Tax on Conversion of Unaccounted Money

- Blog|Income Tax|

- 28 Min Read

- By Taxmann

- |

- Last Updated on 24 February, 2022

Table of Contents

1. Gifts received by any person [Sec. 56(2)(x)]

2. Analysis of Gifts received without consideration

3. Analysis of Sale of Assets for inadequate consideration

4. Premium on Issue of Shares by Closely held Company[Sec. 56(2)(viib)]

5. Determination of Fair Market Value (FMV) [Rule 11UA]

6. Bond Washing Transactions [Sec. 94(1), (2)]

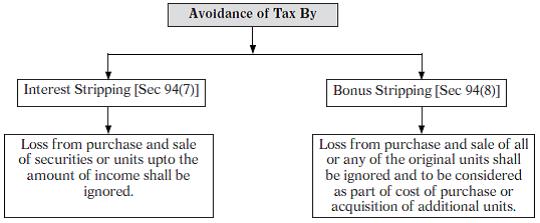

7. Interest Stripping [Sec. 94(7)]

8. Bonus Stripping [Sec. 94(8)]

9. Analysis of Section 94(7) and Section 94(8)

10. Cash Credits [Sec. 68]

Check out Taxmann’s Income Tax Calculator which helps you compute the taxable income and tax liability under the Income-tax Act. This calculator provides comprehensive coverage for every type of assessee and all heads of income.

1. Gifts received by any person [Sec. 56(2)(x)]

Where any person receives the following in any previous year, from any person or persons on or after 1st April, 2017 it shall be taxable under the head ‘Income from Other Sources’:

(1) Any sum of money:

Without consideration, the AGGREGATE VALUE of which exceeds ` 50,000, the whole of the aggregate value of such sum;

(2) Any immovable property:

(a) Without consideration, the stamp duty value of which exceeds ` 50,000, the stamp duty value of such property; [Single Transaction Wise]

(b) For inadequate consideration, if the stamp duty value exceeds the consideration by more than higher of ` 50,000 or 10% of the consideration, the difference of Stamp duty value and the consideration. [Single Transaction Wise]

Provided that in case of a property being referred to in the 2nd proviso to Sec. 43CA(1), the limit shall be 20% instead of 10%. [Inserted by Finance Act, 2021 w.e.f. A.Y. 2021-22]

| Reason for Amendment: In order to provide consequential relief to buyers of residential units who had acquired as per the 2nd proviso to Sec. 43CA(1), the Finance Act, 2021 has increased the safe harbour limit from existing 10% to 20%. |

(3) Any property, other than immovable property:

(a) Without consideration, the AGGREGATE FMV of which exceeds ` 50,000, the whole of the aggregate FMV of such property;

(b) For inadequate consideration, if the AGGREGATE DIFFERENCE between the FMV and consideration exceeds ` 50,000, the difference of FMV and consideration.

Further this clause shall NOT APPLY to any sum of money or any property received:

(i) From any Relative; or

(ii) On the occasion of the Marriage of the Individual; or

(iii) Under a Will or by way of Inheritance; or

(iv) In contemplation of Death of the Payer; or

(v) From any Local Authority as defined in Sec. 10(20); or

(vi) From any Fund/Foundation/University/Educational Institution or Hospital or other medical Institution or Trust or Institution referred u/s 10(23C); or

(vii) From or by any Trust/Institution registered u/s 12AA or 12AB; or

(viii) By any Fund/Trust/Institution/University/Educational Institution or Hospital or other medical Institution referred under sub-clause (iv), (v), (vi) or (via) of Section 10(23C); or

(ix) On total or partial partition of HUF u/s 47(i); transfer of capital asset by holding company to its 100% Indian subsidiary company u/s 47(iv); transfer of capital asset by 100% subsidiary to its Indian holding company u/s 47(v); in the scheme of amalgamation/demerger u/s 47(vi)/(vib); receipt of shares held in Indian company in the scheme of amalgamation or demerger of foreign company u/s 47(via)/(vic); in a scheme of amalgamation of banking company u/s 47(viaa); on business reorganization of cooperative bank u/s 47(vica)/(vicb); transfer or issue of shares by resulting company to demerged company u/s 47(vid); receipt of shares on the amalgamation of a company u/s 47(vii); transfer of capital asset by original fund to resulting fund in relocation u/s 47(viiac); transfer of share/unit/interest in the original fund in consideration of share/unit/interest in resultant fund u/s 47(viiad); transfer of capital asset by India Infrastructure Finance Company Ltd. to institution established for financing the infrastructure and development u/s 47(viiae); transfer of capital asset by public sector company to another public sector company u/s 47(viiaf).

[Inserted by Finance Act, 2021 w.e.f. A.Y. 2022-23]

(x) From an individual by a trust created or established solely for the benefit of relative of individual.

(xi) From such class of persons and subject to such conditions, as may be prescribed.

Notification No. 96/2019 dated 11.11.2019:

Prescribed class of persons for the purpose of clause (xi) of proviso to Sec. 56(2)(x): [Rule 11UAC]

The provisions of Sec. 56(2)(x) shall NOT apply to:

(1) any immovable property, being land or building or both, received by a resident of an unauthorised colony in the National Capital Territory of Delhi, where the Central Government regularised the transactions of such immovable property based on the latest Power of Attorney, Agreement to Sale, Will, possession letter and other documents including documents evidencing payment of consideration for conferring or recognising right of ownership or transfer or mortgage in regard to such immovable property in favour of such resident.

‘Resident’ means a person having physical possession of property on the basis of a registered sale deed or latest set of Power of Attorney, Agreement to Sale, Will, possession letter and other documents including documents evidencing payment of consideration in respect of a property in unauthorised colonies and includes their legal heirs but does not include tenant, licensee or permissive user.

(2) any movable property, being unquoted shares, of a company and its subsidiary and the subsidiary of such subsidiary received by a shareholder, where:

(i) the Tribunal, on an application moved by the Central Government has suspended the Board of Directors of such company and has appointed new directors nominated by the Central Government; and

(ii) share of company and its subsidiary and the subsidiary of such subsidiary has been received pursuant to a resolution plan approved by the Tribunal after affording a reasonable opportunity of being heard to the jurisdictional Principal Commissioner or Commissioner.

(3) any movable property, being equity shares, of the reconstructed bank, received by the investor or the investor bank, as the case may be, where the said share has been allotted by the reconstructed bank under the scheme at a price specified in the scheme.

‘Scheme’ means Yes Bank Limited Reconstruction Scheme, 2020.

(4) any movable property, being equity shares, of the public sector company, received by a person from the Central Government or any State Government under strategic disinvestment.

PCIT v. Dr. Ranjan Pai (2021) 431 ITR 250 (Kar)

The bonus shares received by shareholders shall not be taxable u/s 56(2)(x) under the head ‘Income from other sources’ as per section 56(2)(x).

The Karnataka High Court observed that the issue of bonus shares by capitalization of reserves is merely a reallocation of the company’s funds. There is no inflow of fresh funds or increase in the capital employed and the total funds available with the company remain the same. On the other hand, when a shareholder gets bonus shares, the value of the original shares held by him goes down and the market value as well as intrinsic value of the two shares put together will be the same or nearly the same as the value of original share before the issue of bonus shares. Thus, any profit derived by the assessee shareholder on account of receipt of bonus shares is adjusted by depreciation in the value of equity shares originally held by him.

Accordingly, the High Court held that section 56(2)(x) would not be attracted in the hands of the recipient shareholders on receipt of bonus shares.

For the purpose of section 56(2)(x):

Meaning of ‘Relative’ for Individual:

(i) Spouse of the Individual,

(ii) Brother or Sister of the Individual,

(iii) Brother or Sister of the Spouse of the Individual

(iv) Brother or Sister of either of the Parents of the Individual,

(v) Any lineal ascendant or descendant of the Individual,

(vi) Any lineal ascendant or descendant of the Spouse of the Individual,

(vii) Spouse of the persons referred above; except in clause (i)

Meaning of ‘Relative’ for HUF: Any member of the HUF.

Meaning of ‘Gift in Contemplation of Death of Payer’:

A gift is said to be made in contemplation of death where a person, who is ill and expects to die shortly due to his illness, delivers to another the possession of any movable property to keep as gift in case the payer/giver shall die due to his illness.

Such a gift may be resumed by the giver from the person to whom it was made and shall not take effect if he recovers from the illness during which it was made or if he survives.

Property means the following assets, being ‘Capital Assets’ for the assessee:

(1) Immovable Property being Land or Building or both,

(2) Shares and Securities,

(3) Jewellery,

(4) Bullions,

(5) Drawings,

(6) Paintings,

(7) Archaeological collections,

(8) Sculptures,

(9) Any work of Art.

Jewellery includes:

-

- Ornaments made of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semi precious stone, and whether or not sewn into any wearing apparel,

- Precious or semi precious stones whether or not set in any furniture, utensil or other article or worked or sewn into any wearing apparel.

Note: Provisions of Sec. 56(2)(x) are attracted, in relation to the properties received, only when they are in the nature of capital asset as defined u/s 2(14) of the Income Tax Act, for the recipient.

Where the Date of Agreement and the Date of Registration are not same:

Where the date of agreement fixing the value of consideration and the date of registration of the transfer of the asset are not same, the stamp duty value as on the date of the agreement may be taken, provided that the amount of consideration or part thereof has been received by way of an account payee cheque or an account payee bank draft or by use of electronic clearing system (ECS) through a bank account or through such other electronic mode as may be prescribed on or before the date of the agreement.

Meaning of FMV: FMV of a property, other than an immovable property, for the purpose of section 56(2)(x) means the value determined as per the prescribed method under Rule 11UA on the Date of receipt of such property.

| Note: As per Section 49(4), where on the acquisition of a capital asset, income is charged u/s 56(2)(vii) or (viia) or (x), the cost of acquisition of such capital asset shall be the value which has been taken into consideration for the purpose of section 56(2)(vii) or (viia) or (x). |

2. Analysis of Gifts received without consideration

| Nature of Property Gifted | Capital Gains for Transferor | Income from other sources for transferee u/s 56(2)(x) | Cost of acquisition of such gift for transferee u/s 49(4) | Period of holding of such gift for transferee |

| Immovable property being land or building | Exempt u/s 47(iii) |

Stamp value of the property, if it exceeds ` 50,000 | Stamp value of such property taken for the purpose of taxation u/s 56(2)(x) * |

From the date of transfer of such asset, as sec. 49(1) is not applicable. |

| Shares & securities, bullion, jewellery, archaeological collections, drawings, paintings, sculptures or any work of art. | Exempt u/s 47(iii) |

FMV of such asset, if it exceeds ` 50,000 | FMV of the asset taken for the purpose of taxation u/s 56(2)(x) * | From the date of transfer of such assets, as sec. 49(1) is not applicable. |

| Any other assets | Exempt u/s 47(iii) |

NIL | Cost of acquisition of the previous owner u/s 49(1) | From the date on which the previous owner u/s 49(1) acquired such asset. |

| * If the stamp value of property or FMV of assets does not exceed ` 50,000, then it will the same treatment as above that of ‘Any other assets’. | ||||

Note: If such asset or assets are acquired or received without consideration from any relative, or on the occasion of the marriage of the individual, etc., then-

-

- no capital gains for the transferor, as gift is exempt u/s. 47(iii),

- no income from other sources for transferee, as sec. 56(2)(x) shall not be applicable,

- the cost of acquisition for the transferee will be the cost at which the previous owner referred in sec. 49(1) acquired such asset and

- period of holding, as per Explanation 1 to Sec. 2(42A), shall include the period during which such asset was held by the previous owner.

3. Analysis of Sale of Assets for inadequate consideration

| Nature of property Sold | Capital Gains or Business Income for Transferor | Income from other sources for transferee u/s 56(2)(x) | COA of such gift for transferee u/s 49(4) | Period of holding of such gift for transferee |

| Immovable property being land or building | Stamp value (–) Cost of acquisition [Sec. 50C or 43CA applicable for transferor] | Difference between the stamp value and sale consideration, if exceeds the higher of ` 50,000 or 10%/20% of sale consideration | Stamp value of property taken for the purpose of taxation u/s 56(2)(x) * |

From the date of transfer of such asset. |

| Shares and securities, jewellery, archaeological collections, drawings, paintings, sculptures, any work of art, bullion | Sale consideration (–) Cost of acquisition | Difference between the FMV and sale consideration, if exceeds ` 50,000 | FMV of the asset taken for the purpose of taxation u/s 56(2)(x) * |

From the date of transfer of such assets |

| Any other assets | Sale consideration (–) Cost of acquisition | NIL | Cost at which it was received by the transferee | From the date of transfer of such assets |

| * If the difference between the stamp value of property and the sale consideration does not exceed the higher of ` 50,000 or 10%/20% of sale consideration, then the treatment will be same as that of ‘Any other assets’.

* If the difference between the FMV of assets and the sale consideration does not exceed ` 50,000, then the treatment will be same as that of ‘Any other assets’. |

||||

Note: If such asset or assets are purchased without adequate consideration from any relative, or on the occasion of the marriage of the individual, etc., then –

-

- same treatment as above for transferor; but

- no income from other sources for transferee [as sec. 56(2)(x) shall not be applicable].

Practical Question: Mr. Samkit, a property dealer, sold a building in the course of his business to his friend Raj, who is a dealer in automobile parts, for ` 90 lakhs on 1.1.2022, when the stamp duty value was ` 150 lakhs. The agreement was, however, entered into on 1.7.2021 when the stamp duty value was ` 140 lakhs. Mr. Samkit had received a down payment of ` 15 lakhs by a/c payee cheque from Raj on the date of agreement. Discuss the tax implications in the hands of Samkit and Raj, assuming that Mr. Samkit had purchased the building for ` 75 lakhs on 12.07.2020.

Would your answer be different if Samkit was a share broker instead of a property dealer?

What would be the case if the stamp duty value on the date of agreement was ` 94 lakhs and Mr. Samkit is the property dealer?

Solution:

Case 1: Tax implications if Mr. Samkit is a property dealer

| In the hands of Mr. Samkit |

In the hands of Mr. Raj |

| The provisions of section 43CA would be attracted, since the building represents his stock-in-trade and it has been transferred for a consideration less than the stamp duty value on the date of agreement and also the stamp duty value exceed 110% of the consideration.

Therefore, difference between the stamp duty value on the date of agreement (i.e., ` 140 lakhs) and the purchase price (i.e., ` 75 lakhs) = ` 65 lakhs, would be chargeable as business income for Mr. Samkit. |

Since Mr. Raj is a dealer in automobile spare parts, the building purchased is a capital asset in his hands. The provisions of section 56(2)(x) would be attracted in the hands of Mr. Raj as he received immovable property, being a capital asset, for inadequate consideration and the stamp duty value exceeds the consideration by more than higher of ` 50,000 or 10% of the consideration.

Therefore, difference between the stamp duty value of the property (i.e., ` 140 lakhs) and the actual consideration (i.e., ` 90 lakhs) = ` 50 lakhs, would be taxable as Income from other sources u/s 56(2)(x) in the hands of Mr. Raj. |

Case 2: Tax implications if Mr. Samkit is a stock broker

| In the hands of Mr. Samkit |

In the hands of Mr. Raj |

| In case Mr. Samkit is a stock broker and not a property dealer, the building would be his capital asset and not stock-in-trade, thereby provisions of section 50C would be attracted.

Since, the consideration is less than the stamp duty value on the date of agreement and also the stamp duty value exceed 110% of the consideration, as per the provisions of sec. 50C, the difference between the stamp duty value on the date of agreement (i.e., ` 140 lakhs) and the purchase price (i.e., ` 75 lakhs) = ` 65 lakhs would be chargeable as short-term capital gains. |

There would be no difference in the taxability in the hands of Mr. Raj, whether Mr. Samkit is a property dealer or a stock broker.

Therefore, the provisions of section 56(2)(x) would be attracted in the hands of Mr. Raj who has received immovable property, being a capital asset, for inadequate consideration and the stamp duty value of which exceed the consideration by more than higher of ` 50,000 or 10% of the consideration.. Therefore, difference between the stamp duty value of the property (i.e., ` 140 lakhs) and the actual consideration (i.e., ` 90 lakhs) = ` 50 lakhs, would be taxable as Income from other sources u/s 56(2)(x) in the hands of Mr. Raj. |

Case 3: Tax implications if stamp duty value was ` 94 lakhs and Mr. Samkit is a property dealer

| In the hands of Mr. Samkit |

In the hands of Mr. Raj |

| The provisions of section 43CA would be attracted, since the building represents his stock-in-trade and it has been transferred for a consideration less than the stamp duty value on the date of agreement. But, if the stamp duty value does not exceed 110% of the consideration, then the consideration so received shall be deemed to be the full value of consideration.

Since, here the stamp duty value (i.e. ` 94 lakhs) does not exceed 110% of consideration (i.e. ` 99 lakhs), the actual consideration (i.e. ` 90 lakhs) shall be deemed to be the full value of consideration. Therefore, the difference between the sale consideration (i.e., ` 90 lakhs) and the purchase price (i.e., ` 75 lakhs) = ` 15 lakhs, would be chargeable as business income for Mr. Samkit. |

Where the stamp duty value does not exceed the consideration by more than 10% of the consideration, the provisions of section 56(2)(x) would not be attracted, even though the difference between the stamp duty value and actual consideration is more than ` 50,000.

Therefore, there will be no taxability in the hands of Mr. Raj, since, the difference between the stamp duty value and actual consideration [i.e. ` 4 lakhs (` 94 lakhs – ` 90 lakhs)] does not exceed 10% of the actual consideration [i.e. ` 9 lakhs (` 90 lakhs x 10%)]. |

Note: Here, the 2nd proviso to Sec. 43CA shall not be applicable since the conditions are not satisfied.

Practical Question: Mr. X sells his building to Mr. Y on 5.1.2022 for ` 38,00,000 which was acquired by Mr. X on 12.10.2008 for ` 12,00,000. What will be the tax treatment of the above transactions if the stamp value of such building is (a) ` 38,75,000 or (b) ` 55,00,000? What will be tax treatment if such building was given as gift (i.e. transferred without consideration) by Mr. X to his wife and the stamp value of the building is ` 45,00,000?

CII: Year 2021-22; 317, Year 2008-09; 137

Solution:

(a) Capital gains for Mr. X: `

| Sale consideration (Note) | 38,00,000 |

| Less: Indexed cost of acquisition [` 12,00,000 x 317/137] | 27,76,642 |

| Long Term Capital Gain | 10,23,358 |

Note: As per Sec. 50C, where the stamp duty value does not exceed 110% of the actual consideration, the actual consideration shall be deemed as the full value of consideration. Here, the stamp duty value does not exceed 110% of the actual consideration and therefore, the actual consideration shall be taken as the full valueof consideration.

For Mr. Y:

Sec. 56(2)(x) will not be attracted here as the stamp duty value does not exceed the consideration by more than higher of ` 50,000 or 10% of the consideration.

Cost of acquisition for Mr. Y will be cost at which it was acquired by him i.e. ` 38,00,000 and the period of holding shall be from the date when the building was acquired by him i.e. 5.1.2022.

(b) Capital gains for Mr. X: `

| Sale consideration (Note) | 55,00,000 |

| Less: Indexed cost of acquisition [` 12,00,000 x 317/137] | 27,76,642 |

| Long Term Capital Gains | 27,23,358 |

Note: As per Sec. 50C, the stamp duty value shall be taken as full value of consideration only when it exceeds 110% of the actual consideration. Here, the stamp duty value exceeds 110% of the actual consideration and therefore, the stamp duty value shall be taken as the full value of consideration.

For Mr. Y:

In this case, sec. 56(2)(x) will be attracted since the stamp duty value exceeds the consideration by more than higher of ` 50,000 or 10% of the consideration. The amount chargeable to tax under the head ‘Income from other sources’ will be ` 27,00,000 (` 55,00,000 – ` 38,00,000). 2nd proviso to Sec, 43CA(1) shall not be applicable since the conditions are not satisfied and therefore threshold limit of 10% shall only be considered.

Cost of acquisition for Mr. Y will be the stamp value which was taken for the purpose of taxation u/s 56(2)(x) i.e. ` 55,00,000 as per sec. 49(4) and the period of holding shall be from the date on which such building was acquired by him i.e. 5.1.2022.

If the above building was gifted by Mr. X to his wife, then the capital gains for Mr. X will be exempt u/s 47(iii). Further, as the gift was made to his wife; i.e. a relative; sec. 56(2)(x) will not be attracted for the wife. The cost of acquisition for Mrs. X will be the cost of acquisition to Mr. X as per sec. 49(1) and the period of holding shall include the period during which such building was held by Mr. X (i.e. the previous owner).

Practical Question: Mr. B received the following gifts/amounts during the previous year 2021-22:

(a) Gift of Bullion worth ` 51,000 on his Birthday from his friend.

(b) Received a car from his cousin on payment of ` 3 Lakhs, FMV of which was ` 5 Lakhs.

(c) Received cash gift of ` 28,000 each from three of his friends X, Y & Z on 12.06.2020.

(d) In respect of land of Mr. B compulsorily acquired by Railways in the year 2018, he received the following amount on 27.01.2022 as Interest on enhanced compensation on the order of the Court,

Relating to Previous Year

| 2019-20 | INR 2,80,000 | |

| 2020-21 | INR 3,20,000 | |

| 2021-22 | INR 2,10,000 |

(e) 50 shares of Raja Ltd., the FMV of which was ` 50,000, on his marriage anniversary from his cousin. He also received 100 shares of Raghu Ltd., the FMV of which was ` 60,000 on the date of transfer. This gift was received on the occasion of Diwali. The original cost of such shares was ` 50,000.

(f) On 17th January, 2022, he sold the 100 shares of Raghu Ltd. for ` 1,00,000.

You are required to compute the Income of Mr. B under the head ‘Income from Other Sources’ and Capital gains, if any, for the Assessment Year 2022-23 assuming that he has no other Income.

Solution:

| ` | ` | |

| Income from Other Sources | ||

| Gift of Bullion worth ` 51,000 on his birthday from his friend | 51,000 | |

| Receipt of Car [Note 2] | Nil | |

| Cash Gift (` 28,000 x 3) [Note 3] | 84,000 | |

| Interest on Enhanced Compensation [Note 4] | 4,05,000 | |

| Shares of Raja Ltd. and Raghu Ltd. [Note 5] | 1,10,000 | 6,50,000 |

| Short Term Capital Gain: [Note 6] | ||

| Sale Consideration | 1,00,000 | |

| Less: Cost of Acquisition | 60,000 | 40,000 |

| Gross Total Income | 6,90,000 |

Notes:

-

- Bullion is received without consideration and aggregate FMV exceeds ` 50,000 and hence full value of the bullion is taxable u/s 56(2)(x).

- Car is not included in the definition of ‘property’ as specified in the Explanation to Section 56(2)(x) and therefore nothing shall be taxable.

- Any sum of money received without consideration and aggregate value if exceeds ` 50,000 is taxable u/s 56(2)(x).

- Interest on Enhanced Compensation is taxable in the year of receipt after a deduction of 50% as provided by section 57 (i.e. ` 8,10,000 – ` 4,05,000).

- If shares of any company are received without consideration and aggregate FMV of shares exceeds ` 50,000, the whole of such aggregate FMV of shares is taxable u/s 56(2)(x). Although the FMV of shares of Raja Ltd. does not exceed ` 50,000, but the aggregate of the FMV of the shares of Raja Ltd. and Raghu Ltd. is ` 1,10,000 which exceeds ` 50,000. Hence, their aggregate value shall be taxable. Cousins are not included in the definition of relatives for the purpose of sec. 56(2)(x) and so shares received without consideration from them shall be taken for the purpose of taxability under this section.

- Section 49(4) provides that where the capital gain arises from the transfer of such property which has been subject to tax u/s 56(2)(x), the cost of acquisition shall be deemed to be the value taken for the purpose of section 56(2)(x). Therefore ` 60,000 would be the cost of acquisition in this case.

Practical Question: Mohit transferred 500 Shares of GE Pvt. Ltd. to KL Pvt. Ltd. on 12.09.2021 for ` 6,00,000 when the market price was ` 10,00,000. The indexed cost of acquisition for Mohit was computed at ` 8,90,000. The transfer was not subjected to STT. Determine the taxable income in hands of Mohit and KL Pvt. Ltd. because of above said transaction. Further, if Mohit transferred shares of Reliance Industries Ltd. instead of GE Pvt. Ltd. then what will be taxable income in the hands of KL Pvt. Ltd.

Solution:

For Mohit:

| ` | |

| Sale Consideration (as per Sec. 50CA, as shares are unquoted) | 10,00,000 |

| Less: Expenses on Transfer | NIL |

| Net Sale Consideration | 10,00,000 |

| Less: Indexed Cost of Acquisition – As given | (8,90,000) |

| Long Term Capital Gain | 1,10,000 |

For KL Pvt. Ltd.:

As per Sec. 56(2)(x), where any assessee receives any shares from any person or persons for inadequate consideration and the difference between the Fair Market Value of the shares and the consideration exceeds ` 50,000, then such difference shall be taxable as ‘Income from Other Sources’. In this case, KL Pvt. Ltd. has acquired shares of GE Pvt. Ltd. from Mohit for ` 6,00,000 which is less than the FMV of the shares i.e. ` 10,00,000 and therefore, ` 4,00,000 (` 10,00,000 – ` 6,00,000), being the difference between the FMV of the shares and consideration paid, would be chargeable to tax in the hands of KL Pvt. Ltd. u/s 56(2)(x).

By inserting clause (x) to Sec. 56(2), the situation of double taxation arises in respect of transfer of unquoted shares lower than the FMV. Taking a view of above question, it can be seen that the difference of ` 4,00,000 is taxable in the hands of both, transferor i.e. Mohit as well as transferee i.e. KL Pvt. Ltd. To avoid this, Mohit should have transferred his shares for consideration of ` 10,00,000 as this will result into no change in liability of Mohit, but it will reduced the tax liability of KL Pvt. Ltd. to NIL.

If Mohit transferred the shares of Reliance Industries Ltd, then there will be no change in liability in the hands of KL Pvt. Ltd. as there is no difference in taxability u/s 56(2)(x) for shares of listed companies or unlisted companies. However, the tax liability of Mohit will change in the sense that the sale consideration shall be taken as ` 6,00,000 instead of ` 10,00,000 as Sec. 50CA is not applicable in respect of quoted shares.

4. Premium on Issue of Shares by Closely held Company[Sec. 56(2)(viib)]

Where a closely held company receives in any previous year, from any person, being a resident, any consideration for issue of shares, which exceeds the face value of such shares; then the aggregate consideration received by the company as reduced by the FMV of the shares shall be ‘Income from other sources’ in the hands of the company.

Provided that this clause shall not apply where the consideration for issue of shares is received:

(a) by a venture capital undertaking from a venture capital company or a venture capital fund or a specified fund; or

(b) by a company from a class or classes of persons as may be notified by the Central Government.

Notification No. 13/2019 dated 05.03.2019 [w.e.f. 09.02.2019]:

In exercise of the powers provided in clause (b) above, the Central Government has notified that this section shall not apply to such Startups which fulfils the following conditions:

(i) It has been recognized by the Department for Promotion of Industry and Internal Trade as startup;

(ii) Aggregate of paid up capital and share premium after issue or proposed issue of shares shall not exceed ` 25 crores, excluding the paid up capital and share premium in respect of shares issued to:

(a) non-resident,

(b) venture capital company or venture capital fund,

(c) Specified Company i.e. a company whose shares are frequently traded and whose net worth on the last date of financial year preceding the year in which shares are issued exceeds ` 100 crores or turnover for the financial year preceding the year in which shares are issued exceeds ` 250 crores.

(iii) It has not invested in any of the following assets for 7 years from the end of the latest financial year in which shares are issued at premium:

(a) building or land appurtenant thereto, being a residential house, other than that which is used renting or to be held as stock-in-trade, in the ordinary course of business;

(b) land or building, or both, not being a residential house, other than that occupied for business or used for renting or to be held as stock-in trade, in the ordinary course of business;

(c) loans and advances, other than loans or advances extended in the ordinary course of business where the lending of money is substantial part of the business;

(d) capital contribution made to any other entity;

(e) shares and securities;

(f) motor vehicle, aircraft, yacht or any other mode of transport, the actual cost of which exceeds ` 10 lakhs, other than that held for the purpose of plying, hiring, leasing or as stock-in-trade, in the ordinary course of business;

(g) jewellery other than that held as stock-in-trade in the ordinary course of business;

(h) any other asset, whether in the nature of capital asset or otherwise, of the nature specified in section 56(2)(vii)(d)(iv) to (ix) i.e., archaeological collections, drawings, paintings, sculptures, any work of art or bullion.

Meaning of Startup

A company would be considered as Start-up if it satisfies the following conditions:

-

- It would be considered as startup upto 10 years from the date of incorporation/registration, if it is incorporated as a private limited company.

- Turnover for any of the financial years since incorporation/registration has not exceeded ` 100 crores.

- The company is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

However, a private limited company shall not be considered a ‘Startup’, if it formed by splitting up or reconstruction of an existing business. This notification shall be deemed to have come into effect from 19.02.2019.

Non-fulfilment of conditions specified in notification:

Provided further that where this clause has not been applied to a company on account of fulfilment of conditions specified in the notification issued above and such company fails to comply with any of those conditions, then, any consideration received for issue of share that exceeds the FMV of such share shall be deemed to be the income of that company chargeable to tax for the previous year in which such failure has taken place and, it shall also be deemed that the company has under-reported the income in consequence of misreporting referred to in Sec. 270A(8) and 270A(9) of the said previous year.

FMV of the shares shall be the higher value of following:

(i) Value determined in accordance with the prescribed method; or

(ii) Value substantiated by the company to the satisfaction of the Assessing Officer, based on the value, (on the date of issue of shares) of its assets, including intangible assets being goodwill, know-how, patents, copyrights, trademarks, licenses, franchises or any other business or commercial rights of similar nature.

‘Specified fund’ means a fund established or incorporated in India in the form of a trust or a company or a LLP or a body corporate which has been granted a certificate of registration as a Category I or a Category II Alternative Investment Fund and is regulated under the SEBI (Alternative Investment Fund) Regulations, 2012 made under the SEBI Act, 1992.

‘Venture capital company’, ‘venture capital fund’ and ‘venture capital undertaking’ shall have the meanings respectively assigned to them in section 10(23FB).

| Note: The section applies only if a closely held company issues shares at a premium. This section does not apply if a widely held company issues shares at a premium. The reason is that SEBI approves the price at which shares are issued by a widely held company. |

5. Determination of Fair Market Value (FMV) [Rule 11UA]

For the purposes of section 56 of the Act, the FMV of a property, other than immovable property, shall be determined in the following manner, namely:

(a) Valuation of Jewellery:-

(i) FMV of jewellery shall be estimated to be the price which such jewellery would fetch if sold in the open market on the valuation date;

(ii) in case the jewellery is received by way of purchase on the valuation date, from a registered dealer, the invoice value of the jewellery shall be the FMV;

(iii) In case the jewellery is received by any other mode and the value of the jewellery exceeds ` 50,000, then assessee may obtain the report of registered valuer in respect of the price it would fetch if sold in the open market on the valuation date;

Although this Rule has not been amended after Finance Act, 2010, yet bullion should also be valued in the same manner as jewellery.

Practical Question:

(i) An assessee purchased diamond from a jeweller registered under GST for ` 25 lakhs. According to the Assessing Officer, the FMV of the Diamond is ` 30 lakhs. Whether ` 5 lakhs shall be taxable in the hands of the assessee?

(ii) Would your answer change in case if the diamond is purchased from a jeweller who is not registered under the GST?

Solution:

(i) No, as per Rule 11UA, if the assessee purchases diamond from the jeweller registered under GST, then the invoice value shall be considered as the FMV. Therefore, FMV shall be ` 25 lakhs and since assessee purchased the jewellery for ` 25 lakh, no income will be charged under section 56(2)(x).

(ii) Yes, if ` 30 lakhs is the price that the diamond will fetch, if sold in the open market, then ` 30 lakhs shall be taken as the FMV. If assessee purchased diamond for ` 25 lakhs, then ` 5 lakhs shall be charged as ‘Income from other sources’ u/s 56(2)(x). The assessee can determine the FMV of diamond himself or obtain report of registered valuer.

(b) Valuation of archaeological collections, drawings, paintings, sculptures or any work of art:

(i) FMV of archaeological collections, drawings, paintings, sculptures or any work of art (hereinafter referred as artistic work) shall be estimated to be the price which it would fetch if sold in the open market on the valuation date;

(ii) in case the artistic work is received by way of purchase on the valuation date, from a registered dealer, the invoice value of the artistic work shall be the FMV;

(iii) in case the artistic work is received by any other mode and the value of the artistic work exceeds ` 50,000, then assessee may obtain the report of registered valuer in respect of the price it would fetch if sold in the open market on the valuation date;

(c) Valuation of shares and securities:

(1) FMV of quoted shares and securities shall be determined in the following manner, namely:-

(i) if the quoted shares and securities are received by way of transaction carried out through any recognized stock exchange, the FMV of such shares and securities shall be the transaction value as recorded in such stock exchange;

(ii) if such quoted shares and securities are received by way of transaction carried out other than through any recognized stock exchange, the FMV of such shares and securities shall be:

-

-

-

- the lowest price of such shares and securities quoted on any recognized stock exchange on the valuation date, and

- the lowest price of such shares and securities on any recognized stock exchange on a date immediately preceding the valuation date when such shares and securities were traded on such stock exchange, in cases where on the valuation date there is no trading in such shares and securities on any recognized stock exchange;

-

-

(2) FMV of unquoted equity shares shall be the value, on the valuation date, of such unquoted equity shares determined as under:

| The FMV of unquoted equity shares = | (A + B + C + D – L) x (PV) | |

| (PE) |

where,

| A = | Book value of ALL the assets (other than jewellery, artistic work, shares, securities and immovable property) in the balance-sheet as reduced by- |

-

- any amount of income tax paid, if any, less the amount of income-tax refund claimed, if any;

- any amount shown as asset including the unamortized amount of deferred expenditure which does not represent the value of any asset;

| B = | The price which the jewellery and artistic work would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer; |

| C = | FMV of shares and securities as determined in the manner provided in this rule; |

| D = | The value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property; |

| L = | Book value of liabilities shown in the balance-sheet, but not including the following amounts, namely:- |

(i) the paid-up equity capital;

(ii) the amount set apart for payment of dividends on preference shares and equity shares where such dividends have been declared in the AGM after the date of transfer;

(iii) reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

(iv) any amount representing provision for taxation, other than the amount of income-tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

(v) any amount representing provisions made for meeting liabilities, other than ascertained liabilities,

(vi) any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares;

PE = total amount of paid up equity share capital as shown in the balance-sheet;

PV = the paid up value of equity shares received as per provisions of section 56(2)(x).

(c) FMV of unquoted shares and securities other than equity shares in a company which are not listed in any recognized stock exchange shall be estimated to be the price it would fetch if sold in the open market on the valuation date and the assessee may obtain report from a merchant banker in respect of such valuation.

6. Bond Washing Transactions [Sec. 94(1), (2)]

A bond-washing transaction is a transaction where securities are sold some time before the due date of interest and reacquired after the due date is over.

This practice may be adopted by an assessee in the higher tax slab to avoid tax by transferring the securities to their relatives/friends in the lower tax slab just before the due date of payment of interest.

In order to discourage such practice, section 94(1) provides that where the owner of a security transfers the security just before the due date of interest and buys back the same immediately after the due date and interest is received by the transferee, such interest income will be deemed to be the income of the transferor and would be taxable in his hands.

In order to prevent the practice of sale of securities-cum-interest, section 94(2) provides that if an assessee who has beneficial interest in securities sells such securities in such a manner that either no income is received or income received is less than the sum he would have received if such interest had accrued from day to day, then income from such securities for the whole year would be deemed to be the income of the assessee.

However, sec. 94(3) provides that the sec. 94(1) or 94(2) are, not applicable, if the owner proves that:-

(a) there has been no avoidance of income-tax; or

(b) the avoidance of income-tax was exceptional and not systematic and that there was no avoidance of income tax by such a transaction in any of the three preceding years.

7. Interest Stripping [Sec. 94(7)]

Where –

(a) any person buys or acquires any securities or units within a period of 3 months prior to the record date;

(b) such person sells or transfers such securities or units within a period of 3 months (9 months for units) after the record date;

(c) the income on such securities or units received or receivable by such person is exempt,

then, the loss, if any, arising on account of such purchase and sale of securities or units, to the extent such loss does not exceed the amount of income received or receivable on such securities or units, shall be ignored for the purpose of computing his income chargeable to tax.

Practical Question: Vishal purchased on June 25, 2021, 2,000 bonds of ` 10 each in X Ltd. @ ` 45.45. He transfers 1,600 bonds @ ` 36 per share on November 25, 2021 and remaining 400 bonds are transferred on December 25, 2021 @ ` 20 per share. Interest is payable @ 7% every year on 15th September and Vishal receives interest of ` 10,000 which is tax free. During the year 2021-22, he had long term capital gain of ` 65,500 on sale of silver. Determine the tax implications.

Solution:

| 1,600 Bonds (`) | 400 bonds (`) | |

| Sale consideration | 57,600 | 8,000 |

| Less: Cost of acquisition | 72,720 | 18,180 |

| Short term capital loss | (15,120) | (10,180) |

| Interest | 8,000 | 2,000 |

| Whether section 94(7) is applicable | Yes | No |

Computation of income:

| ` | |

| Long term capital gain on sale of silver | 65,500 |

| Less: Short term capital loss on sale of 1,600 bonds [` 15,120 – ` 8,000] | (7,120) |

| Short term capital loss on sale of 400 bonds | (10,180) |

| Long term capital gain | 48,200 |

8. Bonus Stripping [Sec. 94(8)]

Where-

(a) any person buys or acquires any units within a period of 3 months prior to the record date;

(b) such person is allotted additional units without any payment on the basis of holding of such units on such date;

(c) Such person sells or transfers all or any of the units referred to in clause (a) within a period of 9 months after such date while continuing to hold all or any of the additional units referred to in clause (b);

then, the loss, if any, arising to him on account of such purchase and sale of all or any of such units shall be ignored for the purposes of computing his income chargeable to tax and notwithstanding anything contained in any other provisions of this Act, the amount of loss so ignored shall be deemed to be the cost of purchase or acquisition of such additional units referred to in clause (b) as are held by him on the date of such sale or such transfer.

Explanation:

‘Record date’ means such date as may be fixed by-

-

- a Mutual Fund or the Administrator of the specified undertaking or the specified company as referred to in the Explanation to clause (35) of section 10, for the purposes of entitlement of the holder of the units to receiving income, or additional unit without any consideration; or

- a company for the purposes of entitlement of the holder of the securities to receive interest income.

9. Analysis of Section 94(7) and Section 94(8)

Practical Question: Pranay purchased 2,000 units of SBI mutual fund (Debt based) [Face Value: ` 10] on 15.04.2021 @ ` 23 per unit. He gets 1,000 bonus units on record date. Date of allotment of bonus units (record date): 10.06.2021 in the ratio of 1:2 i.e. a person holding 2 units will get 1 Bonus unit.

Compute the capital gains for the A.Y. 2022-23 and A.Y. 2023-24 for each of the below separate cases:

| Separate Cases | Transfer of Original units | Transfer of Bonus Units | ||||

| No. of Units | Date of Transfer | Rate ` | No. of Units | Date of Transfer | Rate ` | |

| A | 1,400 | 08.02.2022 | 26 | 400 | 05.06.2022 | 14 |

| B | 1,800 | 15.02.2022 | 18 | 200 | 30.04.2022 | 17 |

| C | 1,400 | 14.03.2022 | 14 | 800 | 02.05.2022 | 13 |

| D | 800 | 01.02.2022 | 24 | 400 | 05.12.2022 | 15 |

| 400 | 02.02.2022 | 19 | ||||

Solution:

| Case A ` | Case B ` | Case C ` | Case D ` | ||

| Transfer of Original Units | |||||

| Sale Consideration | 36,400 | 32,400 | 19,600 | 7,600 | 19,200 |

| Less: Cost of Acquisition | 32,200 | 41,400 | 32,200 | 9,200 | 18,400 |

| Short Term Capital Gain/(Loss) | 4,200 | (9,000) | (12,600) | (1,600) | 800 |

| Short term capital loss to be ignored for set-off (a) | N.A [Note-1] | 9,000 | N.A [Note-2] | 1,600 | |

| Bonus units held after above transaction (b) | 1,000 | 1,000 | 1,000 | 1,000 | |

| Cost of acquisition of Bonus units (per unit) (a)/(b) | NIL | 9.0 | NIL | 1.6 | |

| Transfer of Bonus units | |||||

| Sale Consideration | 5,600 | 3,400 | 10,400 | 6,000 | |

| Less: Cost of Acquisition | Nil | 1,800 | Nil | 640 | |

| Short Term Capital Gain taxable in A.Y. 2023-24 | 5,600 | 1,600 | 10,400 | 5,360 | |

Note 1: Capital gain shall not be considered for the above purpose.

Note 2: As the original units are transferred after 9 months form the record date, provision of section 94(8) shall not be applicable and the loss arising on transfer can be set-off against any other capital gain in A.Y. 2023-24 or carry forward, if could not be set-off.

10. Cash Credits [Sec. 68]

Where any sum is found credited in the books of an assessee maintained for any previous year, and

(a) the assessee offers no explanation about the nature and source thereof; or,

(b) the explanation offered by him is not, in the opinion of the Assessing Officer, satisfactory,

the sum so credited may be charged to income-tax as the income of the assessee of that previous year.

Provided that where the assessee is a company, not being a company in which the public are substantially interested and the sum so credited consists of share application money, share capital, share premium or any such amount by whatever name called, any explanation offered by such assessee-company shall be deemed to be not satisfactory, unless:

(a) the person, being a resident in whose name such credit is recorded in the books of such company also offers an explanation about the nature and source of such sum so credited; and

(b) such explanation in the opinion of the Assessing Officer aforesaid has been found to be satisfactory:

Provided further that nothing contained in the first proviso shall apply if the person, in whose name the sum referred to therein is recorded, is a venture capital fund or a venture capital company as referred to in section 10(23FB).

Note: The above proviso to section 68 is not applicable to money received

-

- from Venture Capital Company and Venture Capital Fund since they are regulated by SEBI; and

- from non-residents since money received from non-residents is regulated by FEMA and rules of RBI.

CIT v. M. Venkateswara Rao (2015) 370 ITR 212 (T & AP)

Capital contribution of the individual partners credited to their accounts in the books of the firm cannot be taxed as cash credit in the hands of the firm, even where the partners admitting their capital contribution failed to explain satisfactorily the source of receipt in their individual hands.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

I appreciate you sharing information on Tax on Conversion of Unaccounted Money . this site was quite beneficial in many aspects; thank you for informing us.