40+ FAQs on Auditing & Auditors

- Blog|Account & Audit|

- 26 Min Read

- By Taxmann

- |

- Last Updated on 10 July, 2023

FAQ 1: What is an Audit?

Audit is an independent examination of financial information of an entity, irrespective of its form, nature, and objective, with a view to express an opinion on such financial information

Dive Deeper:

Internal Audit – A Quick Overview

FAQ 2: What is the financial information in financial statements?

Financial information is often contained in financial statements.

Broadly speaking ‘Financial statements’ are a set of documents which include the following (along with the purpose of each statement).

| Document Name | It Presents | |

| 1. | Balance sheet/Statement of affairs | The financial position of the entity as on a particular date (i.e., generally 31st Mar); |

| 2. | Statement of Profit and Loss/Income Statement | The financial result of its operations during the period; |

| 3. | Cash Flow Statement | The movement (in and out) of cash and cash equivalents during the period; |

| 4. | Statement of Changes in Equity | The movement of Share capital and Reserves & Surplus during the period; |

| 5. | Notes to Accounts | (a) The Significant accounting policies and procedures adopted in preparation and presentation of above financial statements;

(b) Details of the items presented in the financial statements; Say in Balance sheet – you may find just PPE – 1,000 Crore. But in the notes – the entity explains what are included in PPE in detail. |

Financial statements do NOT include the following statements

-

- Director’s Report;

- Statement by the Chairman;

- Discussion and analysis by management.

FAQ 3: What is General purpose financial statements and Special purpose financial statements?

Financial statements which are used by varied users like creditors, lenders, government, shareholders are known as general purpose financial statements.

However, if financial statements are prepared only for a specific purpose, such financial statements are known as special purpose financial statements.

For example, financial statements prepared for the purpose of Bankers on Cash basis;

FAQ 4: Who prepares ‘Financial statements?

As per section 129 of the Companies Act, 2013 – Every year, Board of Directors shall submit the financial statements to the members in the Annual General Meeting (AGM);

Governing body of the entity is responsible to prepare financial statements.

For Example

| Form of Business Organization | Person responsible to prepare FS |

| Company | BOD |

| Partnership Firm | Partners |

| Trust | Trustees |

| Sole proprietorship | Proprietor |

As you know governing body changes from entity to entity, hence from now onwards – Instead of naming them BOD, partners, trustees, etc.

‘Charged’ means – who is empowered to govern.

FAQ 5: Why to audit “from the point view of a company”?

-

- As you know – Members/Shareholders of the company are the real owners of the company;

- As the members of the company cannot run the business together (especially listed companies), they appoint Board of Directors;

- BOD is ultimately responsible to the members. BOD creates the hierarchy, establishes the controls and runs the business through the management;

- BOD is responsible to prepare the financial statements. (Just imagine, how to ensure whether these Statements give true and fair view?)

- To check and report on the financial statements, members of the company appoint an auditor. In the case of a company, it is a statutory requirement U/s 139 of the Companies Act, 2013 to appoint an auditor– hence, such auditor is called “Statutory auditor”.

FAQ 6: Is there any difference between “Those Charged with Governance (TWCG)” and “Management”?

Board of Directors are the TCWG in case of a company – They take all the operating and financial decisions of the company in the board meetings. BOD includes Managing director, Whole time directors (Executive directors) & Part time directors (non-Executive directors).

Who executes the decisions taken in the Board?

This execution work is performed by Management i.e., one level below TCWG. Generally, management includes ALL Wholetime directors (executive directors) and others like Chief executive officer, Chief operating officer, etc.

Generally, in case of small companies – There won’t be any difference between TCWG & Management as they do both the jobs i.e., decision making as well as execution;

Practically, though TCWG is responsible to prepare financial statements, it is – management who prepares the financial statements under the guidance of TCWG.

FAQ 7: Who are the stakeholders of an entity and how are financials useful to them?

Ans:

The following table explains the usefulness from the point of view of different stakeholders:

| Stakeholders/Users | Purpose |

| Proprietor/Shareholders | To analyse performance, profitability and financial position of the entity and accordingly decide whether to hold/sell the shares (in case of shareholders); |

| Management | For day-to-day decision-making and performance evaluation; |

| Employees | To assess their growth prospects as well as bonus entitlement; And ESOPs if they are based on performance; |

| Lenders (Give money) | To determine the financial position of the company to decide whether to given loan or not? It also helps them determine the ability of the entity to make the payments on debts by calculating debt service coverage ratio, interest coverage ratio etc. |

| Suppliers (Provider goods/services) | To determine the credit worthiness of the company in order to give credit; |

| Customers | To know the general business viability before entering into long term contracts and arrangements; |

| Government | To ensure prompt collection of direct and indirect tax revenues and to decide eligibility for any government grants; |

| Prospective Investor | To assess the solvency and future prospects of the organization. Decides whether to buy the shares or not? |

FAQ 8: What are other Responsibilities of Management of the entity?

Besides preparation of financial statements, management’s other responsibilities include:

-

- The maintenance of adequate accounting records and internal controls (will discuss this term in detail in next chapter).

- The selection and application of accounting policies.

- The safeguarding of the assets of the enterprise.

- Compliance with applicable laws and regulations.

*Entity irrespective of its form, nature and objective

As per the definition

Independent examination of financial information of an “entity”.

It means any entity – irrespective of its form – means it can be a Company, Partnership firm, Limited Liability partnership (LLP), a Trust, a Society, etc.

Irrespective of Nature of business – it can be a manufacturer, service provider, software, real estate, etc.

Irrespective of Objective – means it can be a profit oriented OR Non-profit-oriented organisation.

*Independent Examination

The auditor should be independent.

FAQ 9: What is the “Concept of Auditor’s Independence”?

-

- There is no definition for independence;

- Independence is a state of mind in which one feels free & it is an attitude of mind.

- Audit objective is to express an opinion on financial information; Auditor should be in a position to express his opinion on the financial statements; Hence, independence is a prime requisite for the auditor;

- The judgment of the person is NOT subject to the wishes or directions of another person who might have engaged him and also not subject to his own interest;

- The Companies Act, 2013 – safeguards the auditor’s independence with provisions like

-

-

- Section 141(3) – Auditor should not hold any share in the company (If the auditor has interest in the company, he cannot perform his duties independently);

- Section 141(3) – Auditor or his partners or his relative cannot be officers of the company;

- Section 140 (1) – Auditor cannot be removed by the company without prior permission from the Central Government and passing special resolution;

-

-

- ICAI issued a guidance note on Independence; as per the guidance note –

-

-

- Auditor should be independent and appear to be independent; (Just being independent is not sufficient and the users of financial statements should also feel that auditor is independent – Otherwise Auditor will lose public confidence);

- These laws may be relaxed or strengthened but the quality of independence should remain unchanged. (It means even if there are loopholes in the law – auditor should ensure that he independent);

-

Considering the above points, auditor should accept the work only when there are no threats to independence;

FAQ 10. How are ‘independence of mind’ and ‘independence in appearance’ interlinked perspectives of Independence of auditors?

“Independence” implies that the judgment of a person is not subordinate to the wishes or direction of another person who might have engaged him. The auditor should be independent of the entity subject to the audit.

(a) Independence of mind

The state of mind that permits the provision of an opinion without being affected by influences allowing an individual to act with integrity, and exercise objectivity and professional skepticism; and

(b) Independence in appearance

The avoidance of facts and circumstances that are so significant that a third party would reasonably conclude an auditor’s integrity, objectivity or professional skepticism had been compromised. Independence of the auditor has not only to exist in fact, but also appear to so exist to all reasonable persons.

FAQ 11. What is the objective of Audit?

Audit (examination) is conducted with an objective to express an opinion on the financial statements as to whether financial statements:

-

- prepared by the management give true and fair view of financial position and performance;

- comply with the applicable Financial Reporting Framework; (explained below);

- are FREE from material misstatements, whether due to Fraud or Error

FAQ 12. What are the guiding principles for Chartered Accountants to remain independent?

The Chartered Accountant has a responsibility to remain independent by taking into account the context in which they practice, the threats to independence and the safeguards available to eliminate the threats.

The following are the guiding principles in this regard:—

-

- For the public to have confidence in the quality of audit, it is essential that auditors should always be and appears to be independent of the entities that they are auditing.

- In the case of audit, the key fundamental principles are integrity, objectivity and professional skepticism, which necessarily require the auditor to be independent.

- Before taking on any work, an auditor must conscientiously consider whether it involves threats to his independence.

- When such threats exist, the auditor should either desist from the task or put in place safeguards that eliminate them.

- If the auditor is unable to fully implement credible and adequate safeguards, then he must not accept the work.

FAQ 13: What is the Audit opinion/Audit Report?

Auditor expresses his opinion in writing – that is called as “Audit report”.

This opinion is expressed in a prescribed format as provided in SA 700/SA 705/SA 706, etc. or for tax audits, it is prescribed by the Income-tax Act, 1961- Form 3CD.

FAQ 14: What is the “Concept of True and Fair view”?

True and fair view is NOT defined in either accounting or under the Companies Act, 2013;

We should understand this based on general conclusions/judgments of the courts, etc.

| True means | Arithmetical accuracy, factual validity and completeness of the recording of the transaction and events; Complied with Financial reporting framework; |

| Fair means | Proper classification, summarization and disclosure as per regulatory requirements; No bias; presentation in FS shall reflect the economic substance rather than their legal form (Substance over form – as per AS 1) |

Look into the following examples to get an idea :

-

- Company constructed an additional floor with Rs. 40 Lac and shown it as an expense in Profit and Loss in the same year;

- Company has incurred loss of Rs. 25 Lacs due to fire at godown and company has shown such losses under miscellaneous expenses in the Balance sheet;

- Secured loan received from state bank of India amounting Rs. 50 Lacs by giving the building as security but not disclosed appropriately in the financial statements;

- As there is loss in the CY, depreciation Rs. 25 Lacs has not been provided.

All the above points do not give true and fair view and it misleads the users of financial statements;

True and fair is mentioned in some of the sections of the Companies Act, 2013:

-

- Sec. 128 – Every company shall maintain proper books of account. Proper books of Account means preparing books of account by following Double entry system of accounting and Accrual basis;

- Sec 129 – All the matters of financial statements are to be disclosed in accordance with Schedule III of the Companies Act i.e., the Balance Sheet and Profit and Loss account should be prepared in accordance with Part I and Part II of Schedule III respectively;

- Sec. 129 – Financial statements should comply with Accounting standards so as to provide true and fair view;

- True and Fair view is a matter of judgment and depends on facts and circumstances of each case. To ensure T&F view the Auditor has to ensure the following:

-

-

- The assets are neither undervalued nor overvalued;

- No material asset OR liability is omitted;

- The charge on assets (if any) is properly disclosed;

- All the matters of financial statements are disclosed in accordance with Schedule III of the Companies Act;

- Accounting principles are consistently followed (AS 1);

- All unusual or exceptional items are disclosed appropriately (AS 5)

-

FAQ 15: Is there difference between ‘Opinion’ and ‘Certificate’?

Opinion means one’s point of view towards any given fact; One person’s opinion may vary with another person’s opinion; it involves professional judgments/estimations/ assumptions, etc. In case of opinion, accuracy is not possible – Only fairness is possible;

Certificate means establishing a given fact. Certificate confirms the correctness/ accuracy. It cannot be different for two persons and if certificate goes wrong – issuer of certificate is punishable. There is no involvement of professional judgment;

“Auditor usually issues opinion and does not certify financial health of an organization.”

FAQ 16: What is “Financial Reporting Framework” (FRF)?

In simple words – we can call it as Indian GAAP (Generally accepted accounting principles);

In general, Financial reporting framework includes the following :

(a) Accounting standards/Ind AS;

(b) Statutes, regulations like Schedule III of the Companies Act, 2013 and Ministry of Corporate Affairs (MCA) notifications;

(c) Court decisions;

(d) Professional and ethical obligations in relation to accounting matters (Guidance notes issued by ICAI);

(e) General and industry practices widely recognised and prevalent; and

(f) Accounting literature;

The financial reporting framework has to be adopted by management and TCWG for the preparation and presentation of the financial statements. The selected framework should be acceptable in view of the nature of the entity and the objective of the financial statements, or that is required by law or regulation.

FAQ 17: What is meant by the term “Misstatement”?

Misstatement is the difference between (a) and (b) below:

(a) The Amount, classification, presentation, or disclosure which is reported in Financial Statements; and

(b) The Amount, classification, presentation, or disclosure that is required to be presented as per the applicable Financial Reporting Framework.

Misstatements can arise from error or fraud.

For Example:

AS 2 “Inventory valuation” (Financial Reporting Framework) requires to follow either FIFO or weighed average method for valuation of inventory; and

If an entity applies LIFO, it would be a departure from what was expected to be followed i.e., FRF. This will result in misstatements.

FAQ 18: Is it the duty of Auditor to detect & correct the frauds & errors?

-

- Fraud may be – ‘Misappropriation of assets’ and ‘Fraudulent reporting’.

- Error is an unintentional mistake. Some of the errors are self-revealing. i.e., they are clearly identifiable.

For example: Partial omission (Trail Balance will not tally). Wrong entries in bank account ledger (BRS will show up the error). Entering a transaction of Mr. X in Mr. Y Account. (When external parties statements are checked, that will not tally). Wrong Entry of Purchase of Furniture in Purchase account. (Physical verification of inventory will show up the difference). - Errors are – Error of omission, Error of commission, Error of Principle, Compensating error.

- The primary responsibility for the prevention & detection of fraud rests with Management & TCWG. It is important that management place a strong emphasis on fraud prevention, which may reduce opportunities for fraud to take place, and fraud deterrence (punishment), which could persuade individuals not to commit fraud. (SA 200)

- When obtaining reasonable assurance, the auditor is responsible for maintaining an attitude of professional skepticism (Explained later) throughout the audit.

- If the auditor can prove with the help of his papers (documentation) that he has followed adequate procedures, he cannot be held responsible for the same. Management will only be held responsible in such cases.

- The liability of the auditor for failure to detect fraud exists only when such failure is clearly due to not exercising reasonable care and skill. If the same cannot be proved, then auditor will not be held responsible.

- Detection & Correction of fraud & error is not the primary duty of the auditor. But if auditor comes across instances of frauds & errors, then it is the part of his audit to suggest the corrective measures to avoid the repetition of such mistakes. (SA 200)

- The auditor also has the responsibility to communicate the misstatement to the management on a timely basis & discuss it and rectify. If management fails to do so, then auditor shall mention the same in his report.

FAQ 19: What are the “Qualities of an Ideal Auditor”?

These may be broadly classified into Professional/Technical Qualities and Personal Qualities.

- Professional/Technical Qualities

(a) He must be a CA in practice, i.e., he must be member of ICAI and he must hold a certificate of practice in India;

(b) He must possess an exhaustive knowledge of accounting; He must have thorough understanding of all accounting principles and techniques;

(c) He should possess thorough and in-depth knowledge of Auditing and Taxation laws;

(d) He must have adequate knowledge of corporate laws and Mercantile laws – he must be going through many agreements in the profession;

(e) He must have a reasonable knowledge of the concepts of financial management, Management accounting, Computers & systems, Economics;

(f) He must have knowledge of the client’s business;

- Personal Qualities:

Auditor should have:

(a) Enquiring mind and analytical approach in his work i.e., Professional skepticism;

(b) Integrity (Honesty);

(c) Good communication skills, both written and oral;

(d) Be tactful (diplomatic) and practical in approach in dealings;

(e) Independence and must not compromise his independence for any material or social gain;

(f) He should be clear and unambiguous in his reporting;

(g) Confidentiality – i.e., he should not disclose the secrets/details of his clients which are acquired during the course of audit unless it is required by the law & with the permission of the client;

FAQ 20: What are the different types of Audit?

(1) Audit required under law:

The organisations which require audit under law are the following:

Companies governed by the Companies Act; Banking companies; other statutory bodies required by their regulators or by specific Act.

(2) Voluntary category

Accounts of proprietary entities, partnership firms, Hindu undivided families, etc. In respect of such accounts, there is no basic legal requirement of audit. Many of such enterprises as a matter of internal rules require audit. Some may be required to get their accounts audited on the directives of Government for various purposes like sanction of grants, loans, etc.

FAQ 21: What are the responsibilities of the Management?

As discussed above, preparation and presentation of financial statements is the responsibility of the Management of the entity and it will be supervised (oversight) by TCWG.

Remember: Audit of financial statements does not relieve the management from their responsibilities;

Responsibilities of Management include:

(a) Preparation and presentation of financial statements; (already discussed above)

(b) Maintenance of adequate accounting records;

(c) Establishment of good internal control systems and ensuring its effectiveness throughout the period;

(d) Compliance of laws and regulations;

(e) Selection and application of appropriate accounting policies;

(f) Safeguarding of the assets of the enterprise; and

(g) Prevention and detection of frauds and errors.

FAQ 22: What are the types of Audit Reports?

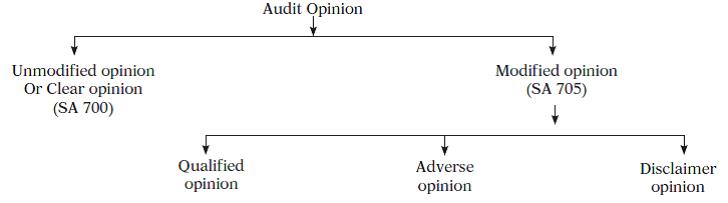

Audit opinions are broadly two types i.e., Unmodified and Modified. Modified opinion is further classified into three i.e., Qualified, Adverse and Disclaimer.

Auditor may form and express ANY ONE of the following opinions in his report.

(1) Unmodified opinion

Where an auditor gives an opinion on the various matters without any reservations/qualifications/material misstatements, it is termed as an unqualified opinion. It means, financial statements give true and fair view in all material respects, comply with financial reporting framework and free from material misstatements either from fraud or errors.

These words will be presented in the unmodified opinion:

“in our opinion and the best of our information and according to the explanations given to us, the Balance Sheet and the Statement of Profit and Loss give a true and fair view of the state of affairs and working results”.

(2) Modified Opinion

(a) Qualified opinion

All items in the financial statements are fine except one or few misstatements which are material which cannot be ignored. It means auditor feels that “he should bring these items to the attention of the stakeholders.”

BUT remember, the effect of these items is NOT pervasive (i.e., Not effecting the financial statements as a whole i.e., confined to a specific area). In simple words, misstatements are material but not pervasive.

For example, the wordings in the audit report would be “Subject to the qualifications, we report that the Balance Sheet shows a true and fair view”.

(b) Adverse (or negative) Opinion

The auditor shall express an adverse opinion when the auditor

-

- Has OBTAINED sufficient appropriate audit evidence regarding misstatement; and

- Concludes that misstatements, individually or in the aggregate, are BOTH MATERIAL AND PERVASIVE to the financial statements. Consider below examples :

- Going concern assumption does not hold good with the entity but it is valuing assets at historical cost instead of at Net realisable value.

- The entity did not consolidate one of its subsidiaries as per AS 21;

In these two cases, the misstatement is not confined to one area of financial statements – hence qualification is not sufficient. It is pervasive that means it effects the financial statements as a whole.

Indirectly, the financial statements as whole are not reliable and doesn’t provide true and fair view;

(c) Disclaimer of opinion

The auditor shall disclaim an opinion when the auditor is :

-

- UNABLE TO OBTAIN sufficient appropriate audit evidence based on which he should be able to express the opinion; and

- Concluded that the possible effects of such undetected misstatements, could be BOTH MATERIAL AND PERVASIVE on the financial statement.

An example of wording of a disclaimer of opinion:

“We have been unable to verify the existence and value of the fixed assets of the company. Hence, we are unable to state whether the Balance Sheet shows a true and fair view”.

Summary of above definitions

| Nature of Matter Giving Rise to the Modification | Auditor’s Judgment about the Pervasiveness of the Effects or Possible Effects on the Financial Statements | |

| Material but Not Pervasive | Material and Pervasive | |

| Financial statements are materially misstated | Qualified opinion | Adverse opinion |

| Inability to obtain sufficient appropriate audit evidence | Qualified opinion | Disclaimer of opinion |

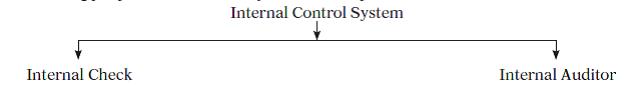

FAQ 23: What is Internal Control System (ICS)?

As you learnt as part of “Management responsibilities” – ICS refers to Internal rules and procedures established by the management for smooth running of the business. Management establishes ICS and monitors the same frequently.

Through a strong ICS – it can avoid errors and frauds that otherwise take place in the company;

For understanding purpose, we can classify ICS into two parts i.e., Internal check and Internal auditor.

“Work of checking day to day transactions which operate continuously as part of the routine system whereby the work of one person is proved independently or is complementary to the work of another, the object being the prevention or early detection of errors or fraud”.

Thus, internal check covers two things:

(a) Work of one person is checked automatically by another person; and

(b) No single person is allowed to carry out transaction from origin to its end.

Internal check is a part of the overall internal control system and operates as a built-in device as far as the staff organisation and job allocation aspects of the control system are concerned.

Simple example to understand:

If you go to a bank for taking a Demand draft – observe there. One person collects money and filled form. Another person ensures that money is received and gets the approval of senior online. Later DD is printed and takes to higher official signature. Now, you will receive the DD after signing on a book.

In the above case, each step of one person is verified by another person.

Internal auditor

-

- Monitoring of the ICS is the duty of the management.

- Management takes the help by appointing an Internal auditor.

- Internal auditor is a professional (he need not be a Qualified Chartered accountant) who visits offices and checks almost 100% of transactions.

- Internal auditor’s scope & remuneration is determined by the management. Scope can be reduced or increased based on understanding. But in case of statutory auditor, Scope of audit is determined by the law and management cannot reduce this scope but they can increase if it is permitted by the law.

FAQ 24: What are the differences between statutory auditor and Internal auditor?

On the basis of function, auditors can be classified into two categories, external auditors and internal auditors

| External/Statutory Auditor | Internal Auditor | |

| Appointment | Appointed by owners of the organization | Appointed by Management, Generally Directors |

| Scope | Determined by the statute, Official Pronouncements of ICAI and Engagement Letter (appointment letter) | Determined by the management |

| Qualification | A Qualified Chartered accountant in practice/Chartered accountant’s firm. | Internal auditor need not be a Qualified Chartered accountant. |

| Approach | His objective is to satisfy himself that the accounts to be presented to the shareholders provide a T&F view | To ensure that the accounting system is efficient, so that accounting information presented to the Management is accurate and discloses all the information that Management requires. |

| Responsible | To the Appointing authority (i.e., SHs) | To the management |

| Independence | Totally Independent | Comparatively Less Independent as appointed by the Management |

| Report submission | To Appointing Authority (i.e., SHs) | To management |

| Format of Report | As prescribed by Law | No prescribed format |

| Is it mandatory? | Yes. It is mandatory to ALL companies as per Sec. 139 of the Companies Act, 2013; | It is mandatory only for prescribed companies’ U/s 138 of the Companies Act, 2013 BUT NOT for all companies. |

FAQ 25: What are the differences between Accounting and Auditing (Statutory)?

| Points | Accounting | Auditing |

| Meaning | It includes recording of all the day to day transactions in the books of account leading to preparation of financial statements to get meaningful information | It is critical examination of the transactions recorded in the books of account. |

| Objects | The objective is to determine the operational results | To express an opinion on True and fairness of financial statements; |

| Commencement | Accounting begins when book-keeping ends. | Auditing begins when accounting ends. |

| Scope | It involves maintenance of books of account. It does not go beyond books of account. | It depends upon the agreement or upon the provisions of law and may go beyond books of account. |

| Qualification | An accountant needs not be a Qualified chartered accountant; | An auditor must be a Qualified Chartered accountant; (for statutory audit) |

| Reporting | An accountant does not submit any report | An auditor has to submit report in the prescribed format. |

| Status | An accountant is an employee of an organization | An auditor is not an employee of an organization. |

FAQ 26: What is the objective of audit? Is auditor responsible to find out Frauds in the entity?

As per SA-200 the overall objectives of the auditor are:

(a) To obtain REASONABLE ASSURANCE about whether the financial statements as a whole are free from material misstatement; and (reasonable assurance is explained below)

(b) To report on the financial statements and communicate as required by the SAs, in accordance with the auditor’s findings.

Points to remember

-

- Primary objective of Auditor’s appointment is not to find the frauds and errors;

- But auditor has to give reasonable assurance that financial statements are free from material misstatement.\

- While performing audit, he should bear in mind the possibility of existence of fraud or other irregularities in the accounts.

- “The Auditor is only a watchdog, not a bloodhound”.

- Where the auditor has any suspicion that some fraud or error may exist, which could result in material misstatements, he should extend his audit procedures to confirm or dispel his suspicion.

The Auditor has to consider the effect of an error or fraud on the financial statements. He shall draw the attention of the management and/or the appointing authority about such error or fraud through his report and may need to report the same to Central government (as per the Companies Act, 2013).

FAQ 27: Why reasonable assurance only and why NOT absolute assurance?

Reasonable Assurance means high level of assurance but NOT ABSOLUTE assurance (Perfect assurance). Auditor cannot express absolute assurance because of Inherent limitations in the audit process. For example, auditor relies on sample testing and not 100% testing, etc.

Remember:

-

- Auditor’s opinion does not give an assurance as to the future viability of the entity; (Say, when auditor gives clear opinion, it only means that financial statements are okay but it does not mean that the entity will sustain forever).

- Auditor’s opinion does not give an assurance of the efficiency nor the effectiveness of management.

FAQ 28: What is meant by “Assurance”?

Dictionary meaning of assurance is – a positive declaration intended to give confidence. As per ICAI “Assurance Engagement” means.

-

- an engagement in which

- a practitioner expresses a conclusion (explained below)

- designed to increase confidence of the intended users other than the responsible party (i.e., preparers of financial statements)

- About the outcome of the evaluation or measurement of a subject matter against criteria.

In simple words, it refers to giving assurance (confidence) as to whether financial statements prepared by the TCWG provide True and fair view OR not, by an independent auditor to the users of financial statements.

FAQ 29: What is meant by Auditor’s “CONCLUSION”?

-

- Auditor obtains audit evidence on every item of financial statements by performing audit procedures.

- Based on the audit evidence obtained, he decides whether financial statements give true and fair view or not;

- Such conclusions are known as audit conclusions;

FAQ 30: What are the inherent limitations to audit?

As discussed above, an auditor cannot obtain absolute assurance that material misstatements in the financial statements will be detected because of the inherent limitations of an audit.

These inherent limitations (inbuilt restrictions/limits) of audit are:

(a) Test Check: In general, auditor performs test audit (i.e., less than 100%) not full audit. This may be due to lack of time or excessive cost or he believes that sample test may be suitable based on his professional judgment. By performing test audit, it is not possible to provide absolute assurance (perfect).

(b) Exercise of judgment: Auditor applies a lot of professional judgment as discussed above in deciding the extent of audit procedures and moreover, preparation of financial statements also involves a lot of estimations and judgments made by management – In this case absoluteness is not possible to achieve.

(c) Persuasive (believable) audit evidence rather than conclusive: Persuasive means giving evidence to believe; whereas, conclusive means 100% accurate. Based on persuasive evidence, auditor can draw only reasonable conclusion but not absolute evidence. Therefore, absolute certainty in auditing is rarely attainable. Say an entity recorded expenses, auditor may agree to it based on the invoices received because it is believable. But it may be a dummy invoice created by the management.

(d) Inherent Limitations of Internal Controls: Generally, auditor depends on an effective system of internal control. If auditor comes to a conclusion that ICS is strong, he performs less substantive procedures, but the ICS also suffers from certain inherent limitations like human error, collusion among employees, fraud by management and management overriding the controls. Example for overriding controls, by directing subordinates to record transactions incorrectly or to conceal them, or by suppressing information relating to transactions.

FAQ 31: What is Audit Evidence?

Audit evidence is an Information used by the Auditor for arriving at the conclusions. These conclusions will be the basis for the opinion to be expressed.

FAQ 32: What type of audit evidence to be obtained by the auditor?

Auditor should obtain “Sufficient and Appropriate audit evidence” by performing audit procedures.

-

- Sufficiency of Audit Evidence is the measure of the quantity of Audit Evidence. The quantity of the Audit Evidence is based on the risk of material misstatement and also by the quality of such Audit Evidence.

- Appropriateness of Audit Evidence is the measure of the QUALITY of Audit Evidence i.e., its relevance and its reliability;

These two words are interrelated and interdependent. If the evidence is more reliable, less evidence is also sufficient.

For Example

To conclude that fixed assets appearing in the Financial Statement provide true and fair view – auditor need to obtain Audit Evidence – by performing physical verification, valuation based on AS 10, depreciation calculation, and presentation and disclosure is based on Accounting standards and Schedule III of the Companies Act, 2013.

FAQ 33: What are “audit procedures”?

Auditor procedures are audit methods to obtain sufficient and appropriate audit evidence.

Audit procedures are broadly divided into TWO types:

1. Compliance procedures – These are tests on Internal control system (ICS). Auditor tests the ICS before relying upon it. Based on the strength of ICS, auditor decides what extent of substantive procedures are to be performed;

2. Substantive procedures – This further divided into (a) Test of details; and (b) Analytical procedures. This includes inspection, observation, recomputation, external confirmation, analysis like comparing CY with PY, Trend analysis, etc.

FAQ 34: What is Nature, timing and extent of audit procedures (NTE)?

Auditor decides Nature, timing and extent of audit procedures based on the materiality of the item, risks involved and his past experience. This is pure professional judgment of auditor.

Nature of audit procedures: What type of procedures to be selected i.e., compliance, substantive, inspection, observation, confirmation, etc.

Timing of audit procedures: When to perform the above work? & How much time to spend on that?

Extent of audit procedures: How much to perform? i.e., whether 100% checking, Sample selection or selective basis.

FAQ 35: What are the differences between “Auditing” and “Investigation”?

Investigator’s primary objective is to find out the frauds/irregularities. They start their work with suspicious mind whereas auditor won’t start with suspicious mind. Examples of investigators are CBI, CID, etc.

| Points | Auditing | Investigation |

| Objective | The objective is to find out whether Balance Sheet and Statement of Profit and Loss exhibit a T&F view of business | It is undertaken to know the essential facts about a matter under enquiry. It is done to attain some special purpose. |

| Period | It usually covers one accounting year. | It may cover more than one accounting year. |

| Conducted for | For various users. | It is carried out on behalf of any interested party. E.g., Govt., Members; |

| Scope | Restricted to Balance Sheet and Statement of Profit and Loss | It is wider in scope. It may be carried out beyond Balance Sheet. |

| Compulsion | Audit is legally compulsory for companies | It is voluntary. It is required under certain circumstances. |

| When is it conducted | At the end of the year. | Any time in case of suspicion; |

| Form of Report | Prescribed by law and SAs | Not prescribed. |

| Appointment | Normally owners appoint the auditors | Even third parties can appoint investigators. |

| Qualification | Must be a practicing Chartered Accountant. | Not necessarily a CA. |

| Rework | Re-Audit is not generally undertaken. | Re-investigation may be undertaken. If needed. |

FAQ 36: How to deal with material misstatements due to fraud in the financial statements?

- Because of the limitations of an audit, there is an unavoidable risk that some material misstatements of the financial statements may not be detected, even though the audit is properly planned and performed in accordance with SAs.

- Accordingly, the subsequent discovery of a material misstatement of the financial statements resulting from fraud or error does not by itself indicate a failure to conduct an audit in accordance with SAs.

- However, the inherent limitations of an audit are not a justification for the auditor to be satisfied with less-than-persuasive audit evidence.

- Whether the auditor has performed an audit in accordance with SAs is determined by the audit procedures performed in the circumstances, the sufficiency and appropriateness of the audit evidence obtained as a result thereof and the suitability of the auditor’s report based on an evaluation of that evidence in light of the overall objectives of the auditor.

FAQ 37: What are the “Advantages of independent Audit”?

The main objective of audit is to ensure the financial statements are reliable and useful to the users of financial statements; Apart from this, there are other advantages of audit even though audit is not mandatory as per the law for the entity.

-

- It safeguards the financial interest of persons i.e., partners or shareholders (who are not taking part in management).

- It acts as a moral check on the employees from committing frauds and errors.

- Audited statements of account are helpful in settling liability for taxes, negotiating loans and for determining the purchase consideration for a business.

- These are also useful for settling trade disputes whether it is a matter of performance bonus or increment or it is claim for the damages due to fire or other accident.

- With the help of an Audit, one can discover the areas of wastages and losses that occur due to the absence of inadequacy of internal checks or internal control measures.

- Audit report generally states the fact that whether proper books of account and related records have been property kept so as to make the deficiencies or inadequacies good in this respect.

- As an appraisal function, Audit reviews the existence effectiveness and continuity of various controls in the organization and reports weakness, inadequacies, etc. in them.

- Audited accounts are of great help in the settlement of accounts at the time of admission or dissolution or death or retirement of partner.

Hence, we can say auditing is necessity and not luxury.

FAQ 38: What are the different aspects to be covered in Audit?

- Examine the system of accounting and internal control to ascertain whether it is appropriate for the business and helps in properly recording all transactions.

- Reviewing the system and procedures to find out whether they are adequate and comprehensive and incidentally whether material inadequacies and weaknesses exist to allow frauds and errors going unnoticed.

- Checking of the arithmetical accuracy by the verification of postings, balances, etc.

- Verification of the authenticity and validity of transaction with the relevant supporting documents.

- Ascertaining that a proper distinction has been made between capital and revenue nature and that the amounts of various items of income and expenditure adjusted in the accounts corresponding to the accounting period.

- Comparison of the balance sheet and profit and loss account or other statements with the underlying record in order to see that they are in accordance therewith.

- Verification of the title, existence and value of the assets appearing in the balance sheet.

- Verification of the liabilities stated in the balance sheet.

- Checking the result shown by the P&L and to see whether the results shown are true and fair.

- If it is a company audit, confirming that the statutory requirements have been complied with.

- Reporting to the appropriate person/body whether the statements of account examined do reveal a true and fair view of the state of affairs and of the profit and loss of the organisation.

FAQ 39: What is the Relationship of Auditing with Other Disciplines?

| S. No. | Disciples | Relationship |

| 1 | Auditing and Accounting |

|

| 2 | Auditing and Law

(RTP Nov. 2018) |

|

| 3. | Auditing and Economics |

|

| 4. | Auditing and Behavioural Science |

|

| 5. | Auditing and Statistics & Mathematics |

|

| 6. | Auditing and Data Processing |

|

FAQ 40: What is an Assertion?

Assertions means representations/confirmations by management. These are embodied in the financial statements.

Say

When an investor holds published financial statements in his hand and looks at the Property, Plant and Equipment with its value of ` 1,000 Crore, then it relies on such values because he assumes that it is true and fair view and decides that the entity possess these PPE, and management has valued correctly and complete information is presented and disclosed.

Auditor should ensure that all these assertions are correct by performing the audit procedures.

Few examples are provided here and we are going to discuss in details under SA 500.

Balance sheet assertions: Existence, Rights and obligations, Valuation, Completeness, Cut-off, Presentation and disclosures;

P&L Assertions: Occurrence, Measurement, Completeness, Cut-off, Presentation and disclosures;

FAQ 41: What is Audit Risk?

Risk means “Expected may go wrong”. Audit Risk refers to the risk that the audit opinion may go wrong/opinion expressed is materially misstated.

Audit Risk is a multiplication of (a) & (b) below:

(a) The risk of material Misstatement; and

(b) Detection Risk.

Audit Risk = ROMMS * DR

ROMMS = Inherent risk * Control Risk;

Hence AR = IR * CR * DR

Auditor’s objective is to reduce audit risk to acceptably low level by performing appropriate audit procedures.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA