge basis

- Table 4C of GSTR 1

- Supplies made through e-commerce operator attracting Tax Collection at Source (TCS)

Supplies made by the registered person to registered persons i.e. B2B

Related Article: FAQs on GSTR 9A – GST Annual Return for Composition Scheme

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

How to show tax already paid voluntarily through DRC03 in annual return of 19-20?