What is Valuation of Supply under GST?

- Blog|GST & Customs|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 8 November, 2022

Table of Contents

1. Introduction

2. Methods of Calculation of Value of Taxable Supply (An overview)

3. Value of taxable supply [Section 15(1)]

4. Determination of Value of Taxable Supply where Section 15(1) is not applicable [Section 15(4)]

5. Value of Supply in case of Lottery, Betting, Gambling and Horse Racing [RULE 31A]

6. Value of notified supplies [Section 15(5)]

7. Determination of value in respect of certain supplies

1. Introduction

In any fiscal statute, the determination of tax may be based on value of item or on some other basis (like quantity, length, number, square meter, etc.). When tax is determined as a percentage of value (expressed in monetary terms), it is called as ad valorem basis. Under GST laws, the tax is levied as a percentage of the value of supply, whether of goods or of services. In other words, GST is payable on ad valorem basis. Therefore, it becomes important to know the mechanism for determining the value of a supply on which tax is to be paid. This chapter describes the statutory provisions, related rules and their analysis, which are given in CGST Act and CGST Rules.

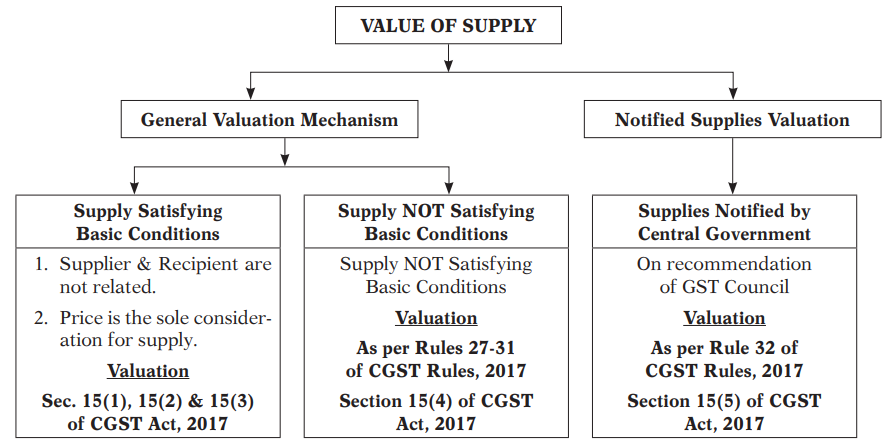

2. Methods of Calculation of Value of Taxable Supply (An overview)

The Section 9 of CGST Act, 2017 gives the basis of charge. As per this section, the GST shall be levied on the basis of taxable Supply of goods, services determined under section 15. The section 15 contains the provisions of “Value of Taxable Supply”. The following is the overview of these provisions.

| Section 15(1) | Transaction Value is the value of Supply |

| Section 15(2) | Inclusions in the Value of Supply |

| Section 15(3) | Discount not to be included |

| Section 15(4) | When section 15(1) is not applicable (Rule 27 to Rule 31) |

| Section 15(5) | About notified Services/Goods (Rule 32) |

| It may be noted that |

| 1. The provisions of value of supply under CGST Act have also been made applicable to IGST Act vide section 20 of the IGST Act.

2. In most of the cases of regular normal trade, the invoice value is the taxable value. However, when value cannot be determined under section 15 and for certain specific transactions, the value is determined using CGST Rules, 2017. |

2.1 CGST Rules at a Glance

Chapter IV of CGST Rules Contains the following in relation with Valuation.

| Rule 27 | Where consideration is not wholly in money |

| Rule 28 | Supply between distinct or related persons |

| Rule 29 | Supply through an Agent |

| Rule 30 | Value based on Cost |

| Rule 31 | Residual Method |

3. Value of taxable supply [Section 15(1)]

As per section 15(1) of CGST Act, 2017,

“The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.”

The following are the important inferences:

(a) There are two basic conditions for application of section 15(1):

1. Supplier and recipient are not related.

2. The price is the sole consideration for the supply.

(b) If these two conditions are met, then

| Value of Supply | = | Transaction Value

[Price paid or payable] |

+ | Certain Elements [Given in Section 15(2)] |

The price payable refers to price that is agreed to be paid for the goods/services.

| Meaning of Relevant Terms |

| Transaction Value: The transaction value refers to the price which is the price actually paid or payable for the supply of goods and/or services where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply. It includes any amount which the supplier is liable to pay but which has been incurred by the recipient of the supply. |

| Related Persons [Explanation to Section 15]: The persons shall be deemed to be “related persons” The term “related persons” is defined by explanation to section 15. By virtue of this definition, person shall be deemed to be “related person” if––

(i) such persons are officers or directors of one another’s businesses; (ii) such persons are legally recognised partners in business; (iii) such persons are employer and employee; (iv) any person directly or indirectly owns, controls or holds 25% or more of the outstanding voting stock or shares of both of them; (v) one of them directly or indirectly controls the other; (vi) both of them are directly or indirectly controlled by a third person; (vii) together they directly or indirectly control a third person; or (viii) they are members of the same family. |

The Clause (b) of the explanation prescribes that person also includes legal persons. As per clause (c), the persons who are associated in the business of one another in that one is the sole agent or sole distributor or Sole concessionaire, howsoever described, of the other, shall be deemed to be related.

Definition of Family [Section 2(49)]:

Family means,-

(i) the spouse and children of the person, and

(ii) the parents, grand-parents, brothers and sisters of the person if they are wholly or mainly dependent on the said person.

3.1 Inclusions in Transaction Value [Section 15(2)]

When the value of supply is assessed on the basis of transaction value, the taxable value includes certain elements in addition to price actually paid or payable for the supply. These ingredients are as follows:

(i) Any taxes, duties, Cesses, fees and charges except GST. [Refer Example 1]

(ii) Any payments made to third parties by the recipients on behalf of the supplier in relation to the supply. [Refer Example 2]

(iii) The incidental expenses, such as, commission and packing, charged by the supplier or anything else done by the supplier in relation to the supply at the time of or before the delivery of goods or supply of services. [Refer Example 3]

(iv) Interest, late fee and penalty for delayed payment of any consideration for any supply and

(v) Any subsidy directly linked to the price excluding subsidies provided by the Government (Central/ State). [Refer Example 4]

Valuation Methodology for ascertainment of GST on TCS under Income-tax Act, 1961

For the purpose of determination of value of supply under GST, tax collected at source (TCS) under section 206C of the Income-tax Act, 1961 is not includible as it is an interim levy not having the character of tax. [Circular No. 76/50/2018 GST, dated 31-12-2018 amended vide corrigendum dated 7-3-2019]

| Example 1 (Treatment of Municipal and other taxes) |

| The list price of the goods is ` 40,000 (exclusive of taxes). The tax levied by Municipal authority is ` 2,000. The CGST/SGST chargeable on the goods is @ 18%. Now, since the value includes any taxes, duties (other than GST), etc., the Value of Supply shall be ` 42,000 in the given case. Hence, GST payable will be 18% of ` 42,000 i.e. ` 7,560. |

| Example 2 (Payment on behalf of supplier) |

| Chitra Advertisers conceptualized and designed the advertising campaign for a new product launched by HLL for a consideration of ` 8,00,000. Chitra Advertisers had to pay ` 40,000 to Massom Limited. It has also been agreed between the parties that HLL will discharge this ` 40,000 liability of Chitra Advertisers. The price of ` |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Comments are closed.